Free Payment Tracker

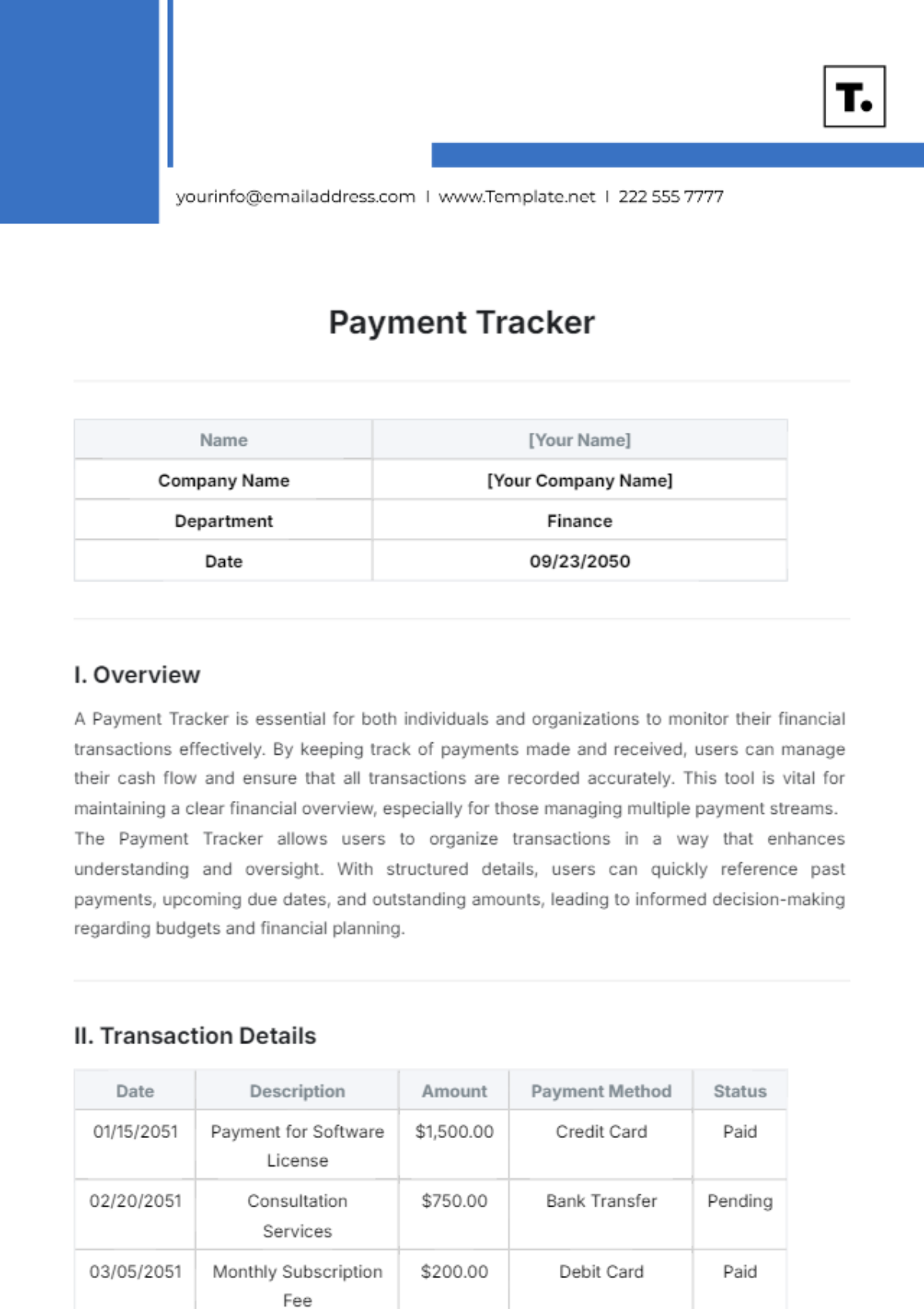

Name | [Your Name] |

|---|---|

Company Name | [Your Company Name] |

Department | Finance |

Date | 09/23/2050 |

Transaction Details

Date | Description | Amount | Payment Method | Status |

|---|---|---|---|---|

01/15/2051 | Payment for Software License | $1,500.00 | Credit Card | Paid |

02/20/2051 | Consultation Services | $750.00 | Bank Transfer | Pending |

03/05/2051 | Monthly Subscription Fee | $200.00 | Debit Card | Paid |

04/10/2051 | Equipment Purchase | $3,200.00 | Wire Transfer | Overdue |

05/25/2051 | Invoice #98765 | $950.00 | Cash | Pending |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Easily manage your finances with Template.net’s Payment Tracker Template. Fully customizable and designed to keep your payments organized, it’s perfect for personal or business use. The template is editable in our intuitive Ai Editor Tool, allowing you to tailor it to your exact needs. Stay on top of payments with this user-friendly, editable template that saves you time and effort.