Free Boutique Expense Report

I. Introduction

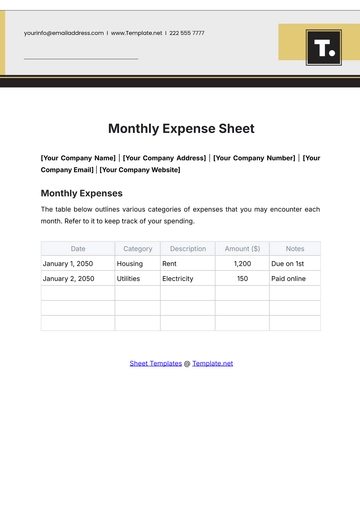

This comprehensive expense report for [Your Company Name] provides a detailed analysis of all business-related expenses incurred during the fiscal year 2050. The purpose of this report is to offer stakeholders a transparent and thorough understanding of how the company's funds were utilized across various operational areas. It aims to facilitate effective budgeting and strategic planning while ensuring that all expenditures align with the company's mission and long-term goals.

Expense reporting plays a crucial role in financial management, allowing businesses to track spending, manage budgets, and identify trends. By understanding the financial landscape, stakeholders can make informed decisions about resource allocation, investment opportunities, and future business strategies. Accurate and detailed expense reporting is vital for compliance with financial regulations, ultimately promoting fiscal responsibility and sustainable growth.

This report is structured to include an overview of expenses, detailed breakdowns by category, and a summary of total expenses. Each section will provide insight into the financial practices of [Your Company Name], ensuring that stakeholders have a clear view of the company's financial health and operational efficiency.

II. Overview of Boutique Expenses

In order to provide clarity on the financial operations of [Your Company Name], expenses have been categorized into several primary sections. This categorization allows for a focused examination of where resources were allocated and highlights areas of both strength and potential improvement.

A. Categories of Expenses

Operational Expenses

This section encompasses all expenses directly associated with the day-to-day operations of the boutique. It includes fixed and variable costs such as rent, utilities, inventory procurement, equipment maintenance, and any other expenses necessary for running the business effectively.Employee-Related Expenses

Employee-related expenses cover salaries, benefits, training programs, and any additional perks provided by the company to attract and retain a talented workforce. This category is critical to maintaining employee satisfaction and promoting a positive work environment.Marketing and Advertising

Marketing plays an essential role in the growth and visibility of [Your Company Name]. This section details expenses related to digital marketing, print advertisements, social media campaigns, and influencer partnerships, reflecting the company’s commitment to building its brand presence.Miscellaneous and Unexpected Expenses

This section will highlight any unforeseen costs that occurred during the fiscal year, ensuring that all financial activities are documented, even those outside of planned budgets.Professional Services and Consultancy

Expenses related to engaging external experts, including legal counsel and financial advisors, are detailed here. These services are integral for ensuring compliance and providing strategic guidance to the business.Sustainability and Environmental Initiatives

In alignment with global trends and corporate social responsibility, [Your Company Name] is committed to sustainability. This section outlines expenses related to eco-friendly operations, including sustainable materials and initiatives designed to reduce the company’s carbon footprint.

III. Detailed Breakdown of Expenses

This section provides an in-depth breakdown of each expense category, offering insights into how resources were allocated across various operational areas.

A. Operational Expenses

Rent and Property Costs

The boutique operates in a strategically chosen location that offers high foot traffic and visibility. The monthly rent for the boutique location totals [$30,000], amounting to an annual property cost of [$360,000]. In addition to rent, the company incurs costs associated with property maintenance, repairs, and insurance. The estimated annual property maintenance costs are [Amount: $50,000], which cover routine upkeep, emergency repairs, and annual insurance premiums.The rental agreement is structured to provide stability, allowing [Your Company Name] to plan long-term investments in the location without the risk of sudden rent increases. Negotiating favorable lease terms is a priority to ensure the boutique can sustain its operations in a competitive market.

Utilities (Electricity, Water, Internet, etc.)

Utilities are a fundamental aspect of operational expenses, contributing significantly to the overall cost of running the boutique. Monthly electricity bills average [$1,500], with an annual total of [$18,000]. Water usage is estimated at [$300] monthly, leading to an annual expense of [$3,600]. Internet services, essential for both customer interactions and internal communications, come to [$200] per month, totaling [$2,400] annually. In total, utility expenses for the year amount to [$24,000].Implementing energy-saving practices, such as utilizing energy-efficient appliances and smart thermostats, is a focus for the company to reduce these costs in future years. This effort not only lowers operational costs but also aligns with sustainability goals.

