Free Equipment Financing Payment Plan

Prepared by: [YOUR NAME]

I. Introduction

The equipment financing payment plan is designed to help businesses and individuals acquire necessary machinery or tools through a structured and manageable financial arrangement. This plan outlines the steps, terms, and responsibilities involved in financing equipment effectively.

II. Understanding Equipment Financing

A. Definition

Equipment financing refers to the loan or lease used to purchase business-related equipment. It allows businesses to spread out the cost of expensive equipment over time.

B. Benefits

Improved cash flow management

Potential tax benefits

Preservation of working capital

III. Key Components of the Payment Plan

A. Loan Terms and Interest Rates

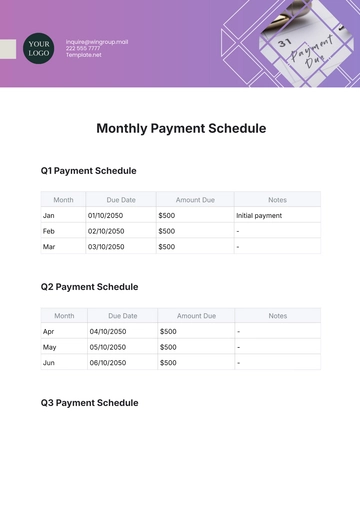

The terms and interest rates are crucial factors. Loan terms typically range from 1 to 7 years with interest rates depending on creditworthiness and market conditions.

B. Down Payment

A down payment may be required, which is typically a percentage of the total equipment cost.

IV. Steps to Create an Equipment Financing Payment Plan

1. Assess Financial Situation

Evaluate current financial status, including cash flow, credit score, and existing financial obligations.

2. Research Lenders

Identify potential lenders who offer favorable terms and have a track record of reliability. Consider banks, credit unions, and online lenders.

3. Prepare Necessary Documentation

Business financial statements

Tax returns

Equipment quotes or invoices

4. Negotiate Terms

Work with the lender to establish manageable terms, including monthly payments and interest rates.

5. Finalize Agreement

Review the loan agreement thoroughly, ensuring that all terms are understood and agreed upon before signing.

V. Repayment Strategy

A. Budgeting

Develop a budget plan to ensure timely payments, incorporating the monthly payment into regular financial planning.

B. Monitoring and Adjustments

Keep an eye on cash flow and be ready to make adjustments if necessary to avoid defaulting on the loan.

VI. Conclusion

By understanding and implementing a well-structured equipment financing payment plan, businesses can acquire the tools they need for success while maintaining financial stability. It is essential to perform due diligence when selecting financing options to optimize benefits and minimize risks.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

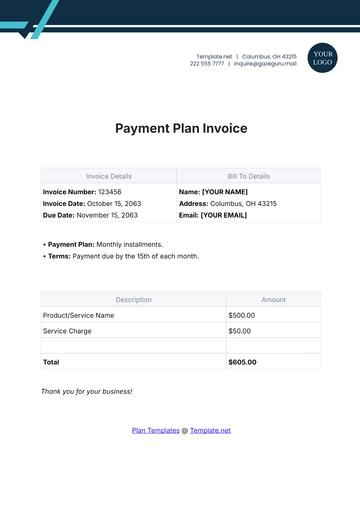

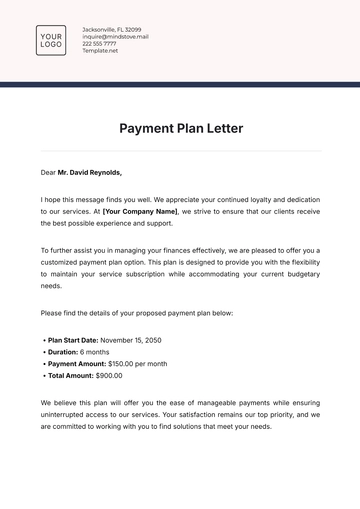

Template.net’s Equipment Financing Payment Plan Template is ideal for businesses or individuals looking to structure financing agreements for equipment purchases. This customizable template, editable in our AI Editor Tool, allows for easy adjustments to reflect the specific terms of your financing, including installment amounts, due dates, and interest rates.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan