School Cashflow Statement

Cash Flow Statement for the Year Ended December 31, 2050

Introduction

This Cash Flow Statement provides a detailed analysis of the cash inflows and outflows experienced by [Your Company Name] during the fiscal year ended December 31, 2050. This statement is an essential financial document that helps stakeholders understand the liquidity position of the school.

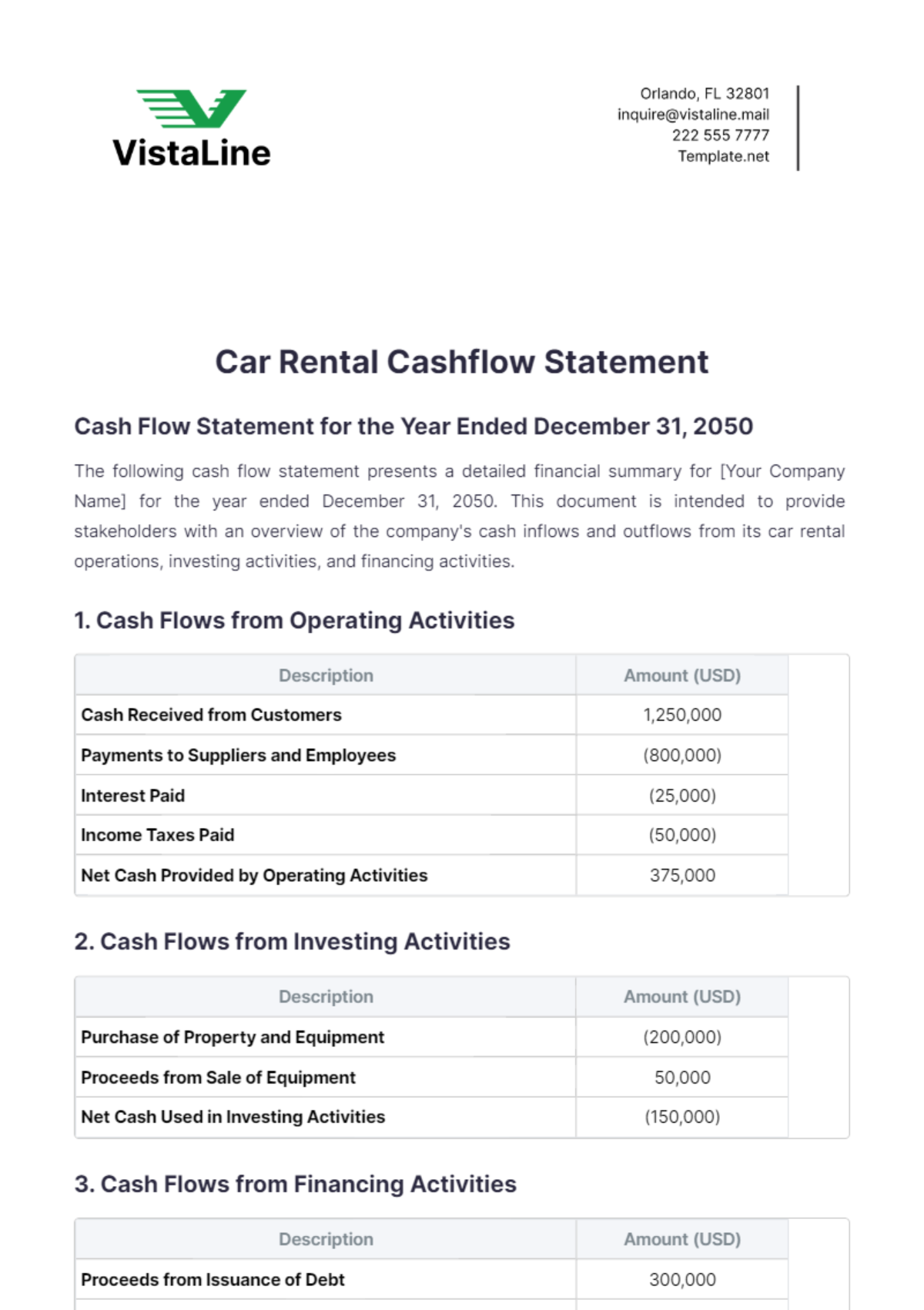

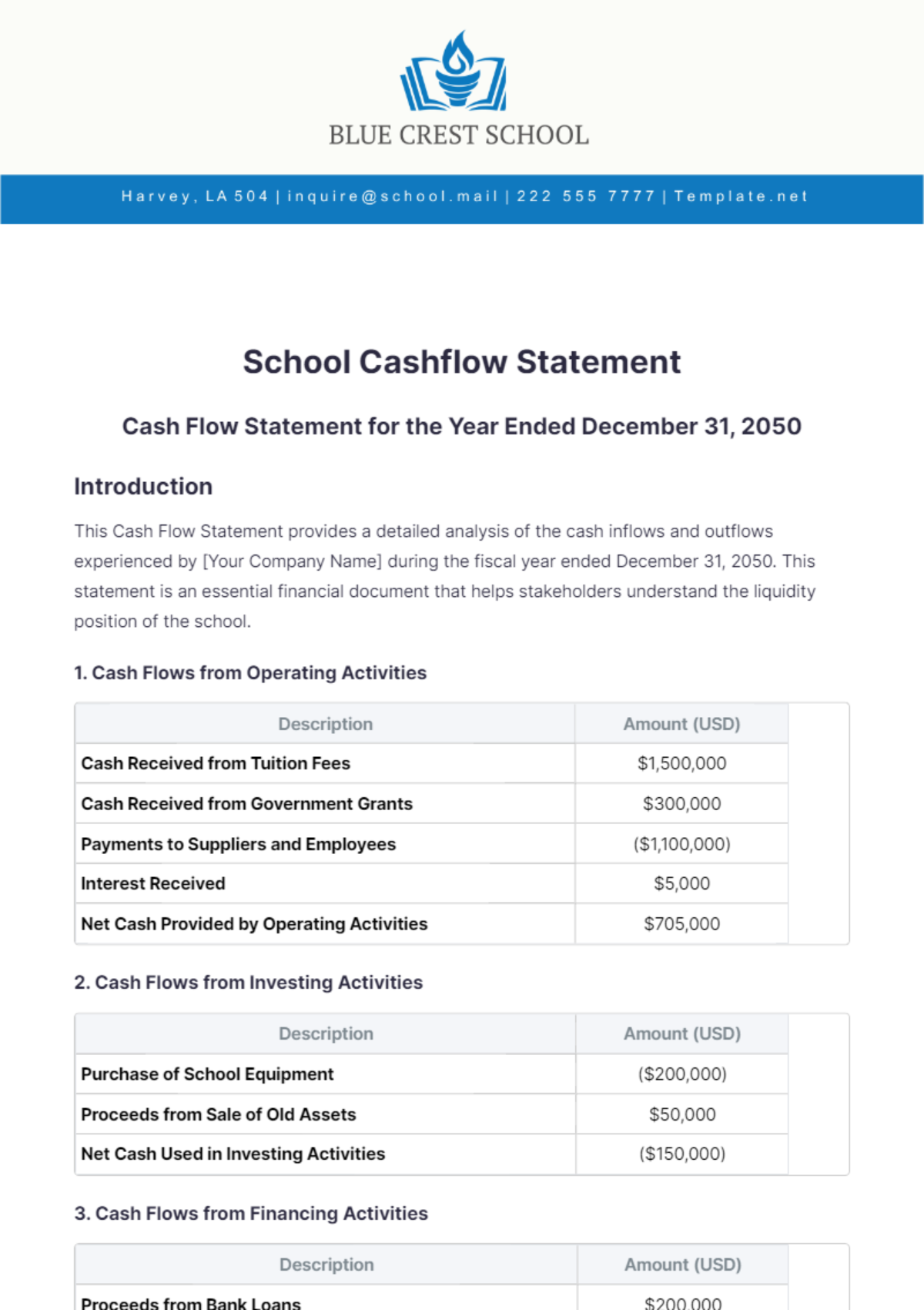

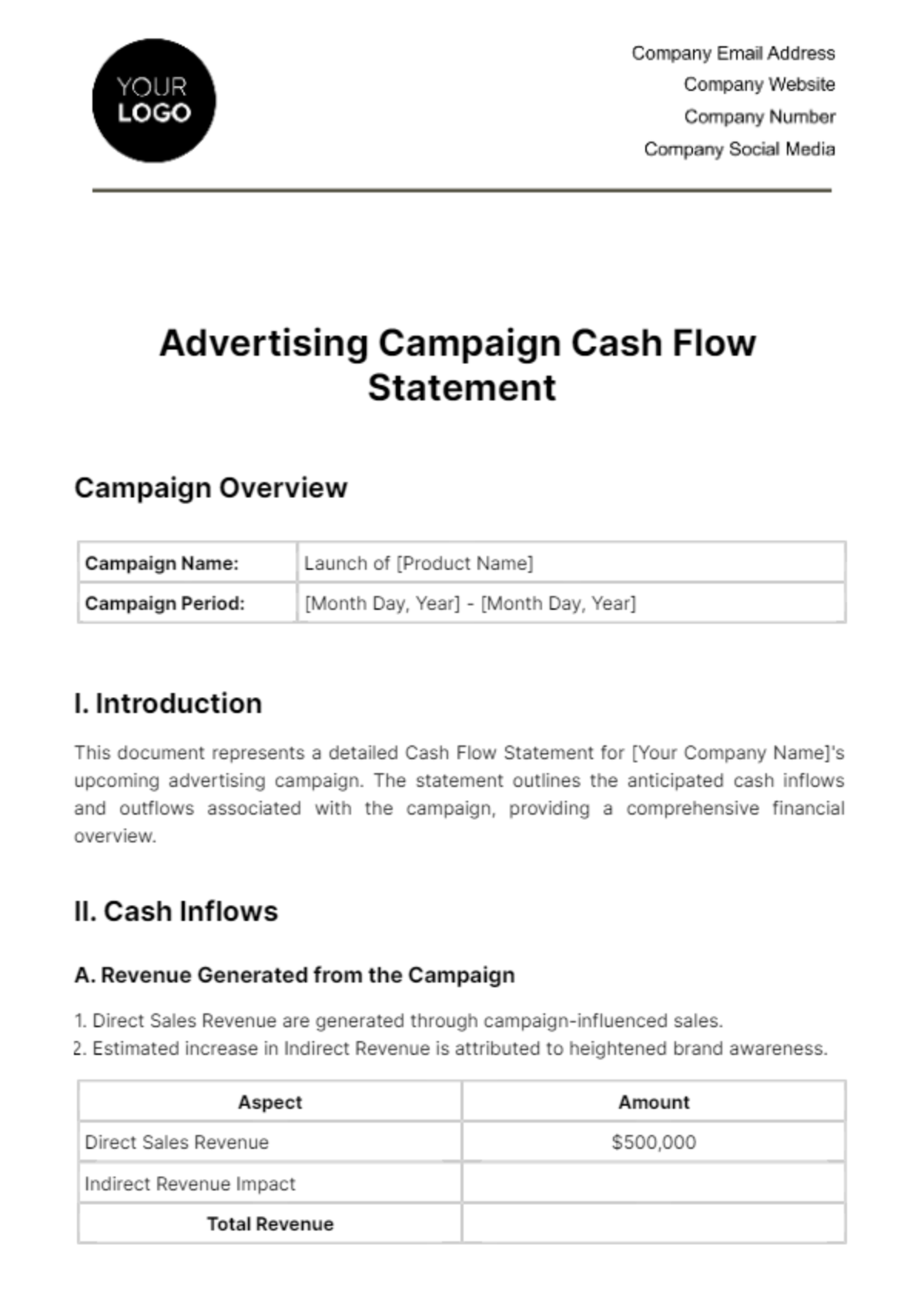

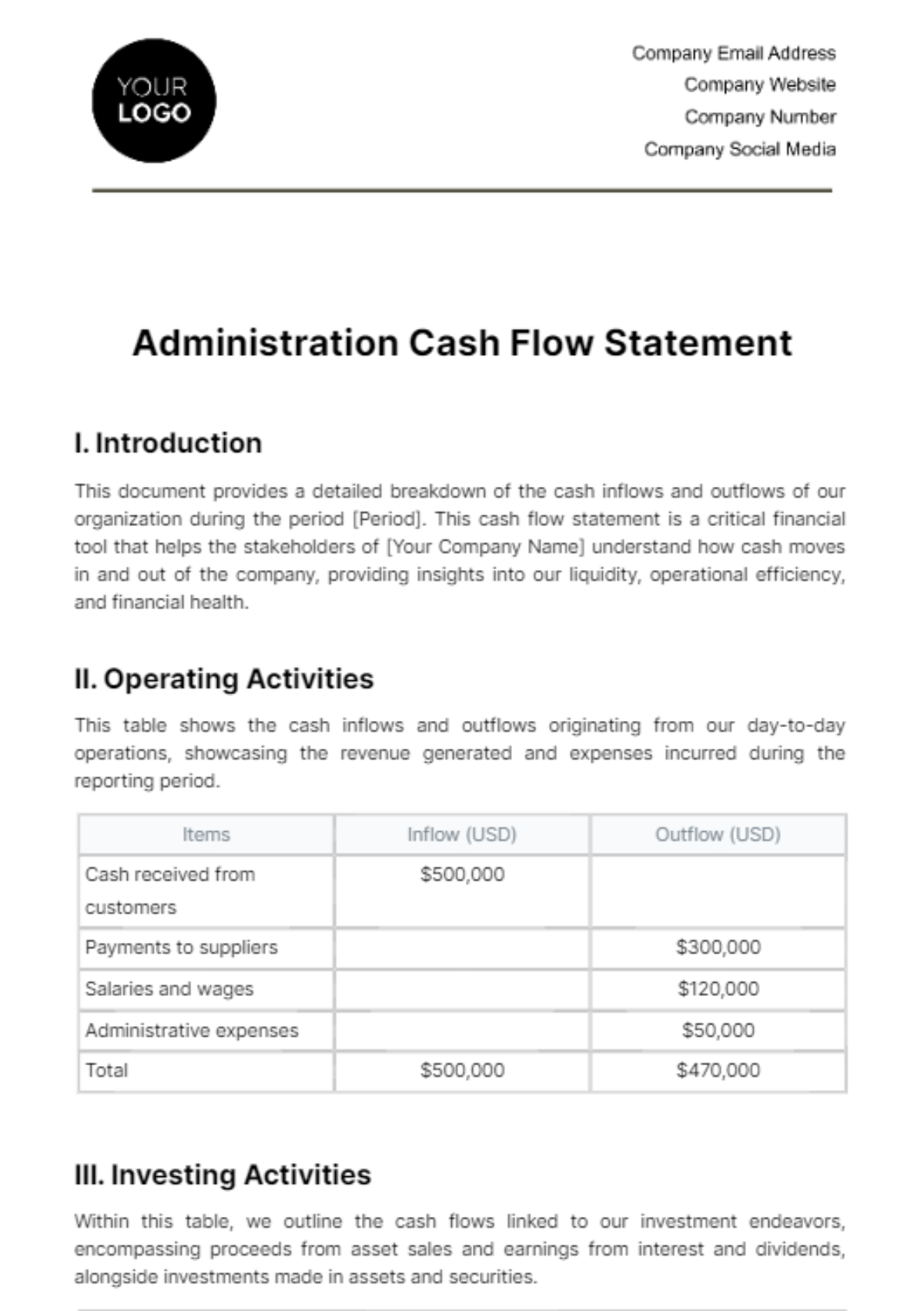

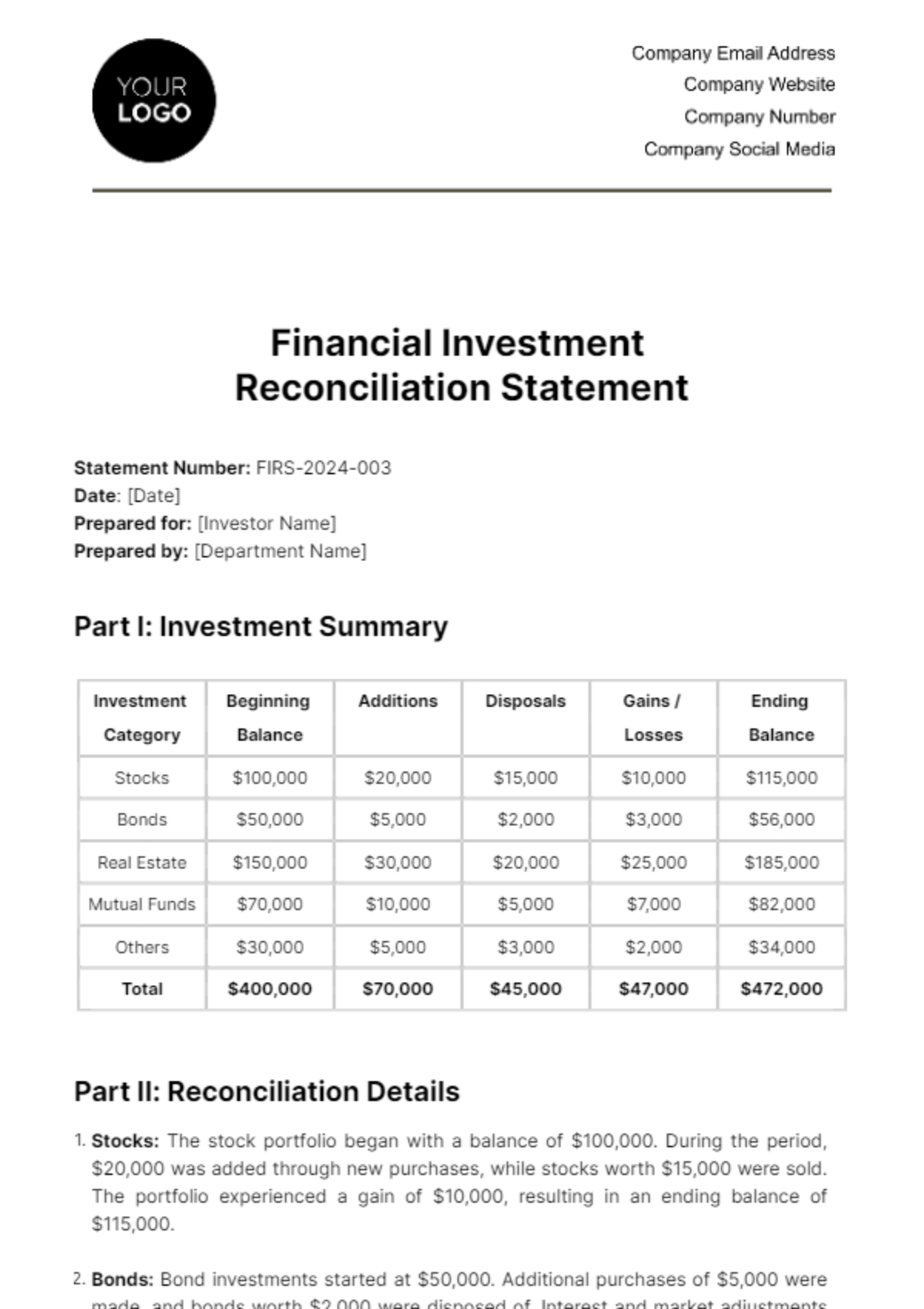

1. Cash Flows from Operating Activities

Description | Amount (USD) |

|---|---|

Cash Received from Tuition Fees | $1,500,000 |

Cash Received from Government Grants | $300,000 |

Payments to Suppliers and Employees | ($1,100,000) |

Interest Received | $5,000 |

Net Cash Provided by Operating Activities | $705,000 |

2. Cash Flows from Investing Activities

Description | Amount (USD) |

|---|---|

Purchase of School Equipment | ($200,000) |

Proceeds from Sale of Old Assets | $50,000 |

Net Cash Used in Investing Activities | ($150,000) |

3. Cash Flows from Financing Activities

Description | Amount (USD) |

|---|---|

Proceeds from Bank Loans | $200,000 |

Repayments of Bank Loans | ($100,000) |

Net Cash Provided by Financing Activities | $100,000 |

4. Net Increase in Cash and Cash Equivalents

Description | Amount (USD) |

|---|---|

Net Cash at Beginning of Period | $250,000 |

Net Increase in Cash and Cash Equivalents | $655,000 |

Net Cash at End of Period | $905,000 |

Conclusion

The Cash Flow Statement for [Your Company Name] for the year ended December 31, 2050, shows a positive net increase in cash and cash equivalents, reflecting robust management of cash inflows and outflows. The school remains in a healthy financial position to support its educational mission and future investments.

Prepared by:

[Your Name]

Finance Director, [Your Company Name]

[Your Email]

[Your Company Number]