Annual Account Reporting

I. Executive Summary

A. Introduction

In 2050, Tech Innovators Inc. maintained its position as a trailblazer in transformative technologies. From artificial intelligence to quantum computing, our commitment to innovation is unwavering. This year's Annual Account Report highlights our financial achievements and strategic endeavors, showcasing the resilience and adaptability that defines our company.

B. Highlights of Financial Performance

Tech Innovators Inc. achieved a remarkable 14% growth in revenue, reaching $10.5 billion. Net income saw a substantial increase of 16.7%, amounting to $2.8 billion. The upward trajectory in earnings per share (EPS) at $8.50 reflects the effectiveness of our operational strategies. Additionally, our cash flow from operations expanded by 16.1% to $3.6 billion, demonstrating our ability to convert sales into robust cash generation.

Metric | 2050 | 2049 | Change (%) |

|---|---|---|---|

Revenue | $10.5 billion | $9.2 billion | +14% |

Net Income | $2.8 billion | $2.4 billion | +16.7% |

Earnings per Share (EPS) | $8.50 | $7.20 | +18.1% |

Cash Flow from Ops | $3.6 billion | $3.1 billion | +16.1% |

C. Key Achievements and Milestones

This year marked the successful launch of our Quantum Computing Division, positioning us at the forefront of the next computing frontier. Emphasizing our commitment to sustainability, we achieved a 20% reduction in our carbon footprint through expanded initiatives in renewable energy. Furthermore, our foray into AI-driven healthcare solutions has been met with market success, contributing to our overall strategic diversification.

II. Letter to Shareholders

Dear Shareholders,

In the face of challenges, Tech Innovators Inc. persevered, delivering a year of substantial growth and strategic advancement. The unforeseen hurdles, such as supply chain disruptions, were met with agile solutions and innovative partnerships. Looking ahead, we remain steadfast in our commitment to pioneering technologies, anticipating sustained growth through strategic initiatives and market expansion.

A. Acknowledgment of Challenges and How They Were Addressed

Our acknowledgment of challenges includes navigating global supply chain disruptions through diversified sourcing and forming strategic alliances with reliable partners. Proactive risk mitigation strategies allowed us to maintain operational continuity and minimize the impact on our product delivery timelines.

B. Future Outlook and Strategic Initiatives

The future outlook for Tech Innovators Inc. is optimistic. We anticipate entering new markets and sustaining growth through the Quantum Computing Division's advancements, our commitment to sustainable energy, and the transformative impact of AI in healthcare. Our strategic initiatives align with emerging trends, ensuring our relevance and leadership in the dynamic tech landscape.

III. Financial Highlights

A. Summary of Financial Results

In 2050, Tech Innovators Inc. reported a revenue of $10.5 billion, marking a 14% increase from the previous year. Net income surged to $2.8 billion, translating to an impressive 16.7% growth. Earnings per share (EPS) reached $8.50, showcasing our commitment to shareholder value. Cash flow from operations soared to $3.6 billion, underscoring our financial strength and efficient cash management.

B. Comparative Analysis (Year-over-Year)

The year-over-year comparative analysis highlights the robust growth in key financial metrics. Increased revenue was driven by strong sales in AI and quantum computing segments, while disciplined cost management contributed to the growth in net income. The comparative analysis underscores our commitment to delivering consistent and sustainable financial performance.

IV. Management Discussion and Analysis (MD&A)

A. Business Overview

Tech Innovators Inc. stands as a global leader in transformative technologies. Our diverse portfolio, spanning artificial intelligence, quantum computing, sustainable energy, and healthcare solutions, positions us uniquely in the tech industry. Our focus on innovation and adaptability enables us to respond effectively to evolving market demands.

B. Key Performance Indicators (KPIs)

Our Key Performance Indicators (KPIs) reflect the company's strength and growth. Research & Development (R&D) investment increased by 12.5%, signaling our dedication to pushing technological boundaries. With a global tech market share now at 18%, we've achieved a 2% increase year-over-year, showcasing our expanding influence. Additionally, our employee satisfaction reached an impressive 92%, affirming our commitment to a positive workplace culture.

