Free Annual Payroll Accounting Report

Date: [Month Day, Year]

Prepared By: [Your Name]

For: [Your Company Name]

Table of Contents

1. Executive Summary

2. Introduction

Purpose of the Report

Overview of Payroll System

3. Payroll Expense Analysis

A. Total Payroll Costs

B. Comparative Analysis

4. Compliance and Regulatory Overview

A. Tax Compliance

B. Regulatory Changes

5. Employee Data and Trends

A. Staffing Overview

B. Compensation Trends

6. Benefits and Deductions Analysis

A. Overview of Benefits

B. Deductions Analysis

7. Recommendations and Future Outlook

A. Improvements and Adjustments

B. Future Projections

8. Conclusion

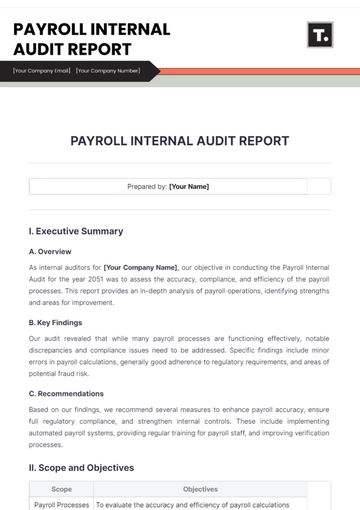

1. Executive Summary

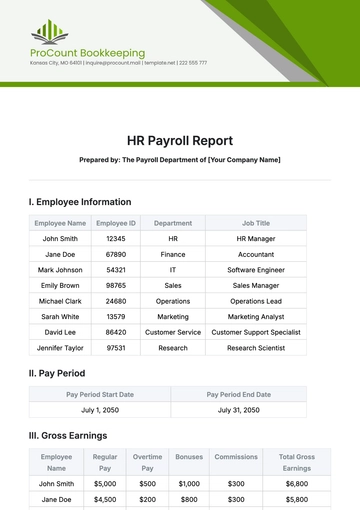

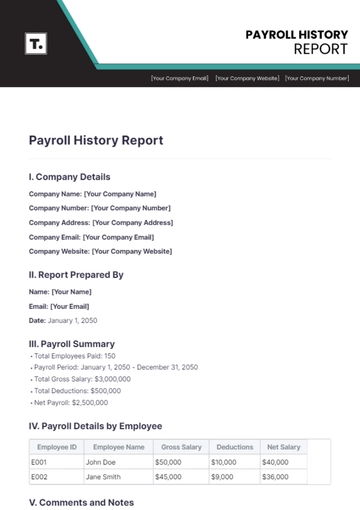

Overview of Report Objectives: This Annual Payroll Accounting Report for [Your Company Name] is meticulously designed to provide a professional and analytical review of the company's payroll activities over the past fiscal year. Its primary objective is to evaluate the financial integrity and compliance of the payroll system with regulatory standards. This report serves as a critical instrument for scrutinizing the efficiency and effectiveness of payroll management, thereby aiding in the strategic decision-making process for financial and human resource planning.

Key Findings: The analytical review of the fiscal year's payroll activities reveals a consistent trend in overall payroll expenses, marked by a nominal increase in benefits costs due to enhancements in employee welfare programs. The report highlights a noteworthy achievement in maintaining strict compliance with tax regulations, as evidenced by the absence of significant discrepancies in recent audits. This compliance underscores the effectiveness of our payroll system in adhering to complex legal requirements and demonstrates [Your Company Name]'s commitment to rigorous financial management. The stability observed in payroll expenditures reflects the company's adeptness in balancing financial efficiency with the commitment to employee compensation and benefits.

2. Introduction

Purpose of the Report

This Annual Payroll Accounting Report is crafted with a professional, analytical approach to comprehensively review [Your Company Name]'s payroll system over the previous fiscal year. It aims to dissect and evaluate the system's performance in terms of financial accuracy, efficiency, and compliance with regulatory standards. This detailed review is pivotal for ensuring that the payroll processes align with the company's financial policies, adhere to legal requirements, and meet the expectations of accuracy and reliability. The insights garnered from this report are crucial for enhancing payroll management and guiding strategic financial decisions.

Overview of Payroll System

At [Your Company Name], the payroll process is powered by a sophisticated cloud-based software system. This technological choice has significantly streamlined our payroll operations, facilitating efficient and accurate handling of employee compensation and deductions. The cloud-based system offers a range of advantages, including real-time data processing, scalability to accommodate company growth, and enhanced security features to protect sensitive financial information. Additionally, this system ensures seamless integration with other financial and HR management tools, contributing to a cohesive and efficient approach to payroll management. This overview sets the stage for understanding how the current system supports the company's payroll needs and where improvements can be targeted.

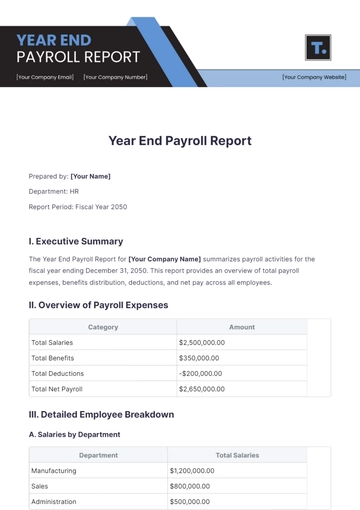

3. Payroll Expense Analysis

This section of the report provides a detailed breakdown of [Your Company Name]'s payroll expenses for the fiscal year. It not only outlines the total payroll costs but also compares them with the previous year's figures, offering vital insights into the trends and changes in our payroll expenditure.

A. Total Payroll Costs

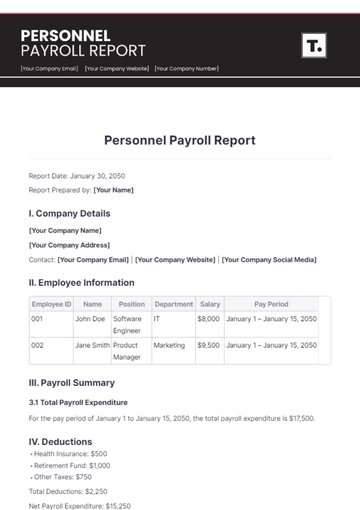

The total payroll expenditure for the year amounted to $4.5 million, with wages constituting 70%, bonuses 15%, and other earnings 15%.

Cost Category | Amount (USD) | Percentage of Total Payroll |

|---|---|---|

Wages | $3,150,000 | 70% |

Bonuses | $675,000 | 15% |

Other Earnings | $675,000 | 15% |

Total | $4,500,000 | 100% |

B. Comparative Analysis

Compared to the previous year, there has been a 5% increase in overall payroll costs, primarily due to salary increments and enhanced benefits.

Year | Total Payroll Costs (USD) | Percentage Change | Primary Factors for Change |

|---|---|---|---|

Previous Year | $4,285,000 | - | - |

Current Year | $4,500,000 | 5% | Salary increments, enhanced benefits |

The analysis of the payroll expenses reveals that the total cost for the current year amounted to $4.5 million, with the majority allocated to wages. The comparative analysis with the previous year indicates a 5% increase in total payroll costs. This increase is primarily attributed to salary increments and the enhancement of employee benefits, reflecting [Your Company Name]'s commitment to competitive compensation and employee welfare. This detailed financial breakdown is essential for understanding the allocation of payroll funds and guiding future budgeting and compensation strategies.

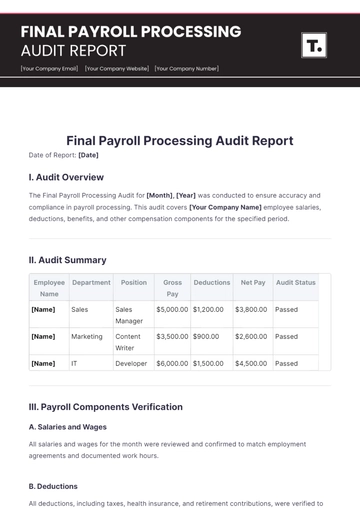

4. Compliance and Regulatory Overview

This section of the report presents a thorough overview of [Your Company Name]'s adherence to tax laws and regulatory standards in payroll processing. It reflects our commitment to maintaining compliance with evolving legal requirements and showcases our ability to adeptly manage changes in these regulations.

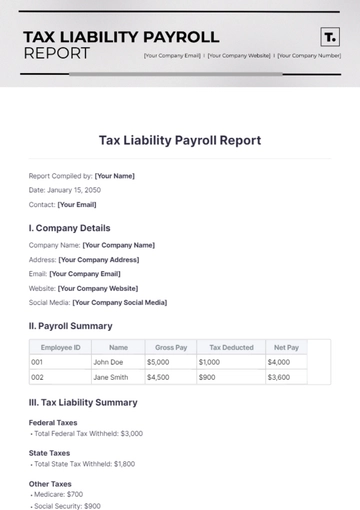

A. Tax Compliance

The payroll system remained fully compliant with all federal and state tax requirements, as evidenced by clean audits.

Compliance Aspect | Status | Details |

|---|---|---|

Federal Tax Requirements | Compliant | All federal tax liabilities accurately calculated and paid. Regular audits confirm adherence. |

State Tax Requirements | Compliant | Compliance with state-specific tax regulations across all operating locations. |

Local Tax Regulations | Compliant | Adherence to local tax ordinances where applicable. |

Payroll Audit Outcomes | Satisfactory | Recent audits have returned no significant issues. |

B. Regulatory Changes

Adaptations were made in response to new state tax regulations, with no significant challenges in implementation.

Regulatory Change | Implementation Status | Impact on Payroll System |

|---|---|---|

New State Tax Regulations | Successfully Implemented | Adjustments made to the payroll system to incorporate new state tax rates and rules with seamless integration. |

Updated Labor Laws | In Progress | Ongoing updates to comply with revised labor standards, including overtime and leave entitlements. |

The comprehensive analysis in this section underscores [Your Company Name]'s rigorous approach to ensuring tax compliance and efficiently managing regulatory changes. Our payroll system's capacity to seamlessly adapt to new tax regulations and updated labor laws demonstrates both the robustness of our payroll infrastructure and our proactive stance in staying ahead of regulatory shifts. This not only ensures legal compliance but also fortifies trust and reliability in our payroll operations.

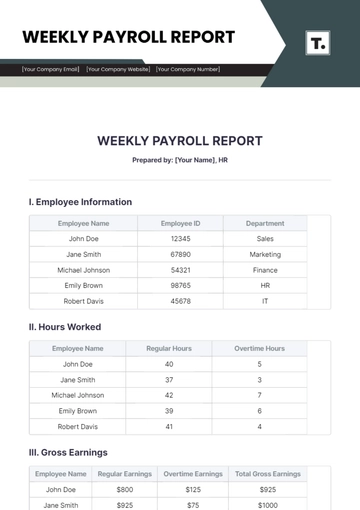

5. Employee Data and Trends

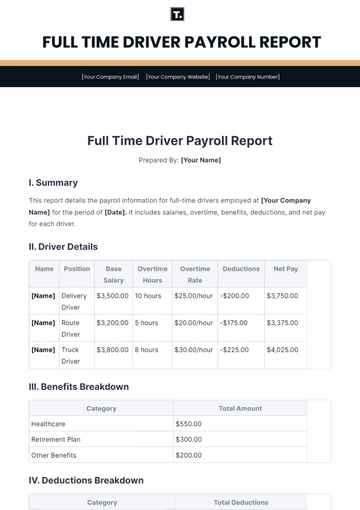

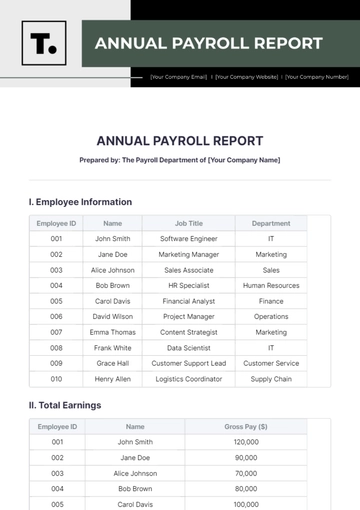

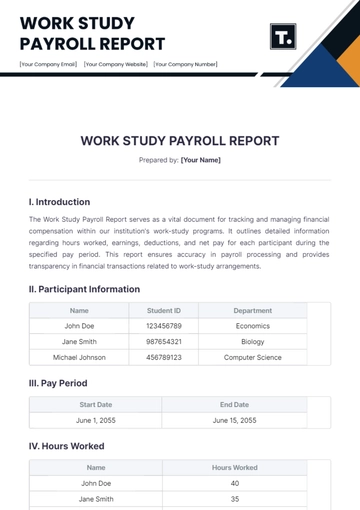

This section of the report delves into the staffing dynamics and compensation trends at [Your Company Name], providing essential insights into our workforce composition and the evolving nature of employee compensation. These metrics are crucial for understanding our human resource allocation and compensation strategies.

A. Staffing Overview

The total employee count stands at 300, with a turnover rate of 8%, reflecting a stable workforce.

Staffing Metric | Current Year | Previous Year | Change (%) |

|---|---|---|---|

Total Employee Count | 300 | 290 | +3.4% |

New Hires | 45 | 40 | +12.5% |

Employee Separations | 24 | 30 | -20% |

Turnover Rate | 8% | 10% | -2% |

Average Tenure (Years) | 4.5 | 4.3 | +4.7% |

Note: The company maintains a stable workforce with a moderate increase in total employees and a decrease in turnover rate.

B. Compensation Trends

Compensation Metric | Current Year | Previous Year | Change (%) |

|---|---|---|---|

Average Salary (USD) | $50,000 | $48,000 | +4.2% |

Performance-Based Bonuses Paid | $1.5M | $1.2M | +25% |

Overtime Payments | $300,000 | $250,000 | +20% |

Benefits Expenditure | $2.5M | $2.3M | +8.7% |

Note: There is a significant increase in performance-based bonuses, indicating a shift towards meritocratic reward systems.

The data presented in this section highlights [Your Company Name]'s commitment to maintaining a stable and skilled workforce. The company has seen a slight increase in the total number of employees, coupled with a reduced turnover rate, indicating effective retention strategies. In terms of compensation, there is a notable shift towards performance-based rewards, emphasizing the company's focus on recognizing and rewarding employee contributions. This trend aligns with the company's strategic objective of fostering a performance-driven culture while ensuring competitive compensation for our employees.

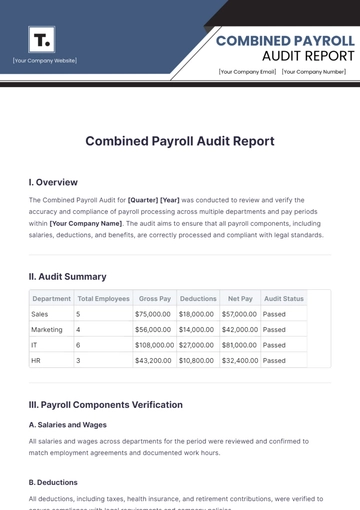

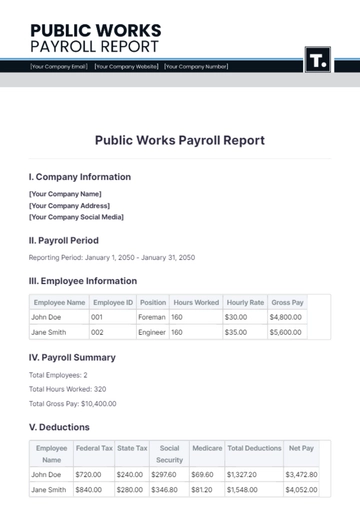

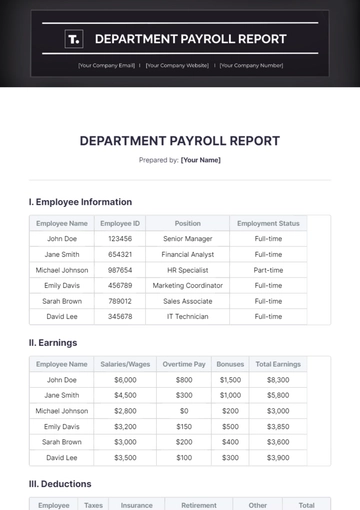

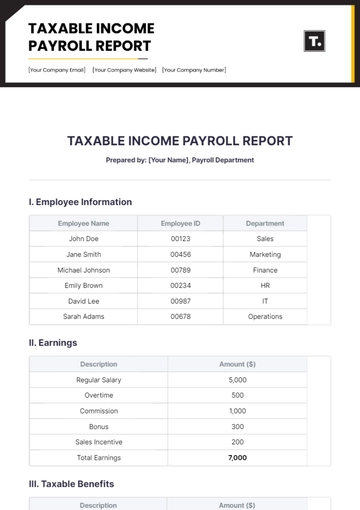

6. Benefits and Deductions Analysis

In this section, we present an in-depth analysis of the benefits and deductions associated with [Your Company Name]'s payroll system. The report breaks down the total expenditure on employee benefits and provides a detailed assessment of the various payroll deductions. This analysis is crucial for understanding the company's investment in employee welfare and the management of mandatory and voluntary deductions from employees' salaries.

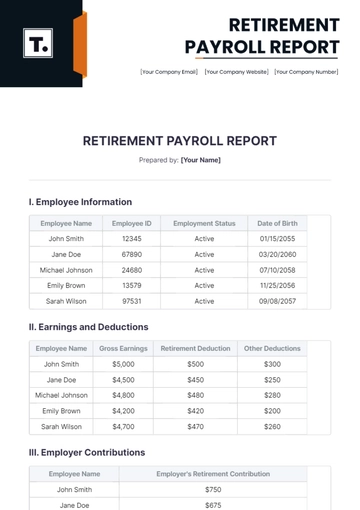

A. Overview of Benefits

Benefit Type | Expenditure (USD) | Percentage of Total Benefits | Change from Previous Year |

|---|---|---|---|

Health Insurance | $1,500,000 | 50% | +12% |

Retirement Contributions | $750,000 | 25% | +8% |

Employee Wellness Programs | $300,000 | 10% | +15% |

Other Benefits (e.g., Life Insurance) | $450,000 | 15% | +5% |

Total Benefits | $3,000,000 | 100% | +10% |

Note: The total benefits expenditure increased by 10%, primarily driven by enhanced health insurance coverage and investment in employee wellness programs.

B. Deductions Analysis

Standard deductions like taxes and 401(k) contributions remained consistent, while voluntary health and wellness program deductions rose by 5%.

Deduction Type | Amount Deducted (USD) | Percentage of Total Deductions | Change from Previous Year |

|---|---|---|---|

Federal and State Taxes | $2,000,000 | 40% | Consistent |

Social Security and Medicare | $1,200,000 | 24% | Consistent |

401(k) Contributions | $800,000 | 16% | Consistent |

Health & Wellness Programs | $500,000 | 10% | +5% |

Other Voluntary Deductions | $500,000 | 10% | +3% |

Total Deductions | $5,000,000 | 100% |

Note: While standard deductions like taxes and 401(k) contributions remained consistent, there was a noticeable increase in deductions for voluntary health and wellness programs.

This comprehensive breakdown of benefits and deductions at [Your Company Name] highlights the company's significant investment in employee health and well-being. The increase in benefits expenditure reflects our commitment to providing comprehensive coverage and support to our workforce. The deductions analysis shows a stable trend in standard deductions, with a growing employee interest in voluntary wellness programs, aligning with our focus on promoting a healthy work-life balance.

7. Recommendations and Future Outlook

This section outlines strategic recommendations for enhancing [Your Company Name]'s payroll system and provides a forward-looking perspective on future payroll trends and expectations. The aim is to position the payroll system for improved efficiency and adaptability in response to projected changes in the business environment.

A. Improvements and Adjustments

Advanced Automation in Data Entry: Implementing state-of-the-art automation technology will significantly reduce manual input in payroll processes. This includes adopting Optical Character Recognition (OCR) for data extraction from timesheets and leveraging Robotic Process Automation (RPA) to automate routine payroll tasks. These technologies aim to minimize human error and optimize processing time, leading to more efficient payroll cycles.

Enhanced Analytics for Payroll Forecasting: Developing sophisticated analytics capabilities involves integrating advanced software tools capable of deep data analysis. These tools will provide insights into payroll spending patterns, enabling more accurate budgeting and resource allocation. Predictive analytics can forecast future payroll costs based on variables like hiring trends, salary increments, and statutory changes.

Sophisticated Error Detection and Correction: Introducing enhanced error detection algorithms and real-time correction mechanisms will improve payroll accuracy. This can involve AI-powered auditing tools that continuously scan for discrepancies and irregularities, offering immediate corrective suggestions.

AI-Driven Tools for Predictive Analysis: Exploring AI-driven tools for payroll management can revolutionize decision-making processes. AI can predict the impact of various payroll decisions, simulate different scenarios, and provide recommendations based on historical data and current trends.

Strengthened Employee Training Programs: Enhancing training programs to focus on new payroll system features and updates in compliance will empower the payroll team. Regular training sessions on the latest software functionalities and legal updates will ensure the team is proficient and up-to-date.

B. Future Projections

Increase in Payroll Expenses: As [Your Company Name] expands its workforce, a proportional increase in payroll expenses is anticipated. This includes not only salaries and wages but also associated benefits and taxes. Strategic planning for this increase is essential to maintain budgetary balance.

Preparation for Regulatory Changes: The payroll department must stay vigilant about changes in tax laws and labor regulations. Proactive planning and system adaptability are key to managing these changes without disrupting payroll operations.

Additional Payroll Resources: With the projected increase in workload, there will be a need to expand the payroll team. This may involve hiring more staff or investing in further training for current employees to handle complex payroll tasks and compliance requirements efficiently.

Advancements in Payroll Technology: The future of payroll processing in [Your Company Name] will likely be shaped by technological advancements. Cloud-based payroll systems offer more flexibility and scalability, while AI integration can bring efficiency and precision. Staying ahead in adopting these technologies will be crucial for the company’s payroll operations.

By addressing these improvement areas and preparing for future projections, [Your Company Name] can ensure its payroll system is not only efficient and compliant today but also ready to adapt and thrive in the evolving business landscape.

8. Conclusion

This Annual Payroll Accounting Report for [Your Company Name] has meticulously detailed the current state of our payroll system, providing a comprehensive overview of its performance, compliance, and efficiency. The insights garnered from this analysis are invaluable, revealing both the strengths and areas where strategic improvements are necessary. Our key findings indicate a stable and compliant system, yet highlight opportunities for technological advancements and process optimizations.

The implementation of advanced automation and enhanced analytics capabilities emerges as a critical need, aiming to reduce manual errors and optimize payroll processing. The introduction of AI-driven tools and sophisticated error detection mechanisms promises not only improved accuracy but also a more proactive approach in payroll management. Furthermore, the strengthening of employee training programs is essential to maintain a knowledgeable and adaptable payroll team, equipped to handle evolving system features and compliance requirements.

Looking forward, the projected increase in payroll expenses aligned with staff expansion, and potential regulatory changes necessitates proactive planning and budgeting. The need for additional resources to manage this increased workload is evident, as is the importance of staying abreast with technological advancements in payroll processing. By embracing cloud-based solutions and AI integration, [Your Company Name] can significantly enhance its payroll system's efficiency and adaptability.

In conclusion, this report serves as a roadmap for [Your Company Name] to not only fortify the current payroll system but also to strategically evolve it to meet future challenges and opportunities. By addressing the identified areas for improvement and staying attuned to emerging trends and technologies, we can ensure a payroll system that is efficient, compliant, and robust - a system capable of supporting the company's growth and the well-being of its workforce.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial reporting with Template.net's Annual Payroll Accounting Report. This editable, customizable tool makes payroll management easy and efficient. Immediately accessible in our AI Editor Tool, it's perfect for any business size. Enhance your organization's productivity and maintain meticulous records with this essential tool. Upgrade your payroll today.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report