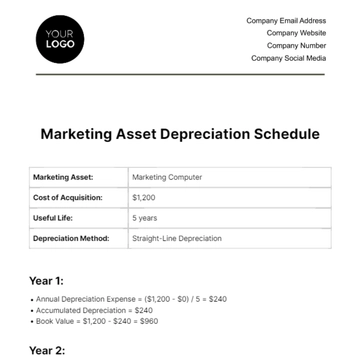

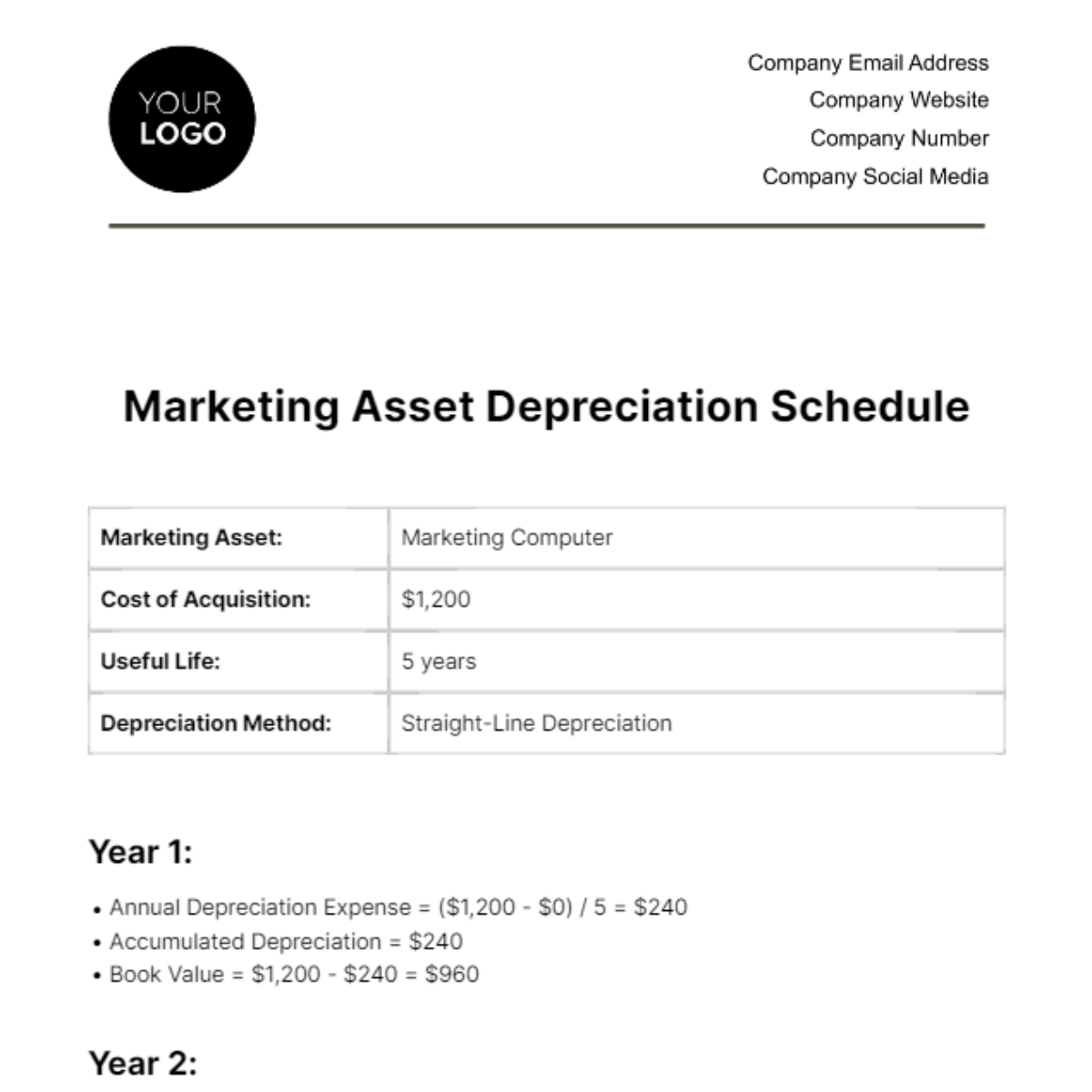

Free Marketing Asset Depreciation Schedule

Marketing Asset: | Marketing Computer |

Cost of Acquisition: | $1,200 |

Useful Life: | 5 years |

Depreciation Method: | Straight-Line Depreciation |

Year 1:

Annual Depreciation Expense = ($1,200 - $0) / 5 = $240

Accumulated Depreciation = $240

Book Value = $1,200 - $240 = $960

Year 2:

Annual Depreciation Expense = ($1,200 - $0) / 5 = $240

Accumulated Depreciation = $240 + $240 = $480

Book Value = $1,200 - $480 = $720

Year 3:

Annual Depreciation Expense = ($1,200 - $0) / 5 = $240

Accumulated Depreciation = $480 + $240 = $720

Book Value = $1,200 - $720 = $480

Year 4:

Annual Depreciation Expense = ($1,200 - $0) / 5 = $240

Accumulated Depreciation = $720 + $240 = $960

Book Value = $1,200 - $960 = $240

Year 5:

Annual Depreciation Expense = ($1,200 - $0) / 5 = $240

Accumulated Depreciation = $960 + $240 = $1,200

Book Value = $1,200 - $1,200 = $0

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate solution for managing your marketing assets' depreciation effortlessly with Template.net's Marketing Asset Depreciation Schedule Template. This editable and customizable template, equipped with an AI Editor Tool, streamlines tracking processes. Effectively manage asset values, predict replacements, and optimize investments. Maximize efficiency and accuracy in financial planning with this innovative tool from Template.net.

You may also like

- Schedule Appointment

- Work Schedule

- Weekly Schedule

- Cleaning Schedule

- Payment Schedule

- School Schedule

- Maintenance Schedule

- Daily Schedule

- Class Schedule

- Workout Schedule

- Event Schedule

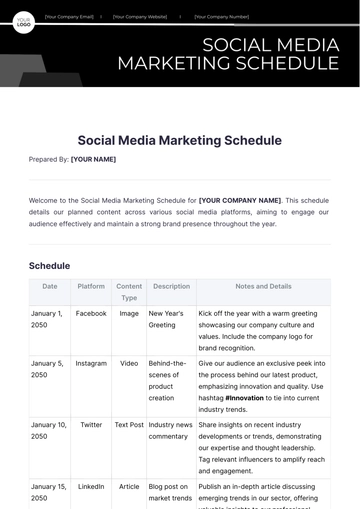

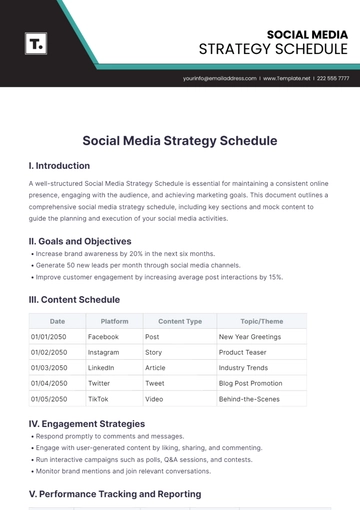

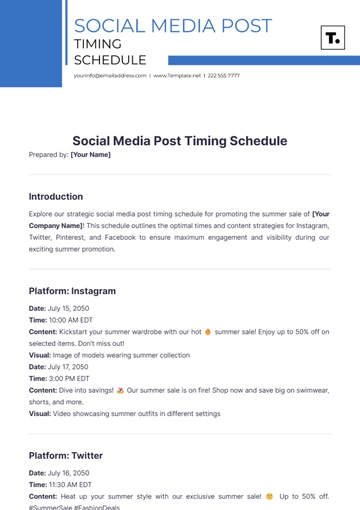

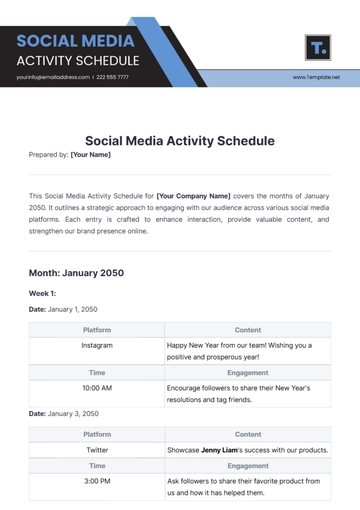

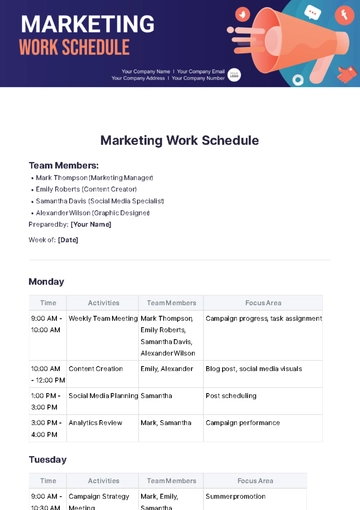

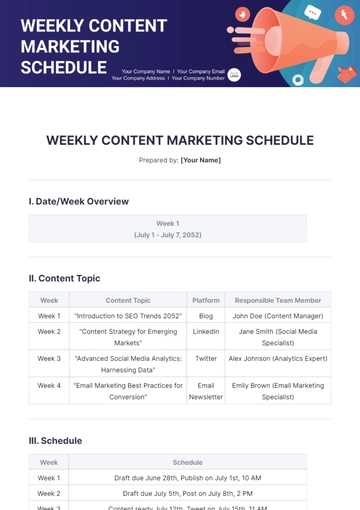

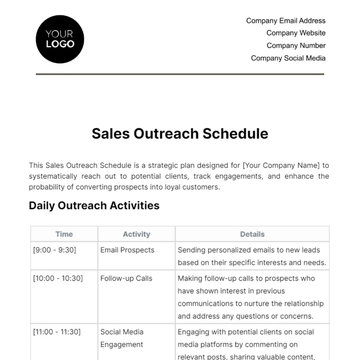

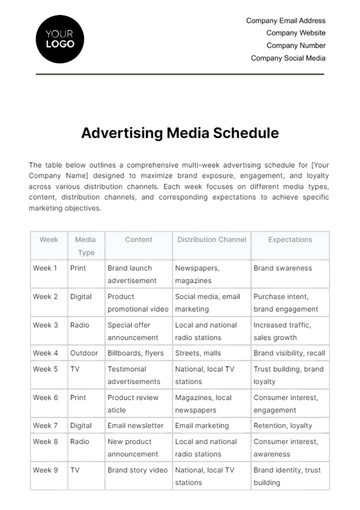

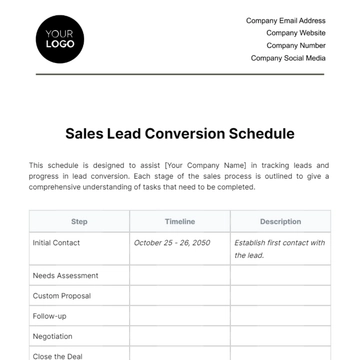

- Marketing Schedule

- Weekly Cleaning Schedule

- Work From Home Schedule

- Payroll Schedule

- Restaurant Schedule

- Kitchen Cleaning Schedule

- Schedule of Values

- Hourly Schedule

- Study Schedule

- University Schedule

- Construction Schedule

- Preventive Maintenance Schedule

- Fitness Schedule

- Education Schedule

- Training Schedule

- Agency Schedule

- Panel Schedule

- Monthly Schedule

- Nursing Home Schedule

- Project Schedule

- Real Estate Schedule

- Freelancer Schedule

- Medication Schedule

- IT and Software Schedule

- Interior Design Schedule

- Travel Schedule

- Travel Agency Schedule

- Hotel Schedule

- Wedding Schedule

- Camp Schedule