How to Write a Loan Agreement

Prepared by: [Your Name]

Loan agreements are essential documents that formalize the terms of borrowing between two parties. Whether you're lending money to a friend or arranging a formal business loan, a well-crafted loan agreement ensures clear communication and protects both parties' interests. This guide walks you through creating a comprehensive loan agreement that meets your specific needs.

I. What Is a Loan Agreement?

A loan agreement is a legally binding document that details the terms and conditions of a loan. It serves as proof of the arrangement between the lender and the borrower.

Key Features of a Loan Agreement

Parties Involved: Includes details about the lender ([Lender's Name]) and borrower ([Borrower's Name]).

Loan Amount: Specifies the agreed amount of money ([Loan Amount]).

Repayment Terms: Describes how and when the loan will be repaid ([Repayment Schedule]).

Interest Rate: If applicable, outline the rate ([Interest Rate]%).

Signatures: Indicates agreement by both parties through signatures ([Signature Dates]).

II. Steps to Write a Loan Agreement

Follow these steps to draft a clear and professional loan agreement:

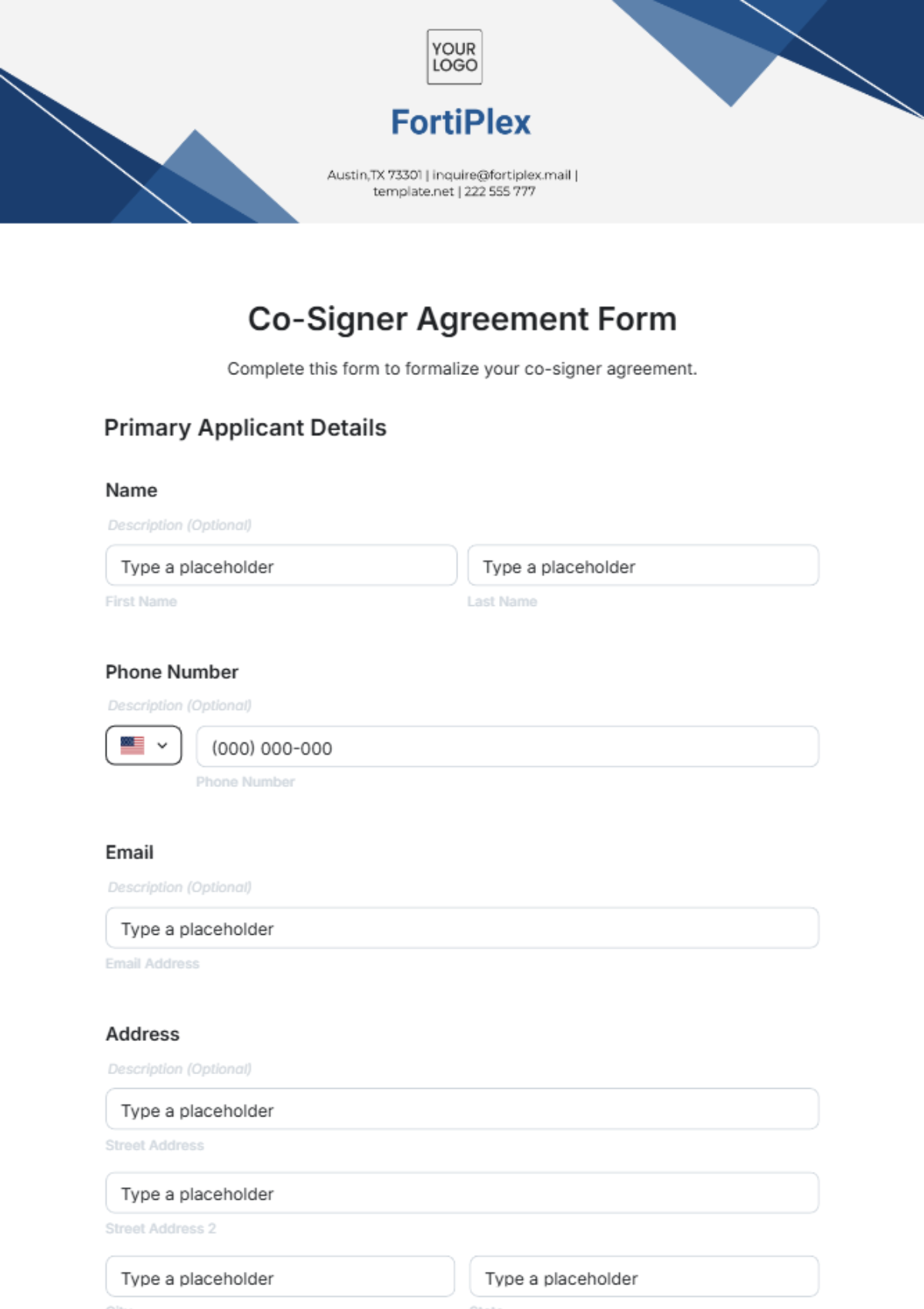

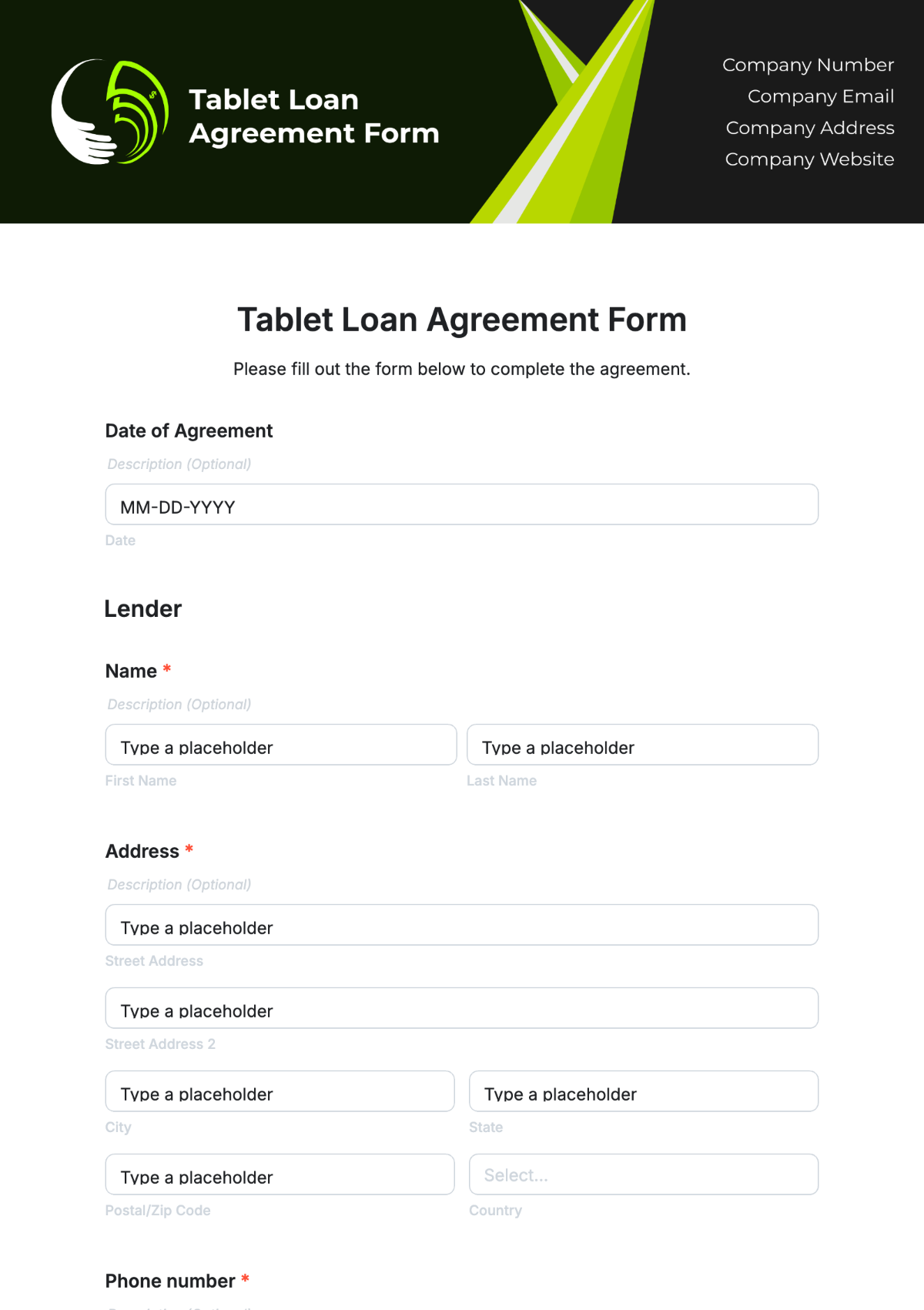

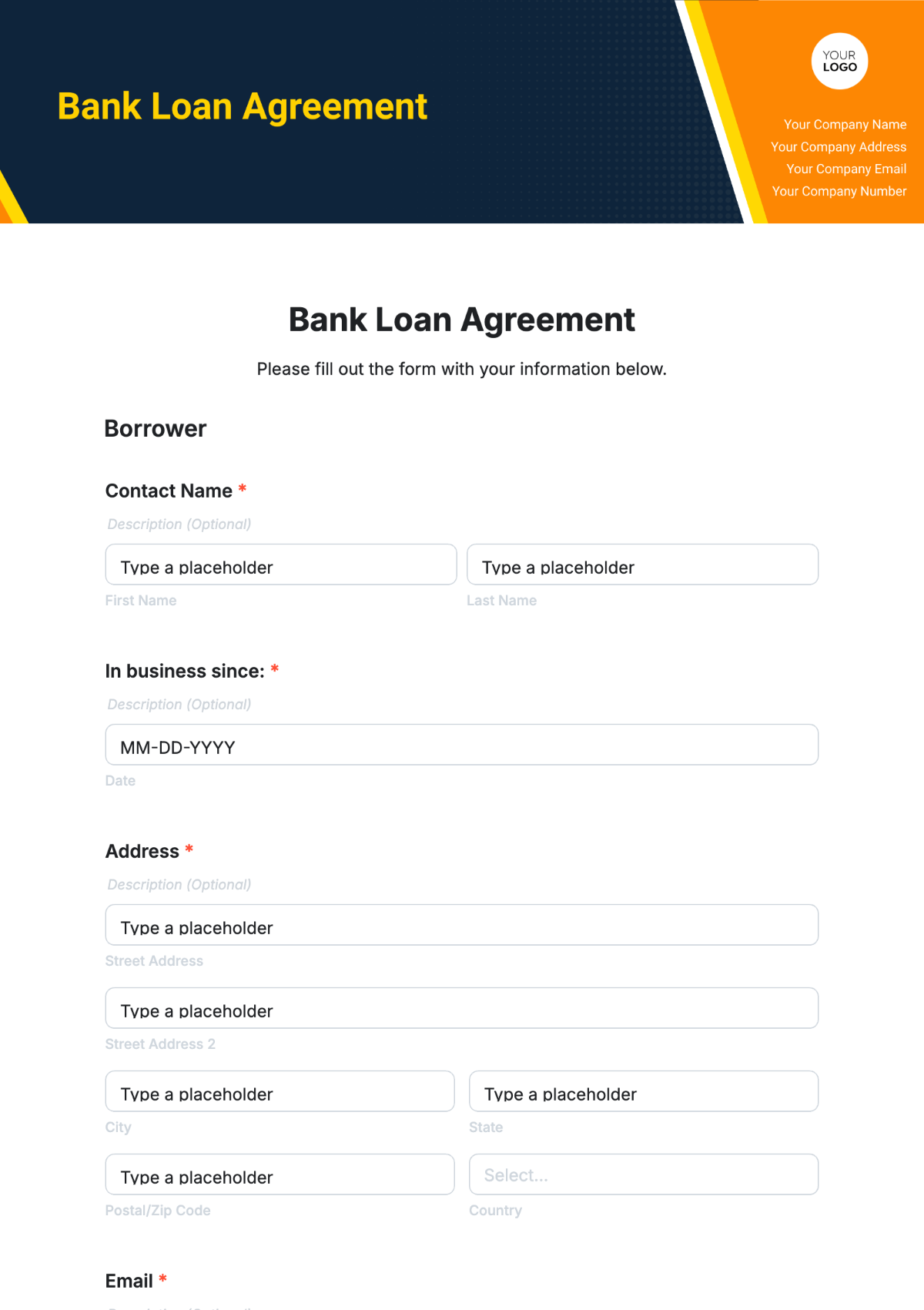

1. Identify the Parties

Clearly state the names and addresses of the lender and borrower:

Lender: [Lender's Full Name and Address]

Borrower: [Borrower's Full Name and Address]

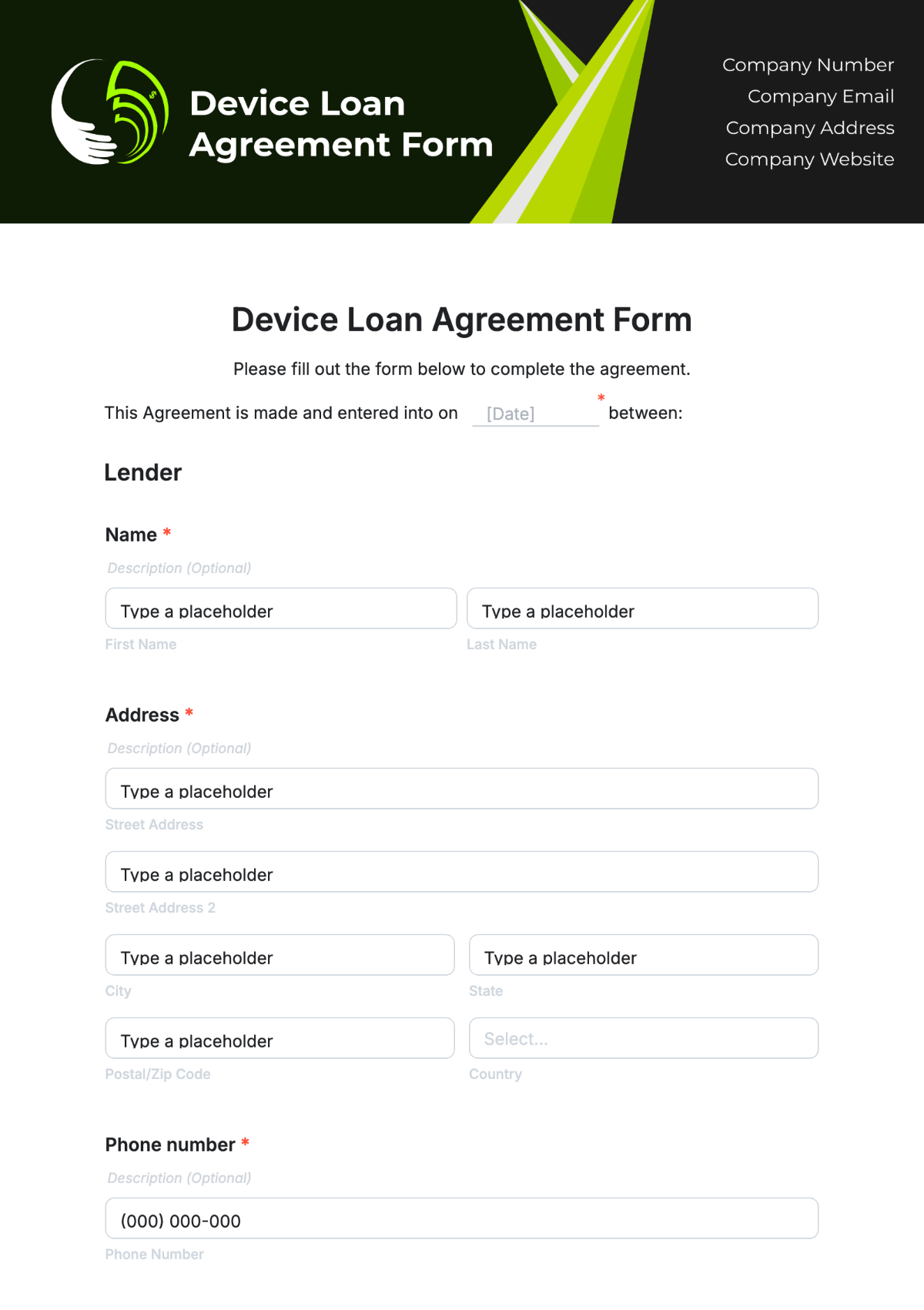

2. Define the Loan Details

Specify the exact amount being borrowed: [Loan Amount].

State the loan purpose: [Loan Purpose].

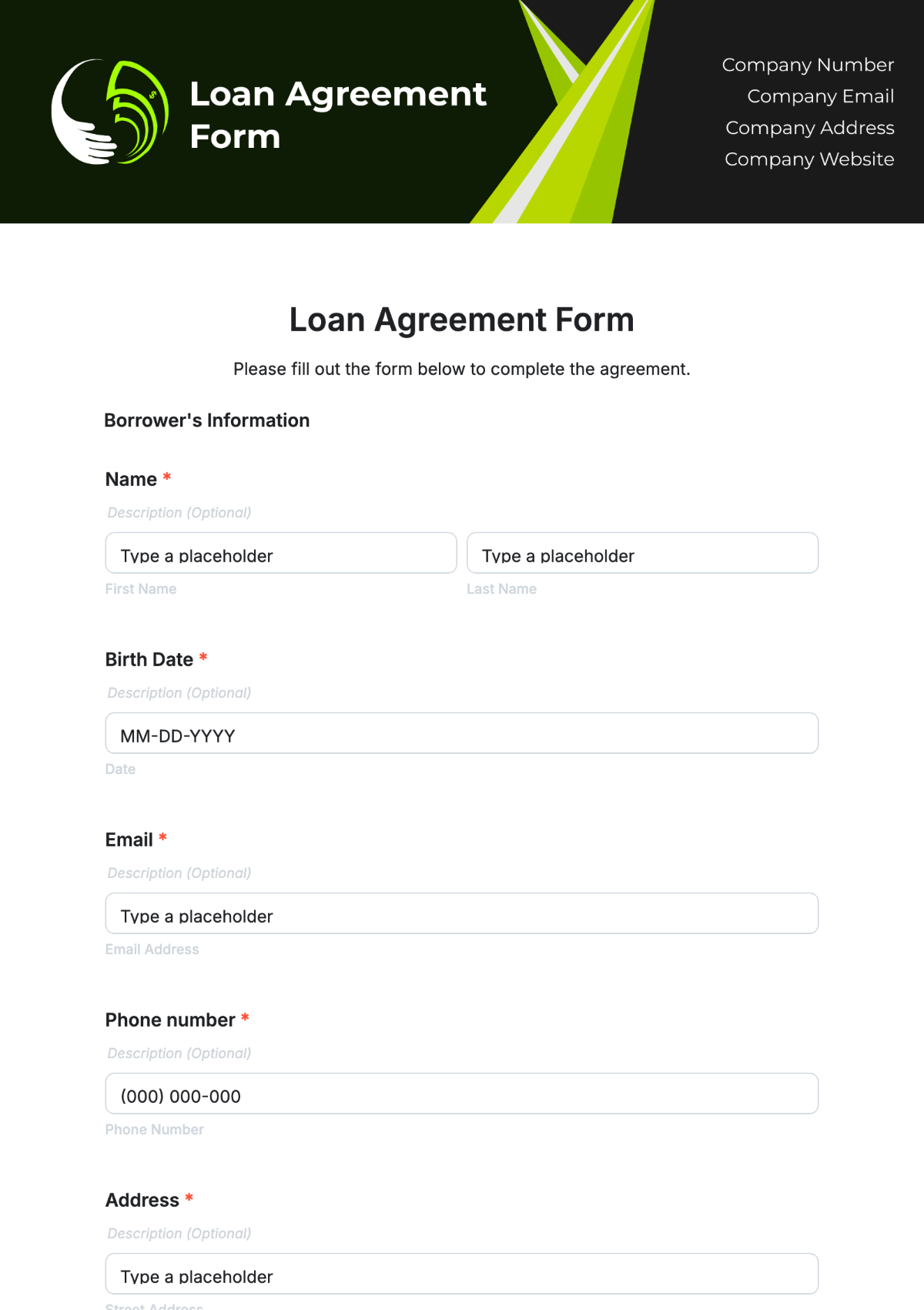

3. Outline Repayment Terms

Include the repayment schedule, such as:

Payment Frequency: [Monthly, Quarterly, etc.].

Start Date: [Repayment Start Date].

End Date: [Final Payment Date].

Use a table like the one below for clarity:

Installment No. | Payment Date | Payment Amount | Balance Remaining |

|---|---|---|---|

1 | [Date] | [Amount] | [Remaining] |

2 | [Date] | [Amount] | [Remaining] |

III. Additional Clauses to Include

To ensure your loan agreement is comprehensive, consider adding the following clauses:

