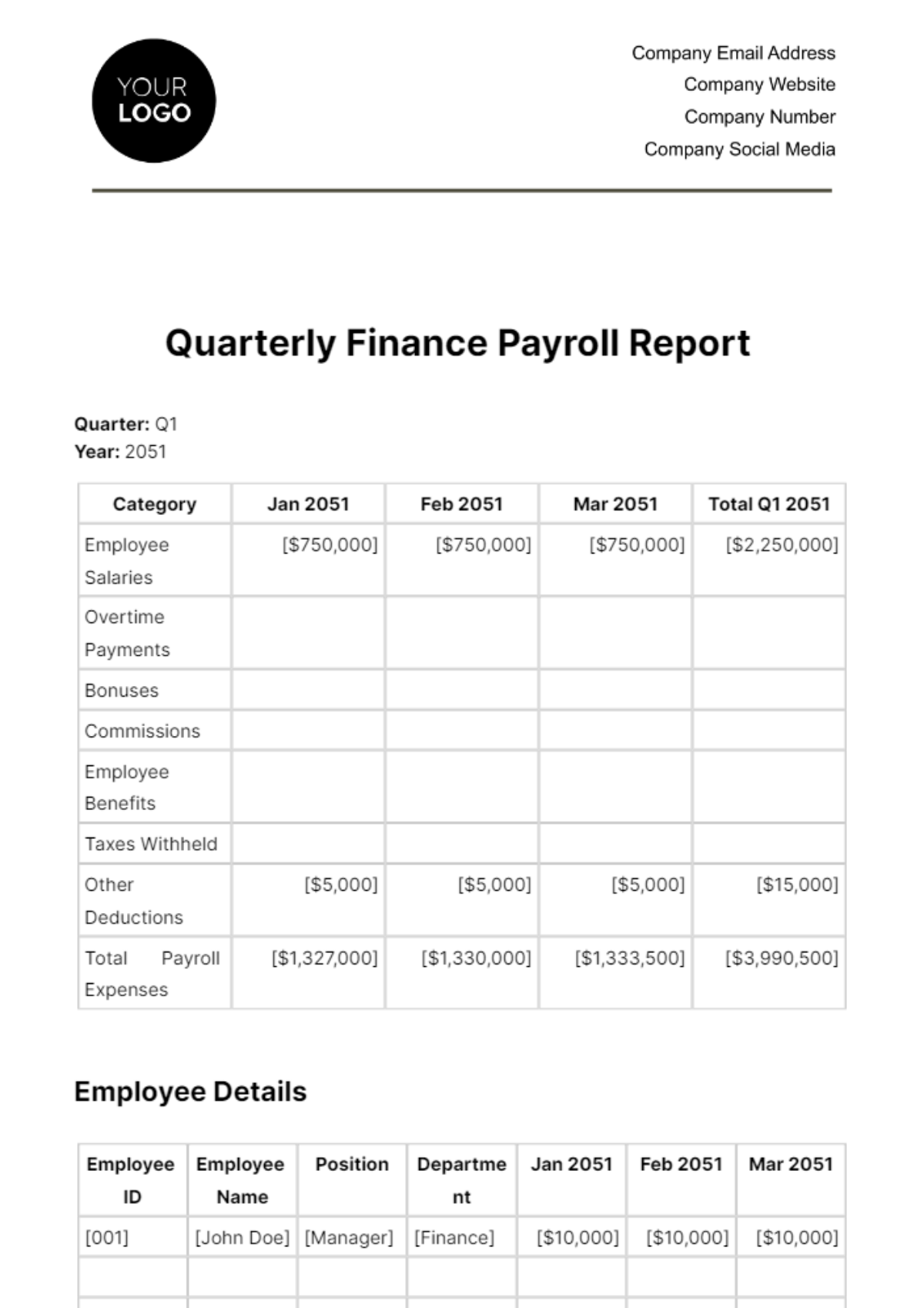

Free Quarterly Finance Payroll Report

Quarter: Q1

Year: 2051

Category | Jan 2051 | Feb 2051 | Mar 2051 | Total Q1 2051 |

Employee Salaries | [$750,000] | [$750,000] | [$750,000] | [$2,250,000] |

Overtime Payments | ||||

Bonuses | ||||

Commissions | ||||

Employee Benefits | ||||

Taxes Withheld | ||||

Other Deductions | [$5,000] | [$5,000] | [$5,000] | [$15,000] |

Total Payroll Expenses | [$1,327,000] | [$1,330,000] | [$1,333,500] | [$3,990,500] |

Employee Details

Employee ID | Employee Name | Position | Department | Jan 2051 | Feb 2051 | Mar 2051 |

[001] | [John Doe] | [Manager] | [Finance] | [$10,000] | [$10,000] | [$10,000] |

Tax Breakdown

Category | Jan 2051 | Feb 2051 | Mar 2051 | Total Q1 2051 |

Federal Income Tax | [$180,000] | [$180,000] | [$180,000] | [$540,000] |

State Income Tax | ||||

Social Security | ||||

Medicare | ||||

Other Deductions | ||||

Total Taxes |

Notes and Observations

The total payroll expenses for Q1 2051 amount to [$3,990,500], reflecting regular salaries, overtime, bonuses, commissions, benefits, and deductions.

All tax obligations, including federal and state income taxes, social security, and Medicare, have been accurately withheld and reported.

Approved by:

____________________

[Your Name]

[Finance Manager]

[Date: Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Evaluate quarterly payroll trends with Template.net's Quarterly Finance Payroll Report Template. This editable, customizable template compiles payroll data over three-month periods. It's essential for financial tracking and planning, providing insights into payroll expenses, tax obligations, and wage changes, facilitating informed decision-making and effective budgetary management in the payroll domain.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report