Free Investment Opportunity Proposal

Prepared By: [YOUR NAME]

Company Name: [YOUR COMPANY NAME]

Date: 01/15/2069

Executive Summary

Opportunity Overview:

This proposal outlines an exciting investment opportunity in the renewable energy sector. The project aims to achieve market leadership in green hydrogen production by leveraging cutting-edge technology and strategic partnerships in the energy industry.

Investment Required: $15 million

Expected ROI: 35% over 5 years

Timeframe: 5 years

Business Overview

Company Overview:

[YOUR COMPANY NAME] specializes in sustainable energy solutions, focusing on clean energy production and advanced storage systems. Since its founding in 2045, the company has achieved $200 million in annual revenue and a 12% market share in the global clean energy sector.

Industry Overview:

The renewable energy industry is currently valued at $1.8 trillion and is projected to grow at a 7.5% CAGR over the next decade. Key drivers of growth include increasing regulatory support for clean energy, technological advancements, and rising demand for decarbonization solutions.

Investment Opportunity

Project Description:

This investment focuses on the construction and operation of a 50-megawatt green hydrogen production facility. The project is designed to meet the growing demand for hydrogen fuel in transportation and industrial applications.

Key milestones include:

Facility construction completion by Q3 2070

Full-scale production launch by Q1 2071

Achieving $50 million in annual revenue by 2074

Market Analysis:

The target market includes transportation companies, heavy industries, and utility providers, representing 35% of the total hydrogen market. Trends indicate a significant increase in demand for hydrogen fuel, projected to grow by 25% annually.

Competitive Advantage:

[YOUR COMPANY NAME] offers a distinct advantage through:

Proprietary electrolyzer technology that reduces production costs by 15%

Established partnerships with leading transportation and industrial companies

A seasoned leadership team with decades of experience in renewable energy

Financial Plan

Investment Breakdown:

40%: Facility construction

25%: Equipment procurement

20%: Research and development

15%: Marketing and business development

Projected Financial Performance:

Year | Revenue | Expenses | Net Profit | ROI (%) |

|---|---|---|---|---|

1 | $5 million | $3 million | $2 million | 13% |

2 | $12 million | $7 million | $5 million | 22% |

3 | $20 million | $10 million | $10 million | 35% |

4 | $30 million | $15 million | $15 million | 50% |

5 | $50 million | $25 million | $25 million | 70% |

Risk Assessment

Potential Risks:

Market fluctuations in hydrogen pricing

Delays in regulatory approvals

Emergence of competing technologies

Mitigation Strategies:

Establishing fixed-price contracts with key buyers

Proactive engagement with regulatory agencies

Continued investment in technology to maintain a competitive edge

Conclusion

We invite you to join us in this transformative venture, capitalizing on the explosive growth in the hydrogen economy. Together, we can drive the transition to a cleaner, more sustainable energy future.

Contact Information:

[YOUR NAME]

[YOUR COMPANY NAME]

Phone: [YOUR COMPANY NUMBER]

Email: [YOUR COMPANY EMAIL]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Investment Opportunity Proposal Template exclusively offered by Template.net provides a professional structure for presenting investment opportunities. Customizable and editable in our AI Editor Tool, this template allows businesses to clearly outline the value, risks, and rewards of an investment opportunity, making it ideal for attracting investors and securing capital.

You may also like

- Business Proposal

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

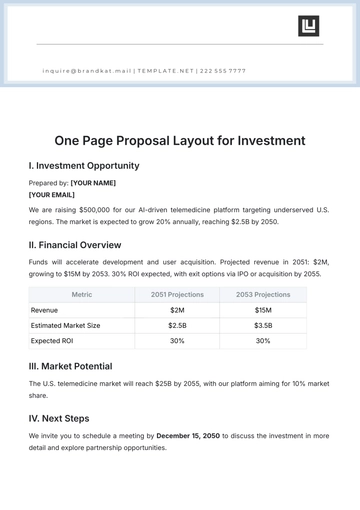

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal