Free Yoga Studio Expense Report

1. Introduction

This report provides a comprehensive overview of the expenses incurred by [Your Company Name] Yoga Studio for the fiscal year 2052. As a leading establishment in the wellness industry, maintaining a detailed account of our financial activities is vital to ensure sustainability, profitability, and strategic planning. This report will outline the various categories of expenses, provide a breakdown of costs, and offer insights into areas where financial efficiency can be improved. By analyzing these expenses, we aim to make informed decisions that can help optimize our operations and support our long-term vision.

The yoga industry continues to grow as more individuals seek wellness solutions that enhance both physical and mental health. As such, it is imperative that [Your Company Name] Yoga Studio not only focuses on providing exceptional yoga classes and wellness programs but also on managing its financial health effectively. This report serves as an essential tool for understanding our financial landscape, guiding our operational strategies, and preparing for future challenges and opportunities.

2. Executive Summary

The fiscal year 2050 has seen [Your Company Name] Yoga Studio incur a total expenditure of $[1,500,000], representing a [20%] increase from the previous year. This increase can be attributed to several factors, including expansion initiatives, increased operational costs, and investments in marketing strategies aimed at enhancing brand visibility.

In particular, we have seen a significant rise in our marketing efforts, reflecting our commitment to reaching a broader audience and engaging our community through innovative programs. The emphasis on attracting new clients and retaining existing ones has resulted in increased spending in advertising and promotional activities, which, while costly, is essential for our growth strategy.

The key findings of this report include:

Total operational expenses: $[1,500,000]

Breakdown of fixed and variable costs

Analysis of specific expense categories such as rent, utilities, staff salaries, marketing, and supplies

Recommendations for optimizing expenses in the upcoming fiscal year

By providing these insights, we hope to equip stakeholders with a clearer understanding of our financial position and the strategic decisions that will drive our success in the years to come.

3. Total Expenses Overview

3.1 Total Annual Expenses

In 2052, [Your Company Name] Yoga Studio's total expenses amounted to $[1,500,000]. This figure encompasses all direct and indirect costs associated with operating the studio, including both fixed and variable expenses. A comparative analysis with previous years reveals significant trends in spending habits and financial management, allowing us to identify areas for improvement.

To put this in perspective, the total expenses have been analyzed over the past three years, revealing valuable insights into our financial trajectory. For instance, in 2050, our total expenses were $[1,250,000], marking an increase of [20%] compared to 2051's total expenses of $[1,050,000]. Understanding these trends enables us to forecast future expenses and make data-driven decisions for resource allocation.

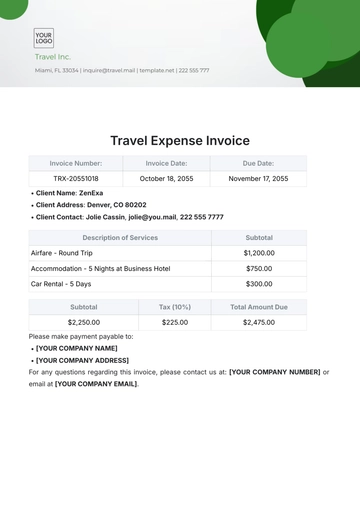

Year | Total Expenses ($) | Change (%) |

|---|---|---|

2050 | $[1,050,000] | |

2051 | $[1,250,000] | [+19%] |

2052 | $[1,500,000] | [+20%] |

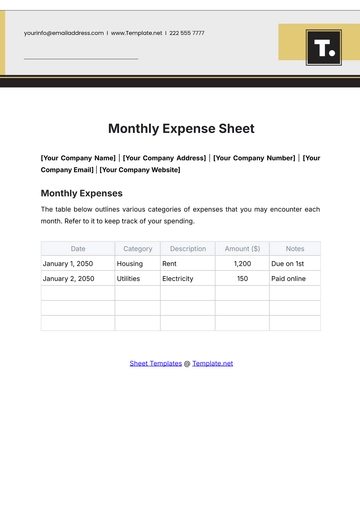

3.2 Monthly Expense Distribution

To better understand our financial obligations, the monthly distribution of expenses has been summarized in the table below. This breakdown provides insights into which months tend to have higher or lower expenditures, allowing us to anticipate cash flow needs throughout the year.

