Free Senior Tax Accountant Resume

Address: [YOUR ADDRESS]

Phone Number: [YOUR PHONE NUMBER]

LinkedIn: https://www.linkedin.com/in/your_own_profile

Objective

Detail-oriented and highly skilled Senior Tax Accountant with 10 years of experience in tax planning, compliance, and advisory services. Seeking a challenging position at Elite Accounting Firm where I can leverage my expertise to provide exceptional tax solutions and contribute to the firm's success.

Education

Bachelor of Science in Accounting

[University Name]

Graduated: [Year]

Relevant Coursework:

Advanced Taxation

Corporate Finance

Auditing and Assurance Services

Business Law

Experience

Senior Tax Accountant

[Current Company Name], [Location]

[Month Year] - Present

Managed a portfolio of corporate and individual clients, ensuring timely and accurate tax filings and compliance with tax laws and regulations.

Conducted tax research to identify opportunities for tax savings and minimize tax liabilities for clients.

Developed tax planning strategies to optimize clients' financial positions and achieve their long-term goals.

Provided support during tax audits, liaising with tax authorities, and preparing necessary documentation.

Led a team of junior tax accountants, providing guidance and training to ensure high-quality work and client satisfaction.

Tax Accountant

[Previous Company Name], [Location]

[Dates of Employment]

Prepared federal, state, and local tax returns for individuals, partnerships, and corporations, adhering to strict deadlines.

Assisted clients in understanding complex tax issues and recommended solutions to minimize tax exposure.

Conducted financial analysis to identify potential tax deductions and credits for clients.

Collaborated with cross-functional teams to ensure accurate reporting and compliance with tax laws.

Participated in continuous professional development to stay updated on changes in tax regulations and accounting standards.

Certifications

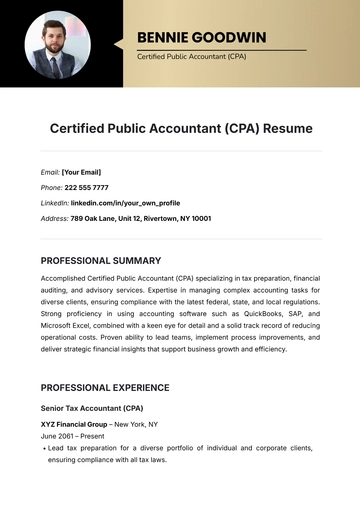

Certified Public Accountant (CPA)

American Institute of Certified Public Accountants (AICPA), [Year]

Certified Management Accountant (CMA)

Institute of Management Accountants (IMA), [Year]

Enrolled Agent (EA)

Internal Revenue Service (IRS), [Year]

Skills

Tax Preparation | Tax Planning | Financial Analysis |

|---|---|---|

Compliance | Strategic Thinking | Problem-Solving |

Research | Communication | Attention to Detail |

Audit Support | Team Leadership | Time Management |

Professional Affiliations

Member, American Institute of Certified Public Accountants (AICPA)

Member, New York Society of Certified Public Accountants

Achievements

Recognized for exceptional client service, resulting in a 20% increase in client retention rate.

Implemented streamlined tax preparation processes, reducing turnaround time by 15%.

Successfully represented clients in IRS audits, resulting in favorable outcomes and minimized penalties.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

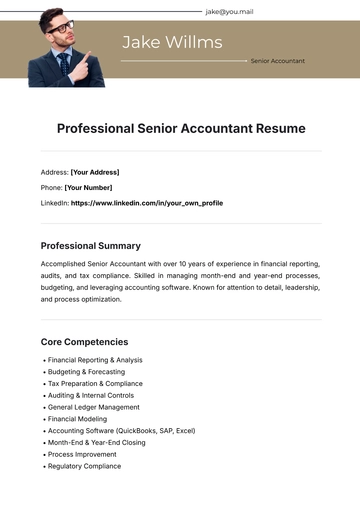

Elevate your career with the Senior Tax Accountant Resume Template from Template.net. Crafted for professionals seeking to stand out, this editable and customizable template ensures your expertise shines through. Tailor your resume effortlessly using our Ai Editor Tool, guaranteeing a polished presentation of your skills and experience. Unlock opportunities with a standout resume today.

