Accounting Financial Statement

The Accounting Financial Statement is a critical document that provides a comprehensive overview of the financial performance and position of [Your Company Name].

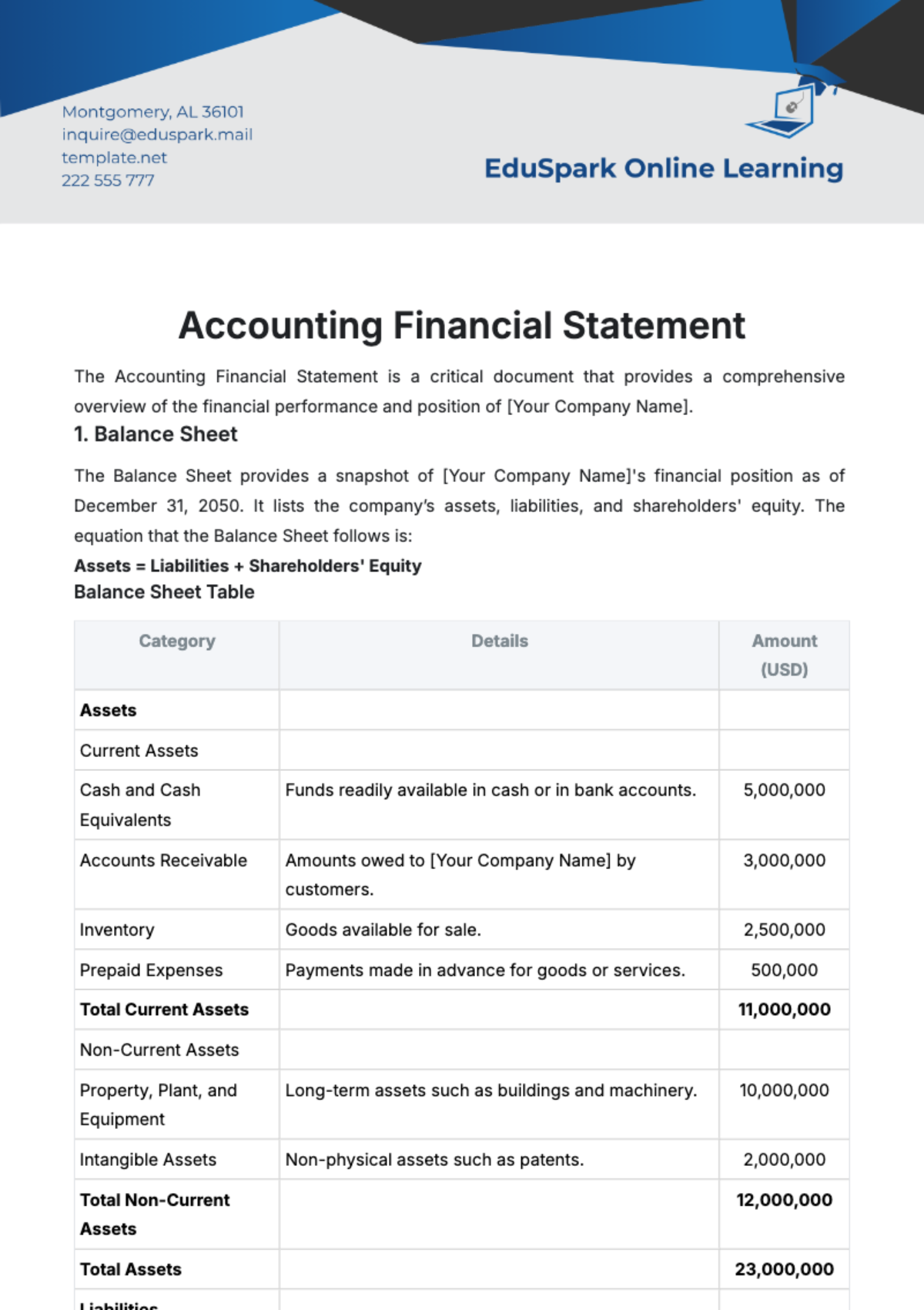

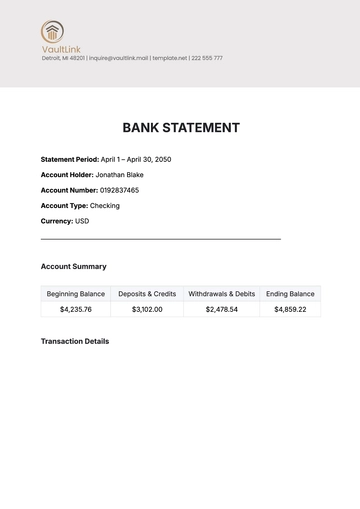

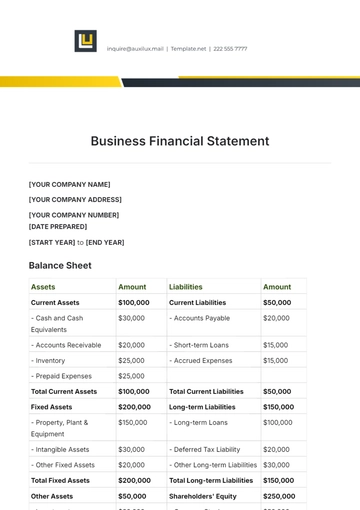

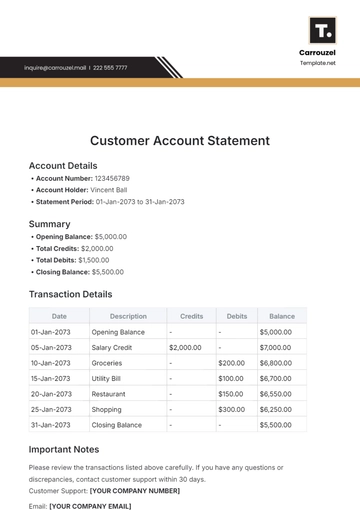

1. Balance Sheet

The Balance Sheet provides a snapshot of [Your Company Name]'s financial position as of December 31, 2050. It lists the company’s assets, liabilities, and shareholders' equity. The equation that the Balance Sheet follows is:

Assets = Liabilities + Shareholders' Equity

Balance Sheet Table

Category | Details | Amount (USD) |

|---|

Assets | | |

Current Assets | | |

Cash and Cash Equivalents | Funds readily available in cash or in bank accounts. | 5,000,000 |

Accounts Receivable | Amounts owed to [Your Company Name] by customers. | 3,000,000 |

Inventory | Goods available for sale. | 2,500,000 |

Prepaid Expenses | Payments made in advance for goods or services. | 500,000 |

Total Current Assets | | 11,000,000 |

Non-Current Assets | | |

Property, Plant, and Equipment | Long-term assets such as buildings and machinery. | 10,000,000 |

Intangible Assets | Non-physical assets such as patents. | 2,000,000 |

Total Non-Current Assets | | 12,000,000 |

Total Assets | | 23,000,000 |

Liabilities | | |

Current Liabilities | | |

Accounts Payable | Amounts [Your Company Name] owes to suppliers. | 2,000,000 |

Short-Term Loans | Loans due within a year. | 1,000,000 |

Accrued Expenses | Expenses incurred but not yet paid. | 800,000 |

Total Current Liabilities | | 3,800,000 |

Non-Current Liabilities | | |

Long-Term Debt | Loans due after more than a year. | 7,000,000 |

Deferred Tax Liabilities | Taxes owed in the future due to timing differences. | 500,000 |

