Hotel Payment Plan

I. Executive Summary

The Payment Plan of [Your Company Name] aims to streamline and optimize the financial transactions between our hotel and its clients. This plan includes various payment options, terms, and schedules designed to enhance customer satisfaction while ensuring financial stability for the hotel. Key details include flexible payment methods, attractive discount structures, and clear timelines for payment.

Our approach focuses on offering diverse payment methods such as credit cards, bank transfers, and digital wallets to cater to different customer preferences. Additionally, we have established discount policies for early payments and long-term bookings, which are expected to improve cash flow and customer loyalty.

Financially, the plan projects an increase in timely payments by 15%, reducing overdue accounts by 5%, and enhancing overall revenue by $200,000 annually. These improvements are crucial for maintaining the hotel's financial health and ensuring consistent service quality.

II. Payment Options

The following table presents a summary of the payment options available at [Your Company Name]. These options are designed to cater to diverse customer preferences and enhance the overall payment experience:

Payment Option | Details |

|---|---|

Credit Card Payments | Accepts major credit cards; 2.5% processing fee; secure transactions. |

Bank Transfers | Direct payments to bank account; 2-3 business days processing time. |

Digital Wallets | Supports PayPal, Apple Pay, Google Wallet; instant processing. |

A. Credit Card Payments

Accepted Credit Card Types: Our hotel accepts major credit cards including Visa, MasterCard, American Express, and Discover. This variety ensures that most guests can conveniently pay using their preferred credit card.

Processing Fees: A standard processing fee of 2.5% is applied to all credit card transactions. This fee is necessary to cover the costs imposed by credit card companies.

Security Measures: All credit card payments are processed through a secure, PCI-compliant payment gateway to protect guest information and prevent fraud.

Pre-authorization Requirements: For reservations, a pre-authorization amount equivalent to one night's stay is required to guarantee the booking. This policy helps reduce the risk of no-shows and cancellations.

Settlement Period: Credit card payments are settled within 24 hours after check-out, ensuring quick receipt of funds.

B. Bank Transfers

Bank Details for Transfers: Guests can make payments directly to our bank account. Our bank details are provided at the time of booking or upon request to ensure smooth transactions.

Transfer Confirmation: Guests are required to send a transfer confirmation receipt to the hotel email for verification. This step ensures that payments are accurately recorded.

Transaction Fees: International bank transfers may incur additional fees, which are the responsibility of the guest. This policy is communicated clearly during the booking process.

Processing Time: Bank transfers typically take 2-3 business days to process. Guests are advised to initiate payments well in advance to avoid any inconvenience.

C. Digital Wallets

Supported Wallets: The hotel supports payments through popular digital wallets such as PayPal, Apple Pay, and Google Wallet. These options cater to tech-savvy guests who prefer digital transactions.

Transaction Limits: There are no minimum or maximum transaction limits for digital wallet payments, making it a flexible option for guests.

Security Protocols: Payments made through digital wallets are secured by multi-factor authentication and encryption, ensuring safe and reliable transactions.

Convenience Factor: Digital wallet payments are processed instantly, providing a quick and hassle-free payment experience for guests.

Promotion for Digital Payments: Guests opting for digital wallet payments are eligible for a 2% discount on their total bill. This promotion encourages the use of digital payments and reduces processing times.

III. Payment Terms and Conditions

A. Payment Schedules

Advance Payments: Guests are required to make a 50% advance payment at the time of booking. This policy secures the reservation and reduces the risk of cancellations.

Final Payment: The remaining balance must be paid upon check-in. This ensures that the hotel receives full payment before the guest's stay begins.

Extended Stays: For stays longer than 30 days, payment can be made on a bi-weekly basis. This option provides flexibility for long-term guests and helps manage their finances better.

Early Check-out Policies: In case of early check-out, the hotel refunds the unused portion of the payment after deducting a one-night stay cancellation fee.

Group Bookings: For group bookings, a 25% non-refundable deposit is required at the time of booking. The remaining balance is due 14 days before the arrival date.

B. Discount Structures

Early Payment Discount: Guests who pay their full bill 30 days in advance are eligible for a 5% discount. This incentive encourages timely payments and improves cash flow.

Long-term Stay Discounts: Guests staying for more than 15 days receive a 10% discount on their total bill. This policy attracts long-term guests and increases occupancy rates.

Seasonal Discounts: During off-peak seasons, guests can avail of a 15% discount on bookings. This strategy helps maintain steady occupancy during slower periods.

Loyalty Program: Repeat guests are eligible for a 7% discount on their bookings. This program fosters customer loyalty and encourages repeat business.

