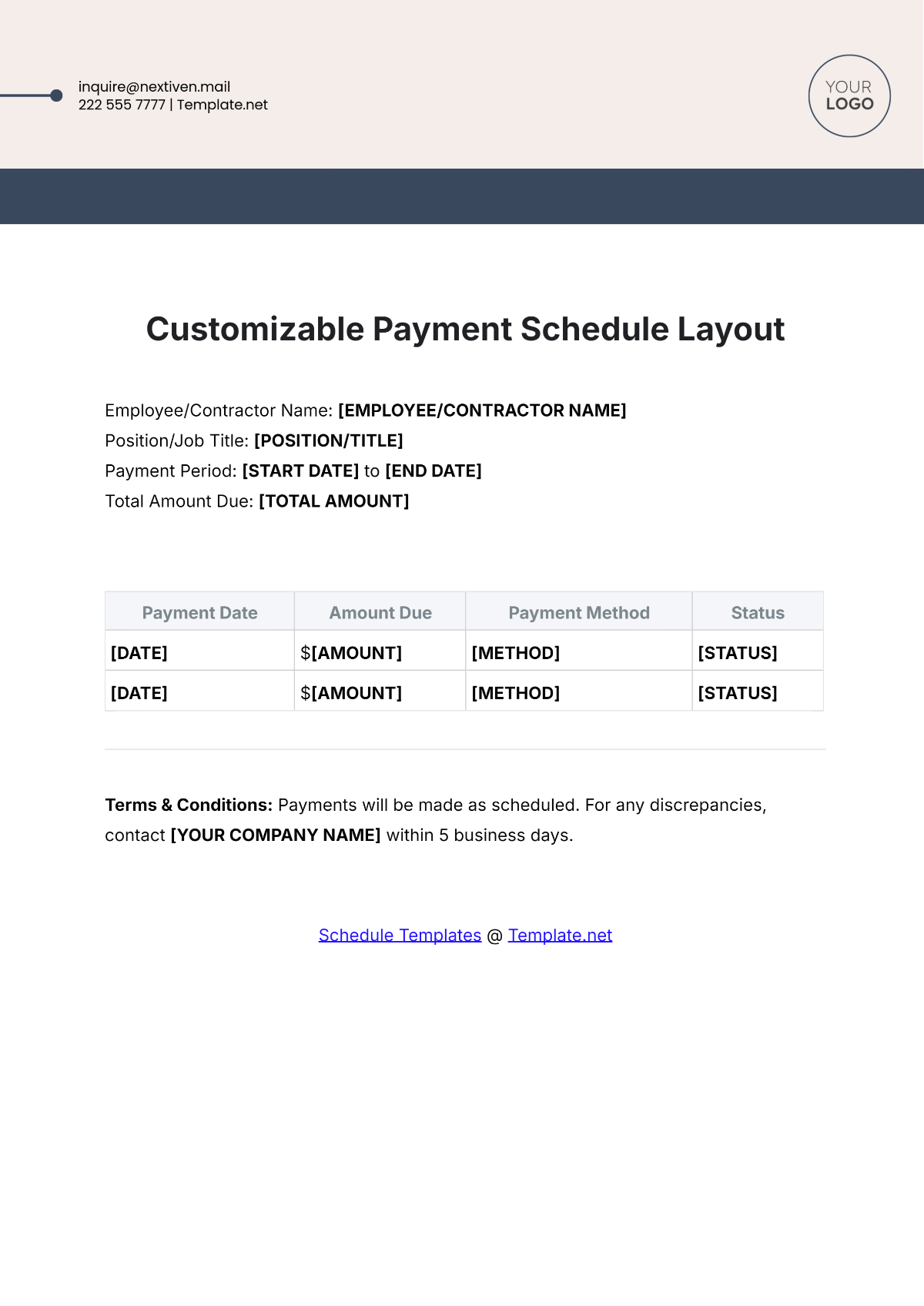

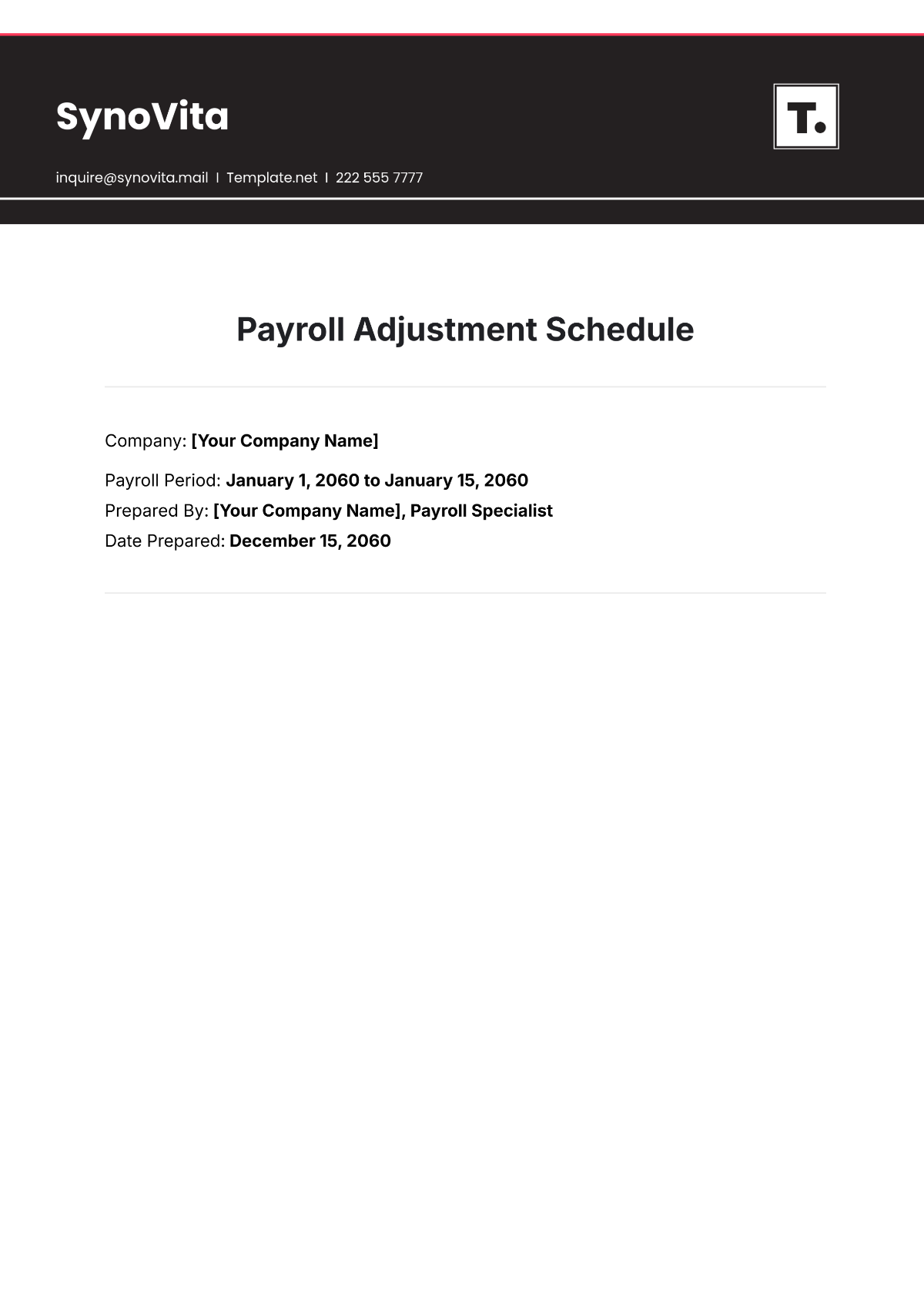

Recurring Payment Schedule

This schedule outlines the recurring payment plan for salaries and wages to ensure timely and regular employee compensation.

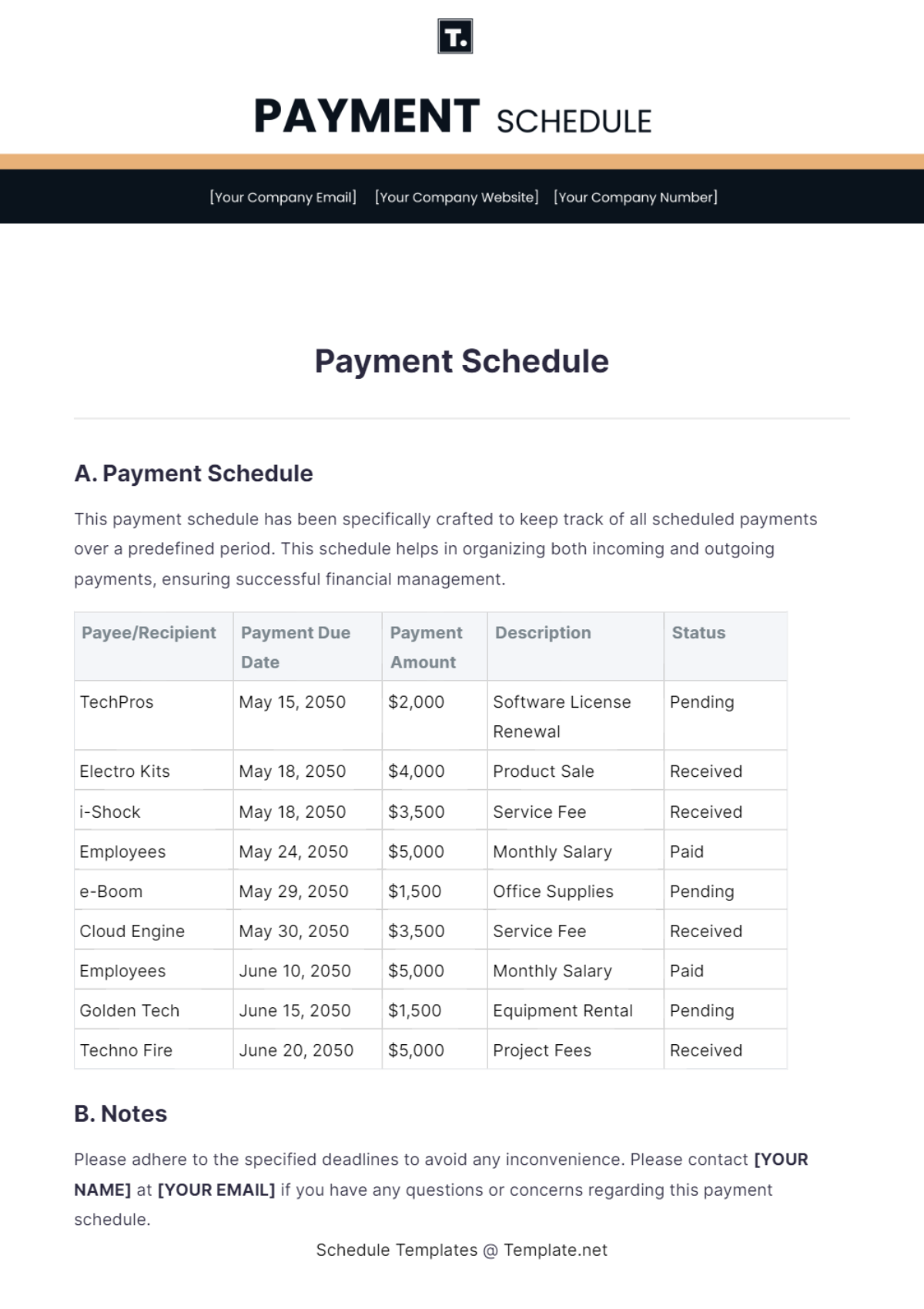

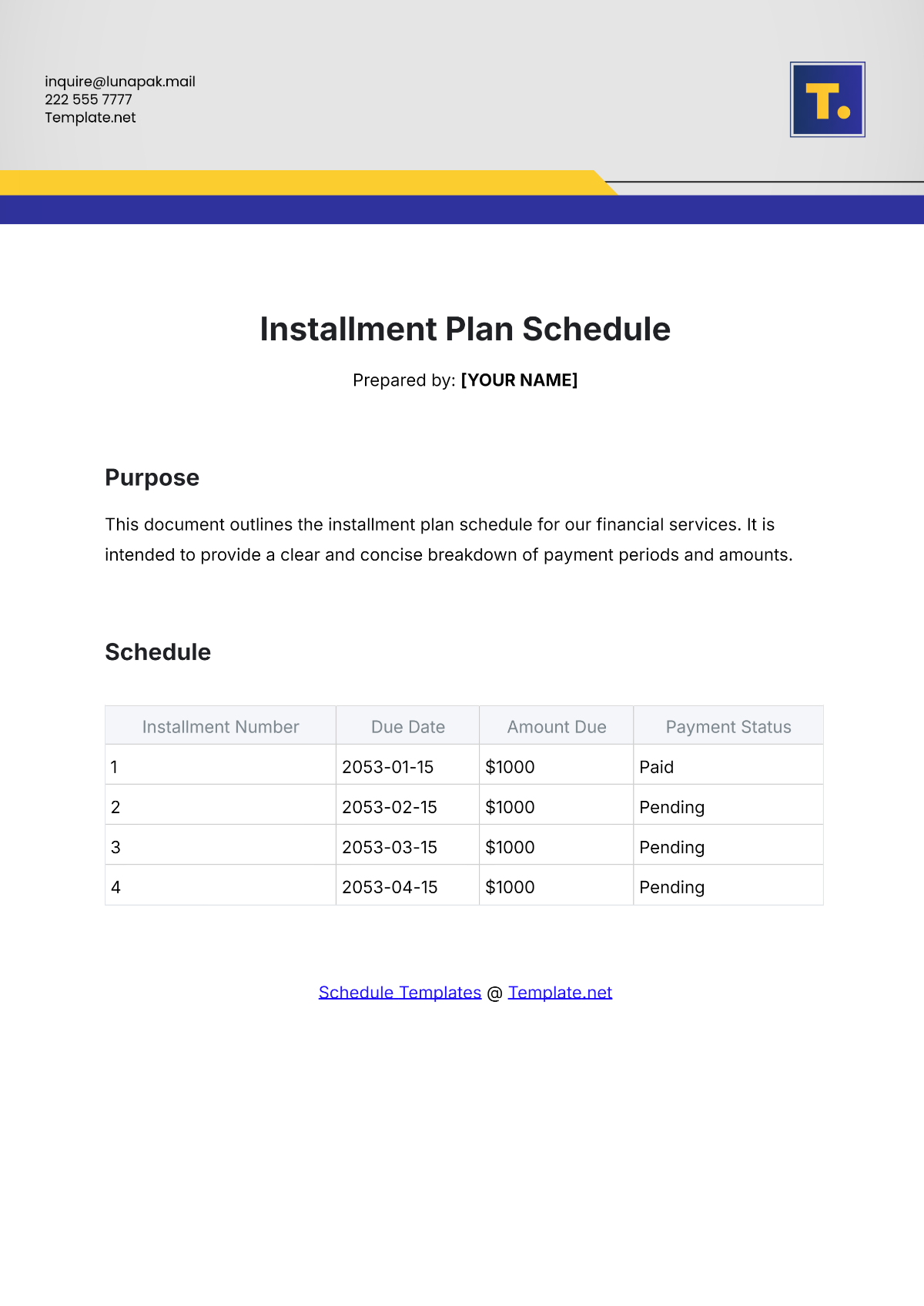

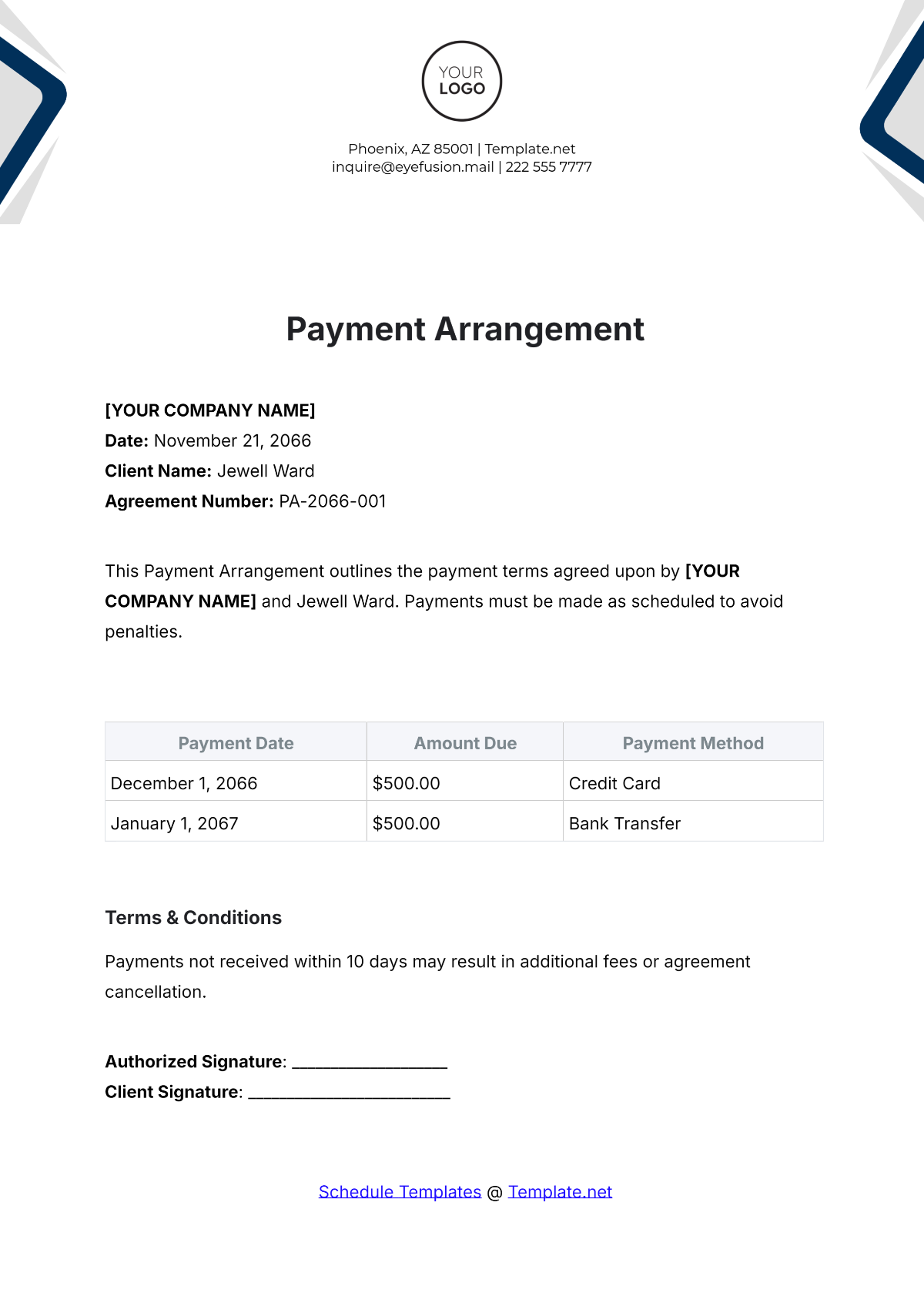

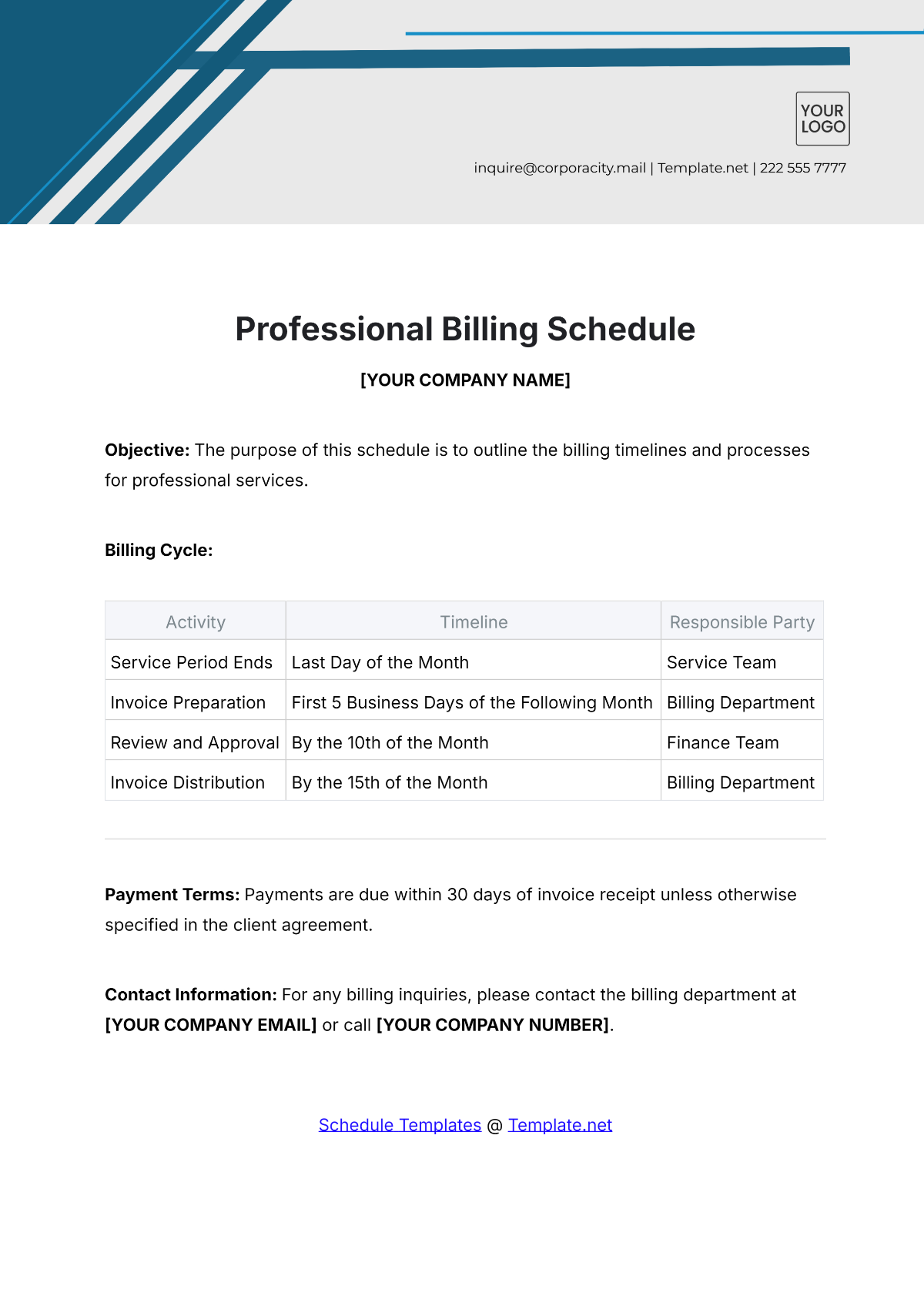

Date | Employee Name | Position | Salary | Deductions | Net Payment |

|---|---|---|---|---|---|

2050-03-01 | John Doe | Marketing | $4,000 | $500 | $3,500 |

2050-03-01 | Jane Smith | Sales | $3,500 | $450 | $3,050 |

2050-03-01 | Michael Brown | Operations | $3,800 | $480 | $3,320 |

2050-03-01 | Emily Johnson | Finance | $4,200 | $550 | $3,650 |

Note/Comments:

Deductions include taxes, insurance premiums, and any other applicable withholdings.

Ensure all payments are processed through the designated payroll system to maintain accuracy and compliance.

Double-check employee information to prevent errors in payment distribution.

Prepared by: [YOUR NAME]