Free Sample Budget Planner

Introduction

Welcome to the Sample Budget Planner designed for educational purposes. This planner is intended to help you understand and apply budgeting principles effectively. By following this template, you’ll gain valuable insights into managing finances, whether for personal use, classroom exercises, or financial literacy programs.

Prepared By

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Company: [YOUR COMPANY NAME]

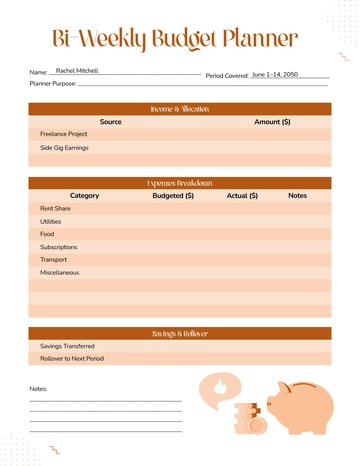

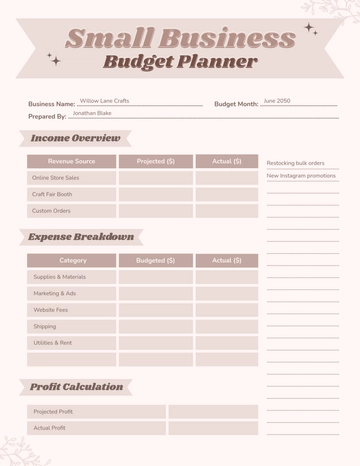

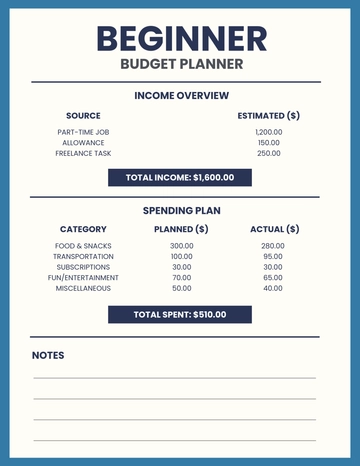

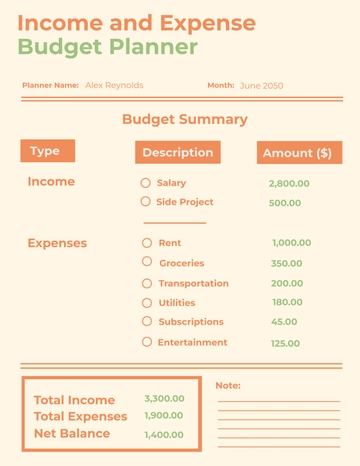

Income

Source | Amount | Date | Frequency | Notes |

|---|---|---|---|---|

Salary | $5,000 | January 1, 2050 | Monthly | Primary income source |

Investments | $500 | February 1, 2050 | Quarterly | Dividend income |

Other Income | $200 | March 1, 2050 | One-time | Freelance project |

Total Income | $5,700 |

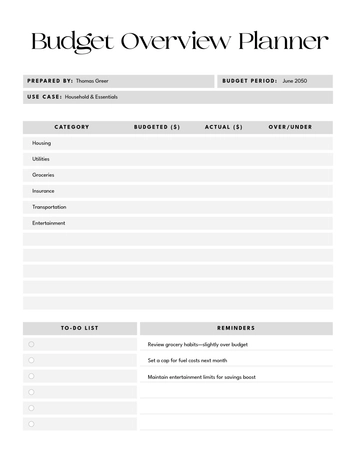

Fixed Expenses

Category | Amount | Date | Frequency | Notes |

|---|---|---|---|---|

Rent/Mortgage | $1,500 | January 5, 2050 | Monthly | |

Utilities | $200 | January 10, 2050 | Monthly | Electricity and water |

Insurance | $150 | January 15, 2050 | Monthly | Health insurance |

Loan Payment | $300 | January 20, 2050 | Monthly | Student loan |

Total Fixed Expenses | $2,150 |

Variable Expenses

Category | Amount | Date | Frequency | Notes |

|---|---|---|---|---|

Groceries | $300 | January 25, 2050 | Monthly | |

Transportation | $150 | February 1, 2050 | Monthly | Public transit |

Entertainment | $100 | February 10, 2050 | Monthly | Movies and outings |

Dining Out | $75 | February 15, 2050 | Monthly | |

Total Variable Expenses | $625 |

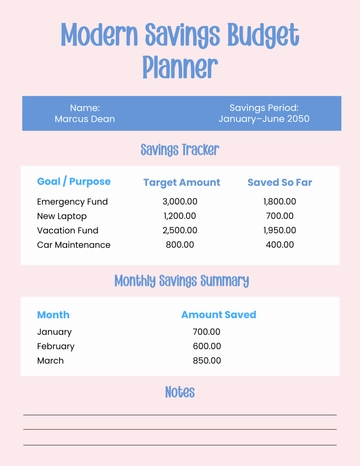

Savings and Investments

Category | Amount | Date | Frequency | Notes |

|---|---|---|---|---|

Emergency Fund | $200 | March 1, 2050 | Monthly | |

Retirement Fund | $300 | March 5, 2050 | Monthly | |

Investment Account | $250 | March 10, 2050 | Monthly | |

Total Savings and Investments | $750 |

Summary

Category | Amount |

|---|---|

Total Income | $5,700 |

Total Fixed Expenses | $2,150 |

Total Variable Expenses | $625 |

