Financial Transparency Reporting

TABLE OF CONTENTS

I. Executive Summary

II. Detailed Financial Statements

A. Income Statement Analysis

B. Balance Sheet Breakdown

C. Cash Flow Statement

III. Accounting Policies and Practices

A. Description of Accounting Methods

B. Changes in Accounting Policies

IV. Corporate Governance and Compliance

A. Governance Structure

B. Regulatory Compliance

V. Supplementary Information and Analysis

A. Risks and Uncertainties

B. Management's Discussion and Analysis (MD&A)

VI. Investment and Capital Allocation

A. Strategic Investment Initiatives

B. Capital Allocation

VII. Future Outlook and Projections

A. Market Trends and Projections

B. Financial Projections

I. Executive Summary

Overview of the Report

The Financial Transparency Report for [Your Company Name] serves as a testament to our commitment to openness and accountability in financial reporting. This document offers a detailed and accessible overview of our financial activities and strategies over the current fiscal year. It is crafted to provide our stakeholders, including investors, employees, and regulatory bodies, with an accurate and comprehensive understanding of the company's financial health and operational efficiency. The report is structured to not only present financial data but to also contextualize it within our broader business strategy and market environment.

Key Financial Highlights

The fiscal year has been marked by robust financial growth and strategic investments for [Your Company Name].

Our revenue showed an impressive increase of 12%, amounting to $5.6 million, exceeding industry growth rates. This increase can be attributed to our successful expansion in digital services and a strong market presence.

The net profit margin saw a significant improvement of 2% from the previous year, reflecting our enhanced operational efficiency and cost management strategies.

A noteworthy aspect of this fiscal year has been our investment in technology and infrastructure, totaling $1.2 million, signaling our dedication to innovation and long-term growth.

These investments are pivotal in keeping us at the forefront of technological advancements and in expanding our operational capabilities to meet evolving market demands.

II. Detailed Financial Statements

This section provides a detailed breakdown of [Your Company Name]'s financial statements, including an analysis of the income statement, balance sheet, and cash flow statement. These insights offer a comprehensive view of our financial performance and position.

