Free Startup Cash Flow Statement Template

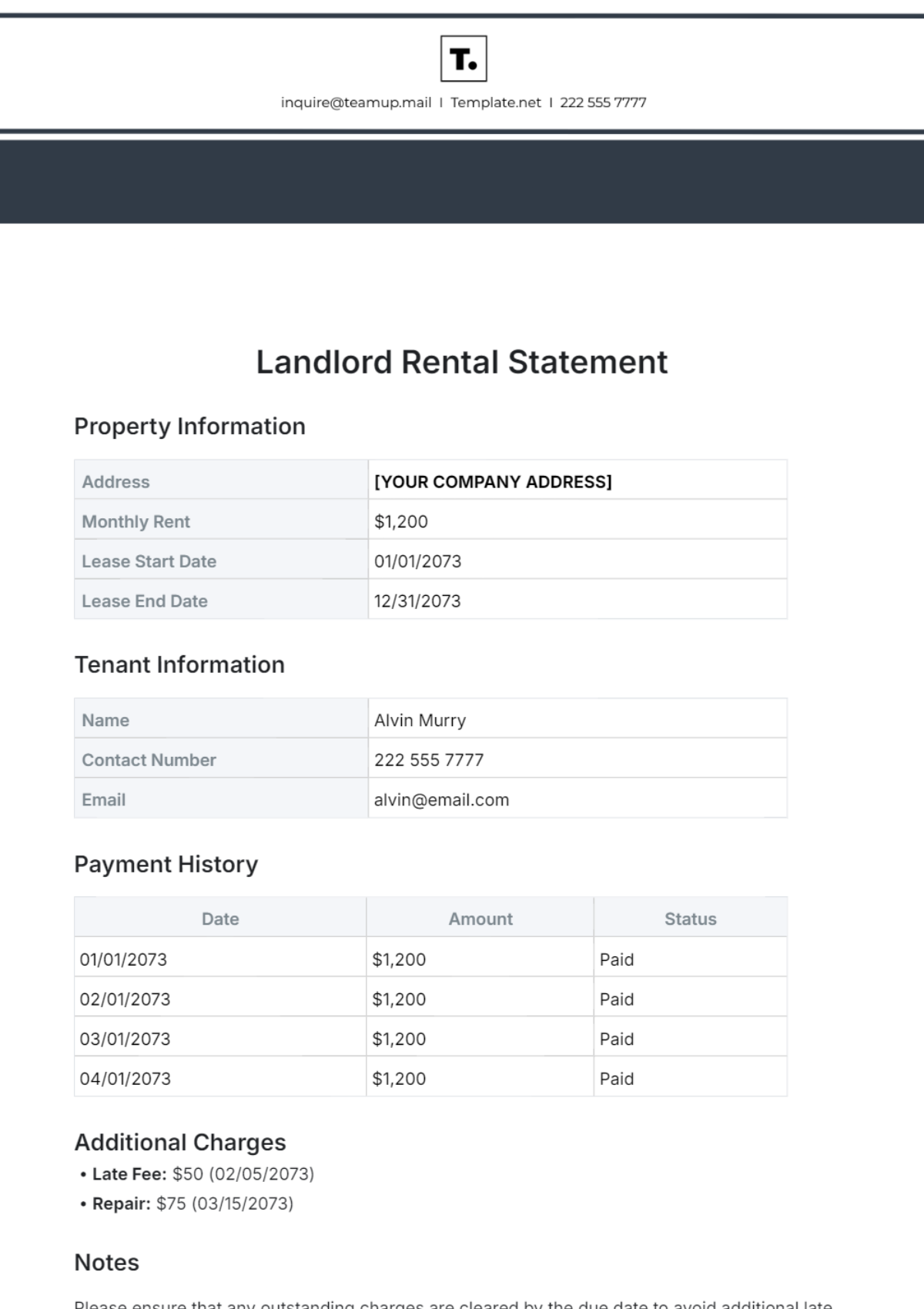

Startup Cash Flow Statement

This Cash Flow Statement provides a detailed overview of [Your Company Name]'s cash inflows and outflows for August [Year]. Use this statement to monitor liquidity, assess financial health, and make informed operational and financial decisions.