Total Savings and Investments | $750 |

Net Balance | $2,175 |

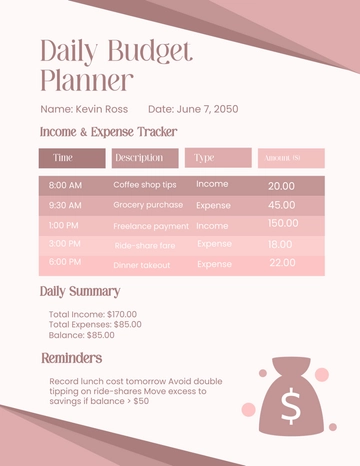

Reminders

Review and update your budget regularly to reflect any changes in income or expenses.

Track all your expenses to ensure you stay within your budget.

Set specific savings goals and monitor your progress.

Adjust your budget as needed to accommodate unforeseen expenses.

Utilize financial tools or apps to help manage and analyze your budget.

Seek advice from financial experts if you need assistance with complex budgeting issues.

Keep a record of all financial documents for reference and planning.

Stay disciplined and committed to your budget for long-term financial success.

By following this Sample Budget Planner, you’ll develop a solid foundation in budgeting and financial management, paving the way for a more organized and financially secure future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Achieve financial clarity with the Sample Budget Planner Template from Template.net. This fully customizable and editable template is designed to simplify your budgeting process. Use the AI Editor Tool to tailor it to your specific needs effortlessly. Manage expenses, track income, and stay on top of your finances with this easy-to-use budgeting solution.

You may also like

- Aesthetic Planner

- Hourly Planner

- Daily Planner

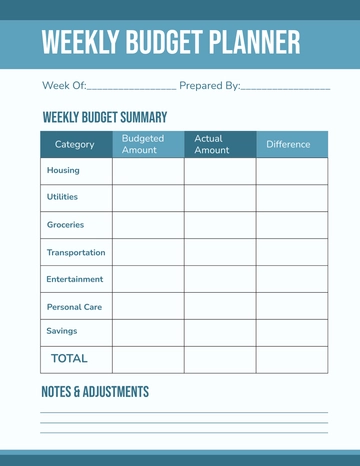

- Weekly Planner

- Monthly Planner

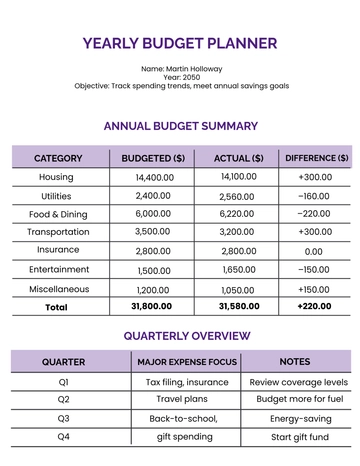

- Planners Yearly

- Event Planner

- Project Planner

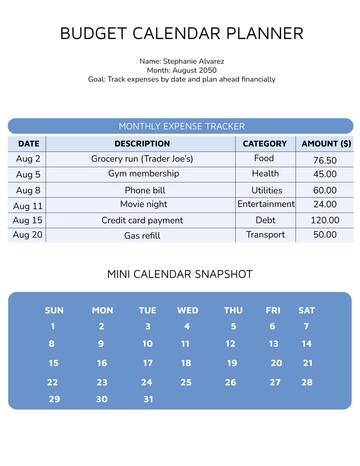

- Calendar Planner

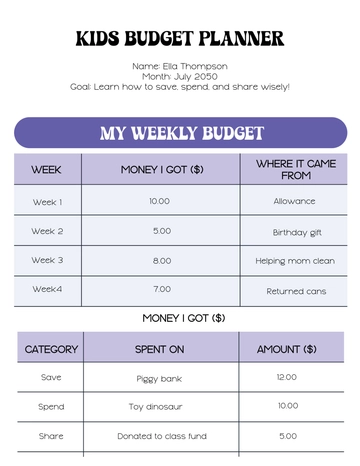

- Student Planner

- School Planner

- Teacher Planner

- Kawaii Planner

- Budget Planner

- Life Planner

- Meal Planner

- Study Planner

- Business

- Workout Planner

- Work Schedule Planner

- Party Planner

- Social Media Planner

- Baby Shower Planner

- Book Planner

- Planner Cover

- Debt Planner

- Desk Planner

- Diet Planner

- Family Planner

- Fitness Planner

- Goal Planner

- Health Planner

- Medical Planner

- Holiday Planner

- Homework Planner

- Itinerary Planner

- Journal Planner

- Personal Planner

- Route Planner

- Smart Goal Planner

- Travel Planner

- Wedding Planeer