Audit Summary

Audit Period: January 1, 2049 - December 31, 2049

Date of Report: September 19, 2050

Auditor: [Your Name]

Email: [Your Email]

I. Executive Summary

This internal audit was conducted to evaluate the effectiveness of [Your Company Name]'s internal controls, operational processes, and compliance with company policies for the fiscal year 2049. The audit revealed several areas of strength as well as opportunities for improvement.

Key highlights include:

Control Strengths: Effective controls in several departments.

Areas for Improvement: Notable weaknesses in specific internal controls.

Compliance: Generally compliant with internal policies, with minor discrepancies.

II. Audit Objectives and Scope

A. Objectives

The primary objectives of this internal audit were to:

Assess the adequacy and effectiveness of internal controls.

Review adherence to internal policies and procedures.

Identify inefficiencies or weaknesses in operational processes.

Recommend improvements for enhancing control and efficiency.

B. Scope

The audit focused on:

Internal Control Systems: Evaluating control mechanisms.

Compliance with Policies: Internal compliance check.

Operational Processes: Assessing operational efficiency and effectiveness.

III. Detailed Findings and Recommendations

A. Internal Control Systems

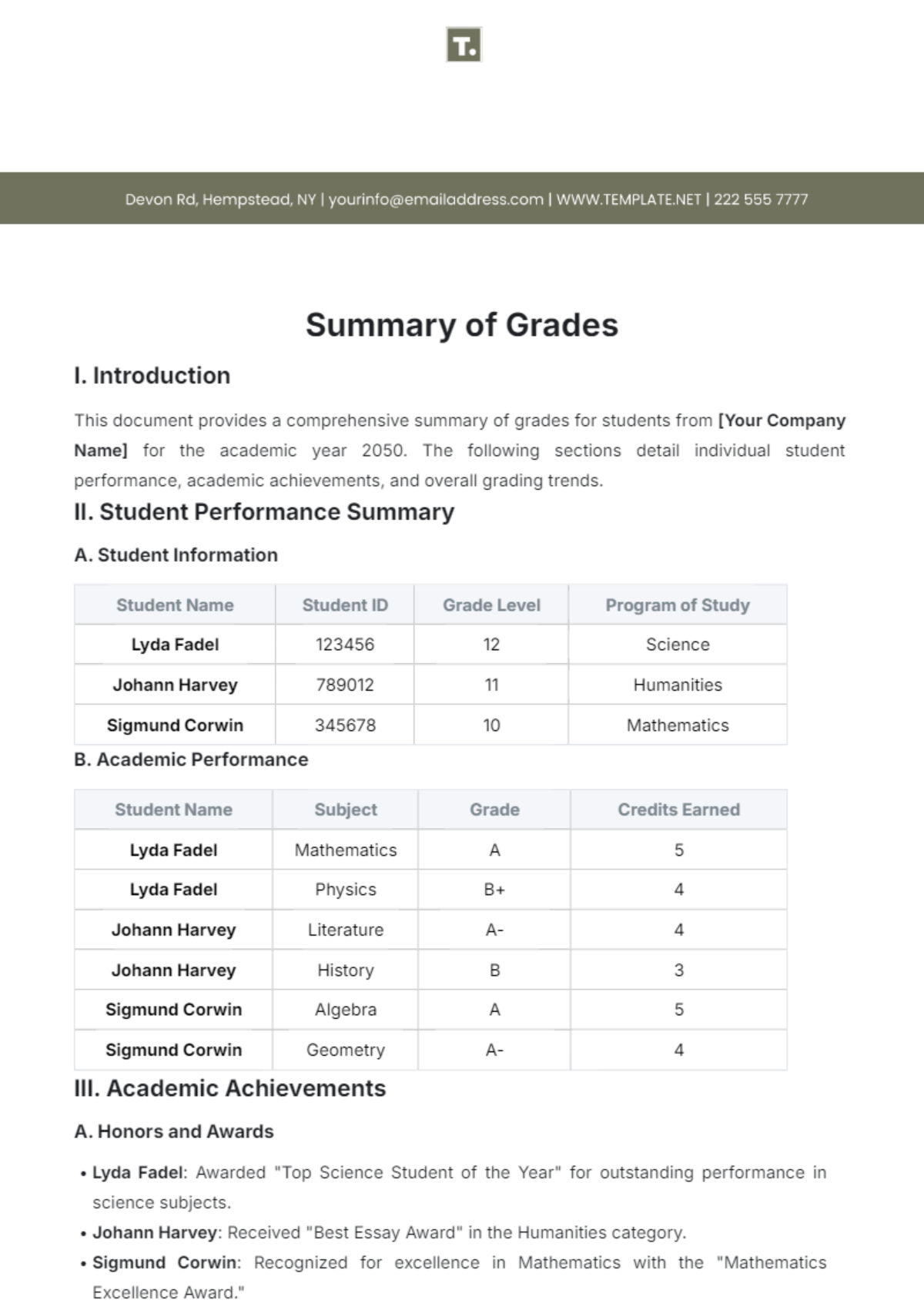

Control Area | Findings | Recommendations |

|---|---|---|

Segregation of Duties | Lack of segregation in key financial areas. | Implement stronger segregation of duties to reduce risk. |

Access Controls | Inadequate access controls for critical systems. | Enhance access controls and regularly review access permissions. |

Documentation | Incomplete documentation for some financial transactions. | Ensure comprehensive and accurate documentation for all transactions. |

B. Compliance with Policies

Policy Area | Findings | Recommendations |

|---|---|---|

Expense Reimbursement | Some reimbursements were not fully documented. | Tighten expense documentation rules. |

Approval Processes | Approval workflows not consistently followed. | Enforce adherence to approval workflows and document deviations. |

Reporting | Delays in reporting financial information. | Improve timeliness and accuracy in financial reporting. |

C. Operational Processes

Operational Area | Findings | Recommendations |

|---|---|---|

Inventory Management | Inventory tracking inefficiencies noted. | Adopt advanced inventory management systems and practices. |

Procurement Procedures | Procurement processes have delays and inconsistencies. | Streamline procurement procedures and enhance training for staff. |

Customer Service | Inconsistencies in customer service processes. | Implement standardized customer service procedures and training. |

IV. Conclusion

The internal audit has identified several strengths in [Your Company Name]'s internal control systems and operational processes but also highlights areas that require attention. Implementing the recommended changes will enhance control effectiveness, ensure compliance with internal policies, and improve operational efficiency.

V. Follow-Up Actions

The following steps are recommended:

Action Plan: Develop and implement an action plan to address audit findings and recommendations.

Monitoring: Establish a monitoring mechanism to track progress on the implementation of corrective actions.

Review: Schedule a follow-up audit to assess the effectiveness of implemented changes and make further recommendations as needed.

For any questions or further information, please contact [Your Name] at [Your Email].