Finance Payroll Schedule

Introduction

A. Purpose

The [Your Company Name] Financial Payroll Schedule serves as a vital document that outlines the systematic timeline for processing employee salaries. Its primary objective is to ensure transparency, accuracy, and efficiency in the payroll procedures, contributing to employee satisfaction and organizational compliance. This schedule plays a crucial role in maintaining financial stability and trust among our workforce.

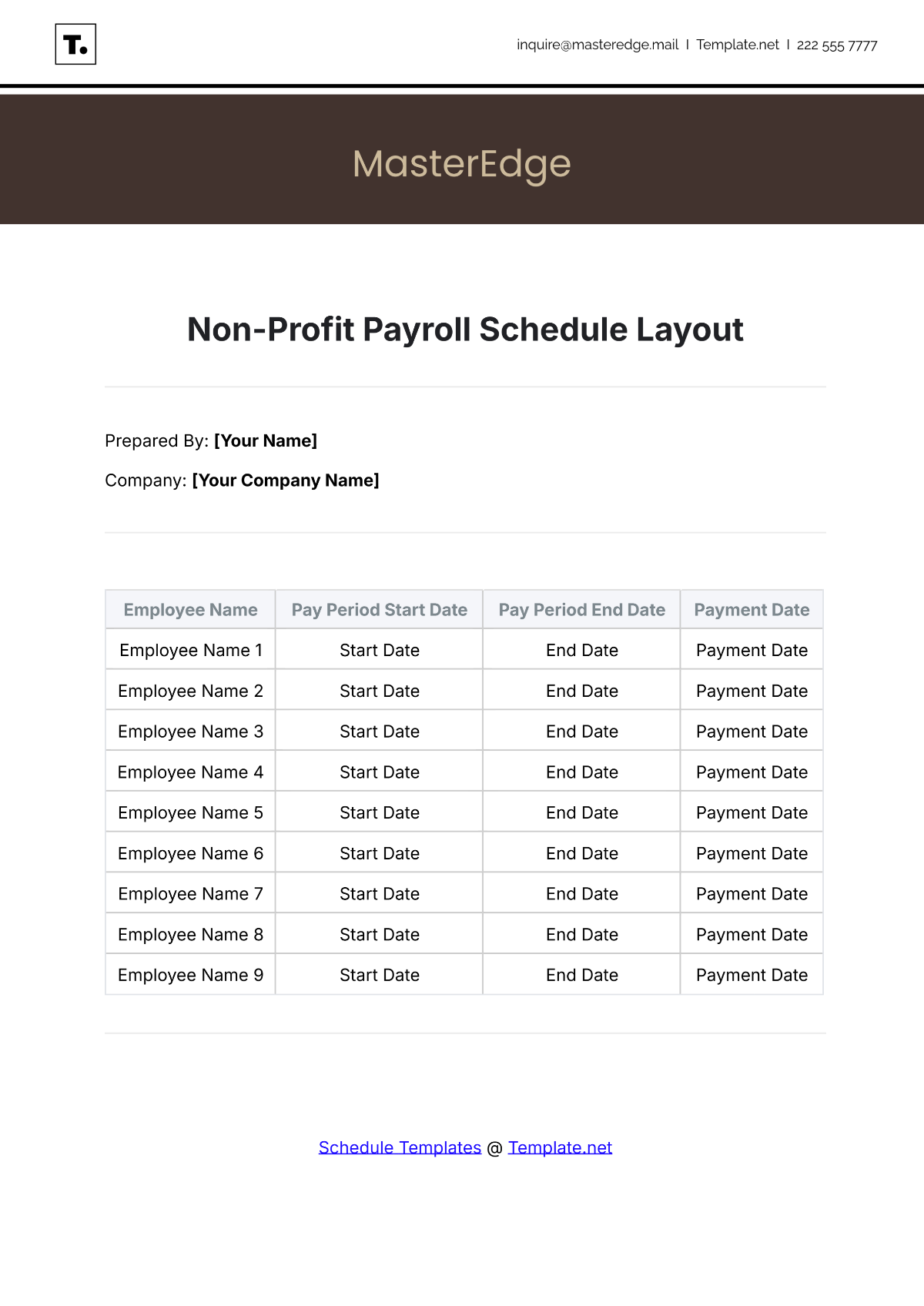

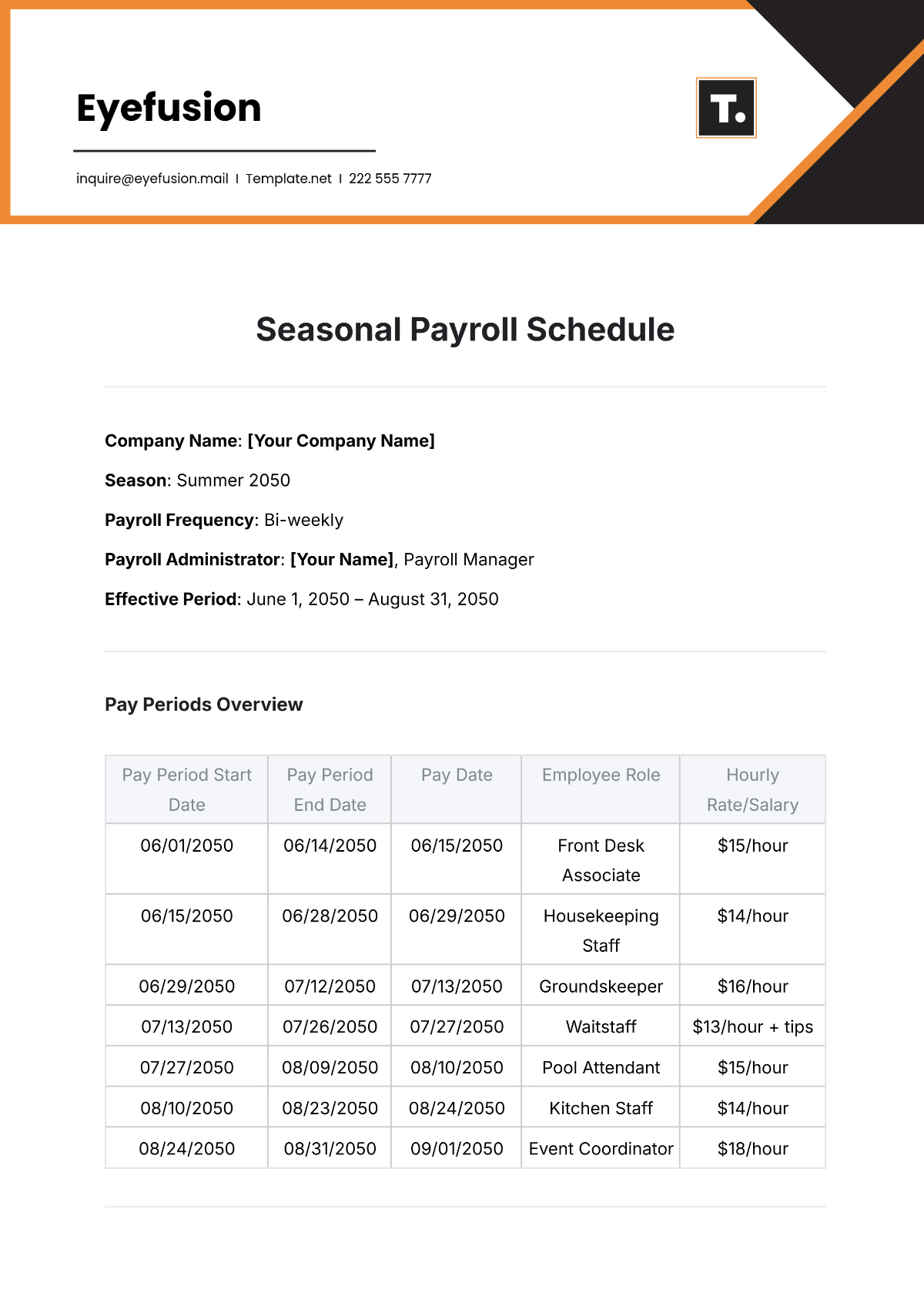

Schedule Details

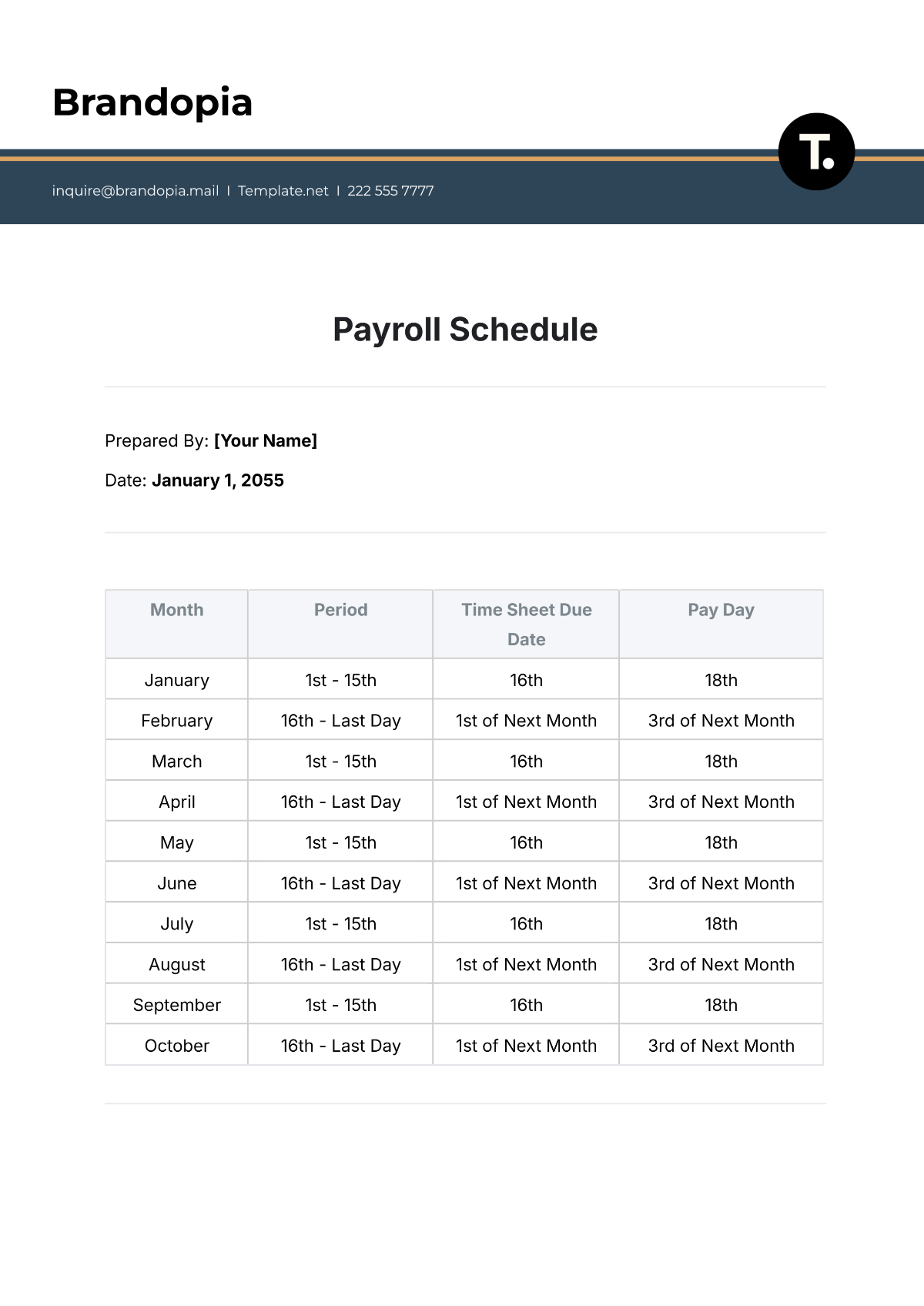

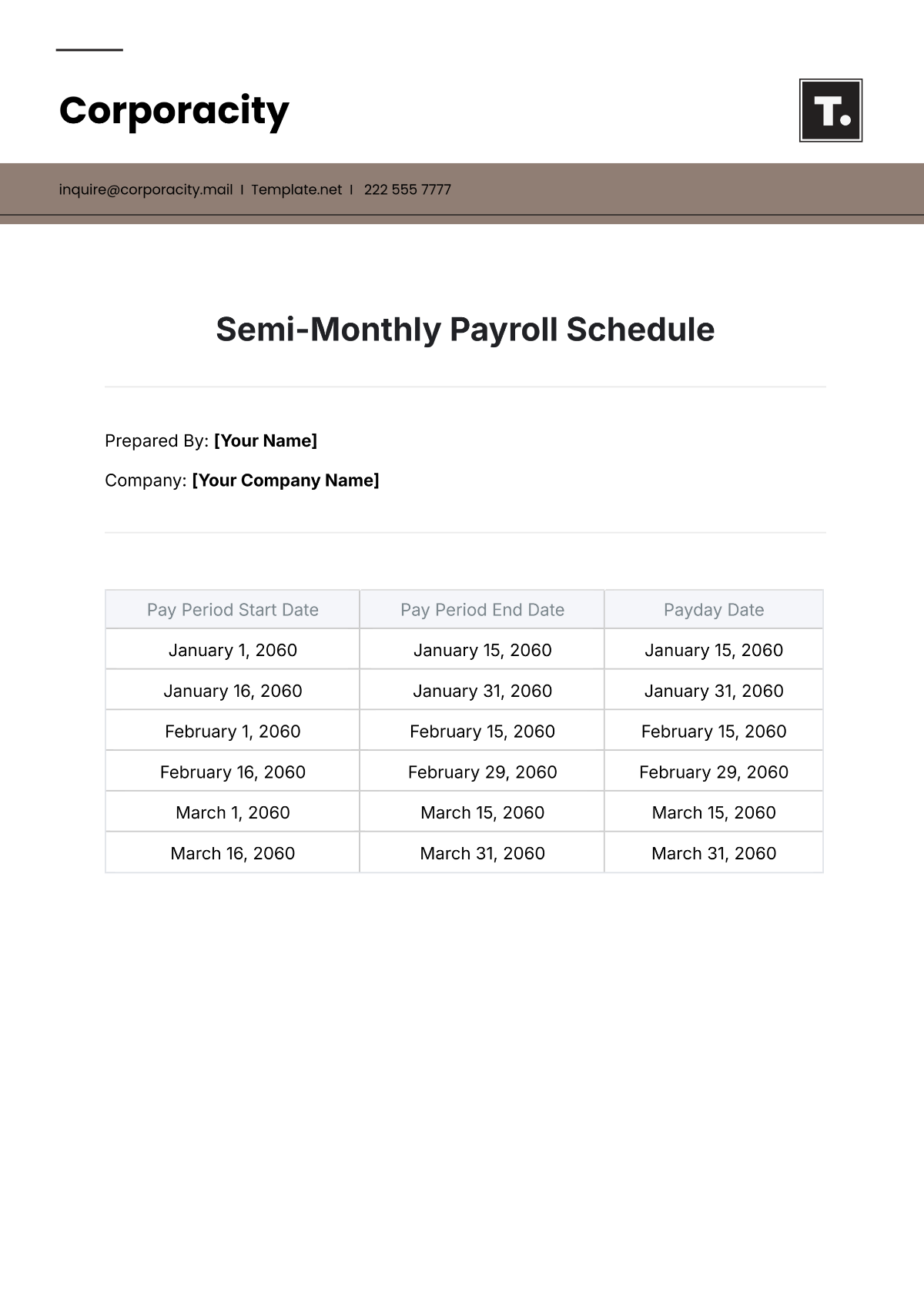

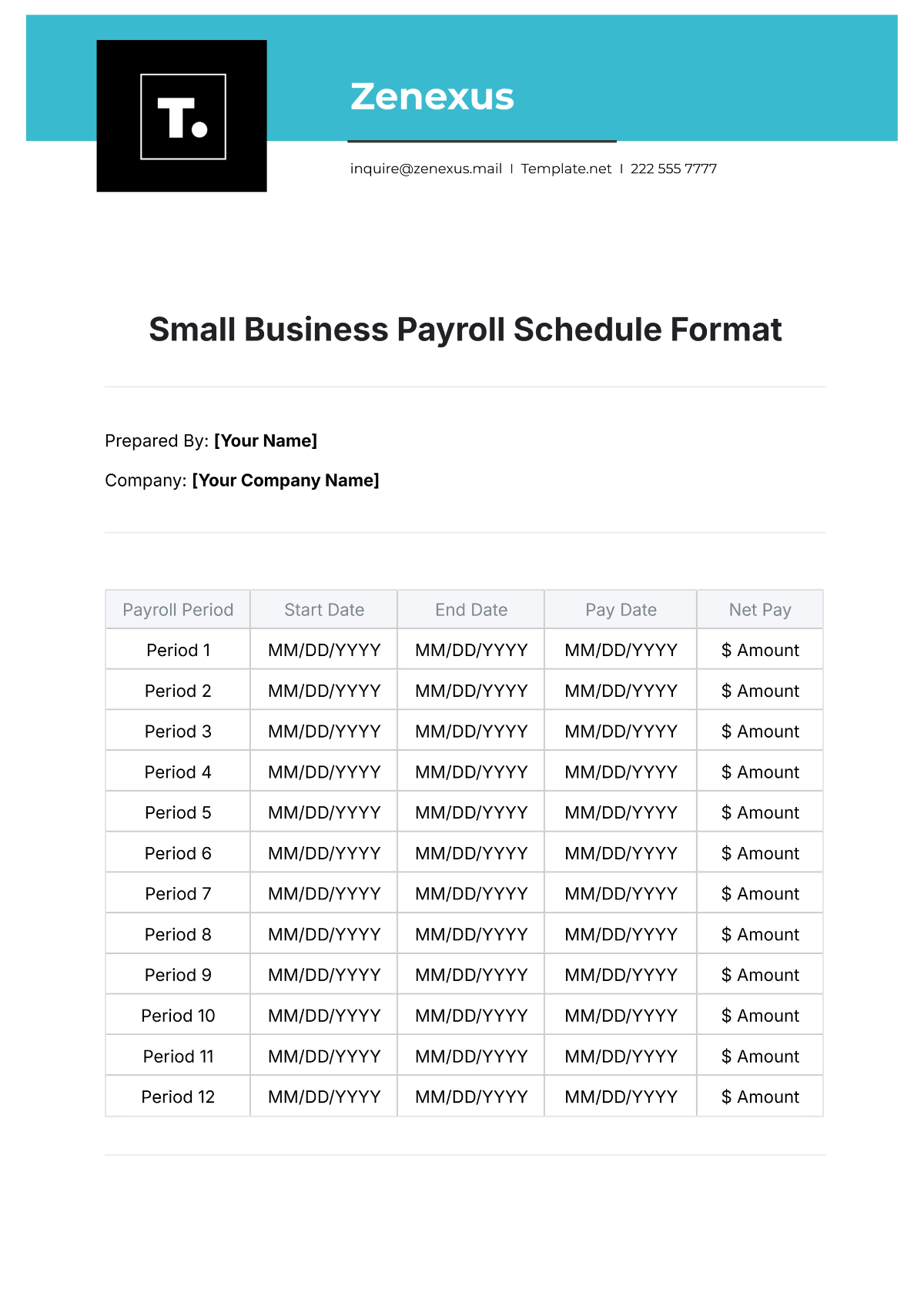

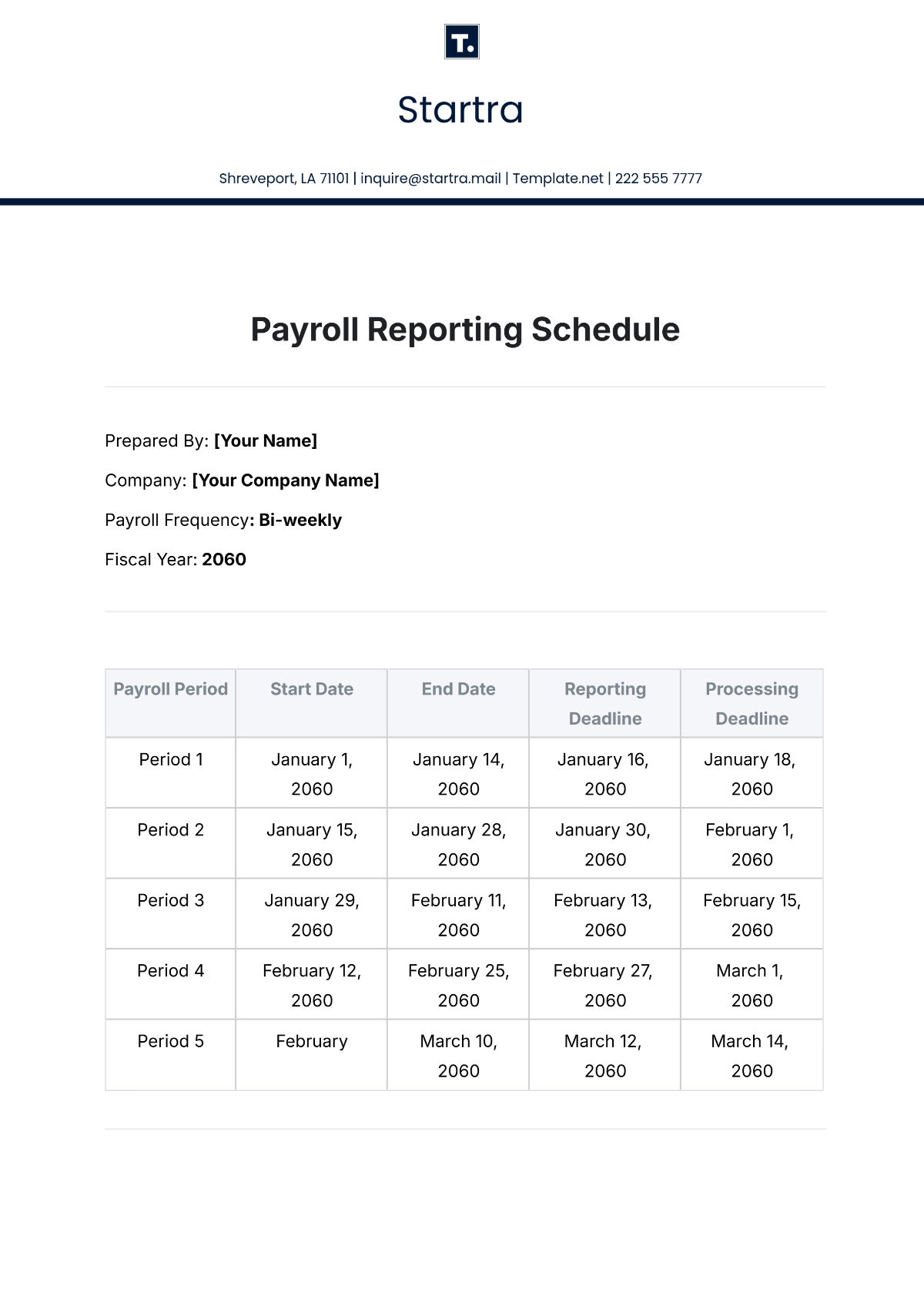

A. Payroll Period

