Free Professional Investor Teaser Memo

Date: November 30, 2051

Prepared By: [Your Name] / [Your Company Name]

Contact Information: [Your Email]

Subject: Investment Opportunity in Sustainable Landscaping Services

1. Company Overview:

[Your Company Name] is a leading provider of sustainable landscaping and environmental management services based in Portland, OR. Our mission is to promote eco-friendly practices that enhance outdoor spaces while conserving natural resources. Over the past five years, we have successfully completed over 500 projects for residential, commercial, and municipal clients.

2. Investment Opportunity:

We are seeking $3 million in funding to expand our service offerings and geographic reach. With the increasing demand for sustainable practices in landscaping, this investment will allow us to introduce innovative services, such as native plant landscaping and rainwater harvesting systems, catering to environmentally conscious consumers.

3. Market Analysis:

Industry Overview: The green landscaping market is projected to grow to $30 billion by 2053, driven by rising consumer awareness about environmental issues and the benefits of sustainable practices.

Target Market: Our primary customers include homeowners, businesses, and municipalities focused on sustainability and enhancing their outdoor spaces. The target demographic includes eco-conscious consumers aged 30-55, as well as government entities pursuing green initiatives.

Competitive Landscape: Our competitive edge lies in our unique service offerings and expertise in sustainable practices. Unlike traditional landscaping companies, we prioritize environmentally friendly materials and methods, which sets us apart in a growing market.

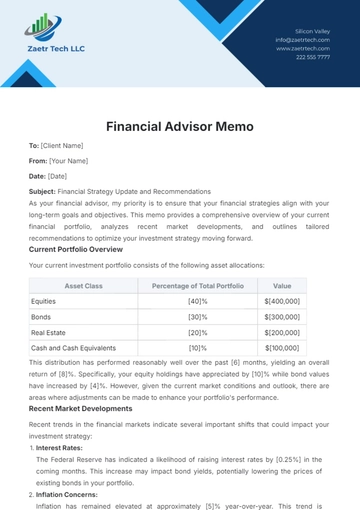

4. Financial Highlights:

Revenue: $1.5 million in 2050, with a 40% growth rate year-over-year, driven by an increase in project requests and customer referrals.

Profitability: Projected EBITDA of $600,000 in 2051, with gross margins at 50%.

Funding Requirements: We are seeking $3 million to expand our workforce, invest in marketing campaigns, and acquire new equipment for specialized services.

5. Management Team:

Our management team combines expertise in environmental science and business operations. CEO Johan Green has over 15 years of experience in the landscaping industry and holds an MBA from the University of Oregon. COO Adela Abshire has a background in environmental engineering and has successfully managed large-scale projects for both public and private sectors.

6. Exit Strategy:

Potential exits include acquisition by a larger landscaping firm or a public offering within 5-7 years, given the industry's growth and increasing investor interest in sustainable businesses. We anticipate that strategic partnerships with green product manufacturers will enhance our valuation.

7. Next Steps:

Interested investors are invited to schedule a meeting to discuss this opportunity further. Please contact us for a detailed business plan and financial projections.

8. Conclusion

We believe this investment represents a unique opportunity to support a sustainable future while achieving attractive returns. Thank you for your consideration, and we look forward to connecting.

Attachments:

Financial Statements (Last 3 Years)

Service Brochure

Market Research Report

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock your investment potential with the Professional Investor Teaser Memo Template from Template.net. This editable and customizable template allows you to present your ideas clearly and professionally. Easily tailor your content to meet your needs and preferences. Plus, you can conveniently edit it in our AI Editor Tool for a seamless experience. Start impressing investors today!