IV. Late Payment Policies

A. Penalty Charges

Grace Period: A grace period of 3 days is allowed for late payments without any penalty. This period provides a buffer for guests facing temporary financial difficulties.

Late Fee: A late fee of $25 per day is charged after the grace period. This fee serves as a deterrent against late payments and compensates for the delay.

Interest on Overdue Amounts: An interest rate of 1.5% per month is applied to overdue amounts. This policy ensures that the hotel is compensated for the additional time taken to receive payments.

Payment Reminders: Automated payment reminders are sent to guests 5 days before the payment due date. These reminders help guests avoid late fees and ensure timely payments.

Debt Collection Procedures: For payments overdue by more than 30 days, the hotel engages debt collection agencies. This step ensures that outstanding payments are recovered efficiently.

B. Exceptions and Waivers

Medical Emergencies: Guests facing medical emergencies can request a waiver of late fees. Such requests must be supported by relevant documentation.

Natural Disasters: In the event of natural disasters, late fees and penalties are waived for affected guests. This policy shows empathy and support during difficult times.

Payment Plan Adjustments: Guests experiencing financial hardship can request adjustments to their payment plans. The hotel evaluates each request on a case-by-case basis to provide suitable solutions.

VIP Guests: Late fees are waived for VIP guests as a gesture of goodwill. This policy enhances the guest experience and fosters loyalty among high-profile clients.

V. Refund Policies

A. Refund Eligibility

Cancellation Refunds: Guests cancelling their booking 7 days prior to the check-in date are eligible for a full refund. This policy provides flexibility and encourages advance bookings.

Early Check-out Refunds: Refunds for early check-outs are processed after deducting the applicable cancellation fee. This ensures that the hotel is compensated for the short notice.

Service Disruption Refunds: In cases of service disruptions, guests are eligible for a partial refund. This policy ensures that guests are compensated fairly for any inconvenience.

Promotional Booking Refunds: Bookings made under promotional offers are non-refundable. This policy is clearly communicated to guests during the booking process.

B. Refund Process

Refund Request Submission: Guests must submit a refund request form within 14 days of the eligible event. This process ensures that all refund requests are documented and processed systematically.

Refund Approval Timeframe: Refund requests are reviewed and approved within 7 business days. This timeframe ensures that guests receive timely updates on their refund status.

Refund Method: Refunds are processed using the original payment method. This policy ensures that refunds are credited back to the guest's account securely.

Communication of Refund Status: Guests are notified of their refund status via email. This communication provides transparency and keeps guests informed throughout the process.

VI. Payment Security Measures

A. Data Protection

Encryption Protocols: All payment data is encrypted using advanced encryption standards (AES). This measure protects guest information from unauthorized access.

PCI Compliance: The hotel adheres to PCI DSS standards to ensure the secure handling of credit card information. Compliance is regularly reviewed and updated.

Secure Payment Gateways: Payments are processed through secure gateways with multi-layered security protocols. This approach minimizes the risk of fraud and data breaches.

Employee Training: Staff handling payment information receive regular training on data protection and security protocols. This training ensures that all employees are aware of the latest security measures.

B. Fraud Prevention

Transaction Monitoring: All transactions are monitored in real-time for suspicious activities. Any anomalies are flagged and investigated immediately to prevent fraud.

Verification Processes: Guests are required to verify their identity during the payment process. This step includes verifying contact information and providing valid identification.

Chargeback Management: The hotel has a dedicated team to manage chargebacks and disputes. This team works to resolve issues quickly and maintain a low chargeback ratio.

Regular Audits: Regular security audits are conducted to identify and address vulnerabilities. These audits ensure that the hotel's payment systems remain robust and secure.

Two-Factor Authentication: Two-factor authentication is implemented for digital wallet and online transactions. This additional security layer protects against unauthorized access.

VII. Financial Projections and Impact

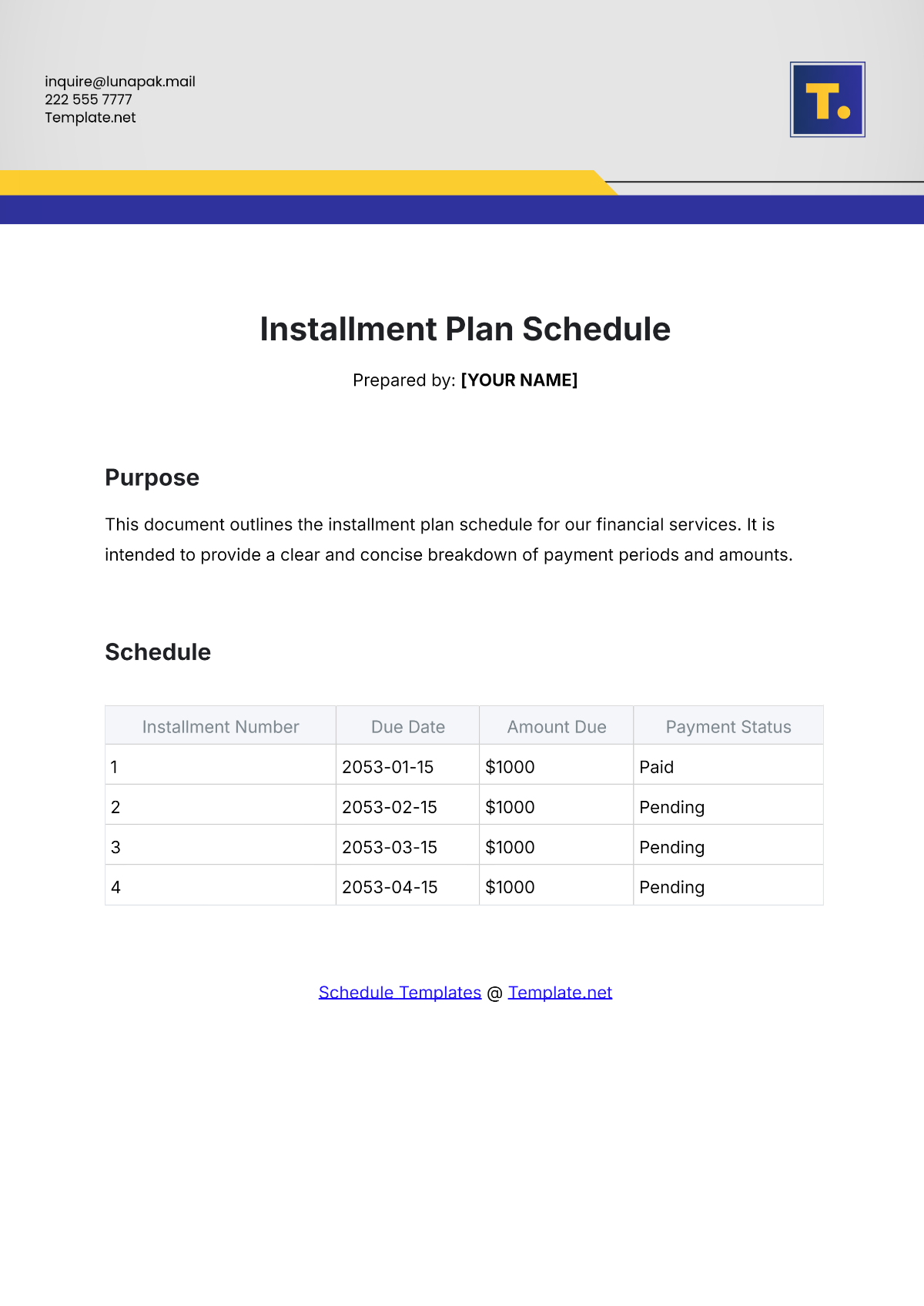

The following table presents the projected financial impact of implementing the Payment Plan over the next fiscal year:

Metric | Current Status | Projected Status | Change |

|---|---|---|---|

Prompt payments | 75% | 90% | +15% increase |

Overdue Accounts | 10% | 5% | -5% decrease |

Annual Revenue | $1,000,000 | $1,200,000 | +$200,000 growth |

Customer Satisfaction | 85% | 95% | +10% increase |

A. Timely Payments Increase

Current Situation: Currently, 75% of our guests make timely payments, which affects the hotel's cash flow and operational efficiency.

Projected Improvement: With the new payment plan, timely payments are expected to increase to 90%. This improvement will significantly enhance the hotel's cash flow, allowing for better resource allocation and financial stability.

Strategies Implemented: Strategies such as offering multiple payment options, providing early payment discounts, and sending timely reminders are key factors driving this improvement.

Financial Impact: The 15% increase in timely payments will reduce the reliance on external financing, lowering interest costs and improving profitability.

B. Overdue Accounts Reduction

Current Situation: Currently, 10% of our accounts are overdue, leading to financial strain and increased debt collection efforts.

Projected Reduction: The new payment plan aims to reduce overdue accounts to 5%, effectively halving the current rate.

Strategies Implemented: Strict late payment policies, efficient debt collection procedures, and clear communication of payment terms are critical to achieving this reduction.

Financial Impact: Reducing overdue accounts by 5% will minimize financial losses and enhance the overall financial health of the hotel.

C. Annual Revenue Growth

Current Situation: The hotel's annual revenue stands at $1,000,000, with limited growth due to inconsistent payment practices.

Projected Growth: With the new payment plan, annual revenue is expected to increase to $1,200,000, reflecting a growth of $200,000.

Strategies Implemented: Enhanced payment methods, attractive discounts, and improved customer satisfaction are key drivers of this revenue growth.

Financial Impact: The additional $200,000 in revenue will provide funds for reinvestment in hotel amenities, services, and marketing efforts, further boosting guest satisfaction and occupancy rates.

D. Customer Satisfaction Improvement

Current Situation: Currently, customer satisfaction is at 85%, with room for improvement in payment convenience and flexibility.

Projected Improvement: The new payment plan is expected to increase customer satisfaction to 95%, a 10% improvement.

Strategies Implemented: Providing flexible payment options, clear payment terms, and prompt customer support are essential to enhancing customer satisfaction.

Financial Impact: Higher satisfaction levels will lead to positive reviews, repeat business, and increased brand loyalty, contributing to long-term revenue growth.

The Payment Plan is crucial for maintaining the hotel's financial health and ensuring consistent service quality. By offering diverse payment options, attractive discounts, and clear payment terms, the hotel can cater to a wide range of guests and enhance their overall experience. The projected financial improvements will also enable the hotel to invest in new initiatives, maintain competitive pricing, and adapt to market changes effectively.

VIII. Marketing and Communication Strategies

A. Marketing Channels

Website and Online Booking Platforms: The hotel's website and online booking platforms will prominently feature the new payment plan details. This approach ensures that potential guests are informed about the flexible payment options and discounts available.

Email Campaigns: Targeted email campaigns will be sent to past and potential guests, highlighting the benefits of the new payment plan. These emails will include detailed information about payment options, discounts, and incentives.

Social Media Promotion: Social media channels will be used to promote the new payment plan, reaching a broader audience and engaging with guests through interactive content and advertisements.

In-Hotel Signage: Informational brochures and posters will be placed in key areas of the hotel, such as the reception, lobby, and guest rooms. This strategy ensures that current guests are aware of the payment options and policies.

B. Customer Support

Dedicated Helpline: A dedicated customer support helpline will be established to assist guests with payment-related inquiries and issues. This service will provide prompt and efficient support to enhance guest satisfaction.

FAQ Section on Website: A comprehensive FAQ section will be added to the hotel's website, addressing common questions about the payment plan. This resource will help guests find quick answers and reduce the volume of support inquiries.

Training for Frontline Staff: Frontline staff will receive thorough training on the new payment plan to ensure they can effectively communicate the details to guests. This training will cover payment options, terms, discounts, and security measures.

Feedback Mechanism: A feedback mechanism will be implemented to gather guest opinions on the payment plan. This feedback will be used to make necessary adjustments and improvements to the plan.

IX. Conclusion and Next Steps

A. Conclusion

The Payment Plan for [Your Company Name] is designed to provide flexible, secure, and convenient payment options for guests while ensuring the hotel's financial stability. By offering a variety of payment methods, attractive discounts, and clear terms, the plan aims to enhance guest satisfaction and loyalty. The projected financial benefits, including increased timely payments, reduced overdue accounts, and overall revenue growth, underscore the plan's positive impact on the hotel's operations and profitability.

The comprehensive security measures and fraud prevention protocols further ensure the safety of guest transactions, fostering trust and confidence in the hotel's financial practices. With effective marketing and communication strategies, the hotel can successfully promote the new payment plan and achieve its financial and customer satisfaction goals.

B. Next Steps

Implement Payment Plan: Roll out the new payment plan across all booking channels, including the hotel's website, online booking platforms, and in-hotel signage.

Train Staff: Conduct thorough training sessions for frontline staff to ensure they are well-versed in the details of the payment plan and can effectively communicate them to guests.

Launch Marketing Campaigns: Initiate targeted marketing campaigns through email, social media, and other channels to inform potential guests about the new payment plan and its benefits.

Monitor and Adjust: Continuously monitor the performance of the payment plan and gather guest feedback to make necessary adjustments and improvements.

Review Financial Impact: Regularly review the financial impact of the payment plan, analyzing key metrics such as timely payments, overdue accounts, and revenue growth to ensure the plan's effectiveness.

By following these steps, [Your Company Name] can successfully implement the Payment Plan, achieving both financial stability and enhanced guest satisfaction.