Free Financial Plan

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Introduction

Managing debt effectively is crucial for maintaining financial stability and achieving long-term goals. This financial plan outlines a comprehensive strategy for tackling existing debt and preventing future accumulation. By following the outlined steps, you can gain control over your finances and work towards a debt-free future.

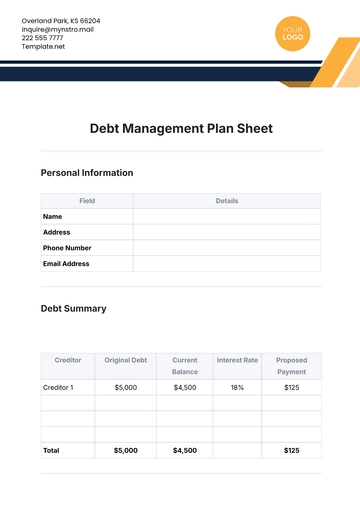

Overview of Current Debt

Here is a summary of your current debt situation:

Debt Type | Creditor | Total Amount Owed | Minimum Monthly Payment | Interest Rate |

|---|---|---|---|---|

Credit Card 1 | Bank of Horizons | $4,500.00 | $100.00 | 18.00% |

Credit Card 2 | National Credit Corp | $2,200.00 | $75.00 | 15.00% |

Student Loan 1 | EduFinance Ltd. | $12,000.00 | $150.00 | 5.00% |

Car Loan | AutoBank | $8,000.00 | $200.00 | 7.00% |

Mortgage | Home Loans Inc. | $150,000.00 | $1,200.00 | 3.50% |

Debt Reduction Strategy

Evaluate and Prioritize Debts

Start by listing all debts and their associated interest rates. Focus on paying off high-interest debts first while making minimum payments on others.Create a Budget

Develop a detailed budget to track your income and expenses. Allocate a portion of your monthly income towards debt repayment.Negotiate with Creditors

Contact creditors to negotiate lower interest rates or revised payment terms. This can reduce the overall cost of your debt.Increase Income

Explore opportunities to increase your income through side jobs, freelance work, or selling unused items.Implement a Debt Repayment Plan

Consider using methods like the Snowball or Avalanche method to systematically pay off your debts. The Snowball method focuses on paying off the smallest debts first, while the Avalanche method prioritizes the highest interest debts.

Key Milestones

Milestone | Target Date | Status |

|---|---|---|

Complete Budget | January 1, 2050 | Not Started |

Negotiate with Creditors | February 1, 2050 | Not Started |

First Debt Paid Off | March 1, 2050 | Not Started |

Increase Income | April 1, 2050 | Not Started |

Achieve Debt-Free Status | December 31, 2050 | Not Started |

Conclusion

By adhering to this debt management plan, you can systematically reduce your debt and work towards financial freedom. Remember to regularly review your progress and adjust the plan as needed to stay on track.

Reminders

Regularly update your budget to reflect changes in income and expenses.

Review your debt repayment progress monthly.

Communicate with creditors if you face any difficulties.

Stay informed about changes in interest rates and terms.

Avoid accumulating new debt while managing existing obligations.

Seek professional financial advice if needed.

Maintain an emergency fund to cover unexpected expenses.

Celebrate milestones to stay motivated on your journey to being debt-free.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize your financial planning with the versatile Financial Plan Template from Template.net. This fully customizable and editable template empowers you to tailor your financial strategy precisely to your needs. Utilize the AI Editor Tool for seamless adjustments and professional results. Perfect for personal or business use, this template simplifies managing your finances with ease.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan