Finance Oversight Report

This Finance Oversight Report provides a comprehensive analysis of our organization's financial status for the quarter ending September 30, 2084. The report includes a detailed review of financial activities, highlighting key areas of revenue, expenditure, and investment performance.

Financial Highlights

Our total revenue for the quarter was $4.5 million, a 5% increase from Q2.

Net profit stood at $1.2 million, marking a 3% growth compared to Q2.

Cost-saving measures led to a 2% decrease in operational expenses.

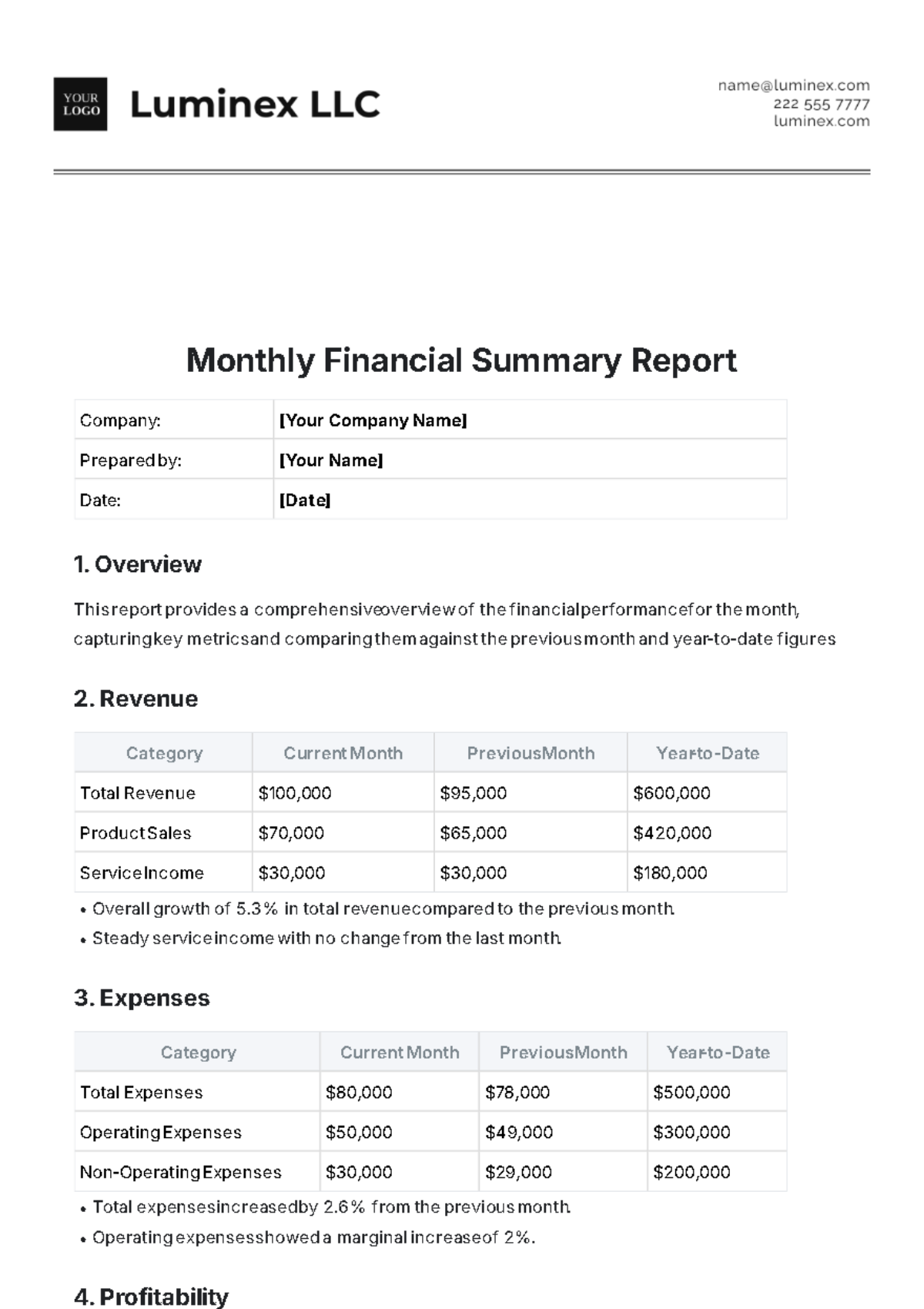

Revenue Analysis

Revenue Source | Q3 Revenue | % of Total Revenue |

Product Sales | $2.8M | 62% |

Services | $1.2M | 27% |

Other | $0.5M | 11% |

Expenditure Overview

Expenditure Type | Amount | % of Total Expenses |

Operational | $2.1M | 60% |

Marketing | $0.8M | 23% |

R&D | $0.6M | 17% |

Investment Performance

Our investment portfolio showed a stable performance, with a net yield of 4.5% this quarter. This is aligned with our conservative investment strategy focused on long-term gains.

Financial Ratios

Debt-to-Equity Ratio: The ratio stands at 0.45, indicating a healthy balance between debt financing and equity.

Return on Investment (ROI): Our ROI for this quarter was 5.5%, reflecting effective use of investments.

Risk Assessment and Mitigation

We identified potential risks in market fluctuations and supply chain disruptions. To mitigate these, we have diversified our product lines and established alternative supply chain routes.

Our financial position remains strong, with steady growth in revenue and profits. We recommend continuing our current investment strategies while exploring new market opportunities. Further focus on R&D could drive innovation and future growth.