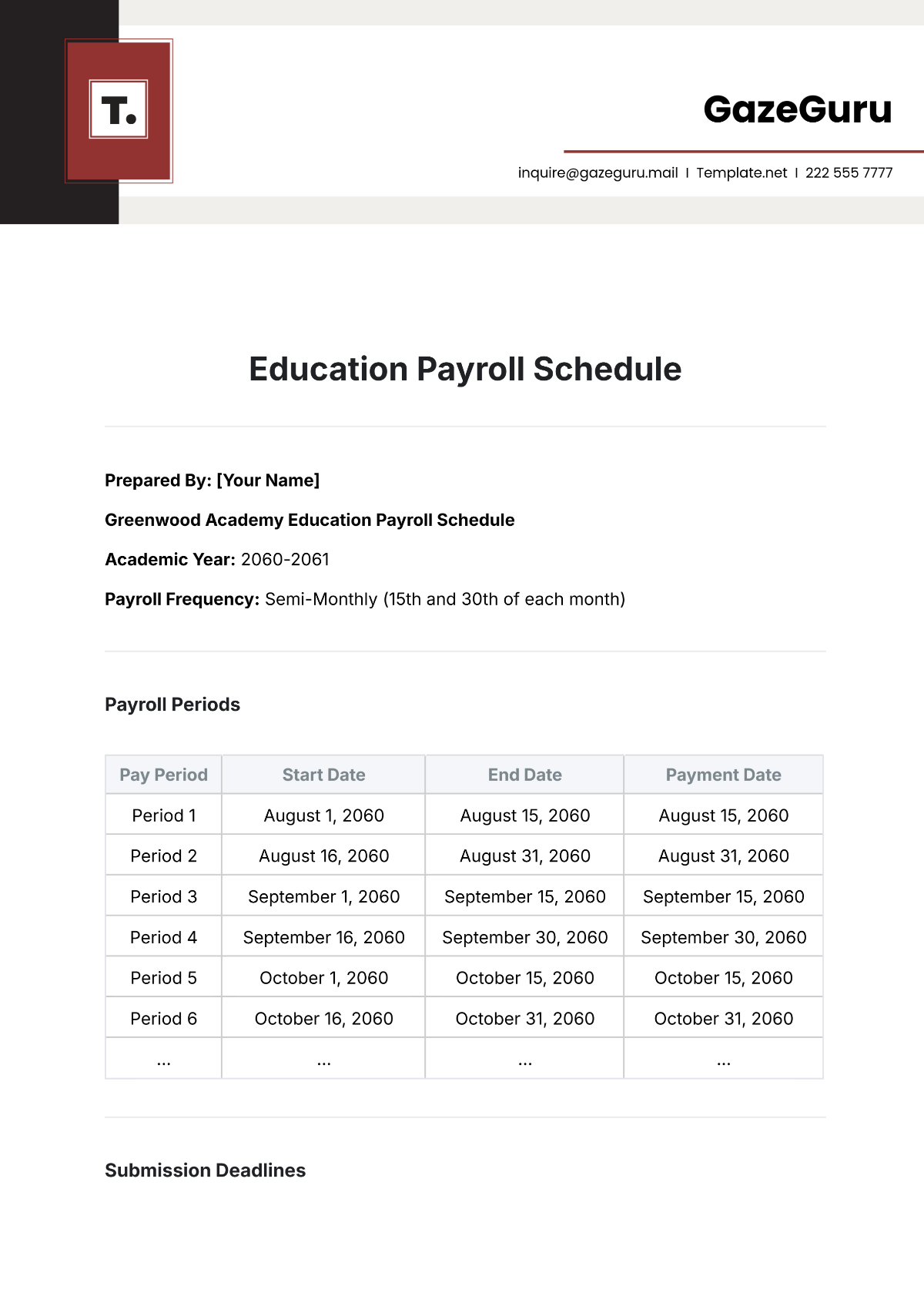

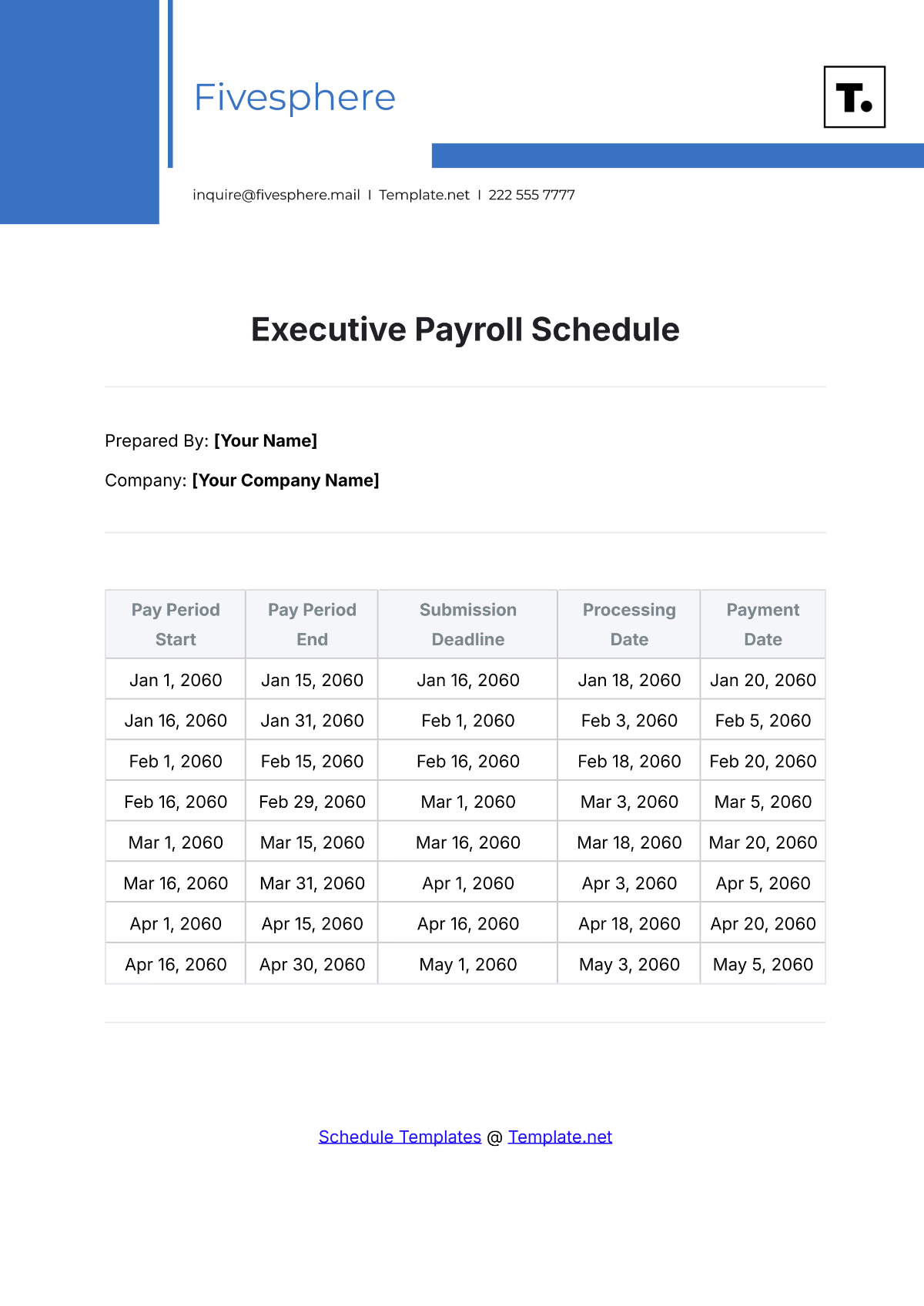

The payroll at [Your Company Name] is processed on a bi-weekly basis, covering a two-week period. This frequency ensures that employees receive timely compensation for their work. It provides a regular cadence for financial planning and supports our commitment to prompt salary disbursements.

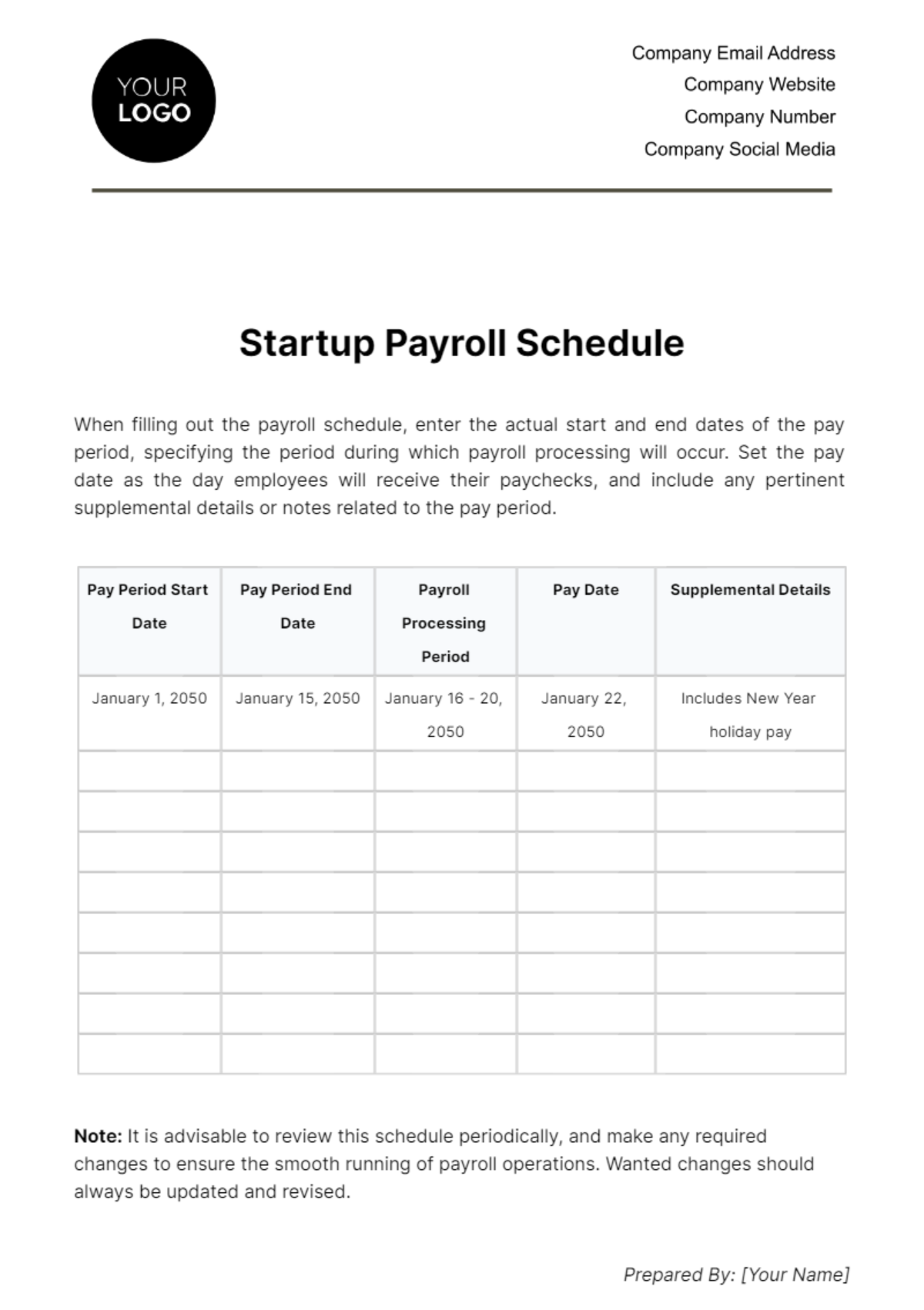

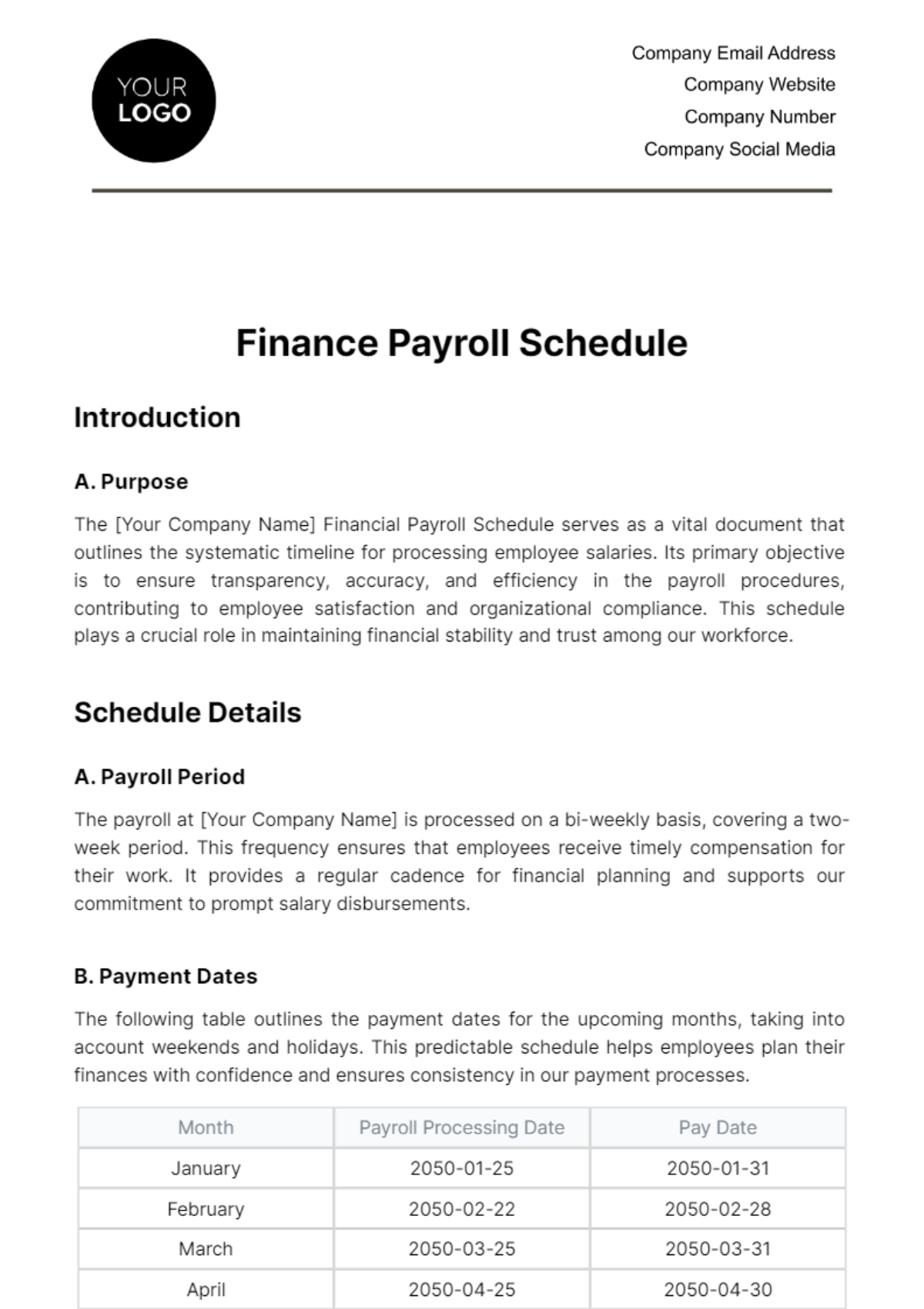

B. Payment Dates

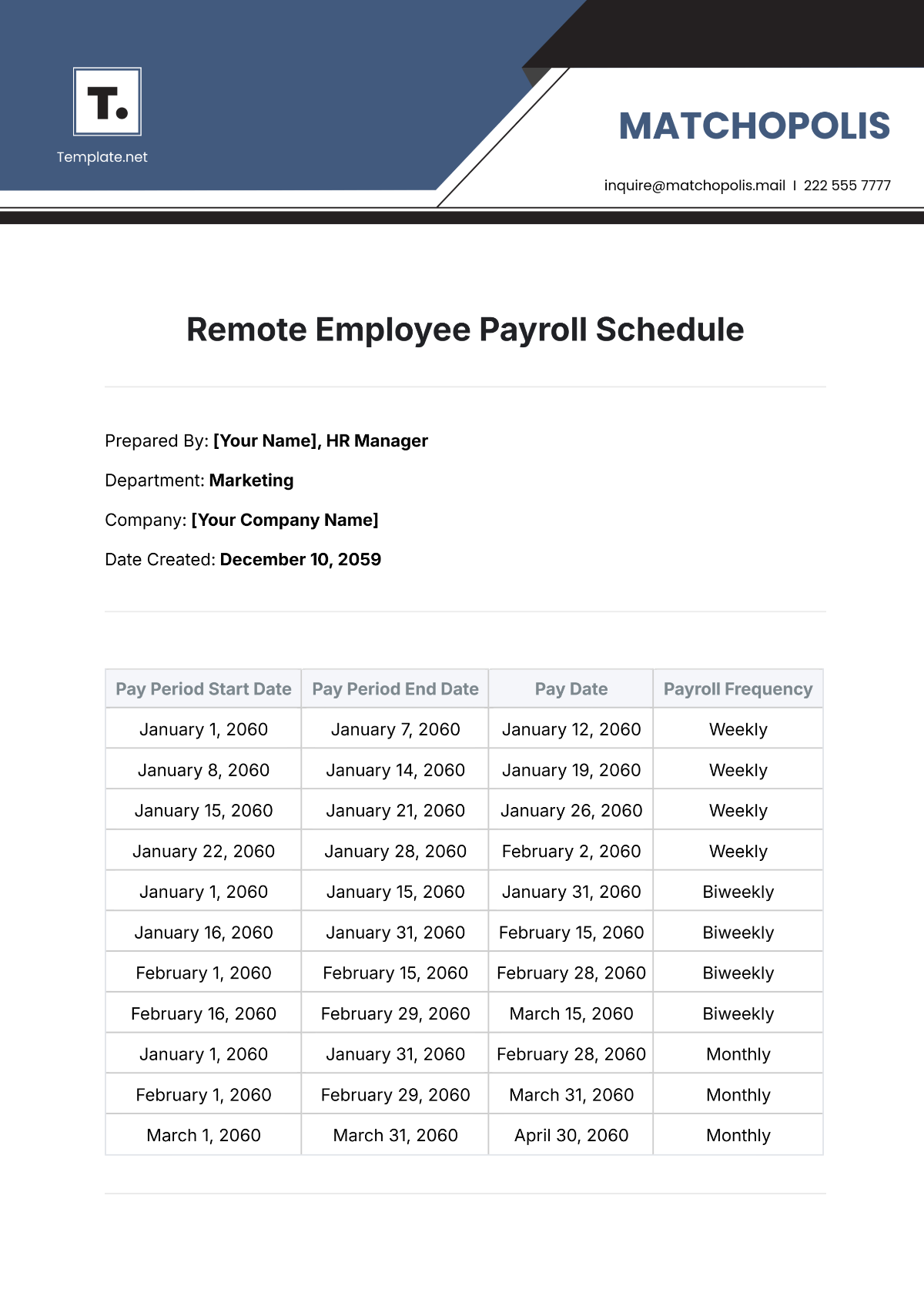

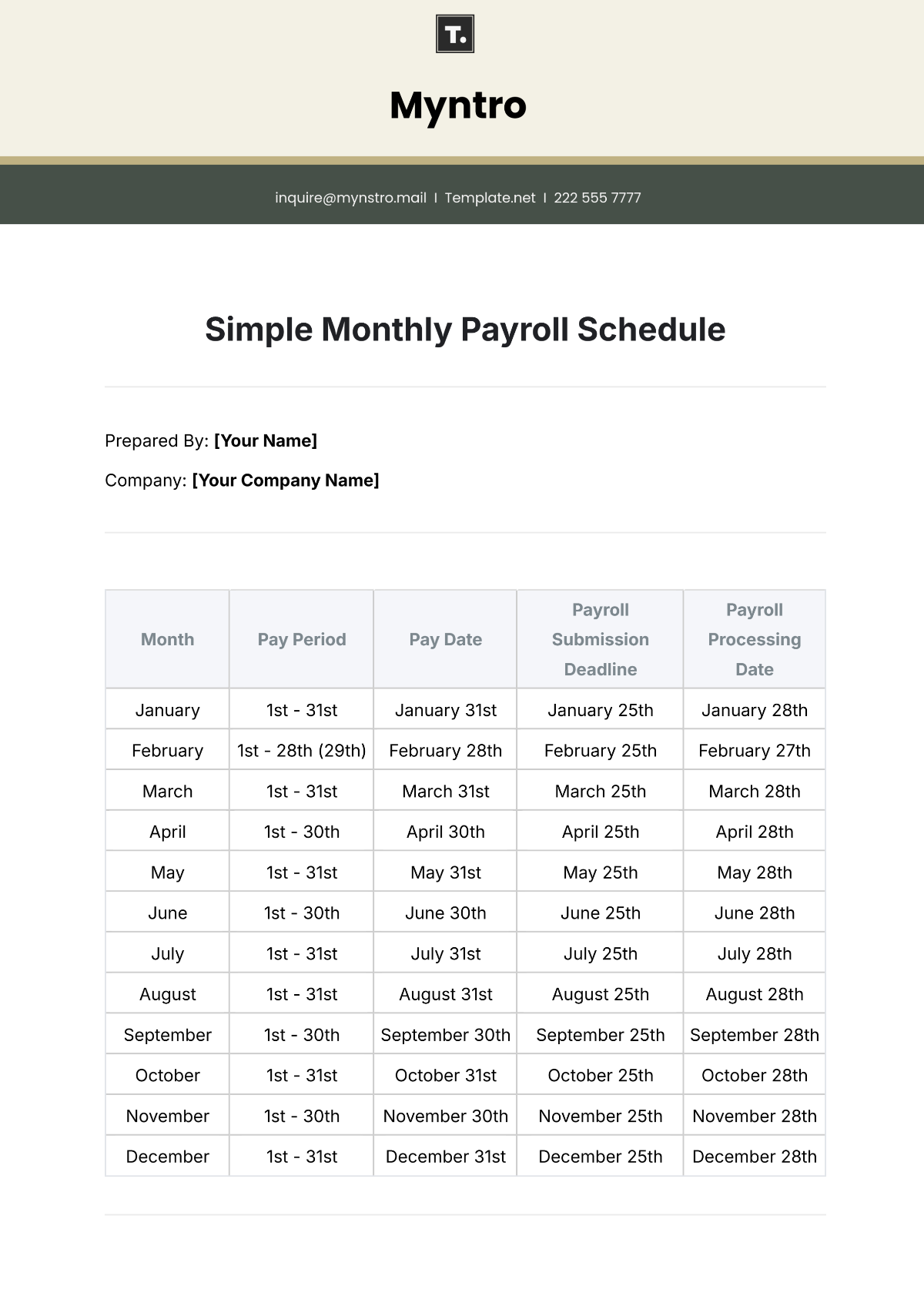

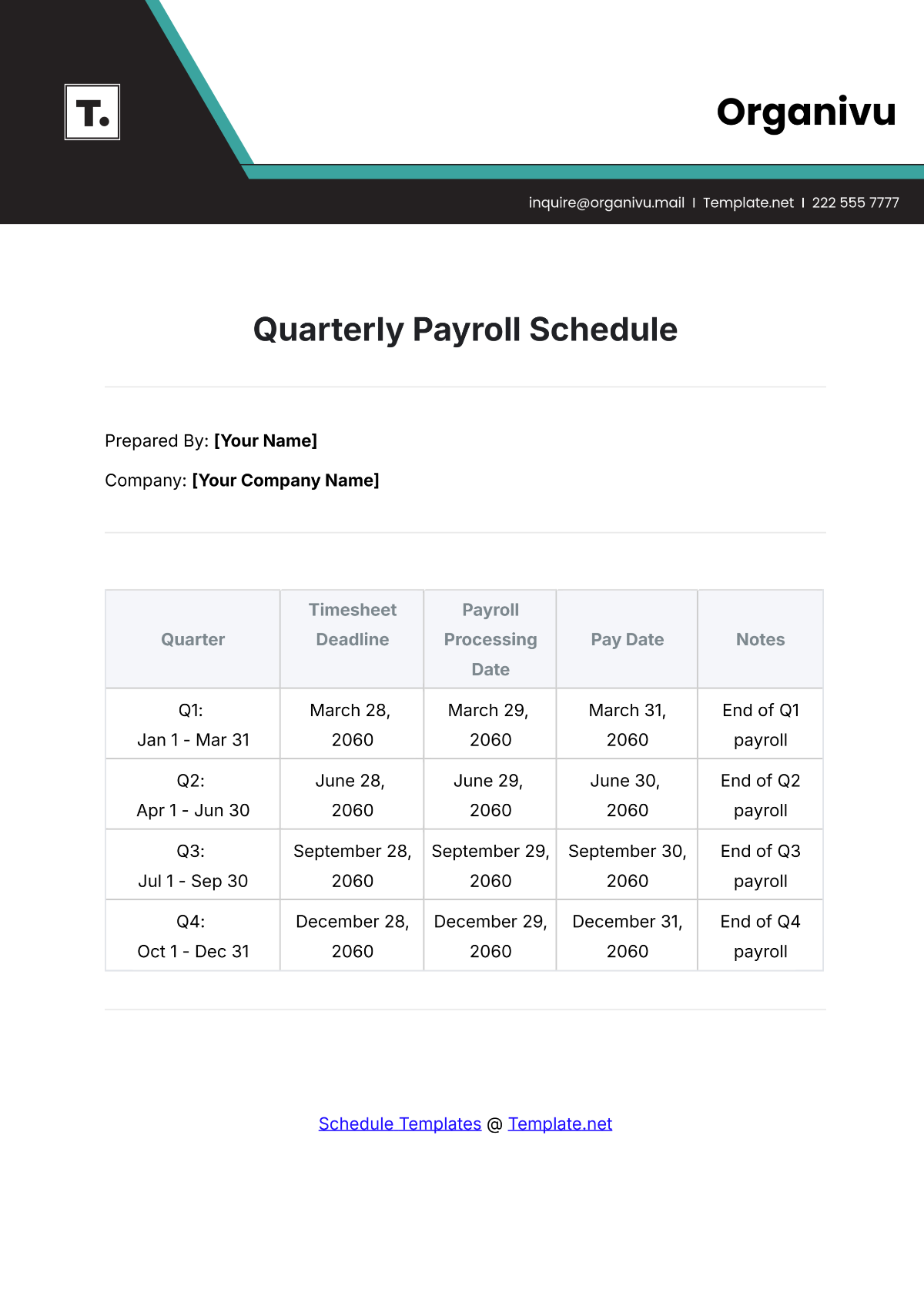

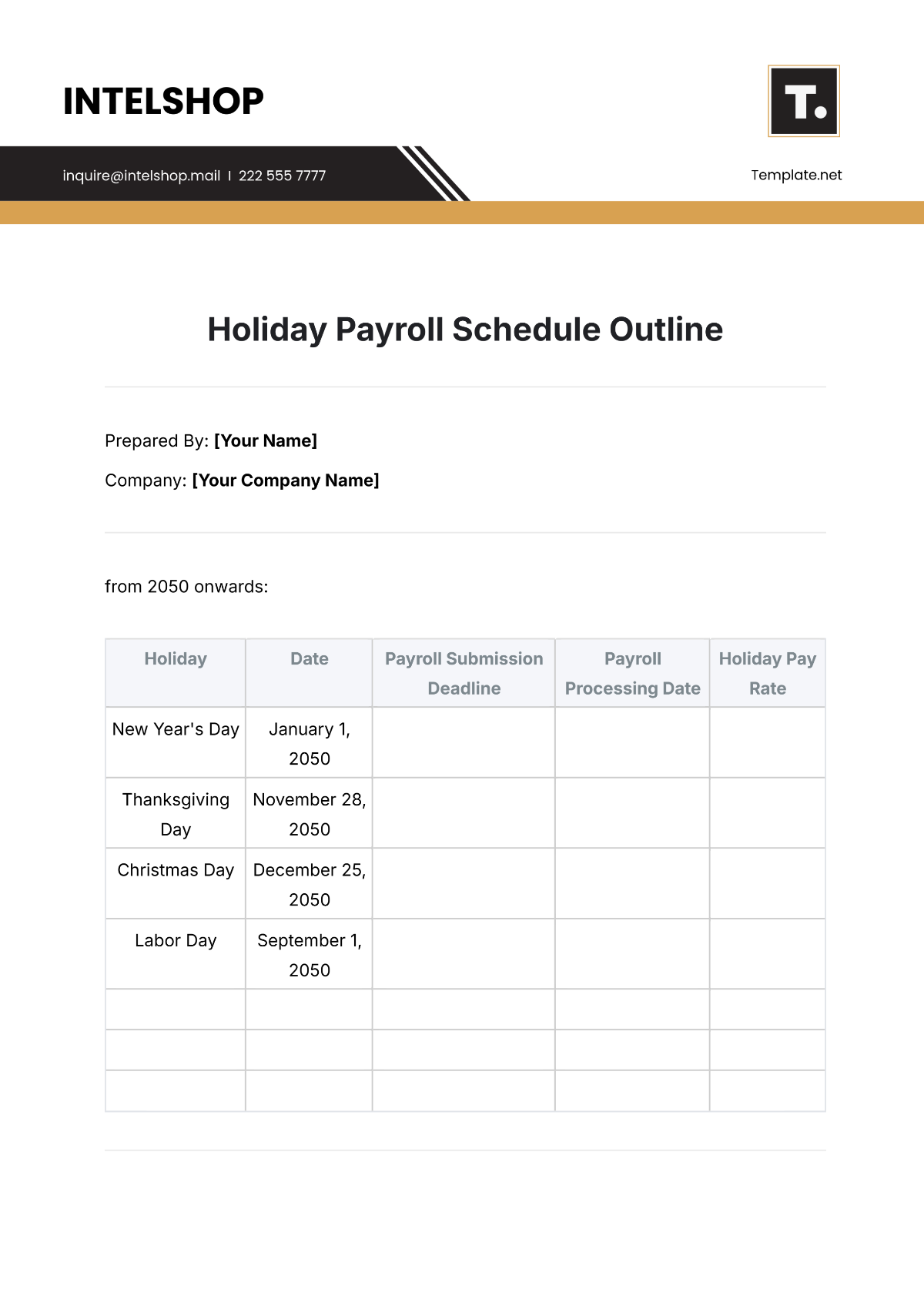

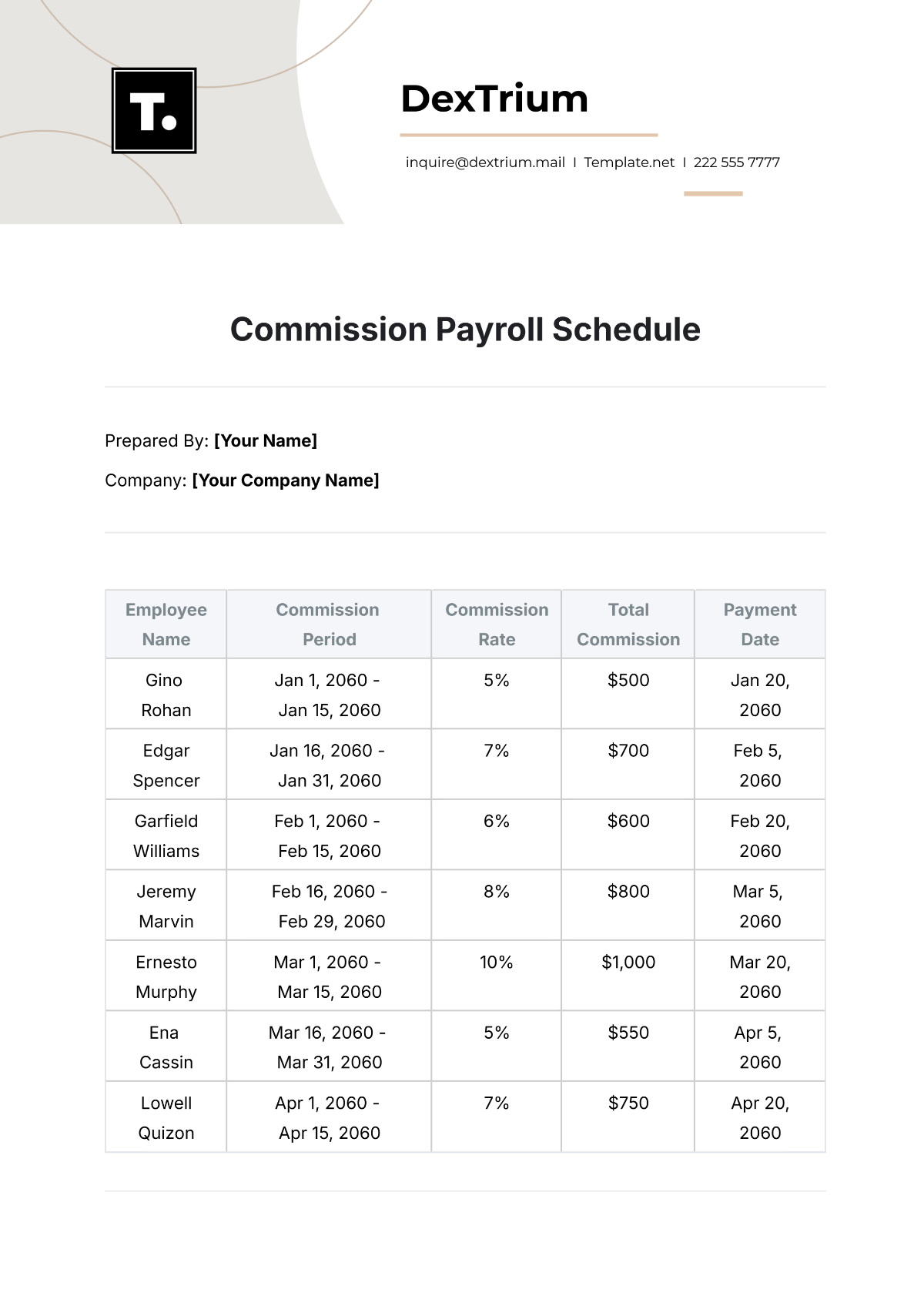

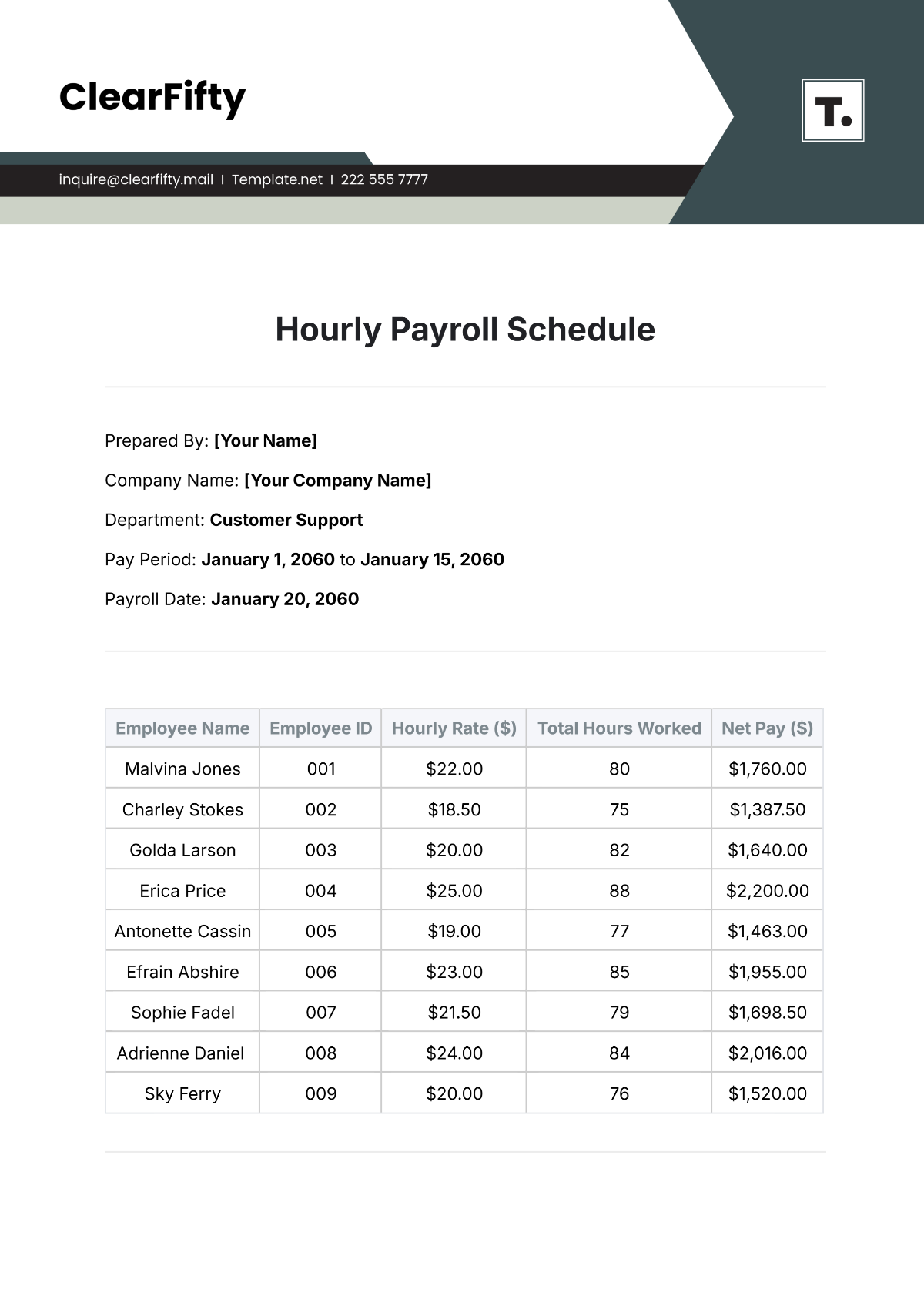

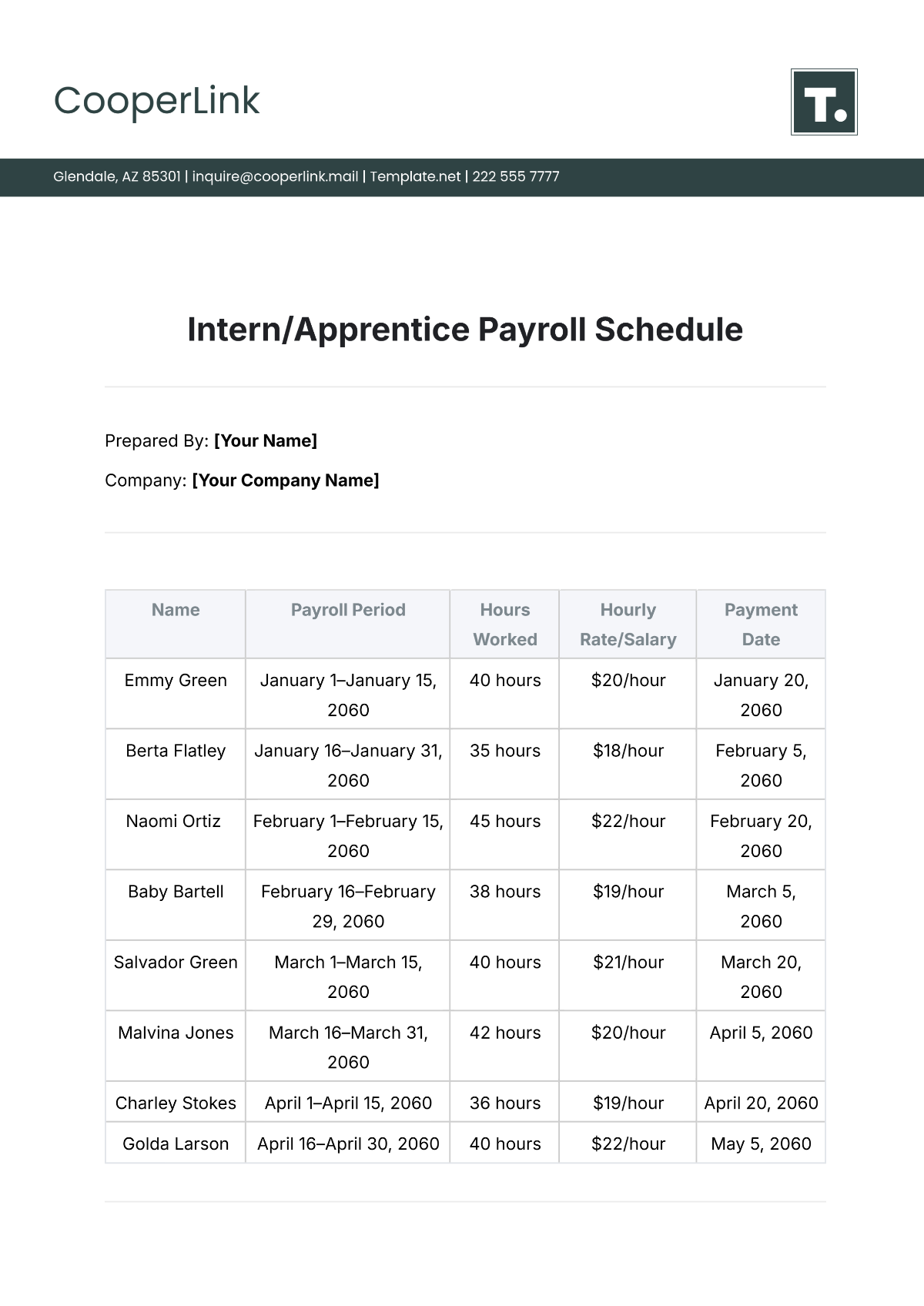

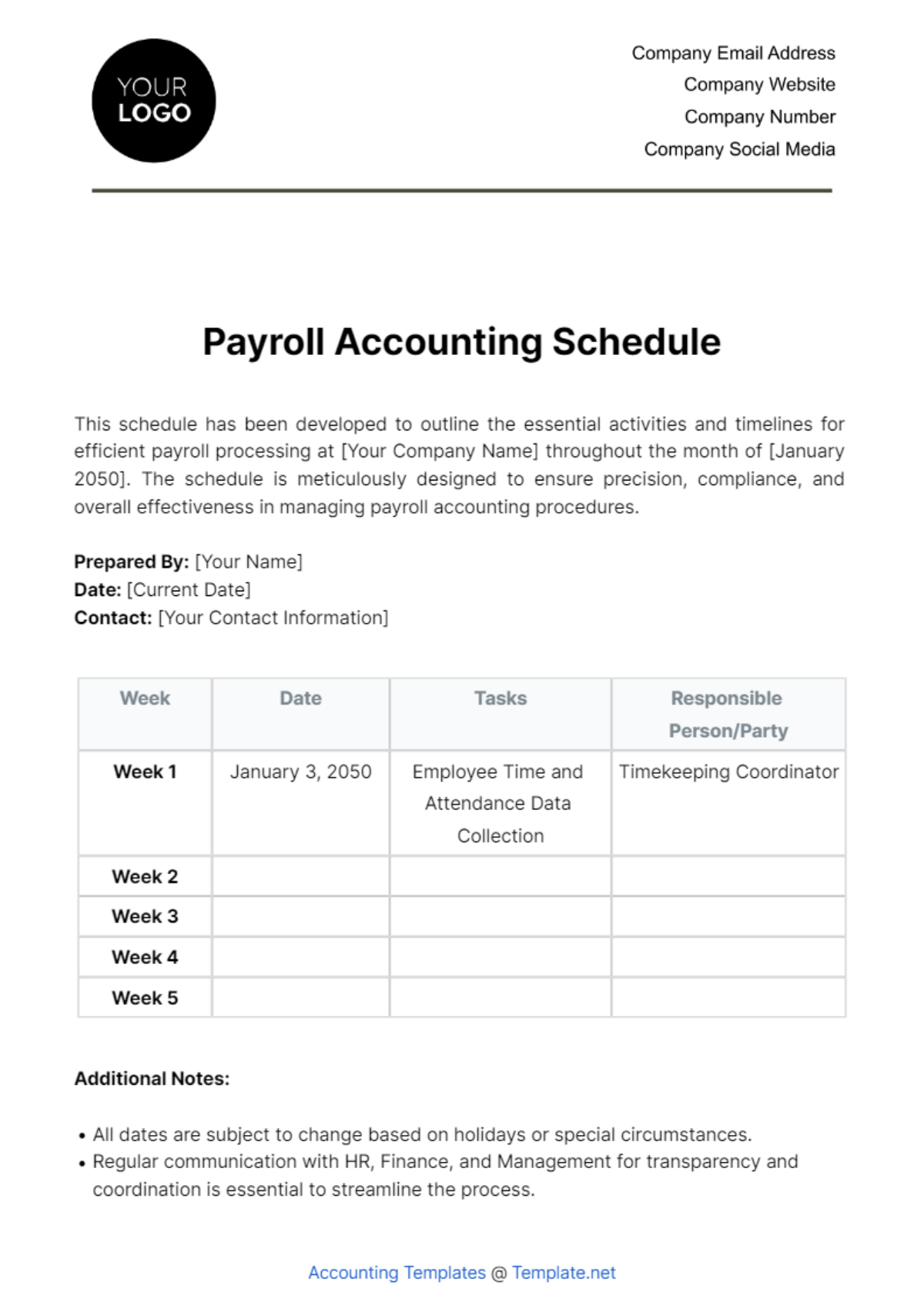

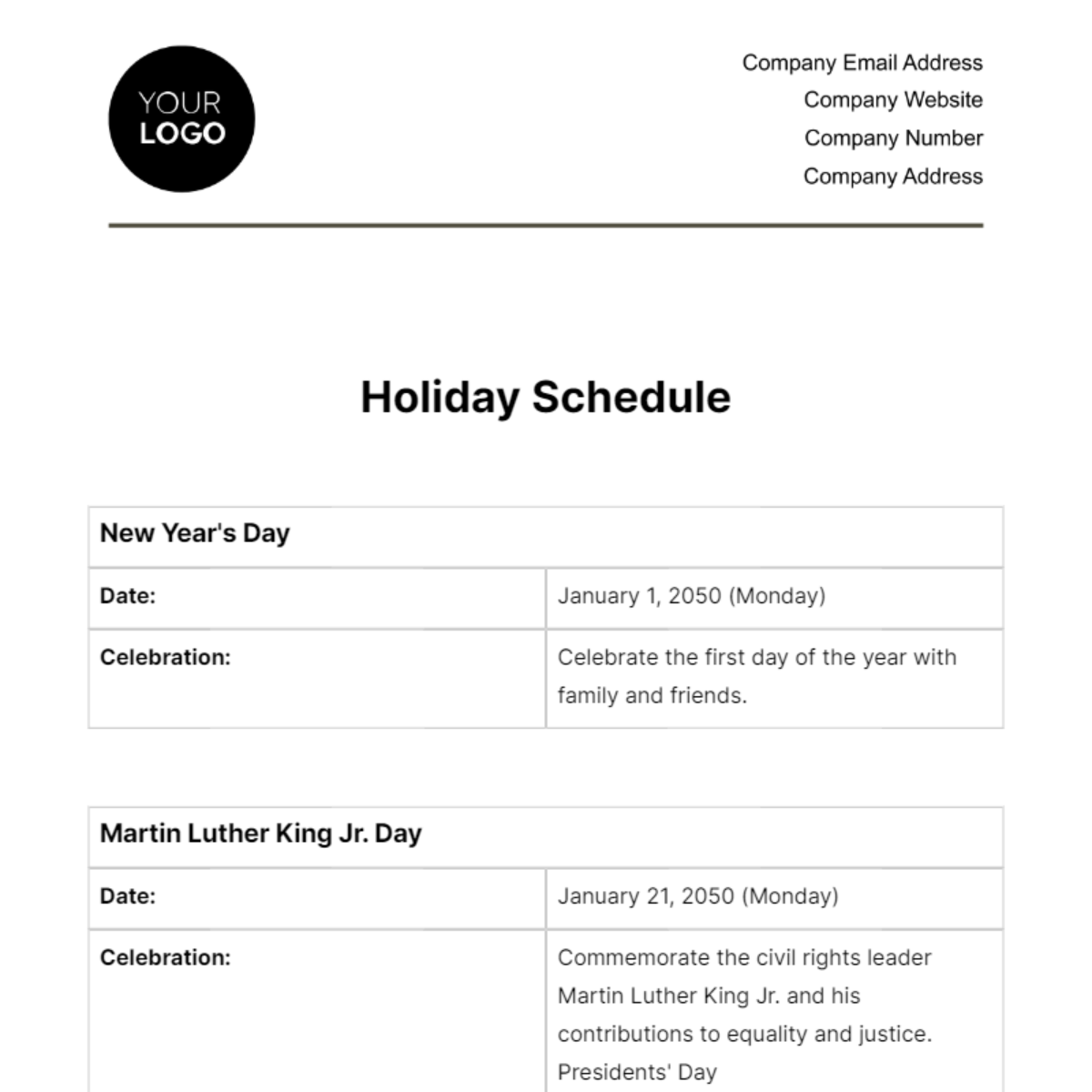

The following table outlines the payment dates for the upcoming months, taking into account weekends and holidays. This predictable schedule helps employees plan their finances with confidence and ensures consistency in our payment processes.

Month | Payroll Processing Date | Pay Date |

|---|---|---|

January | 2050-01-25 | 2050-01-31 |

February | 2050-02-22 | 2050-02-28 |

March | 2050-03-25 | 2050-03-31 |

April | 2050-04-25 | 2050-04-30 |

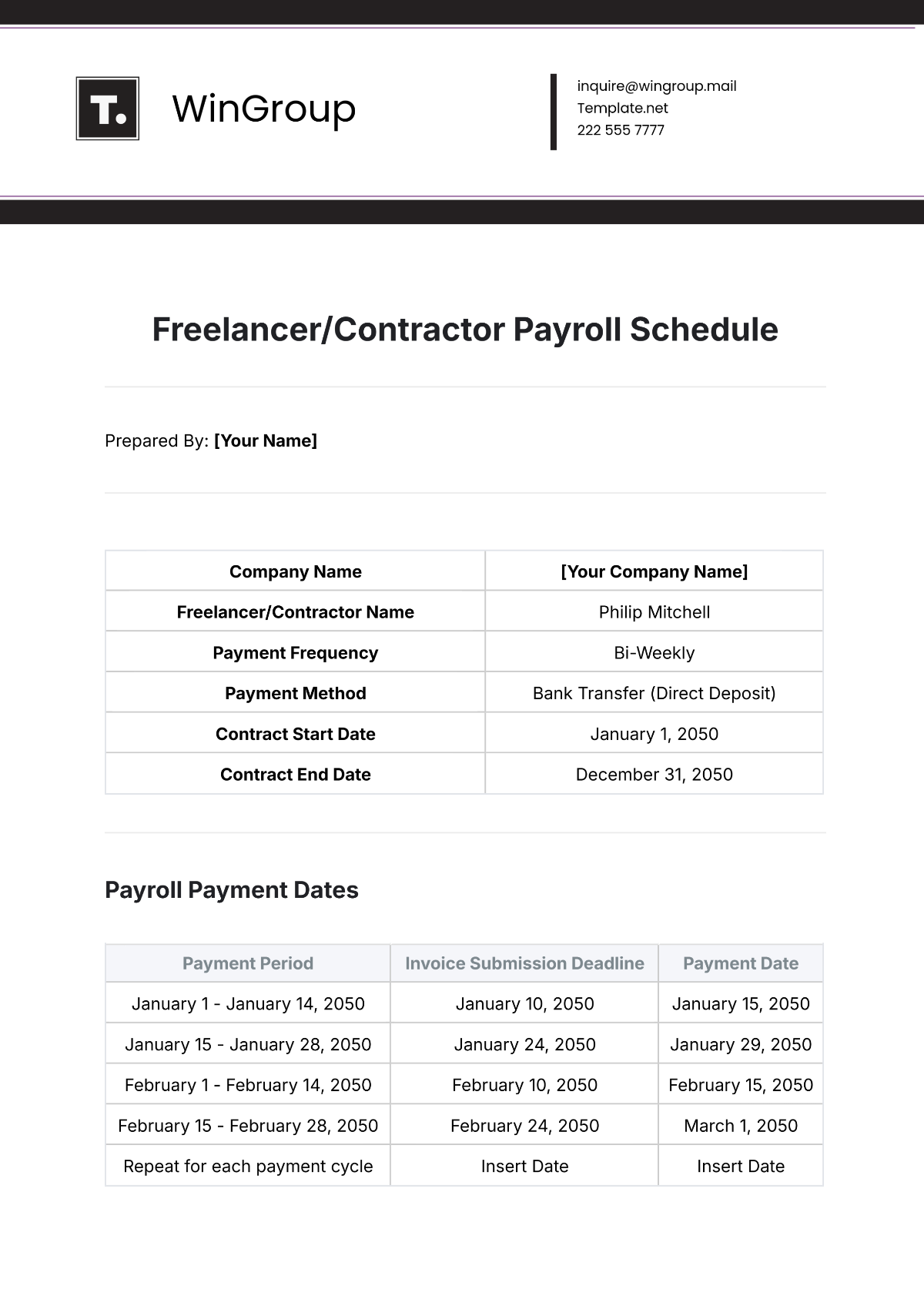

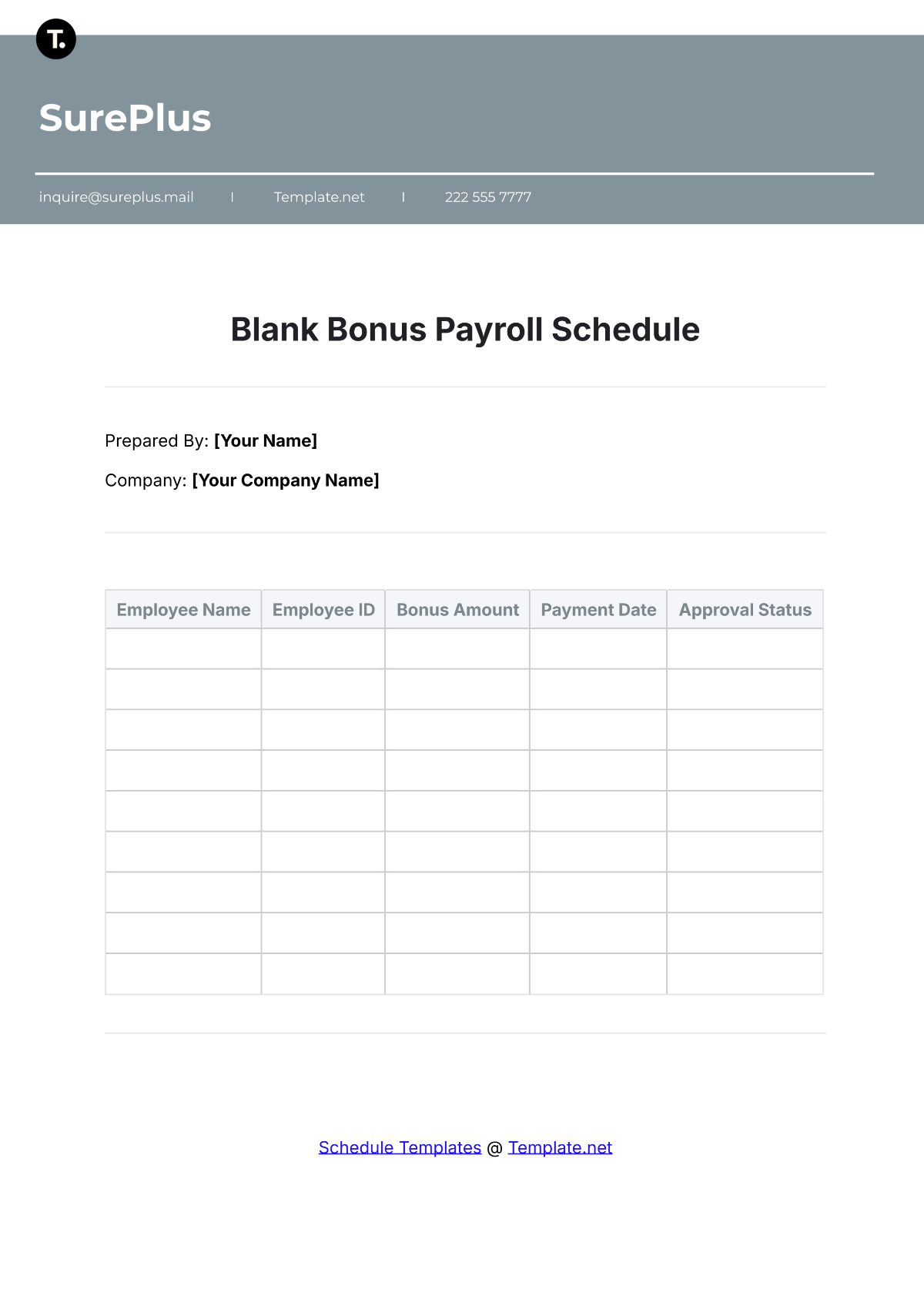

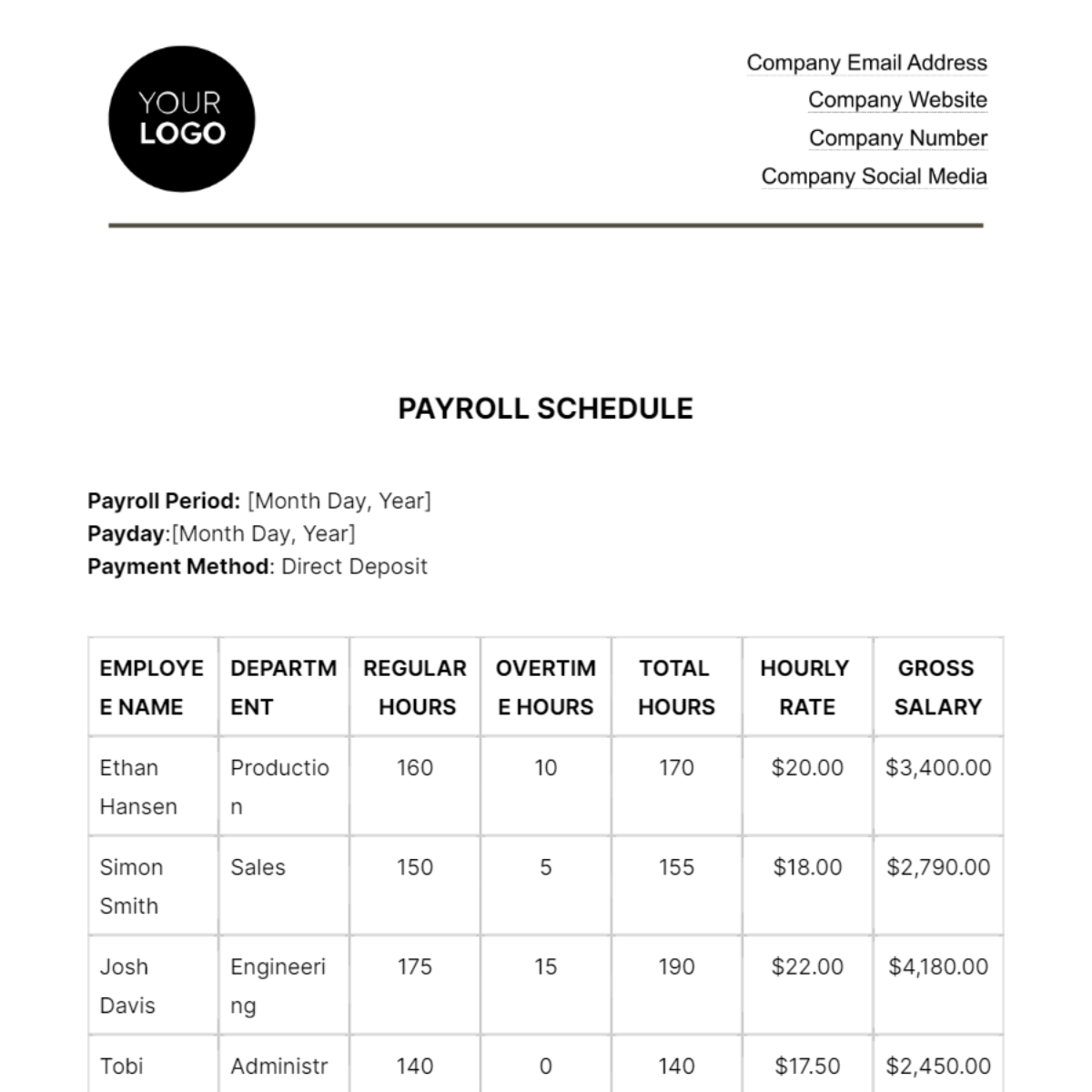

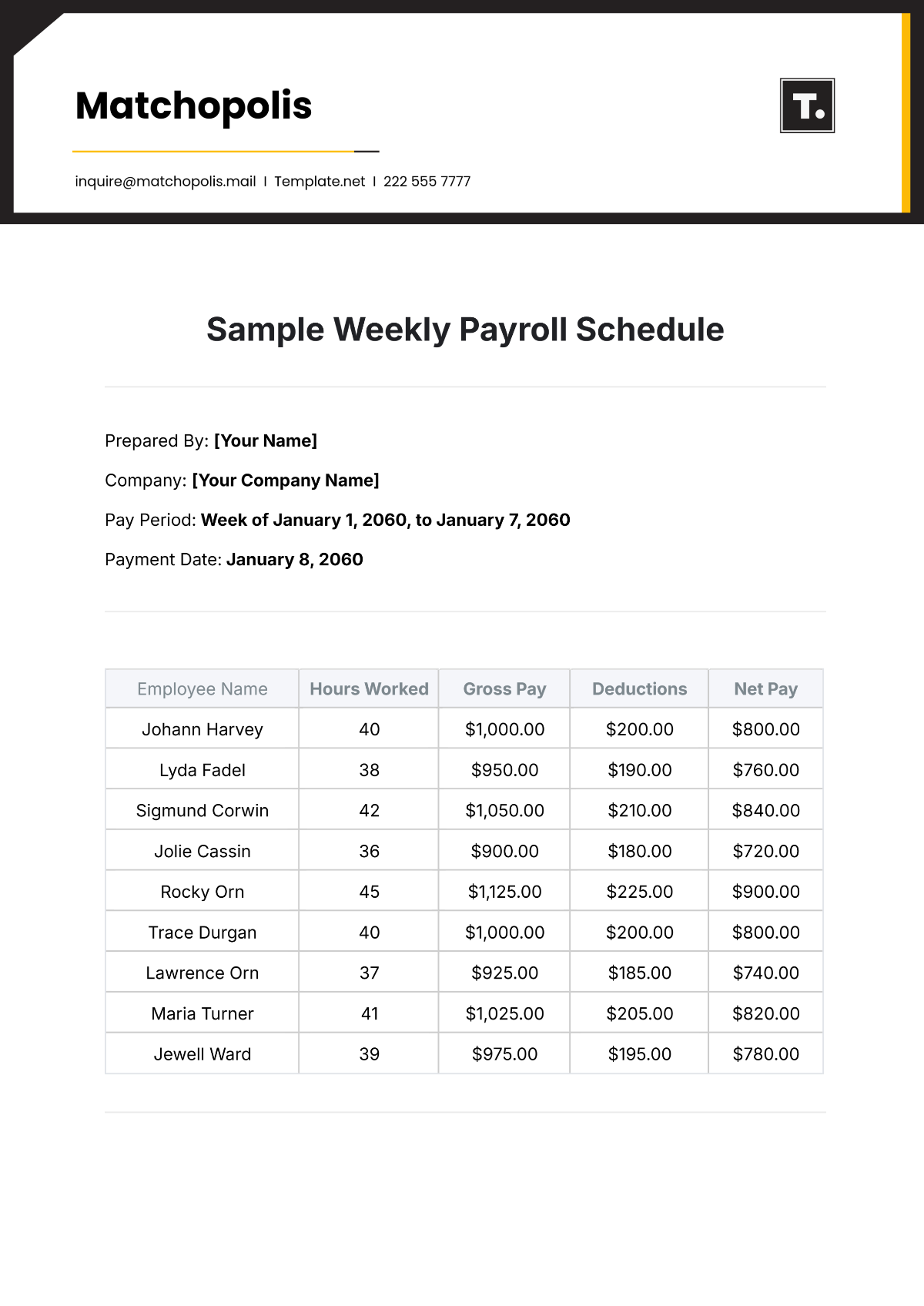

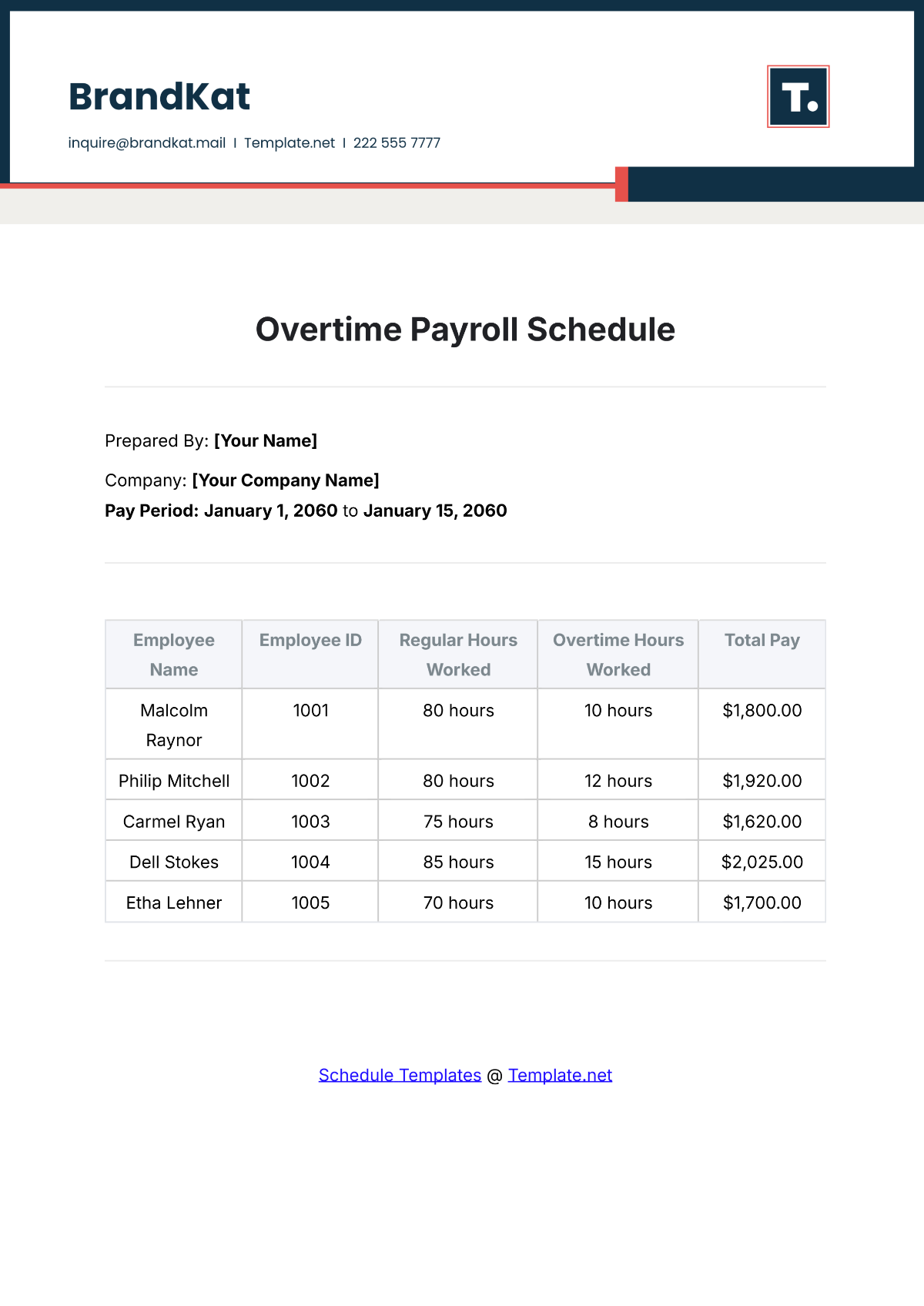

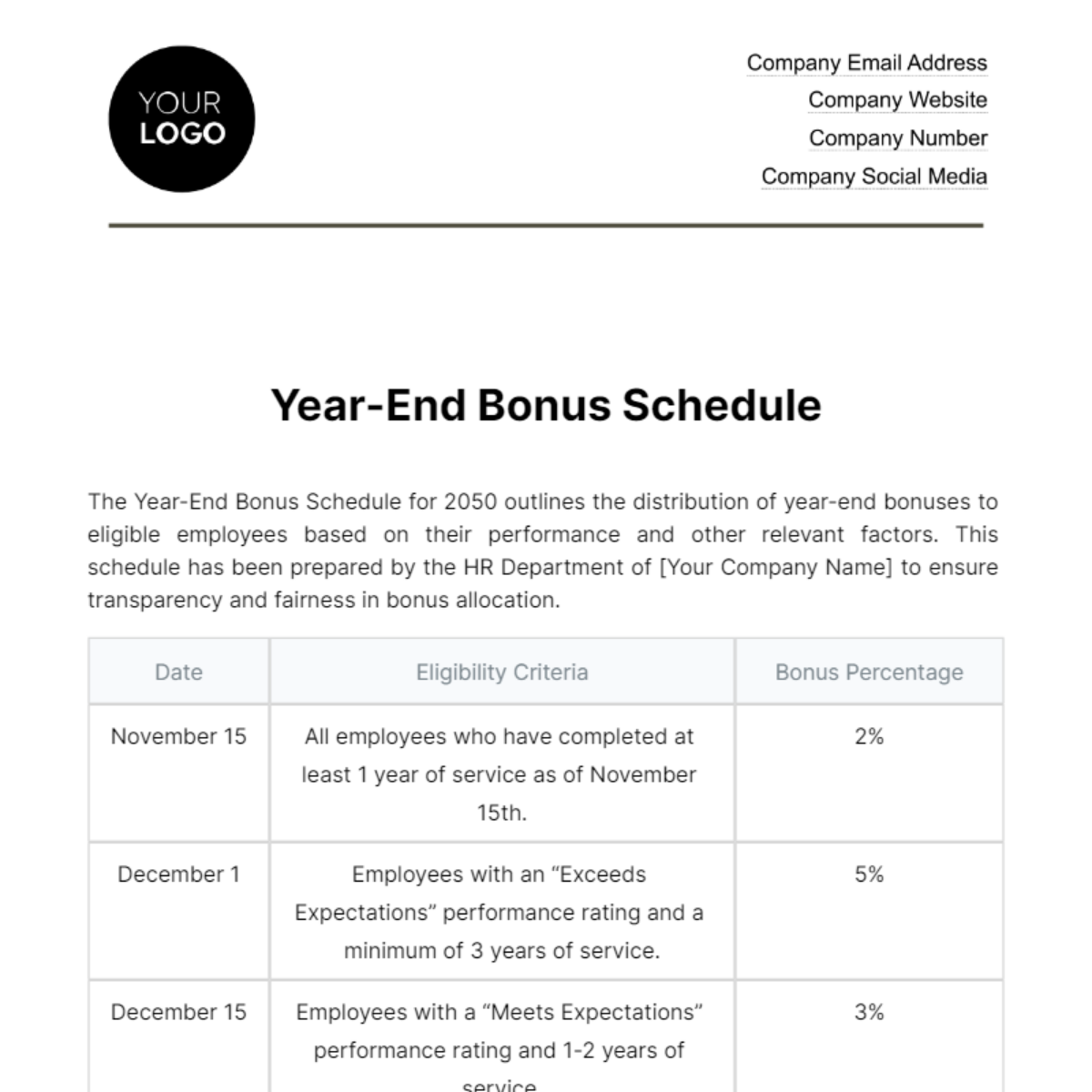

C. Overtime and Bonuses

Overtime and bonuses are integrated into the payroll schedule to accurately reflect additional compensation. Overtime pay is processed in the subsequent payroll period, while bonuses are typically dispersed on a separate date, such as the last working day of the month. This ensures that employees are fairly compensated for their extra efforts and achievements.

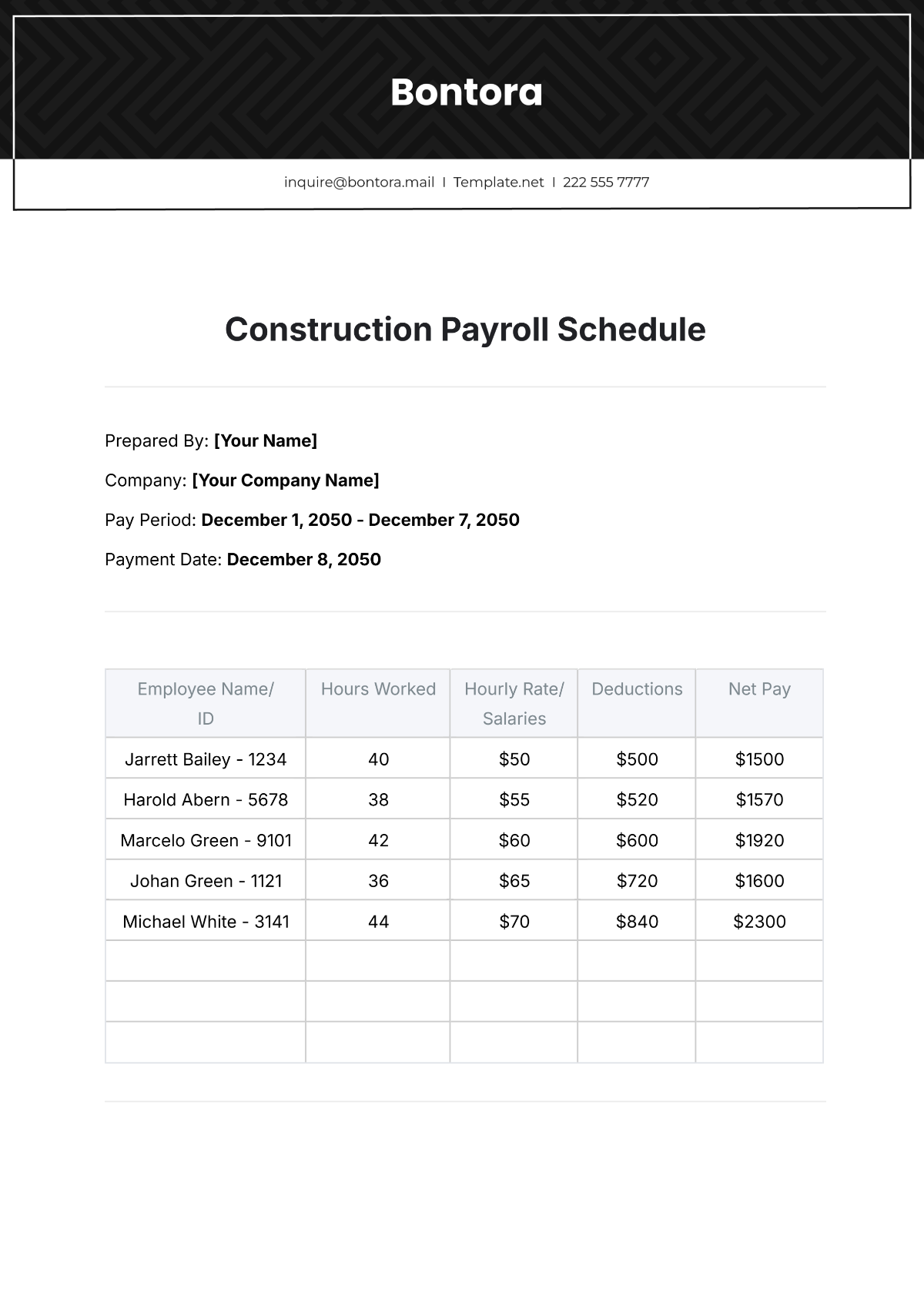

D. Deductions

Deductions, including taxes, insurance premiums, and retirement contributions, are subtracted from the gross pay to determine the net pay. Detailed records of these deductions are provided on individual pay stubs. This practice aligns with legal requirements and allows employees to have a clear understanding of their take-home pay.

Communication Protocol

A. Notification

Employees will be notified of any changes or updates to the payroll schedule via email. Additionally, announcements will be posted on [Your Company Social Media] and the company website to ensure widespread awareness. This multi-channel approach aims to keep employees informed and minimizes any potential confusion.

Compliance and Legal Considerations

A. Tax Compliance

[Your Company Name] adheres to all relevant tax regulations, and any adjustments necessary for compliance are integrated into the payroll processing. This may involve periodic reviews to ensure ongoing conformity with tax laws. Ensuring tax compliance is a fundamental aspect of our commitment to financial responsibility and legal integrity.

Conclusion

This comprehensive Financial Payroll Schedule establishes a clear and dependable framework for processing employee salaries at [Your Company Name]. By prioritizing transparency, communication, and compliance, we aim to provide employees with a reliable and efficient payroll experience. This commitment reflects our dedication to fostering a positive work environment and supporting the financial well-being of our team.

For more information or detailed inquiries, please contact [Your Name] at [Your Email] or [Your Company Number].