Gym Financial Statement

[Your Company Name]

Financial Statements

For the Year Ended December 31, 2050

[Your Company Address] |

|---|

Phone: [Your Company Number] |

Email: [Your Company Email] |

Website: [Your Company Website] |

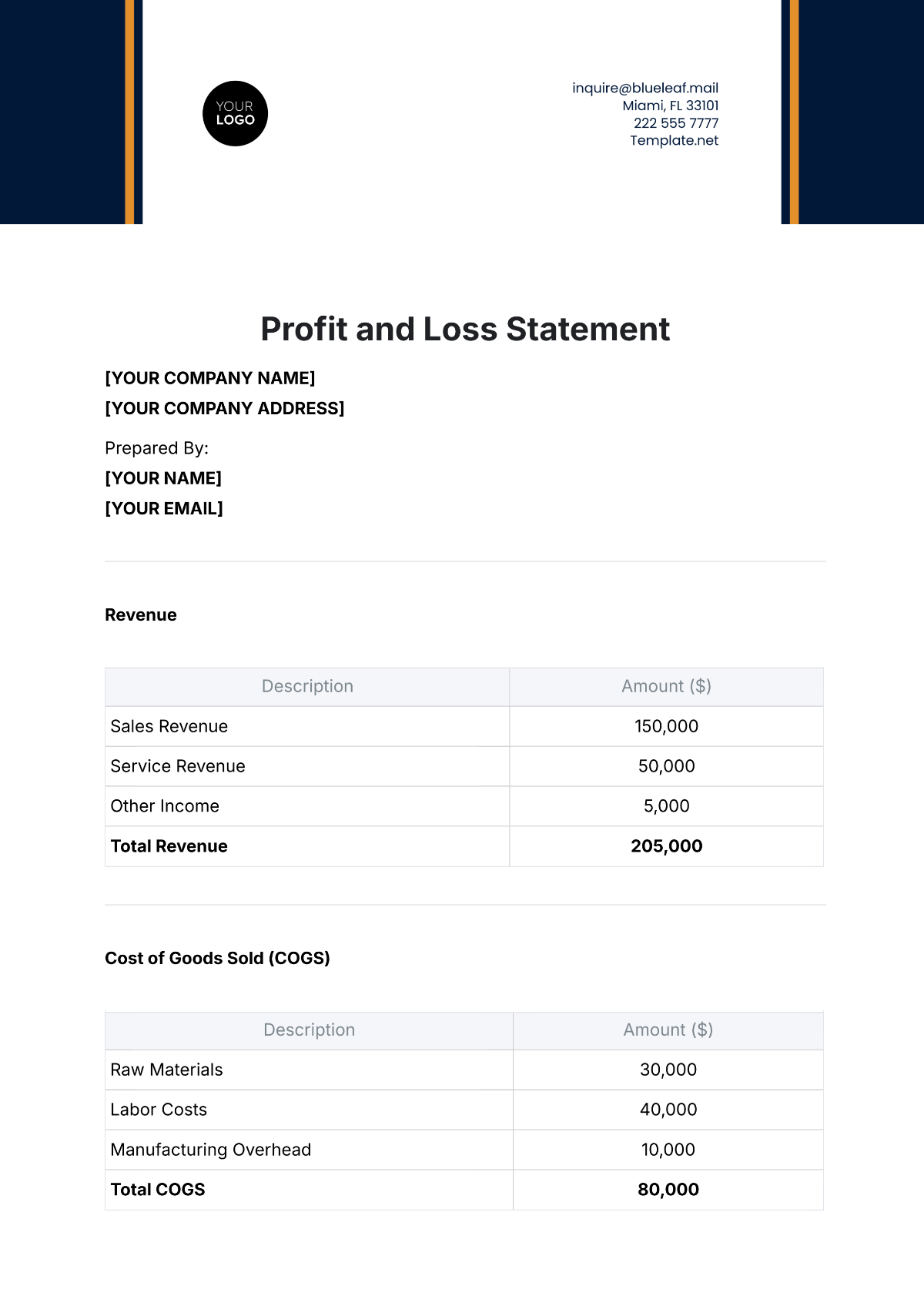

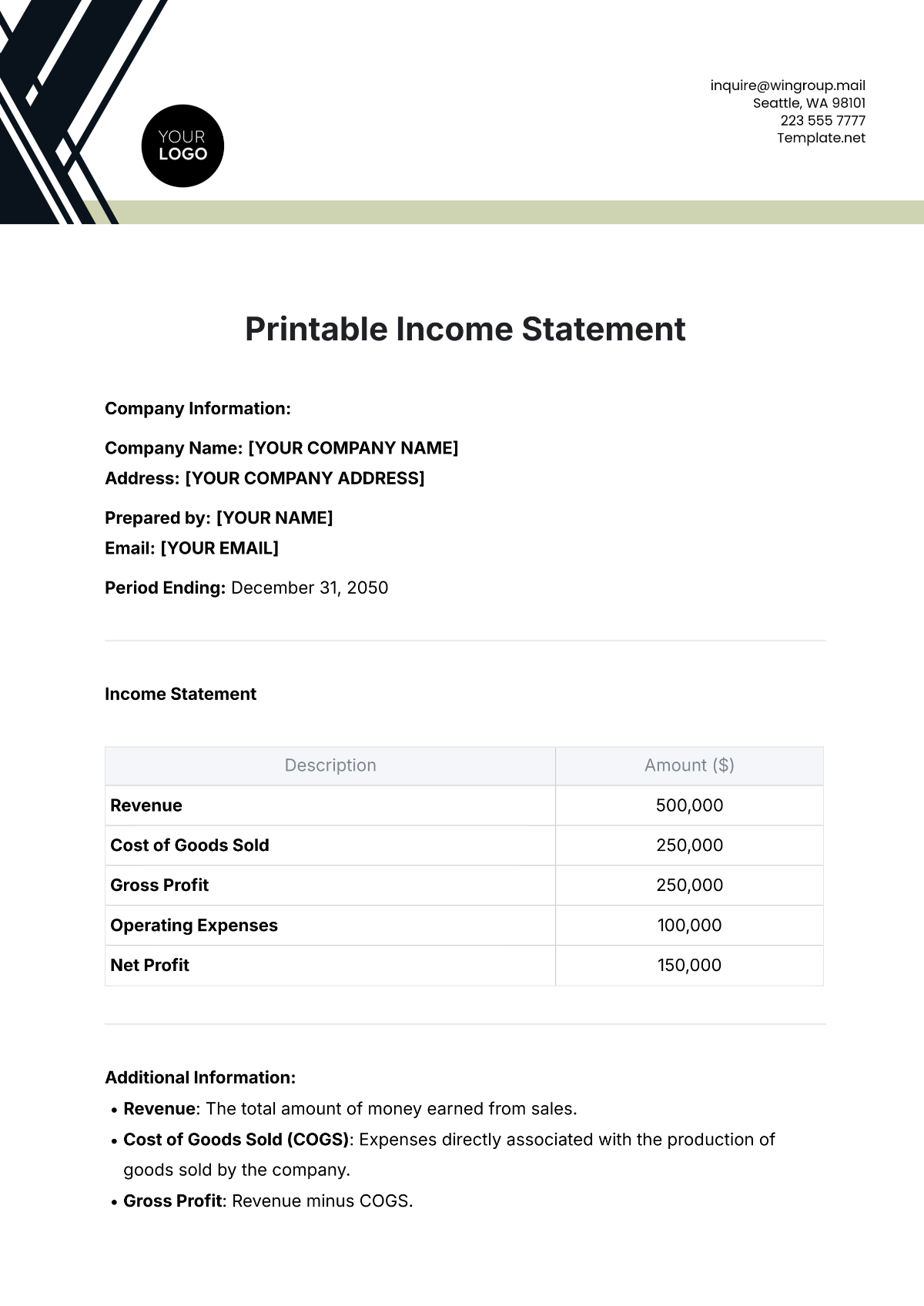

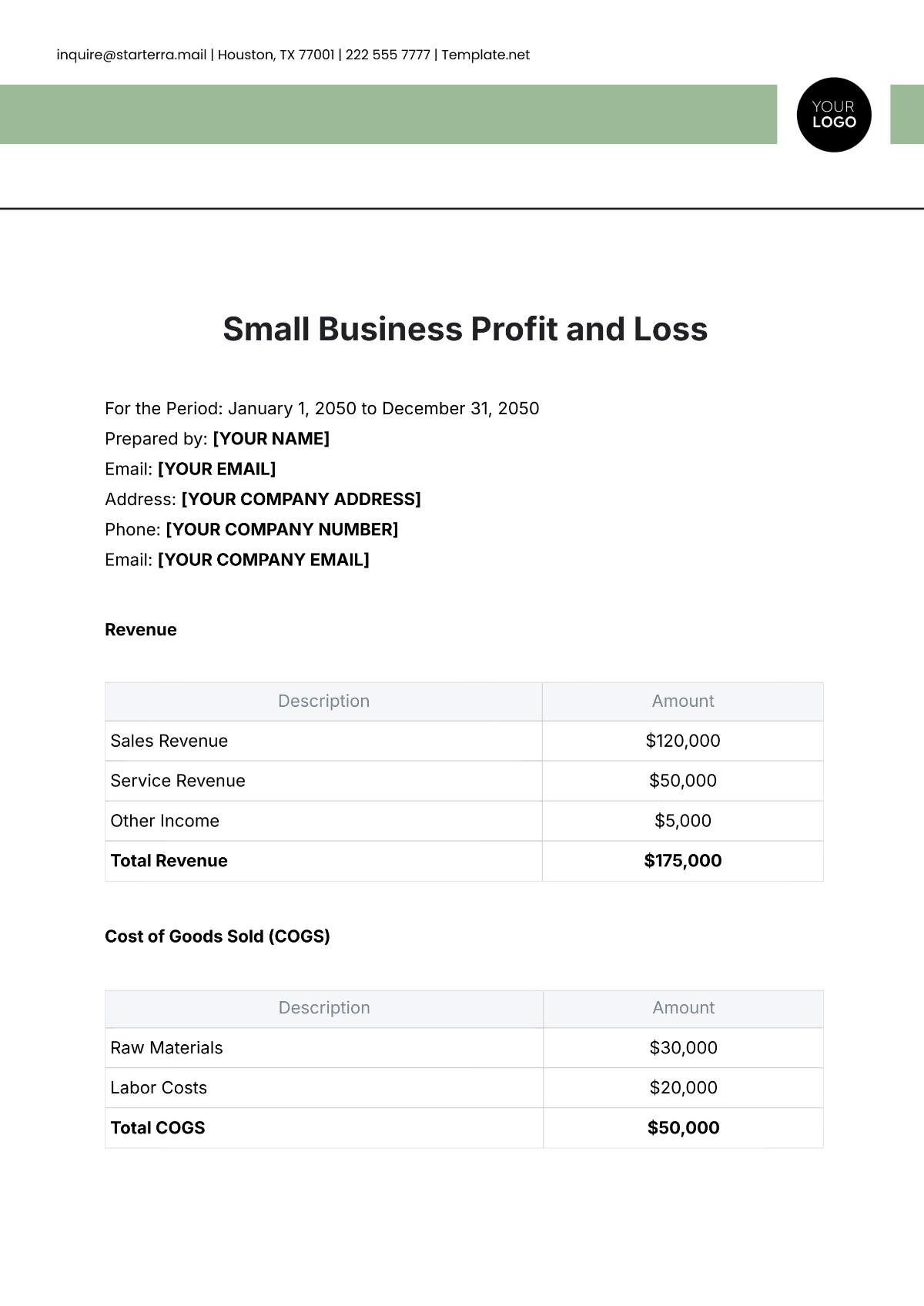

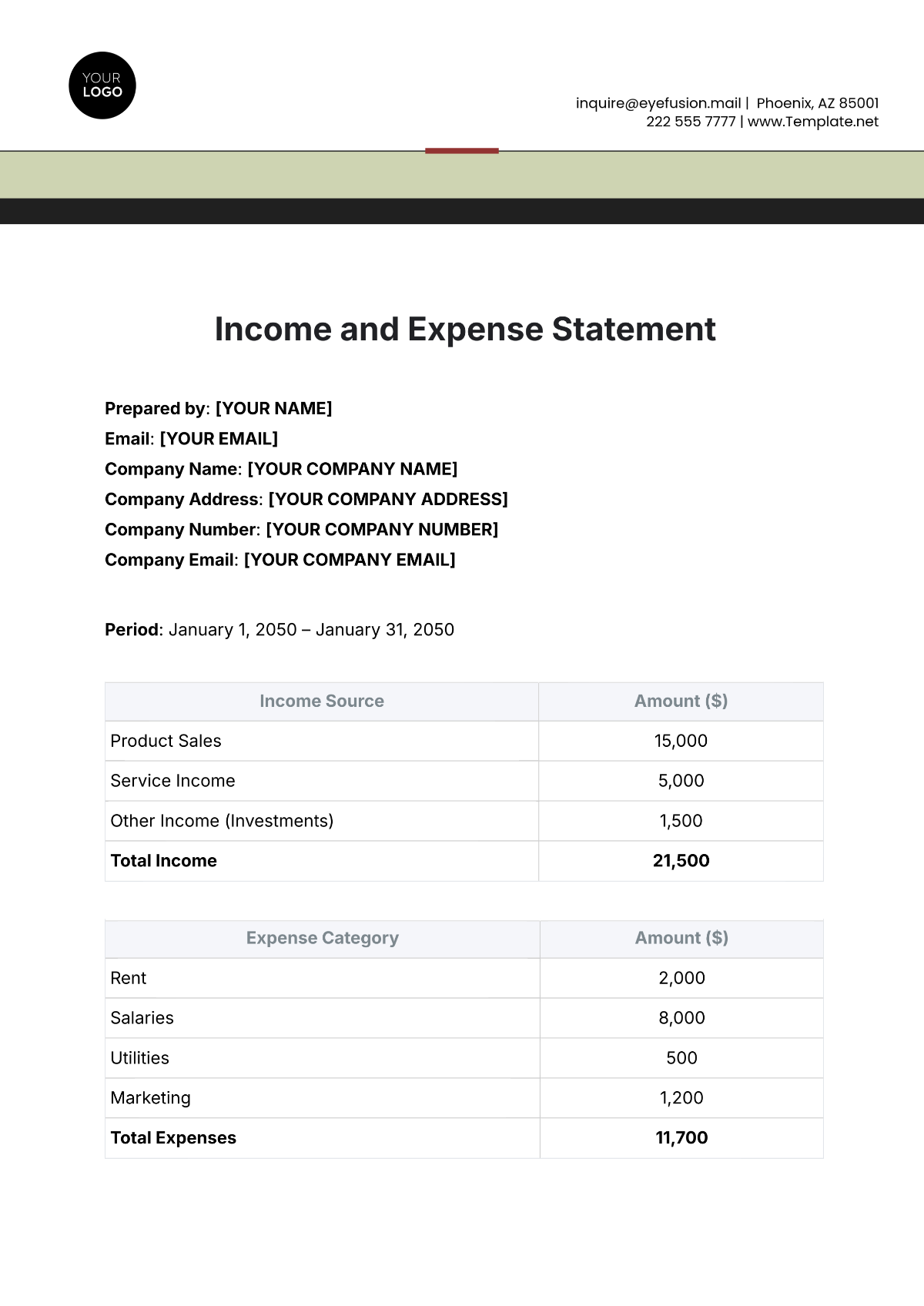

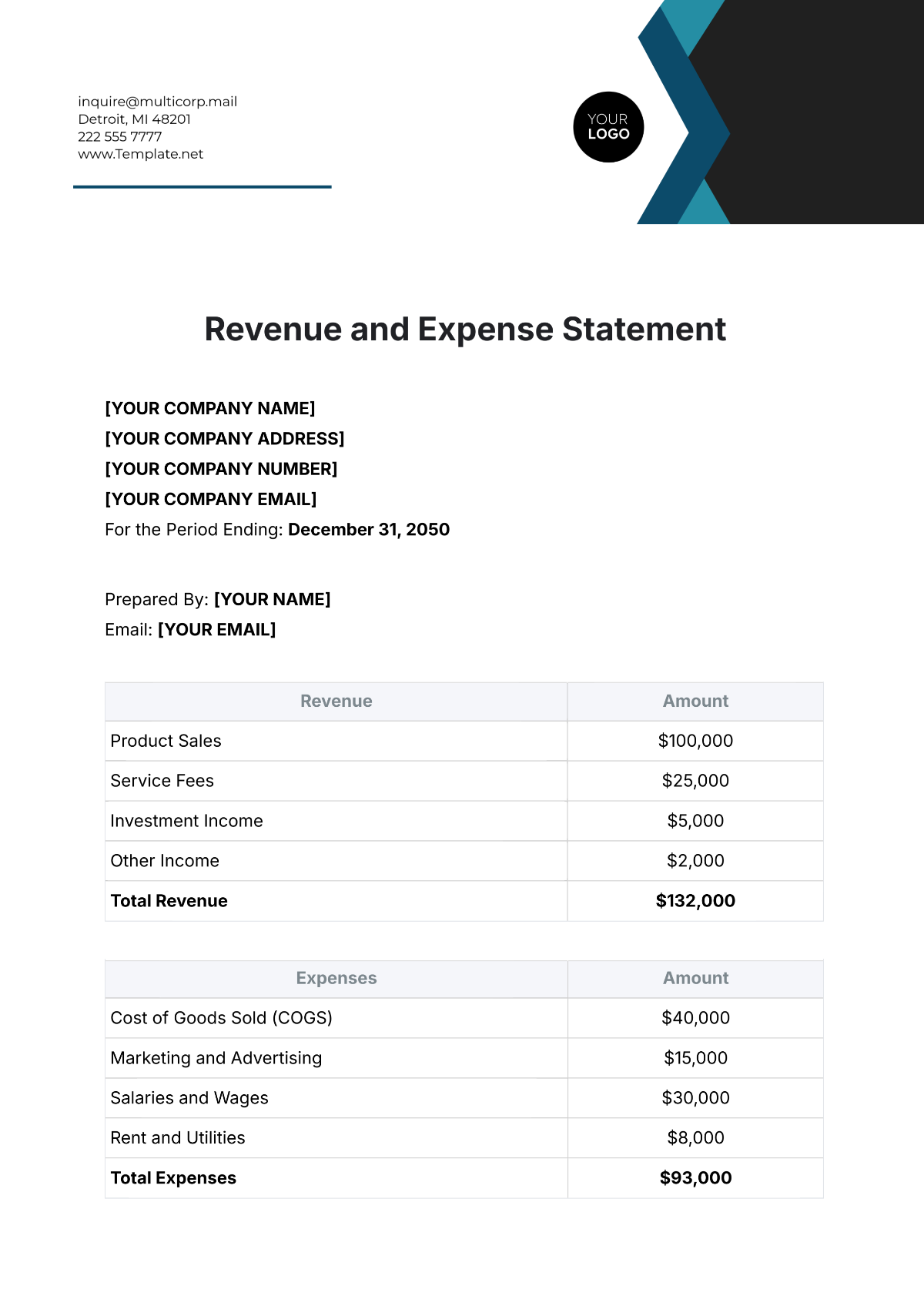

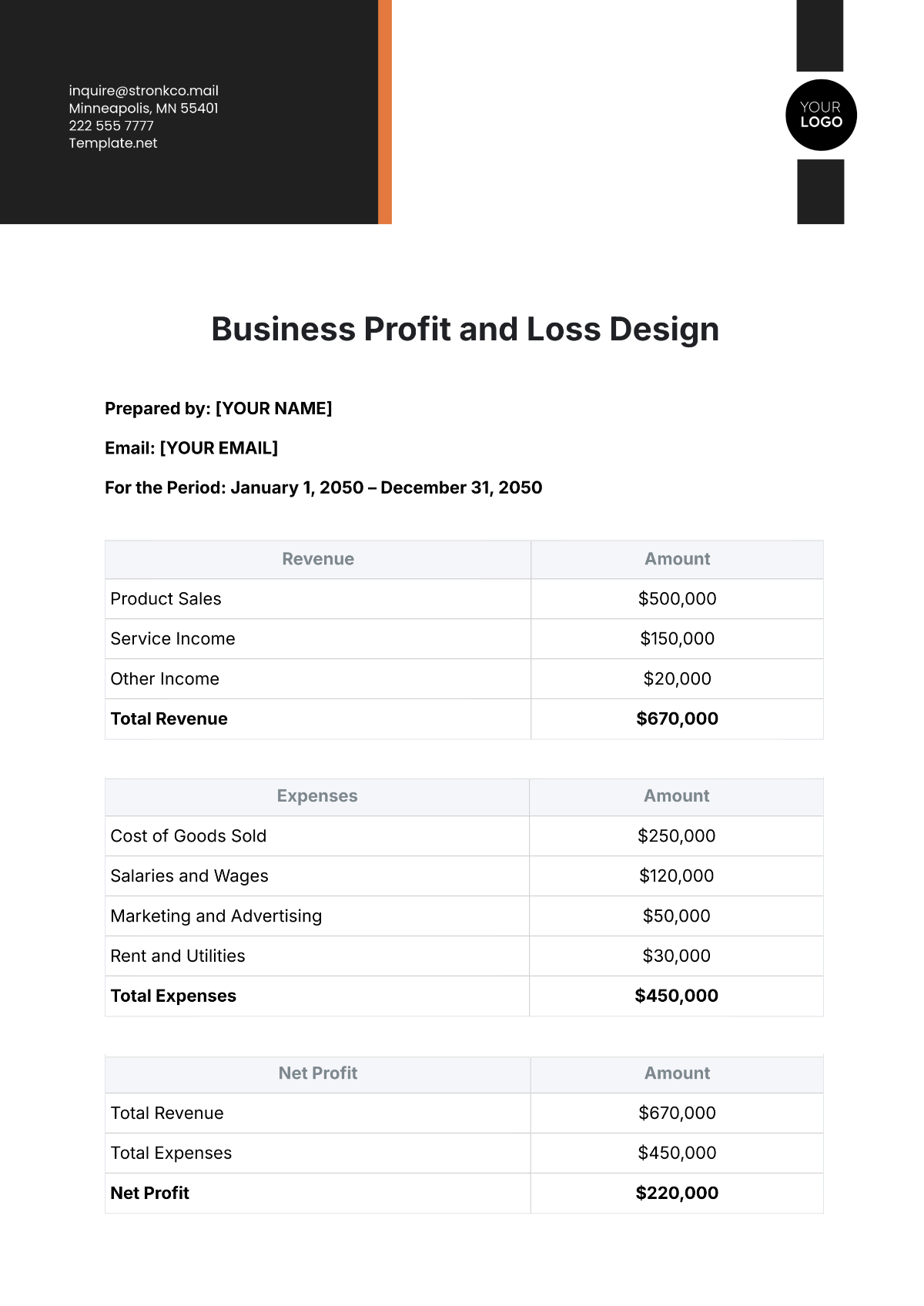

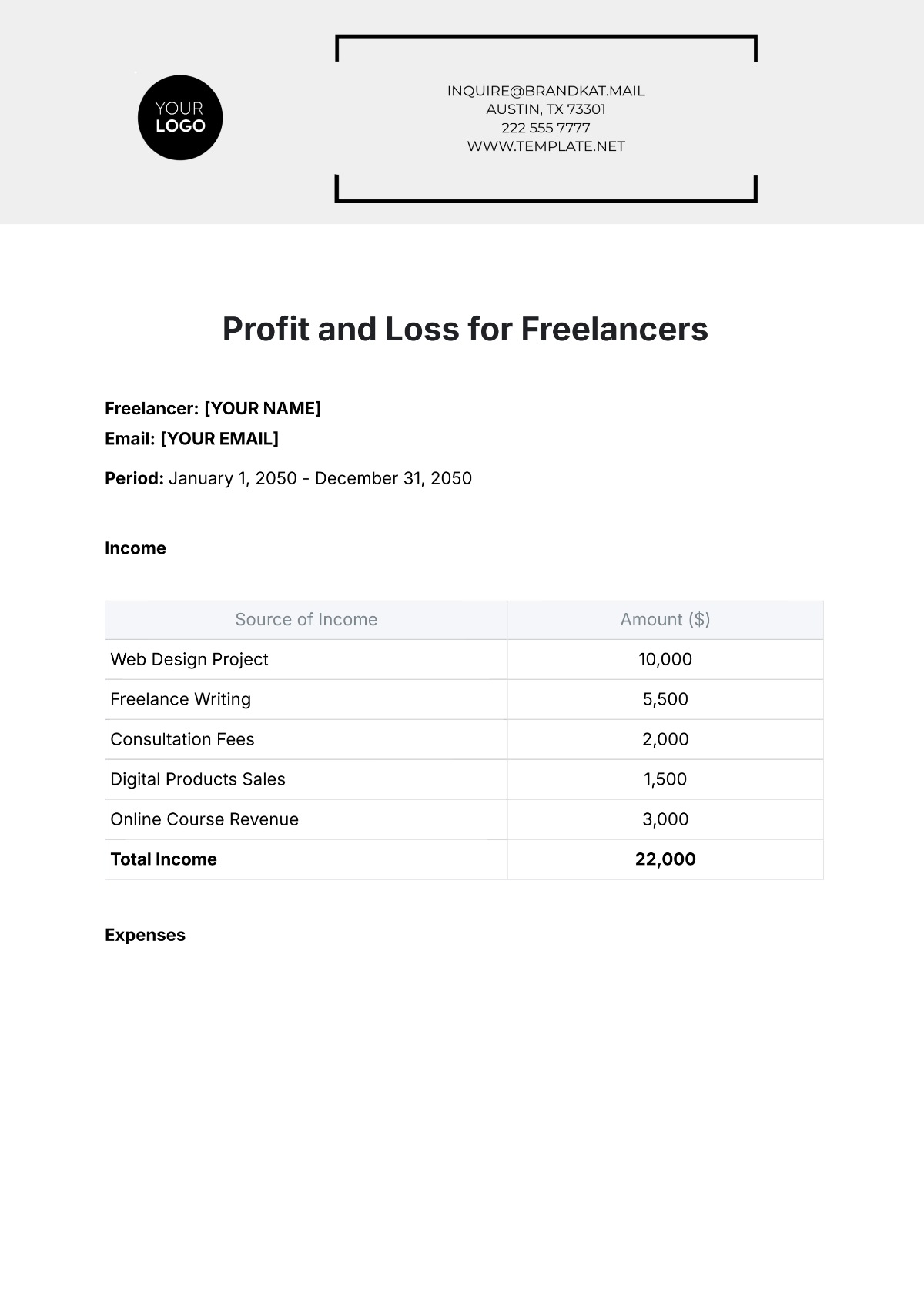

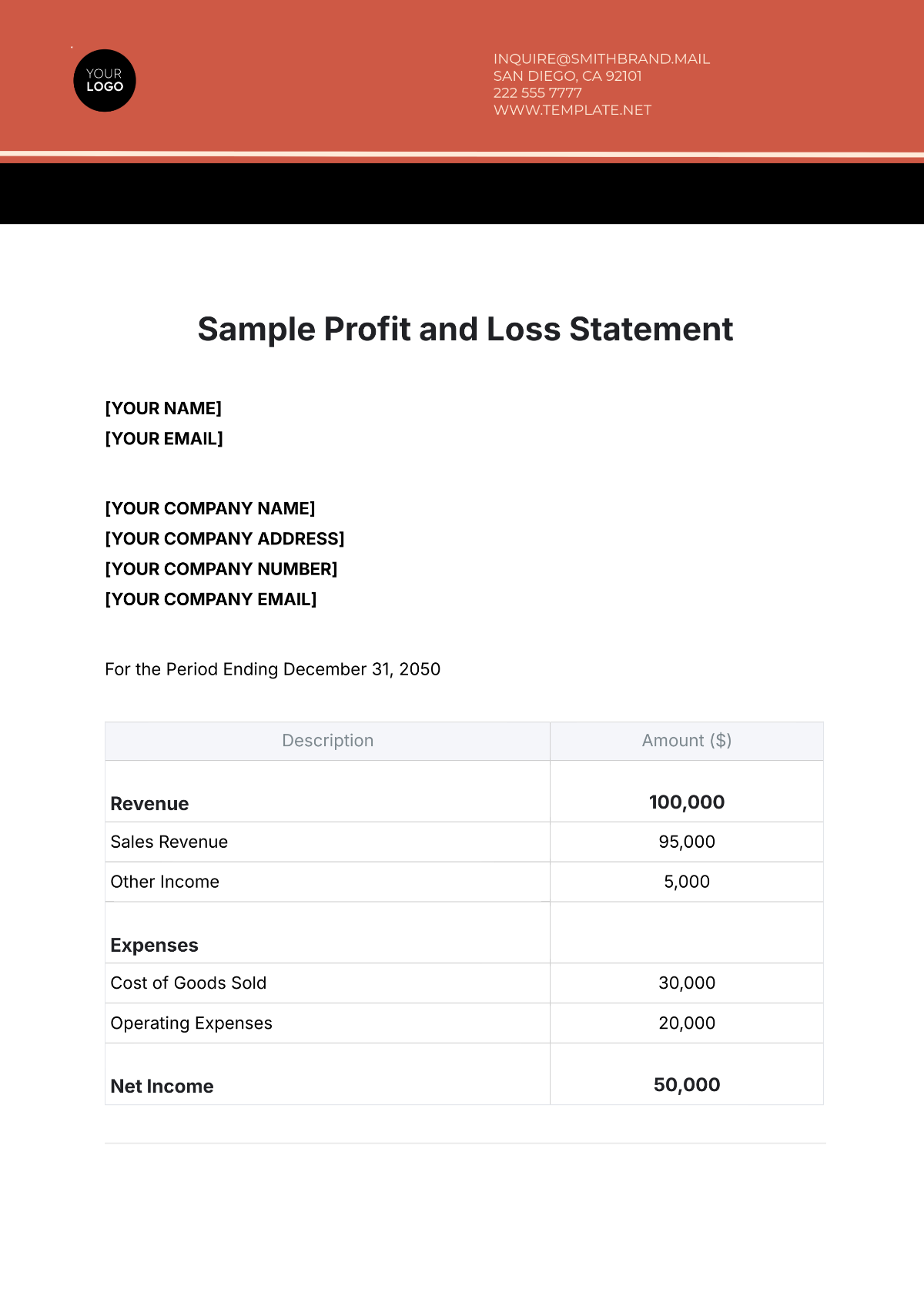

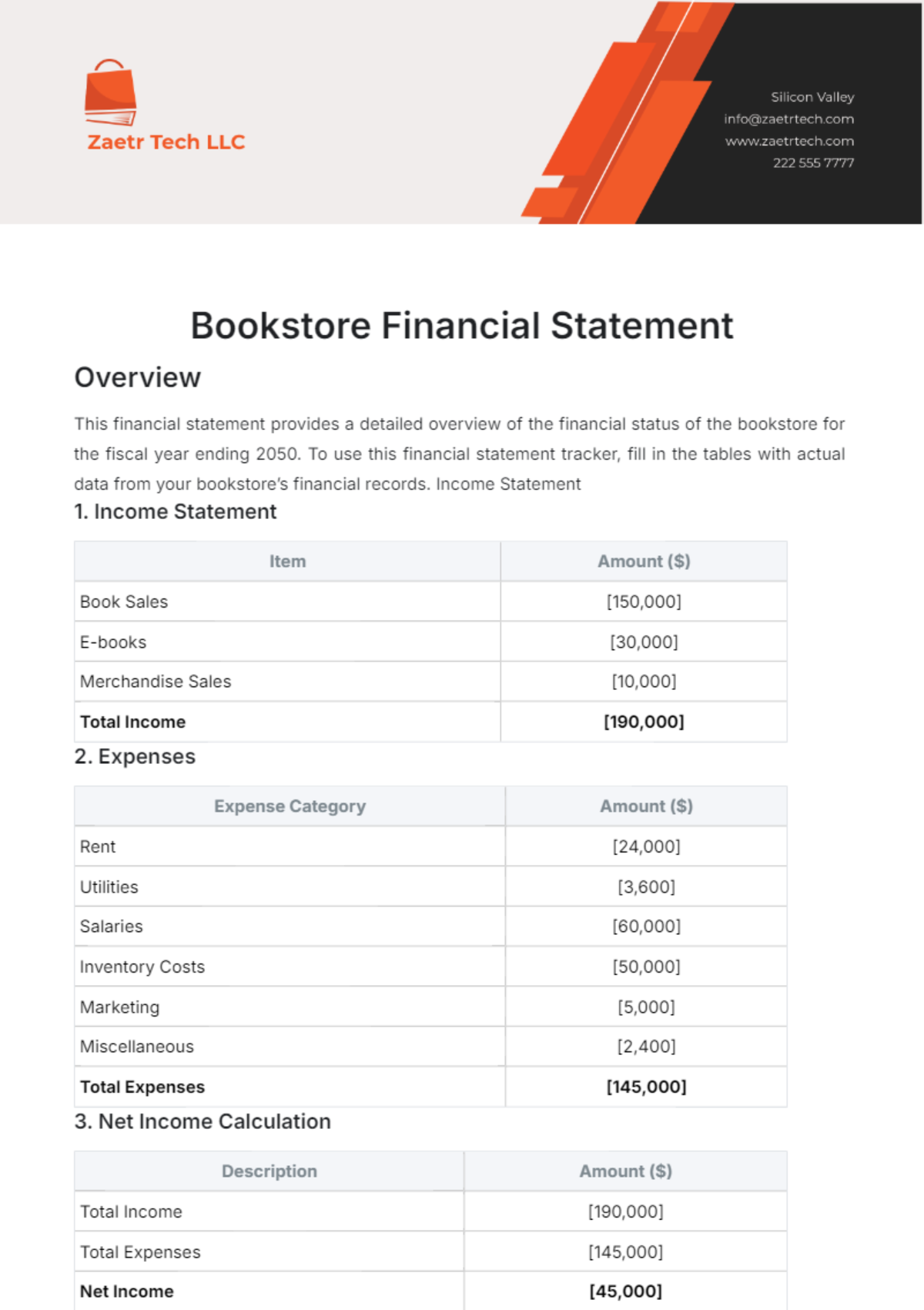

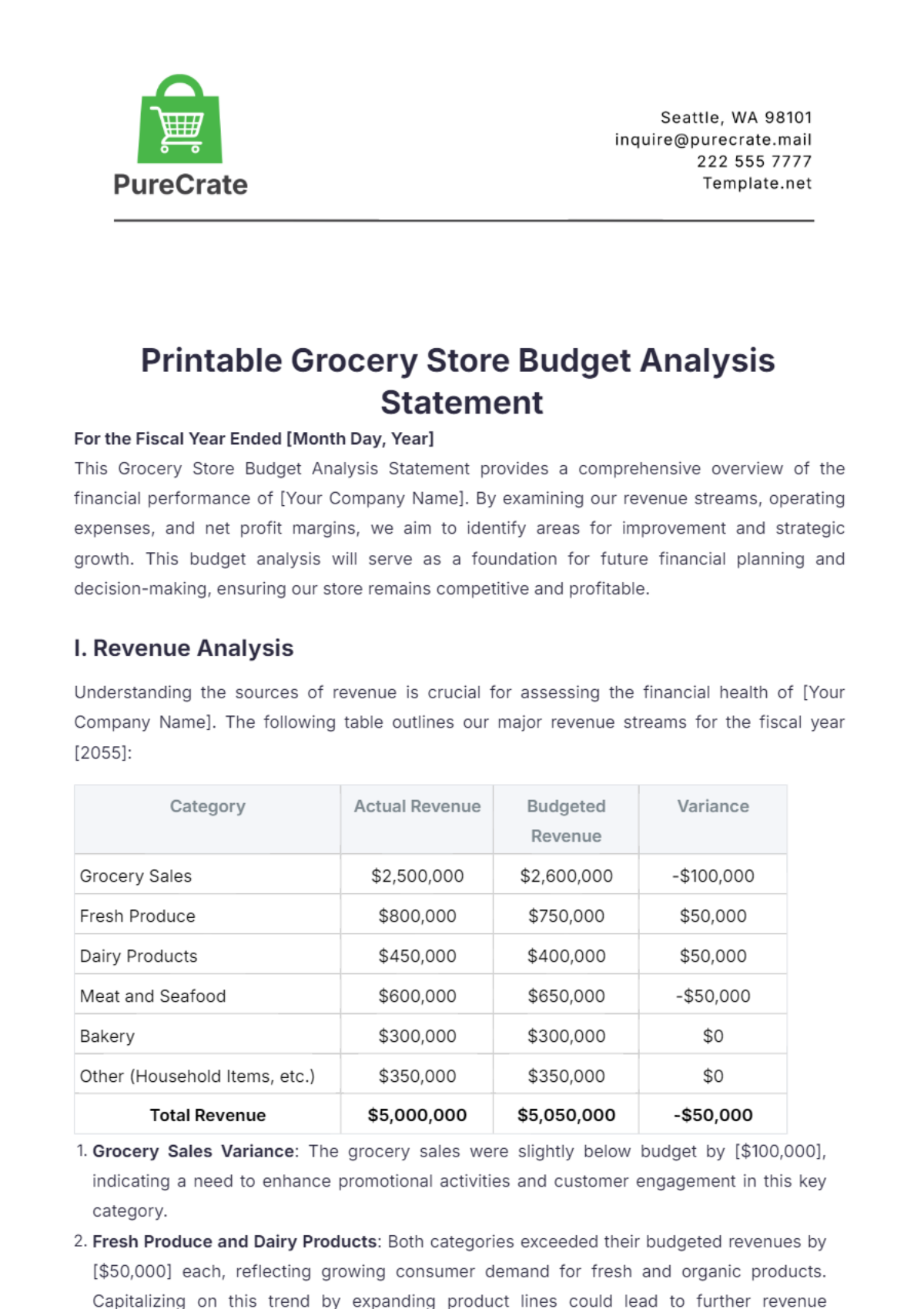

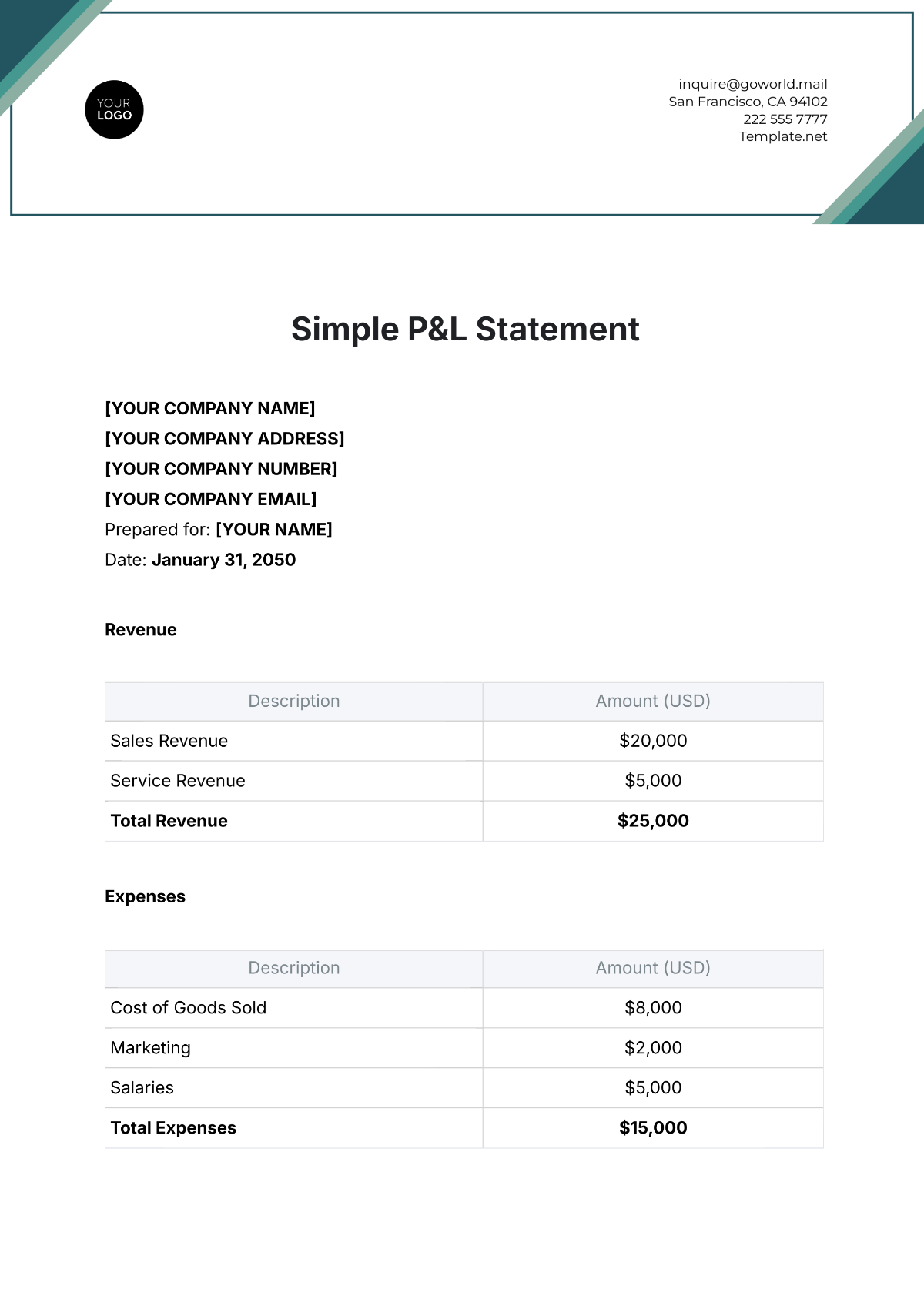

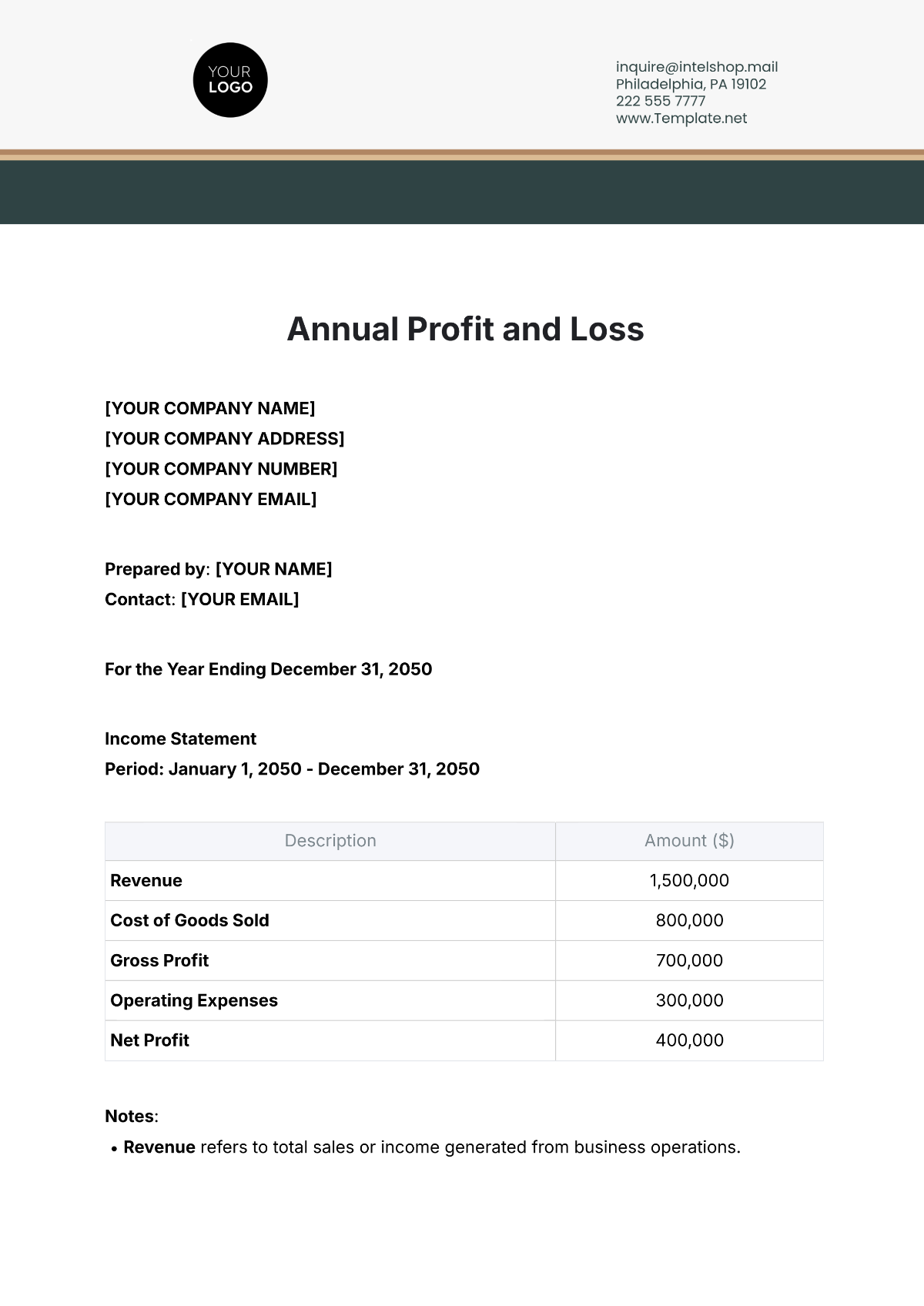

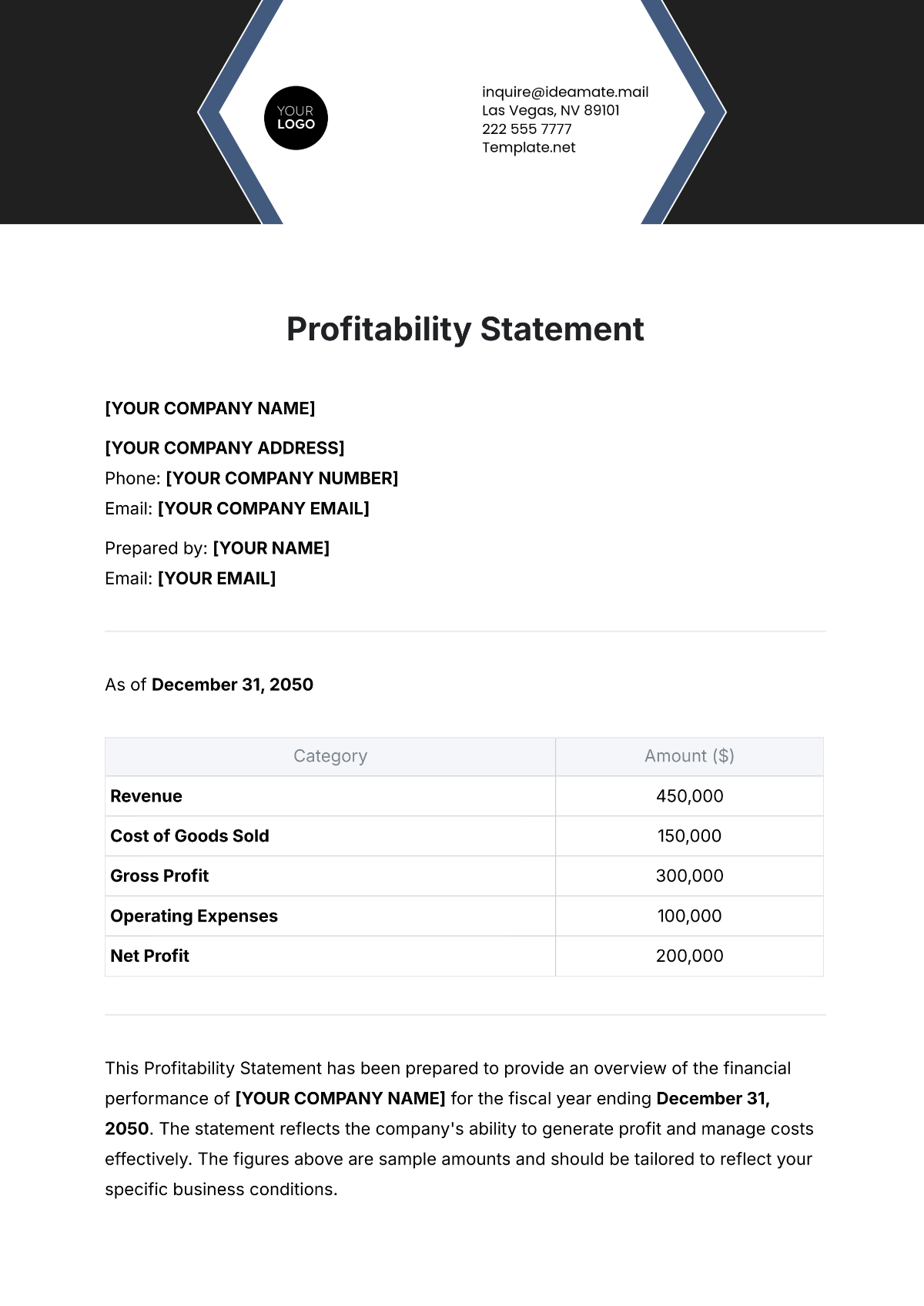

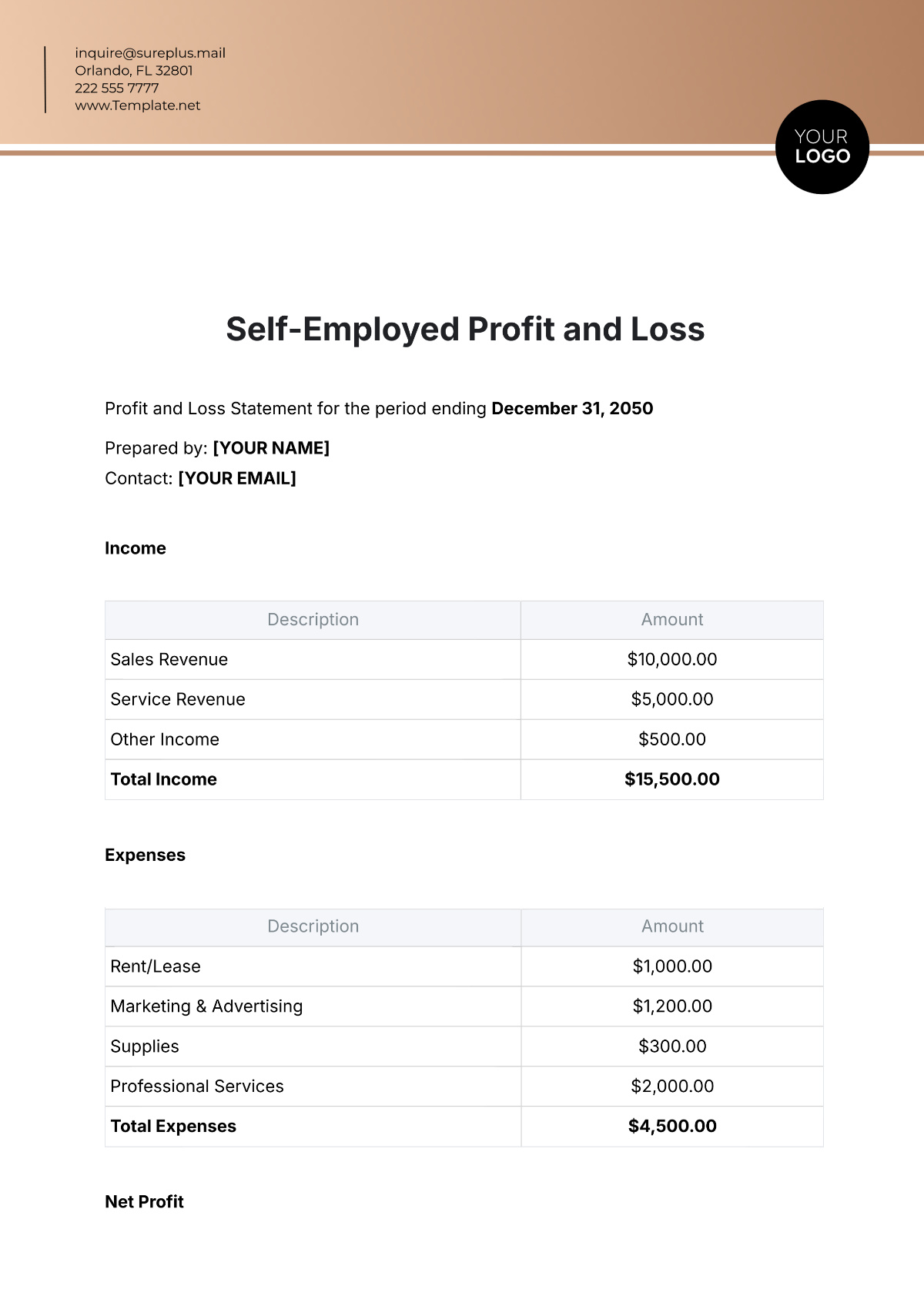

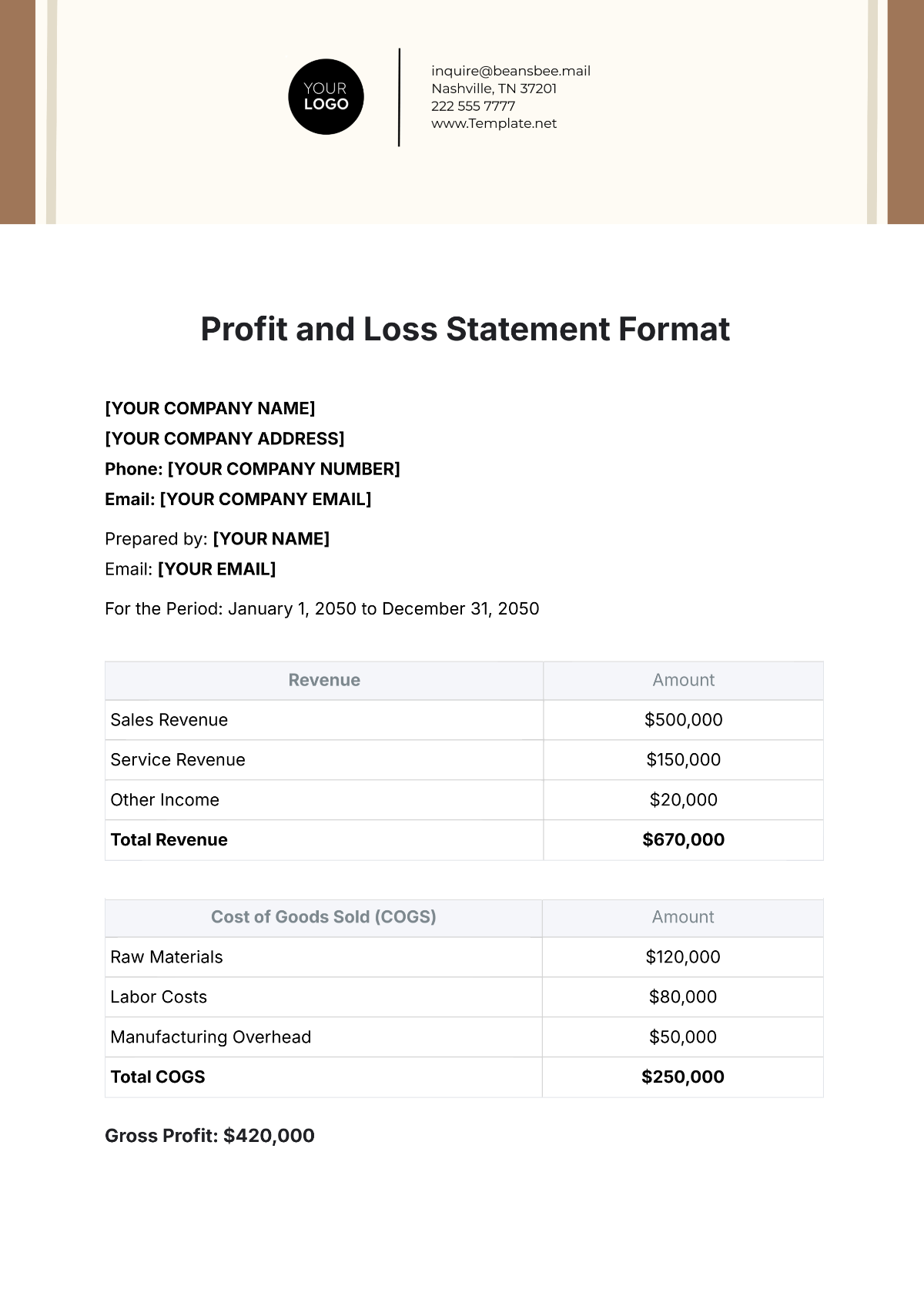

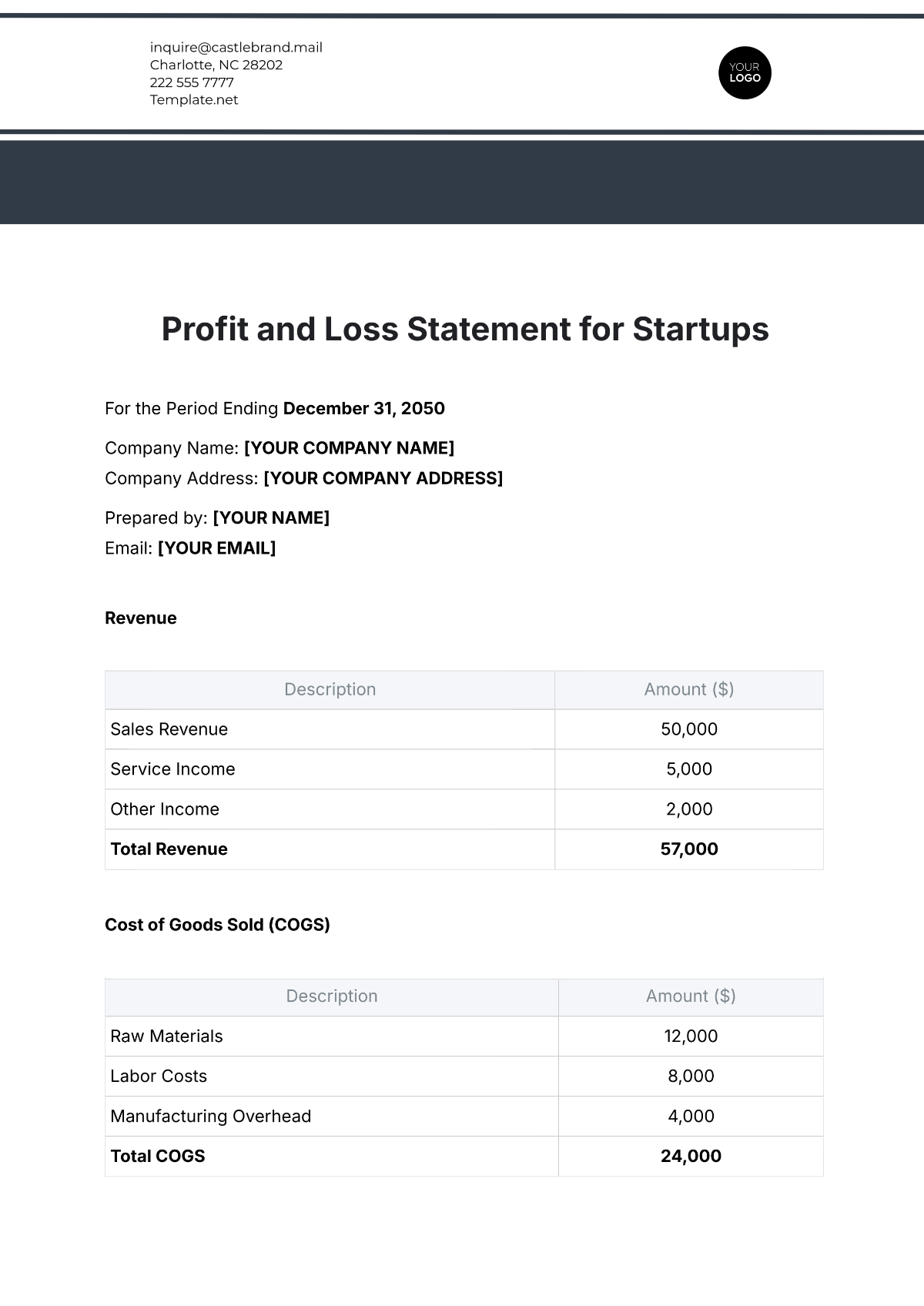

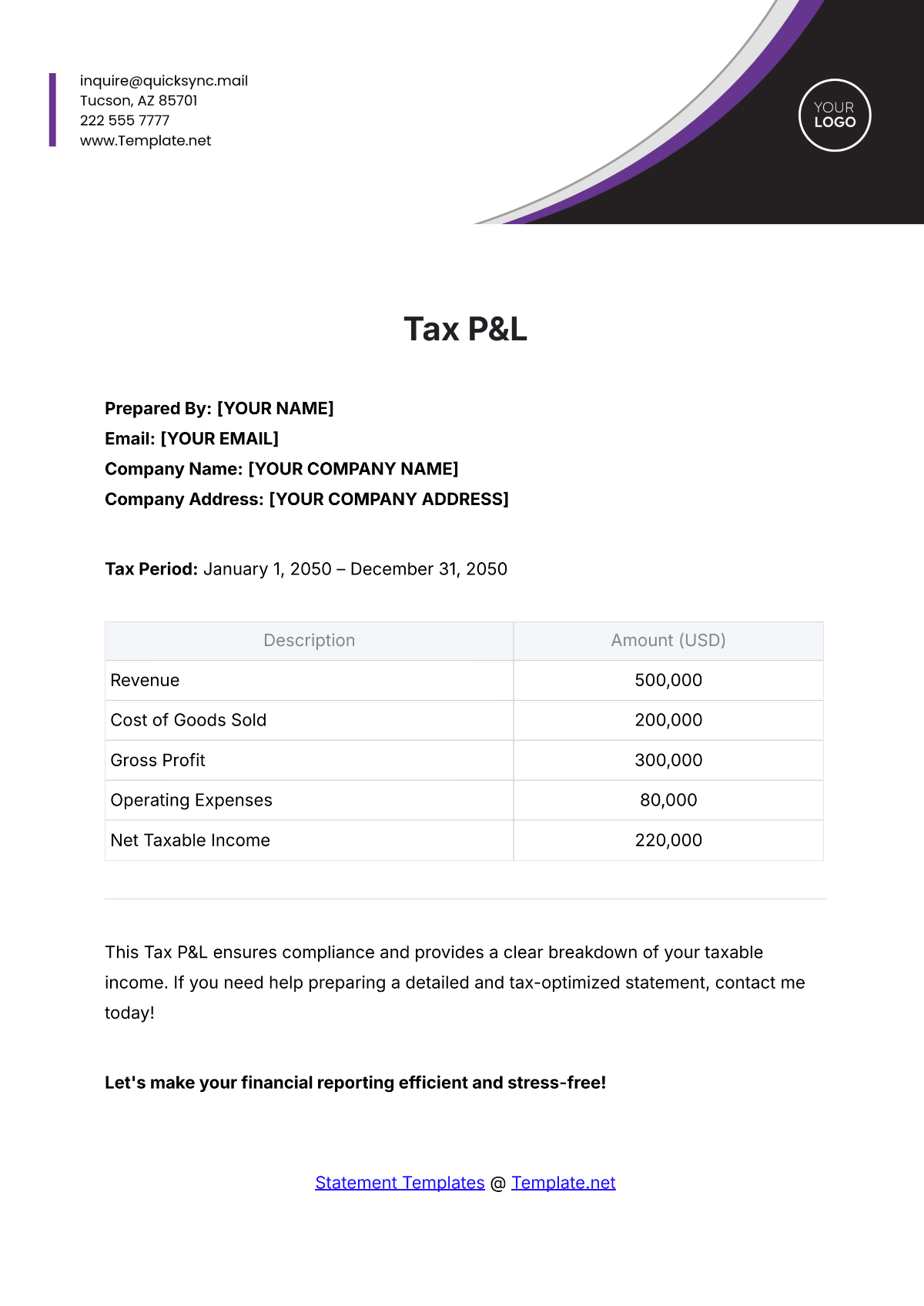

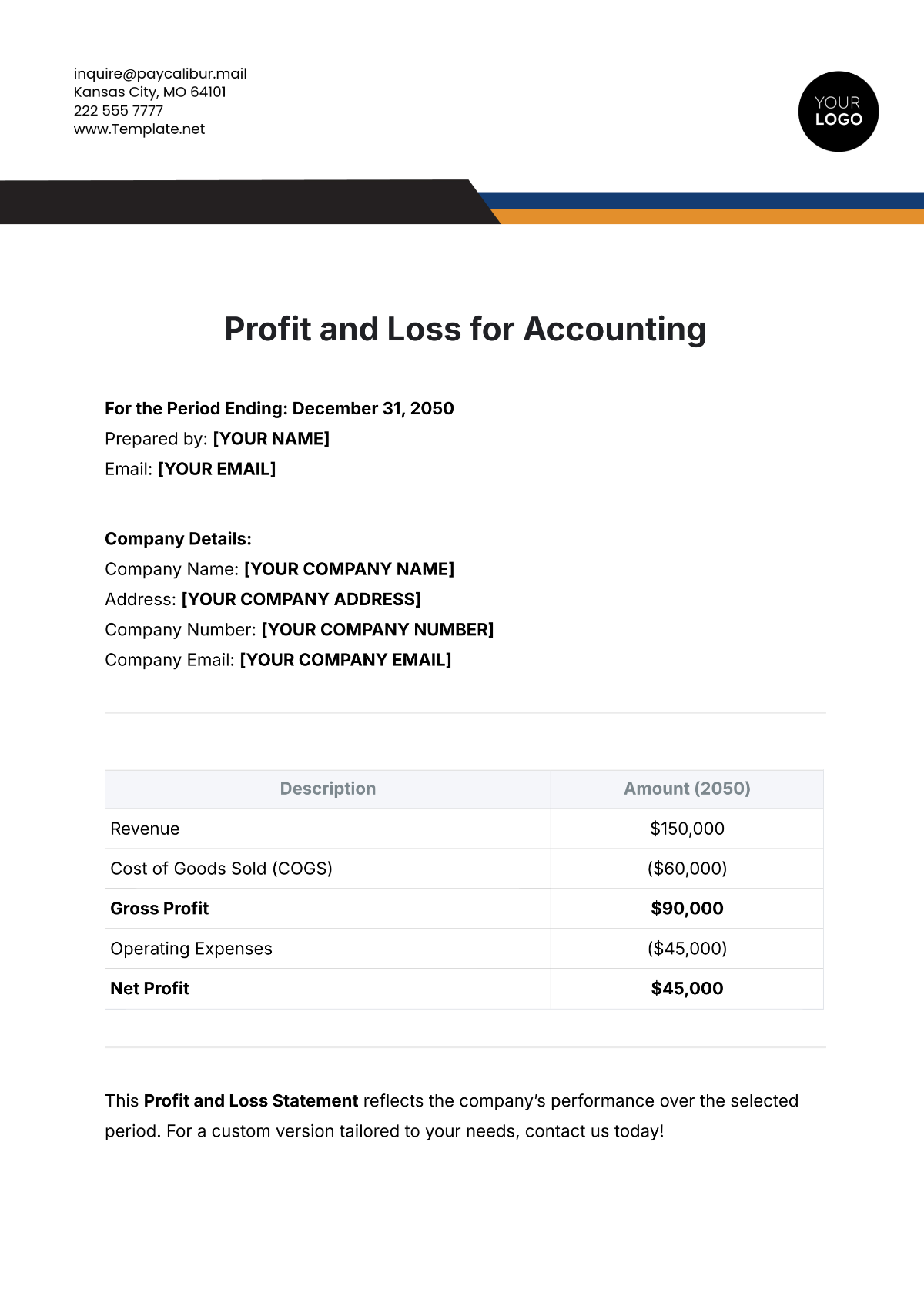

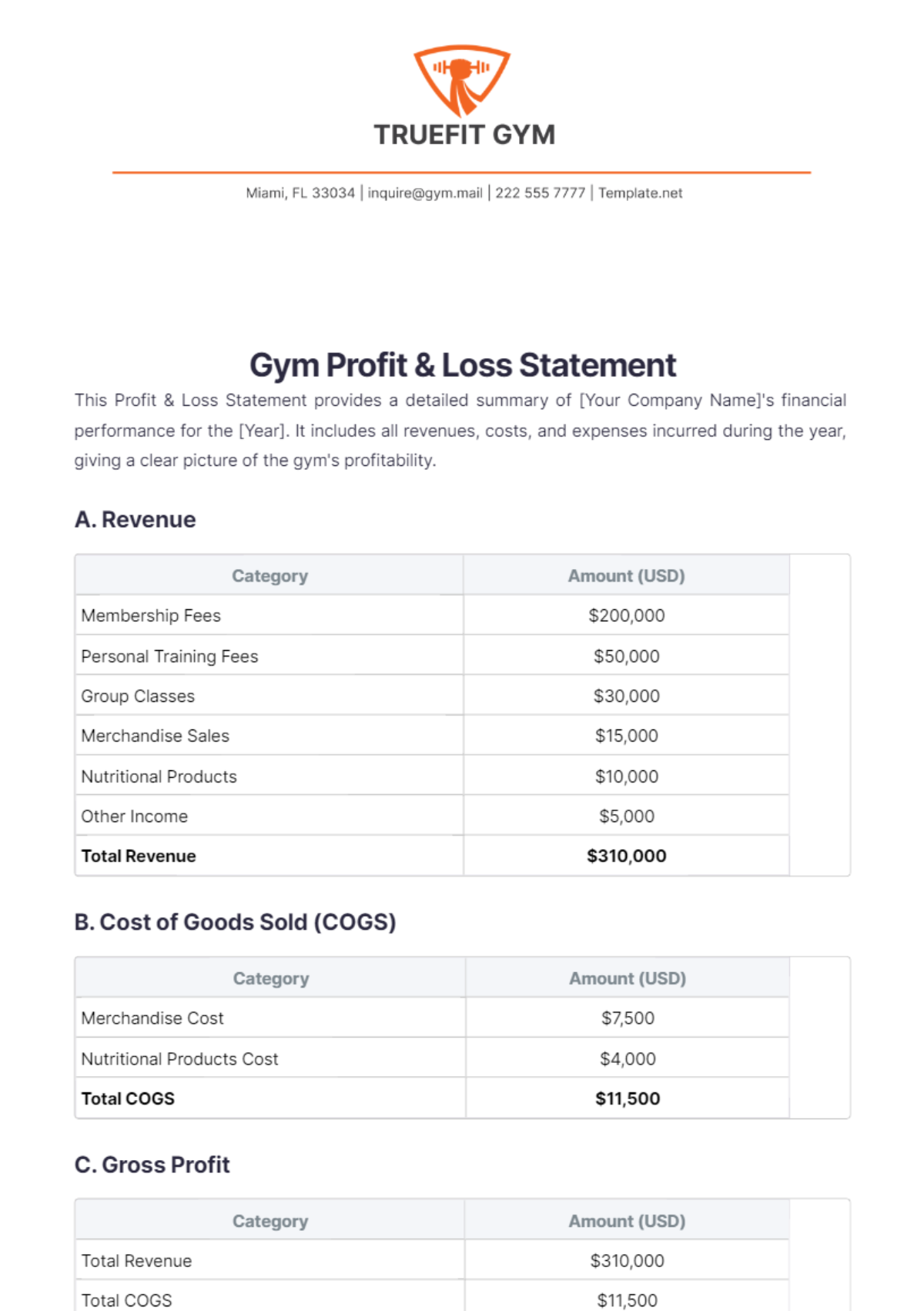

Income Statement

Description | Amount ($) |

|---|---|

Total Revenue | 680,000 |

Cost of Goods Sold | -23,000 |

Gross Profit | 657,000 |

Operating Expenses | -515,000 |

Operating Income | 142,000 |

Interest Expense | -25,000 |

Net Income Before Taxes | 117,000 |

Income Taxes (20%) | -23,400 |

Net Income | 93,600 |

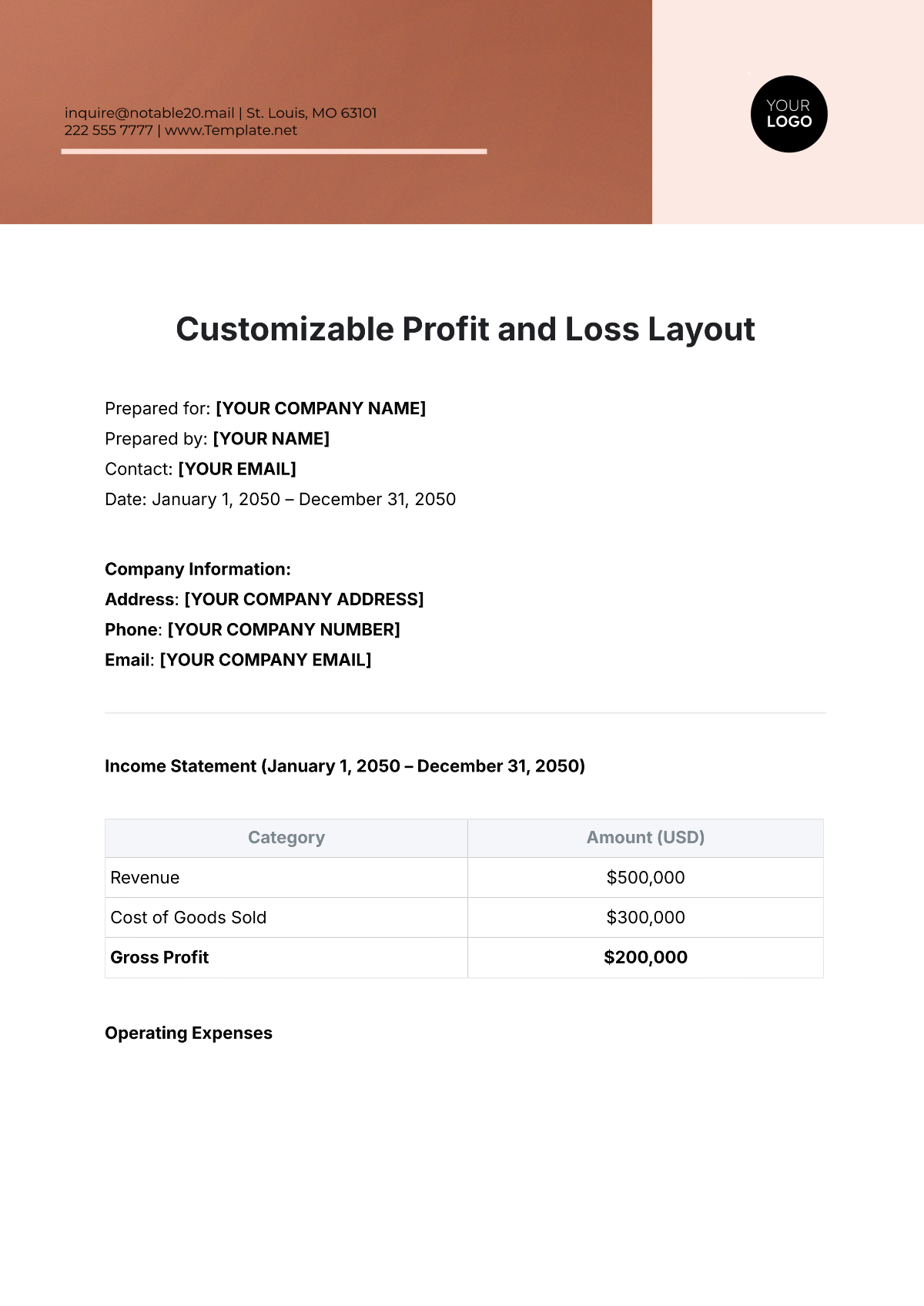

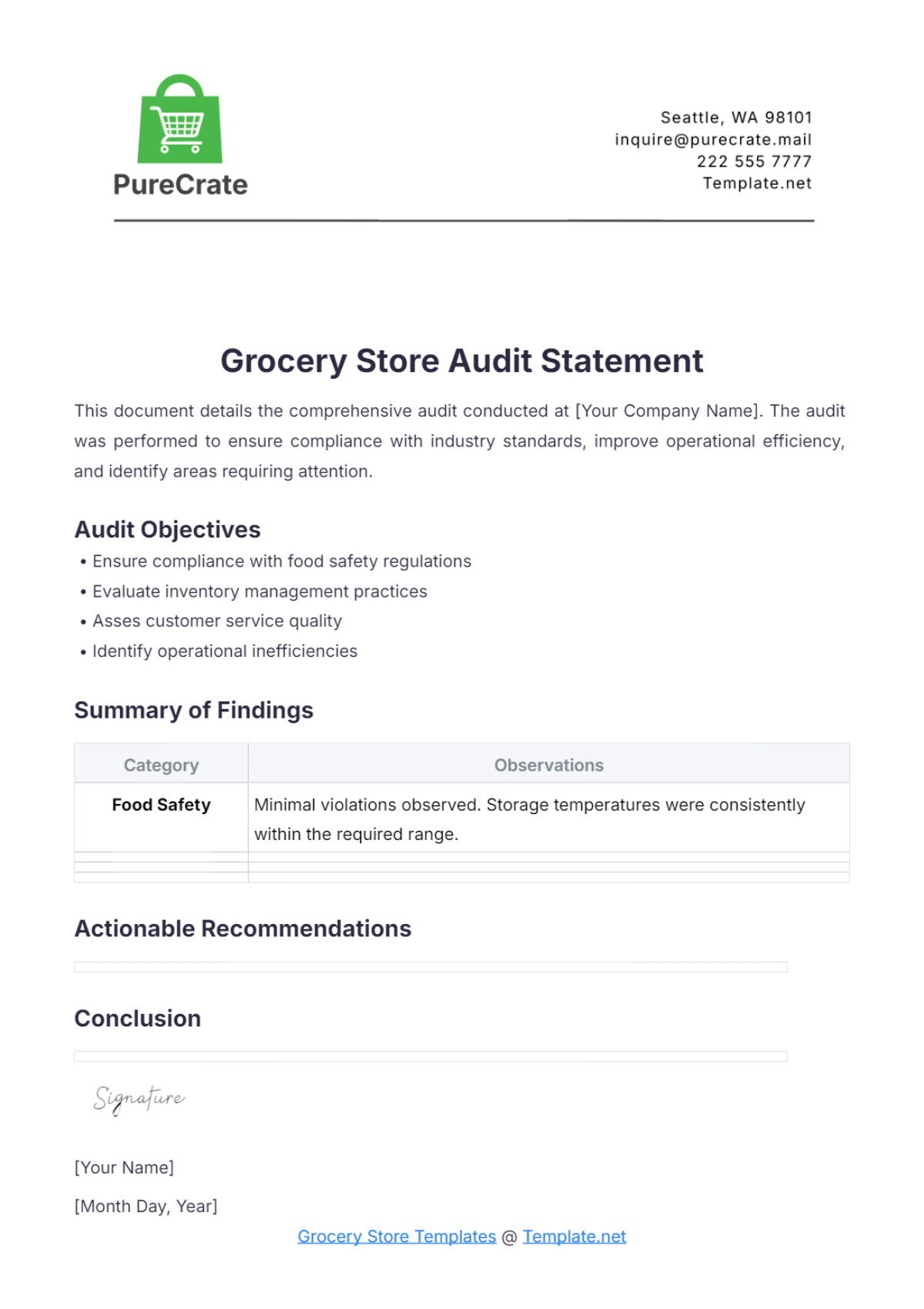

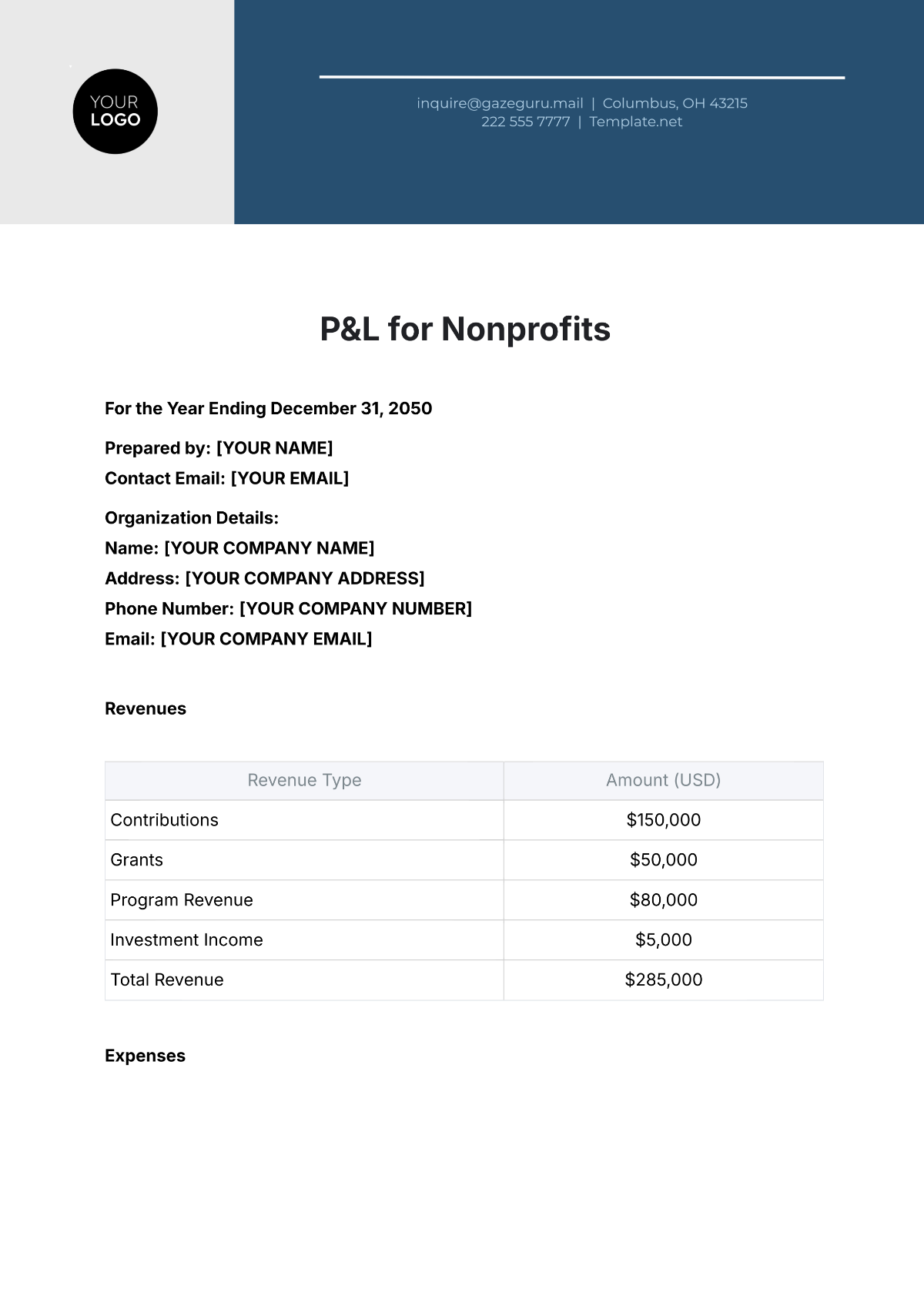

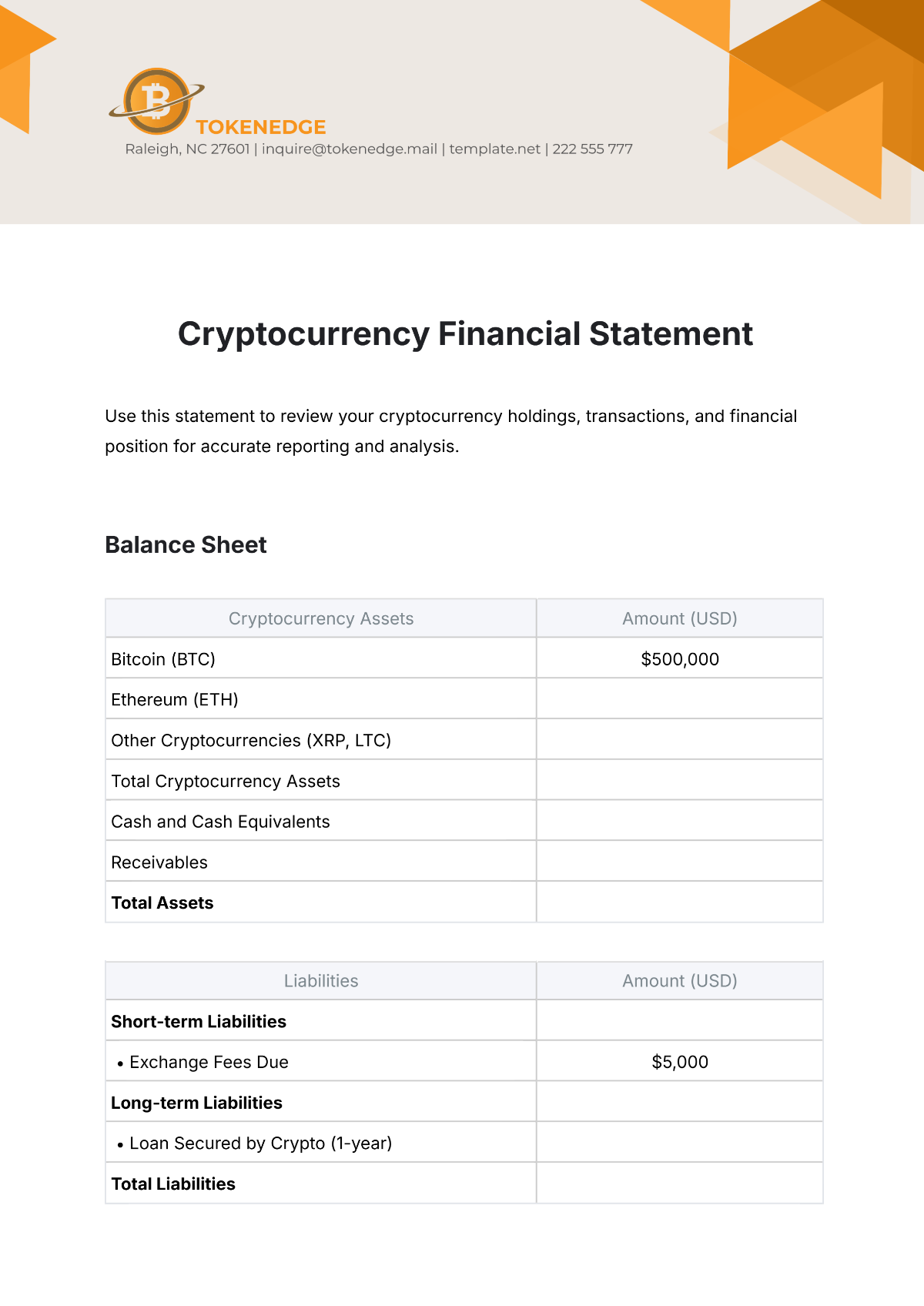

Balance Sheet

Assets | Amount ($) |

|---|---|

Current Assets | |

Cash and Cash Equivalents | 50,000 |

Accounts Receivable | 30,000 |

Inventory | 25,000 |

Prepaid Expenses | 5,000 |

Total Current Assets | 110,000 |

Non-Current Assets | |

Property, Plant, and Equipment | 300,000 |

Less: Accumulated Depreciation | -90,000 |

Total Non-Current Assets | 210,000 |

Total Assets | 320,000 |

Liabilities and Equity | Amount ($) |

|---|---|

Current Liabilities | |

Accounts Payable | 40,000 |

Accrued Expenses | 15,000 |

Short-Term Loans | 70,000 |

Total Current Liabilities | 125,000 |

Long-Term Liabilities | |

Long-Term Debt | 150,000 |

Total Liabilities | 275,000 |

Equity | |

Retained Earnings | 45,000 |

Total Equity | 45,000 |

Total Liabilities and Equity | 320,000 |

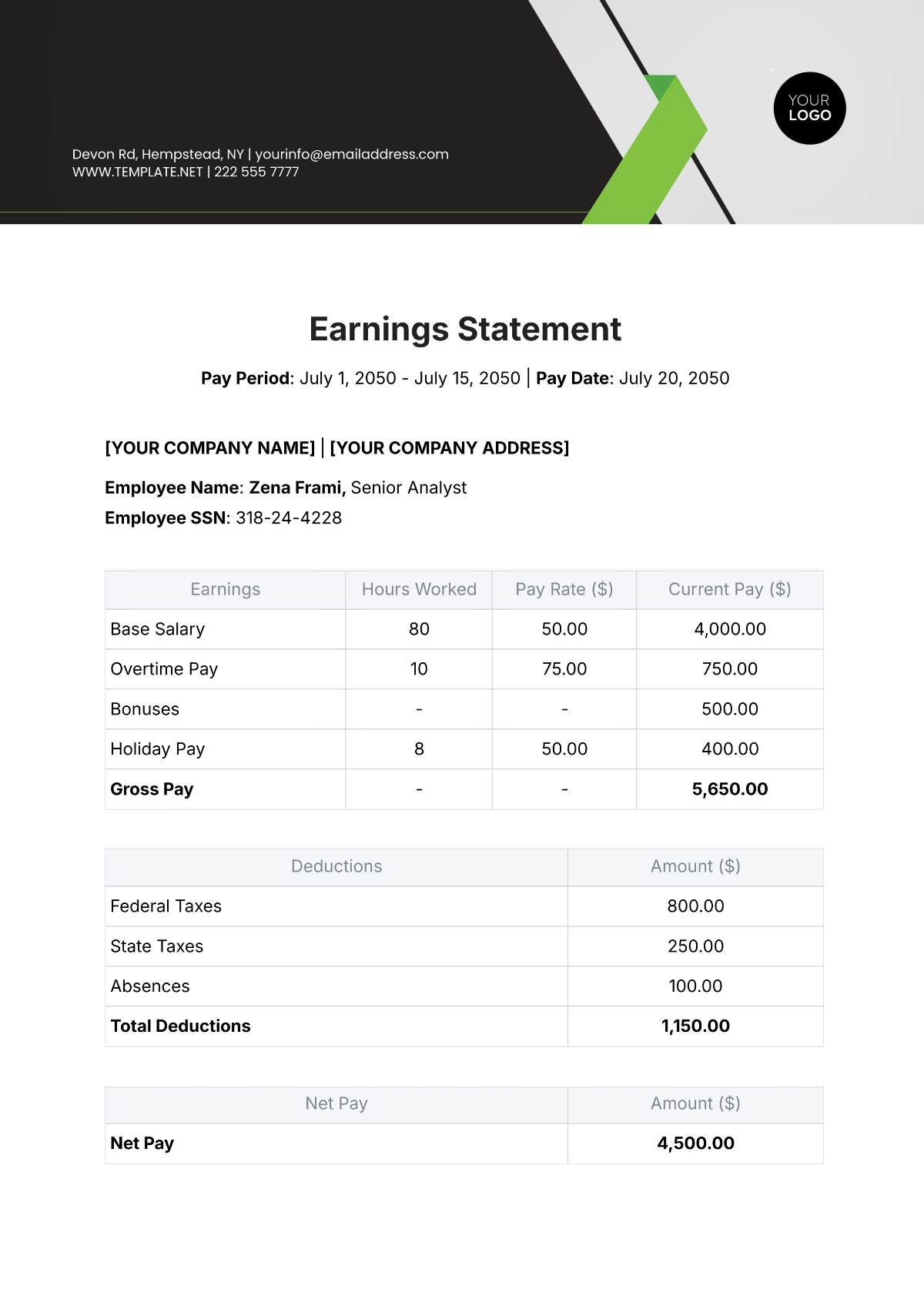

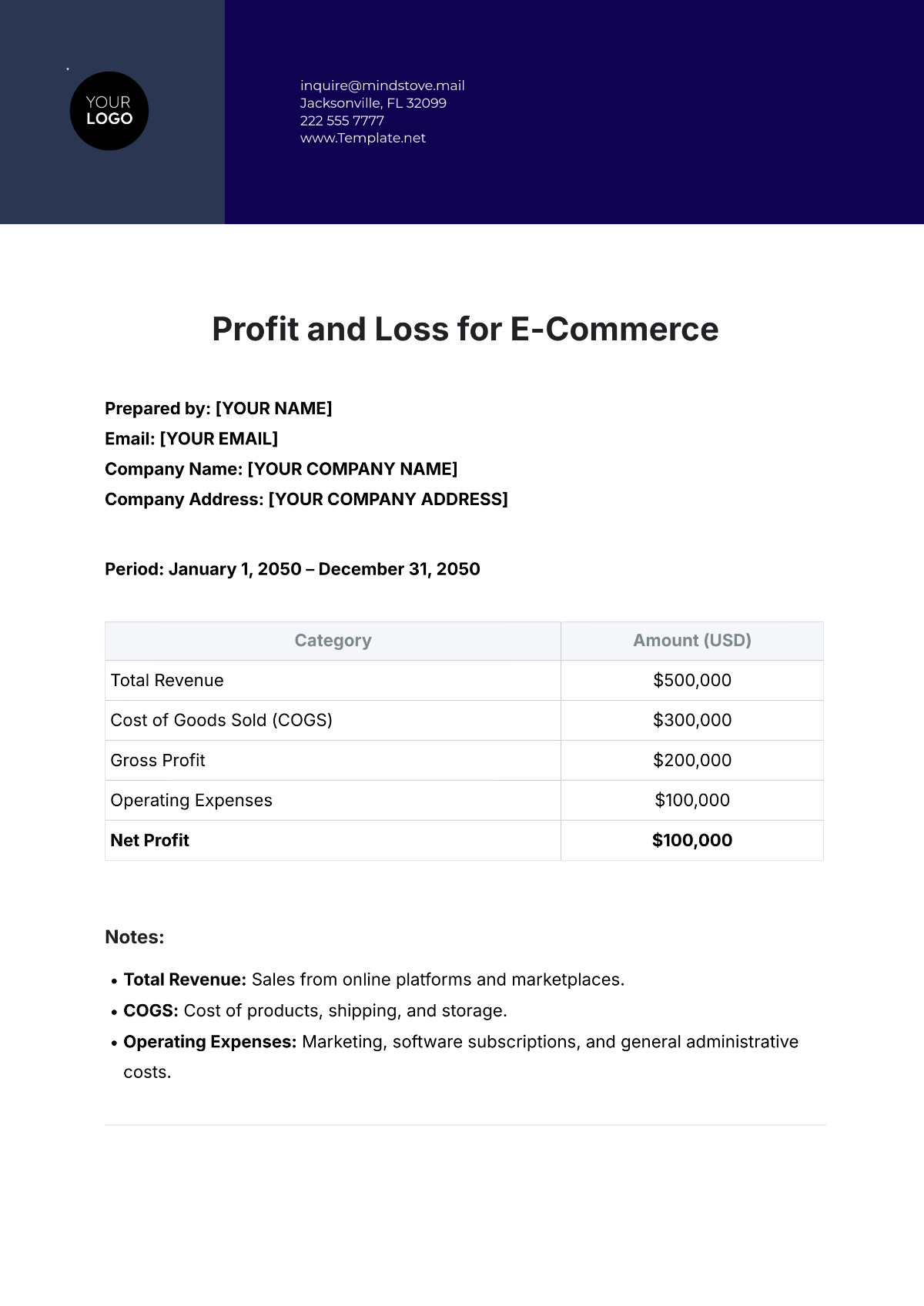

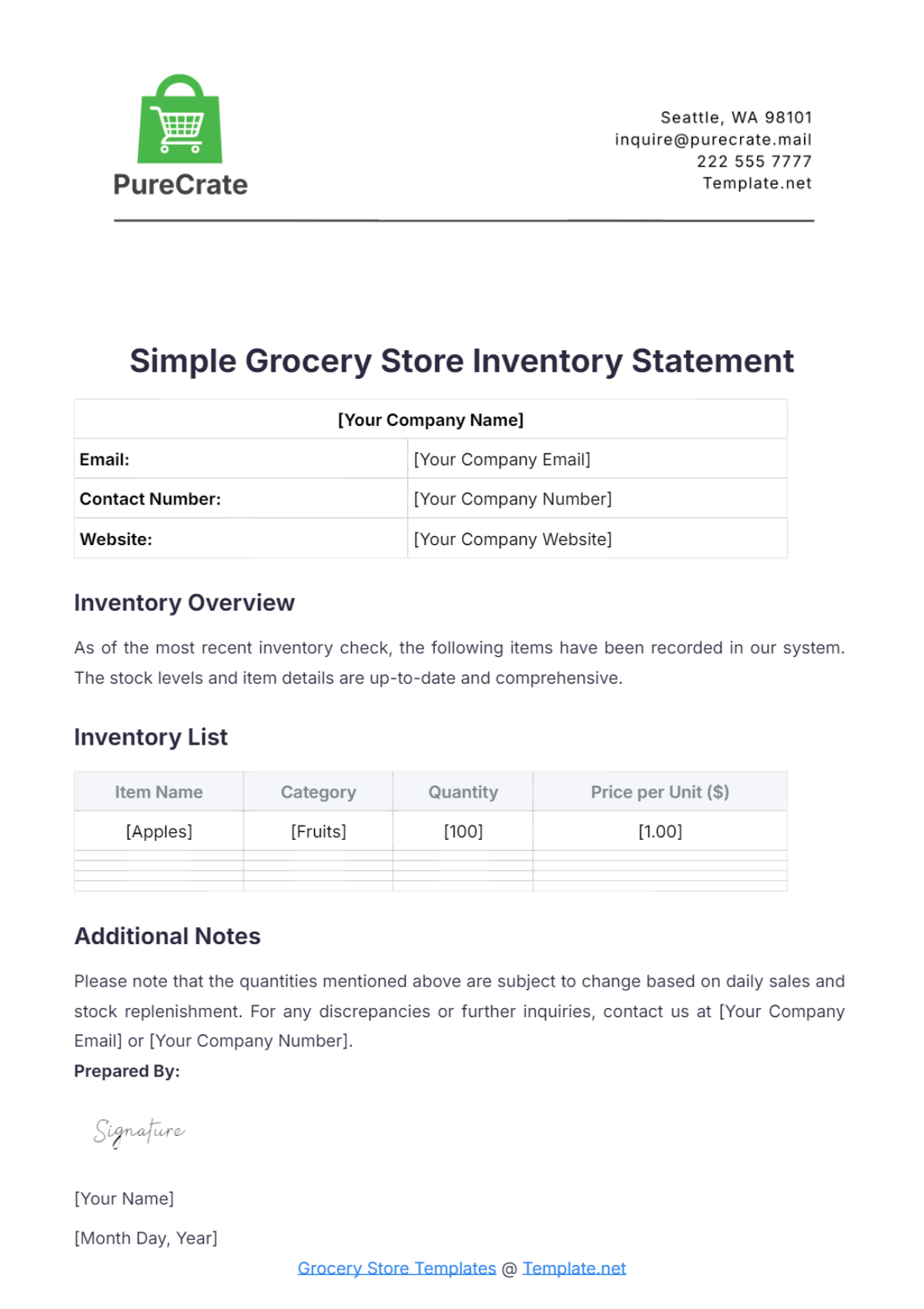

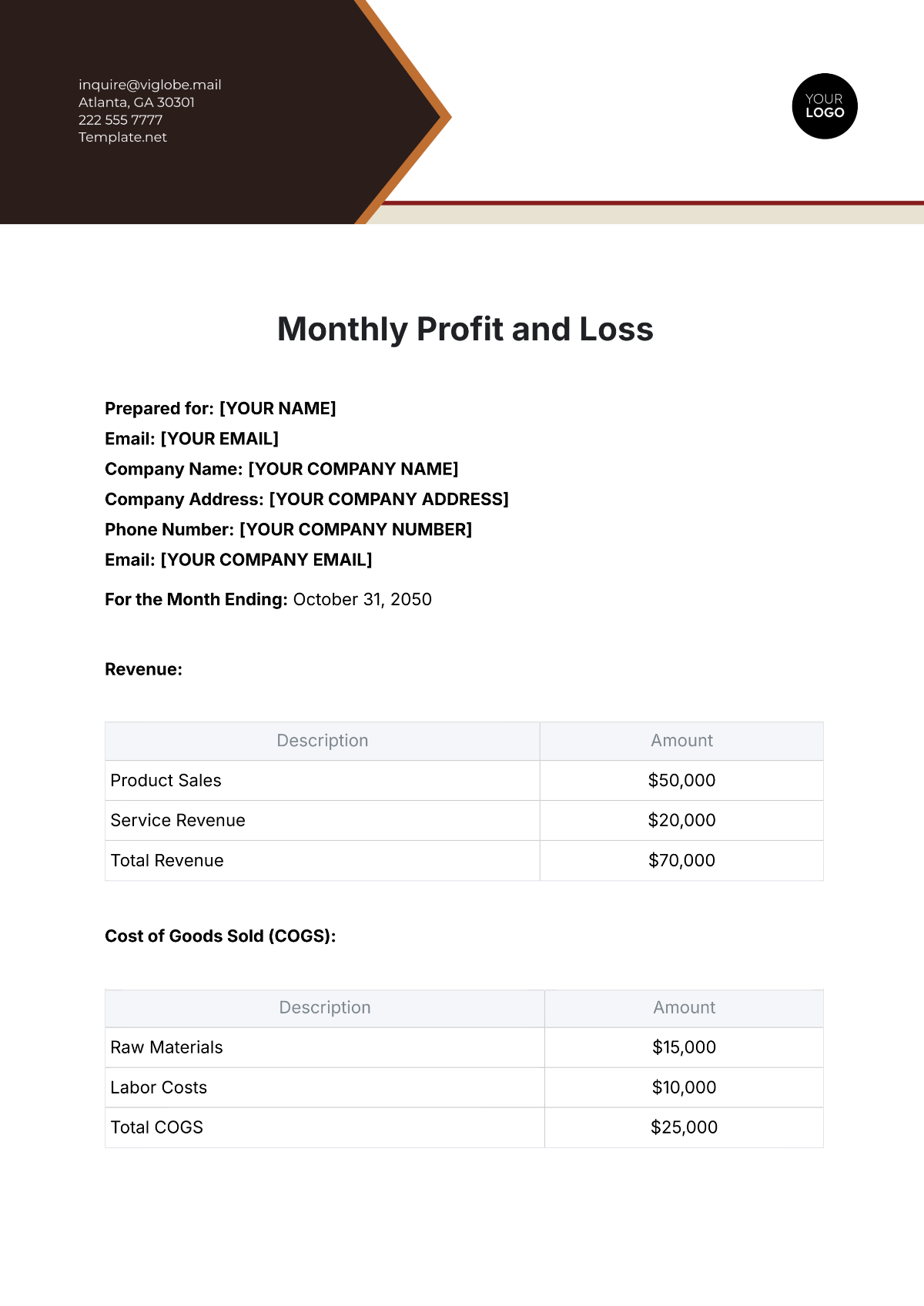

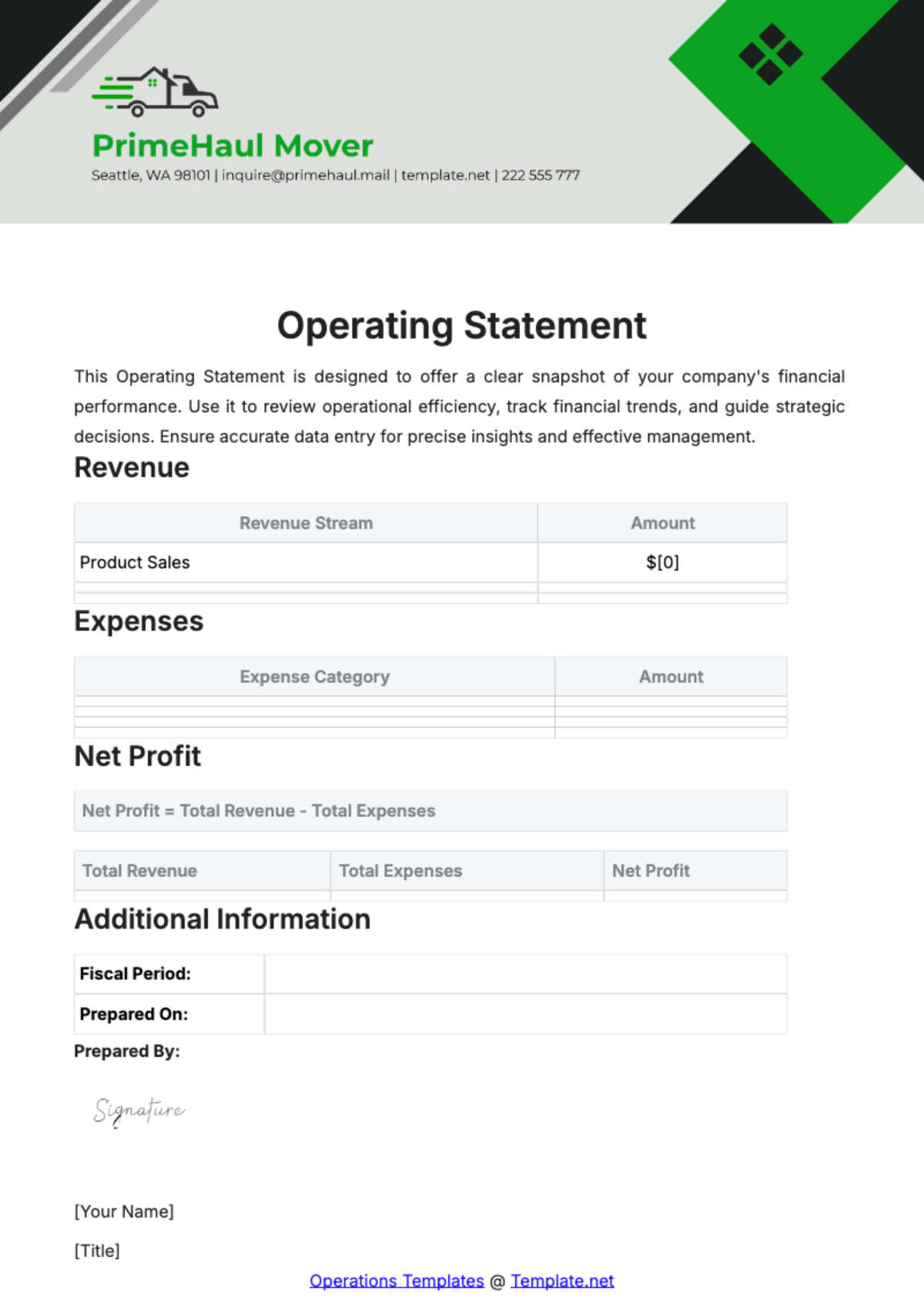

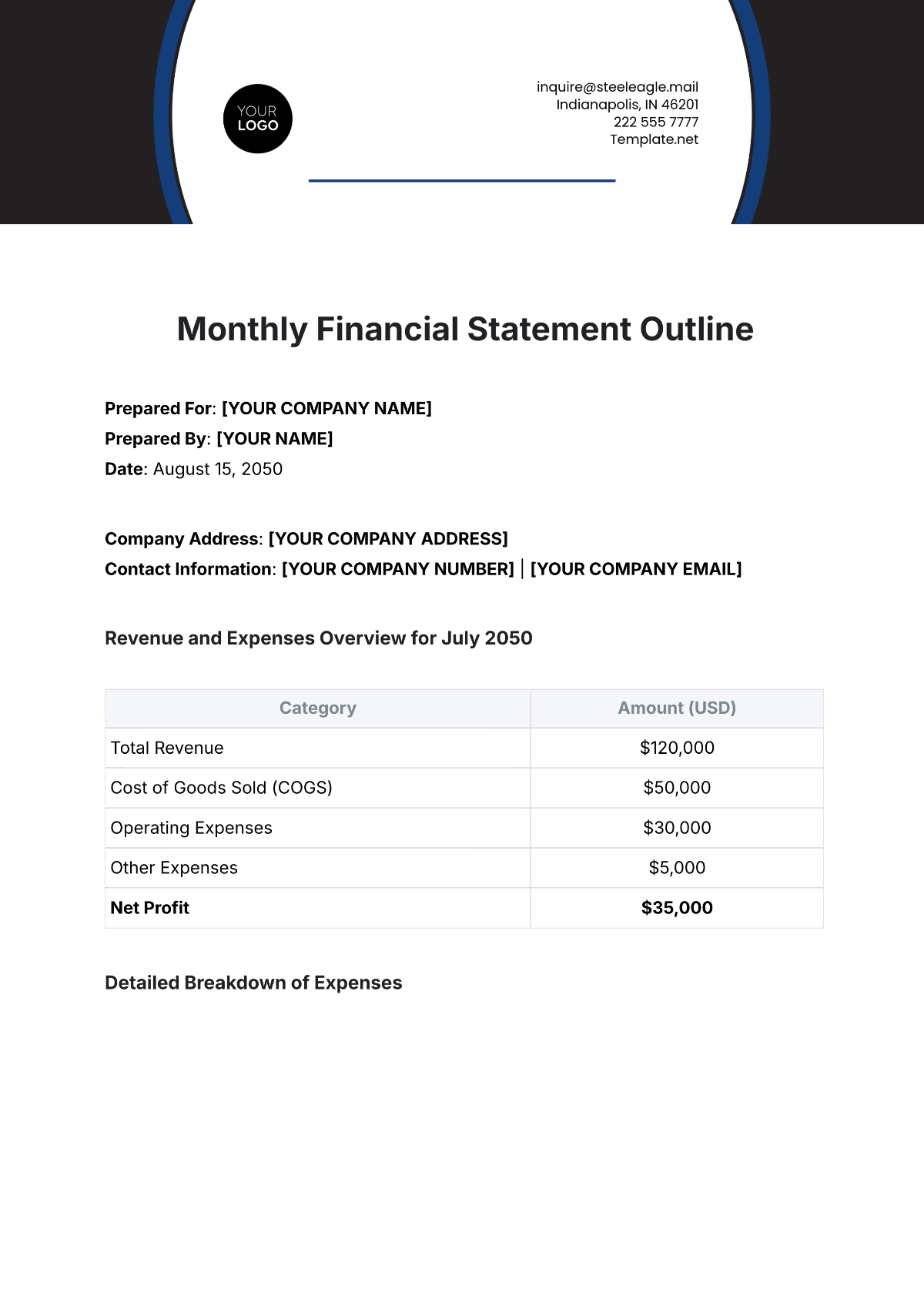

Statement of Cash Flows

Description | Amount ($) |

|---|---|

Cash Flows from Operating Activities: | |

Net Income | 93,600 |

Adjustments to reconcile net income to net cash provided by operating activities: | |

Depreciation | 30,000 |

Changes in working capital: | |

(Increase)/Decrease in Accounts Receivable | -30,000 |

Increase/(Decrease) in Accounts Payable | 40,000 |

Increase/(Decrease) in Inventory | -25,000 |

Increase/(Decrease) in Prepaid Expenses | -5,000 |

Increase/(Decrease) in Accrued Expenses | 15,000 |

Net Cash Provided by Operating Activities | 118,600 |

Cash Flows from Investing Activities: | |

Purchase of property, plant, and equipment | -200,000 |

Net Cash Used in Investing Activities | -200,000 |

Cash Flows from Financing Activities: | |

Proceeds from issuance of debt | 150,000 |

Repayments of debt | -70,000 |

Net Cash Provided by Financing Activities | 80,000 |

Net Increase (Decrease) in Cash | -1,400 |

Cash at Beginning of Period | 51,400 |

Cash at End of Period | 50,000 |

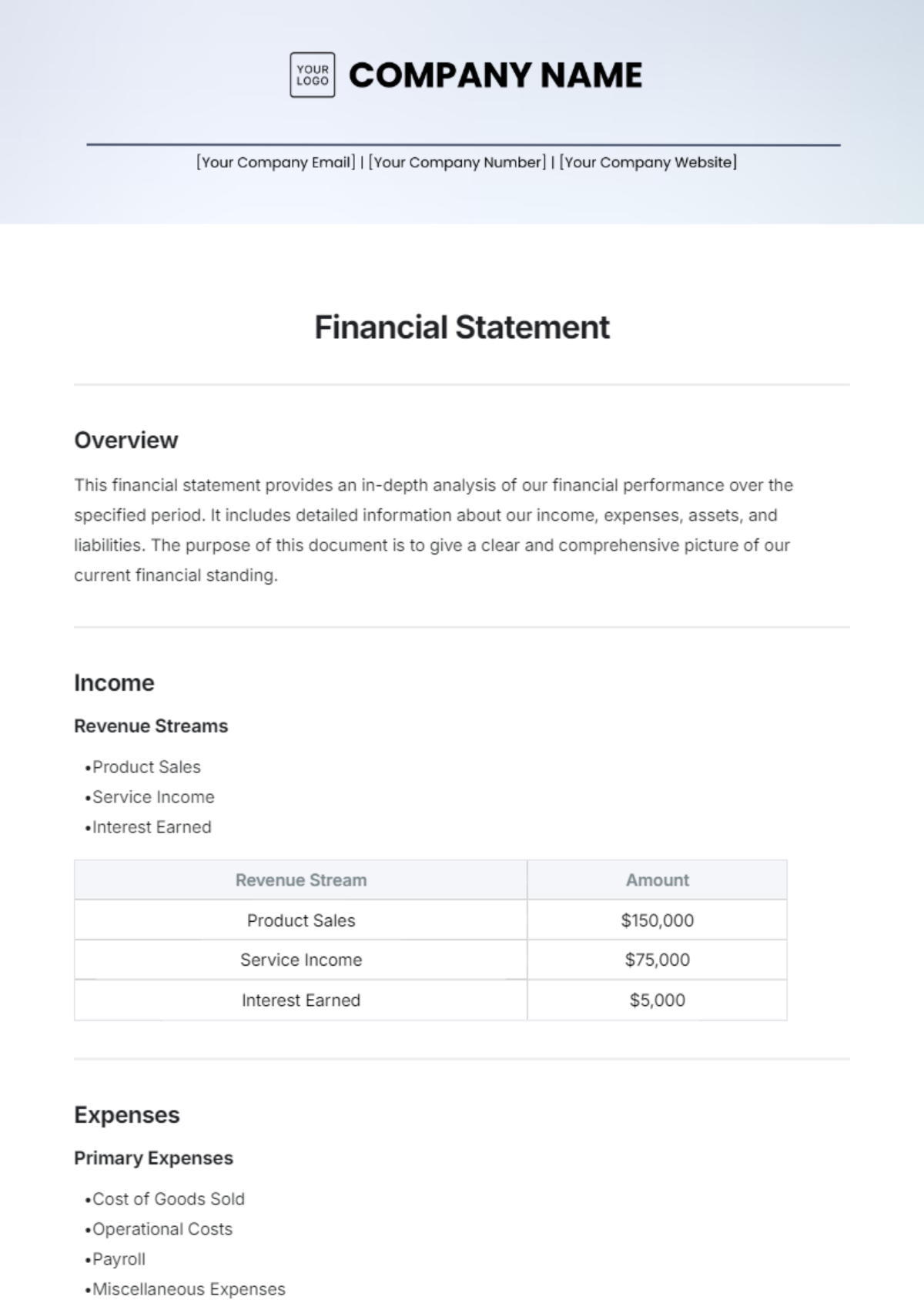

Notes:

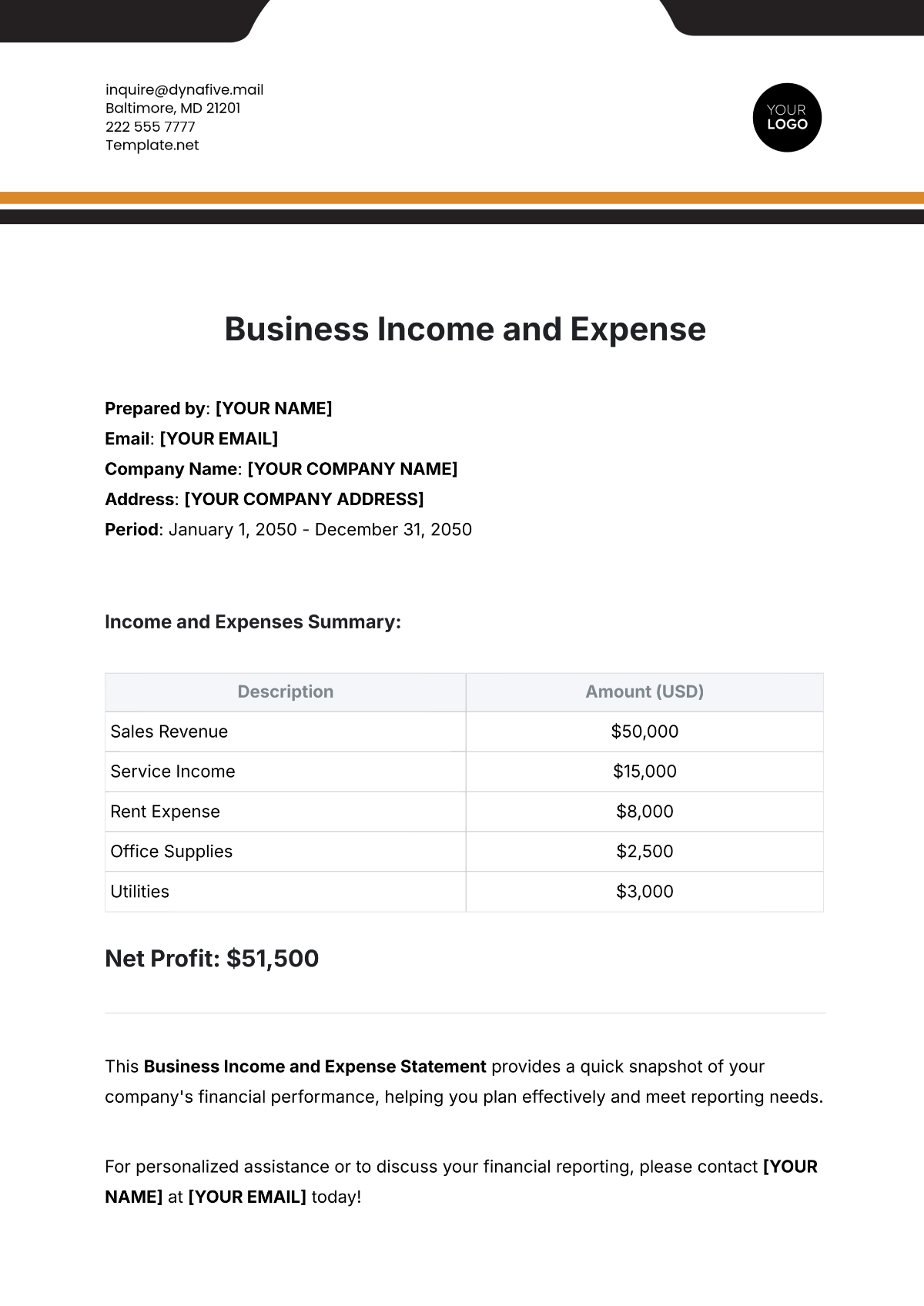

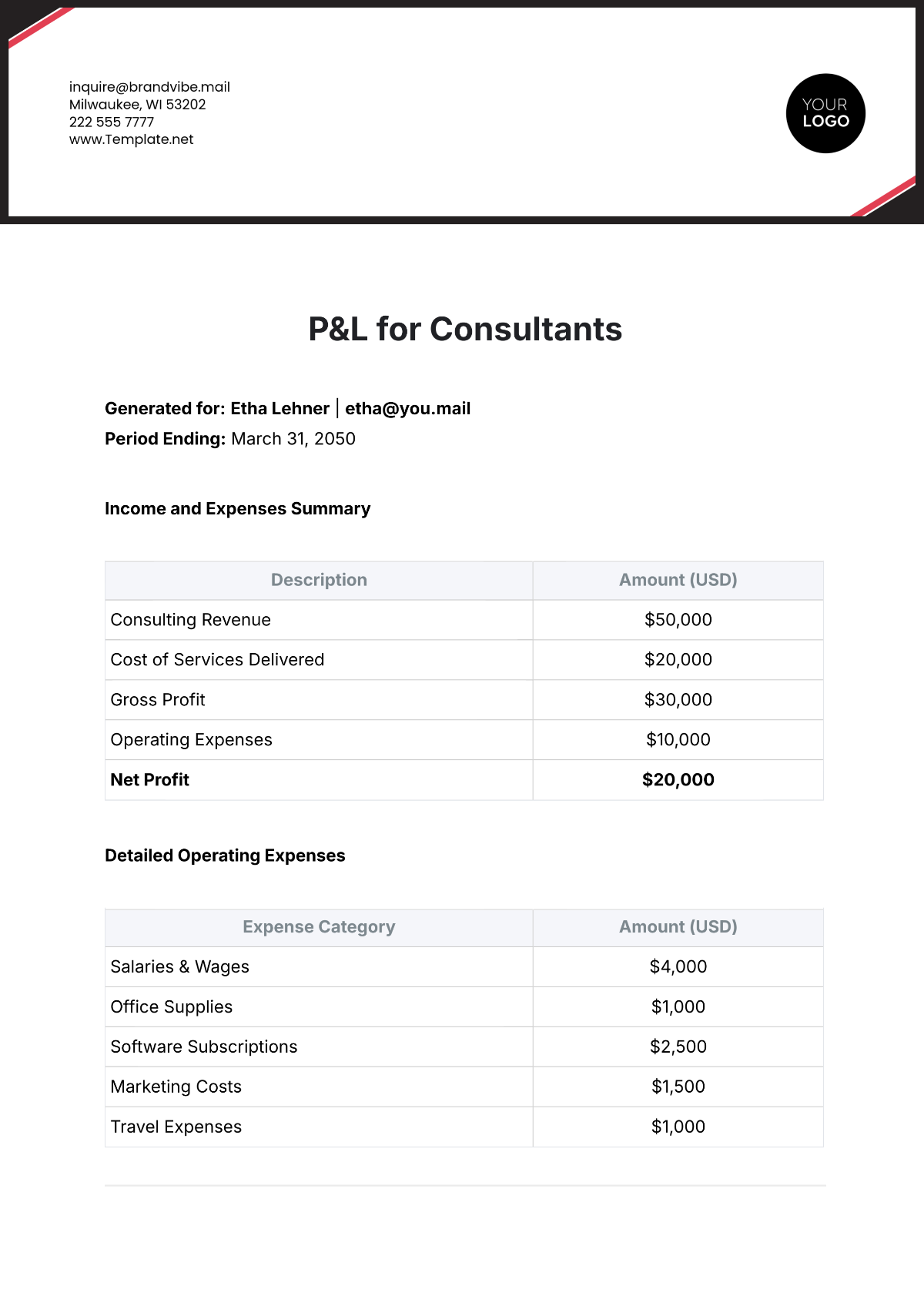

This comprehensive set of financial statements provides an extensive overview of [Your Company Name]'s financial performance and position as of December 31, 2050. The income statement details the revenues, costs, and resulting net income for the year. The balance sheet presents a snapshot of the company's assets, liabilities, and equity, showing the financial stability of the gym. Lastly, the statement of cash flows illustrates the cash inflows and outflows from operating, investing, and financing activities, highlighting the gym's cash management over the period.

For further details or inquiries about these financial statements, please contact our finance department using the information provided above. We are committed to maintaining transparency and providing stakeholders with accurate and timely financial data.