Free Venture Capital (VC) Investment Memo

To: Maxwell Mante

From: [Your Name]

Date: September 30, 2054

Subject: VC Investment Memo for [Your Company Name]

I. Executive Summary

Company Overview:

[Your Company Name] is a technology startup focused on AI-driven healthcare solutions that streamline patient management and improve clinical outcomes.Investment Opportunity:

This memo outlines the opportunity to invest in [Your Company Name] for a total of $2 million.

Key Highlights:

Strong market demand for AI applications in healthcare

Unique value proposition in predictive analytics and patient engagement

Experienced management team with a track record of success in technology and healthcare sectors

II. Company Description

A. Business Model

Description of revenue streams:

Subscription fees for software-as-a-service (SaaS) model

Consulting services for implementation and training

B. Market Position

Current market share: 5%

Competitors:

HealthTech Innovations

DataCare Solutions

III. Market Analysis

A. Industry Overview

Size of the market: $50 billion

Growth rate: 15% annually

B. Target Market

Key demographics:

Age: 25-65 years

Location: North America and Europe

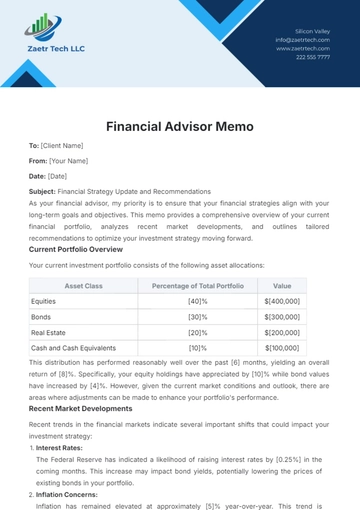

IV. Financial Overview

A. Historical Financial Performance

Year | Revenue | Profit/Loss |

|---|---|---|

2050 | $500,000 | -$200,000 |

2052 | $1 million | -$50,000 |

2053 | $2 million | $250,000 |

B. Projections

Expected revenue for next 3 years:

Year 1: $4 million

Year 2: $6 million

Year 3: $10 million

V. Investment Thesis

Reasons for Investment:

Strong growth potential in the digital health sector

Innovative technology with proprietary algorithms for predictive patient analytics

Experienced team capable of executing the business plan with backgrounds in software development and healthcare management

VI. Risks and Mitigation Strategies

Risk | Description | Mitigation Strategy |

|---|---|---|

Market Competition | Increased competition from established players | Develop strategic partnerships and enhance marketing efforts |

Regulatory Challenges | Navigating healthcare regulations and compliance | Hire compliance experts to ensure all products meet regulatory standards |

VII. Conclusion and Recommendations

Recommendation:

Invest $2 million in [Your Company Name] to capitalize on the growth opportunities in the AI healthcare market.Next Steps:

Schedule follow-up meeting with Emily Davis, CEO on October 10, 2054.

Review additional documents: Financial Statements, Market Research Report, and Management Team Bios.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock the potential of your investment pitches with the Venture Capital (VC) Investment Memo Template from Template.net. This editable and customizable template allows you to tailor your content effortlessly. Easily modify each section using our AI Editor Tool to create compelling memos that resonate with investors and highlight your venture’s strengths. Start crafting today!