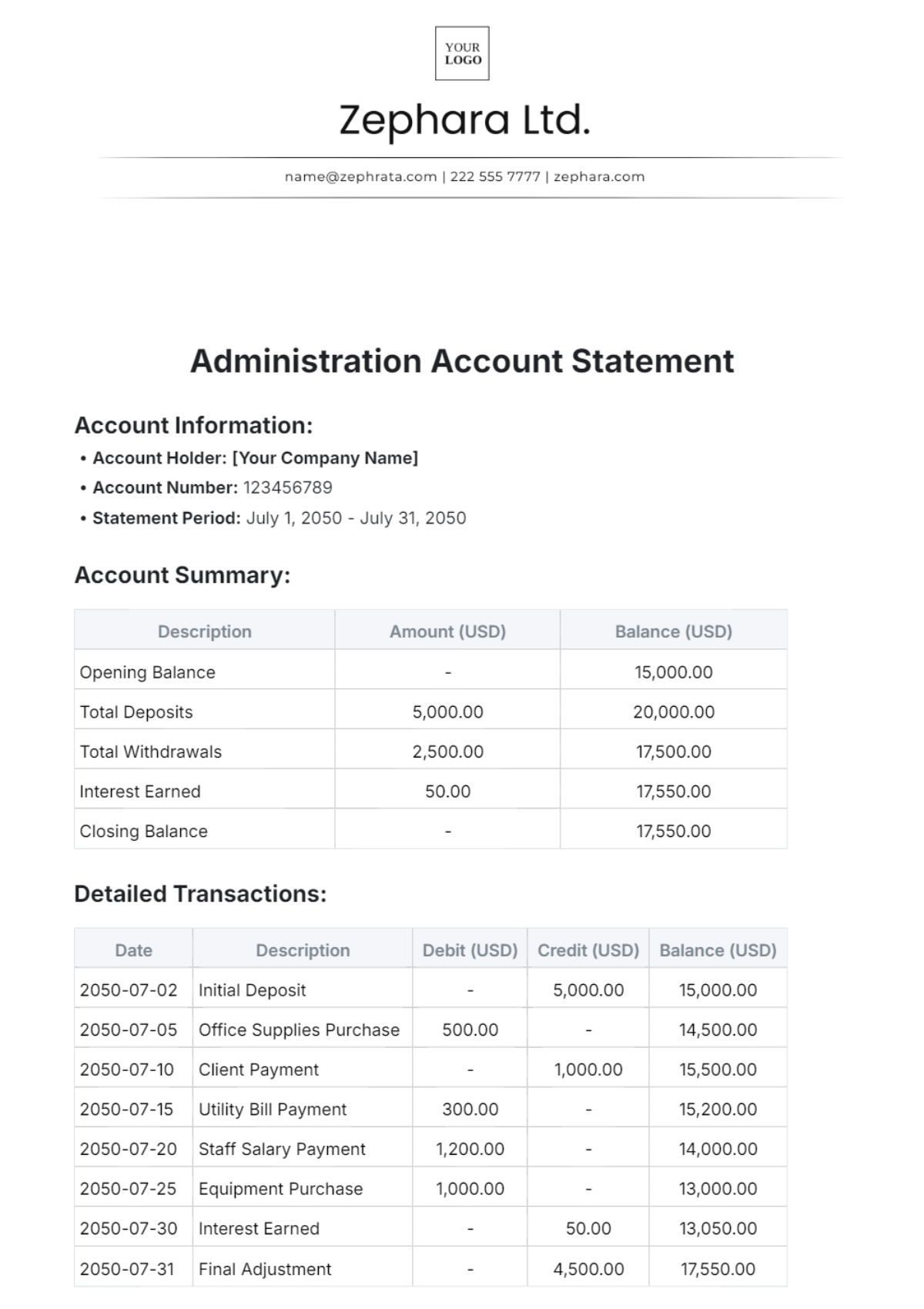

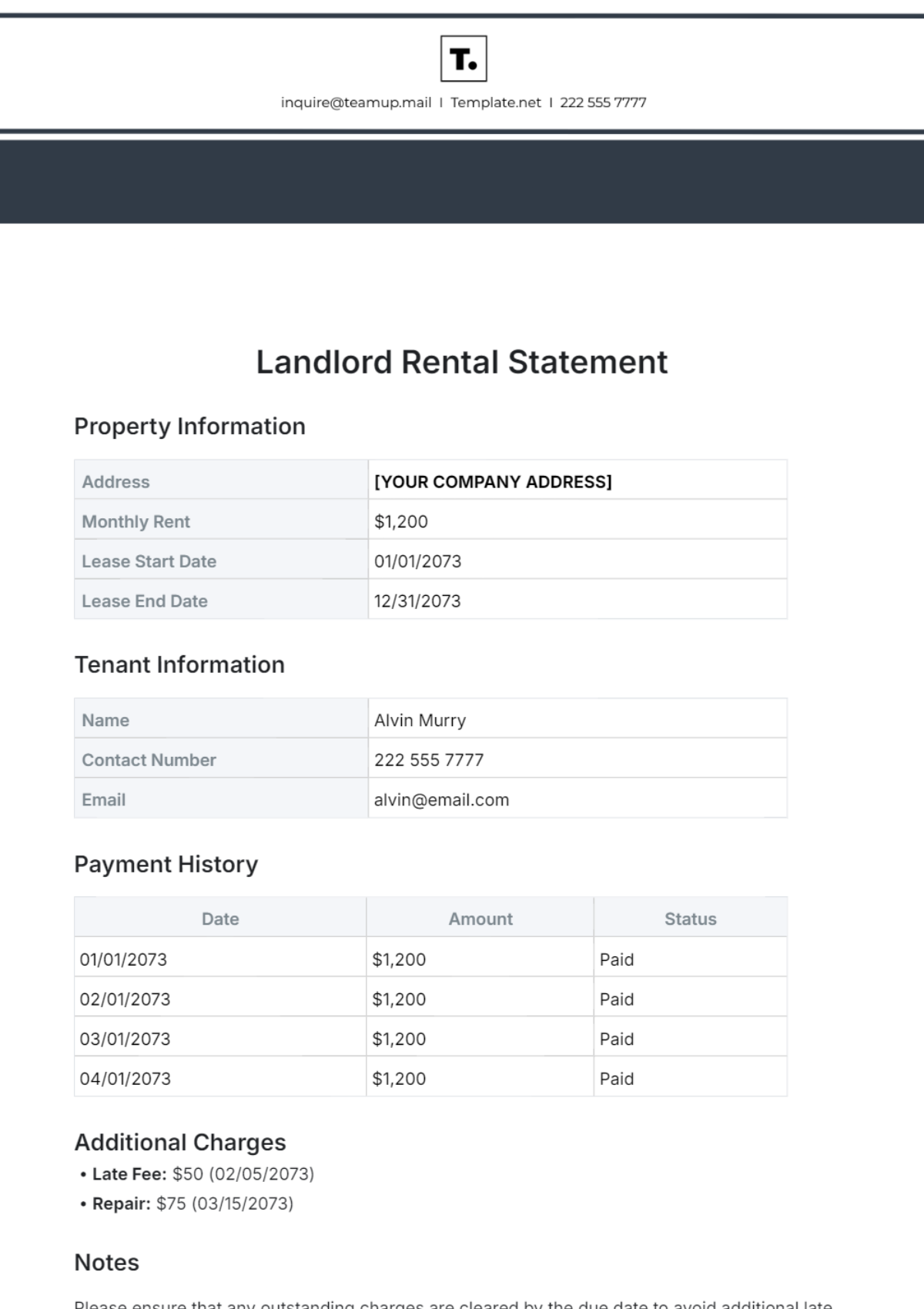

Cafe Balance Sheet Statement

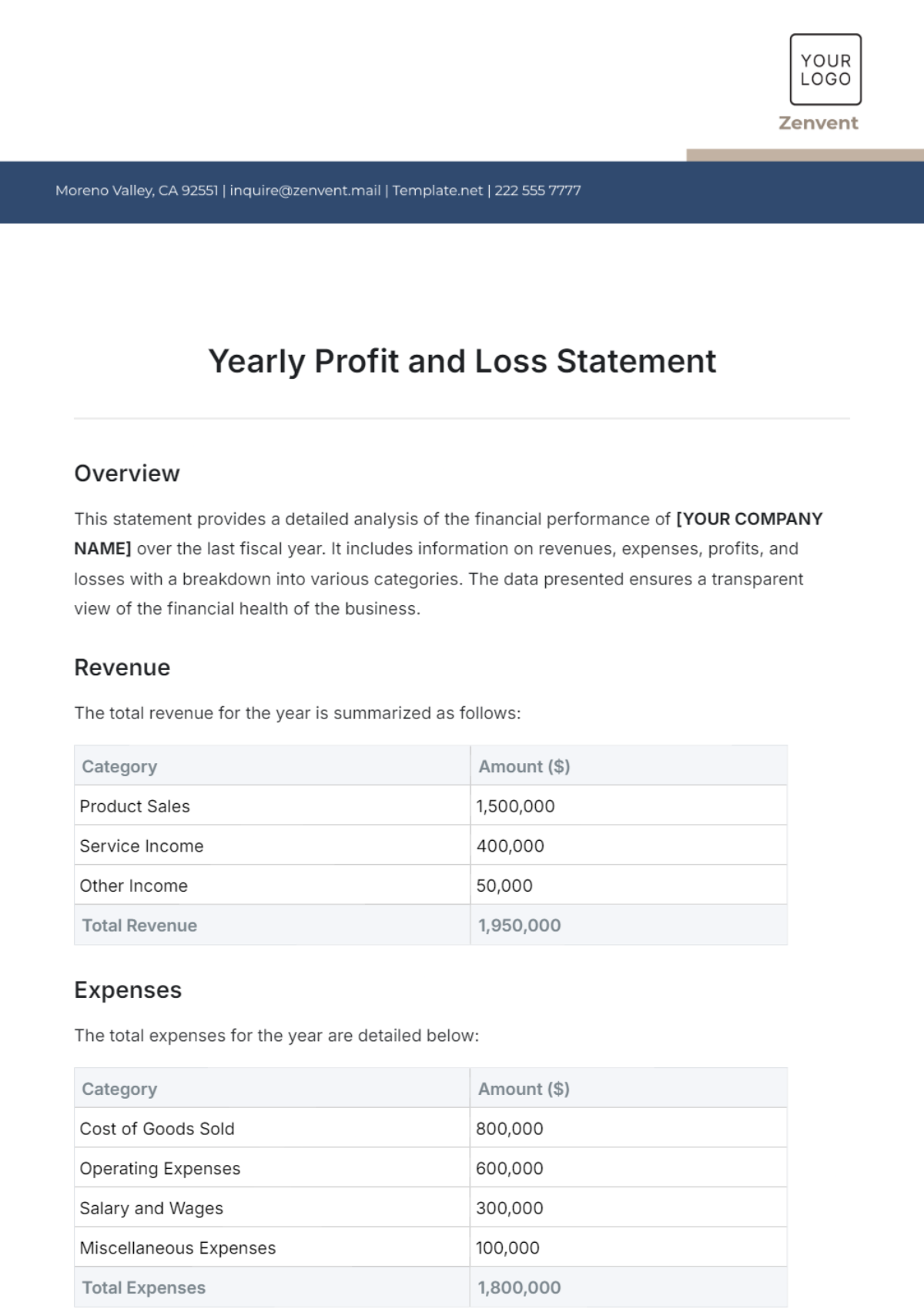

This Balance Sheet provides a snapshot of the financial position of [Your Company Name]. It outlines the cafe's assets, liabilities, and equity, reflecting the cafe's financial health for the period ending [Month Day, Year]. This statement intends to assess the cafe's liquidity, solvency, and overall financial stability.

