Gym Accounting Memo

To: [Recipient’s Title/Department]

From: [Your Name/Title]

Date: [Current Date]

Subject: Update on Monthly Financial Performance and Accounting Adjustments

This memo provides a summary of [Your Company Name]'s financial performance for the month ended [Date], including key accounting adjustments, recent financial issues, and recommendations for forthcoming periods. The purpose is to ensure that all relevant teams are updated on the financial health of our organization and to guide upcoming budgetary decisions.

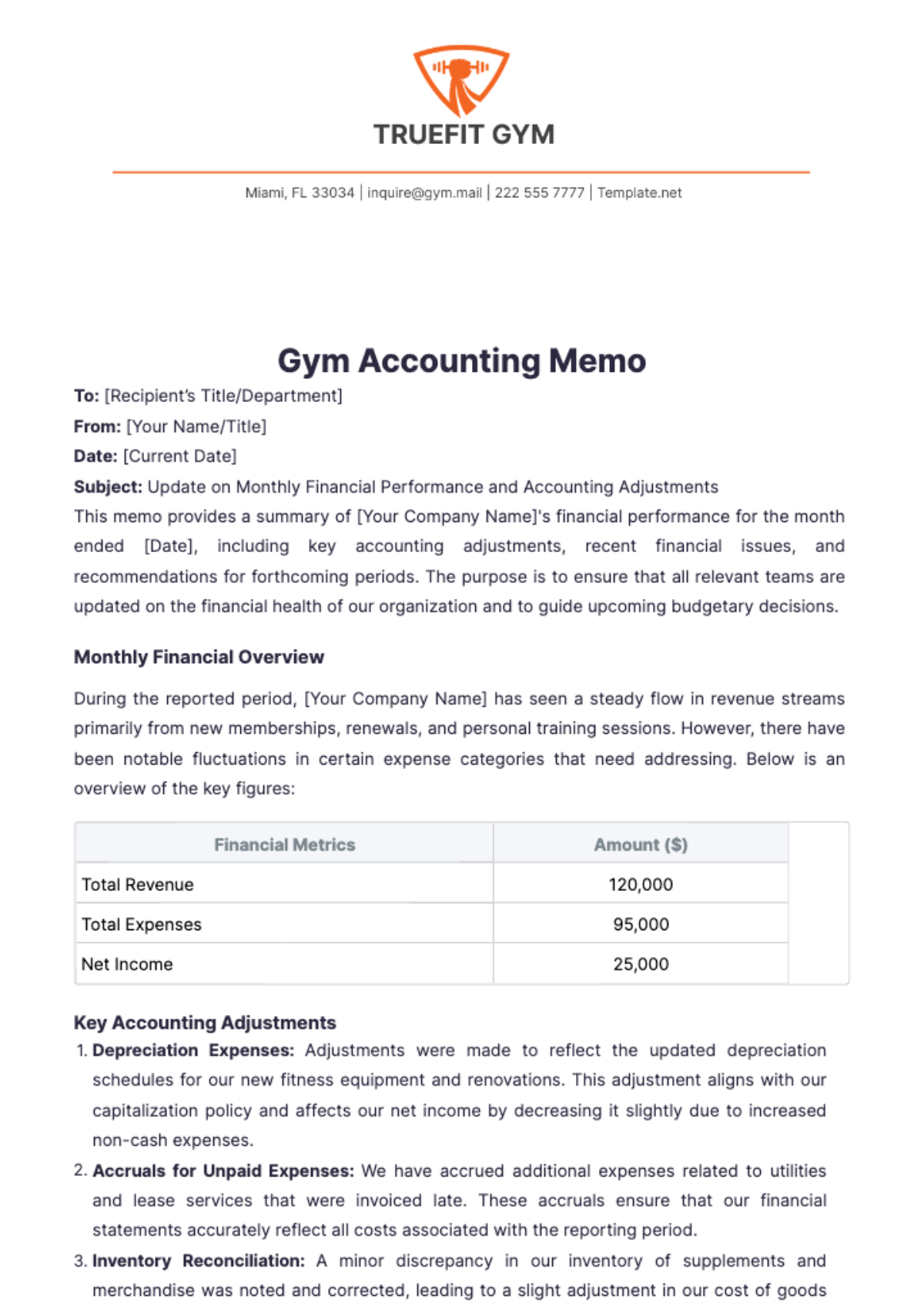

Monthly Financial Overview

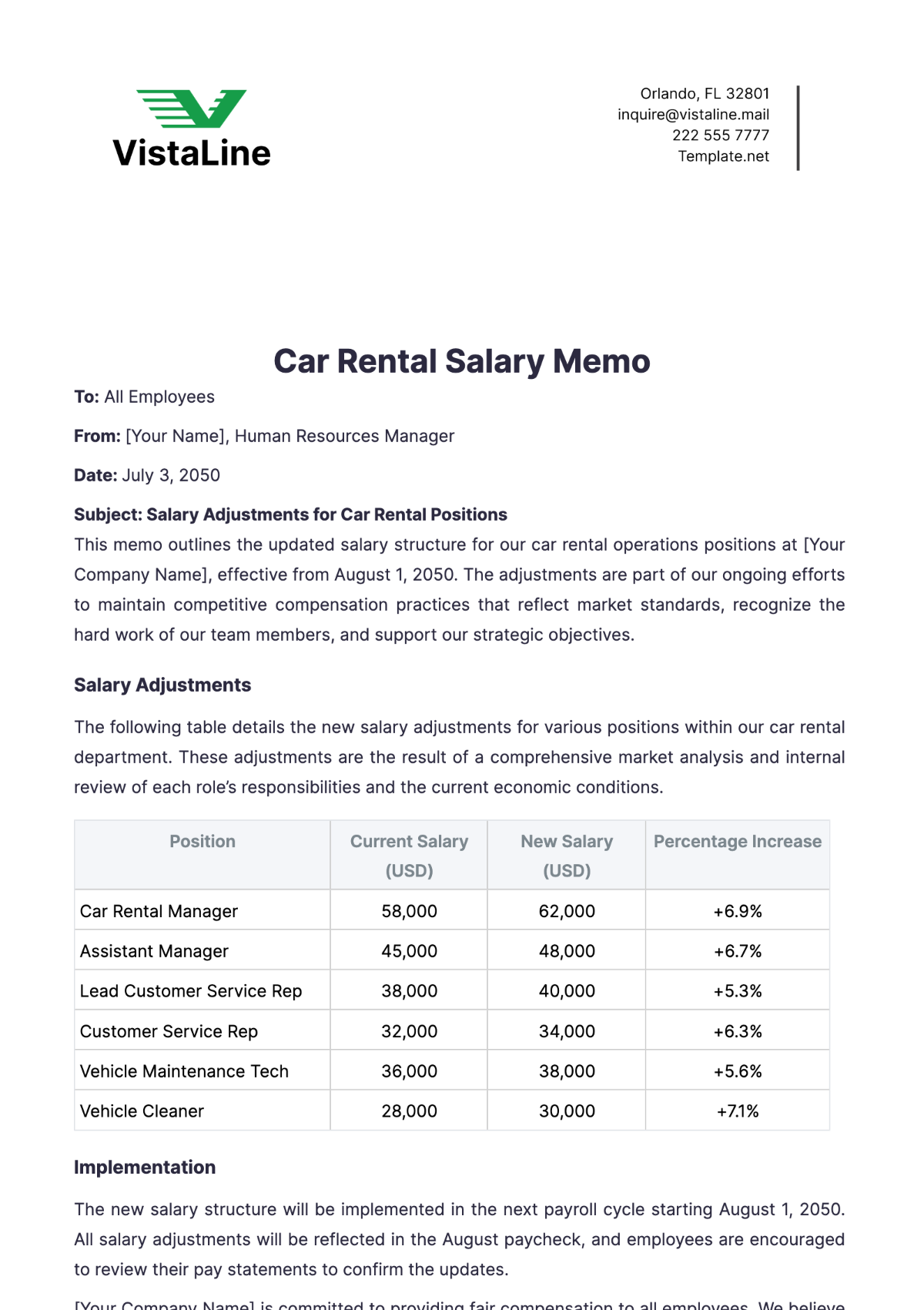

During the reported period, [Your Company Name] has seen a steady flow in revenue streams primarily from new memberships, renewals, and personal training sessions. However, there have been notable fluctuations in certain expense categories that need addressing. Below is an overview of the key figures:

Financial Metrics | Amount ($) |

|---|---|

Total Revenue | 120,000 |

Total Expenses | 95,000 |

Net Income | 25,000 |

Key Accounting Adjustments

Depreciation Expenses: Adjustments were made to reflect the updated depreciation schedules for our new fitness equipment and renovations. This adjustment aligns with our capitalization policy and affects our net income by decreasing it slightly due to increased non-cash expenses.

Accruals for Unpaid Expenses: We have accrued additional expenses related to utilities and lease services that were invoiced late. These accruals ensure that our financial statements accurately reflect all costs associated with the reporting period.

Inventory Reconciliation: A minor discrepancy in our inventory of supplements and merchandise was noted and corrected, leading to a slight adjustment in our cost of goods sold and inventory valuation.

Financial Issues Identified

Underutilization of Budget: Several departments have underutilized their allocated budgets, particularly in marketing and staff development. This underutilization may impact our ability to maximize revenue potential and maintain a competitive edge in the market.

Late Payments from Clients: An increase in late payments for membership fees and personal training sessions has been observed. This delay affects our cash flow and may necessitate tighter credit control measures.

Recommendations

Budget Review and Reallocation: It is recommended that department heads review their current spending and propose adjustments. Reallocation may be necessary to support areas with greater potential for return on investment, such as targeted advertising campaigns or enhanced customer loyalty programs.

Enhanced Credit Control Measures: Implement stricter policies for late payments, including reminders prior to due dates and potential penalties for repeated late payments to improve our cash flow management.

Regular Inventory Audits: To prevent future discrepancies and potential losses, conducting regular inventory audits is advised. This practice will help maintain accurate financial records and reduce the risk of theft or mismanagement.

The detailed financial analysis and the adjustments made this month are crucial for maintaining the integrity of our accounting records and supporting strategic decision-making. Your cooperation in adhering to the recommended changes and controls will be instrumental in driving our gym's continued financial health and operational success.

Action Required

Please review the recommendations and provide your feedback or action plan by [Deadline]. A follow-up meeting is scheduled for [Date] to discuss the implementation of these recommendations.

Attachment:

Detailed Financial Statements for [Month/Year]

Revised Departmental Budget Sheets

For any clarifications or further information, feel free to contact the finance department directly.

[Your Name]

[Your Title]

[Your Email]

[Your Company Number]