Free Financial Planner Criteria

Prepared By: [Your Name]

Date: April 2, 2050

Introduction

Choosing a financial planner is a critical decision that can significantly impact your financial well-being. It's important to assess various criteria to ensure that the planner you select aligns with your financial goals, values, and needs. The following criteria outline essential factors to consider when evaluating potential financial planners.

Purpose

The purpose of these criteria is to provide a structured approach for assessing financial planners. By evaluating them based on these criteria, you can make a more informed decision and select a planner who will best help you achieve your financial objectives.

Scope

This criteria assessment covers various aspects such as qualifications, services offered, fees, and client relationships to ensure a comprehensive evaluation. Each criterion is weighted based on its importance, and planners are scored accordingly.

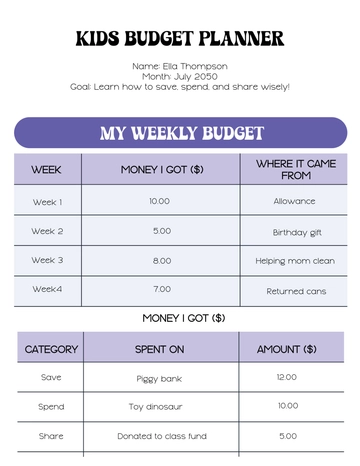

Criteria Table

Criteria | Description | Weight | Score (1-5) | Comments |

|---|---|---|---|---|

Qualifications | Relevant certifications (e.g., CFP, CFA), educational background, and professional experience. | 20% | ||

Experience | Years of experience in financial planning and experience with clients similar to your profile. | 15% | ||

Services Offered | Range of services provided, including financial planning, investment management, tax planning, etc. | 15% | ||

Fees and Costs | Transparency and structure of fees (e.g., hourly, flat fee, percentage of assets). | 15% | ||

Client Reviews | Feedback and reviews from past or current clients, including satisfaction and trustworthiness. | 10% | ||

Communication Skills | Ability to clearly explain financial concepts and maintain open, effective communication. | 10% | ||

Fiduciary Responsibility | Commitment to acting in your best interest, as opposed to just selling products or services. | 10% | ||

Accessibility | Availability for meetings and responsiveness to queries or concerns. | 5% |

Scoring System

1: Poor – The financial planner fails to meet basic requirements.

2: Fair – The planner meets the criterion but has notable weaknesses.

3: Good – The planner meets the criterion adequately with some minor issues.

4: Very Good – The planner surpasses the standard and shows strong competence.

5: Excellent – The planner far exceeds expectations and is exceptional.

Evaluation Process

Gather information on potential planners' qualifications, services, and fees.

Meet with planners to assess their fit based on your criteria and their performance.

Evaluate planners based on criteria and select the best one.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your recruitment with Template.net's Financial Planner Criteria Template. This editable and customizable template details critical competencies such as financial analysis, budgeting, investment strategies, and client advisory skills. Editable in our AI Editor Tool, it offers a comprehensive and professional structure to evaluate candidates' abilities and identify the best fit for your Financial Planner position.

You may also like

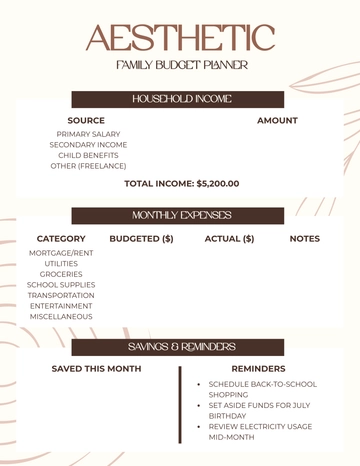

- Aesthetic Planner

- Hourly Planner

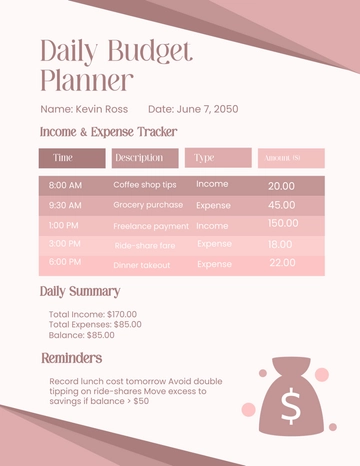

- Daily Planner

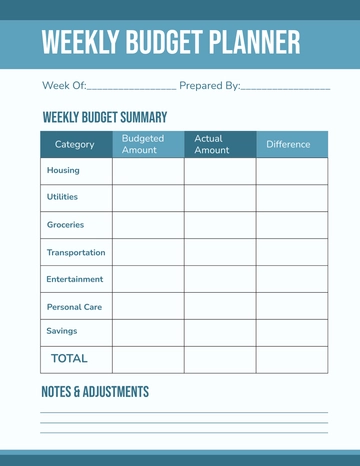

- Weekly Planner

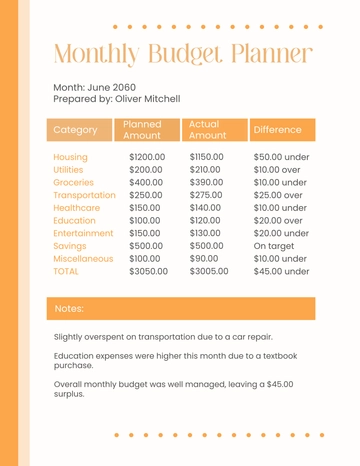

- Monthly Planner

- Planners Yearly

- Event Planner

- Project Planner

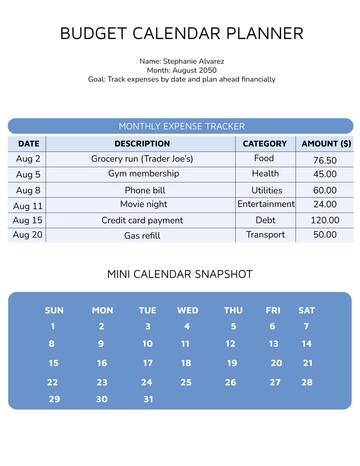

- Calendar Planner

- Student Planner

- School Planner

- Teacher Planner

- Kawaii Planner

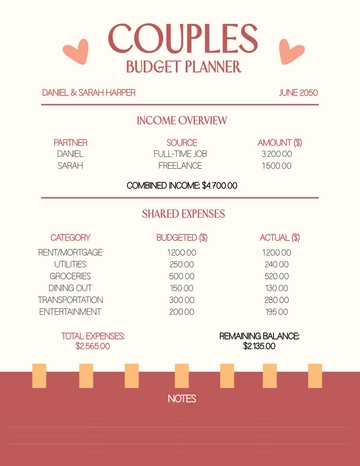

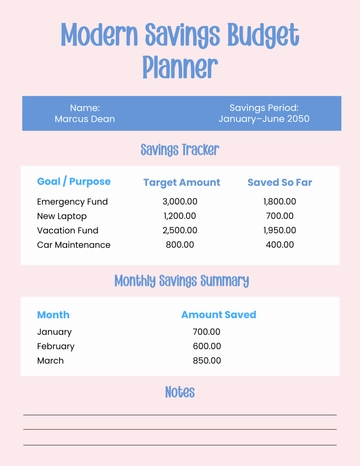

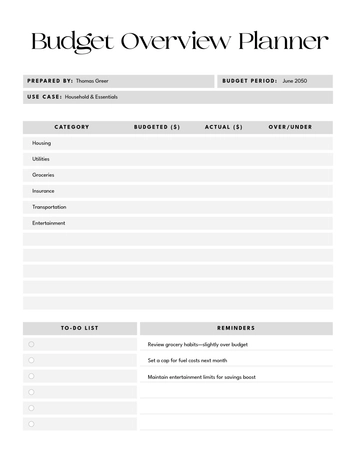

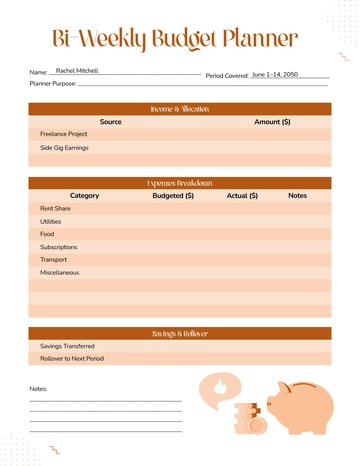

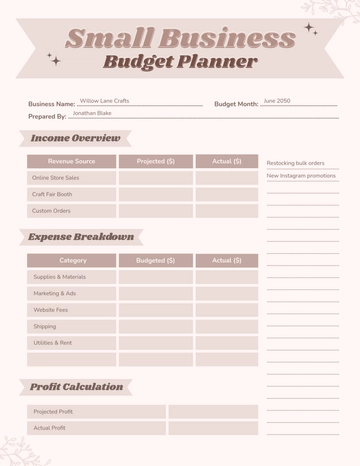

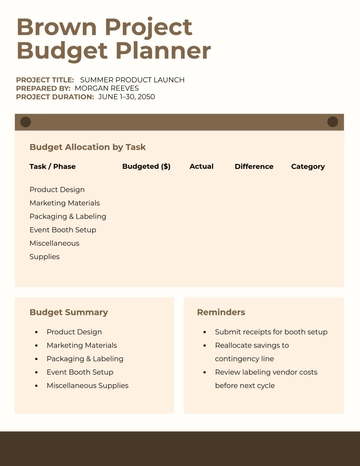

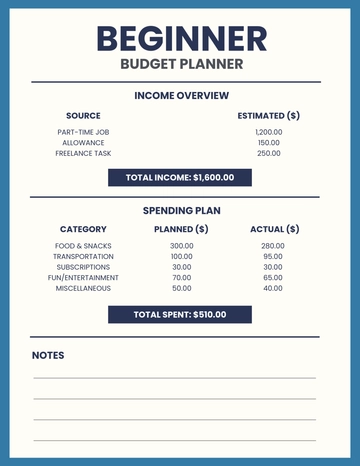

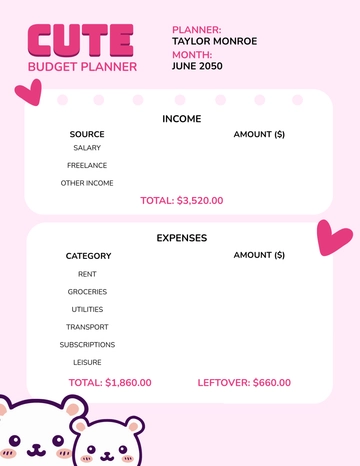

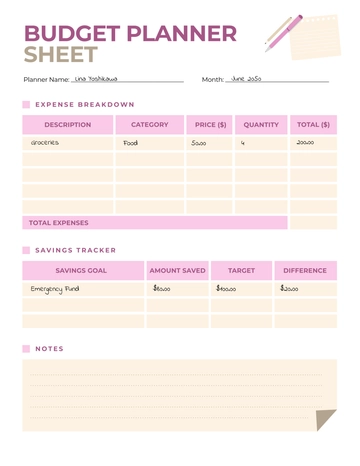

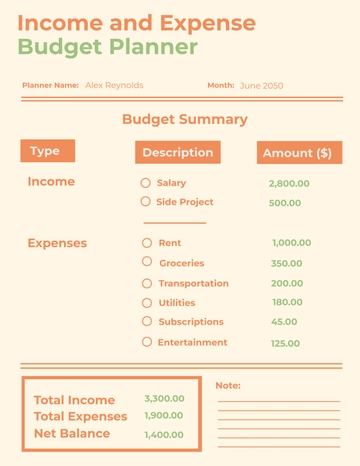

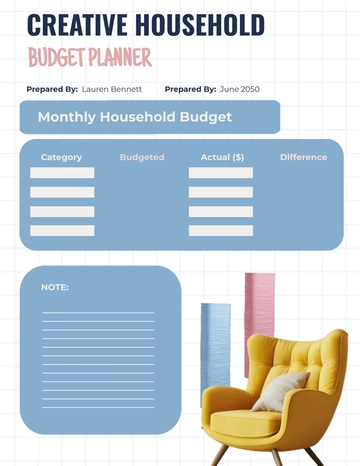

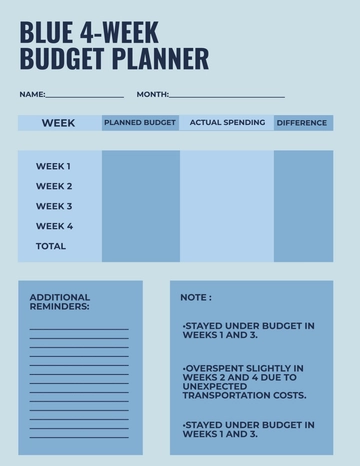

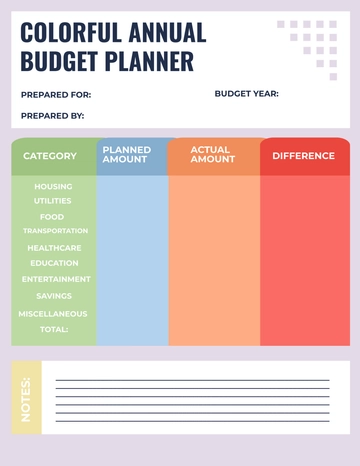

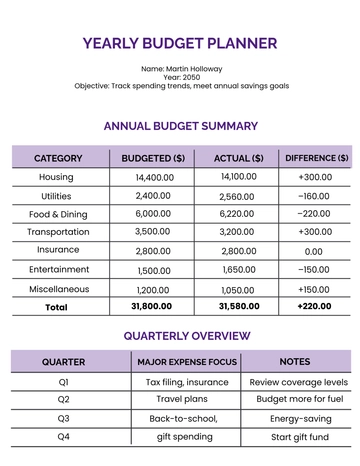

- Budget Planner

- Life Planner

- Meal Planner

- Study Planner

- Business

- Workout Planner

- Work Schedule Planner

- Party Planner

- Social Media Planner

- Baby Shower Planner

- Book Planner

- Planner Cover

- Debt Planner

- Desk Planner

- Diet Planner

- Family Planner

- Fitness Planner

- Goal Planner

- Health Planner

- Medical Planner

- Holiday Planner

- Homework Planner

- Itinerary Planner

- Journal Planner

- Personal Planner

- Route Planner

- Smart Goal Planner

- Travel Planner

- Wedding Planeer