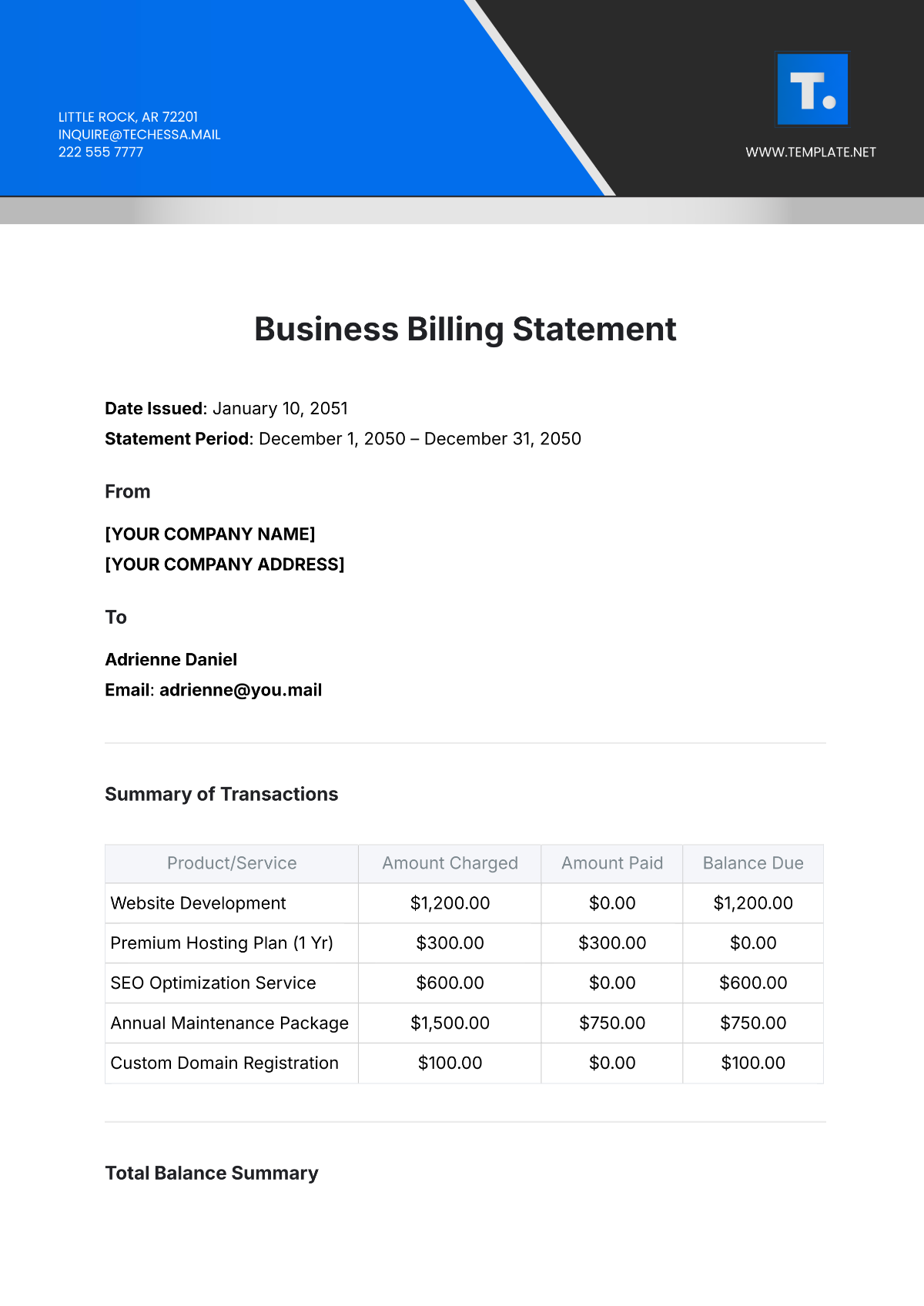

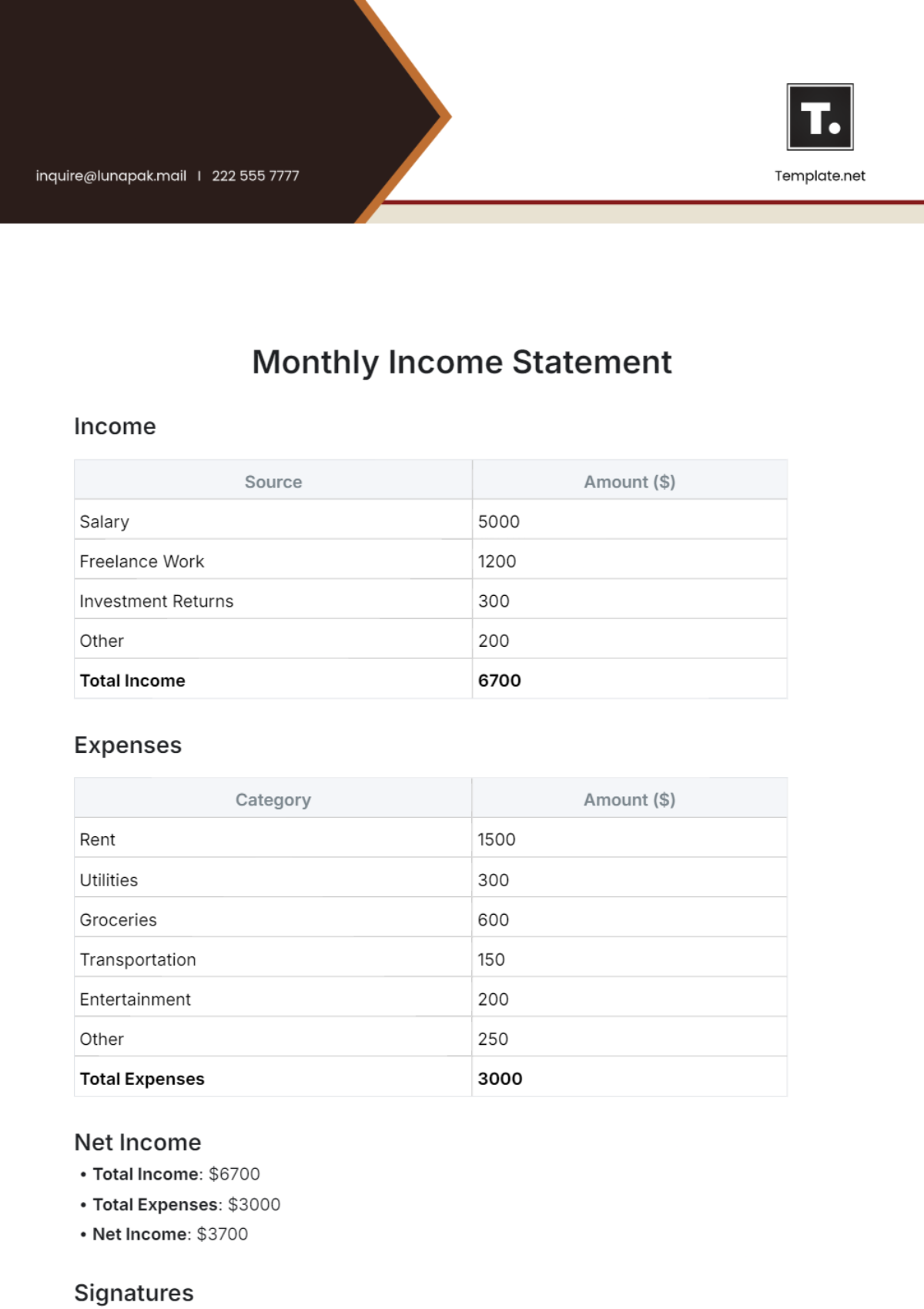

Assets | Amount | Liabilities and Equity | Amount |

|---|---|---|---|

Current Assets | Current Liabilities | ||

Cash and Cash Equivalents | $25,000 | Accounts Payable | $10,000 |

Accounts Receivable | $5,000 | Short-term Loans Payable | $15,000 |

Inventory | $20,000 | Accrued Expenses | $8,000 |

Prepaid Expenses | $3,000 | Current Portion of Debt | $12,000 |

Other Current Assets | $2,000 | Other Current Liabilities | $5,000 |

Total Current Assets | $55,000 | Total Current Liabilities | $50,000 |

Non-current Assets | Non-current Liabilities | ||

