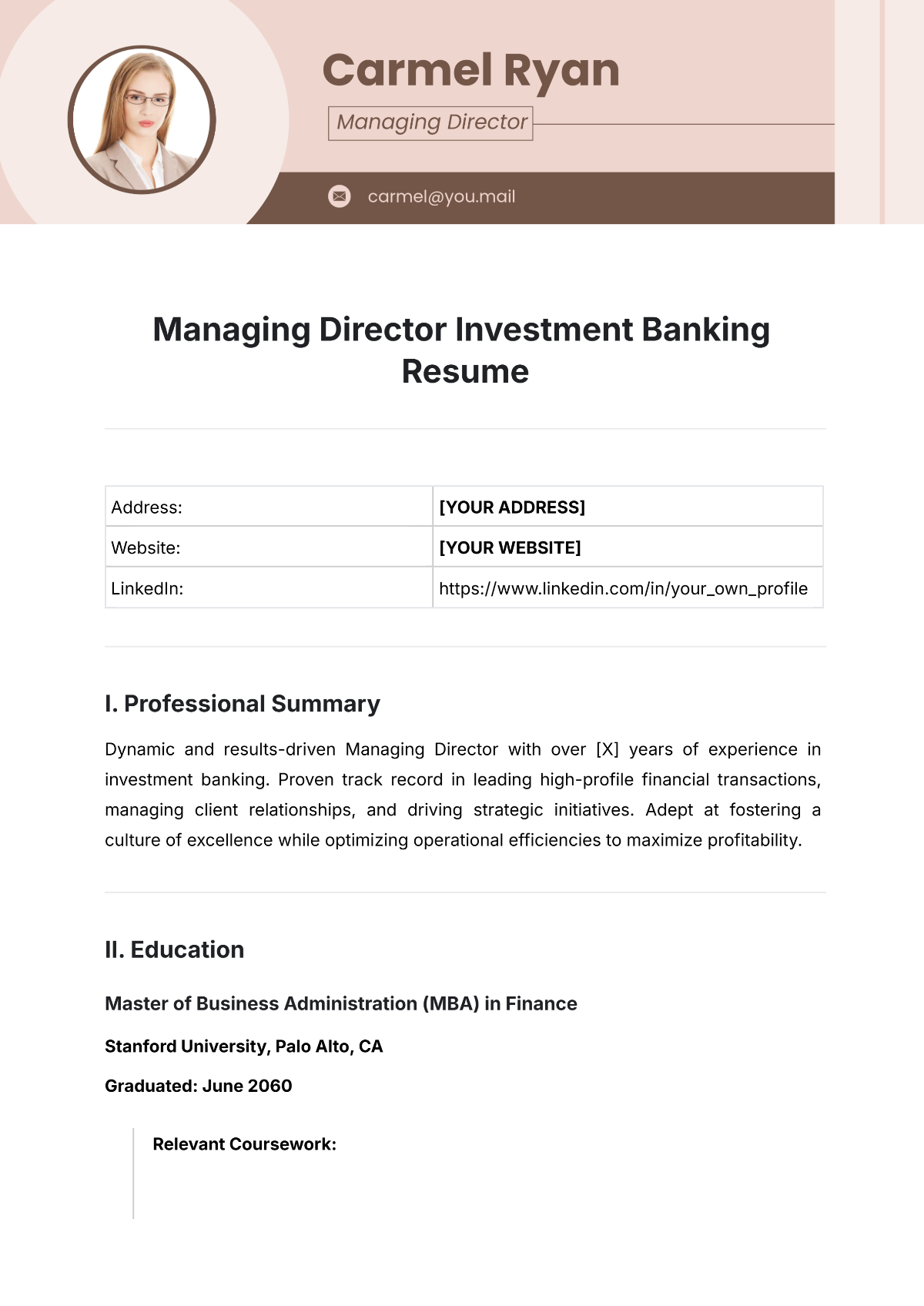

Free Managing Director Investment Banking Resume

Address: | [YOUR ADDRESS] |

Website: | [YOUR WEBSITE] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

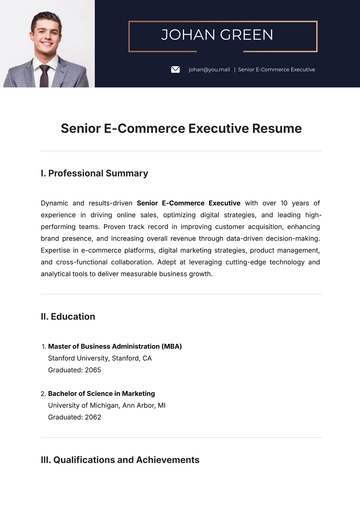

I. Professional Summary

Dynamic and results-driven Managing Director with over [X] years of experience in investment banking. Proven track record in leading high-profile financial transactions, managing client relationships, and driving strategic initiatives. Adept at fostering a culture of excellence while optimizing operational efficiencies to maximize profitability.

II. Education

Master of Business Administration (MBA) in Finance

Stanford University, Palo Alto, CA

Graduated: June 2060

Relevant Coursework:

Corporate Financial Strategies: Explored advanced techniques in financial analysis, risk management, and strategic planning for multinational corporations.

