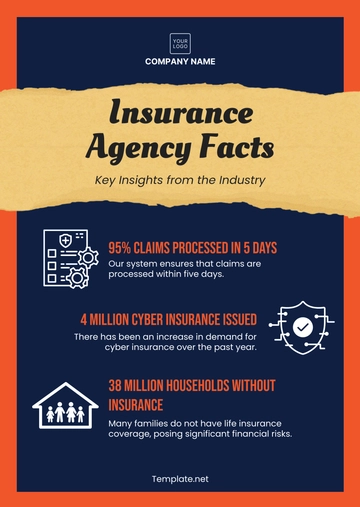

Free Insurance Agency Policy

Effective Date: January 1, 2050

I. Introduction

This document outlines the policies and procedures of [Your Company Name] as an insurance agency, ensuring that all employees, contractors, and partners understand their responsibilities in serving our clients and managing operations. The primary goal of this policy is to guarantee compliance with applicable laws and regulations, promote ethical behavior, and provide high-quality services to our clients. By establishing these guidelines, we aim to build a strong foundation of trust and reliability, ensuring that our clients' needs are met efficiently and effectively.

The sections below describe key operational and ethical guidelines for the management and operation of [Your Company Name]. These policies apply to all types of insurance products offered, including but not limited to life insurance, health insurance, property insurance, casualty insurance, and specialty insurance products. As the insurance landscape continues to evolve, [Your Company Name] remains committed to adapting to new challenges and opportunities, ensuring that we remain a leader in the industry.

II. Organizational Structure and Roles

The organizational structure of [Your Company Name] ensures clarity in responsibilities and accountability. It is crucial that every team member understands their role within the organization to promote efficiency and a cohesive working environment. Below is a detailed description of the various roles and responsibilities:

A. Management Team

Executive Officers

The management team is responsible for overseeing all aspects of the agency’s operations. The executive team is composed of the following officers:Title

Responsibilities

Chief Executive Officer (CEO)

Responsible for the overall strategic direction of [Your Company Name], ensuring compliance with all state and federal regulations. The CEO makes major decisions regarding contracts, client relationships, and operational changes.

Chief Financial Officer (CFO)

Manages the financial health of the company, including budgets, financial reports, risk assessments, and ensuring the company’s solvency and profitability.

Chief Operations Officer (COO)

Oversees day-to-day operations of the insurance agency, ensuring smooth and efficient workflow across departments and implementing best practices for efficiency.

1.1 Chief Executive Officer (CEO)

The CEO is the ultimate decision-maker within [Your Company Name]. He/she is tasked with creating and implementing the agency’s vision, values, and mission. The CEO also represents the agency in public forums and industry events, establishing relationships with key stakeholders, including regulatory bodies, industry associations, and community leaders.1.2 Chief Financial Officer (CFO)

The CFO plays a pivotal role in financial planning and strategy. This position involves monitoring cash flow, analyzing financial data, preparing budgets, and ensuring that the agency operates within its financial means. Additionally, the CFO is responsible for financial forecasting and ensuring compliance with all financial regulations.1.3 Chief Operations Officer (COO)

The COO is responsible for optimizing operational efficiency across all departments. This role involves streamlining processes, ensuring effective communication among teams, and identifying areas for improvement. The COO also oversees the recruitment and training of new employees, ensuring that they align with the agency's goals and culture.

B. Department Heads

Each department within [Your Company Name] reports directly to the COO. Below is an outline of the core departments and their key functions:

Department | Key Functions |

|---|---|

Underwriting Department | Responsible for evaluating insurance applications and determining terms and premiums based on risk assessments. This department employs complex algorithms and actuarial data to arrive at fair and accurate pricing for each client. |

Claims Department | Manages claims processes, ensuring that all claims are handled efficiently and fairly. This department ensures compliance with internal policies and external regulations, thereby protecting both the agency and its clients. |

Sales and Marketing Department | Focuses on client acquisition, retention, and managing marketing strategies. This department works directly with clients to develop tailored insurance products, ensuring they receive the best value for their needs. |

Customer Service Department | Handles inquiries, policy updates, and provides general assistance to both current and prospective clients. This department serves as the face of [Your Company Name], directly impacting customer satisfaction and loyalty. |

C. Insurance Agents

Insurance agents, whether employees or independent contractors, represent [Your Company Name] and act as the direct point of contact with clients. Their responsibilities include:

Advising Clients

Agents must thoroughly understand the insurance products offered by [Your Company Name]. They are responsible for recommending appropriate coverage based on client needs, ensuring that clients are fully informed of their options. This involves explaining complex insurance terms in a manner that is easy for clients to understand.Compliance with Regulations

All agents must adhere to both state and federal insurance regulations, including licensing requirements and ethical sales practices. Continuous training and assessments are conducted to ensure that all agents maintain the necessary credentials and stay updated on regulatory changes.Ongoing Education

Agents are required to attend regular training sessions to stay updated on changes in laws, insurance products, and market trends. This commitment to education helps agents provide informed recommendations and enhances their ability to meet clients' evolving needs.

III. Types of Insurance Offered

[Your Company Name] offers a variety of insurance policies designed to meet the diverse needs of our clients. Each product is crafted with care and a thorough understanding of market demands.

A. Life Insurance

[Your Company Name] offers several life insurance policies that cater to different client needs. These include:

Term Life Insurance

Provides coverage for a specified period, such as [20] or [30] years, at an affordable rate. Beneficiaries receive the policy's face value upon the insured’s death within the term. This policy is often chosen by young families or individuals with temporary financial obligations, such as mortgages.Whole Life Insurance

Offers lifelong protection with a savings component that accumulates cash value over time. This policy guarantees a death benefit and allows policyholders to take out loans against the cash value. Whole life insurance is ideal for those looking for stability and a long-term investment.Universal Life Insurance

A flexible policy that combines the protection of term insurance with an investment component that allows policyholders to adjust premiums and death benefits over time. This adaptability makes it appealing to clients whose financial situations may change.

Type of Life Insurance | Coverage Duration | Cash Value Accumulation | Ideal For |

|---|---|---|---|

Term Life | [10], [20], or [30] years | No | Young families or temporary needs |

Whole Life | Lifetime | Yes | Long-term financial planning |

Universal Life | Lifetime | Yes | Flexible and adjustable coverage |

B. Health Insurance

Our health insurance products are designed to provide comprehensive coverage for individuals, families, and businesses. We offer:

Individual Health Insurance Plans

Provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. Plans are customizable to meet individual client needs, accommodating various budgets and health requirements. Options may include high-deductible health plans (HDHPs) paired with health savings accounts (HSAs).Group Health Insurance Plans

Designed for businesses to offer their employees health coverage. These plans can be tailored to include dental, vision, and mental health services. Group plans typically provide more affordable rates than individual policies, making them an attractive option for employers looking to provide comprehensive benefits.

Type of Health Insurance | Coverage Details | Target Audience |

|---|---|---|

Individual Plans | Customizable coverage | Individuals and families |

Group Plans | Comprehensive benefits | Employers seeking to provide benefits |

C. Property and Casualty Insurance

[Your Company Name] offers a wide range of property and casualty insurance policies to protect clients’ assets:

Homeowners Insurance

Provides coverage for the physical structure of a client’s home, personal property, and liability protection against accidents or injuries occurring on the property. Homeowners insurance can include additional coverage options such as personal property replacement and extended dwelling coverage.Auto Insurance

Covers damage to vehicles, medical expenses related to accidents, and liability for damages caused to third parties. Auto insurance policies can vary in terms of coverage, including comprehensive, collision, and liability options.Commercial Insurance

Offers protection for business assets, including property damage, liability, and loss of income due to unforeseen events. This policy is essential for businesses of all sizes, providing peace of mind against potential financial losses.

Type of Property & Casualty Insurance | Coverage Includes | Target Audience |

|---|---|---|

Homeowners Insurance | Dwelling, personal property, liability | Homeowners |

Auto Insurance | Vehicle damage, medical expenses, liability | Vehicle owners |

Commercial Insurance | Property damage, liability, business interruption | Businesses |

D. Specialty Insurance Products

Specialty insurance products cater to unique needs, including:

Flood Insurance

Provides coverage for property damage caused by floods, which is not typically covered under standard homeowners insurance. This product is essential for clients living in flood-prone areas and may be required by mortgage lenders.Cyber Liability Insurance

Protects businesses from the financial impact of data breaches and cyberattacks. With the increasing prevalence of cyber threats, this insurance has become a critical component for businesses that store sensitive information electronically.

Type of Specialty Insurance | Coverage Focus | Ideal For |

|---|---|---|

Flood Insurance | Property damage from flooding | Homeowners in flood-prone areas |

Cyber Liability Insurance | Financial loss due to data breaches | Businesses handling sensitive data |

IV. Compliance with Regulatory Standards

Compliance with federal, state, and local regulations is vital for the integrity and legality of operations at [Your Company Name]. This section outlines the key regulations and standards that the agency adheres to:

A. Licensing Requirements

Insurance Agent Licensing

All insurance agents must be properly licensed in the states where they operate. Licensing requirements vary by state, but typically include completion of pre-licensing courses and passing a state examination. Agents must renew their licenses periodically, often every [1-2] years, to remain compliant.Company Licensing

[Your Company Name] maintains licenses in all states where it operates. This includes obtaining and renewing business licenses as well as maintaining compliance with state insurance department regulations.

B. Consumer Protection Laws

Truth in Advertising

[Your Company Name] is committed to transparency and honesty in advertising. All marketing materials must accurately represent the products and services offered, avoiding any misleading claims or omissions. This ensures that clients are fully informed and can make educated decisions about their insurance coverage.Fair Claims Practices

The agency adheres to fair claims practices as mandated by state regulations. This includes timely processing of claims, providing clear communication to clients regarding claim status, and conducting thorough investigations into all claims to ensure fairness and accuracy.

Regulatory Standard | Description |

|---|---|

Insurance Agent Licensing | Agents must be licensed and renew periodically. |

Truth in Advertising | Marketing materials must accurately represent products. |

Fair Claims Practices | Claims must be processed fairly and communicated clearly. |

C. Data Protection and Privacy

Compliance with HIPAA

[Your Company Name] complies with the Health Insurance Portability and Accountability Act (HIPAA) regulations regarding the protection of personal health information (PHI). Employees are trained on handling PHI securely to prevent unauthorized access and breaches.Data Security Measures

The agency employs various cybersecurity measures, including encryption, firewalls, and regular security audits, to protect client data from unauthorized access and cyber threats. Continuous monitoring of systems and regular training of employees in data security practices are crucial to safeguarding sensitive information.

V. Policyholder Rights and Responsibilities

Clients have rights and responsibilities that must be clearly communicated and upheld. This section outlines the essential rights and responsibilities of policyholders:

A. Policyholder Rights

Right to Information

Clients have the right to receive clear, accurate information about their insurance policies. This includes understanding coverage options, exclusions, and the claims process.Right to Privacy

Clients' personal information is protected under privacy laws. [Your Company Name] is committed to safeguarding all client data and using it solely for insurance-related purposes.Right to Fair Treatment

All clients have the right to be treated fairly and respectfully by agents and employees. This includes being listened to, having their concerns addressed promptly, and receiving unbiased advice.

B. Policyholder Responsibilities

Timely Premium Payments

Policyholders are responsible for making premium payments on time to ensure continuous coverage. Late payments may result in a lapse of coverage, which can have significant financial consequences.Providing Accurate Information

Clients must provide accurate and complete information when applying for insurance. Failure to disclose relevant information may lead to policy cancellations or denied claims.Understanding Policy Terms

Policyholders should take the time to understand their insurance policies fully, including coverage limits, exclusions, and the claims process. This understanding is essential for effective communication with agents and ensuring proper use of benefits.

VI. Claims Process

The claims process is critical to the relationship between [Your Company Name] and its clients. This section provides an overview of how claims are handled, ensuring transparency and efficiency.

A. Claims Submission

How to Submit a Claim

Clients can submit claims through various channels, including online through the agency’s website, via phone, or in person at the local office. The submission process is designed to be straightforward and accessible.Required Documentation

Clients must provide specific documentation to support their claims. This documentation may include:Document Type

Description

Claim Form

A completed claim form detailing the incident.

Proof of Loss

Photos, police reports, or other evidence.

Policy Information

A copy of the relevant insurance policy.

B. Claims Evaluation

Initial Review

Upon submission, claims are assigned to a claims adjuster who conducts an initial review to determine coverage eligibility. The adjuster will reach out to the client if additional information or documentation is needed.Investigation Process

The claims adjuster conducts a thorough investigation, which may include interviews with the policyholder, reviewing documentation, and consulting with experts. The goal is to assess the validity of the claim fairly and accurately.Decision and Communication

Once the investigation is complete, the claims adjuster will make a decision on the claim and communicate it to the policyholder in a timely manner. If a claim is approved, the client will receive a detailed explanation of the payout process.