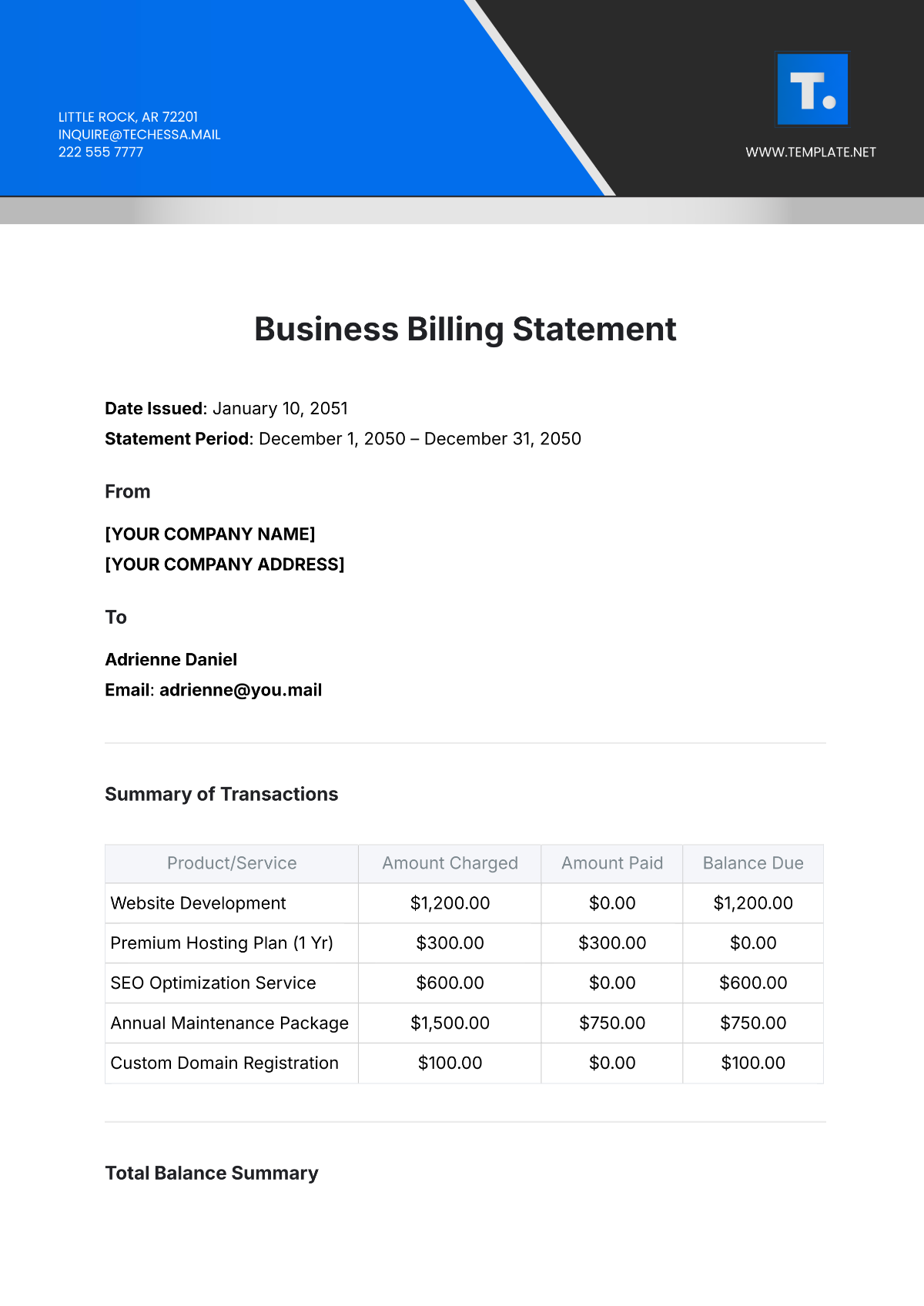

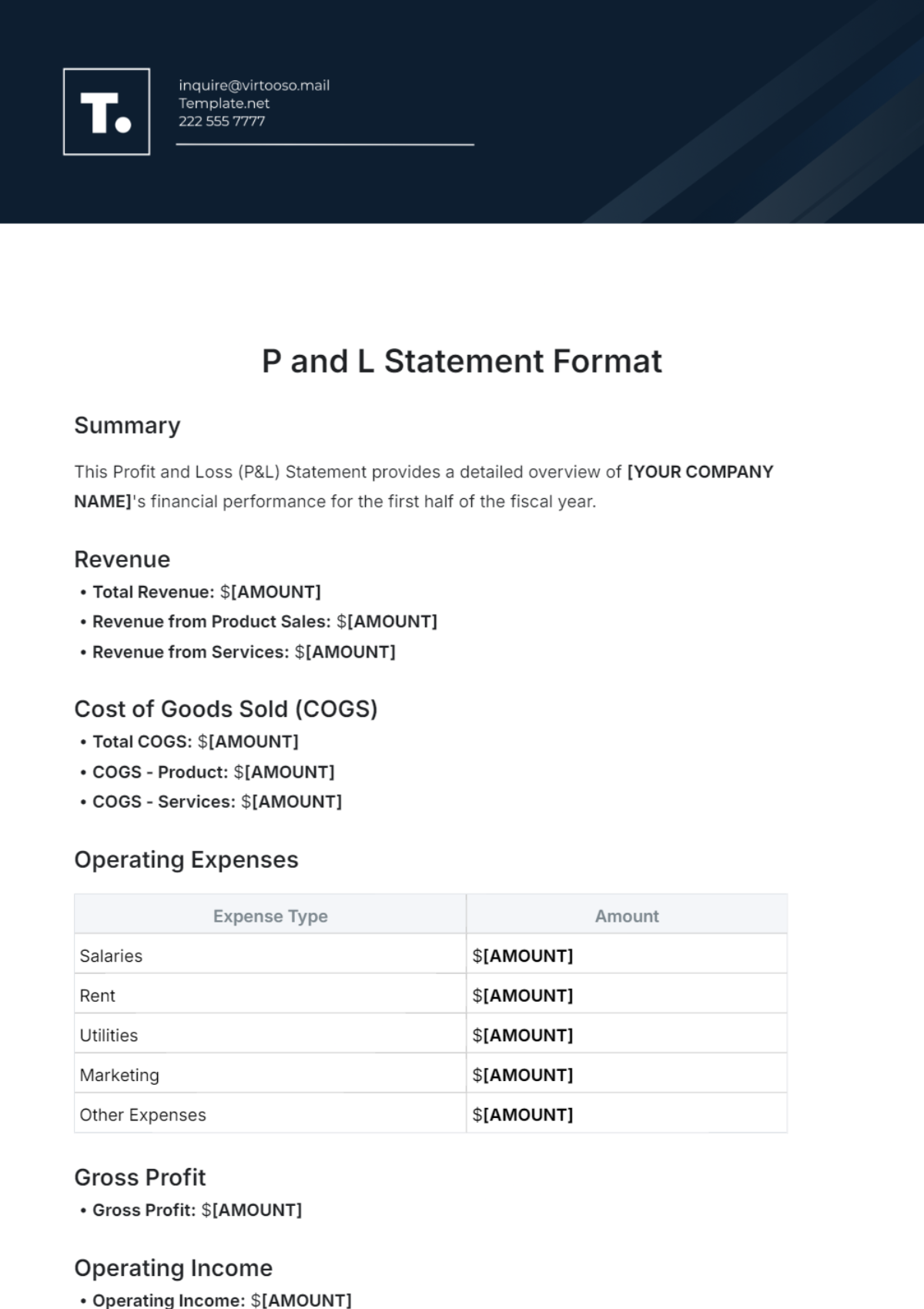

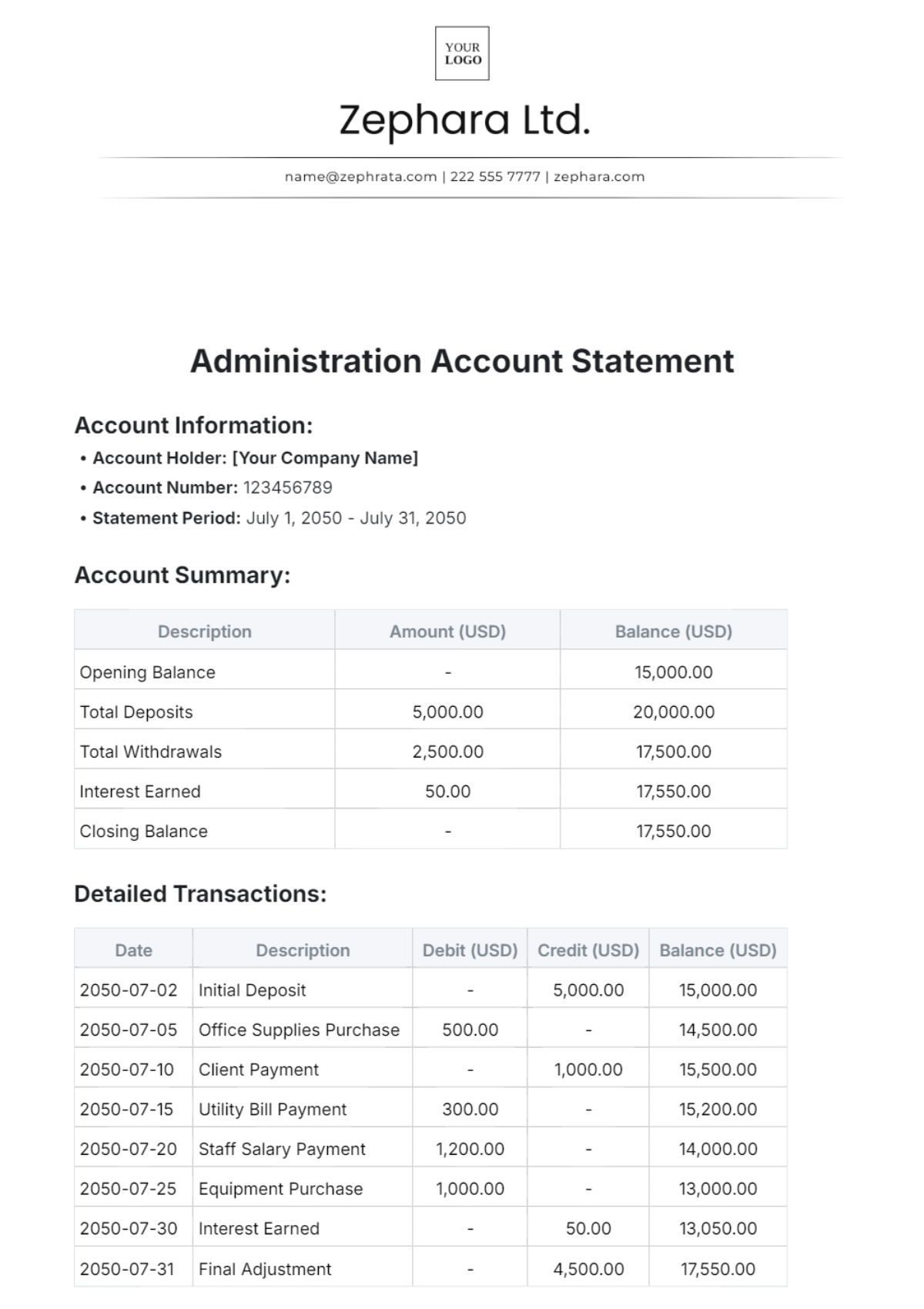

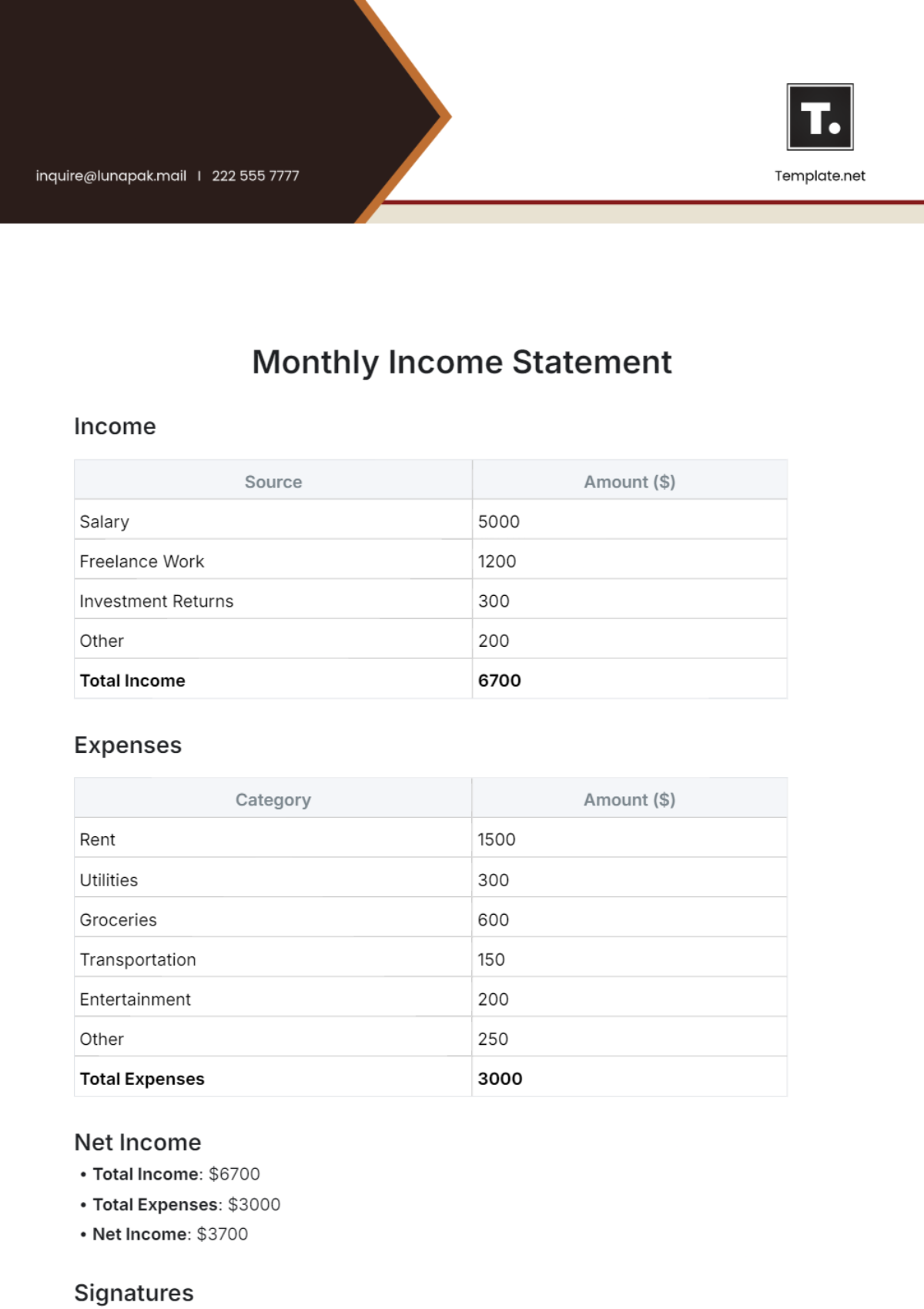

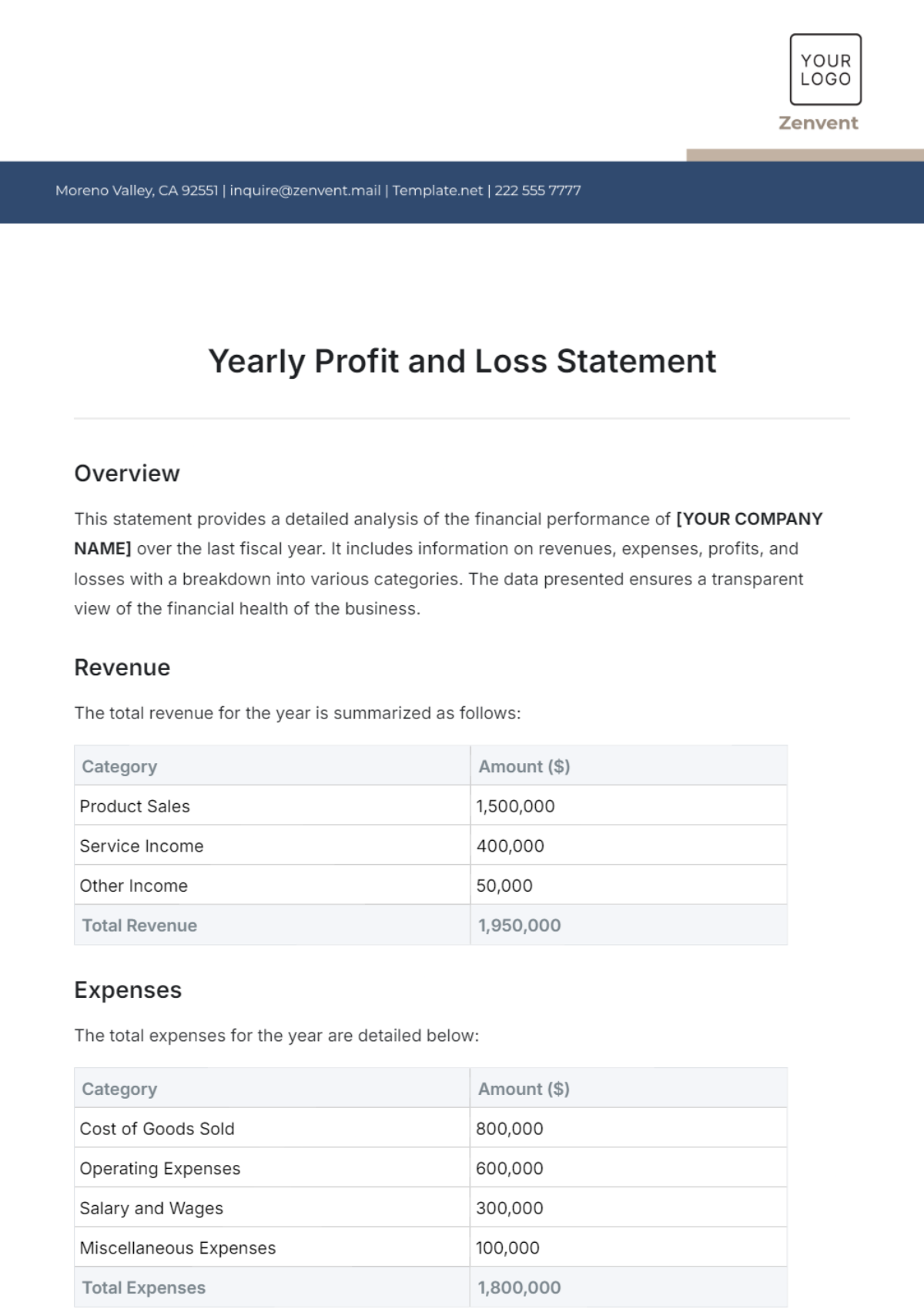

I. Cash Flows from Operating Activities

Cash Inflows

Category | Amount ($) |

|---|---|

Revenue from Sales | [000] |

Receipts from Customers | |

Total Cash Inflows |

Cash Outflows

Category | Amount ($) |

|---|---|

Cost of Goods Sold (COGS) | [000] |

Salaries and Wages | |

Rent and Utilities | |

Supplies and Inventory | |

Marketing and Advertising | |

Other Operating Expenses | |

Total Cash Outflows |

Net Cash Flow from Operating Activities: $[000]

II. Cash Flows from Investing Activities

Cash Inflows

Category | Amount ($) |

|---|---|

Sale of Equipment | [000] |

Total Cash Inflows |

Cash Outflows

Category | Amount ($) |

|---|---|

Purchase of Equipment | [000] |

Total Cash Inflows |

Net Cash Flow from Investing Activities: $[000]

III. Cash Flows from Financing Activities

Cash Inflows

Category | Amount ($) |

|---|---|

Capital Contributions from Owners | [000] |

Loan Received | |

Total Cash Inflows |

Cash Outflows

Category | Amount ($) |

|---|---|

Loan Repayments | [000] |

Total Cash Inflows |

Net Cash Flow from Financing Activities: $[000]

IV. Net Increase/Decrease in Cash

The net increase in cash of $[000] reflects the overall cash movement resulting from operating, investing, and financing activities. This positive cash flow indicates the startup is generating sufficient cash to cover its expenses and investments while maintaining a healthy cash reserve.

V. Beginning Cash Balance

The beginning cash balance of $[000] represents the available funds at the start of August [Year]. This initial amount provides a baseline for assessing the impact of the month’s cash activities on the company’s liquidity.

VI. Ending Cash Balance

The ending cash balance of $[000] is the sum of the beginning balance and the net increase in cash. This balance ensures that the company has a solid financial cushion to support ongoing operations and future growth opportunities.