Investment Analysis and Portfolio Management: Gained in-depth knowledge of portfolio optimization, securities valuation, and asset allocation strategies.

Global Markets and Economic Policy: Examined the impact of global economic policies on financial markets and international investment strategies.

III. Professional Experience

Managing Director

Astro Capital Partners, New York, NY

June 2063 – Present

Lead all investment banking activities, including mergers and acquisitions, capital raising, and strategic financial advisory for Fortune 500 clients.

Manage a high-performing team of 20 professionals, fostering a culture of collaboration and professional development.

Build and sustain key client relationships, driving a 25% year-over-year increase in repeat business and client satisfaction.

Vice President, Investment Banking

Summit Financial Group, Boston, MA

March 2060 – May 2063

Spearheaded investment banking initiatives that contributed to a 30% growth in annual revenue over three years.

Successfully advised on five high-profile IPOs and secondary offerings, raising over $2.1 billion in capital for diverse client sectors.

Developed and implemented innovative strategies that captured a 15% market share growth within the technology sector.

IV. Qualifications

Expert in investment banking, specializing in advisory, M&A, and capital raising.

Proven leader and mentor who exceeds corporate and client goals.

Strategic financial market expert.

Strong track record of successfully closing multimillion-dollar deals and transactions.

Proficient in financial modeling, valuation techniques, and risk management.

V. Achievements

Led 10 successful mergers and acquisitions with a combined value of over $15B.

Advised on 5 IPOs, raising more than $2B in capital for clients.

Boosted market share by 20% through strategic initiatives.

Achieved 95% client retention over 10 years.

VI. Skills

Technical Skills

Financial Modeling

Valuation Techniques

Risk Management

Due Diligence

Interpersonal Skills

Leadership and Team Building

Client Relationship Management

Negotiation and Communication

Strategic Planning and Execution

VII. Additional Information

Member of the CFA Institute and Association for Corporate Growth.

Speaker at the Financial Leaders Conference [YEAR] and M&A Summit [YEAR].

Languages: Fluent in English and proficient in Spanish.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

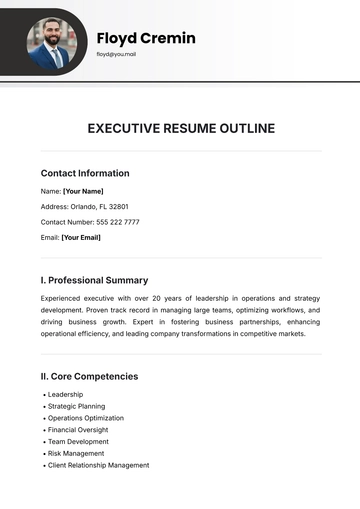

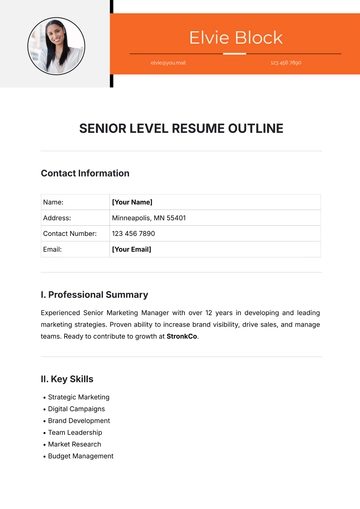

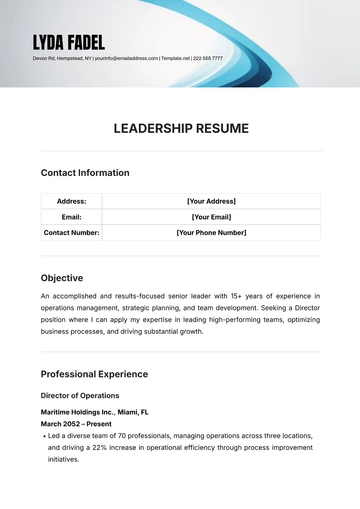

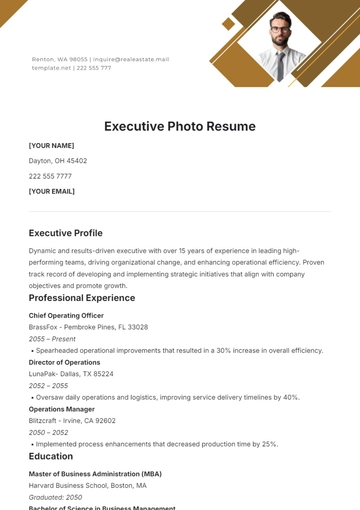

Crafting a Managing Director Investment Banking Resume involves highlighting extensive skills, experience, and qualifications in finance and leadership. Emphasize expertise in investment strategies, mergers and acquisitions, and capital markets. Showcase proficiency in leading teams, managing client relationships, and executing complex financial transactions. Detail experience in strategic planning, financial analysis, and regulatory compliance. Ensure clarity and organization throughout, demonstrating strong leadership and communication skills. Tailor the resume to specific job requirements to showcase your abilities effectively in the competitive investment banking industry.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume