Yearly Benefits Utilization Report HR Layout

Prepared by: [Your Name]

Company: [Your Company Name] Date: [Insert Date]

Executive Summary

In this comprehensive Yearly Benefits Utilization Report, we delve into the utilization and effectiveness of [Your Company Name]'s employee benefits programs throughout the year 2050. This analysis serves as a vital tool for shaping our benefits strategy and ensuring our employees receive the support they need to thrive both personally and professionally.

Benefits Overview

Health Benefits

Employee Enrollment

Enrollment Growth: The primary observation is the growth in enrollment. The Year 2050 shows a clear increase in the number of employees choosing to enroll in the medical insurance program compared to the previous year.

Positive Trend: An upward trend in enrollment indicates that more employees are recognizing the value and importance of medical insurance coverage offered by the company.

Benefits Appreciation: The increase in enrollment suggests that employees have a positive perception of the medical insurance benefits provided by [Your Company Name]. It is likely that they view the coverage as valuable and relevant to their healthcare needs.

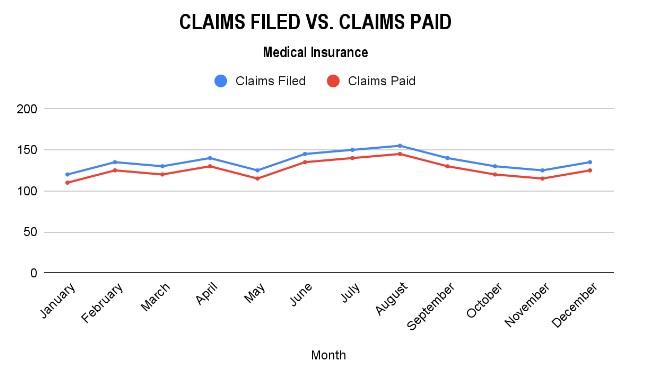

Claims filed vs. Claims Paid

Seasonal Trends: The chart shows monthly variations in both Claims Filed and Claims Paid. This indicates that the utilization of medical insurance is subject to seasonal trends and may be influenced by factors such as weather, holidays, or employee health patterns.

Claims Filed: The line representing Claims Filed fluctuates throughout the year, with the highest number of claims filed in August (155) and the lowest in November (125). These fluctuations suggest that there are months when employees require more medical services, potentially due to factors like seasonal illnesses or routine check-ups.

Claims Paid: The line representing Claims Paid generally follows the same pattern as Claims Filed but lags slightly behind. This lag is typical in insurance processes as claims need to be processed and approved before payments are made. The highest number of claims paid occurs in August (145), while the lowest is in November (115).

Efficiency: The gap between Claims Filed and Claims Paid represents the efficiency of the claims processing system. A smaller gap indicates a quicker turnaround time in processing claims and reimbursing employees for medical expenses. Conversely, a larger gap may suggest delays in processing.

Consistency: Despite the monthly fluctuations, the chart shows a consistent pattern of Claims Filed being slightly higher than Claims Paid. This is expected in any insurance program, as some claims may be pending processing at the end of the reporting period.

Retirement Benefits

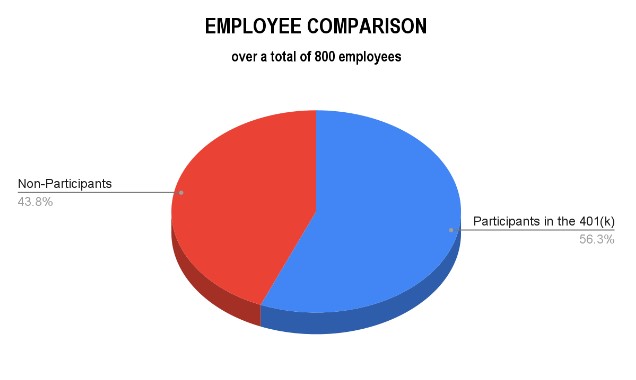

Total Employees: In the year 2050, there were a total of 800 employees in the organization.

Participants in 401(k) Plan: Among these 800 employees, 450 chose to participate in the 401(k) plan. This means that 450 employees made contributions to their retirement savings through the company's 401(k) plan.

Non-Participants: On the other hand, 350 employees did not participate in the 401(k) plan. These employees did not make contributions to the 401(k) plan during the specified period.

Interpreting this chart, it's evident that a significant portion of the workforce, 56.25% of employees (450 out of 800), actively engaged in saving for their retirement through the 401(k) plan, while 43.75% (350 out of 800) chose not to participate in this retirement savings program during the specified year.

Total Contributions

Steady Growth: There is a consistent and upward trajectory in contributions over the ten-year period. This steady growth demonstrates the company's dedication to helping employees secure their financial future.

Compound Effect: The contributions show a cumulative effect, with each year's contributions building upon the previous year's. This suggests that employees are increasingly recognizing the importance of long-term savings.

Positive Employee Participation: The sustained growth implies that a significant number of employees are actively participating in the 401(k) plan. It reflects their commitment to financial preparedness for retirement.

Company Support: The company's willingness to match or contribute to employees' 401(k) accounts is likely contributing to this positive trend. It's a strong indicator of [Company Name]'s commitment to employee well-being.

Future Financial Security: As contributions continue to rise, employees are positioning themselves for a more secure retirement future. The growth trend suggests that they understand the value of long-term savings and are taking action to achieve their financial goals.

Leave Benefits

Vacation Leave

Increasing Trend: There is a trend in the consistent increase in both "Total Days Granted" and "Total Days Utilized" over the five-year period. This suggests that employees are being granted more vacation days, possibly in response to their growing needs or as part of a company initiative to promote work-life balance.

Utilization Efficiency: While the total days granted are increasing, the "Total Days Utilized" also shows a positive trend. This indicates that employees are effectively using their vacation leave, which aligns with the company's goals of encouraging time off for rejuvenation and personal well-being.

Consistency: The gap between "Total Days Granted" and "Total Days Utilized" remains relatively consistent, indicating that the organization maintains a steady rate of leave utilization. This consistency suggests that the company's leave policies and employees' ability to take time off are in equilibrium.

Opportunities for Communication: It also highlights opportunities for HR and management to communicate the importance of utilizing vacation leave. Encouraging employees to take advantage of their allotted time off can contribute to improved work-life balance and overall well-being.

Sick Leave

This report stresses that the total sick leave days granted have been gradually increasing over the five-year period. In [20xx], approximately 5,000 sick leave days were granted, and by [20xx], this number had risen to around 5,600 days.

The utilization of sick leave days, represented by the orange bars, also increased over the same period. In [20xx], employees utilized around 3,500 sick leave days, and by [20xx], this had increased to approximately 4,400 days.

It is also demonstrated that, on average, the organization is granting more sick leave days each year than employees are utilizing. This indicates that employees are not fully using their allocated sick leave days, and there may be an opportunity to review the sick leave policy to align it more closely with actual utilization.

The increasing trend in both sick leave days granted and utilized suggests that sick leave is being effectively managed within the organization, and employees are taking advantage of the benefit when needed.

The utilization rate (utilized days divided by granted days) can also be calculated for each year to assess how effectively sick leave is being used. This rate can help HR and management ensure that employees are taking the leave they need for health reasons while avoiding unnecessary absenteeism.

Other benefits

Tuition Reimbursement

Total Applicants: We received applications from 80 employees seeking tuition reimbursement.

Total Approved Applications: 60 applications were approved, emphasizing our support for employee growth and development.

Total Reimbursement: We disbursed $120,000 in tuition reimbursement, investing in our employees' continued education.

Wellness Programs

Total Participants: 400 employees actively participated in our wellness programs.

Total Events Conducted: We conducted 40 wellness events to promote employee well-being.

Total Wellness Points Earned: Participants earned 8,000 wellness points, reflecting a strong engagement with our wellness initiatives.

Recommendation

Based on the analysis and insights, we recommend the following actions to further enhance our benefits programs:

401(k) Plan Promotion: Continue promoting the 401(k) plan to encourage more employees to participate in retirement savings and ensure financial preparedness for the future. Consider organizing retirement planning workshops or providing personalized financial counseling to empower employees to make informed decisions about their retirement.

Wellness Program Expansion: Explore opportunities to expand wellness programs based on their popularity among employees, contributing to a healthier and more engaged workforce. Consider introducing new wellness initiatives, such as mental health support services, fitness challenges, or nutritional guidance, to cater to diverse employee wellness needs.

Communication Enhancements: Enhance communication strategies to keep employees well-informed about their benefits options, plan changes, and utilization tips. Consider implementing a regular benefits newsletter, interactive webinars, or a dedicated benefits information portal to ensure employees have easy access to essential benefits information.

Vacation Leave Management: Maintain the positive trend of vacation leave utilization by promoting the importance of work-life balance and timely leave planning. Encourage managers to proactively support their team members in taking well-deserved vacations and fostering a healthier workplace culture.

Tuition Reimbursement Awareness: Increase awareness of the tuition reimbursement program by regularly communicating its benefits and eligibility criteria. Host information sessions or provide online resources to guide employees through the application process and showcase the long-term career growth opportunities it offers.

Feedback Collection: Continue to gather feedback from employees regarding benefits preferences and suggestions for improvement. Conduct periodic surveys or focus groups to ensure that our benefits offerings align with employees' evolving needs and expectations.

Conclusion

This Yearly Benefits Utilization Report underscores our commitment to delivering meaningful and effective benefits programs to [Your Company Name]'s valued workforce. By diligently analyzing the utilization data and considering the recommendations provided, we aim to enhance the employee experience, reinforce our support for their well-being, and ensure that our benefits offerings remain competitive and responsive to changing needs.

We appreciate the dedication and hard work of our employees, and this report serves as a testament to our commitment to their financial security, health, and overall satisfaction. [Your Company Name] remains steadfast in its mission to provide exceptional benefits that contribute to a motivated, engaged, and thriving workforce. For any questions, further analysis, or the implementation of recommended actions, please contact our HR department.