Free Real Estate Investment Memo Format

To: Investment Committee

From: [Your Name]

Date: September 30, 2080

Subject: Investment Opportunity in Elmwood Apartments, Atlanta, GA

1. Executive Summary

This memo outlines a real estate investment opportunity in Elmwood Apartments, a 120-unit multifamily residential property located in the growing Atlanta suburb of East Point. The property offers stable cash flow from existing leases and significant upside potential through targeted renovations and rent increases. The asset’s strategic location, coupled with strong market fundamentals, aligns with our investment strategy to acquire and enhance properties in high-growth metropolitan areas. The projected internal rate of return (IRR) is 14% over a five-year hold period, with an estimated equity multiple of 1.8x.

2. Property Overview

Property Address: 123 Elmwood Lane, East Point, Atlanta, GA

Type of Asset: Class B Multifamily Residential

Size: 120 units; 95,000 square feet total

Current Occupancy: 92%

Age of Property: Built in 2050; Renovated in 2060.

Purchase Price: $18,500,000

Projected Closing Date: December 1, 2080

3. Market Analysis

Location Overview: Elmwood Apartments is located in East Point, a suburb of Atlanta known for its affordability and proximity to key job centers, including Hartsfield-Jackson Atlanta International Airport and Camp Creek Business Center. The area is benefiting from spillover demand as renters seek more affordable options outside of the city core.

Demographic Trends: The local population has grown by 4.2% annually over the past five years, supported by recent business developments and infrastructural improvements. Employment growth in Atlanta has averaged 3.5% annually, driven by strong demand in tech, logistics, and healthcare sectors.

Comparable Properties: Recent sales of nearby multifamily properties, such as Pinebrook Heights and Maplewood Gardens, reflect cap rates of approximately 5.75%. Rents have been increasing by 6% annually, driven by strong demand for quality housing in East Point.

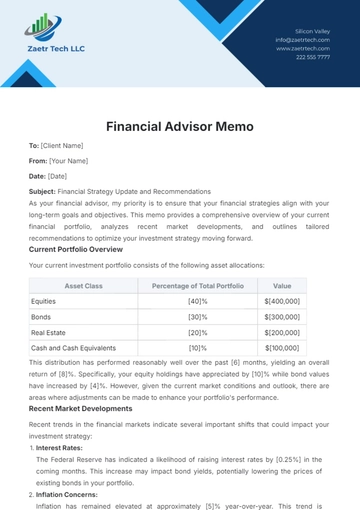

4. Financial Overview

Acquisition Cost: $18,500,000

Financing Details: $12,500,000 loan at a 4.5% interest rate (fixed), 65% loan-to-value (LTV); equity contribution of $6,000,000

Annual Rental Income: $1,620,000

Operating Expenses: $670,000 annually

Net Operating Income (NOI): $950,000

Cap Rate: 5.1%

Projected IRR: 14% over a five-year hold period

Cash-on-Cash Return: 8% in Year 1

Exit Strategy: Planned sale in Year 5 at a 5.5% exit cap rate, with a projected sale price of $21,500,000.

5. Risk Analysis

Market Risk: While the Atlanta market remains strong, any economic downturn could impact tenant demand. However, the diverse economic base in Atlanta helps mitigate the risk of a steep decline in occupancy rates.

Tenant Risk: With 92% current occupancy and many leases expiring within the next 12-18 months, the risk of vacancy could be a concern. However, the strong leasing demand in the area and our planned renovations to increase rent appeal should mitigate this risk.

Financing Risk: Rising interest rates could impact cash flow if refinancing is needed. Our fixed-rate loan at 4.5% helps insulate us from immediate rate hikes, and the loan-to-value ratio provides sufficient equity cushion.

6. Value-Add Opportunities

Renovations: A capital improvement budget of $800,000 will be allocated to upgrade 40 of the 120 units with modern appliances, flooring, and fixtures, allowing for a rent increase of $150 per unit.

Operational Efficiency: Streamlining property management and renegotiating vendor contracts is expected to reduce operating expenses by 5%, increasing NOI by approximately $47,000 annually.

Energy Efficiency: Installing energy-efficient lighting and HVAC systems could reduce utility costs by 10%, improving operating margins.

7. Exit Strategy

Our primary exit strategy is to sell the property after five years, following value-enhancing renovations and lease-up improvements. Based on conservative projections, we anticipate selling the property at a 5.5% cap rate, which would generate a projected sale price of $21,500,000. This results in an estimated IRR of 14% and an equity multiple of 1.8x for our investors.

Recommendation:

Based on the thorough market analysis, financial projections, and upside potential, we recommend proceeding with the acquisition of Elmwood Apartments. This investment aligns with our goal of acquiring value-add multifamily properties in high-growth markets, offering stable cash flow and long-term capital appreciation.

Next Steps:

Complete detailed due diligence by November 15, 2080

Secure financing commitments

Negotiate and finalize the purchase and sale agreement

Close the transaction by December 1, 2080

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your real estate investment process with the Real Estate Investment Memo Format Template from Template.net. Fully customizable and editable to suit your needs, this template ensures professional results. Easily editable in our Ai Editor Tool, it allows you to create polished memos efficiently, saving time while maintaining accuracy. Perfect for real estate professionals!