Free Professional Payroll Accountant Resume

Email: [Your Email]

Phone: 222 555 7777

LinkedIn: linkedin.com/in/your_own_profile

Address: 202 Elm Street, Meadowville, CA 90225

Professional Summary

Detail-oriented and results-driven Payroll Accountant with expertise in payroll processing, tax compliance, and financial reporting. Skilled in managing complex payroll systems, ensuring compliance with federal and state regulations, and resolving discrepancies efficiently. Proven ability to collaborate with HR departments, enhance payroll processes, and support financial operations to contribute to overall company success. Adept at using payroll software and accounting tools to streamline operations and ensure timely and accurate pay processing.

Core Competencies

Payroll Processing & Administration

Tax Filing & Compliance

Payroll Software (e.g., ADP, Paychex, QuickBooks)

General Ledger Reconciliation

Financial Reporting & Analysis

Time & Attendance Systems

Employee Benefits Administration

Multistate Payroll Expertise

IRS Regulations & Tax Laws

Month-End/Year-End Closing

Confidentiality & Data Security

Vendor Management

Excel (Advanced)

Professional Experience

Payroll Accountant

XYZ Corporation | January 2062 – Present

Manage end-to-end payroll processing, ensuring timely and accurate pay distribution for employees while adhering to company policies and legal requirements.

Reconcile payroll data with timesheets and records, addressing discrepancies and ensuring compliance with tax regulations.

Prepare and submit tax filings, including federal, state, W-2s, and 1099s, ensuring compliance with deadlines.

Collaborate with HR to update employee records and manage benefits, deductions, and status changes.

Resolve employee payroll inquiries efficiently, maintaining confidentiality and professionalism.

Payroll Coordinator

ABC Enterprises | June 2058 – December 2061

Coordinated payroll for employees across multiple departments, ensuring compliance with payroll policies and local labor laws.

Assisted with payroll tax filings and managed deductions for federal, state, and local taxes.

Administered payroll for various employment types, including overtime, leave, and benefits.

Trained staff on payroll systems and procedures, ensuring accurate and efficient payroll operations.

Education

Bachelor of Science in Accounting

State University

Graduated: May 2058

Certifications

Certified Payroll Professional (CPP) – 2060

Certified Public Accountant (CPA) – 2061

Technical Skills

Payroll Software: ADP Workforce Now, Paychex, QuickBooks, Gusto, Workday

Accounting Software: QuickBooks, Microsoft Dynamics GP, SAP

Microsoft Excel: Pivot Tables, VLOOKUP, Formulas, Data Analysis

Time & Attendance Systems: Kronos, TSheets, Ceridian Dayforce

Professional Affiliations

American Payroll Association (APA) – Member since 2059

National Association of Accountants (NAA) – Member since 2060

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Professional Payroll Accountant Resume Template from Template.net - the ultimate solution for crafting a standout resume. This editable and customizable template is tailored specifically for payroll accountants, ensuring every detail is perfectly showcased. With seamless editing in our Ai Editor Tool, presenting your expertise and skills has never been easier. Stand out from the crowd effortlessly.

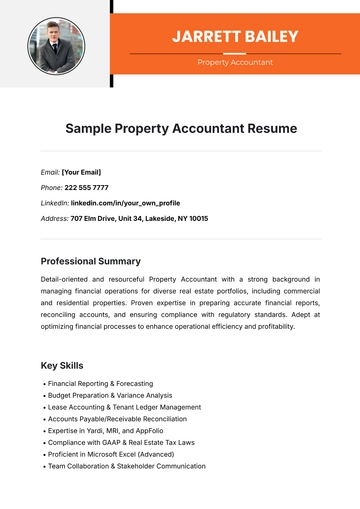

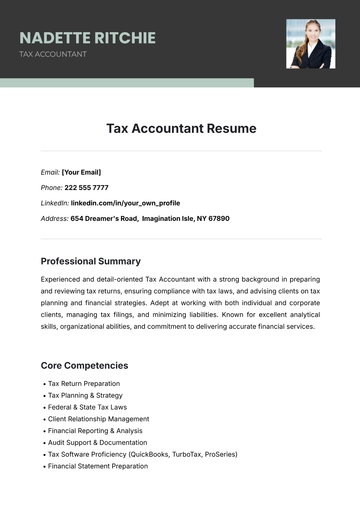

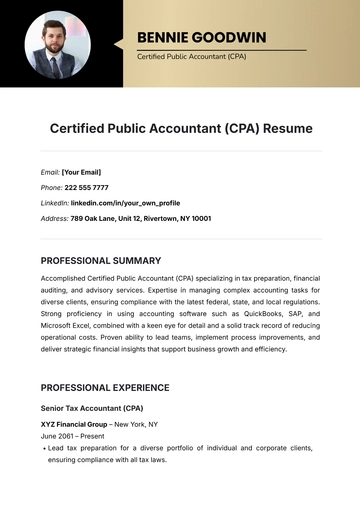

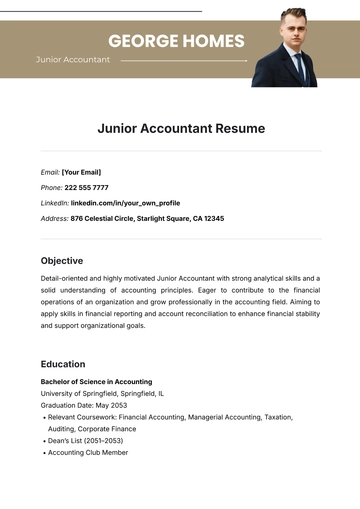

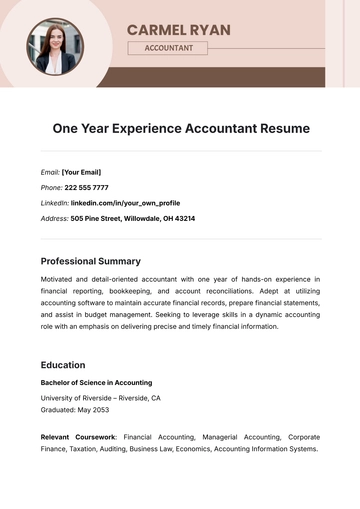

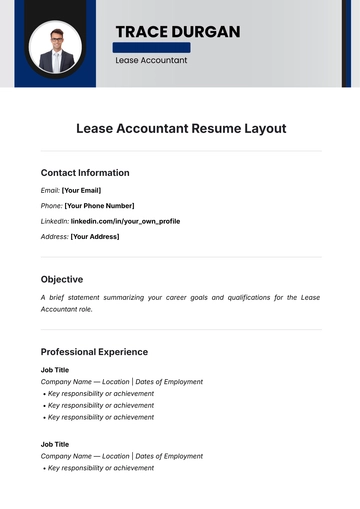

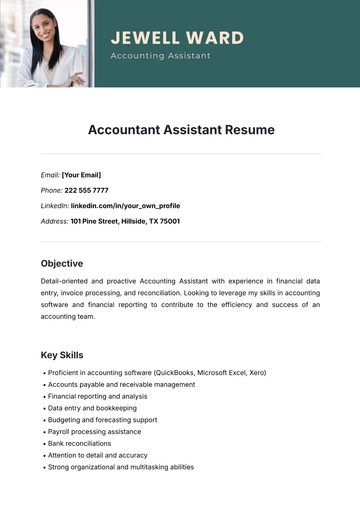

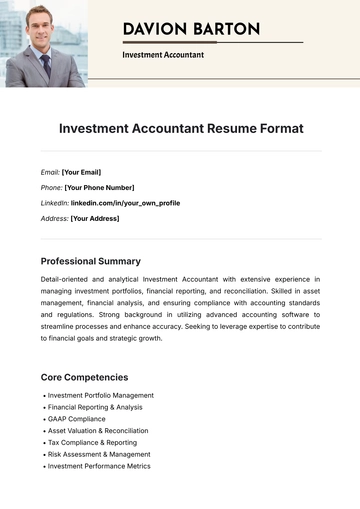

You may also like

- Simple Resume

- High School Resume

- Actor Resume

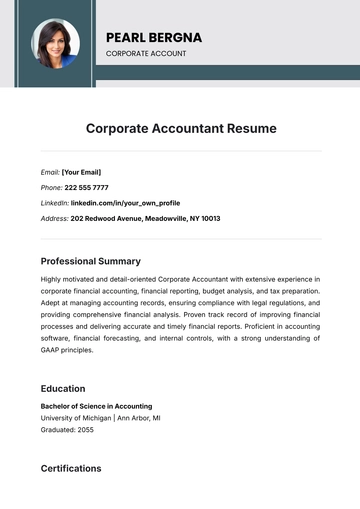

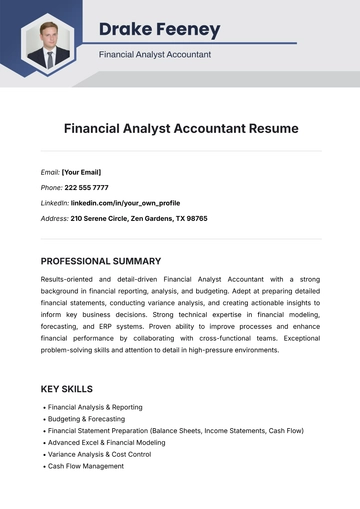

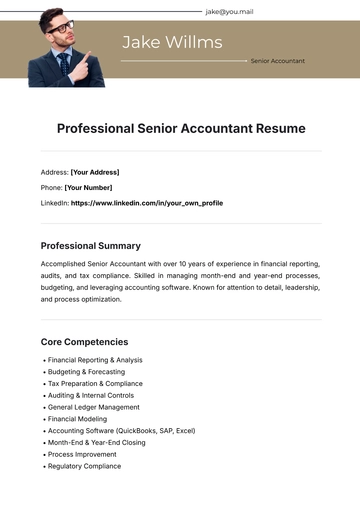

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

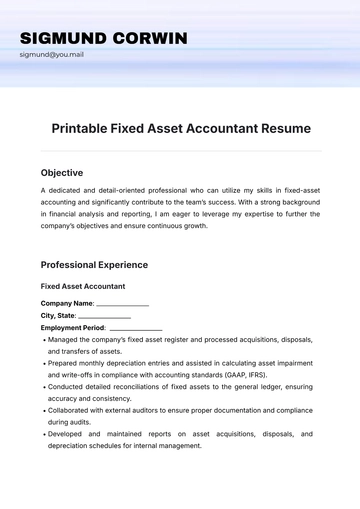

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume