Free Real Estate Feasibility Study

Prepared by: [Your Name]

Date: November 26, 5050

1. Executive Summary

This feasibility study evaluates the potential for a 50-unit apartment complex in Riverside Heights. The study analyzes market conditions, site characteristics, financial projections, and regulatory requirements. The findings indicate a strong demand for rental units in the area, driven by population growth and limited housing supply. The projected Internal Rate of Return (IRR) is estimated at 12%, making the project financially viable. Recommendations include proceeding with the project while refining financial details and securing necessary permits.

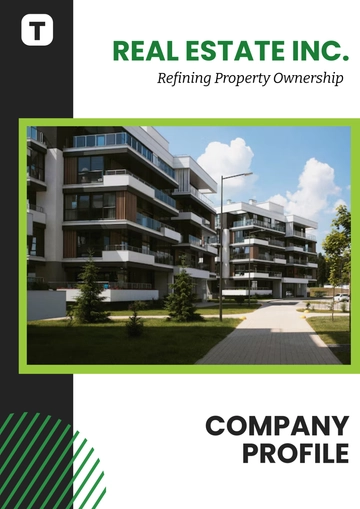

2. Project Description

Project Type: Multi-family residential development

Location: 123 Riverbank Avenue, Riverside Heights

Size and Scope:

Total area: 1 acre

Building size: 40,000 sq. ft.

50 units consisting of 1- and 2-bedroom apartments

Timeline:

Project start: Q2 2051

Expected completion: Q4 2052

3. Market Analysis

A. Local Market Conditions:

The population of Riverside Heights has increased by 10% over the last three years.

The average household income in the area is $75,000.

The current rental vacancy rate is 4%, indicating strong demand.

B. Competitive Analysis:

Competing projects include two new apartment complexes within 0.5 miles, offering similar amenities at slightly higher prices.

Strengths: Proximity to public transport and amenities.

Weaknesses: Higher construction costs than competitors.

C. Target Market:

Young professionals and small families seeking affordable rental options.

Expected average rent per unit: $1,800/month for 1-bedroom and $2,400/month for 2-bedroom units.

4. Site Analysis

A. Site Location and Accessibility:

Located within walking distance of Riverside Heights’ major shopping district.

Excellent access to public transportation, with a bus stop located 200 feet from the site.

B. Physical Characteristics:

The site is flat with no significant environmental issues.

Zoning allows for multi-family residential development.

C. Regulatory Considerations:

Zoning regulations permit the proposed density.

Permitting is expected to take 3-6 months, with no anticipated challenges.

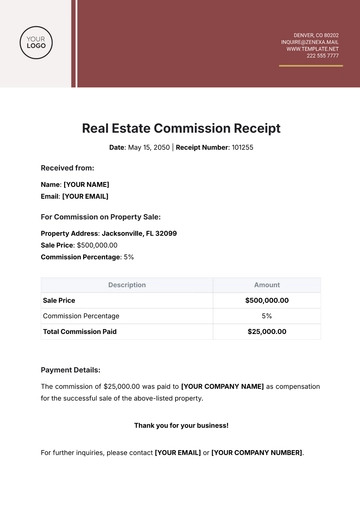

5. Financial Analysis

A. Development Costs:

Land acquisition cost: $1.5 million

Construction costs: $6 million (estimated at $150/sq. ft.)

Soft costs: $1 million (including architecture, legal fees, and marketing)

B. Revenue Projections:

Monthly rental income projected:

30 x $1,800 (1-bedroom) = $54,000

20 x $2,400 (2-bedroom) = $48,000

Annual revenue: $1.224 million

C. Financial Metrics:

Total development costs: $8.5 million

Projected net operating income: $1.224 million annually

NPV (using a discount rate of 8%): $2.3 million

IRR: 12%

6. Risk Assessment

A. Market Risks:

Economic downturn leading to decreased rental demand.

Competing developments may affect occupancy rates.

B. Financial Risks:

Construction cost overruns impacting profitability.

Interest rate fluctuations affect financing costs.

C. Mitigation Strategies:

Conduct regular market assessments to adjust pricing and marketing strategies.

Secure fixed-rate financing to mitigate interest rate risks.

7. Conclusion and Recommendations

The feasibility study concludes that the proposed 50-unit apartment complex in Riverside Heights is financially viable and strategically positioned in a growing market. Given the projected returns and strong demand for rental units, it is recommended to proceed with the project. The next steps include finalizing financial agreements and beginning the permitting process.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock your real estate potential with the Real Estate Feasibility Study Template from Template.net. This customizable and editable resource empowers you to analyze property investments efficiently. Easily adjust the template in our AI Editor Tool, ensuring that it meets your unique requirements. Streamline your planning process and make informed decisions for successful real estate ventures.