Metric | 2050 | 2049 | Change (%) |

|---|---|---|---|

Research & Development (R&D) | $1.8 billion | $1.6 billion | +12.5% |

Market Share (Global Tech) | 18% | 16% | +2% |

Employee Satisfaction | 92% | 89% | +3% |

C. Market Trends and Industry Outlook

The tech industry is dynamic, with sustainability, ethical AI, and quantum computing driving innovation. Tech Innovators Inc. remains at the forefront of these trends, positioning ourselves to capitalize on emerging opportunities. Our continuous monitoring of market dynamics ensures that we stay ahead in the rapidly evolving tech landscape.

D. Risk Factors and Mitigation Strategies

Geopolitical tensions impacting supply chains are recognized as a potential risk. Our mitigation strategies, including diversified sourcing and strategic stockpiling, aim to safeguard against disruptions. Continuous monitoring of geopolitical developments allows us to adapt swiftly, ensuring operational resilience.

E. Financial Strategy

Our financial strategy is anchored in prudent capital allocation and sustainable growth. By maintaining a robust balance sheet, we are well-positioned to weather uncertainties and capitalize on strategic initiatives. Our approach ensures the responsible use of resources and maximizes shareholder value.

F. Capital Expenditures and Investments

Strategic investments totaling $4.5 billion underscore our commitment to future growth. Notably, the Quantum Computing Division received $2.5 billion for research, development, and infrastructure. Sustainable energy projects received $1.2 billion, furthering our commitment to environmental responsibility. Additionally, $800 million was allocated to AI in healthcare, driving innovation in medical technologies.

Investment Area | Amount (USD) | Purpose | Investment Area |

|---|---|---|---|

Quantum Computing | $2.5 billion | Research, development, and infrastructure | Quantum Computing |

Sustainable Energy | $1.2 billion | Expansion of renewable energy projects | Sustainable Energy |

AI in Healthcare | $800 million | Innovation in medical technologies | AI in Healthcare |

G. Operating Results

Our operating results reflect robust demand across all business segments. Improved operational efficiencies have resulted in enhanced margins, contributing to the overall financial success of Tech Innovators Inc. We continue to focus on optimizing operational processes to drive sustained profitability.

H. Liquidity and Capital Resources

Maintaining a strong liquidity position is a key focus for Tech Innovators Inc. With a healthy cash reserve of $5.2 billion and access to credit facilities, we ensure flexibility in pursuing growth opportunities and managing short-term financial needs. This approach fortifies our ability to navigate uncertainties and capitalize on strategic opportunities.

I. Future Plans and Initiatives

Looking ahead, our future plans include accelerating quantum computing research, expanding AI applications in healthcare, and achieving carbon neutrality by 2055. These initiatives align with our commitment to innovation, sustainability, and creating long-term value for our stakeholders.

V. Financial Statements

A. Income Statement

Revenue | 2050 | 2049 | Change (%) |

|---|---|---|---|

Product Sales | $6.2 billion | $5.5 billion | +12.7% |

Service Revenue | $2.8 billion | $2.2 billion | +27.3% |

Licensing and Royalties | $1.5 billion | $1.5 billion | 0% |

B. Balance Sheet

Assets | 2050 | 2049 |

|---|---|---|

Current Assets | $7.5 billion | $6.8 billion |

Property, Plant & Equipment | $5.2 billion | $4.6 billion |

Intangible Assets | $3.8 billion | $3.2 billion |

Total Assets | $16.5 billion | $14.6 billion |

Liabilities & Equity | 2050 | 2049 |

|---|---|---|

Current Liabilities | $3.2 billion | $2.9 billion |

Long-Term Debt | $2.5 billion | $2.2 billion |

Shareholders' Equity | $8.9 billion | $8.3 billion |

Total Liabilities | $16.5 billion | $14.6 billion |

C. Cash Flow Statement

Operating Activities | 2050 | 2049 |

|---|---|---|

Net Income | $2.8 billion | $2.4 billion |

Depreciation and Amortization | $1.1 billion | $900 million |

Changes in Working Capital | $600 million | $300 million |

Operating Cash Flow | $3.6 billion | $3.1 billion |

Net Increase in Cash | $900 million | $300 million |

Cash at End of Year | $2.9 billion | $2.2 billion |

Investing Activities | 2050 | 2049 |

|---|---|---|

Capital Expenditures | ($2.3 billion) | ($2.1 billion) |

Acquisitions and Investments | ($4.5 billion) | ($3.8 billion) |

Sale of Assets | $1.5 billion | $1 billion |

Net Cash from Investing | ($5.3 billion) | ($4.9 billion) |

Financing Activities | 2050 | 2049 |

|---|---|---|

Issuance of Debt | $1.2 billion | $1.5 billion |

Share Buybacks | ($800 million) | ($500 million) |

Dividends Paid | ($1 billion) | ($900 million) |

Net Cash from Financing | $600 million | $100 million |

Net Cash at Beginning of Year | $2 billion | $1.7 billion |

Cash at End of Year | $2.9 billion | $2.2 billion |

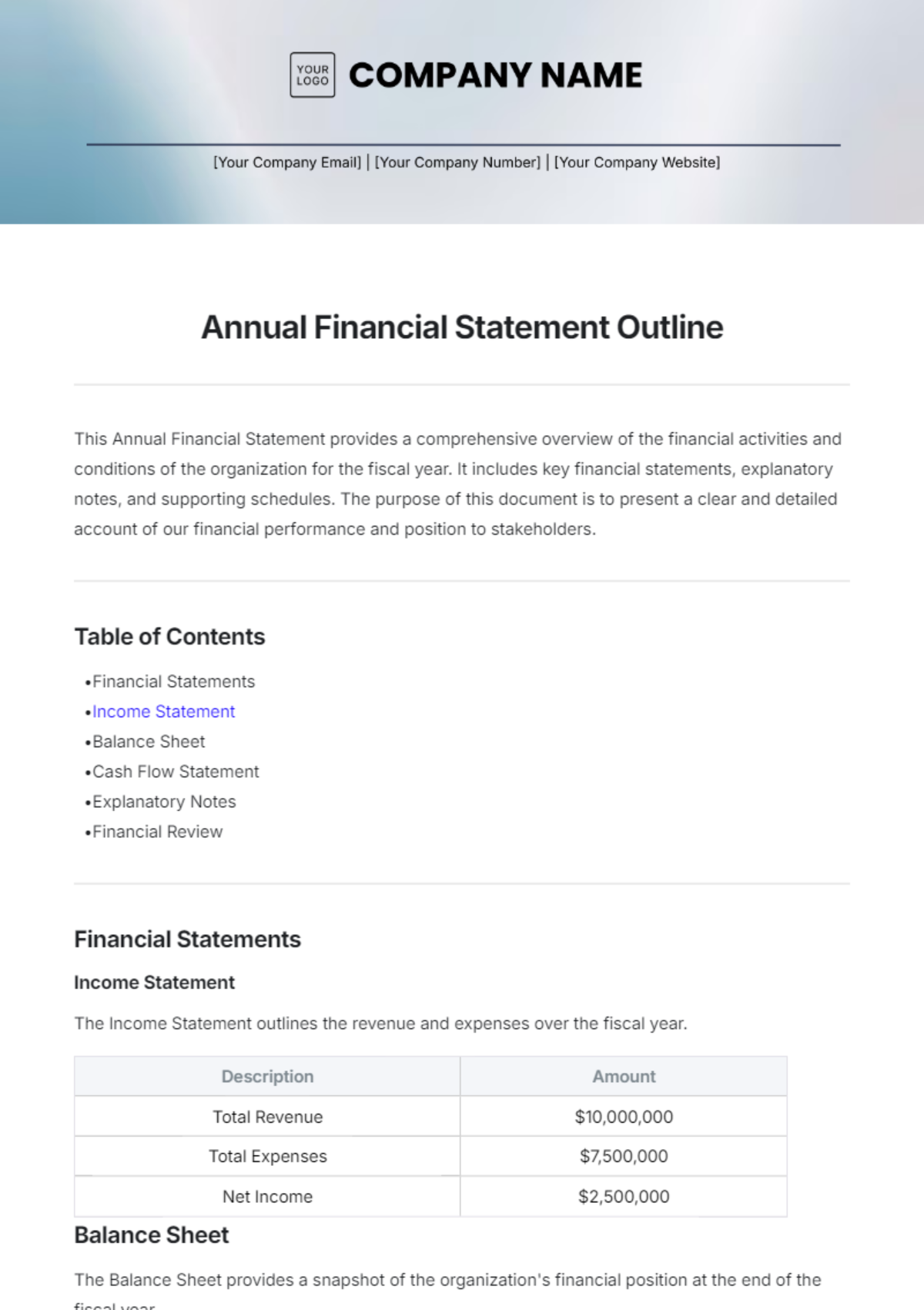

VI. Notes to the Financial Statements

A. Accounting Policies

Our accounting policies adhere to international financial reporting standards. Key policies include revenue recognition criteria, depreciation methods, and valuation of intangible assets. These policies ensure the consistency and transparency of our financial reporting.

B. Significant Accounting Estimates and Assumptions

The preparation of financial statements requires management to make estimates and assumptions. Significant areas include the valuation of goodwill, allowance for doubtful accounts, and useful lives of intangible assets. Changes in these estimates can impact reported financial results.

C. Contingencies and Commitments

We disclose material contingencies and commitments, including pending litigation, contractual obligations, and lease commitments. These are detailed in Note X of the financial statements, providing transparency regarding potential financial obligations.

VII. Auditor's Report

A. Independent Auditor's Opinion

In accordance with generally accepted auditing standards, our external auditors, [Audit Firm], have conducted a thorough examination of our financial statements. They have provided an unqualified opinion, affirming the accuracy and fairness of the presented financial information.

B. Auditor's Statement on Internal Controls

The external auditors have also evaluated our internal controls over financial reporting. Their statement affirms the effectiveness of our internal controls in safeguarding assets and ensuring the reliability of financial reporting.

VIII. Corporate Governance

A. Board of Directors

Our Board of Directors comprises seasoned professionals with diverse expertise. The board is committed to upholding the highest standards of corporate governance, fostering accountability, and promoting the long-term interests of shareholders.

B. Committees and Responsibilities

Our board committees, including the Audit Committee, Compensation Committee, and Nominating and Governance Committee, play crucial roles in overseeing specific aspects of corporate governance. These committees contribute to the integrity of our operations and decision-making processes.

C. Executive Compensation

Our executive compensation practices are designed to align with long-term shareholder value. Compensation packages include a mix of salary, bonuses, stock options, and performance-based incentives, ensuring alignment with our strategic objectives.

D. Code of Ethics and Corporate Values

Tech Innovators Inc. is guided by a comprehensive Code of Ethics that outlines our commitment to integrity, transparency, and ethical conduct. Our corporate values underpin every decision, fostering a culture of responsibility and accountability.

IX. Sustainability and Corporate Social Responsibility (CSR)

A. Environmental Initiatives

Tech Innovators Inc. remains committed to environmental responsibility. Our initiatives include energy-efficient operations, waste reduction programs, and investments in renewable energy projects. In 2050, we achieved a 20% reduction in our carbon footprint.

B. Social Impact Programs

We contribute to social well-being through various initiatives, including education programs, community development projects, and support for underprivileged communities. Our social impact programs aim to create a positive and lasting difference in the lives of people around the world.

C. Ethical Business Practices

Ethical business practices are integral to our corporate DNA. We uphold high standards of integrity, ensuring fair business dealings, and adherence to all applicable laws and regulations. Our commitment to ethical conduct extends across our global operations.

X. Investor Information

A. Shareholder Information

Tech Innovators Incorporated highly appreciates and values the contribution and role its shareholders play in propelling the company forward. Comprehensive information about pertinent matters such as dividend payment schedules and other related financial topics, schedule and details of meetings specifically for shareholders, and full contact information for our dedicated investor relations team can all be accessed readily on our official company website. We would like to express our sincere appreciation to our shareholders for their unwavering trust and unwithering support that they extend to our company.

B. Stock Performance

Our stock performance in 2050 reflects the company's strong financial performance and positive market sentiment. The interactive stock chart on our website provides a detailed overview of historical stock prices and performance metrics.

C. Dividends and Share Buybacks

Tech Innovators Inc. is committed to returning value to shareholders. In 2050, we paid dividends totaling $1 billion. Share buybacks amounted to $800 million, demonstrating our confidence in the company's future prospects.

XI. Risk Management

A. Identified Risks

The critical risks that we face encompass a broad range of issues including the consequences of geopolitical unrest that could affect the reliability of our supply chains, the evolution of technology and the potential disruptions it might lead to, as well as alterations in regulatory frameworks. To ensure that these risks do not significantly impede our operational efficacy and financial successes, a continuous surveillance system has been implemented. This system assesses the potential impact these risks might have on both the operations and financial performance aspects of our organization in real-time, allowing us to respond promptly and effectively.

B. Mitigation Strategies

Mitigation strategies include diversified sourcing to minimize supply chain risks, ongoing investment in technological resilience, and active engagement with regulators to stay ahead of changes. Our risk management framework is designed to proactively address potential challenges.