Month | Expenses ($) |

|---|---|

January | $[150,000] |

February | $[120,000] |

March | $[130,000] |

April | $[110,000] |

May | $[140,000] |

June | $[130,000] |

July | $[160,000] |

August | $[170,000] |

September | $[130,000] |

October | $[140,000] |

November | $[120,000] |

December | $[140,000] |

Total | $[1,500,000] |

The above monthly distribution highlights seasonal variations in expenses that could correlate with fluctuations in client attendance, special events, or promotional campaigns. Notably, months such as January often see increased expenses due to New Year promotions aimed at attracting new members eager to start their wellness journeys.

4. Expense Categories

The expenses incurred by [Your Company Name] Yoga Studio can be classified into several major categories. Understanding these categories is essential for effective financial management and planning.

4.1 Fixed Expenses

Fixed expenses are costs that remain constant regardless of the number of clients or classes offered. These expenses include rent, salaries, and insurance, and they form the foundation of our financial obligations.

4.1.1 Rent

The monthly rent for the studio space is a significant component of our fixed expenses. In 2050, the annual rent totaled $[240,000], which reflects an increase due to market demand and lease renewals. Rent is a crucial aspect of our overhead costs, and we must ensure that the space aligns with our operational needs while remaining cost-effective.

Description | Amount ($) |

|---|---|

Monthly Rent | $[20,000] |

Annual Total | $[240,000] |

This expense is typically negotiated annually, and fluctuations in the rental market can directly affect our bottom line. As we approach lease renewal periods, it is essential to assess comparable rates in the area and negotiate terms that reflect the value we provide to our members.

4.1.2 Salaries

Salaries for our instructors and administrative staff constitute a major fixed expense. In 2050, total salary expenses reached $[800,000]. This amount includes wages, benefits, and taxes, which are crucial to maintaining a motivated and skilled workforce.

Position | Annual Salary ($) | Number of Employees | Total ($) |

|---|---|---|---|

Yoga Instructors | $[60,000] | [10] | $[600,000] |

Admin Staff | $[40,000] | [5] | $[200,000] |

Total | $[800,000] |

In maintaining competitive salaries, [Your Company Name] is committed to attracting top talent in the industry. Our yoga instructors are not only certified professionals but also play a pivotal role in cultivating a welcoming and supportive studio environment. Investing in our staff's continued education and training is essential, ensuring they are equipped to provide the best possible service to our clients.

4.1.3 Insurance

Insurance is another fixed expense that protects the studio from various liabilities, including property damage, employee injuries, and client claims. In 2050, our insurance costs amounted to $[20,000]. This cost includes general liability insurance, property insurance, and workers' compensation.

Description | Amount ($) |

|---|---|

Liability Insurance | $[10,000] |

Property Insurance | $[5,000] |

Workers' Compensation | $[5,000] |

Total | $[20,000] |

Having adequate insurance coverage is critical to mitigate risks associated with running a yoga studio. Regular reviews of our insurance policies ensure we have the right coverage as our business grows and evolves.

4.2 Variable Expenses

Variable expenses fluctuate based on the studio's activity level and can include marketing, utilities, supplies, and maintenance.

4.2.1 Marketing

In 2050, marketing expenses were $[150,000], reflecting our commitment to attracting new clients and promoting our services. This category includes digital marketing campaigns, social media advertising, printed materials, and community outreach events.

Description | Amount ($) |

|---|---|

Digital Advertising | $[70,000] |

Printed Materials | $[30,000] |

Events and Promotions | $[50,000] |

Total | $[150,000] |

Investing in effective marketing strategies is essential for our growth and retention efforts. We have increased our digital presence significantly, utilizing platforms like Instagram and Facebook to reach a broader audience and showcase the unique aspects of our studio.

4.2.2 Utilities

Utilities, including electricity, water, and internet services, are essential for studio operations. In 2050, our utility expenses totaled $[60,000], with electricity being the most significant component due to the need for heating, air conditioning, and lighting.

Description | Amount ($) |

|---|---|

Electricity | $[40,000] |

Water | $[15,000] |

Internet | $[5,000] |

Total | $[60,000] |

To manage utility costs, we are exploring energy-efficient solutions, such as LED lighting and smart thermostats, which can help reduce our overall energy consumption and lower expenses.

4.2.3 Supplies

Supplies needed for yoga classes, such as mats, blocks, straps, and other props, are also a variable expense. In 2050, we spent $[50,000] on supplies.

