Free Quarterly Finance Credit Report

Executive Summary:

During the fourth quarter of 2050, our Finance Credit Management & Analysis department continued to focus on monitoring, assessing, and managing credit risk. We maintained a robust credit portfolio, minimized losses, and optimized credit exposure.

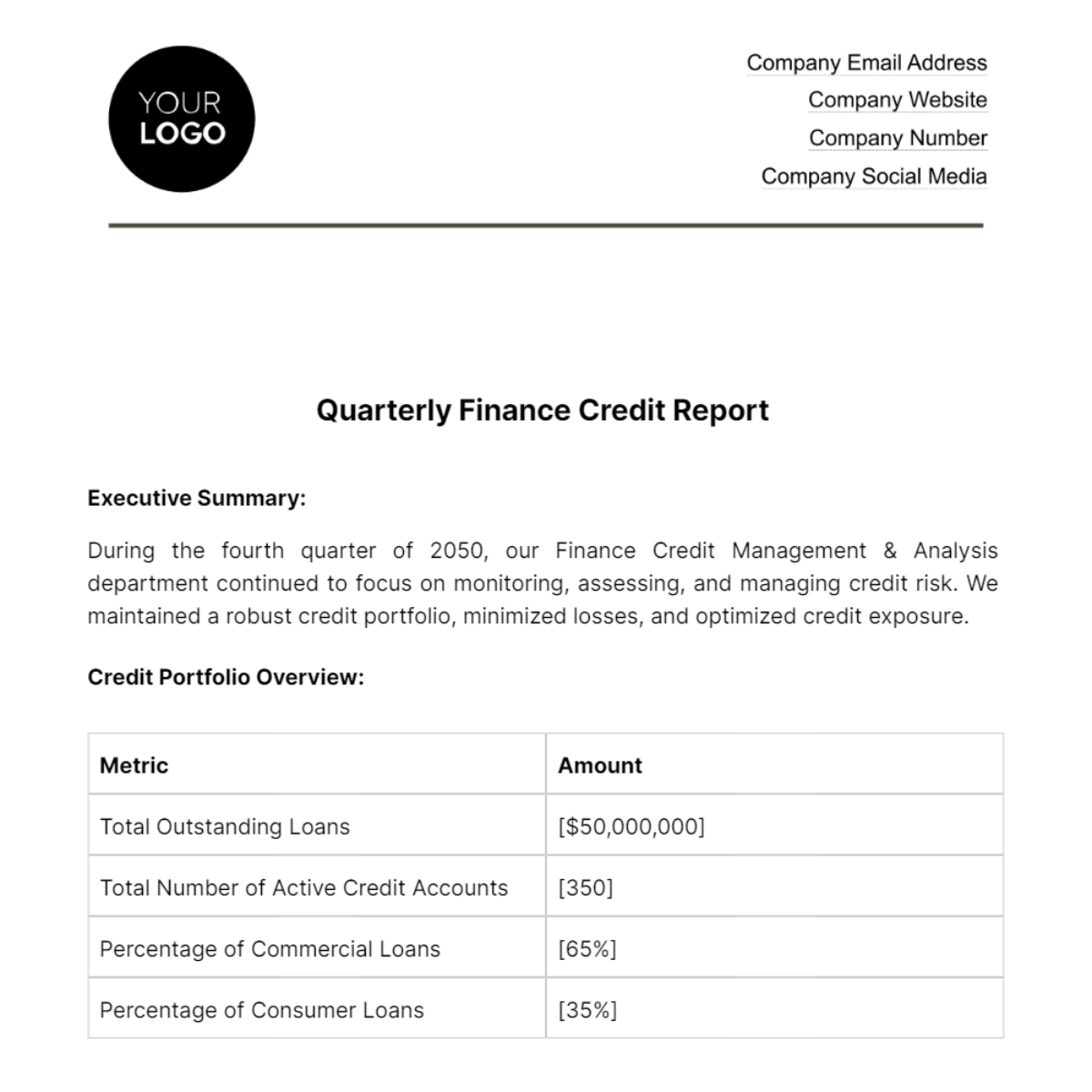

Credit Portfolio Overview:

Metric | Amount |

Total Outstanding Loans | [$50,000,000] |

Total Number of Active Credit Accounts | [350] |

Percentage of Commercial Loans | [65%] |

Percentage of Consumer Loans | [35%] |

Key Credit Metrics:

Credit Quality Distribution:

High-Quality Credits (AAA to A): [75%]

Medium-Quality Credits (BBB to BBB-): [20%]

Low-Quality Credits (Below BBB-): [5%]

Non-Performing Loans:

Total Non-Performing Loans: [$2,500,000]

Percentage of Non-Performing Loans to Total Loans: [5%]

Credit Loss Provision:

Provision for Credit Losses in Q4: [$1,200,000]

Allowance for Credit Losses at the end of Q4: [$10,000,000]

Credit Analysis and Trends:

Our credit quality remained stable during the quarter, with a slight increase in low-quality credits primarily due to economic uncertainties.

The non-performing loans increased slightly compared to the previous quarter, reflecting the ongoing economic challenges faced by some of our clients.

We maintained a healthy allowance for credit losses to cover potential credit losses.

Client Highlights:

Client Name | Status | Remarks |

[Client Name] | Top Performing | Strong financials and timely repayments |

[Client Name] | ||

[Client Name] | ||

[Client Name] | ||

[Client Name] | ||

[Client Name] |

Recommendations:

Based on our analysis and trends observed during the quarter, we recommend the following:

Continue close monitoring of high-risk clients and consider further credit limit adjustments where necessary.

Enhance our risk assessment process to adapt to changing economic conditions.

Review and update credit policies to ensure they align with our risk appetite.

In conclusion, our Finance Credit Management & Analysis department remains committed to maintaining a healthy credit portfolio while proactively addressing credit risks. We will continue to closely monitor market conditions and client performance to ensure the stability and growth of our credit portfolio.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Analyze credit performance with Template.net's Quarterly Finance Credit Report Template. This editable, customizable template consolidates credit-related data quarterly. Ideal for finance teams, it tracks credit activities, outstanding debts, and payment histories, offering a clear view of credit health and trends, crucial for maintaining financial stability and planning future credit strategies.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report