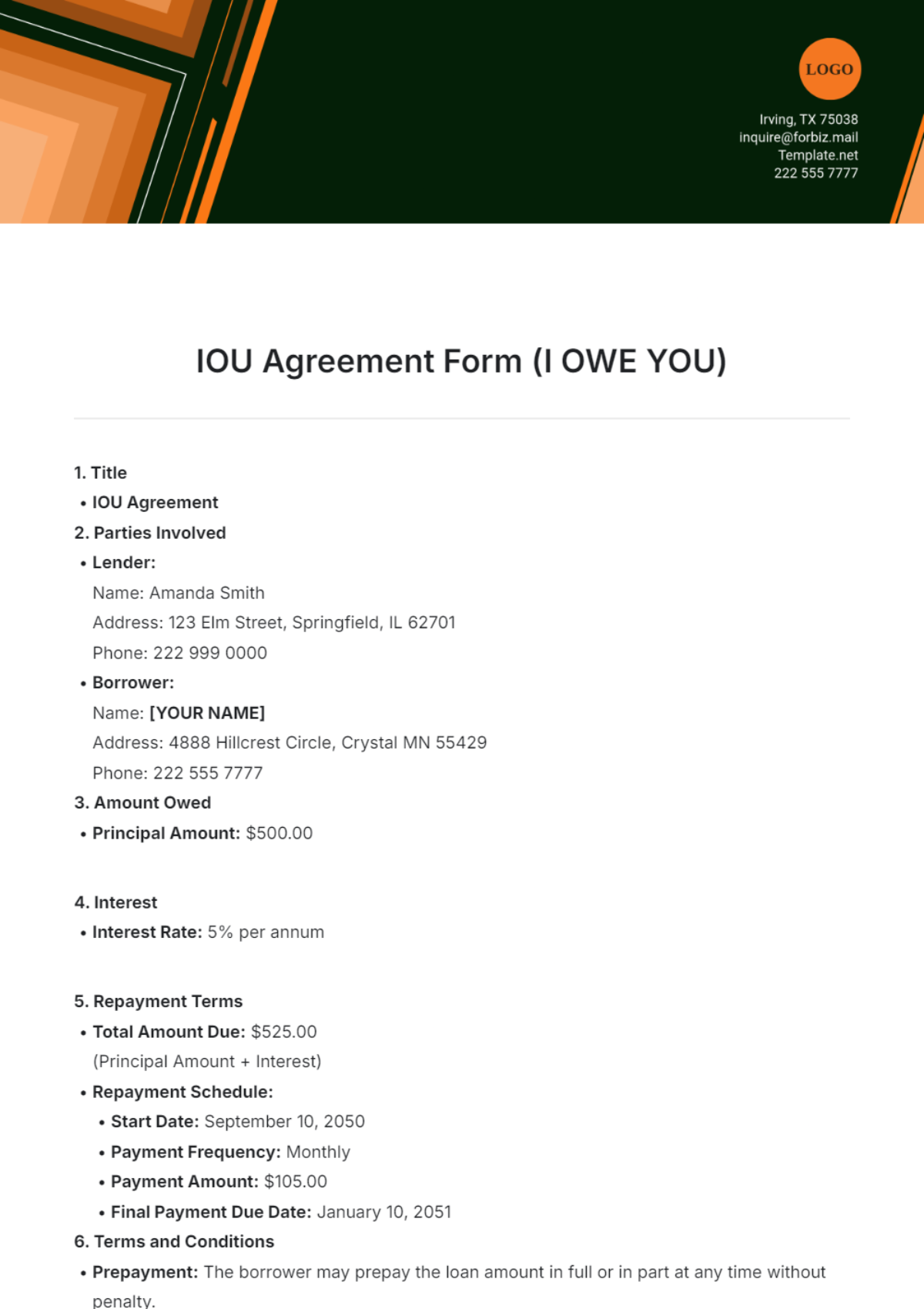

1. Interest Rate Clause

Define the interest rate (if any) and how it applies:

Interest Rate: [Interest Rate]% per [Year/Month].

2. Collateral Clause

Specify any collateral offered as security for the loan:

Collateral Description: [Description of Collateral].

3. Default Clause

Clearly state what constitutes a default and the consequences:

Default Conditions: [Conditions for Default].

Penalties for Default: [Penalty Details].

IV. Finalizing the Loan Agreement

1. Review and Sign

Both parties should carefully review the document to ensure accuracy. Each party should sign and date the agreement:

Lender's Signature: [Lender's Signature Line].

Borrower's Signature: [Borrower's Signature Line].

2. Notarization

Consider notarizing the document for added legal validity.

Notary Information: [Notary Name and Contact Information].

V. Frequently Asked Questions

What Makes a Loan Agreement Legally Binding?

For a loan agreement to be legally binding, it must include an offer, acceptance, intention to create a legal relationship, and consideration ([Loan Amount]).

Can Loan Agreements Be Amended?

Yes, but any amendments must be agreed upon by both parties and documented in writing ([Amendment Details]).