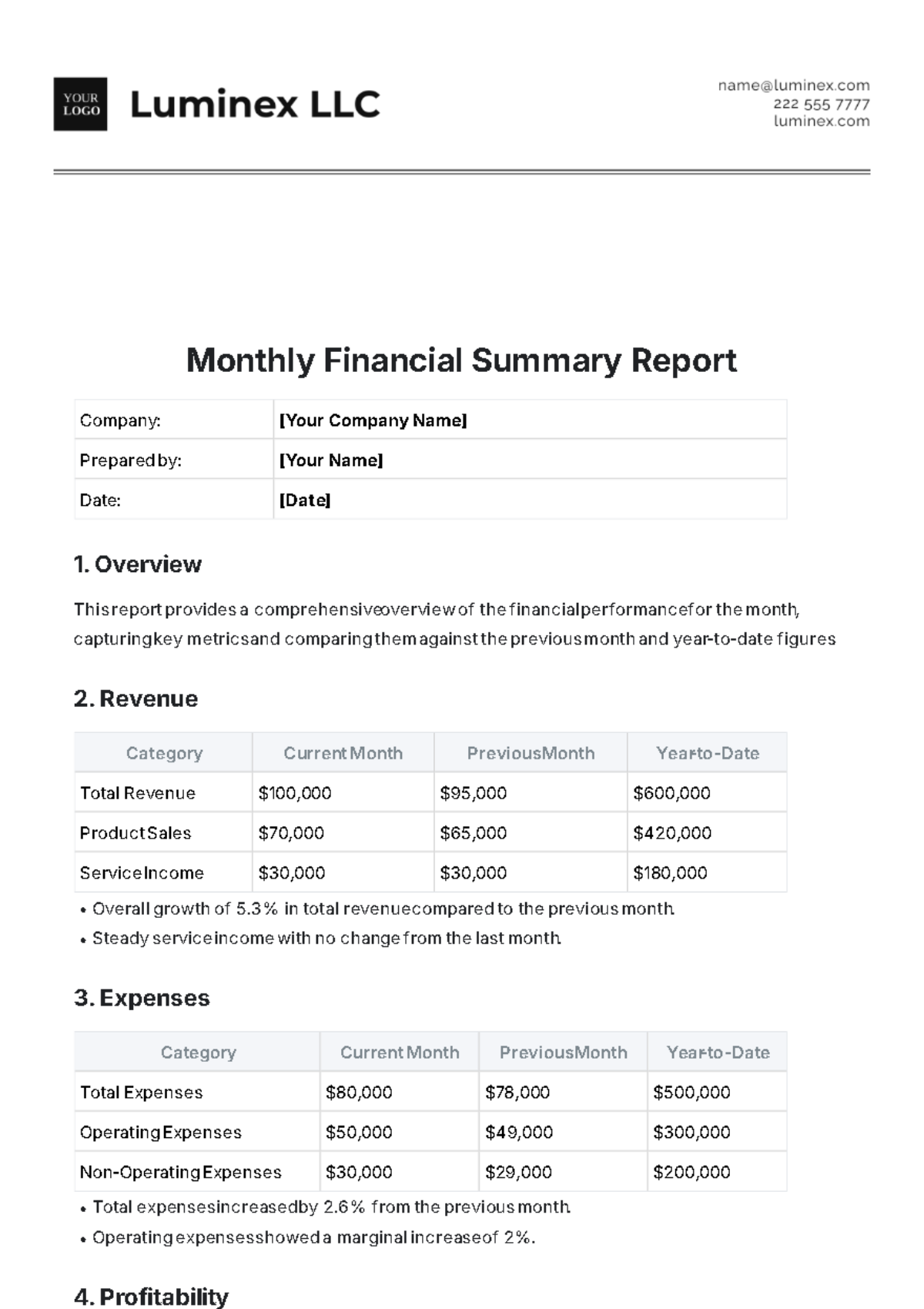

A. Income Statement Analysis

Our total revenue grew to $5.6 million, primarily driven by increased sales in our digital services sector. Operating expenses saw a marginal rise due to expansion efforts, resulting in a net income of $2.3 million.

Item | Amount | % of Total Revenue | Year-over-Year Change |

|---|---|---|---|

Total Revenue | $5.6 million | 100% | 0.12 |

Cost of Goods Sold | $2.1 million | 37.50% | 0.08 |

Gross Profit | $3.5 million | 62.50% | 0.14 |

Operating Expenses | $1.2 million | 21.40% | 0.05 |

Net Income | $2.3 million | 41.10% | 0.1 |

B. Balance Sheet Breakdown

Total assets stand at $10 million, including significant investments in technology. Liabilities are maintained at $4 million, with an emphasis on long-term financial stability. Shareholders’ equity has seen a healthy increase to $6 million.

Item | Current Year | Previous Year | Change |

|---|---|---|---|

Total Assets | $10 million | $8.5 million | 0.176 |

Total Liabilities | $4 million | $3.5 million | 0.143 |

Shareholder's Equity | $6 million | $5 million | 0.2 |

C. Cash Flow Statement

Cash flow from operating activities remained strong at $3 million, with investing activities reflecting our growth-focused expenditure. Financing activities were streamlined, leading to a positive net cash flow.

Activity | Current Year | Previous Year | Change |

|---|---|---|---|

Operating Activities | $3 million | $2.5 million | 0.2 |

Investing Activities | -$1.5 million | -$1 million | Higher outflow |

Financing Activities | $500K | $300K | Higher inflow |

Net Cash Flow | $2 million | $1.8 million | 0.111 |

III. Accounting Policies and Practices

In this section, we detail [Your Company Name]'s accounting policies and practices, underlining our commitment to accuracy, consistency, and transparency in financial reporting. These policies are fundamental to ensuring our financial statements are reliable and comparable over time and across the industry.

A. Description of Accounting Methods

At [Your Company Name], our financial statements are prepared following the Generally Accepted Accounting Principles (GAAP), which ensures a high level of clarity and uniformity in our financial reporting. For revenue recognition, we strictly adhere to the accrual basis, recognizing income when earned and expenses when incurred, regardless of when the cash transactions occur.

This approach provides a more accurate picture of our financial performance. In terms of inventory evaluation, we employ the First-In, First-Out (FIFO) method. This method assumes that the oldest inventory items are sold first, which is particularly effective in times of rising prices as it results in lower cost of goods sold and higher reported profits, reflecting a more current inventory cost on the balance sheet.

B. Changes in Accounting Policies

In alignment with our goal of continual improvement in financial transparency, this year marked a significant shift in our accounting practices with the adoption of the IFRS 15 standard for revenue recognition from contracts with customers. This new standard has brought about a more detailed and structured approach to revenue recognition, ensuring that revenue is recorded accurately and consistently across all types of transactions.

The adoption of IFRS 15 enhances the comparability and clarity of our revenue reporting, providing stakeholders with a more nuanced understanding of our revenue streams and business model. This change underscores our commitment to aligning with global best practices in financial reporting and staying abreast of changes in accounting standards.

IV. Corporate Governance and Compliance

[Your Company Name]'s commitment to corporate governance and compliance is foundational to our operational integrity and stakeholder trust. This section outlines our governance structure and our adherence to regulatory compliance, showcasing our dedication to ethical practices and legal standards.

A. Governance Structure

Our corporate governance framework is designed to support accountability and transparency, with a strong emphasis on ethical practices and stakeholder engagement.

Aspect | Details | Purpose/Impact |

|---|---|---|

Board of Directors | Composed of a mix of independent and executive directors. | Ensures diverse perspectives and independent decision-making. |

Ethical Guidelines | Code of Conduct and Ethics Policy universally applied. | Promotes integrity and ethical behavior across all operations. |

Stakeholder Engagement | Regular meetings with shareholders, employees, and customers. | Facilitates transparency and responsiveness to stakeholder concerns. |

Audit and Risk Committee | Oversees internal and external audit processes; assesses risks. | Ensures financial accuracy and proactive risk management. |

Executive Compensation | Tied to performance metrics and shareholder value creation. | Aligns executives' interests with long-term company success. |

B. Regulatory Compliance

We have complied with all financial regulatory requirements, including those related to financial disclosures, auditing standards, and corporate taxation.

Compliance Area | Compliance Status | Actions Taken/Standards Met |

|---|---|---|

Financial Disclosures | Fully compliant | Adherence to GAAP and IFRS standards; regular SEC filings. |

Auditing Standards | Compliant with international auditing standards. | Annual audits conducted by an independent auditor; follows ISA guidelines. |

Corporate Taxation | Fully compliant with federal and state tax laws. | Timely tax filings and payments; adherence to tax regulations. |

Regulatory Filings | All necessary filings completed and up to date. | Regular filings with regulatory bodies like the SEC, adhering to their guidelines. |

Anti-Money Laundering (AML) | Strict AML policies in place and enforced. | Regular AML training for employees; compliance with global AML standards. |

V. Supplementary Information and Analysis

In addition to core financial statements, [Your Company Name] provides supplementary information to give stakeholders a deeper understanding of our business environment and strategic direction. This section addresses potential risks and uncertainties and includes a thorough Management's Discussion and Analysis (MD&A) to contextualize our financial data within the broader business landscape.

A. Risks and Uncertainties

[Your Company Name] operates in a dynamic market, which inevitably presents various financial risks. Market volatility, influenced by economic cycles, consumer preferences, and technological advancements, remains a primary concern. We also stay vigilant regarding regulatory changes, especially in financial reporting standards and international trade regulations. To mitigate these risks, we have established a comprehensive risk management framework that includes diversified investment strategies, continuous market analysis, and adaptable business models.

Additionally, we maintain open communication with regulatory bodies to anticipate and adapt to regulatory changes proactively. Our risk management strategy is integral to our resilience and sustained success in the face of market uncertainties.

B. Management's Discussion and Analysis (MD&A)

Our management team, while acknowledging the challenges posed by the current economic climate, remains cautiously optimistic about future revenue growth. This optimism is grounded in our strategic initiatives focusing on investment in emerging technologies and expanding our market reach, particularly in untapped international markets. We believe that these areas offer significant growth potential and will drive our revenue streams in the upcoming fiscal year.

Additionally, our ongoing commitment to innovation and customer-centric approaches continues to strengthen our market position. In our MD&A, we detail how these strategies align with our long-term objectives and how they are expected to contribute to our financial and operational performance. This forward-looking perspective is aimed at providing our stakeholders with a clear understanding of our future direction and growth potential.

VI. Investment and Capital Allocation

Effective capital allocation is crucial for the long-term growth and sustainability of [Your Company Name]. This section outlines our approach to investments and how we allocate capital to various business segments and projects.

A. Strategic Investment Initiatives

Our investment strategy is focused on driving growth and enhancing shareholder value. Significant investments are being channeled into technology upgrades, especially in areas like artificial intelligence and big data analytics, which are anticipated to revolutionize our operational capabilities. We are also investing in expanding our geographical footprint, particularly in emerging markets where we see substantial growth opportunities. These investments are selected based on their potential to generate long-term value, aligning with our broader strategic goals of innovation and market expansion.

B. Capital Allocation

Capital allocation decisions are made with a focus on achieving a balanced portfolio that supports both current operational needs and future growth. A significant portion of our capital is allocated to R&D to foster innovation and maintain our competitive edge. We also allocate funds towards marketing and customer acquisition, ensuring continued revenue streams. Additionally, maintaining financial flexibility is a priority, and hence, a reserve fund has been established to manage unforeseen expenses and opportunities. This strategic approach to capital allocation is designed to optimize resource utilization and ensure financial sustainability.

VII. Future Outlook and Projections

In this section, we present [Your Company Name]'s future outlook, including financial projections and anticipated market trends that are expected to impact our business.

A. Market Trends and Projections

Looking forward, we anticipate significant shifts in consumer behavior and technological advancements that will shape our industry. We are closely monitoring trends in digital consumption, sustainability, and global economic changes. These trends are factored into our strategic planning, influencing our product development and market strategies. Our projections indicate steady growth in our core markets, with new opportunities arising in sustainable products and services.

B. Financial Projections

Based on our current performance and market analysis, we project a steady increase in revenue over the next three to five years, with an estimated annual growth rate of 8-10%. Our profitability margins are also expected to improve as we realize efficiencies from our investments and scale our operations. These financial projections are subject to market conditions and economic factors, and we remain committed to adapting our strategies in response to changing market dynamics.