Free Annual Finance Payroll Report

I. Executive Summary

This Annual Finance Payroll Report for [Your Company Name] offers a comprehensive review of our payroll operations for the fiscal year [Year]. It includes an analysis of payroll expenses, employee compensation, compliance with legal standards, and an overview of payroll system efficiencies and improvements.

In addition to providing a fiscal summary, this report also reflects our commitment to aligning payroll operations with the strategic goals of [Your Company Name]. By closely examining our payroll expenses, employee compensation structures, and operational efficiencies, we aim to identify areas for cost savings and process improvements. Our focus remains steadfast on maintaining a balance between cost-effectiveness and employee satisfaction, thereby supporting the overall financial health and employee morale within the company.

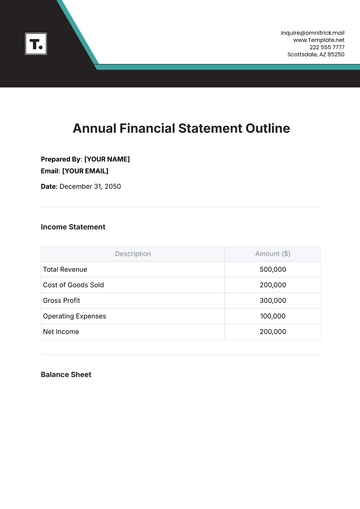

II. Overview of Payroll Expenses

Our payroll expenses for the year were as follows:

Expense Category | Total Amount ($) |

|---|---|

Salaries | $[Amount] |

Overtime Pay | $[Amount] |

Bonuses | $[Amount] |

Employer Taxes | $[Amount] |

Benefits | $[Amount] |

Total | $[Amount] |

This table provides a snapshot of the major components of our payroll expenses. Salaries constitute the largest portion, followed by benefits and employer taxes.

III. Employee Compensation Analysis

We categorized our workforce into full-time, part-time, and contractual categories. The compensation for each category is detailed below:

Full-Time Employees: Comprising 70% of our workforce, their average annual salary was $[Amount].

Part-Time Employees: Making up 20% of our workforce, their average hourly wage was $[Amount].

Contractual Employees: Constituting 10% of our workforce, the average contract amount was $[Amount]

IV. Payroll Processing Efficiency

The payroll processing efficiency at [Your Company Name] is a testament to our dedication to operational excellence. We achieved a significant reduction in processing time from the previous year, primarily due to the implementation of new payroll software that automates several key functions, such as tax calculations and benefits deductions. Our accuracy rate of 98% is among the highest in our industry, a result of rigorous quality control measures and continuous training of our payroll staff. Regular feedback sessions with employees have also been instrumental in identifying and rectifying any payroll issues promptly, thereby enhancing overall satisfaction and trust in the payroll system.

V. Compliance and Legal Standards

Compliance with legal standards is not just a requirement but a core value at [Your Company Name]. This year, we placed an increased emphasis on training programs for our payroll team, focusing on recent changes in labor laws and tax regulations. Additionally, we conducted quarterly internal audits to ensure ongoing compliance, and our collaboration with external auditors provided an additional layer of oversight. These measures ensured that our payroll operations not only met but often exceeded regulatory standards, thereby mitigating risks associated with non-compliance.

VI. Payroll System Improvements

The improvements made to our payroll system this year were both strategic and technologically driven. The upgrade to our payroll software streamlined various processes, including the integration of real-time tax updates and enhanced data security measures. These improvements led to increased efficiency and reduced the possibility of errors. The enhancements to our employee self-service portal, including a more user-friendly interface and additional functionalities like access to historical pay stubs and tax documents, significantly improved employee engagement and autonomy in managing their payroll information.

VII. Employee Benefits and Deductions

The structure of employee benefits and deductions is a critical component of our payroll system. This year, we reviewed and adjusted our benefits offerings to ensure they remained competitive and aligned with employee needs. This included an increase in the employer contribution to health insurance premiums and an expansion of our retirement plan options. We also optimized our payroll deductions process, ensuring accurate and timely deductions for taxes, benefits contributions, and other statutory obligations. Transparency and accuracy in managing these deductions have been key to maintaining employee trust and satisfaction.

VIII. Timekeeping and Attendance

Our timekeeping and attendance system underwent significant enhancements to accommodate the diverse working schedules and locations of our workforce. The system now includes features for remote clocking in and out, facilitating accurate time tracking for our remote and hybrid employees. We also implemented advanced analytics to monitor patterns in attendance and overtime, providing valuable insights for workforce planning and operational decision-making. The improved system has not only streamlined timekeeping processes but also contributed to more accurate payroll calculations and compliance with working hour regulations.

IX. Payroll Challenges and Resolutions

Throughout the year, we encountered several challenges in our payroll operations. One of the primary challenges was adapting to the new remote working model, which required a more flexible approach to timekeeping and payroll processing. To address this, we enhanced our digital timekeeping system to accommodate remote check-ins and streamlined the process for managing varied work hours and locations.

Another challenge was the integration of updated tax regulations into our payroll system. The rapid changes in tax laws, especially those related to remote work, necessitated frequent updates to our software. Our resolution involved close collaboration with our software providers, ensuring that our system remained up-to-date and fully compliant with the latest tax requirements.

X. Payroll Tax Management

Our payroll tax management for the year was characterized by meticulous adherence to tax regulations and timely filings. The breakdown of payroll taxes managed is as follows:

Tax Category | Total Amount ($) |

|---|---|

Federal Income Tax | $[Amount] |

State Income Tax | $[Amount] |

Social Security Tax | $[Amount] |

Medicare Tax | $[Amount] |

Unemployment Tax | $[Amount] |

Total | $[Amount] |

These figures represent our commitment to responsible tax management and compliance with governmental standards.

XI. Future Payroll Strategy and Planning

Looking ahead, we plan to focus on several key areas to enhance our payroll operations. This includes the exploration of AI and machine learning technologies to predict payroll trends and manage resources more effectively. We also intend to enhance our employee self-service portal, adding features like real-time tax estimation and mobile accessibility. Additionally, we aim to further our commitment to sustainable payroll practices, exploring options like paperless payroll and environmentally friendly payroll processes.

XII. Conclusion

The Annual Finance Payroll Report for [Your Company Name] reflects a year of robust payroll management characterized by efficiency, compliance, and continuous improvement. Our focus on technology, adherence to legal standards, and commitment to employee satisfaction have been instrumental in our success. We remain dedicated to advancing our payroll practices to meet the evolving needs of our workforce and the organization.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net's Annual Finance Payroll Report Template offers a professional, customizable, and editable format using an Ai Editor tool which is great for detailed payroll analysis. Crafted to assist in precise financial reporting, this template aids in aligning payroll data with fiscal assessments. It's an essential tool for businesses aiming to maintain accurate records and support strategic financial planning.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report