Financial Advisor Memo

To: [Client Name]

From: [Your Name]

Date: [Date]

Subject: Financial Strategy Update and Recommendations

As your financial advisor, my priority is to ensure that your financial strategies align with your long-term goals and objectives. This memo provides a comprehensive overview of your current financial portfolio, analyzes recent market developments, and outlines tailored recommendations to optimize your investment strategy moving forward.

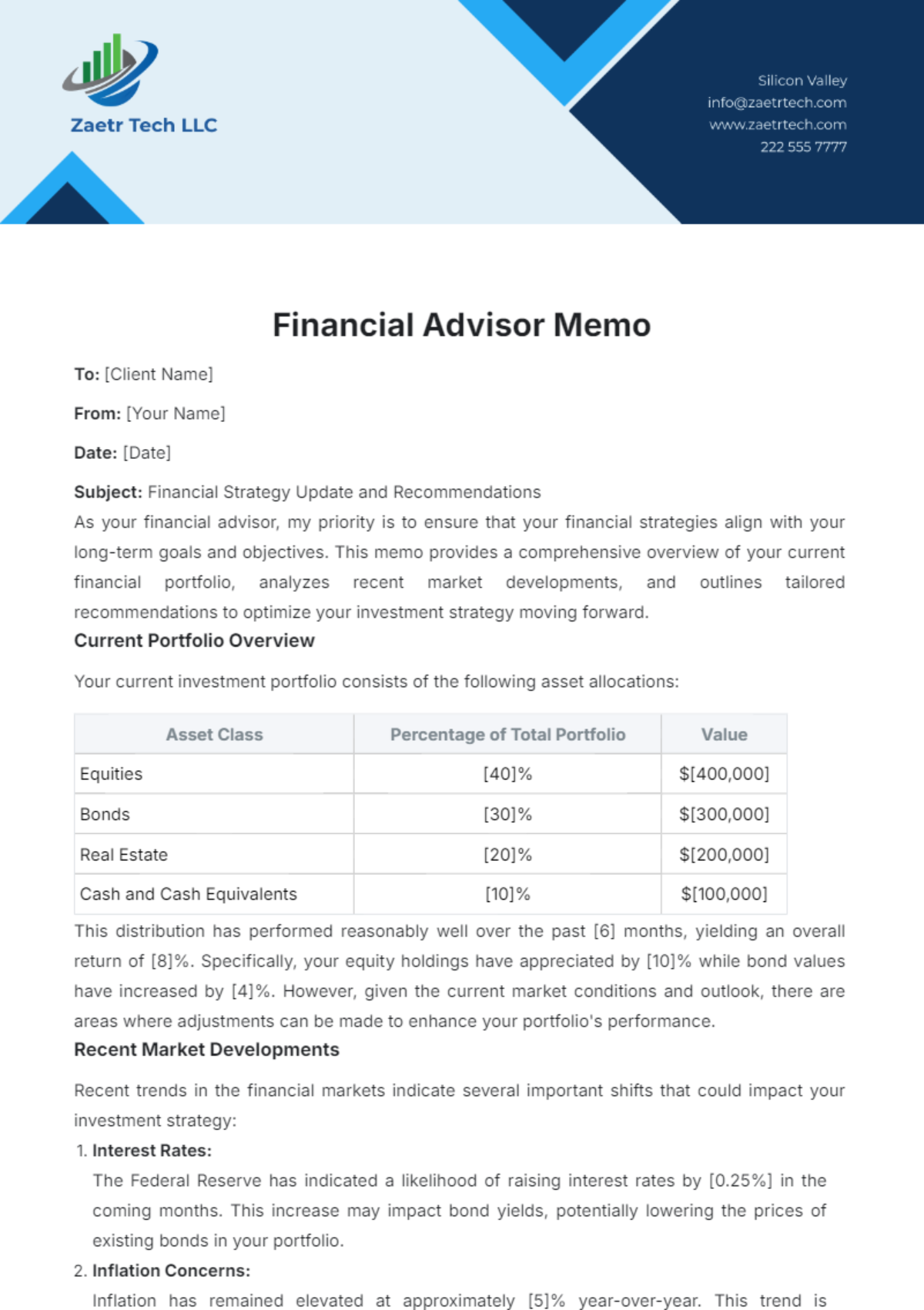

Current Portfolio Overview

Your current investment portfolio consists of the following asset allocations:

Asset Class | Percentage of Total Portfolio | Value |

|---|---|---|

Equities | [40]% | $[400,000] |

Bonds | [30]% | $[300,000] |

Real Estate | [20]% | $[200,000] |

Cash and Cash Equivalents | [10]% | $[100,000] |

This distribution has performed reasonably well over the past [6] months, yielding an overall return of [8]%. Specifically, your equity holdings have appreciated by [10]% while bond values have increased by [4]%. However, given the current market conditions and outlook, there are areas where adjustments can be made to enhance your portfolio's performance.

Recent Market Developments

Recent trends in the financial markets indicate several important shifts that could impact your investment strategy:

Interest Rates:

The Federal Reserve has indicated a likelihood of raising interest rates by [0.25%] in the coming months. This increase may impact bond yields, potentially lowering the prices of existing bonds in your portfolio.Inflation Concerns:

Inflation has remained elevated at approximately [5]% year-over-year. This trend is affecting consumer goods prices and could lead to a decrease in purchasing power, particularly among fixed-income investments.Technological Advancements:

Sectors such as technology and renewable energy continue to experience substantial growth, with the Nasdaq Composite Index rising by [12]% over the past year. Investing in these sectors could present new opportunities for significant returns.

Recommendations

Based on the current economic landscape and your financial goals, I recommend the following adjustments to your investment strategy:

Rebalance Portfolio:

Reduce Exposure to Bonds: Consider reducing your bond holdings from [30]% to [20]% of the total portfolio. This would free up approximately $[100,000].

Reallocate to Growth Stocks: Invest the $[100,000] into growth stocks in sectors such as technology and renewable energy, which have shown an average growth rate of [15]% over the past year.

Increase Cash Reserves:

Given the potential for market volatility, increasing your cash reserves from [10]% to [15]% would provide added flexibility. This translates to increasing your cash holdings to $[150,000], allowing you to capitalize on investment opportunities or address unforeseen expenses.

Diversification:

Explore investments in emerging markets or sector-specific ETFs (Exchange-Traded Funds) to diversify your portfolio further. Allocating approximately $[50,000] towards an emerging market ETF could potentially enhance returns, as these markets are projected to grow by [6]% annually over the next five years.

These recommendations aim to position your portfolio for continued growth while mitigating potential risks associated with changing market conditions. I suggest we schedule a meeting to discuss these strategies in more detail and adjust your portfolio accordingly. Please feel free to reach out to me at [Your Email] or [Your Company Number] to set up a convenient time.

Thank you for your trust in managing your financial future. I look forward to our continued partnership in achieving your financial goals.

Best Regards,

[Your Name]

[Your Name]

[Your Company Name]