Total Non-Current Liabilities | | 7,500,000 |

Total Liabilities | | 11,300,000 |

Shareholders' Equity | | |

Common Stock | Equity investment by shareholders. | 6,000,000 |

Retained Earnings | Cumulative profits retained in the business. | 5,700,000 |

Total Shareholders' Equity | | 11,700,000 |

Total Liabilities and Shareholders' Equity | | 23,000,000 |

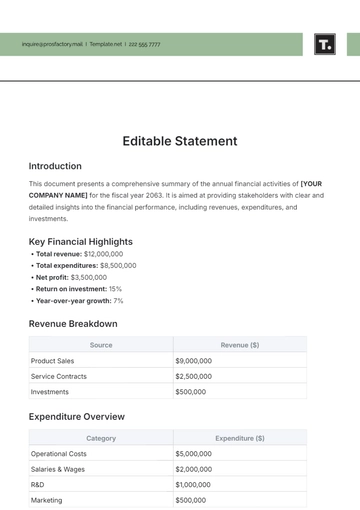

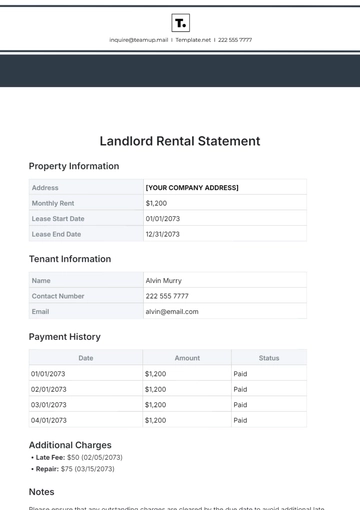

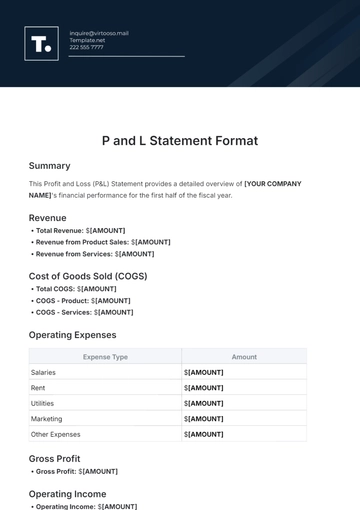

2. Income Statement

The Income Statement, also known as the Profit and Loss Statement, summarizes [Your Company Name]'s revenues, costs, and expenses over the fiscal year ending December 31, 2050. It provides a clear picture of the company's profitability.

Income Statement Table

Category | Details | Amount (USD) |

|---|

Revenue | | |

Sales Revenue | Income from the sale of goods or services. | 20,000,000 |

Other Income | Income from non-core business activities. | 500,000 |

Total Revenue | | 20,500,000 |

Expenses | | |

Cost of Goods Sold (COGS) | Direct costs attributable to the production of goods sold. | 10,000,000 |

Operating Expenses | | |

Salaries and Wages | Payments made to employees. | 3,000,000 |

Rent Expense | Cost of leasing premises. | 500,000 |

Utilities | Payments for electricity, water, etc. | 300,000 |

Depreciation and Amortization | Reduction in the value of tangible and intangible assets. | 400,000 |

Total Operating Expenses | | 4,200,000 |

Total Expenses | | 14,200,000 |

Operating Income | Revenue minus operating expenses. | 6,300,000 |

Interest Expense | Payments on borrowed funds. | 500,000 |

Income Before Taxes | | 5,800,000 |

Income Tax Expense | Provision for taxes on the year’s income. | 1,740,000 |

Net Income | Profit after all expenses have been deducted from revenue. | 4,060,000 |

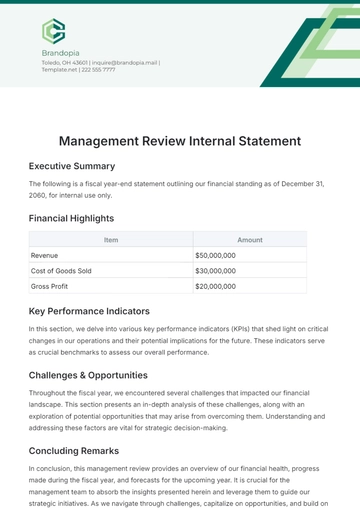

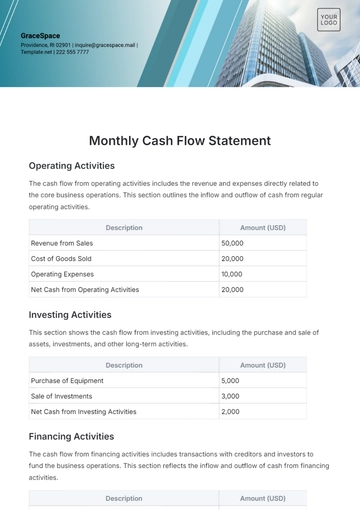

3. Cash Flow Statement

The Cash Flow Statement shows the cash inflows and outflows for [Your Company Name] over the fiscal year ending December 31, 2050. It is divided into three sections: Operating Activities, Investing Activities, and Financing Activities.

Cash Flow Statement Table

Category | Details | Amount (USD) |

|---|

Operating Activities | | |

Cash Receipts from Customers | Cash received from sales. | 18,500,000 |

Cash Paid to Suppliers and Employees | Payments for goods and services. | 11,500,000 |

Net Cash Provided by Operating Activities | | 7,000,000 |

Investing Activities | | |

Purchase of Property, Plant, and Equipment | Cash used for acquiring long-term assets. | 4,000,000 |

Sale of Investments | Cash received from selling investments. | 1,000,000 |

Net Cash Used in Investing Activities | | (3,000,000) |

Financing Activities | | |

Proceeds from Issuing Common Stock | Cash received from shareholders. | 2,000,000 |

Repayment of Long-Term Debt | Cash used to repay loans. | 2,500,000 |

Net Cash Used in Financing Activities | | (500,000) |

Net Increase in Cash | | 3,500,000 |

Cash at Beginning of Year | | 1,500,000 |

Cash at End of Year | | 5,000,000 |

Accounting Templates @ Template.net