C. Appeals Process

Right to Appeal

If a claim is denied or the policyholder disagrees with the settlement amount, they have the right to appeal the decision. The appeals process is clearly outlined in the policy documentation, ensuring that clients are aware of their options.Submitting an Appeal

Clients can submit appeals in writing, detailing their reasons for disagreement and providing any additional supporting documentation. The appeals will be reviewed by a separate team to ensure an unbiased assessment.Final Decision

The results of the appeal will be communicated to the policyholder in writing, along with the rationale behind the decision. [Your Company Name] aims to resolve appeals promptly and fairly, maintaining open communication throughout the process.

VII. Customer Service Commitment

At [Your Company Name], exceptional customer service is at the core of our operations. We are dedicated to providing a positive experience for all clients through responsive communication and support.

A. Customer Service Standards

Response Times

All inquiries and claims should be addressed promptly. The agency commits to responding to customer inquiries within [24] hours, ensuring that clients receive timely assistance.Professional Conduct

All employees are required to uphold high standards of professionalism in their interactions with clients. This includes treating clients with respect, maintaining confidentiality, and providing accurate information.Feedback Mechanism

Clients are encouraged to provide feedback on their experiences with [Your Company Name]. A feedback mechanism, such as surveys and online reviews, is in place to gather insights and improve services continually.

B. Ongoing Support

24/7 Customer Support

[Your Company Name] provides [24/7] customer support through multiple channels, including phone, email, and online chat. This ensures that clients can reach out for assistance at any time.Client Education

The agency offers educational resources to help clients understand their insurance products better. This includes webinars, FAQs, and informational brochures covering various topics related to insurance and risk management.Dedicated Account Managers

Each client is assigned a dedicated account manager who serves as their primary point of contact. This personalized approach allows clients to build a trusting relationship with their account manager, ensuring continuity and tailored service.

VIII. Ethical Conduct and Code of Ethics

At [Your Company Name], ethical conduct is paramount to our success. All employees and agents must adhere to the highest standards of integrity and professionalism. This section outlines the expectations for ethical behavior.

A. Client Fairness and Transparency

Clear Communication

Agents and employees must provide clients with clear, accurate information about their policies, including exclusions and limitations. Misleading or ambiguous information is strictly prohibited, as it undermines trust and can lead to client dissatisfaction.No Undue Pressure

Agents may not pressure clients into purchasing policies or add-ons that are not in their best interest. Clients should feel empowered to make informed decisions without feeling coerced or rushed.

B. Conflicts of Interest

Employees and agents must disclose any potential conflicts of interest. This includes relationships with clients, vendors, or other parties that could affect their impartiality in business decisions. Transparency in these matters is essential to maintain trust and integrity within the agency.

C. Reporting Violations

Whistleblower Policy

[Your Company Name] encourages employees to report unethical behavior or violations of this policy. A whistleblower policy is in place to protect those who come forward, ensuring they do not face retaliation.Investigation Procedures

All reported violations will be thoroughly investigated by a designated ethics committee. Employees involved in the investigation must maintain confidentiality to protect the integrity of the process.

IX. Reporting and Recordkeeping

Accurate reporting and recordkeeping are essential for compliance and operational efficiency at [Your Company Name]. This section outlines our policies regarding record retention and reporting requirements.

A. Record Retention

Client Records

All client records, including applications, claims, and policy adjustments, are retained for a minimum of [10] years. This ensures compliance with regulatory requirements and provides a historical record for reference.Financial Records

All financial transactions, including premium payments and claims payouts, are retained for a minimum of [7] years. This is crucial for audit purposes and ensures that the agency can provide accurate financial statements when required.

Record Type | Retention Period | Purpose |

|---|---|---|

Client Records | [10] years | Compliance and historical reference |

Financial Records | [7] years | Audit purposes and financial reporting |

B. Reporting Requirements

Internal Reporting

Department heads are responsible for submitting regular reports on their operations, performance metrics, and any significant issues that arise. These reports help senior management monitor the agency's performance and make informed decisions.Regulatory Reporting

[Your Company Name] complies with all regulatory reporting requirements. This includes submitting financial statements and claims data to state insurance departments as required. Failure to comply with these reporting obligations can result in penalties and reputational damage.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Establish clear guidelines with the Insurance Agency Policy Template from Template.net. This editable and customizable template provides a framework for your agency’s policies, ensuring compliance and clarity. Tailor it using our Ai Editor Tool to align with your agency's specific needs, fostering a professional and consistent operational environment.