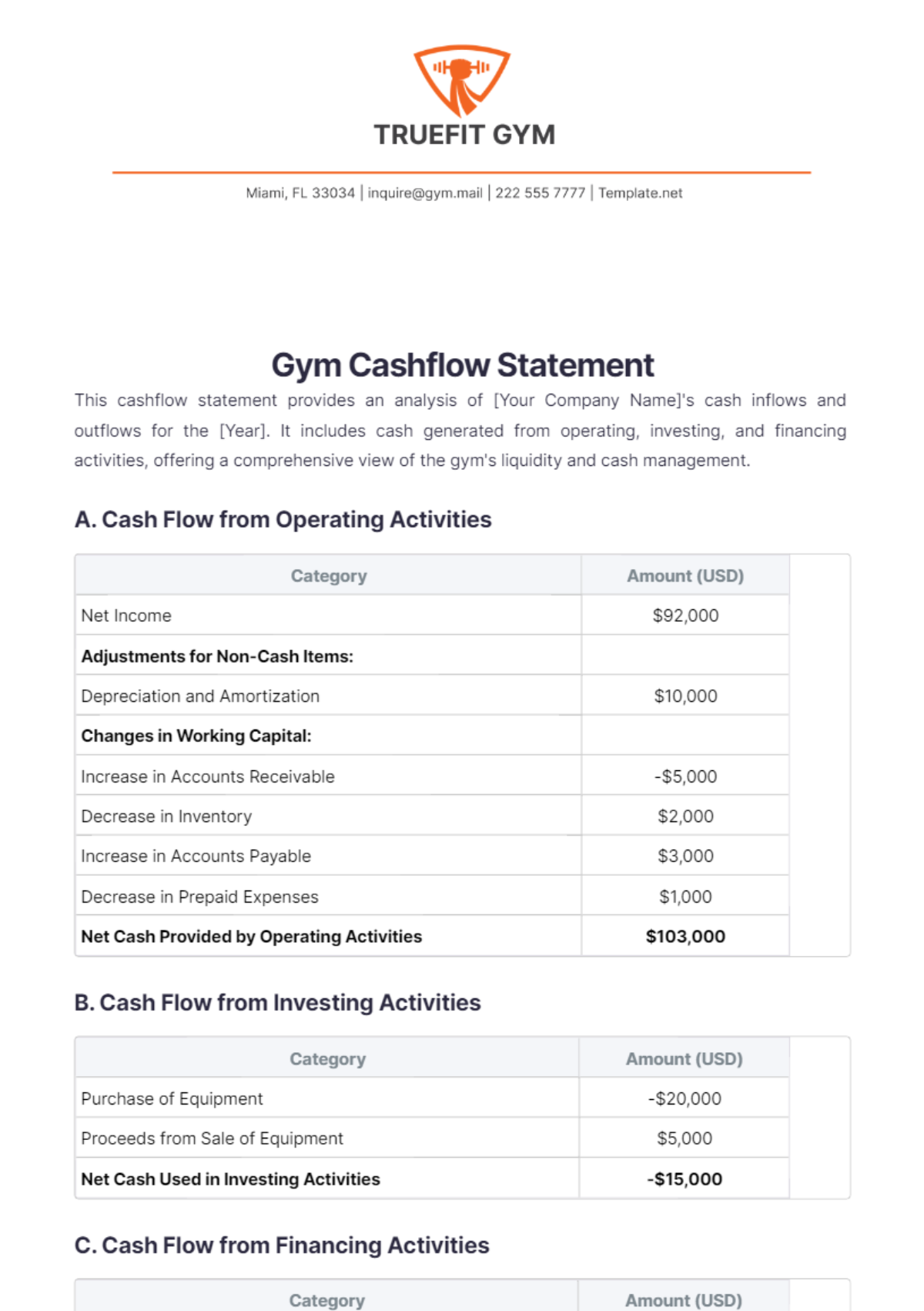

Gym Cashflow Statement

This cashflow statement provides an analysis of [Your Company Name]'s cash inflows and outflows for the [Year]. It includes cash generated from operating, investing, and financing activities, offering a comprehensive view of the gym's liquidity and cash management.

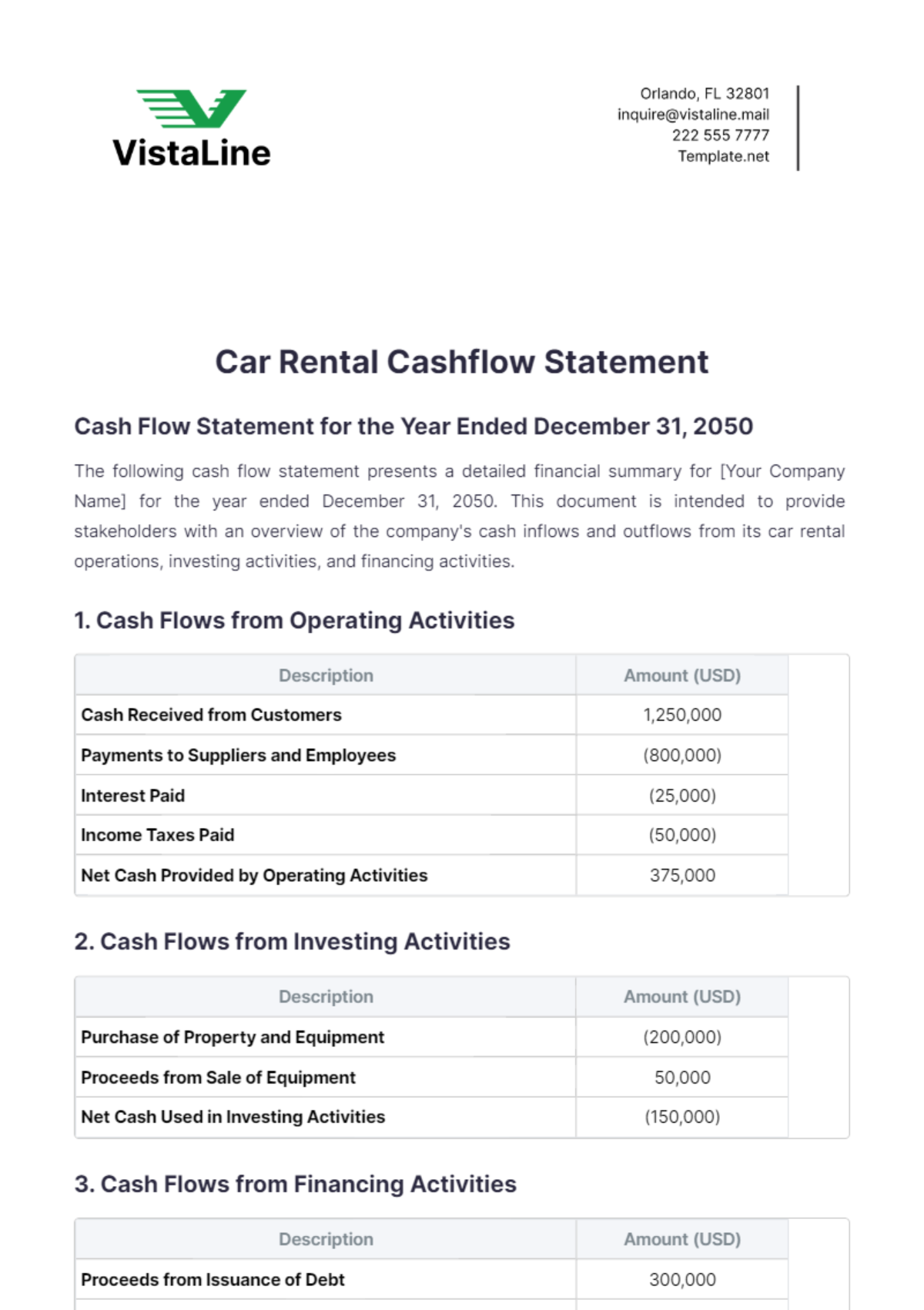

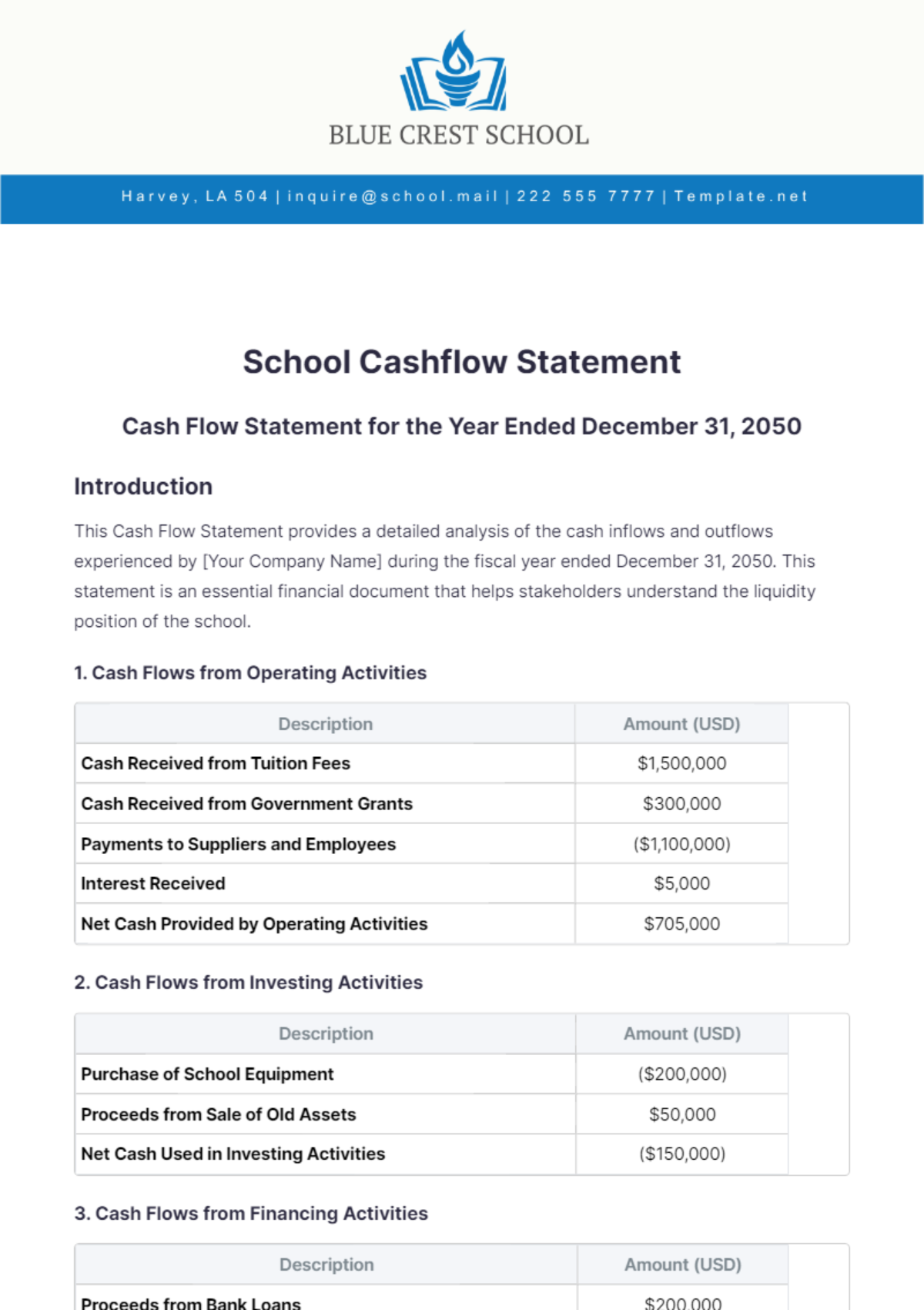

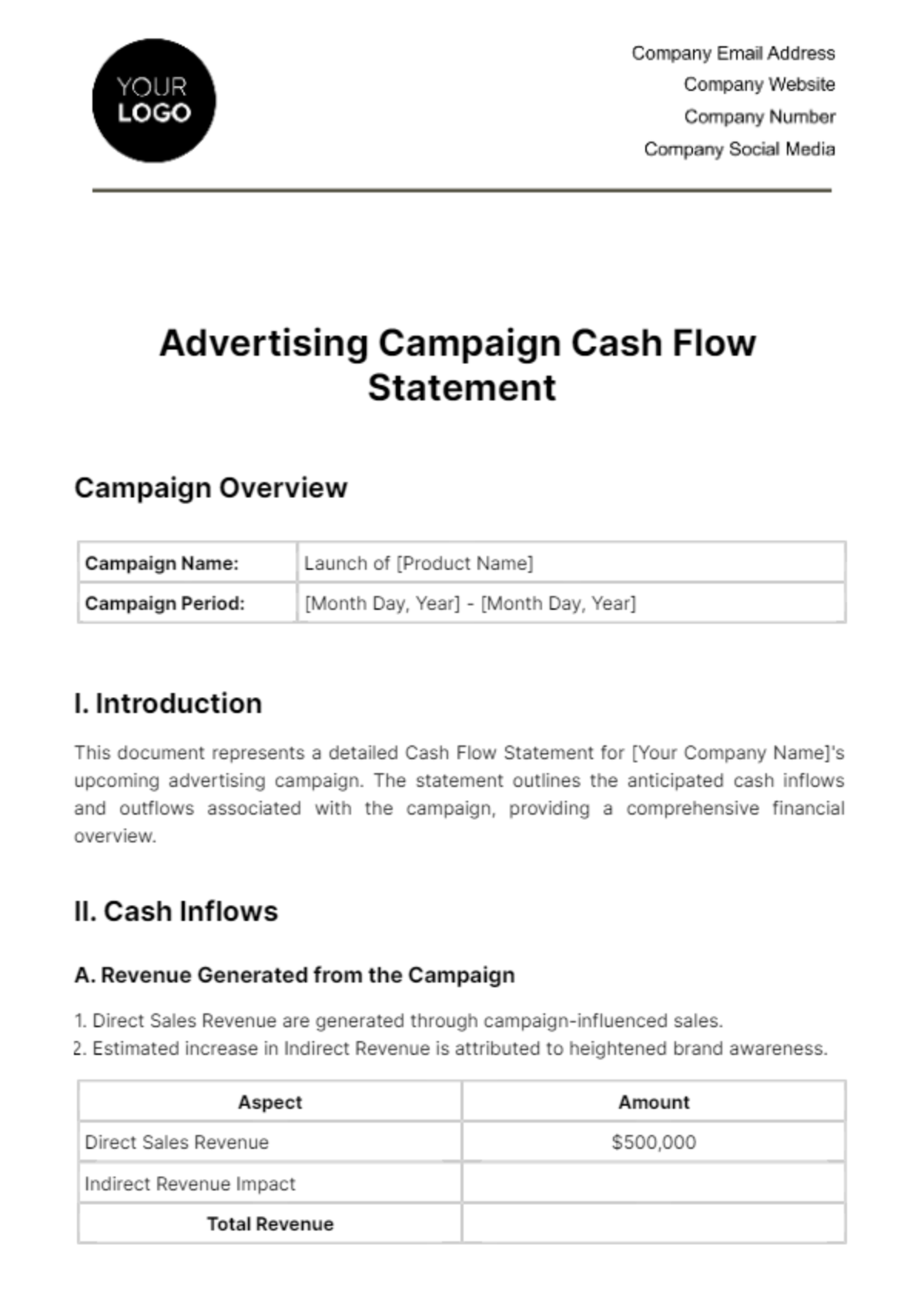

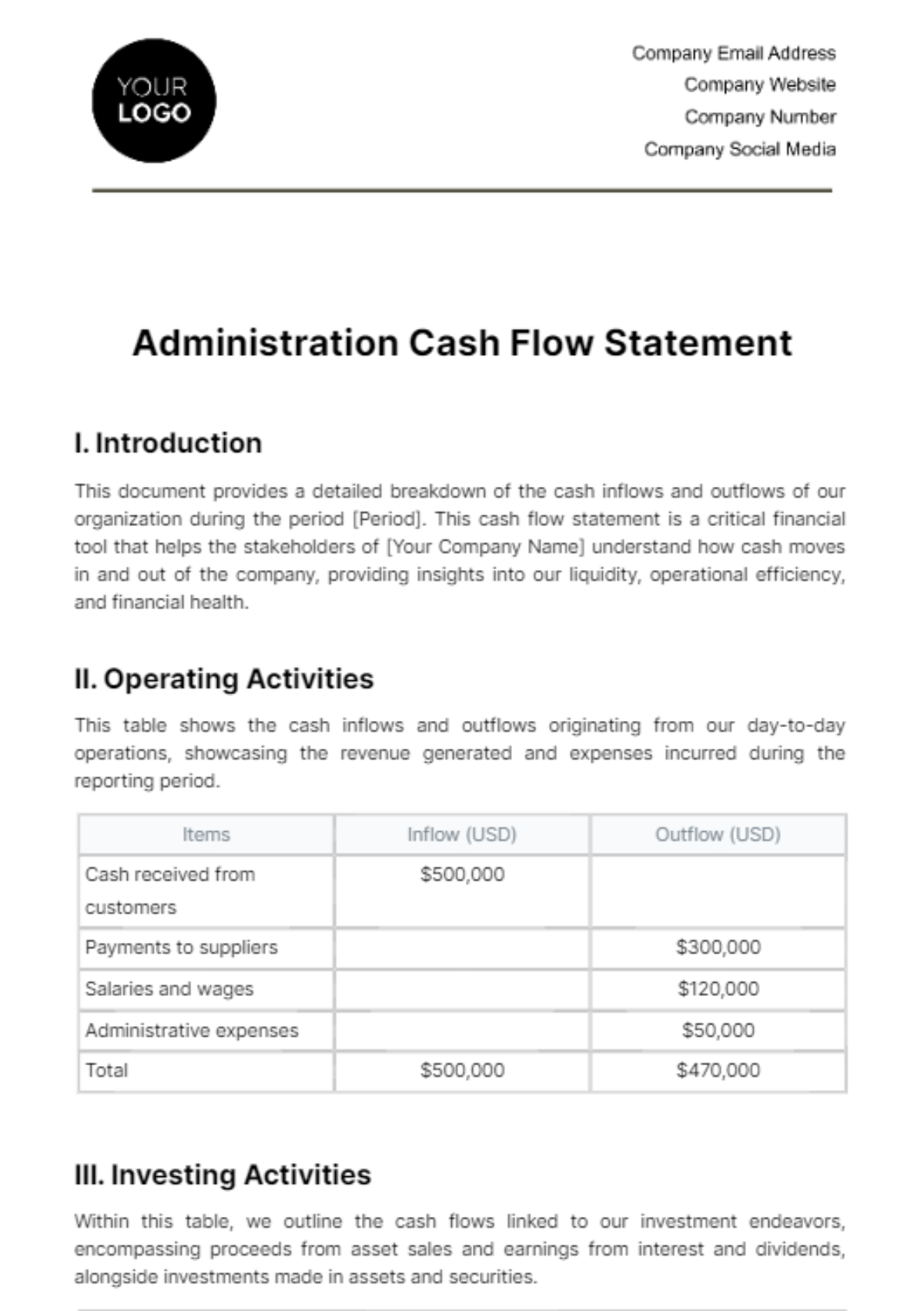

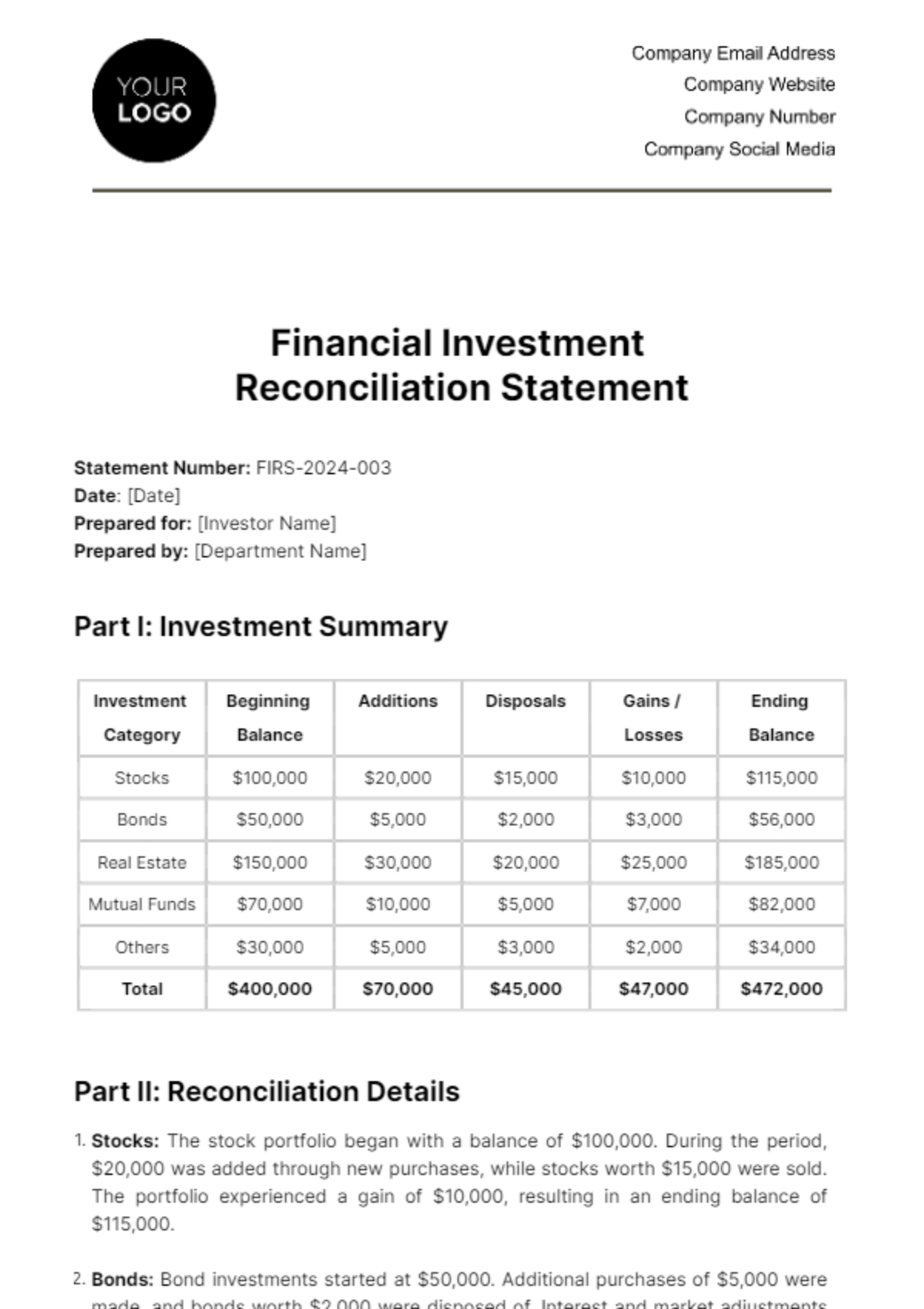

A. Cash Flow from Operating Activities

Category | Amount (USD) |

|---|---|

Net Income | $92,000 |

Adjustments for Non-Cash Items: | |

Depreciation and Amortization | $10,000 |

Changes in Working Capital: | |

Increase in Accounts Receivable | -$5,000 |

Decrease in Inventory | $2,000 |

Increase in Accounts Payable | $3,000 |

Decrease in Prepaid Expenses | $1,000 |

Net Cash Provided by Operating Activities | $103,000 |

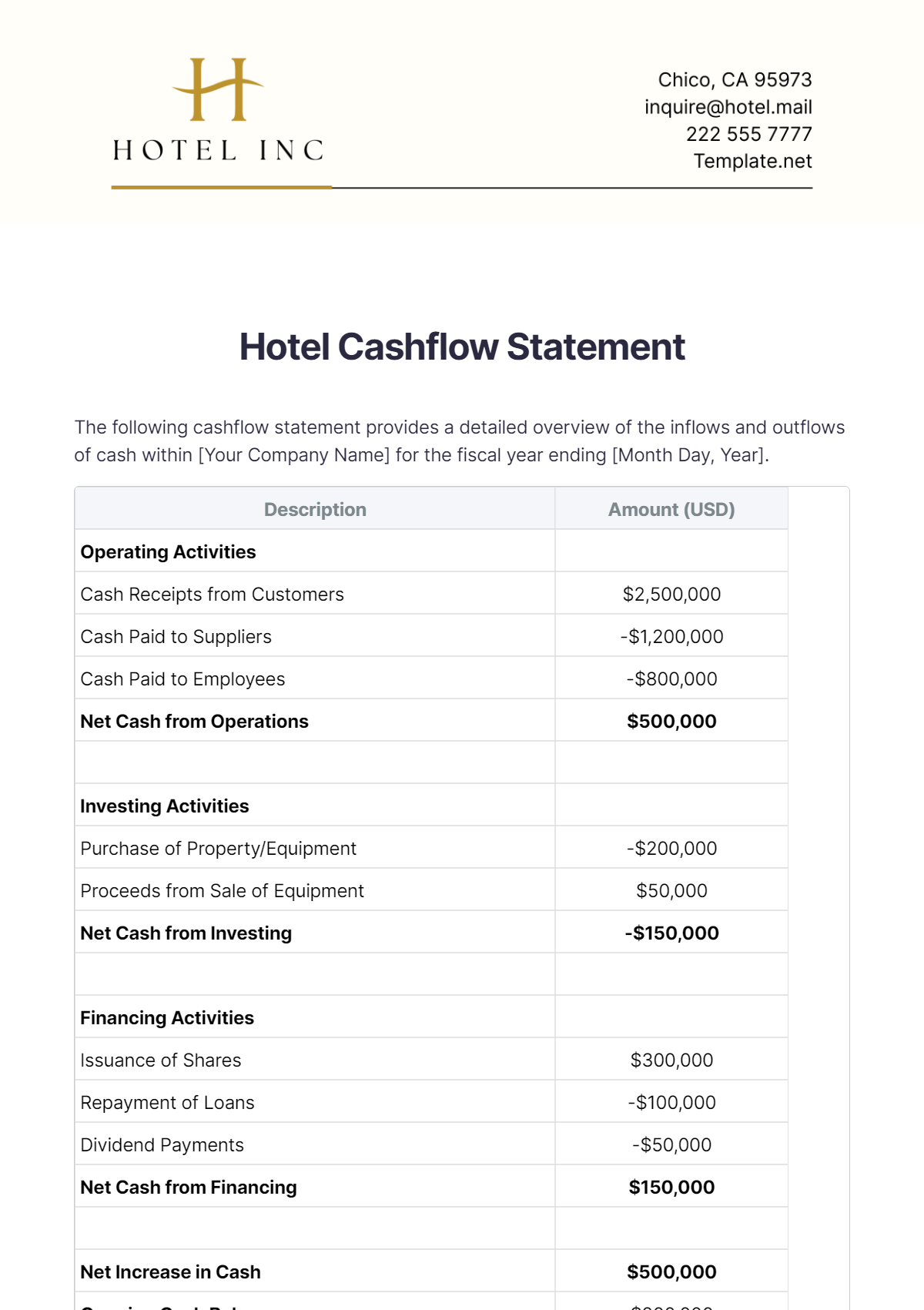

B. Cash Flow from Investing Activities

Category | Amount (USD) |

|---|---|

Purchase of Equipment | -$20,000 |

Proceeds from Sale of Equipment | $5,000 |

Net Cash Used in Investing Activities | -$15,000 |

C. Cash Flow from Financing Activities

Category | Amount (USD) |

|---|---|

Proceeds from Issuance of Common Stock | $30,000 |

Repayment of Long-term Debt | -$10,000 |

Payment of Dividends | -$5,000 |

Net Cash Provided by Financing Activities | $15,000 |

D. Net Increase in Cash and Cash Equivalents

Category | Amount (USD) |

|---|---|

Net Cash Provided by Operating Activities | $103,000 |

Net Cash Used in Investing Activities | -$15,000 |

Net Cash Provided by Financing Activities | $15,000 |

Net Increase in Cash and Cash Equivalents | $103,000 |

E. Cash and Cash Equivalents at the Beginning of Period

Category | Amount (USD) |

|---|---|

Cash and Cash Equivalents, [Month Day, Year] | $20,000 |

Cash and Cash Equivalents at End of Period | $123,000 |

This statement shows that [Your Company Name] has effectively managed its cash resources, resulting in a net increase in cash and cash equivalents of $103,000 by the end of [Year]. This strong cash position will support ongoing operations and future growth initiatives.