Free Capital Investment Proposal

Objective

The primary objective of this capital investment proposal is to secure funds for Project Phoenix, aimed at expanding our operational capacity and enhancing our product lineup to better meet market demand. This capital injection will enable us to invest in advanced machinery, upgrade existing facilities, and implement strategic marketing initiatives, ultimately driving growth and increasing shareholder value.

Project Overview

Project Phoenix is a comprehensive initiative designed to strategically augment our production capabilities and expand our market reach. The project involves three main components: facility expansion, technology upgrades, and marketing enhancement.

Facility Expansion

Our current facilities are operating near maximum capacity, limiting our ability to meet increasing customer demand. The proposed expansion will add 20,000 square feet of manufacturing space, allowing for increased production and storage capacity.

Technology Upgrades

Investment will be directed towards acquiring state-of-the-art machinery and equipment that will improve efficiency, reduce production costs, and enhance product quality. This includes automation technology that will streamline our manufacturing processes.

Marketing Enhancement

A portion of the capital will be allocated to a refined marketing strategy targeting untapped markets and strengthening our brand presence. This will involve digital marketing campaigns and strategic partnerships.

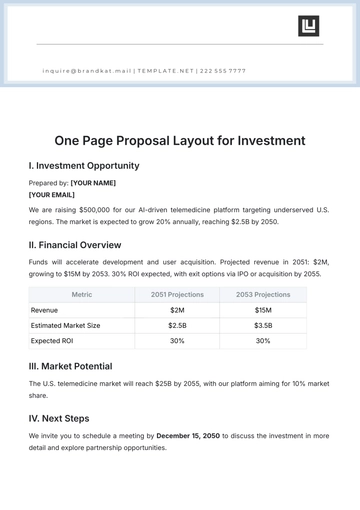

Financial Projections

The following table summarizes the projected financial outcomes over the next five years following the implementation of Project Phoenix:

Year | Revenue (Millions) | Net Profit (Millions) | ROI (%) |

|---|---|---|---|

Year 1 | $50 | $5 | 10% |

Year 2 | $60 | $8 | 13.3% |

Year 3 | $75 | $12 | 16% |

Year 4 | $90 | $18 | 20% |

Year 5 | $110 | $25 | 22.7% |

Risks and Mitigations

We have identified several potential risks associated with this capital investment, along with corresponding mitigation strategies:

Market Volatility: Conduct regular market analysis to adapt strategies accordingly.

Cost Overruns: Implement strict budget controls and continuous project monitoring.

Operational Disruptions: Develop contingency plans to minimize downtime.

Regulatory Changes: Stay informed and compliant with all relevant regulations.

Conclusion

In summary, Project Phoenix represents a pivotal opportunity for growth and increased profitability for our company. The proposed capital investment will not only address current operational constraints but also position us strategically for future success. We recommend the approval of this proposal to meet our growth objectives and maximize shareholder value.

Signature

Prepared by:

[YOUR NAME], Chief Financial Officer

[YOUR NAME], Chief Financial Officer

[YOUR COMPANY NAME]

Date: October 1, 2088

Approved by:

Nadette Ritchie, Chief Executive Officer

Nadette Ritchie, Chief Executive Officer

[YOUR COMPANY NAME]

Date: October 2, 2088

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Secure funding with this Capital Investment Proposal Template from Template.net, designed for businesses seeking capital. This fully customizable template, editable in our AI Editor Tool, provides a professional structure for outlining investment needs, strategies, and projected returns. Tailor it to fit your objectives, creating a compelling document for potential investors.

You may also like

- Business Proposal

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal