Free Audit Report For Insurance Industry

Introduction

This audit report evaluates the compliance and effectiveness of various processes within ABC Insurance Company. The aim is to ensure that the organization is operating within the regulatory requirements of the insurance industry and to provide recommendations for improvements.

Scope and Objectives

The scope of this audit covers:

Underwriting Processes

Claims Management

Financial Reporting

Risk Management

Compliance with Regulatory Standards

The objective is to identify areas of risk, evaluate the controls in place, and recommend enhancements for process efficiency and regulatory compliance.

Methodology

The audit methodology involved:

Interviews with key personnel

Review of policy documents and procedures

Testing of transaction samples

Analysis of financial records and management reports

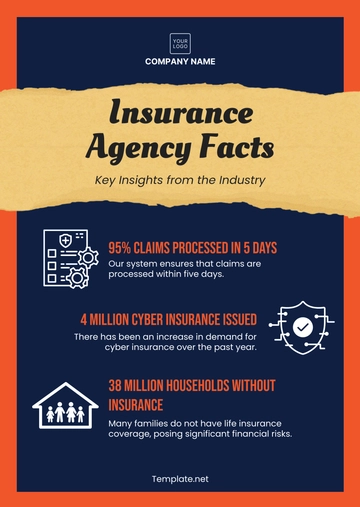

Key Observations

Underwriting Processes: While effective controls are in place, the documentation of underwriting decisions needs standardization and improvement to ensure clarity and consistency.

Claims Management: The system accurately processes claims; however, it experiences inefficiencies under high demand, affecting response times and customer satisfaction.

Financial Reporting: Financial reporting adheres to industry standards but lacks real-time reporting capabilities, limiting the ability to make prompt data-driven decisions.

Risk Management: The risk management framework is generally robust; however, risk assessments are not updated frequently enough to keep pace with emerging risks.

Regulatory Compliance: The company complies with most regulatory standards, but there is room for better alignment with new and evolving regulations to prevent future compliance risks.

Data Analysis

Category | Compliance Level | Recommendations |

|---|---|---|

Underwriting Processes | 80% | Improve documentation procedures |

Claims Management | 75% | Invest in system upgrades |

Financial Reporting | 85% | Enhance real-time reporting tools |

Risk Management | 90% | Regularize risk assessment updates |

Recommendations

Based on the findings, the following actions are recommended to enhance operational efficiency and compliance:

Underwriting Documentation: Implement a formal documentation improvement initiative to standardize underwriting procedures and ensure completeness.

Claims Management System: Upgrade the claims management system to improve its capacity and efficiency during peak periods, ensuring timely processing and better customer experience.

Financial Reporting Tools: Introduce real-time reporting capabilities to enable more agile financial decision-making.

Risk Management Updates: Establish a regular schedule for updating risk assessments, ensuring that emerging risks are consistently identified and mitigated.

Regulatory Training: Enhance employee training and awareness programs to ensure alignment with new regulatory requirements, thereby minimizing future compliance risks.

Conclusion

The audit of ABC Insurance Company indicates a good adherence to existing processes and regulatory standards, with specific areas identified for enhancement. Addressing these weaknesses will help the company strengthen its operational efficiency and regulatory compliance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Create thorough insurance audits with our Audit Report for Insurance Industry Template from Template.net. This customizable and editable template is designed specifically for the insurance sector, ensuring all necessary information is included. Modify and personalize your reports easily using our AI Editor Tool, making it simple to produce accurate and professional documentation. Download now to enhance your audit processes!