Description | Amount ($) |

|---|---|

Yoga Mats | $[20,000] |

Props and Blocks | $[15,000] |

Miscellaneous | $[15,000] |

Total | $[50,000] |

Regularly reviewing our supply needs and vendor relationships ensures that we can manage costs while providing quality equipment for our clients.

4.2.4 Maintenance

Maintenance expenses ensure the studio is well-kept and functional. In 2050, maintenance costs were $[30,000], including repairs, cleaning services, and equipment maintenance.

Description | Amount ($) |

|---|---|

Cleaning Services | $[15,000] |

Equipment Repair | $[15,000] |

Total | $[30,000] |

Keeping the studio clean and well-maintained contributes to the overall experience of our members and helps foster a positive environment.

5. Detailed Financial Analysis

5.1 Year-over-Year Expense Comparison

Analyzing year-over-year expenses allows us to identify trends, areas of growth, and aspects that may require financial adjustments. The following table summarizes the expenses incurred by [Your Company Name] Yoga Studio over the past three years, highlighting changes in each category:

Expense Category | 2050 ($) | 2051 ($) | 2052 ($) | Change (2050-2051) (%) |

|---|---|---|---|---|

Rent | $[240,000] | $[240,000] | $[240,000] | [0%] |

Salaries | $[650,000] | $[750,000] | $[800,000] | [+7%] |

Insurance | $[15,000] | $[15,000] | $[20,000] | [+33%] |

Marketing | $[120,000] | $[130,000] | $[150,000] | [+15%] |

Utilities | $[55,000] | $[60,000] | $[60,000] | [0%] |

Supplies | $[40,000] | $[45,000] | $[50,000] | [+11%] |

Maintenance | $[25,000] | $[30,000] | $[30,000] | [0%] |

Total Expenses | $[1,155,000] | $[1,200,000] | $[1,500,000] | [+25%] |

From this comparison, we can see a notable increase in total expenses from $[1,200,000] in 2049 to $[1,500,000] in 2050, which represents a [25%] increase.

5.1.1 Key Insights

Salaries: The increase in salary expenses reflects our commitment to providing competitive wages for our staff and accommodating new hires to meet growing client demand.

Marketing: The increase in marketing expenses demonstrates a proactive approach to expanding our client base, suggesting our marketing strategies have been effective in raising brand awareness.

Insurance: A notable increase in insurance costs indicates a review and adjustment of our coverage to ensure comprehensive protection as our studio grows and operations expand.

5.2 Cost-Effectiveness Strategies

To maintain financial health while continuing to grow, [Your Company Name] Yoga Studio must consider cost-effectiveness strategies. Below are recommendations based on the analysis of our 2050 expenses:

5.2.1 Streamline Marketing Efforts

While our marketing efforts have proven beneficial, we should analyze which channels yield the highest return on investment (ROI). By utilizing analytics tools, we can measure the effectiveness of our campaigns and reallocate funds from less effective channels to those that demonstrate higher engagement and conversion rates.

Digital Advertising: Focus on platforms that have driven the most traffic and conversions, such as Facebook and Instagram.

Community Events: Prioritize participation in local events that provide direct exposure to potential clients, reducing costs associated with less impactful advertising methods.

5.2.2 Optimize Utility Usage

As utilities represent a substantial ongoing expense, implementing energy-efficient practices can lead to significant savings. Consider the following strategies:

Energy Audits: Conduct an energy audit to identify areas where we can improve efficiency, such as heating and cooling systems.

Sustainable Practices: Transition to energy-efficient lighting and appliances, which may have higher upfront costs but result in long-term savings on energy bills.

5.2.3 Reassess Supply Contracts

Regularly reviewing contracts with supply vendors can help ensure we are receiving competitive rates. By comparing prices and evaluating the quality of supplies, we can reduce costs while still meeting the needs of our clients.

Bulk Purchasing: Consider bulk purchasing agreements for commonly used items like yoga mats and props to secure lower prices.

Vendor Relationships: Establish strong relationships with suppliers to negotiate better rates based on our purchasing volume.

5.3 Financial Forecast for 2051

In anticipation of future growth, it is essential to develop a financial forecast for 2051. By analyzing trends from the previous year and considering expected changes in membership and service offerings, we can project our expenses more accurately.

5.3.1 Revenue Projections

To generate a financial forecast, we must also consider anticipated revenue. Based on current trends and planned marketing initiatives, we project the following revenue for 2051:

Revenue Source | Projected Revenue ($) |

|---|---|

Membership Fees | $[1,000,000] |

Class Packages | $[300,000] |

Workshops/Special Events | $[200,000] |

Merchandise Sales | $[100,000] |

Total Revenue | $[1,600,000] |

We anticipate total revenue of $[1,600,000], an increase from the previous year, reflecting our growing membership base and enhanced service offerings.

5.3.2 Projected Expenses

Based on the revenue projections, we estimate the following expenses for 2051:

Expense Category | Projected Expenses ($) |

|---|---|

Rent | $[240,000] |

Salaries | $[850,000] |

Insurance | $[25,000] |

Marketing | $[175,000] |

Utilities | $[65,000] |

Supplies | $[60,000] |

Maintenance | $[35,000] |

Total Expenses | $[1,450,000] |

The projected total expenses of $[1,450,000] reflect anticipated growth in certain areas, such as salaries and marketing.

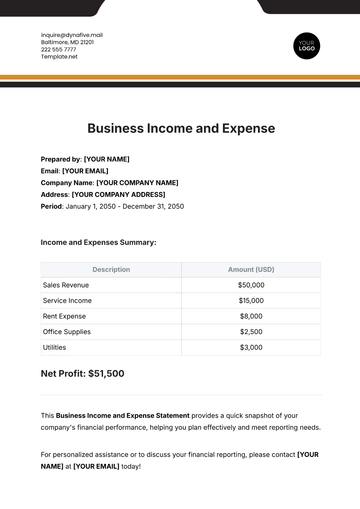

5.4 Profitability Analysis

By comparing projected revenues and expenses for 2051, we can ascertain our profitability:

Projected Revenue: $[1,600,000]

Projected Expenses: $[1,450,000]

This results in a projected profit of $[150,000] for 2051. Maintaining a positive profit margin is essential for ensuring long-term sustainability and growth.

6. Future Growth Opportunities

6.1 Expansion of Services

To capitalize on our growing client base, [Your Company Name] Yoga Studio should explore opportunities to expand our service offerings. Potential avenues for growth include:

6.1.1 Online Classes

Offering virtual classes can help reach clients who prefer practicing at home or are unable to attend in-person sessions. With the rise of digital fitness, this initiative can generate additional revenue and diversify our client engagement.

6.1.2 Specialized Workshops

Introducing specialized workshops, such as yoga for beginners, prenatal yoga, or mindfulness sessions, can attract different demographics and enhance our reputation as a comprehensive wellness provider.

6.2 Community Engagement

Engaging with the local community is crucial for building brand loyalty and attracting new clients. Consider hosting:

6.2.1 Free Community Classes

Offering occasional free classes in local parks or community centers can introduce potential clients to our studio's unique atmosphere and teaching style.

6.2.2 Partnerships with Local Businesses

Collaborating with health-related businesses, such as nutritionists or wellness centers, can create mutual referral opportunities and foster a supportive local network.

7. Conclusion and Recommendations

The expense report for [Your Company Name] Yoga Studio in 2050 illustrates the importance of diligent financial management as we continue to grow and adapt in the ever-evolving wellness industry. Our total expenses of $[1,500,000] demonstrate both the challenges and opportunities we face in maintaining profitability and enhancing our services.

7.1 Key Recommendations

Cost Control: Continuously monitor and control expenses, particularly in marketing and supplies, to enhance profitability without sacrificing quality.

Service Expansion: Explore opportunities for service expansion, particularly in online offerings and specialized workshops, to attract new clients and retain existing ones.

Community Involvement: Strengthen community engagement through free classes and partnerships to boost local brand awareness and create loyal clients.

By implementing these recommendations, [Your Company Name] Yoga Studio can secure its position as a leader in the wellness sector, ensuring financial health and continued growth for years to come.

7.2 Closing Thoughts

Thank you for reviewing the 2050 expense report for [Your Company Name] Yoga Studio. As we move forward, we remain committed to excellence in our services, proactive financial management, and nurturing our community. The future holds immense potential, and we are excited about the opportunities that lie ahead as we continue to promote wellness and holistic health in our community.

By maintaining transparency in our financial operations and fostering a culture of continuous improvement, we can achieve our goals and enhance the well-being of our clients. We look forward to a successful year ahead and invite all stakeholders to engage with us on this journey toward a healthier future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Track finances accurately using the Yoga Studio Expense Report Template from Template.net. This editable and customizable report documents expenses, helping you manage budgets efficiently. Tailor it with our Ai Editor Tool for precise expense tracking.