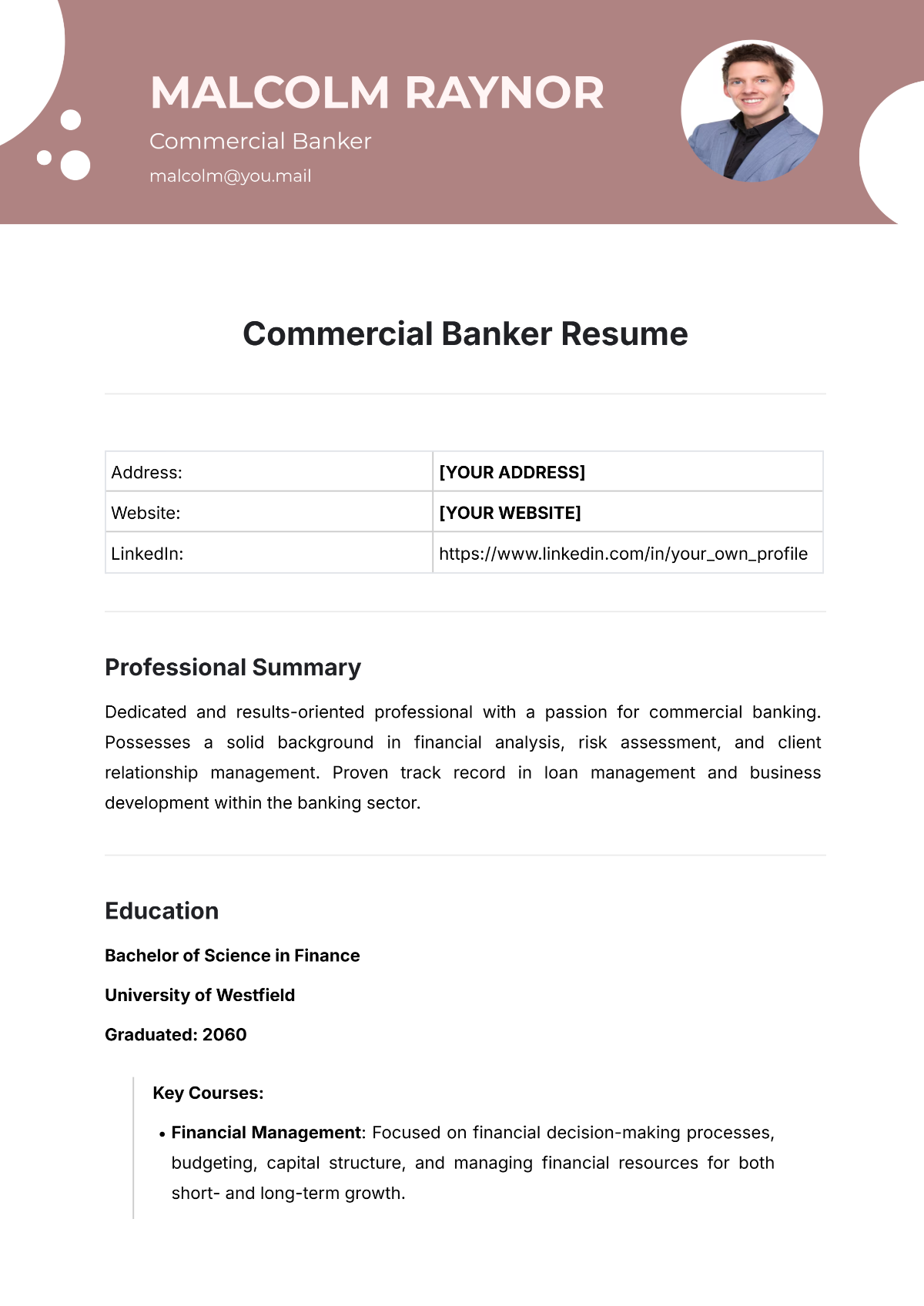

Free Commercial Banker Resume

Address: | [YOUR ADDRESS] |

Website: | [YOUR WEBSITE] |

LinkedIn: | https://www.linkedin.com/in/your_own_profile |

Professional Summary

Dedicated and results-oriented professional with a passion for commercial banking. Possesses a solid background in financial analysis, risk assessment, and client relationship management. Proven track record in loan management and business development within the banking sector.

Education

Bachelor of Science in Finance

University of Westfield

Graduated: 2060

Key Courses:

Financial Management: Focused on financial decision-making processes, budgeting, capital structure, and managing financial resources for both short- and long-term growth.

Investment Analysis: Emphasized evaluating investment opportunities, portfolio management, asset pricing models, and techniques for risk-adjusted returns.

Banking Law and Regulations: Covered the legal framework within which financial institutions operate, including regulations related to lending, compliance, and financial reporting.

Risk Management: Focused on identifying, assessing, and mitigating financial risks, including credit, market, and operational risks.

Experiences

Commercial Banker

Elite Bank, June 2063 – Present

Conduct financial analysis to assess client creditworthiness and risk levels.

Oversee commercial loan portfolio: origination, underwriting, and servicing.

Maintain strong client relationships to meet their financial needs.

Develop and execute growth strategies to expand market share.

Financial Analyst Intern

Capital Investment Solutions

January 2062 – May 2063

Analyzed financials and market trends to spot investment opportunities.

Assessed credit risks and developed loan portfolio mitigation strategies.

Collaborated with teams to launch client marketing campaigns.

Trained and mentored junior staff in financial analysis.

Qualifications

Proficient in financial analysis and evaluation techniques.

Skilled in risk assessment and mitigation strategies.

Experienced in loan management and credit analysis.

Strong interpersonal skills for effective client relationship management.

Proven ability to develop and implement business development strategies.

Familiarity with banking regulations and compliance standards.

Achievements

Boosted revenue by 15% by managing 50 client portfolios.

Implemented risk assessment models that reduced loan defaults by 10%.

Launched marketing campaigns that gained 20 new business accounts.

Received "Excellence in Commercial Banking" award for outstanding performance.

Led training sessions for junior staff on financial analysis techniques.

Skills

Technical Skills:

Financial Analysis

Risk Assessment

Loan Management

Business Development

Banking Regulations

Interpersonal Skills:

Client Relationship Management

Communication

Team Leadership

Problem-Solving

Time Management

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Advance your banking career with the Commercial Banker Resume from Template.net. This fully customizable and editable template highlights your financial expertise. Easily personalize your resume using our Ai Editor Tool to ensure it perfectly reflects your professional strengths. Make a powerful impression and stand out in the competitive banking industry.

You may also like

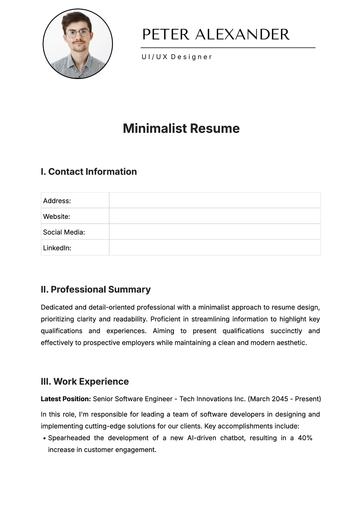

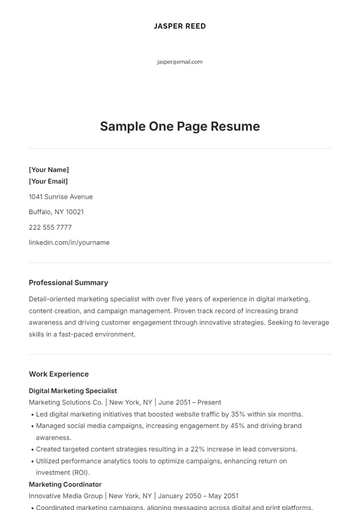

- Simple Resume

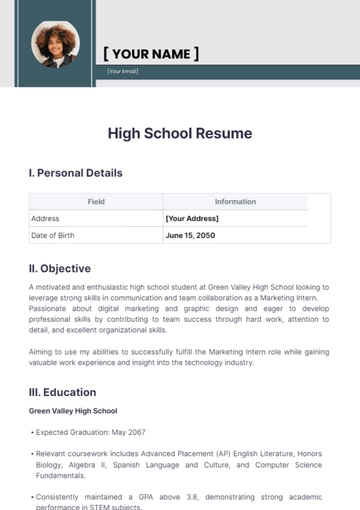

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

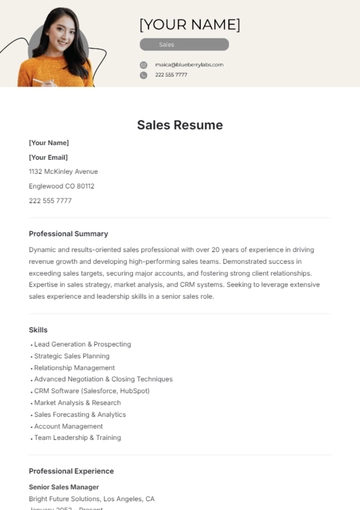

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

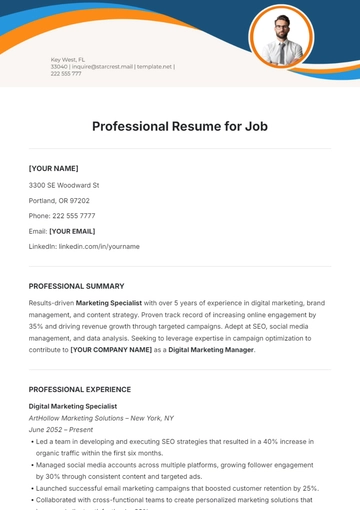

- Professional Resume

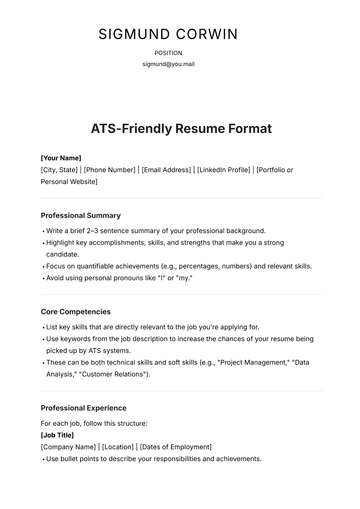

- ATS Resume

- Summary Resume

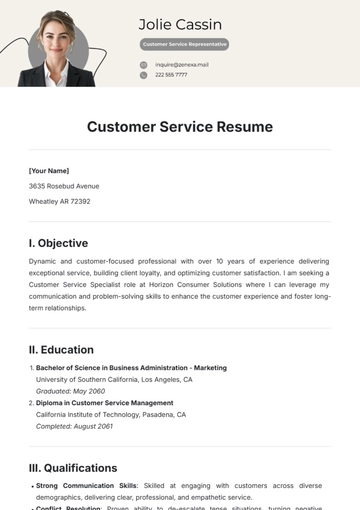

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

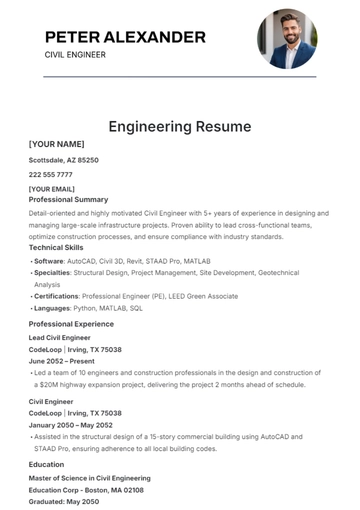

- Engineer Resume

- Data Science Resume

- Warehouse Resume

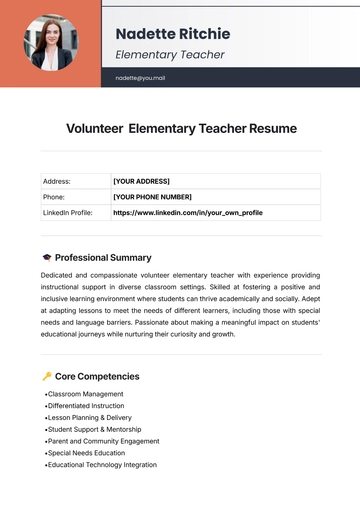

- Volunteer Resume

- No Experience Resume

- Chronological Resume

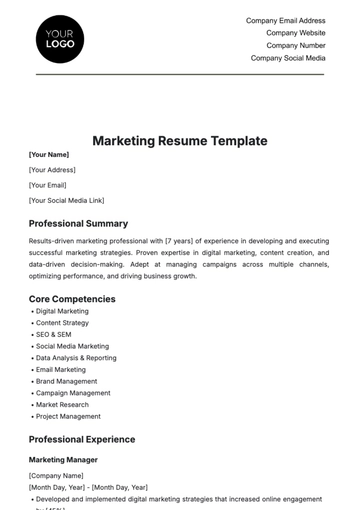

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

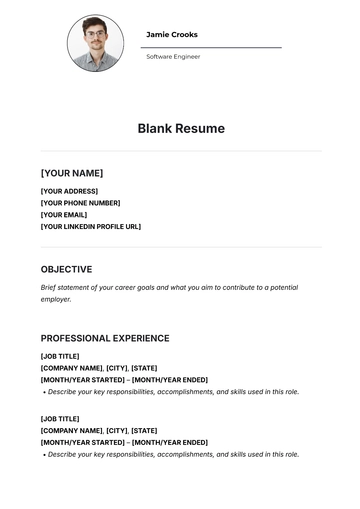

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

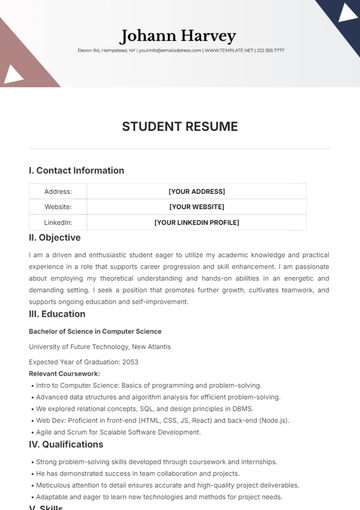

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

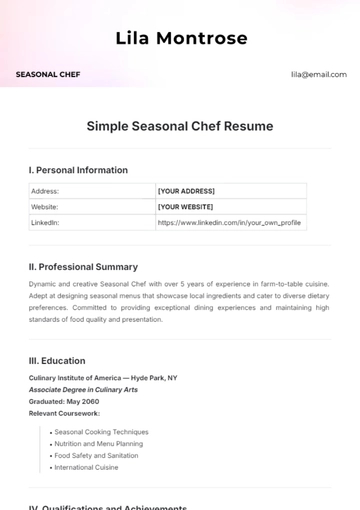

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

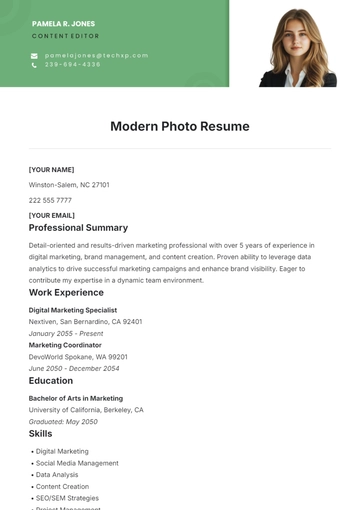

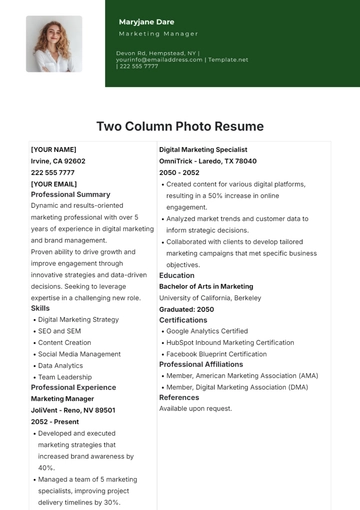

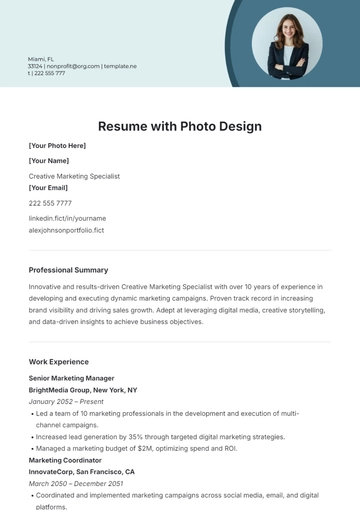

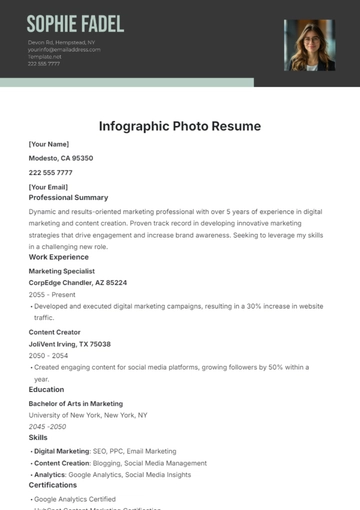

- Photo Resume

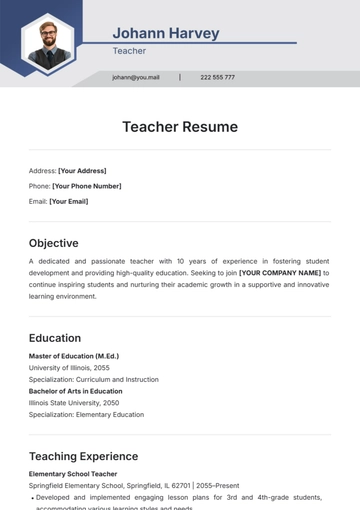

- Teacher Resume

- Modern Resume

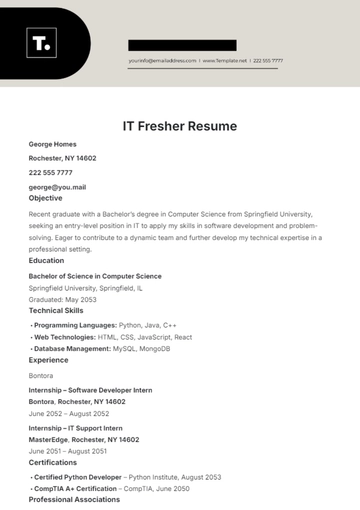

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

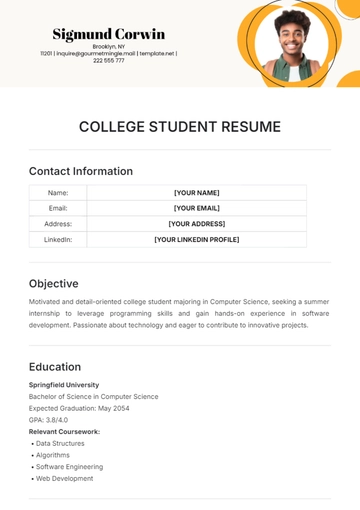

- College Resume