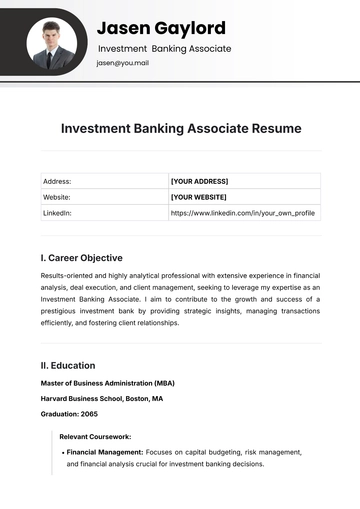

Investment Banking Associate Resume

Address: | [YOUR ADDRESS] |

Website: | [YOUR WEBSITE] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

I. Career Objective

Results-oriented and highly analytical professional with extensive experience in financial analysis, deal execution, and client management, seeking to leverage my expertise as an Investment Banking Associate. I aim to contribute to the growth and success of a prestigious investment bank by providing strategic insights, managing transactions efficiently, and fostering client relationships.

II. Education

Master of Business Administration (MBA)

Harvard Business School, Boston, MA

Graduation: 2065

Relevant Coursework:

Investment Analysis: Analyzes equity, fixed income securities, portfolio management techniques, and valuation methods essential for financial analysis in investment banking.

Strategic Management: Examines competitive analysis, industry dynamics, and corporate strategy formulation, applicable to advisory roles in investment banking.

Bachelor of Arts in Economics

University of California, Berkeley, Berkeley, CA

Graduation: 2062

Relevant Coursework:

Microeconomic Theory: Studies individual economic behavior and market interactions, focusing on supply and demand analysis, pricing mechanisms, and market structures impacting financial markets.

Macroeconomic Policy: Analyzes national and global economic policies, including monetary and fiscal policies, and their effects on economic growth, inflation, and interest rates crucial for investment decisions.

Econometrics: Applies statistical methods like regression analysis, hypothesis testing, and forecasting to economic data, essential for empirical research and economic modeling.

International Trade and Finance: Examines global trade patterns, exchange rate systems, balance of payments, and international financial markets, providing insights into economic factors affecting multinational corporations and global investments.

III. Qualifications

Proven leader in financial analysis and high-profile transactions.

Strong proficiency in financial modeling, valuations, and market research.

Excellent communication and client relationship management skills.

Ability to work under pressure and meet tight deadlines.

IV. Professional Experience

Investment Banking Analyst

Global Finance Group, New York, NY

January 2060 – December 2063

Assisted senior bankers with M&A, IPOs, and capital market activities.

Developed pitch books, transaction memos, and client presentations.

Coordinated due diligence and managed client satisfaction.

Conducted comprehensive financial analyses, including discounted cash flow (DCF) modeling and comparable company analysis.

Financial Analyst Intern

Equity Partners Financial, Los Angeles, CA

June 2060 – August 2060

Assisted in market research and compiled data for industry analysis.

Supported the preparation of investment presentations and client materials.

Teamed up to streamline processes and boost efficiency.

Performed financial statement analysis and prepared detailed reports on potential investment opportunities.

V. Achievements

Top-performing analyst at Goldman Sachs for two years.

Helped prepare a winning pitch book for a major IPO.

Key role in executing 10+ M&A deals worth $5B+.

VI. Certifications

• Chartered Financial Analyst (CFA) - Level II

• Financial Modeling & Valuation Analyst (FMVA) Certification

VII. Additional Information

Nationality: American

Languages: English (Native), Spanish (Fluent)

Interests: Passionate about financial markets analysis, especially equity research and strategic investments, and I enjoy following fintech and digital transformation in the financial industry.

Resume Templates @ Template.net