Property, Plant, and Equipment | $100,000 | Long-term Debt | $80,000 |

Intangible Assets | $10,000 | Deferred Tax Liability | $5,000 |

Investments | $15,000 | Other Non-current Liabilities | $3,000 |

Other Non-current Assets | $8,000 | ||

Total Non-current Assets | $133,000 | Total Non-current Liabilities | $88,000 |

Total Liabilities | $138,000 | ||

Equity | |||

Common Stock | $10,000 | ||

Retained Earnings | $40,000 | ||

Other Equity | $0 | ||

Total Equity | $50,000 | ||

Total Assets | $188,000 | Total Liabilities and Equity | $188,000 |

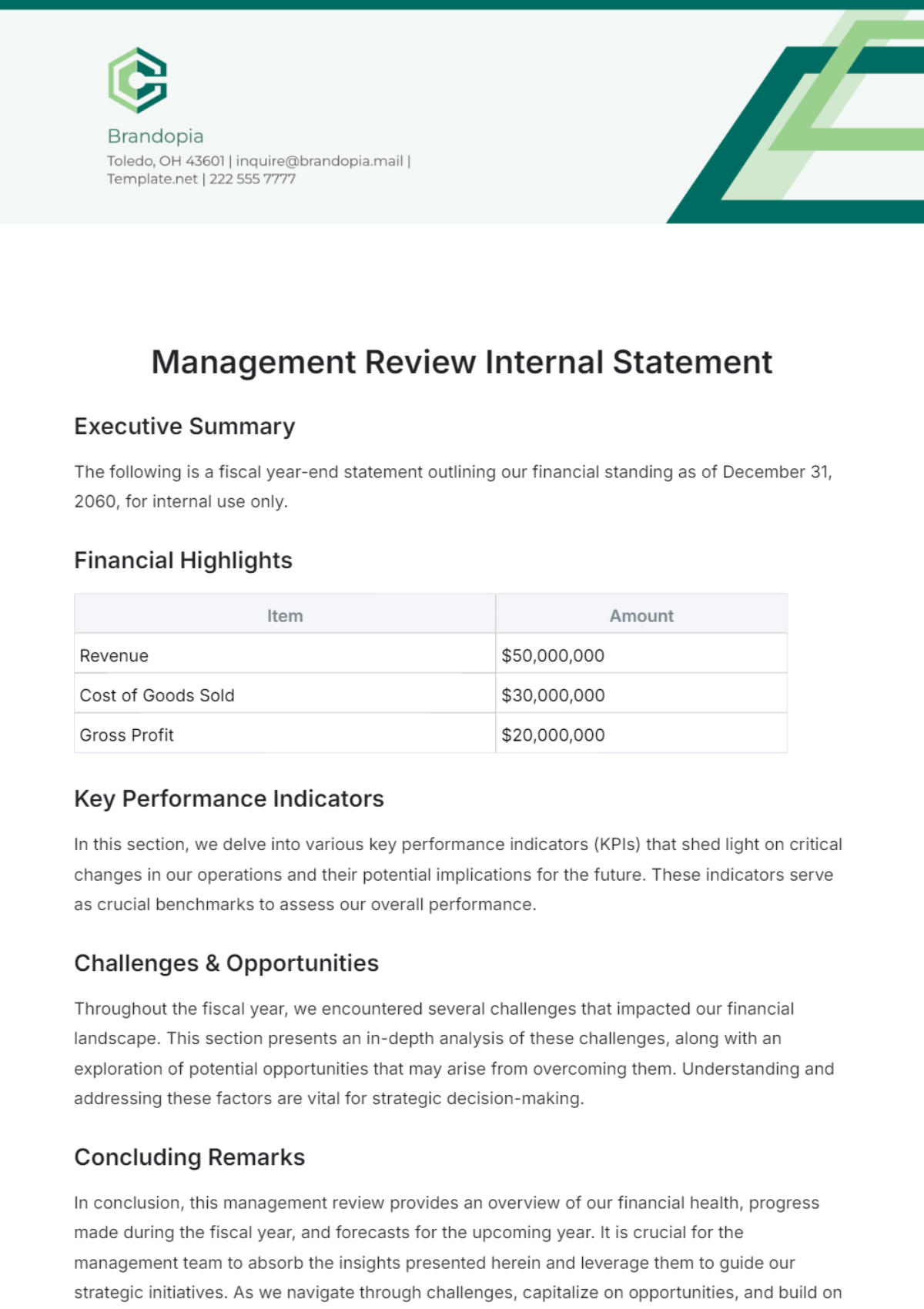

For the period ending [Month Day, Year], [Your Company Name] reveals a strong liquidity position with [$55,000] in current assets, predominantly in cash equivalents, receivables, and inventory, comfortably covering [$50,000] in current liabilities. Non-current assets totaling [$133,000], including significant investments in property and equipment, indicate a commitment to long-term growth. With non-current liabilities at [$88,000] and equity of [$50,000], primarily driven by retained earnings, the cafe demonstrates a stable financial foundation. This balance underscores [Your Company Name]'s ability to manage short-term obligations while strategically investing in future expansion, positioning it well within the competitive cafe market.