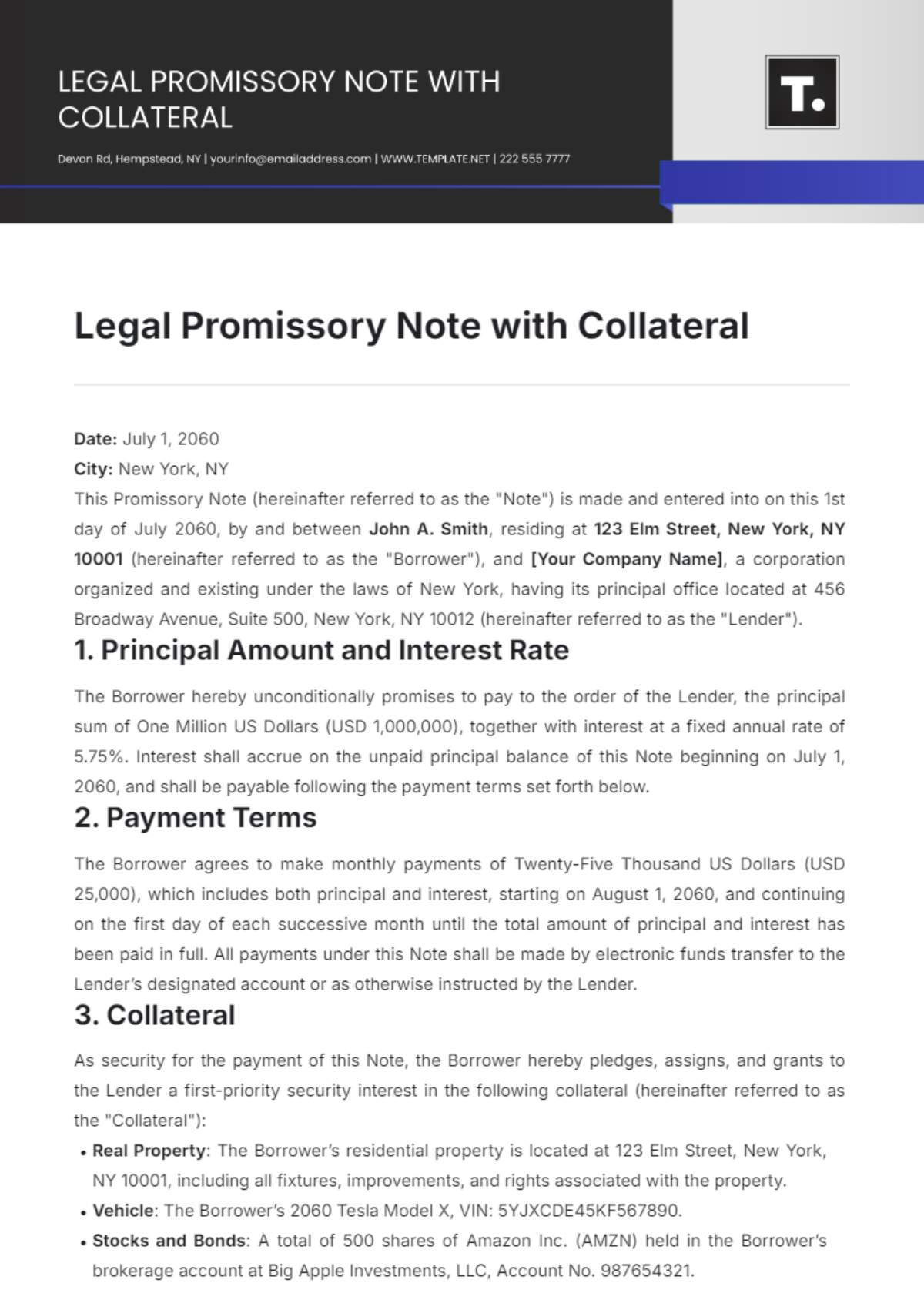

Free Legal Promissory Note with Collateral

Date: July 1, 2060

City: New York, NY

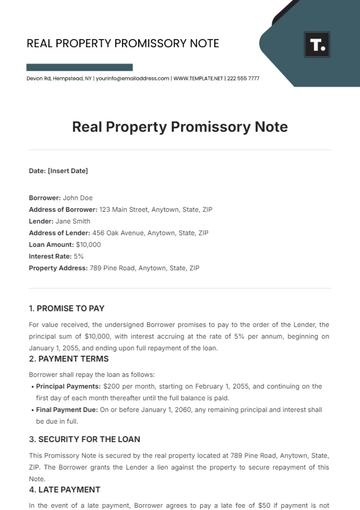

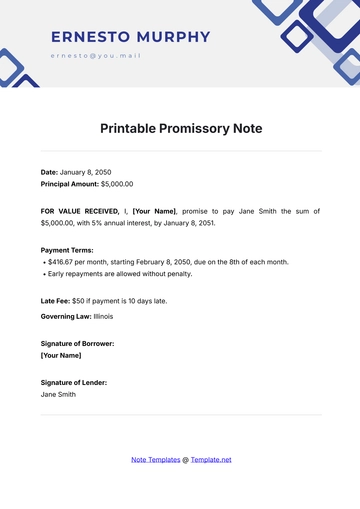

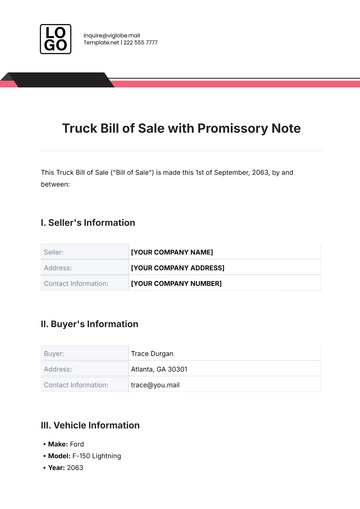

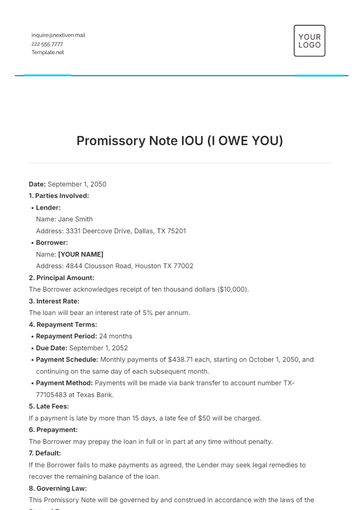

This Promissory Note (hereinafter referred to as the "Note") is made and entered into on this 1st day of July 2060, by and between John A. Smith, residing at 123 Elm Street, New York, NY 10001 (hereinafter referred to as the "Borrower"), and [Your Company Name], a corporation organized and existing under the laws of New York, having its principal office located at 456 Broadway Avenue, Suite 500, New York, NY 10012 (hereinafter referred to as the "Lender").

1. Principal Amount and Interest Rate

The Borrower hereby unconditionally promises to pay to the order of the Lender, the principal sum of One Million US Dollars (USD 1,000,000), together with interest at a fixed annual rate of 5.75%. Interest shall accrue on the unpaid principal balance of this Note beginning on July 1, 2060, and shall be payable following the payment terms set forth below.

2. Payment Terms

The Borrower agrees to make monthly payments of Twenty-Five Thousand US Dollars (USD 25,000), which includes both principal and interest, starting on August 1, 2060, and continuing on the first day of each successive month until the total amount of principal and interest has been paid in full. All payments under this Note shall be made by electronic funds transfer to the Lender’s designated account or as otherwise instructed by the Lender.

3. Collateral

As security for the payment of this Note, the Borrower hereby pledges, assigns, and grants to the Lender a first-priority security interest in the following collateral (hereinafter referred to as the "Collateral"):

Real Property: The Borrower’s residential property is located at 123 Elm Street, New York, NY 10001, including all fixtures, improvements, and rights associated with the property.

Vehicle: The Borrower’s 2060 Tesla Model X, VIN: 5YJXCDE45KF567890.

Stocks and Bonds: A total of 500 shares of Amazon Inc. (AMZN) held in the Borrower’s brokerage account at Big Apple Investments, LLC, Account No. 987654321.

The Borrower agrees that the Lender may file any necessary documents to perfect the security interest in the Collateral.

4. Prepayment

The Borrower may, at their option, prepay all or any portion of the principal amount of this Note without penalty. Any prepayment shall first be applied to accrued and unpaid interest, and then to the outstanding principal balance.

5. Default and Acceleration Clause

If the Borrower fails to make any payment due under this Note or otherwise defaults in the performance of any term of this Note or any related agreement, and such default continues for 30 days, the Lender may declare the entire unpaid principal amount, together with all accrued interest, immediately due and payable. The Lender may also pursue all remedies available under applicable law to collect the full amount owed, including foreclosing on the Collateral.

6. Governing Law

This Note shall be governed by, and construed following, the laws of the State of New York, without regard to its conflict of law principles.

7. Notices

All notices or communications required or permitted under this Note shall be in writing and shall be deemed delivered when sent by certified mail, return receipt requested, or by a reputable overnight delivery service to the following addresses:

Borrower: John A. Smith, 123 Elm Street, New York, NY 10001

Lender: Global Funding Solutions, Inc., 456 Broadway Avenue, Suite 500, New York, NY 10012

8. Amendments

This Note may be amended or modified only by a written agreement signed by both the Borrower and the Lender.

IN WITNESS WHEREOF, the undersigned has executed this Promissory Note as of the day and year first written above.

Borrower

John A. Smith

John A. Smith

Lender

[Your Name]

[Your Name]

Chief Financial Officer

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Protect your interests with the Legal Promissory Note with Collateral Template from Template.net. This editable and customizable template ensures all terms of your loan are clearly defined, with collateral included. Tailor it to your specific needs using our Ai Editor Tool for comprehensive documentation.