Professional Grocery Store Cash Flow Statement

For the Period Ended [Month Day, Year]

Managing cash flow is crucial for ensuring the financial health of [Your Company Name]. This statement provides a detailed overview of the cash inflows and outflows for the store, offering insights into operating, investing, and financing activities. By analyzing this data, stakeholders can make informed decisions to sustain and grow the business effectively.

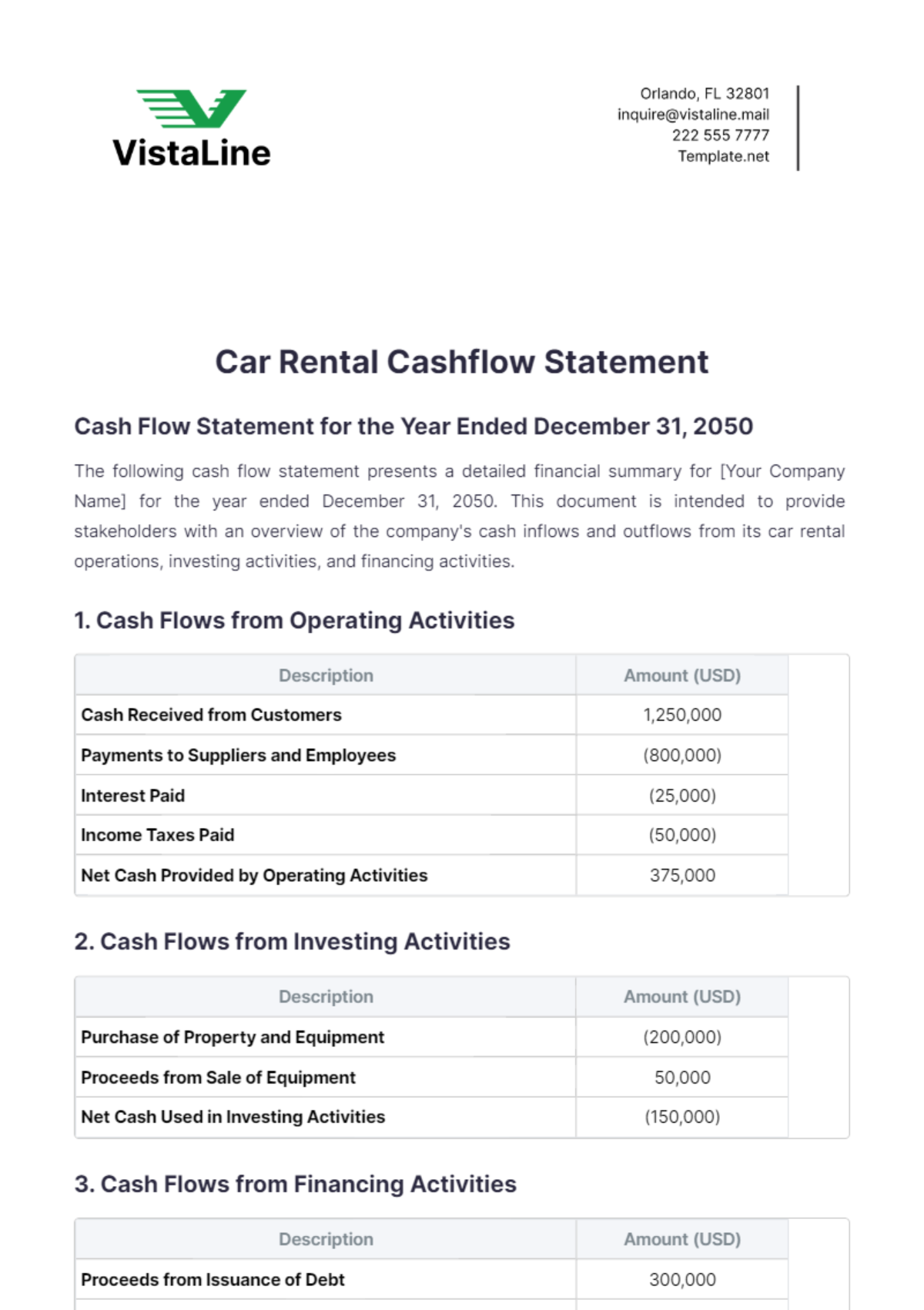

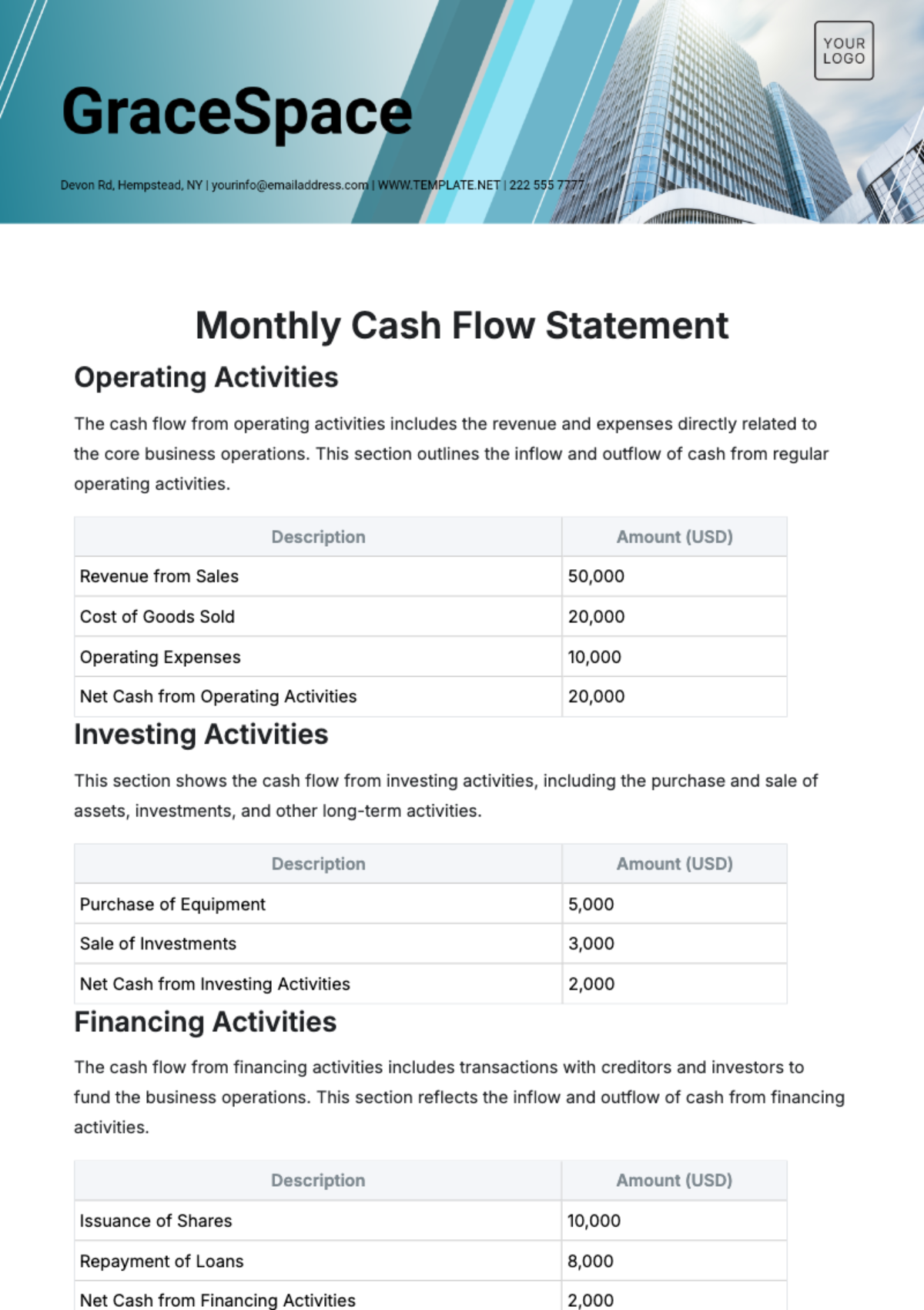

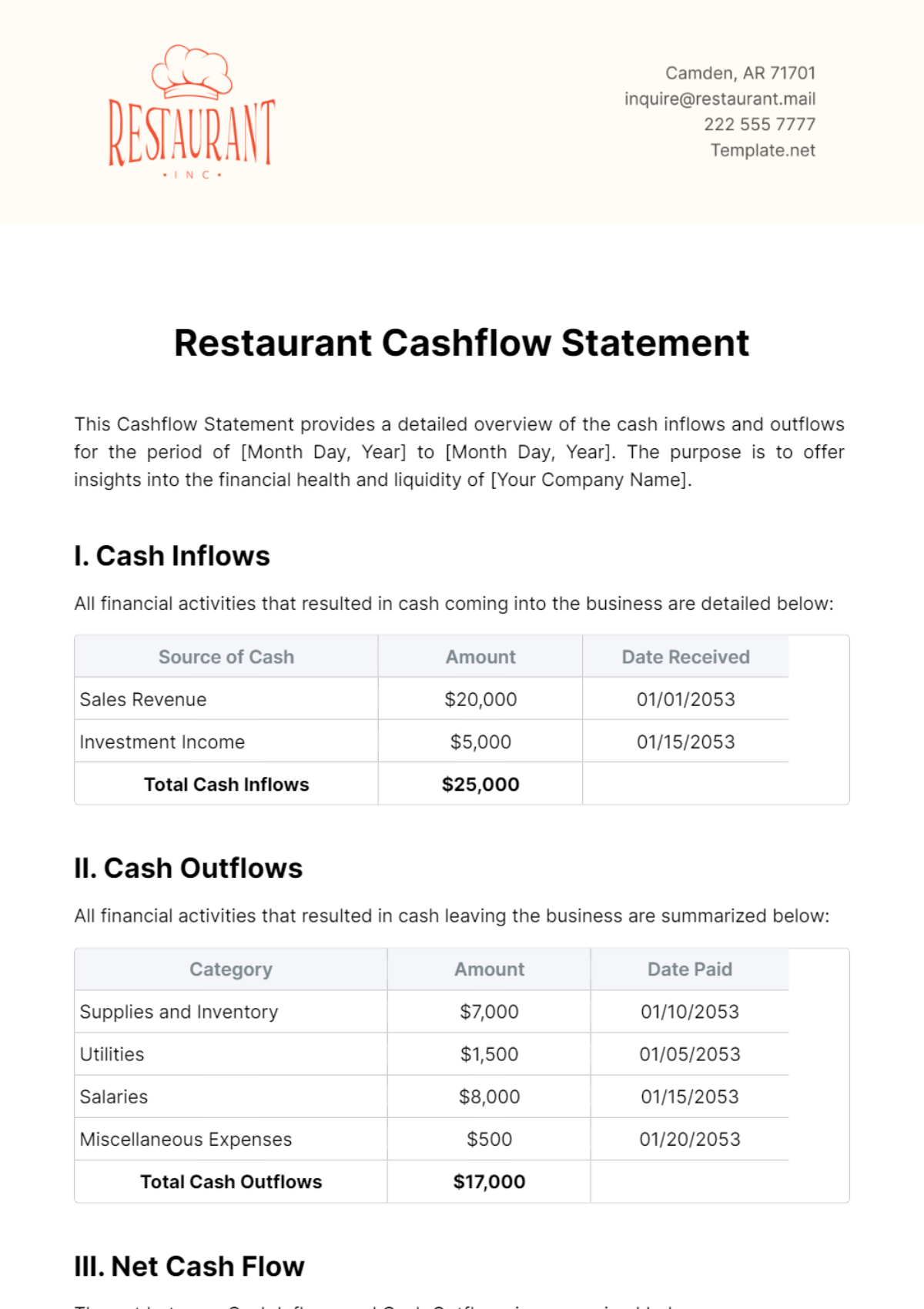

I. Operating Activities

The following table provides a detailed breakdown of cash flows from operating activities. This includes cash received from customers, payments to suppliers and employees, and other operating expenses critical to our day-to-day functioning.

Description | Amount |

|---|---|

Cash Received from Customers | $120,000 |

Payments to Suppliers | -$80,000 |

Payment of Salaries and Wages | -$20,000 |

Other Operating Expenses | -$5,000 |

Net Cash from Operating Activities | $15,000 |

The net cash from operating activities stands at $15,000. This indicates that after accounting for all operational revenues and expenses, [Your Company Name] has generated positive cash flow from its core business operations. The primary source of cash inflow is from customer sales, highlighting effective sales strategies and consumer demand. The significant outflows include payments to suppliers and employee wages, which are essential for maintaining inventory and workforce, critical to the store's operations. Effective management of these expenses helps maintain a balance between revenue and expenditure, ensuring operational continuity.

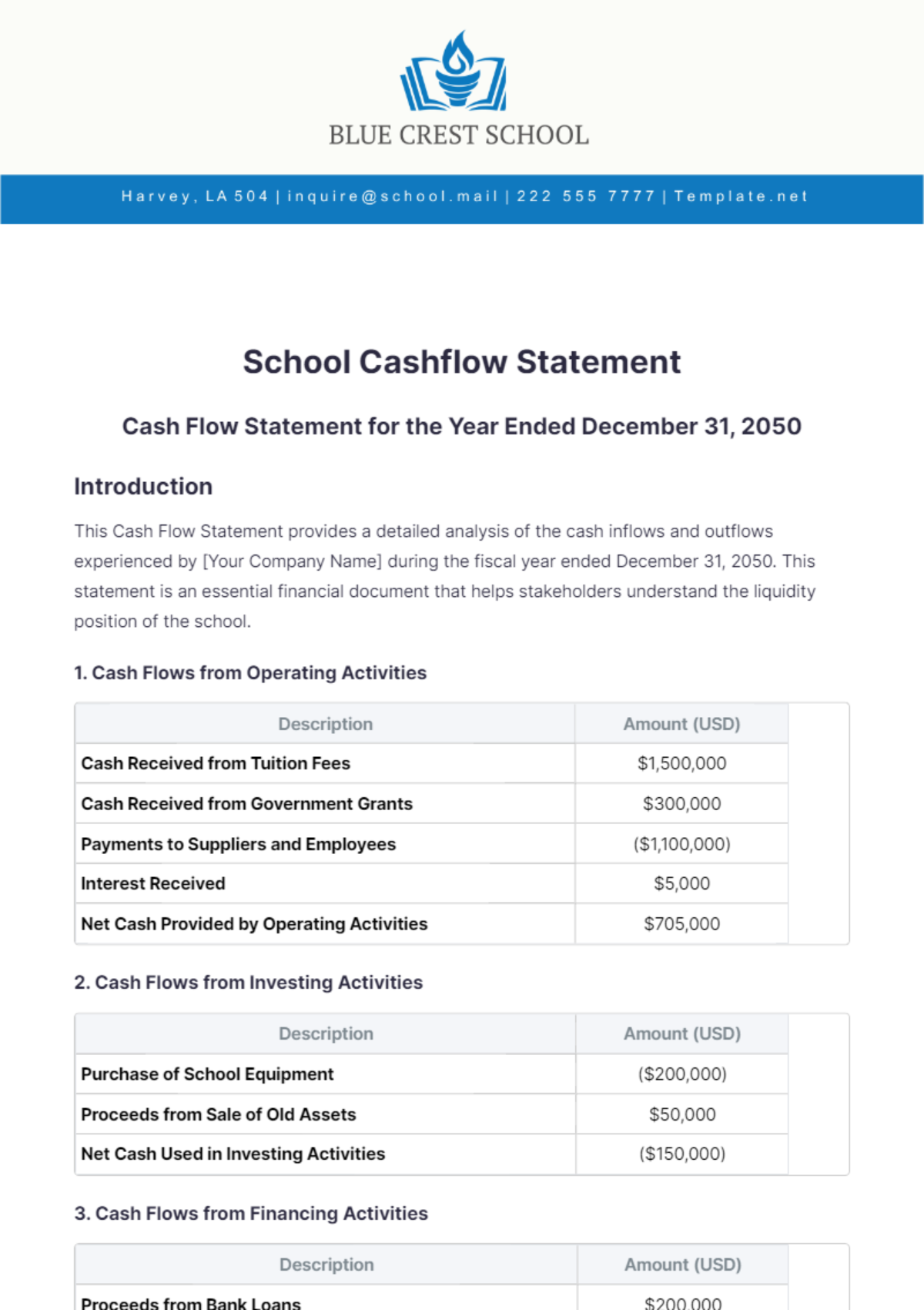

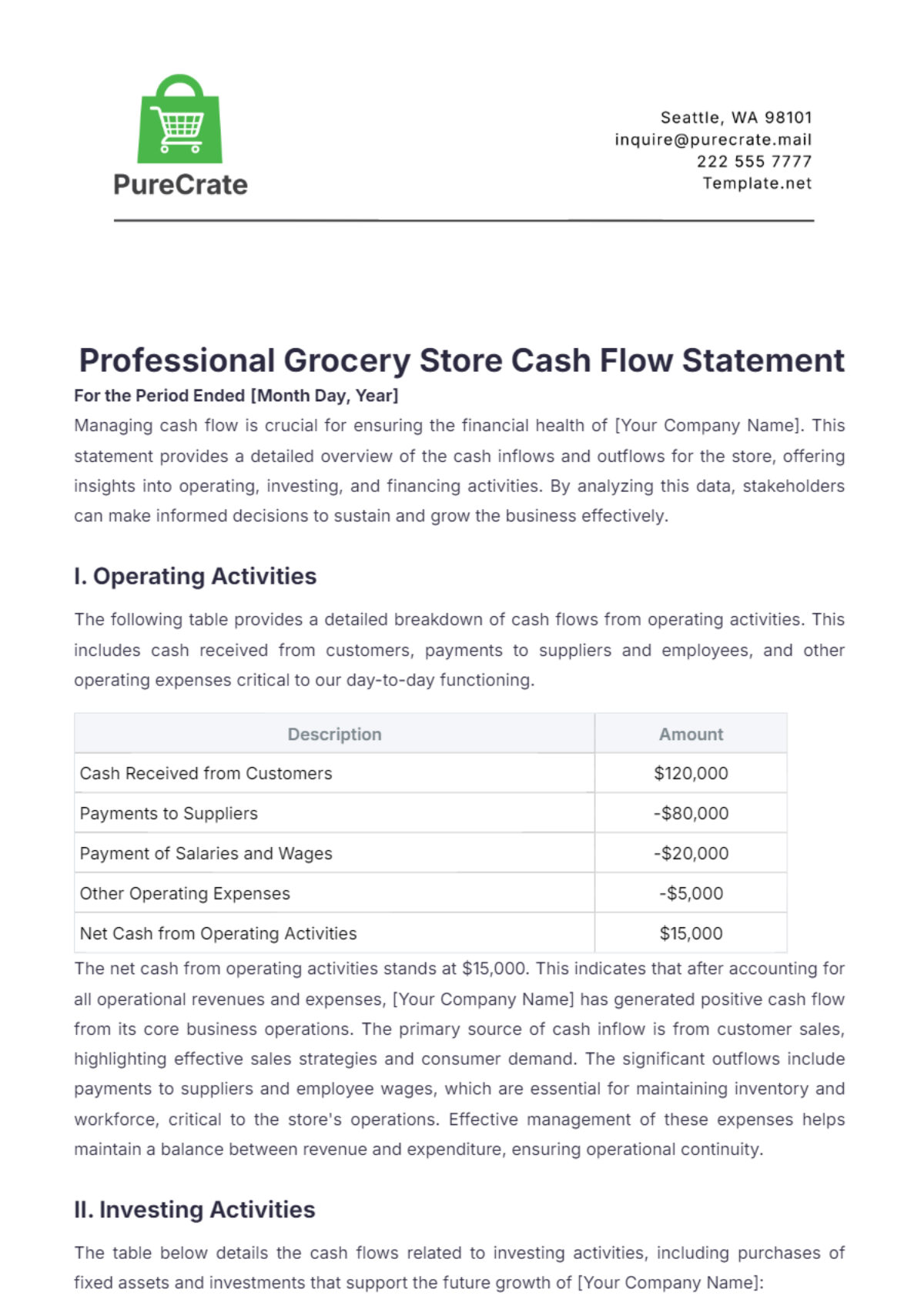

II. Investing Activities

The table below details the cash flows related to investing activities, including purchases of fixed assets and investments that support the future growth of [Your Company Name]:

Description | Amount |

|---|---|

Purchase of Equipment | -$10,000 |

Investment in Property | -$15,000 |

Net Cash from Investing Activities | -$25,000 |

The net cash from investing activities is a negative $25,000, reflecting significant investment in purchasing new equipment and property. These investments are crucial for upgrading the store's infrastructure and expanding its capacity to serve more customers. Although these outlays represent a cash outflow in the short term, they are expected to generate greater revenue in the long run by enhancing operational efficiency and customer experience. The focus on property investment suggests a strategic move towards expanding physical store locations, indicating growth and market penetration goals.

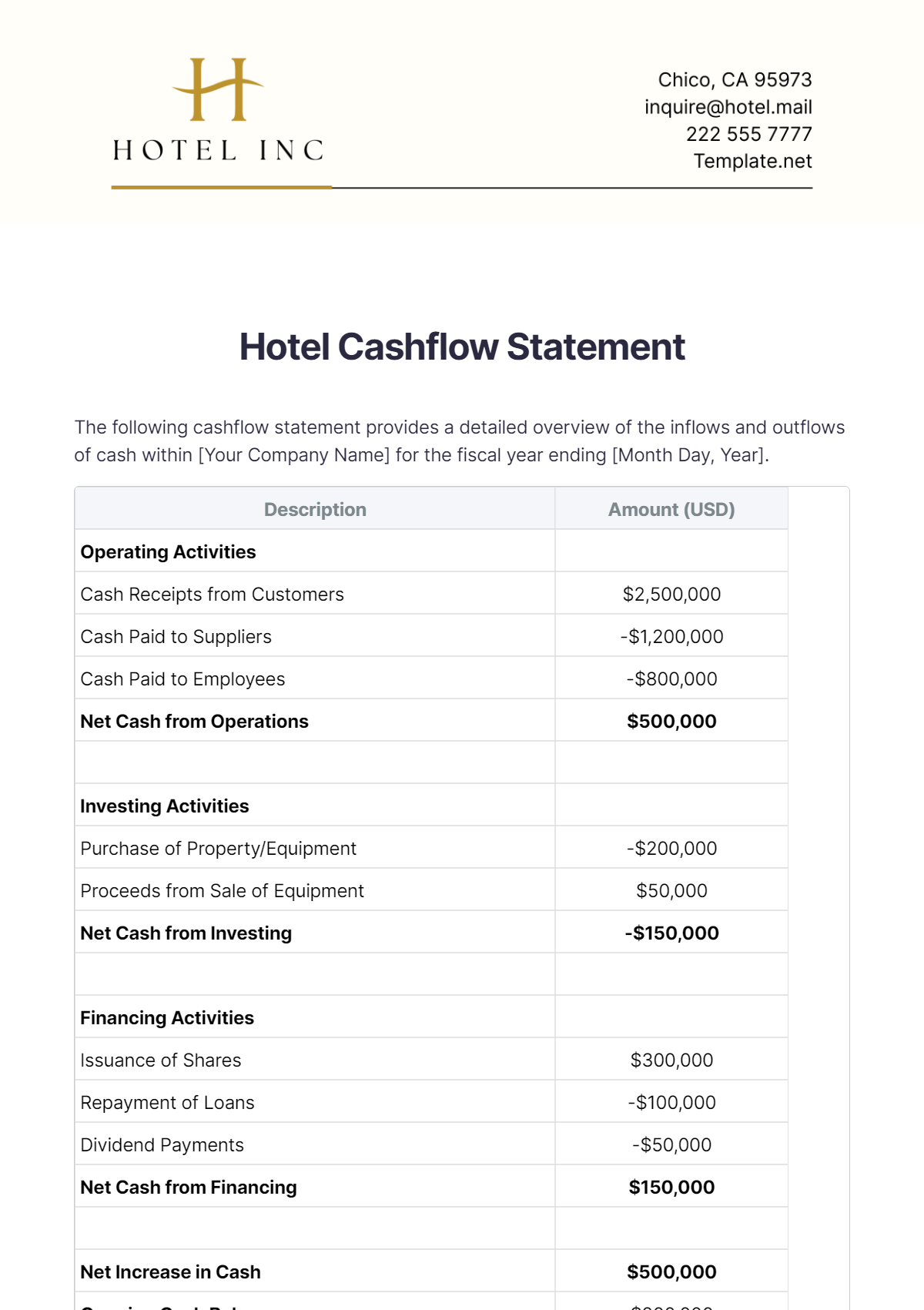

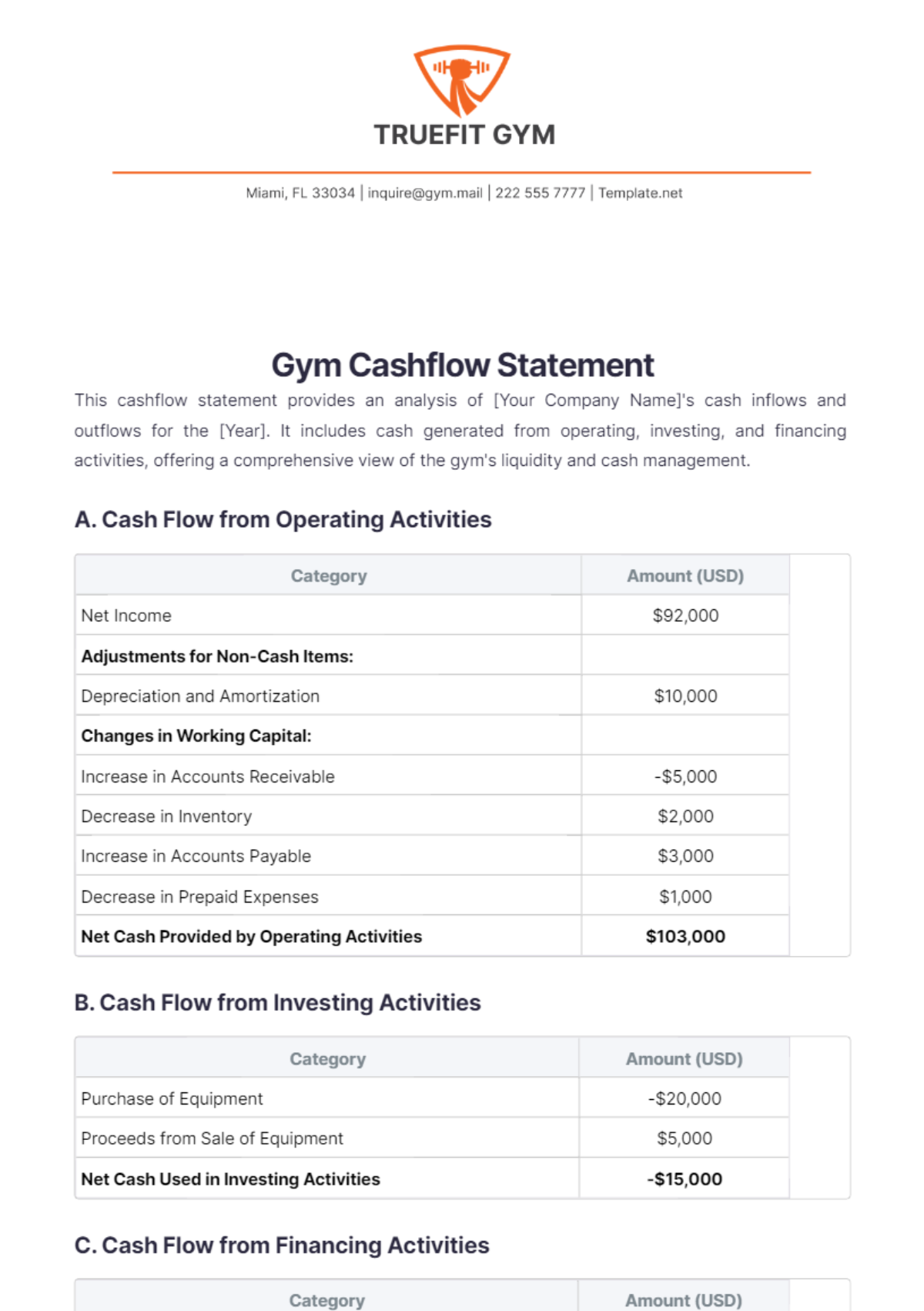

III. Financing Activities

This segment presents information on cash flows related to financing activities, including loans, repayments, and owner contributions or withdrawals:

Description | Amount |

|---|---|

Proceeds from Loans | $30,000 |

Repayment of Loans | -$5,000 |

Owner's Contribution | $10,000 |

Net Cash from Financing Activities | $35,000 |

The net cash from financing activities is $35,000, driven by proceeds from new loans and owner contributions. The loans indicate a reliance on external funding sources to support [Your Company Name]'s financial needs, possibly for large projects or inventory management. Repayments are kept to a minimum to maintain liquidity. The owner's contribution signifies strong confidence in the business's prospects, further bolstering cash reserves. This positive cash flow from financing activities provides additional funds to cover the negative cash flow from investing activities, suggesting robust financial planning and resource allocation.

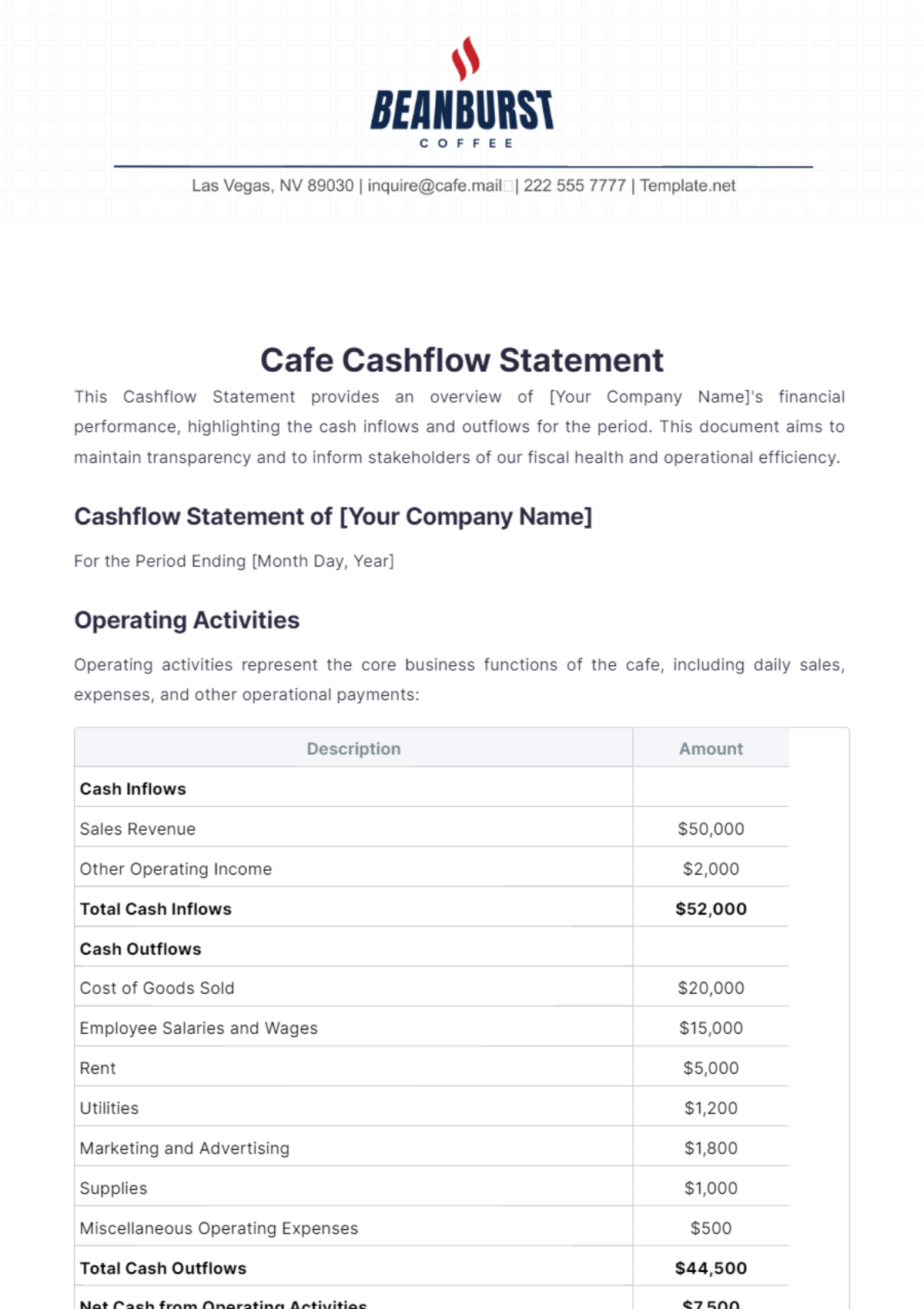

IV. Net Increase in Cash and Cash Equivalents

Summarizing the cash flows from operating, investing, and financing activities provides the overarching view of the net change in the company's cash position:

Description | Amount |

|---|---|

Net Cash from Operating Activities | $15,000 |

Net Cash from Investing Activities | -$25,000 |

Net Cash from Financing Activities | $35,000 |

Net Increase in Cash and Cash Equivalents | $25,000 |

The overall net increase in cash and cash equivalents for [Your Company Name] is $25,000. This positive figure demonstrates successful cash management across all activities. The positive cash flow from operations shows efficient management of everyday business operations. The strategic investments position the store for future growth, while financing activities have ensured adequate liquidity. This comprehensive approach to cash flow management reflects a robust financial strategy that supports both current operations and future expansion.

Prepared by:

[Your Name]

[Your Role/Position]

Date: [Month Day, Year]