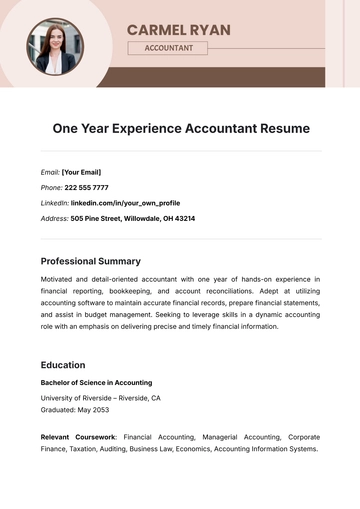

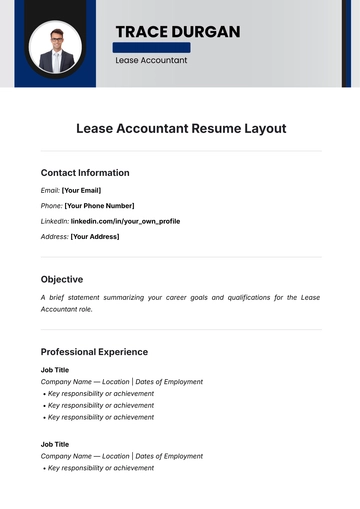

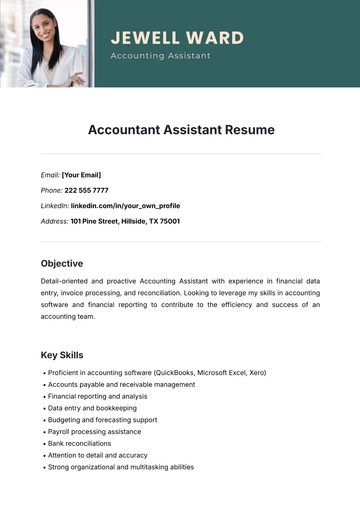

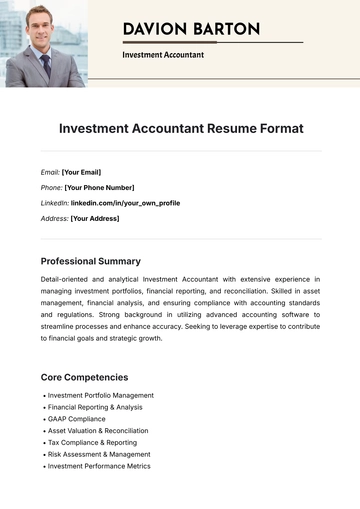

You may also like

- Simple Resume

- High School Resume

- Actor Resume

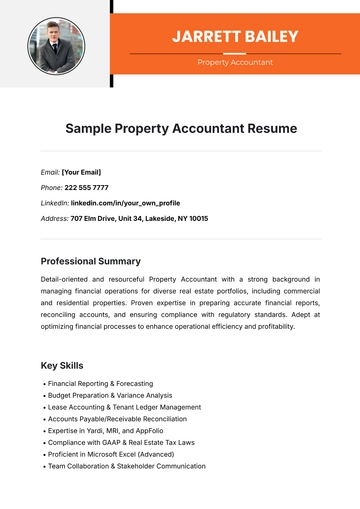

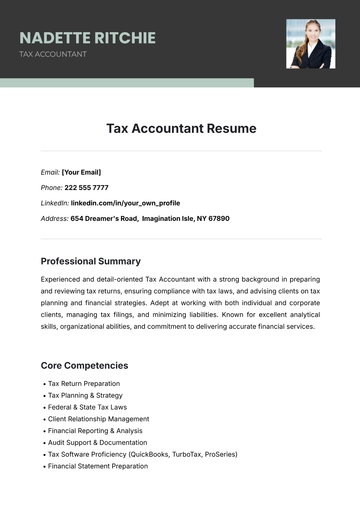

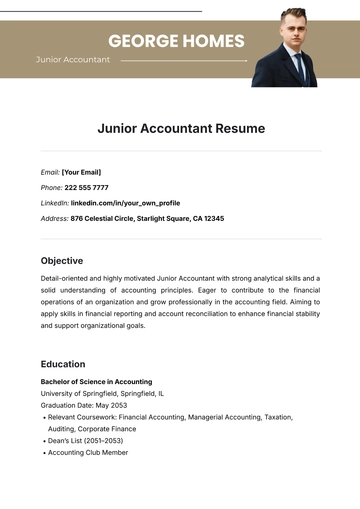

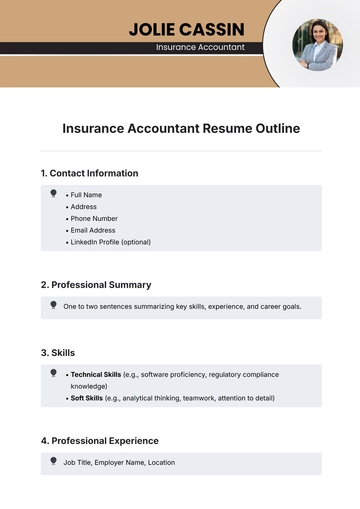

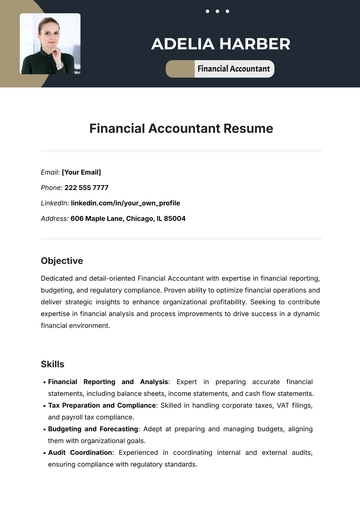

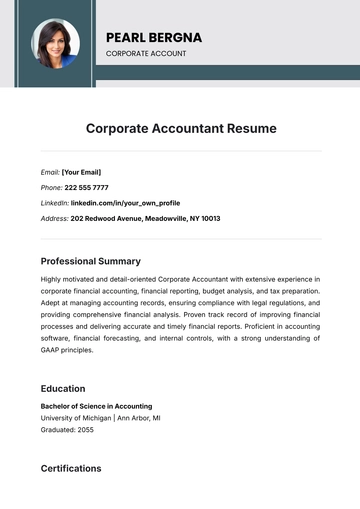

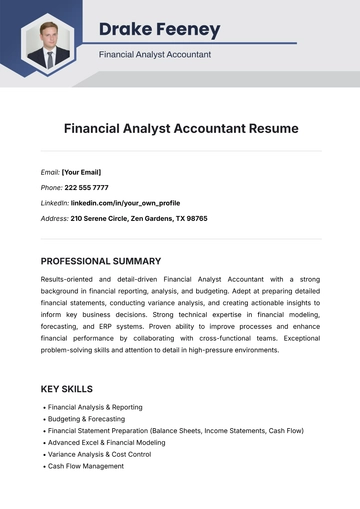

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

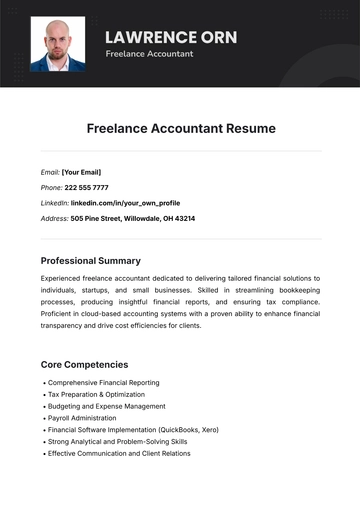

- Freelancer Resume

- Operator Resume

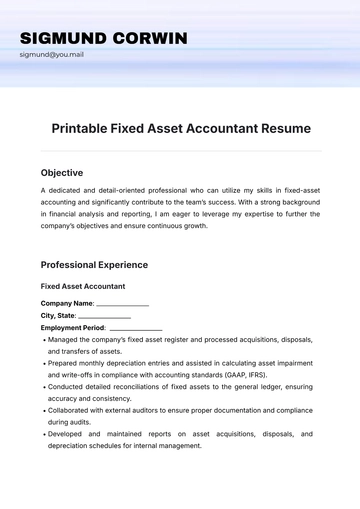

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

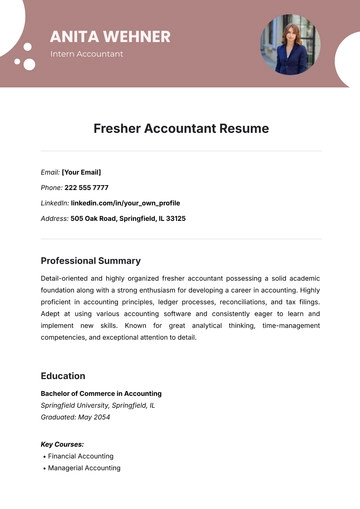

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume