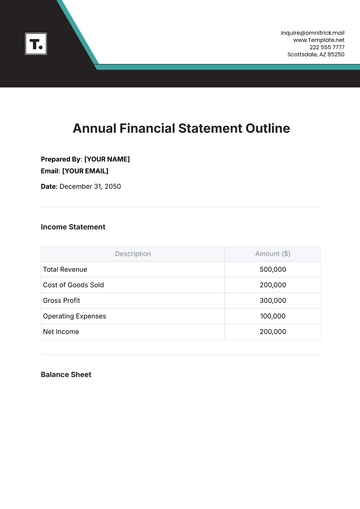

Free Detailed Annual Financial Report

Introduction

This Annual Financial Report for the year [2051], encapsulates our financial performance and demonstrates our commitment to sustainable growth, corporate responsibility, and innovative leadership in the global market. The year was marked by significant milestones in our strategic initiatives, including substantial advancements in technology, expansion into new markets, and notable achievements in our sustainability and CSR endeavors. This report provides an overview of our financial health, strategic investments, and our unwavering commitment to ethical business practices and community development.

Executive Summary

The fiscal year [2051] stands as a landmark year in our company's history, characterized by unprecedented financial growth and strategic achievements. We not only surpassed our financial targets but also strengthened our market position amidst challenging economic conditions.

Key Financial Metrics:

Operating Income: Grew by [20]% to reach [$3 Billion], reflecting our operational efficiency.

Net Profit Margin: Improved to [18%], up from [16%] in [2050], indicating strong profitability.

Earnings Per Share (EPS): Increased to [$5.50], compared to [$4.75] in the previous year, showcasing enhanced shareholder value.

Strategic Initiatives and Achievements

Market Expansion: Successfully entered new markets in [Asia and South America], contributing to a [25%] increase in international sales.

Product Innovation: Launched three new products, each becoming a market leader in its category.

Revenue Analysis

Product Line Performance

Our revenue streams are diversified across multiple product lines, each contributing significantly to our overall financial success.

Product Revenue Breakdown:

Product | Revenue | Percentage of Total Revenue |

[Product A] | [$4,000,000,000] | [40%] |

[Product B] | [$3,000,000,000] | [30%] |

[Product C] | [$2,000,000,000] | [20%] |

[Product D] | [$1,000,000,000] | [10%] |

Product A remains our flagship offering, with a [10%] increase in sales, primarily driven by technological advancements and enhanced marketing strategies.

Geographical Revenue Distribution

Our global footprint has expanded significantly, with notable growth in emerging markets. The following table illustrates our revenue distribution by region:

Region | Revenue ($Billion) | Percentage of Total Revenue |

[North America] | [$4,500,000,000] | [45%] |

[Europe] | [$3,000,000,000] | [30%] |

[Asia-Pacific] | [$2,000,000,000] | [20%] |

[Rest of the World] | [$5,000,000,000] | [5%] |

[North America] continues to be our largest market, but the [Asia-Pacific] region showed the most substantial growth rate of [35%] compared to the previous year.

Revenue Growth Analysis

The year [2051] witnessed strategic shifts in our revenue sources. Key factors contributing to this growth include:

Innovation-Driven Sales: Introduction of cutting-edge features in our product lines resulted in a [15%] increase in sales.

Strategic Partnerships: Collaborations with major distributors in Europe and Asia-Pacific led to a broader market reach.

Customer Loyalty Programs: Enhanced customer engagement strategies resulted in a [20%] increase in repeat customers.

Future Revenue Projections

Looking ahead to [2052], we project a continued upward trajectory in revenue, aiming for a [12%] increase, with particular focus on expanding our digital services and further penetrating emerging markets.

Expense Analysis

Major Expenditure Categories

Our financial strategy has been to optimize expenses while investing in areas crucial for long-term growth. The primary categories of our expenses for 2051 are as follows:

Expenditure Breakdown:

Research and Development (R&D): [$1.5 Billion], representing [15%] of our total revenue. This investment was mainly directed towards innovation in our product lines and technology upgrades.

Marketing and Sales: [$800 Million], accounting for [8%] of total revenue. This included global advertising campaigns and digital marketing initiatives.

Operational Expenses: [$1.2 Billion], constituting [12%] of our revenue. This includes costs related to production, logistics, and general administration.

Expense Optimization Efforts:

AI-Driven Operational Efficiency: We implemented AI solutions in our supply chain, reducing logistics costs by [10%].

Renegotiation of Supplier Contracts: Achieved a [5%] reduction in procurement costs through strategic renegotiations.

Streamlining of Workforce: Improved operational efficiency through workforce restructuring, resulting in a [7%] reduction in administrative expenses.

Cost Comparison with Previous Year

Compared to [2050], our overall expenses increased by [8%]. However, this increase is proportionally lower than the revenue growth, indicating improved expense management.

Capital Structure and Financial Position

Debt and Equity Analysis

Our capital structure has been strategically managed to balance growth with financial stability. Key aspects of our capital structure for [2051] include:

Debt and Equity Metrics:

Total Debt: [$2 Billion], a decrease from [$2.5 Billion] in [2050]. The reduction is primarily due to our focus on debt repayment and improved cash flows.

Equity: [$5 Billion], increased from [$4.5 Billion], reflecting our retained earnings and a successful equity issuance to fund expansion plans.

Debt-to-Equity Ratio: Improved to [0.4], down from [0.6] in [2050], demonstrating our stronger financial position and lower leverage.

Liquidity and Solvency

Our liquidity ratios indicate a strong position to meet short-term obligations, while our solvency ratios show a healthy long-term financial state.

Key Liquidity and Solvency Ratios:

Current Ratio: [1.8], indicating sufficient assets to cover current liabilities.

Quick Ratio: [1.5], a measure of our ability to meet short-term obligations without selling inventory.

Interest Coverage Ratio: [6.0], showing our capability to cover interest expenses with earnings before interest and taxes (EBIT).

Future Capital Structure Goals

For [2052], we aim to further reduce our debt levels and improve our equity base to support our expansion and innovation strategies. Our targets include lowering the debt-to-equity ratio to [0.3] and maintaining a current ratio above [1.5].

Investment and Future Growth Plans

Key Investments

In [2051], our strategic investments were primarily focused on areas that promise long-term growth and innovation. The major investments included:

Technology Upgrades: We allocated [$500 Million] towards upgrading our technology infrastructure, particularly in the areas of artificial intelligence, machine learning, and data analytics.

Expansion into New Markets: An investment of [$750 Million] was made to enter and establish our presence in emerging markets in [Africa and Southeast Asia], with a focus on adapting our products to local needs.

Projected Growth Trends

Our future growth plans are grounded in a blend of market expansion, product innovation, and customer-centric approaches. The key growth projections for [2052] are:

Revenue: Anticipated to grow by [12%], reaching approximately $11.5 Billion.

Market Share: Expected to increase by [5%] in new markets, with a strong focus on customer acquisition and retention strategies.

Innovation: Launch of at least two new products, aimed at emerging technological trends.

Long-Term Growth Strategy

Our long-term strategy focuses on sustainable growth through diversification and continuous innovation. This includes expanding our digital offerings and exploring new business models like service-as-a-product.

Risk Management and Mitigation Strategies

Identified Risks

The primary risks identified for our business include economic fluctuations, technological disruptions, and regulatory changes. Each of these poses potential challenges to our operations and strategic goals.

Mitigation Strategies

To counter these risks, we have developed and implemented the following strategies:

Economic Fluctuations: We have diversified our investment portfolio and established a reserve fund to cushion against economic downturns. This approach helps in maintaining operational stability during unpredictable economic cycles.

Technological Disruptions: Our ongoing investment in R&D is aimed at staying ahead of technological advancements. Additionally, we regularly update our IT infrastructure to mitigate cybersecurity risks.

Regulatory Changes: We maintain a proactive approach to regulatory compliance. This includes having a dedicated legal team that monitors changes in regulations globally and ensures company-wide compliance.

Risk Monitoring and Evaluation

An integral part of our risk management strategy is continuous monitoring and evaluation. We utilize a combination of internal audits and external consultants to regularly assess our risk landscape and adjust our strategies accordingly.

Sustainability and Corporate Social Responsibility (CSR)

Environmental Initiatives

We made significant strides in our commitment to environmental sustainability. Key initiatives included:

Carbon Footprint Reduction: Successfully reduced our carbon emissions by [30%] through the adoption of renewable energy sources and improved energy efficiency in our operations.

Sustainable Sourcing: Over [60%] of our raw materials were sourced from sustainable and certified suppliers.

Waste Management: Implemented a zero-waste policy in our manufacturing units, achieving a [95%] recycling rate.

Community Engagement

Our CSR efforts were focused on creating a positive impact in the communities we operate in:

Education and Skill Development: Launched ['Future Skills Program'] to provide technical and vocational training to over [10,000] individuals in underprivileged regions.

Healthcare Initiatives: Partnered with [NGOs] to improve healthcare facilities and access in rural areas, benefiting approximately [50,000] people.

Local Community Support: Invested [$10 Million] in community development projects, including infrastructure improvements and small business support.

CSR Performance Metrics

To measure the impact of our CSR initiatives, we established the following metrics:

People Impacted: Over [60,000] beneficiaries across various programs.

Investment in CSR: [$25 Million], representing [2.5%] of our net profits.

Employee Volunteer Hours: [20,000] hours contributed by our staff in community service.

Corporate Governance

Board Composition and Oversight

Our board of directors plays a critical role in guiding the company towards its strategic objectives while ensuring accountability and ethical practices.

Diversity and Expertise: The board comprises [12] members, with a diverse mix of expertise in finance, technology, and global business practices.

Regular Training and Assessment: Board members undergo annual training on corporate governance, risk management, and regulatory compliance.

Ethical Standards and Compliance

We uphold the highest standards of integrity and ethical conduct in all our business dealings.

Code of Conduct: A comprehensive code of conduct is in place, outlining expected behaviors and ethical practices for all employees.

Compliance Audits: Regular internal and external audits are conducted to ensure adherence to legal and regulatory standards.

Whistleblower Policy: A robust whistleblower policy encourages employees to report any unethical practices without fear of retaliation.

Conclusion

The fiscal year [2051] stands as a testament to our resilience, strategic foresight, and dedication to excellence. Despite facing a complex and changing business environment, our company has not only achieved remarkable financial success but has also made significant strides in corporate responsibility and sustainable development. We are poised for continued growth and innovation. Our robust financial foundation, combined with our commitment to ethical practices and societal contributions, positions us at the forefront of our industry. This report underscores our journey thus far and illuminates the path for our ambitious vision ahead.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Detailed Annual Financial Report Template, the comprehensive solution for businesses to analyze and present financial performance. Fully customizable and editable in our Ai Editor Tool, this template empowers users to tailor reports to their specific needs. Streamline financial analysis and reporting processes with ease, ensuring accuracy and clarity in annual financial presentations. Simplify financial reporting with our user-friendly platform.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report