Free Accounting Trial Balance Report

I. Introduction

In this report we will present a meticulous overview of our company's financial standing as of [January 31, 2050]. This report encapsulates the culmination of our accounting efforts, providing a detailed snapshot of the balances of all ledger accounts. The information presented herein is a fundamental step before the preparation of financial statements, ensuring accuracy and transparency in our financial reporting. The data encapsulated in this report is as of [January 31, 2050], representing the conclusion of the accounting period covered. The period covered spans [January 1, 2050], to [January 31, 2050], offering a comprehensive view of our financial status during this specified timeframe.

II. Account Details

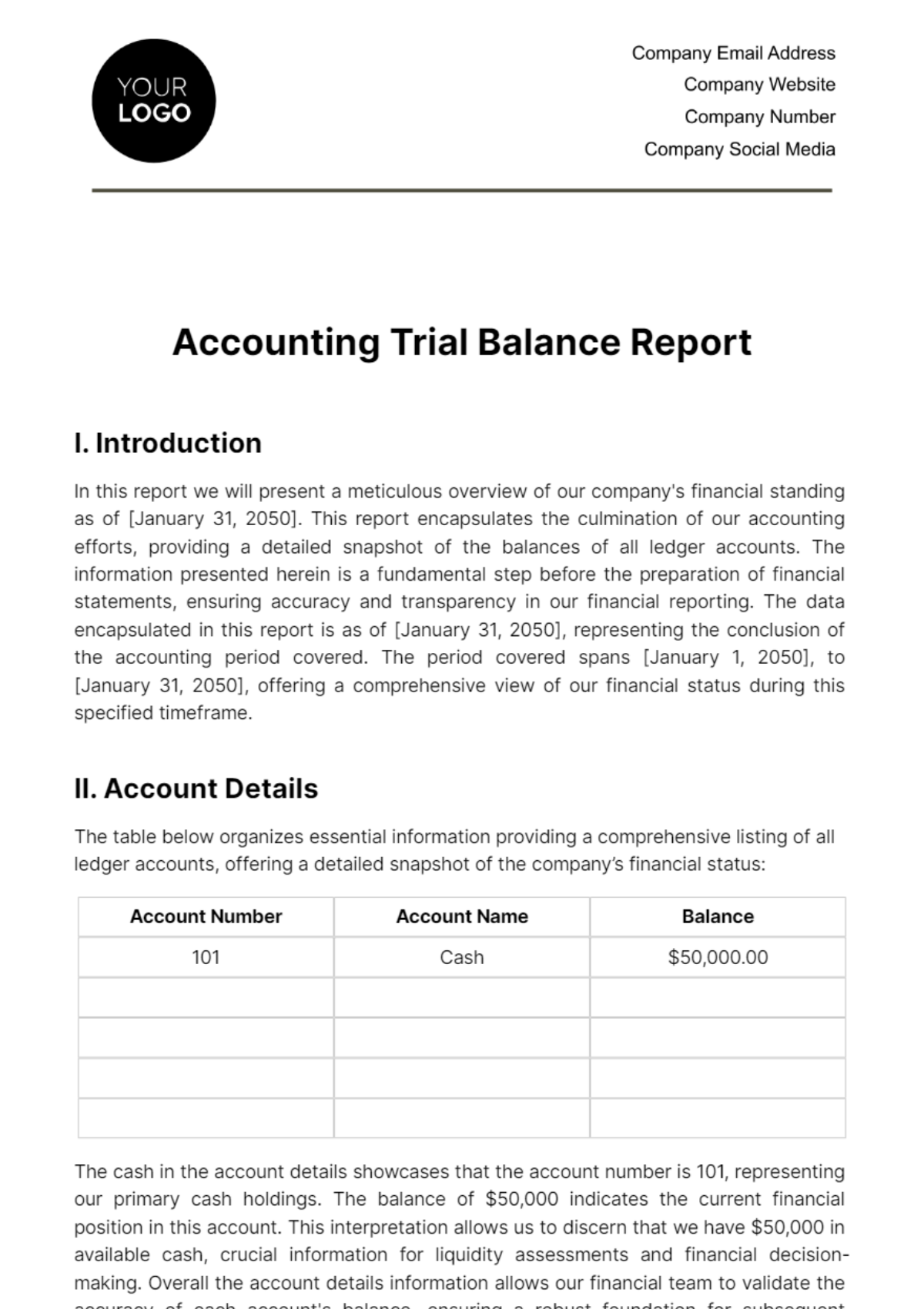

The table below organizes essential information providing a comprehensive listing of all ledger accounts, offering a detailed snapshot of the company’s financial status:

Account Number | Account Name | Balance |

101 | Cash | $50,000.00 |

The cash in the account details showcases that the account number is 101, representing our primary cash holdings. The balance of $50,000 indicates the current financial position in this account. This interpretation allows us to discern that we have $50,000 in available cash, crucial information for liquidity assessments and financial decision-making. Overall the account details information allows our financial team to validate the accuracy of each account's balance, ensuring a robust foundation for subsequent financial statement preparation. This detailed breakdown enhances transparency, both internally and for external stakeholders, establishing a clear audit trail and bolstering confidence in our financial statements.

III. Debit and Credit

The table below presents separate columns for debit and credit balances, offering a summarized view of our financial transactions:

Account Number | Account Name | Debit Balance | Credit Balance |

501 | Accounts Payable | - | ($25,000.00) |

Total Debits and Credits | [$245,000.00] | [$245,000.00] |

On Account Number 501, the absence of a debit balance indicates that there have been no increases in our accounts payable during the specified period. However, the credit balance of ($25,000.00) signals a decrease, suggesting that we've made payments or reduced our outstanding liabilities. The negative sign emphasizes the credit nature of this account, aligning with standard accounting practices. The total debit balance signifies the overall increase in assets and expenses, while the total credit balance represents the overall increase in liabilities and revenues. This reconciliation showcases the reliability and integrity of our financial reporting, contributing to the overall accuracy of the financial reporting.

IV. Adjustments and Corrections

The table below outlines specific details, ensuring a clear record of changes made to rectify errors or reconcile discrepancies:

Entry | Account Number | Account Affected | Adjustment Type | Amount |

1 | 201 | Accounts Receivable | Correction | $5,000.00 |

The entries serve as a valuable reference for auditors, stakeholders, and our internal financial team, offering insights into the adjustments made to align our financial records with the actual financial transactions during the accounting period. Entry 1 pertains to a correction made to the account for Accounts Receivable. The positive adjustment of $5,000.00 suggests an increase in the balance of Accounts Receivable, reflecting an acknowledgment of additional receivables not initially recorded. This adjustment is crucial for rectifying any oversights or omissions in the original ledger entries, ensuring that our financial records accurately reflect the amounts owed to the company. The positive sign indicates a favorable adjustment, contributing to a more faithful representation of our assets. By transparently documenting this correction, our financial reporting gains credibility, demonstrating a commitment to accuracy and thoroughness in the accounting process.

V. Conclusion

In conclusion, this report is a pivotal document that consolidates and validates financial transactions of our company ensuring the accuracy of accounting records for financial reporting. By showcasing the debits and credits, it provides a snapshot of a company's financial standing at the specified reporting period. This comprehensive overview facilitates effective decision-making by management and external stakeholders, offering insights into the company's financial health and performance. Furthermore, this report is integral for regulatory compliance and audit processes, contributing to the overall transparency and reliability of financial information.

Accounting Templates @ Template.net

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Generate accurate trial balance reports with our Accounting Trial Balance Report Template, accessible only on Template.net! This fully editable solution ensures precision in financial reporting. Tailor the report to your specific needs with our user-friendly AI Editor Tool! Strengthen your financial reporting processes with this customizable template! Get it today!

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report