Inventory Procurement and Merchandise

The cost of acquiring inventory is a significant component of operational expenses. In 2050, [Your Company Name] invested approximately [$500,000] in inventory procurement, ensuring a diverse selection of high-quality, unique merchandise. This investment includes sourcing from both local artisans and international suppliers, emphasizing a commitment to quality and sustainability.Seasonal trends and customer preferences guide inventory purchases. The boutique employs data analytics to track sales patterns and adjust inventory accordingly. A strategic approach to inventory management not only optimizes spending but also ensures that the boutique meets customer demands effectively.

Equipment and Technology Maintenance

To maintain a high level of operational efficiency, [Your Company Name] invests in modern equipment and technology. This includes cash registers, Point of Sale (POS) systems, computers, and display units, all of which are crucial for daily operations. The annual maintenance and upgrade costs for these technologies totaled [$20,000]. This investment in technology ensures seamless transactions, inventory management, and customer engagement.

Regular technology audits are conducted to assess the performance and condition of equipment, allowing for timely upgrades and replacements. The company also prioritizes staff training on new technologies to maximize their utility.

Licenses and Permits

Operating a boutique requires compliance with various local and state regulations, necessitating several permits and licenses. These may include business operation permits, health and safety inspections, and sales tax licenses. In 2050, the costs associated with maintaining all necessary permits amounted to [$15,000]. Ensuring compliance is critical to avoid legal issues and maintain the company’s reputation.The company’s compliance officer regularly reviews regulatory requirements and ensures that all permits are up to date, minimizing the risk of fines or interruptions in operations.

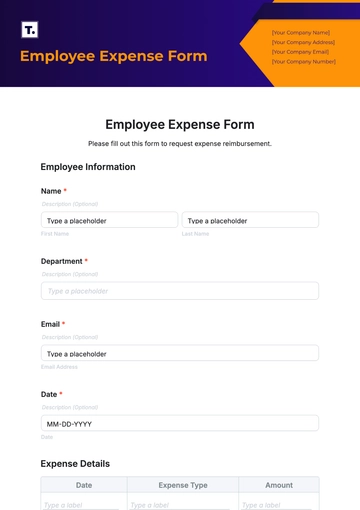

B. Employee-Related Expenses

Salaries and Wages

The employee workforce is a vital component of [Your Company Name]'s success. To attract and retain top talent, the company offers competitive salaries. The boutique employed [20] full-time staff members, each earning an average annual salary of [$60,000]. This results in total annual salary expenses of [$1,200,000].Employee satisfaction surveys indicate that competitive compensation is a key factor in employee retention and morale. The company conducts regular market analyses to ensure that salaries remain competitive within the industry.

Employee Benefits and Insurance

In addition to salaries, [Your Company Name] is committed to offering comprehensive benefits to its employees. These benefits include health insurance, retirement savings plans, and paid leave. Health insurance premiums for all employees total [$100,000] annually. Additionally, the company contributes [$50,000] towards retirement savings plans, ensuring that employees feel secure in their financial futures.Providing robust employee benefits is essential for attracting high-quality talent and fostering a positive workplace culture. Employee feedback mechanisms are in place to continually assess and improve benefits offerings.

Training and Development Programs

Recognizing the importance of continuous learning, [Your Company Name] invests in training programs designed to enhance employee skills in customer service, fashion merchandising, and sales techniques. During the fiscal year 2050, the company spent [$25,000] on various training initiatives, including workshops, online courses, and industry conferences.Investing in employee development not only boosts morale but also enhances the overall service quality provided to customers. The company measures the effectiveness of training programs through performance metrics and employee feedback.

Incentives and Bonuses

To motivate employees and recognize outstanding performance, [Your Company Name] offers performance-based bonuses. In 2050, these bonuses accounted for an additional [$75,000]. The bonus structure is tied to individual and team performance metrics, promoting collaboration and accountability.By linking bonuses to measurable outcomes, the company fosters a culture of excellence and encourages employees to strive for higher performance levels.

C. Marketing and Advertising

Digital Marketing Campaigns

The majority of [Your Company Name]'s marketing budget is allocated to digital channels, which have proven effective in reaching a broader audience. Expenses for digital marketing in 2050 amounted to [$120,000], encompassing social media advertisements, email marketing, and search engine optimization (SEO). The company employs specialized marketing software to track campaign performance and ROI, allowing for data-driven decision-making.Digital marketing initiatives focus on engaging potential customers and building brand loyalty. A/B testing is regularly used to refine messaging and target specific customer demographics.

Influencer Partnerships

In order to enhance brand visibility and credibility, [Your Company Name] collaborates with several fashion influencers. These partnerships, which include social media endorsements and sponsored posts, cost [$50,000] in 2050. Influencers provide authentic connections to target audiences, making them a valuable asset in modern marketing strategies.The effectiveness of influencer campaigns is assessed through tracking metrics such as engagement rates and conversion rates, ensuring that the company maximizes its marketing investments.

Traditional Marketing (Print and Events)

While the focus is largely on digital marketing, [Your Company Name] recognizes the value of traditional marketing methods. The company invests in magazine advertisements, flyers, and in-store events, amounting to [$40,000] in 2050. These efforts help reach customers who may not engage with digital channels and provide opportunities for direct interaction with potential buyers.The boutique regularly evaluates the effectiveness of traditional marketing initiatives by gathering feedback from customers and monitoring sales increases during promotional events.

Brand Collaborations and Sponsorships

[Your Company Name] seeks partnerships with luxury brands and industry events to elevate its brand status. These collaborations not only enhance the boutique's visibility but also provide unique offerings that attract discerning customers. In 2050, costs related to brand collaborations and sponsorships totaled [$30,000].Strategic partnerships are evaluated based on their alignment with the boutique's brand values and target audience, ensuring that collaborations are mutually beneficial and impactful.

D. Miscellaneous and Unexpected Expenses

Repairs and Emergency Costs

During the year 2050, the boutique experienced unexpected repairs due to damage caused by a storm, leading to costs of [$15,000]. Additionally, equipment malfunctions required immediate attention and repairs, costing [$5,000]. These unexpected expenses highlight the importance of maintaining a contingency fund to manage unforeseen financial challenges.The company regularly reviews its emergency preparedness plans to mitigate potential risks and reduce the impact of unexpected events on operations.

Legal Fees and Fines

On occasion, [Your Company Name] has had to consult legal advisors regarding contractual disputes or regulatory compliance. Legal fees and incidental fines during the fiscal year amounted to [$10,000]. These costs underscore the importance of having a proactive legal strategy in place to navigate potential issues before they escalate.The company maintains relationships with legal advisors who specialize in retail and business operations, ensuring timely access to expert advice.

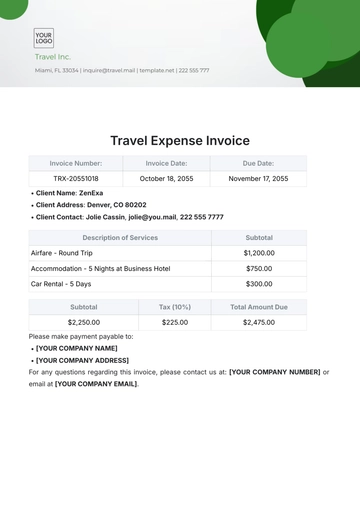

Travel and Accommodation

For events and collaborations, company executives and buyers frequently travel to various locations for meetings, trade shows, and industry events. Expenses related to airfare, hotels, and per diems amounted to [$30,000] in 2050.Effective planning and budgeting for travel are essential to minimize costs while maximizing the benefits of face-to-face interactions and networking opportunities. The company encourages employees to seek cost-effective travel options to stay within budget.

E. Professional Services and Consultancy

Consulting Services

[Your Company Name] regularly engages with experts in the fashion industry, financial advisors, and strategic planning firms. These consulting services help inform critical business decisions, ensuring that the company remains competitive and responsive to market changes. In 2050, consulting expenses totaled [$60,000].The company assesses the impact of consulting services through performance metrics and business outcomes, ensuring that investments in external expertise yield tangible benefits.

Accounting and Auditing

Accurate financial management is paramount for maintaining the integrity of business operations. [Your Company Name] employs an external accounting firm for annual audits, tax preparation, and bookkeeping assistance, with expenses totaling [$35,000]. This partnership ensures compliance with financial regulations and provides insights into areas for financial improvement.Regular financial reviews and audits help identify cost-saving opportunities and enhance overall financial health.

Legal Counsel

In addition to incidental legal fees, the company maintains a retainer with a law firm specializing in retail and business operations. This arrangement allows [Your Company Name] to access legal expertise as needed, promoting proactive legal strategies. Legal counsel expenses totaled [$25,000] for the year.The legal team works closely with the company to ensure compliance with regulations and to address any legal challenges that may arise.

F. Sustainability and Environmental Initiatives

Sustainable Material Procurement

[Your Company Name] is committed to sourcing sustainable and organic materials for its clothing lines. This aligns with growing consumer demand for eco-friendly products. In 2050, the cost for these materials was [$150,000], which is higher than standard alternatives but aligns with the company’s mission to reduce environmental impact.The boutique actively seeks partnerships with suppliers who prioritize sustainability, ensuring that its inventory reflects ethical and environmentally responsible practices.

Energy-Efficient Installations

The boutique has made significant upgrades to improve energy efficiency, including the installation of LED lighting and an advanced HVAC system. These improvements cost [$35,000] but are expected to result in substantial long-term energy savings. By prioritizing energy-efficient solutions, [Your Company Name] aims to reduce its carbon footprint while cutting operating costs.Monitoring energy consumption and setting sustainability goals are essential components of the company’s environmental strategy.

Recycling and Waste Management

To further reduce its environmental footprint, [Your Company Name] invested in a comprehensive recycling program and sustainable packaging solutions. This initiative incurred costs of [$10,000] in 2050. The company promotes recycling among employees and customers, creating awareness about the importance of waste reduction.The success of recycling initiatives is monitored through metrics on waste reduction and customer participation.

Carbon Offsetting Contributions

In an effort to offset the boutique’s carbon emissions from logistics and energy consumption, the company made contributions to verified carbon offset programs, totaling [$20,000]. These contributions are essential for aligning the company’s operations with its sustainability commitments and addressing its environmental impact.Engaging in carbon offsetting not only fulfills corporate responsibility goals but also resonates with a growing segment of eco-conscious consumers.

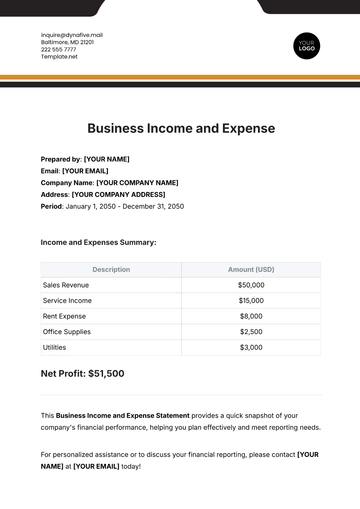

IV. Total Expenses Summary

The total expenses incurred by [Your Company Name] for the fiscal year 2050 can be summarized as follows:

Category | Amount |

|---|---|

Operational Expenses | [$469,000] |

Employee-Related Expenses | [$1,450,000] |

Marketing and Advertising | [$240,000] |

Miscellaneous and Unexpected Expenses | [$60,000] |

Professional Services and Consultancy | [$120,000] |

Sustainability and Environmental | [$215,000] |

Total Expenses: [$2,554,000]

V. Conclusion

This report highlights the diverse and strategic allocation of resources by [Your Company Name] during the fiscal year 2050. Employee-related expenses constitute the majority of expenditures, reflecting the company’s commitment to fostering a talented and satisfied workforce. Significant investments were also made in marketing, professional services, and sustainability initiatives, all of which are crucial for maintaining competitive advantage in the boutique retail market.

The detailed analysis provided in this report serves as a valuable tool for understanding the financial health of [Your Company Name] and identifying areas for future improvement. Moving forward, it is recommended that the company continues to monitor these categories closely, particularly in areas where cost-saving opportunities might arise, such as energy efficiency and supply chain optimization.

[Your Company Name] remains well-positioned for continued growth and profitability. By focusing on operational excellence, employee satisfaction, and sustainable practices, the boutique can navigate the evolving retail landscape while delivering exceptional value to customers and stakeholders alike. Regular reviews of expense categories will ensure that the company adapts to changing market conditions and continues to thrive in the years to come.

As the fashion industry evolves, [Your Company Name] is committed to innovating and investing wisely, ensuring that it remains a leader in boutique retail for years to come.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Monitor your expenses with the Boutique Expense Report Template from Template.net. This editable and customizable template helps you track costs and manage your budget effectively. Use our Ai Editor Tool to ensure accurate reporting. Keep your finances in check—create precise expense reports today!