Payroll Summary Report

Prepared by: [Your Name]

Date: October 29, 2050

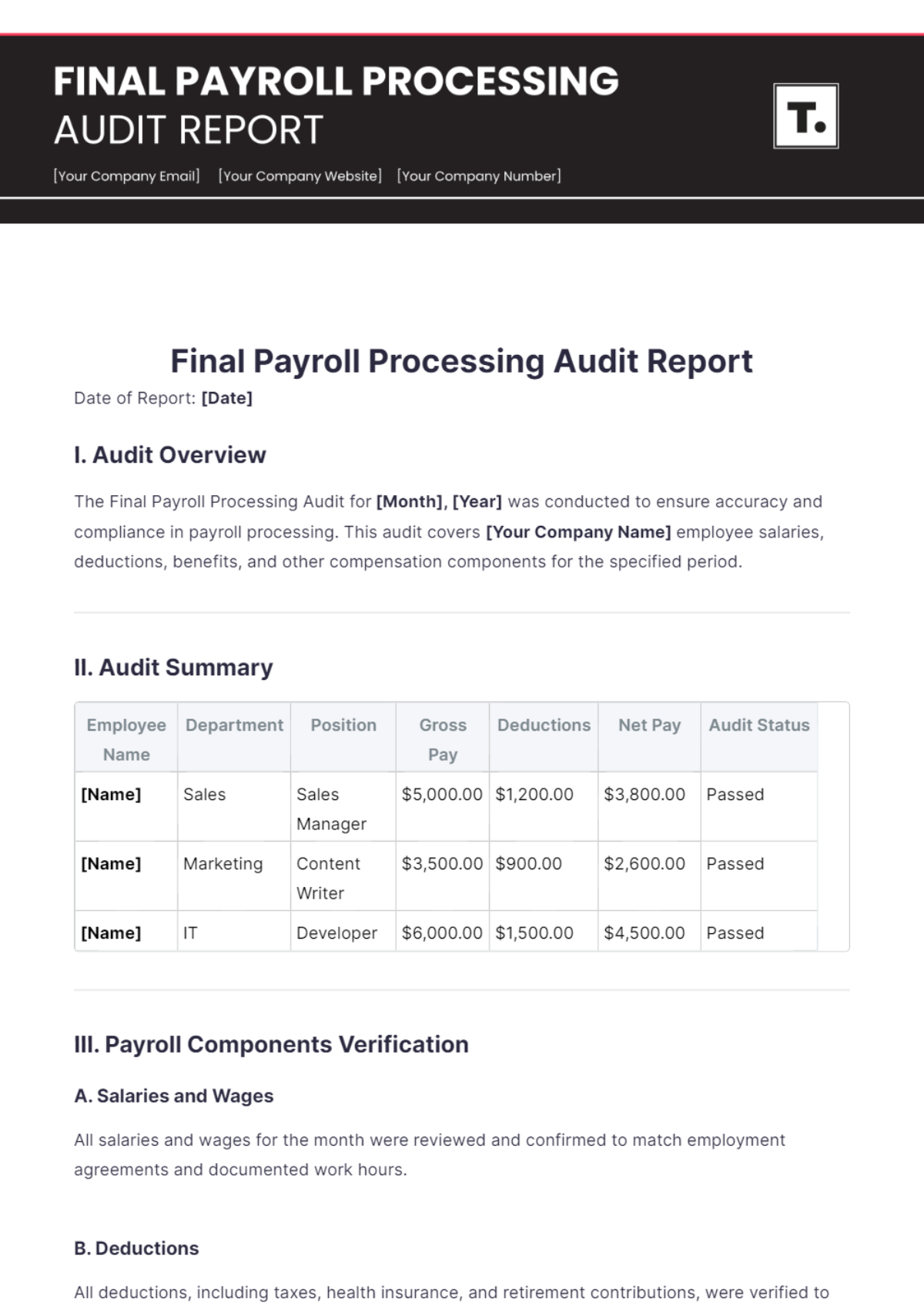

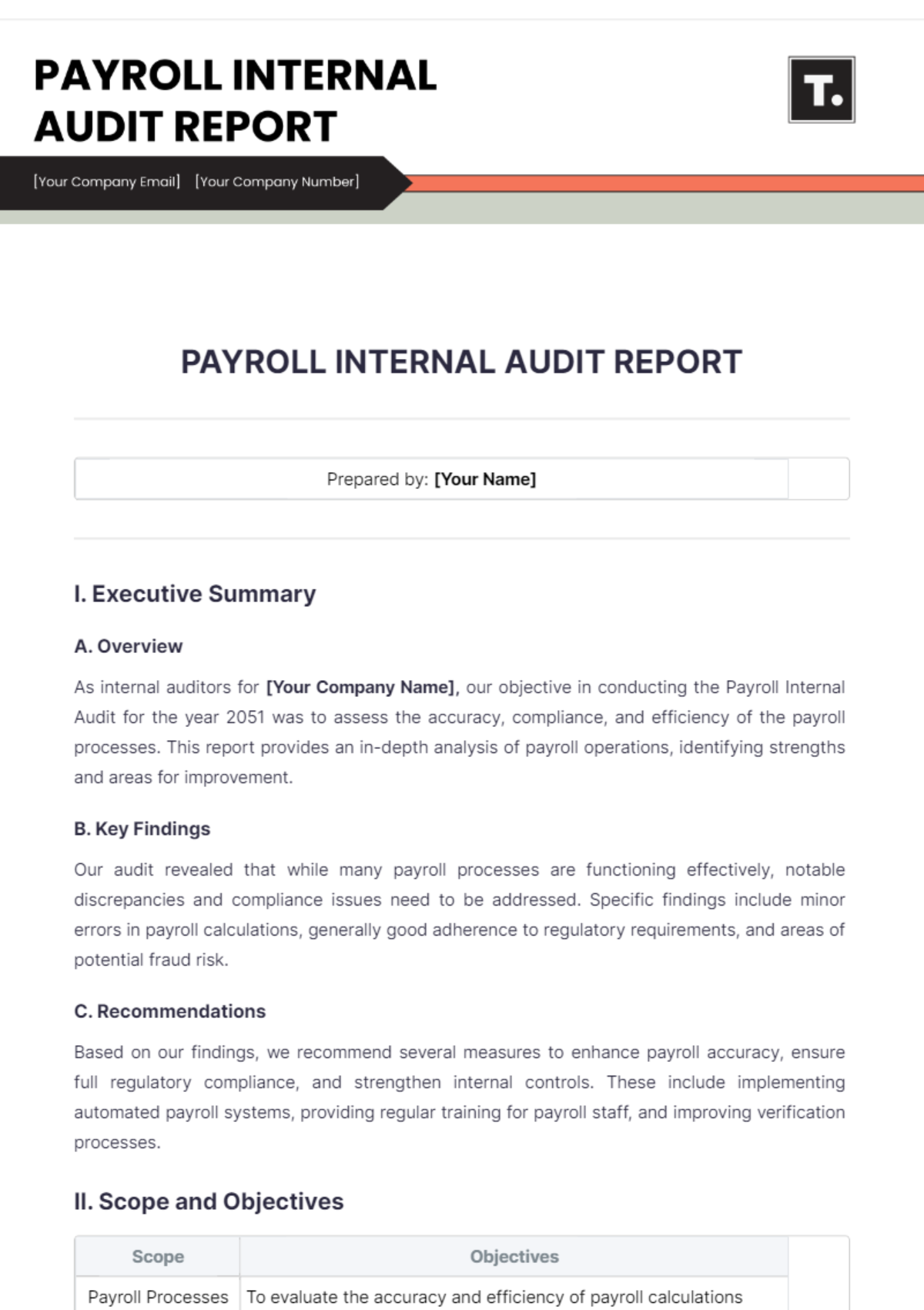

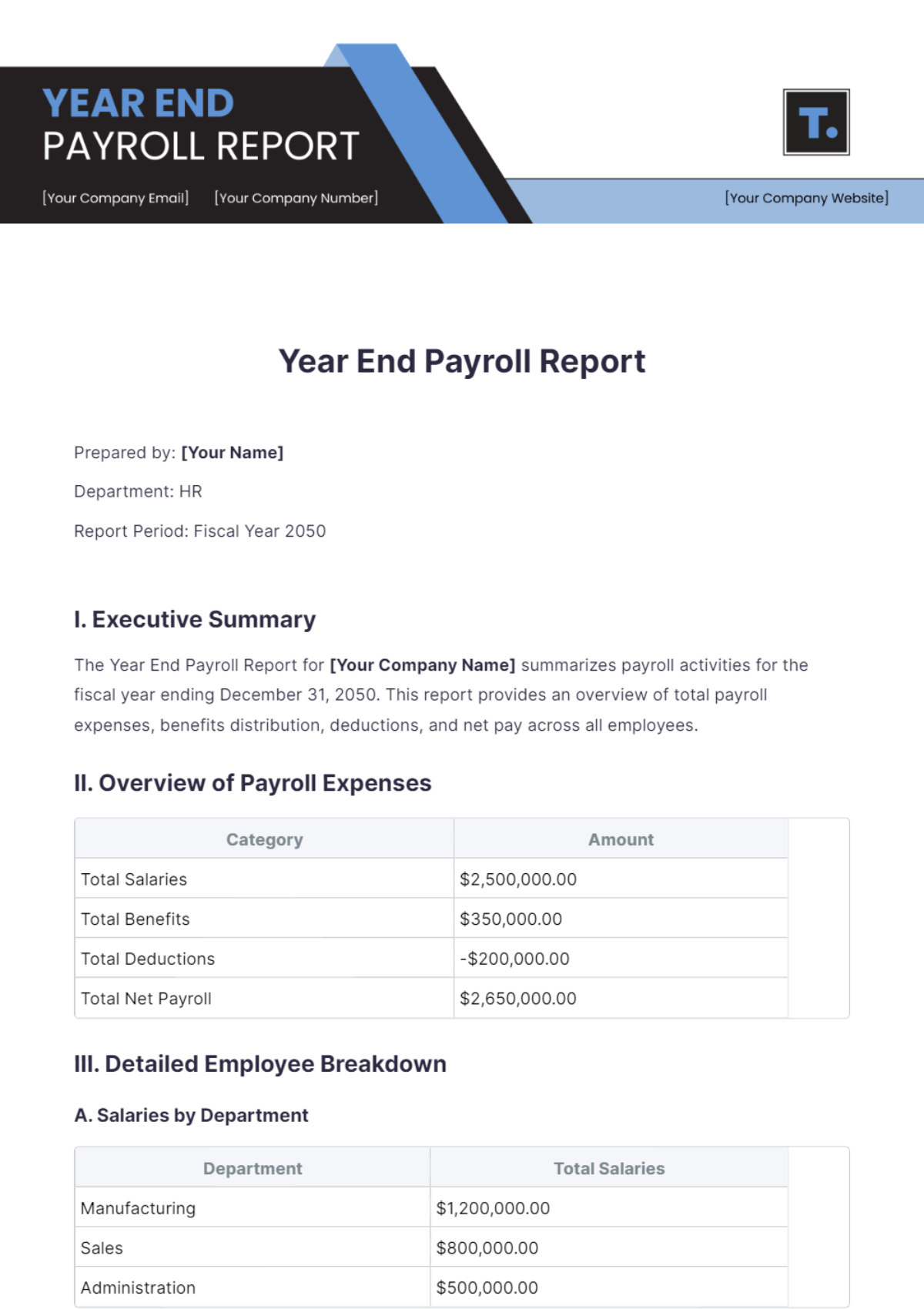

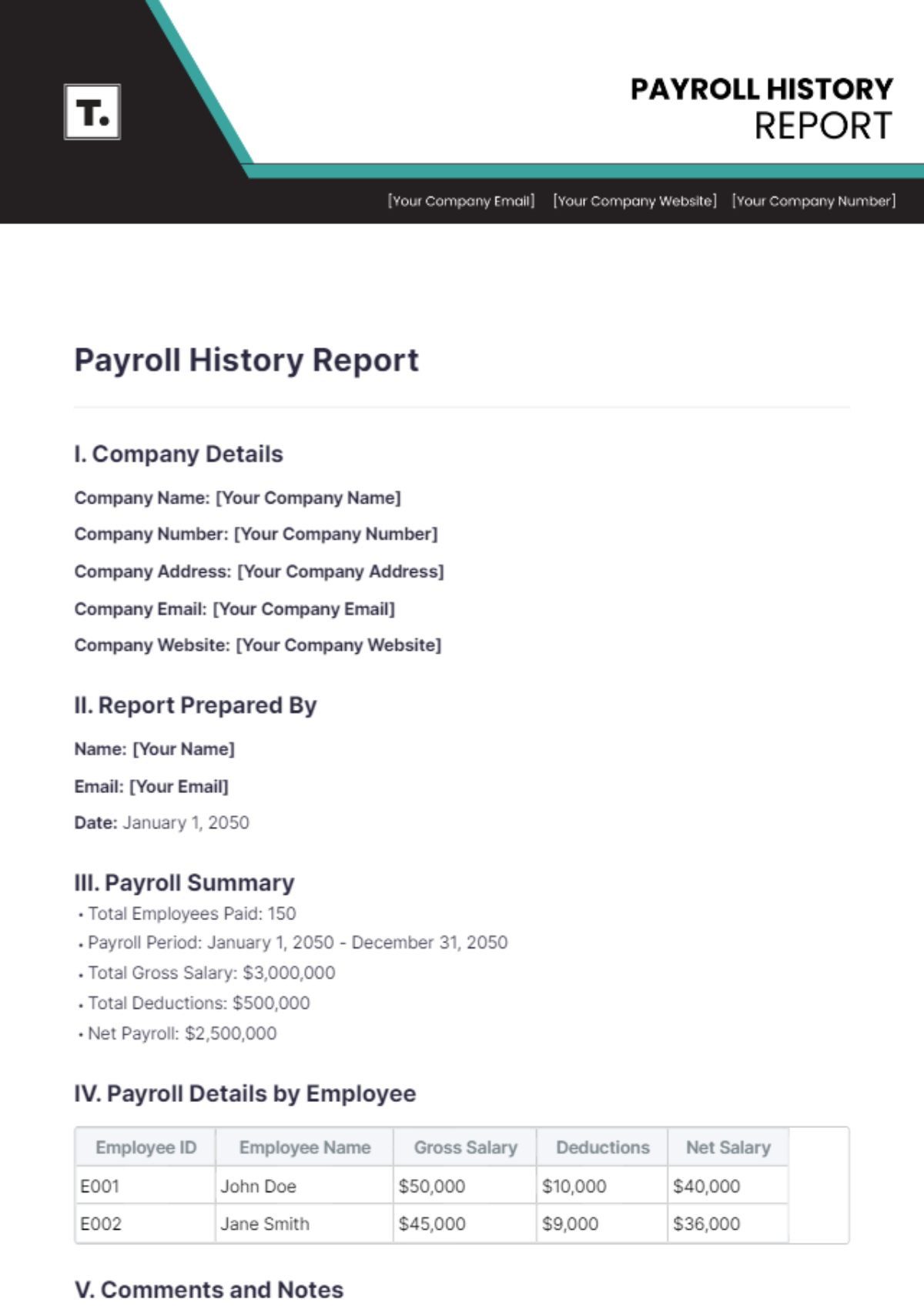

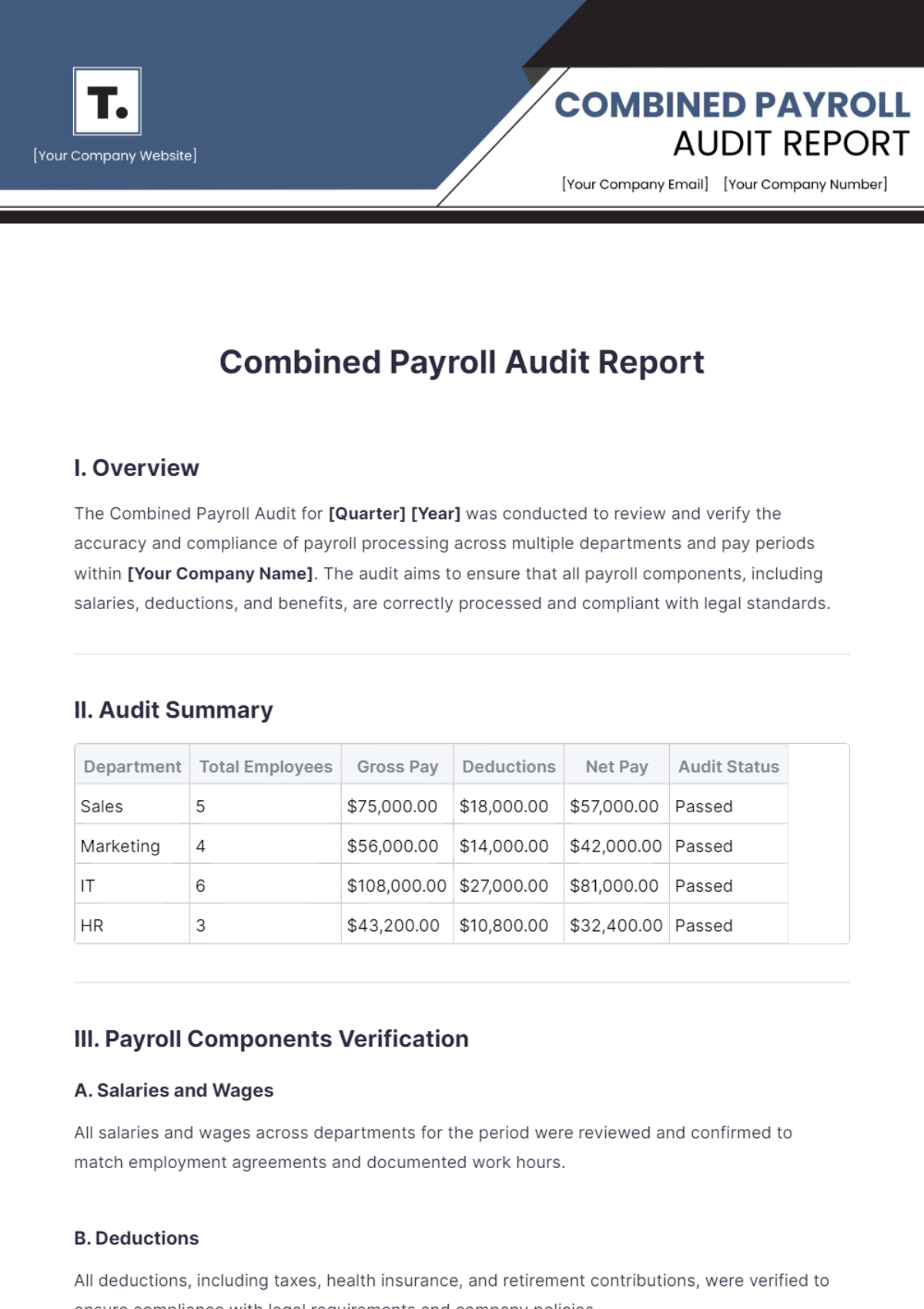

I. Executive Summary

This Payroll Summary Report provides an overview of the payroll expenses for [Your Company Name] for the month of October 2050. It outlines the total wages, benefits, deductions, and net pay distributed to employees. This report is essential for understanding the company’s financial obligations regarding employee compensation.

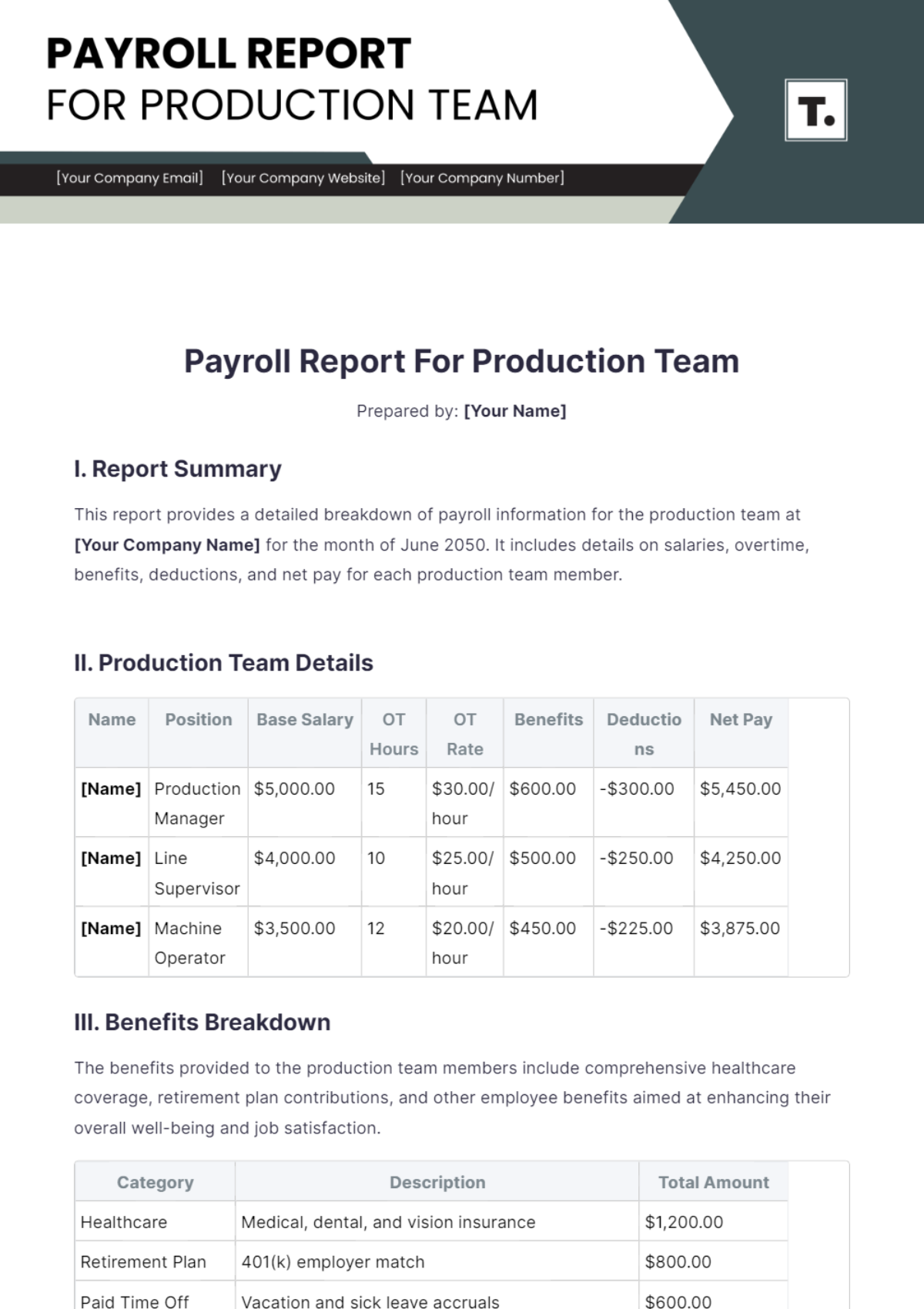

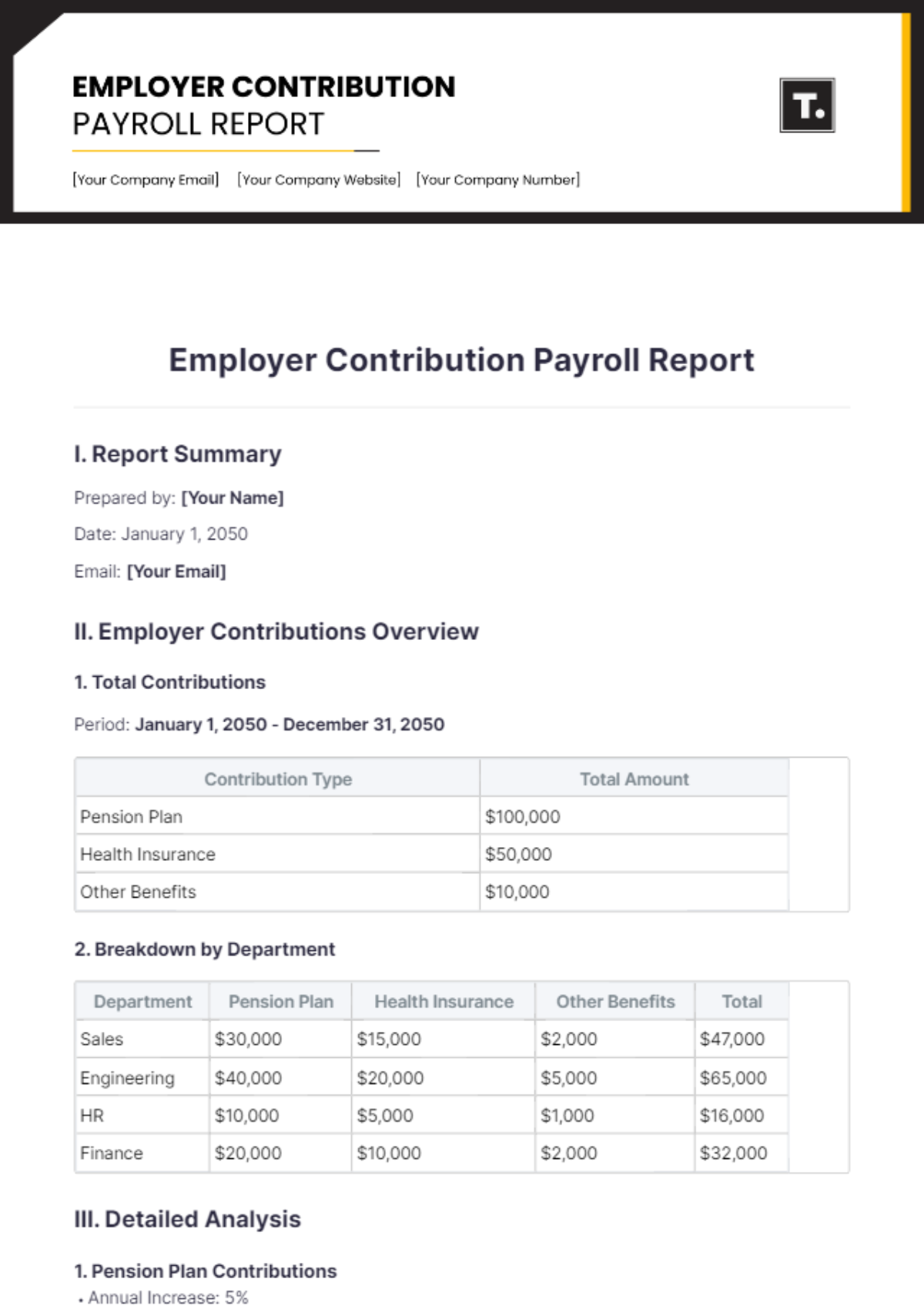

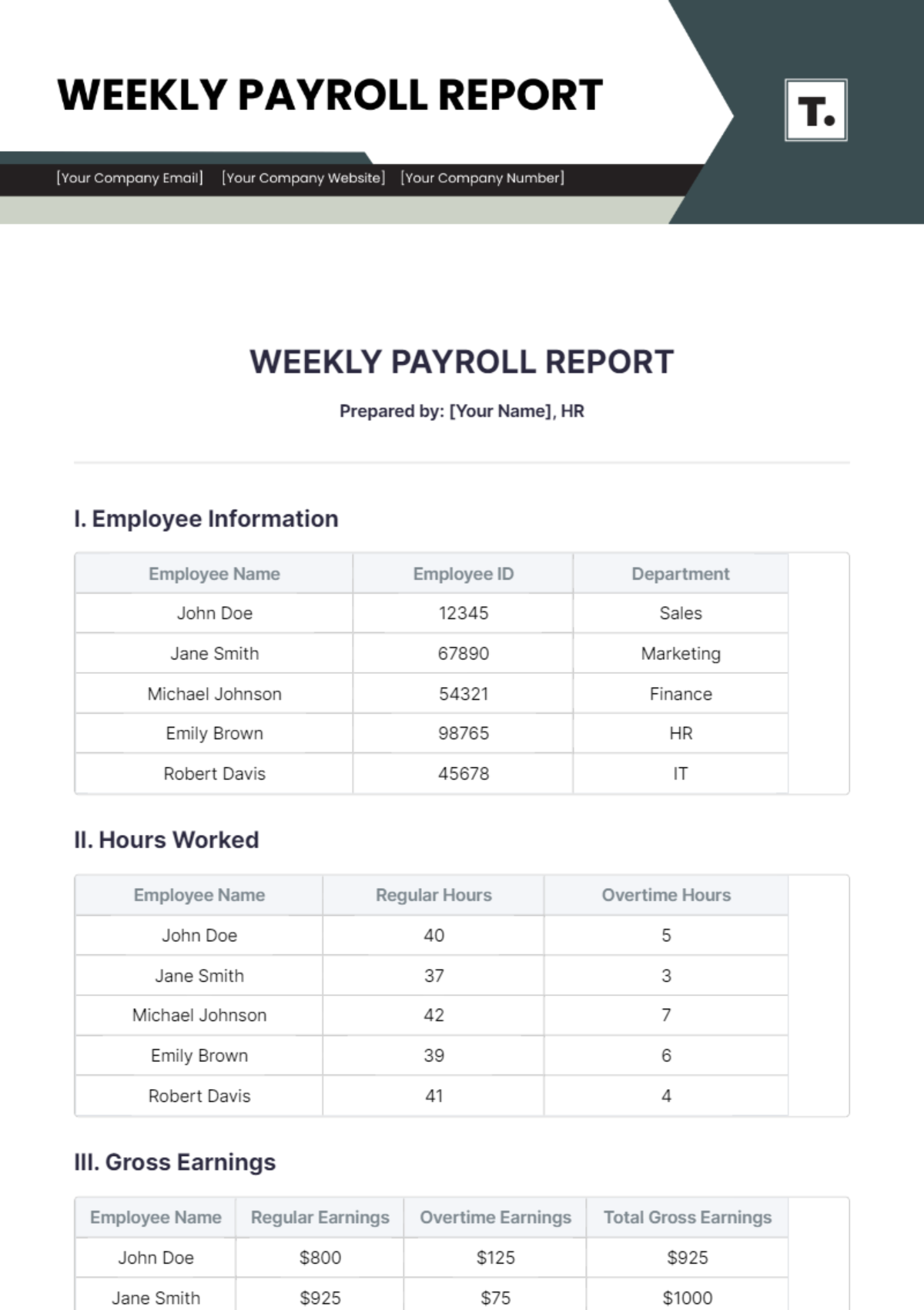

II. Payroll Overview

Total Payroll Costs

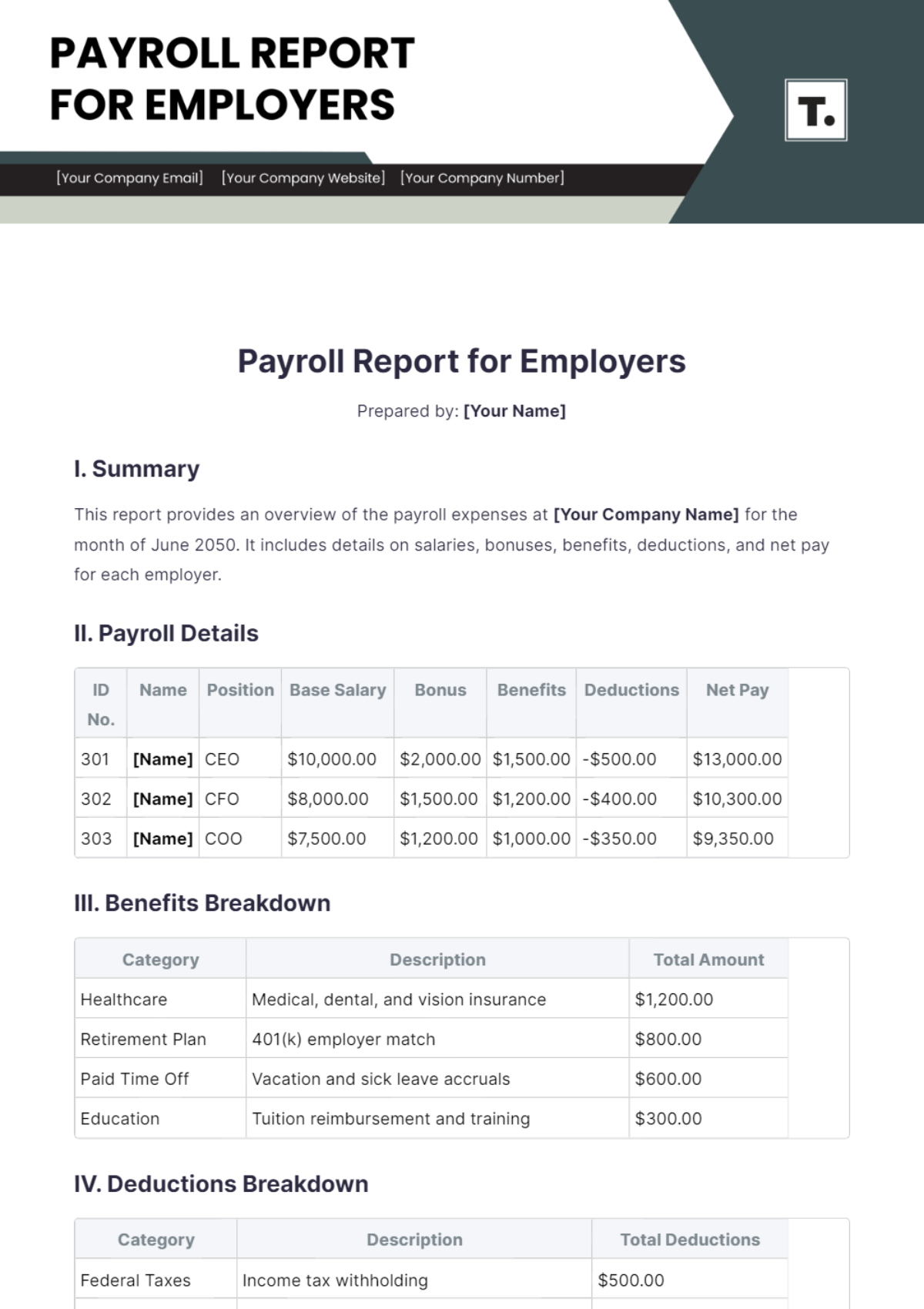

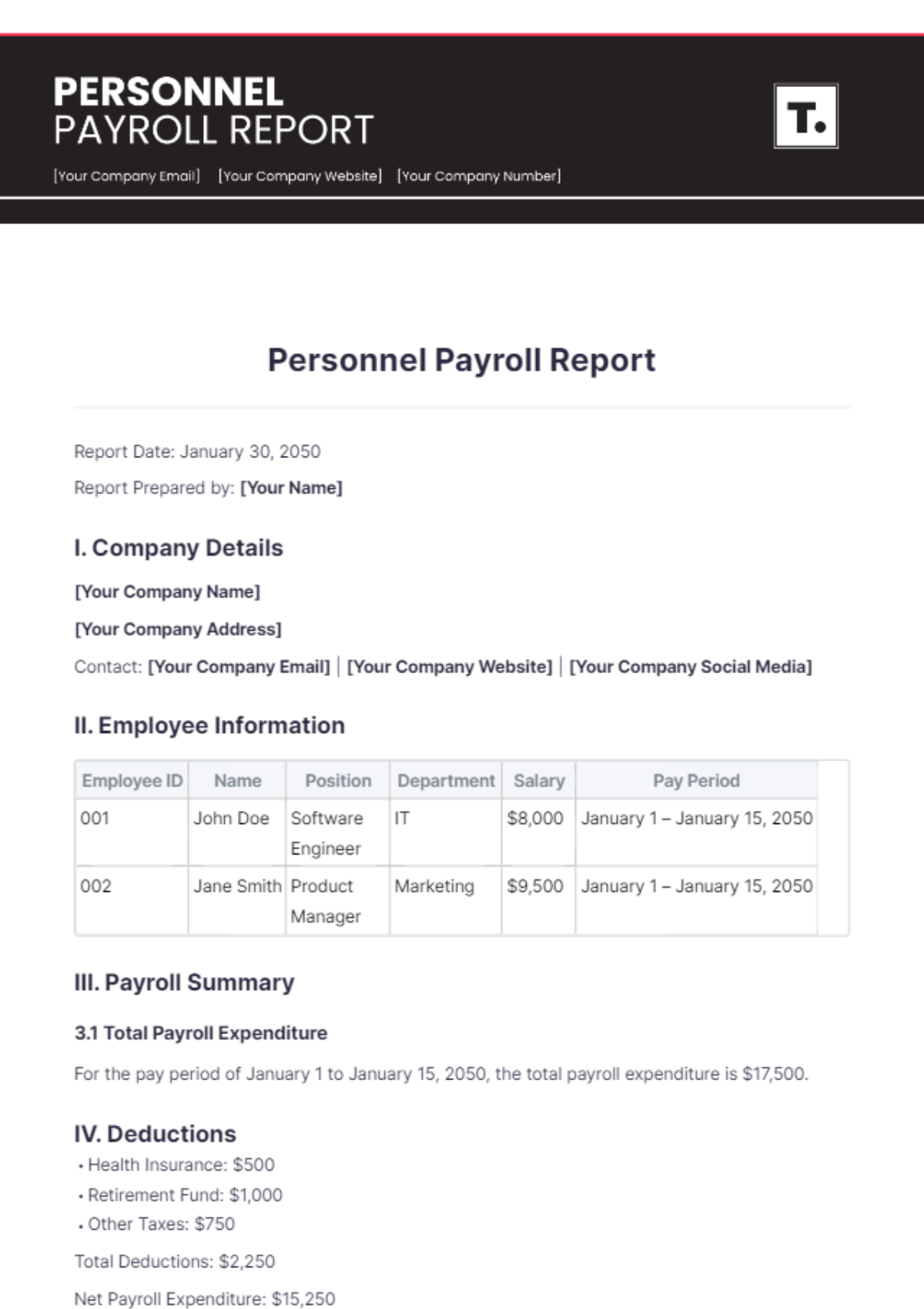

The following table summarizes the total payroll costs incurred by [Your Company Name] in October 2050.

Category | Amount ($) |

|---|---|

Gross Wages | 120,000 |

Employer Taxes | 15,000 |

Employee Benefits | 10,000 |

Total Payroll Cost | 145,000 |

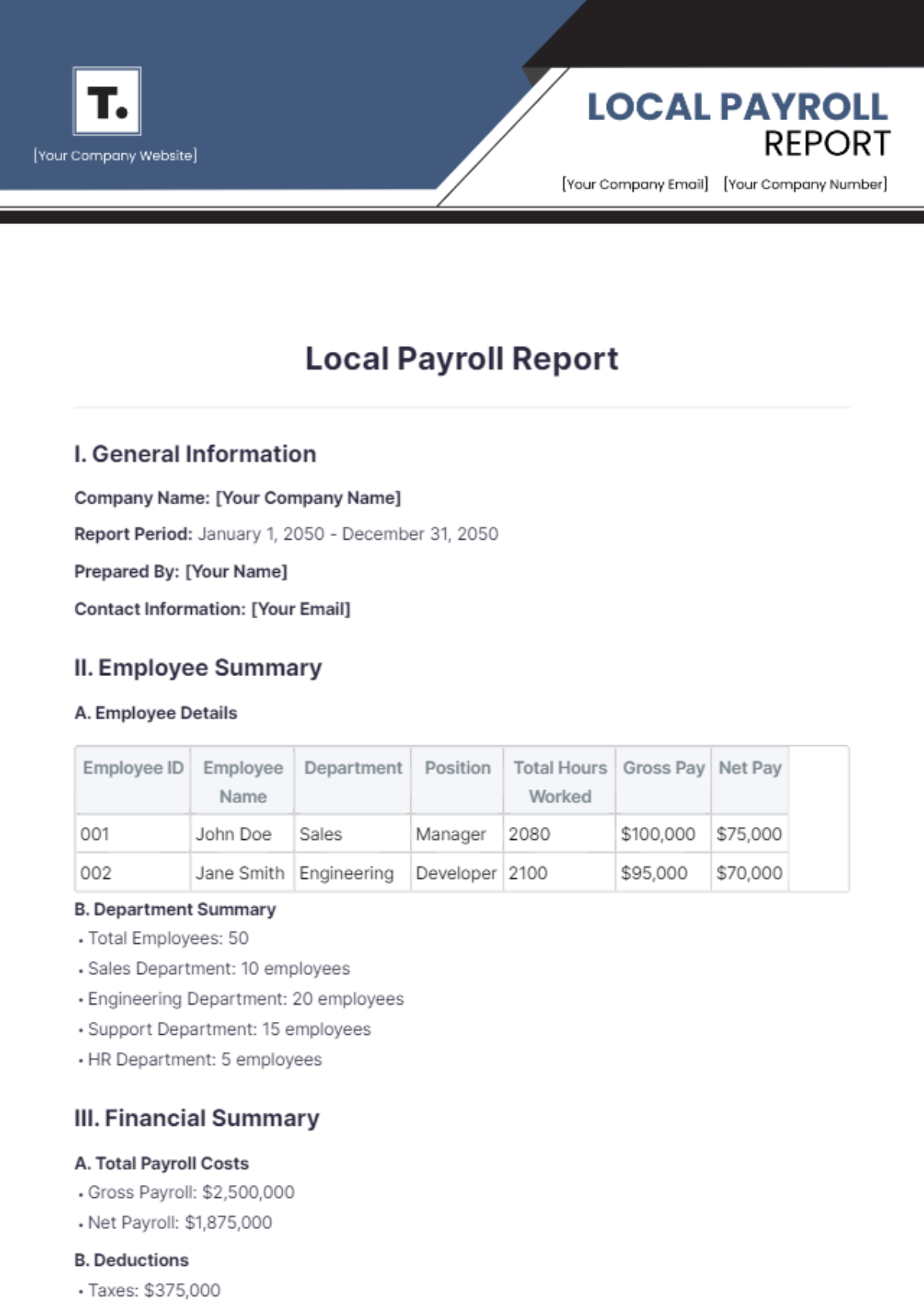

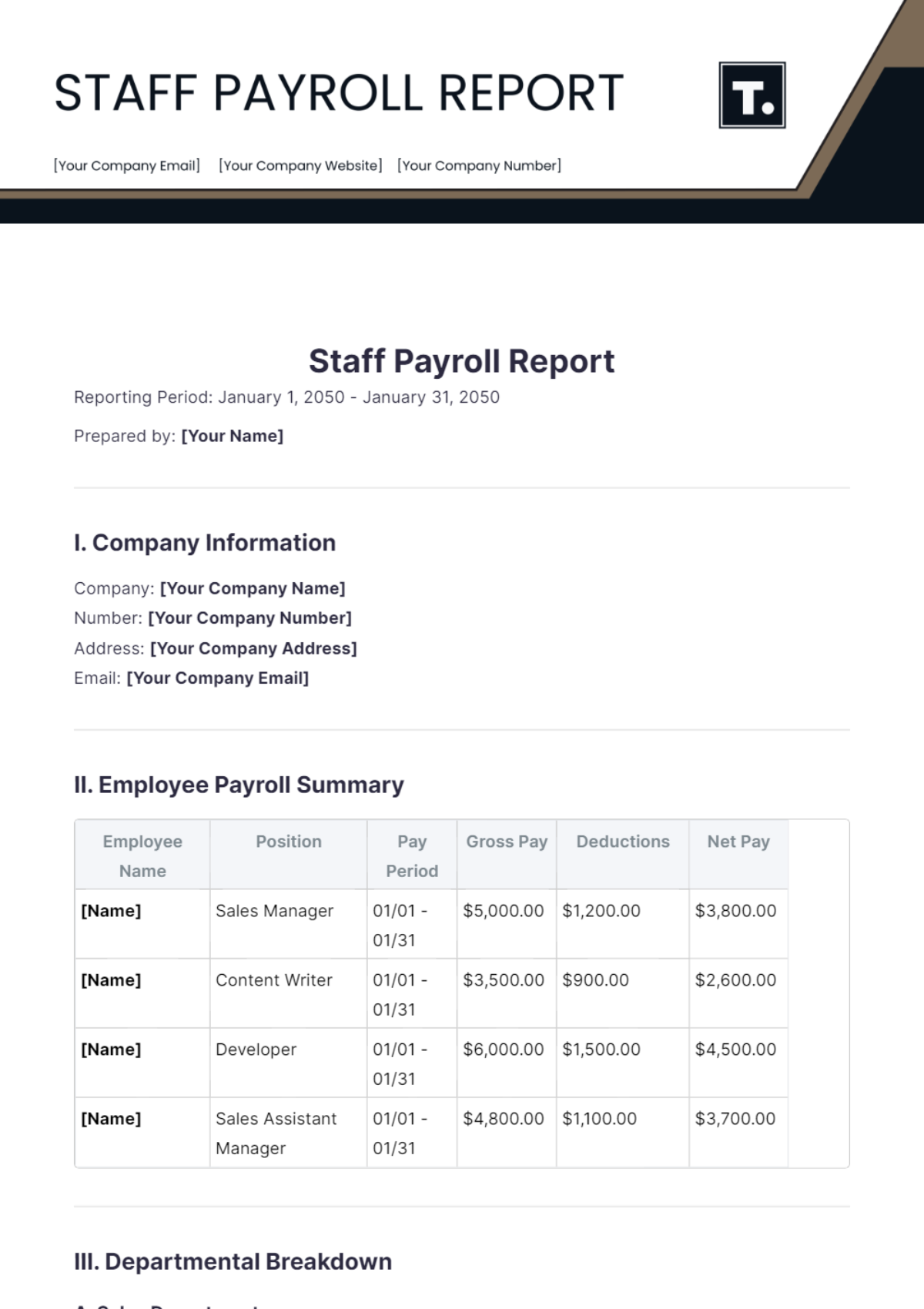

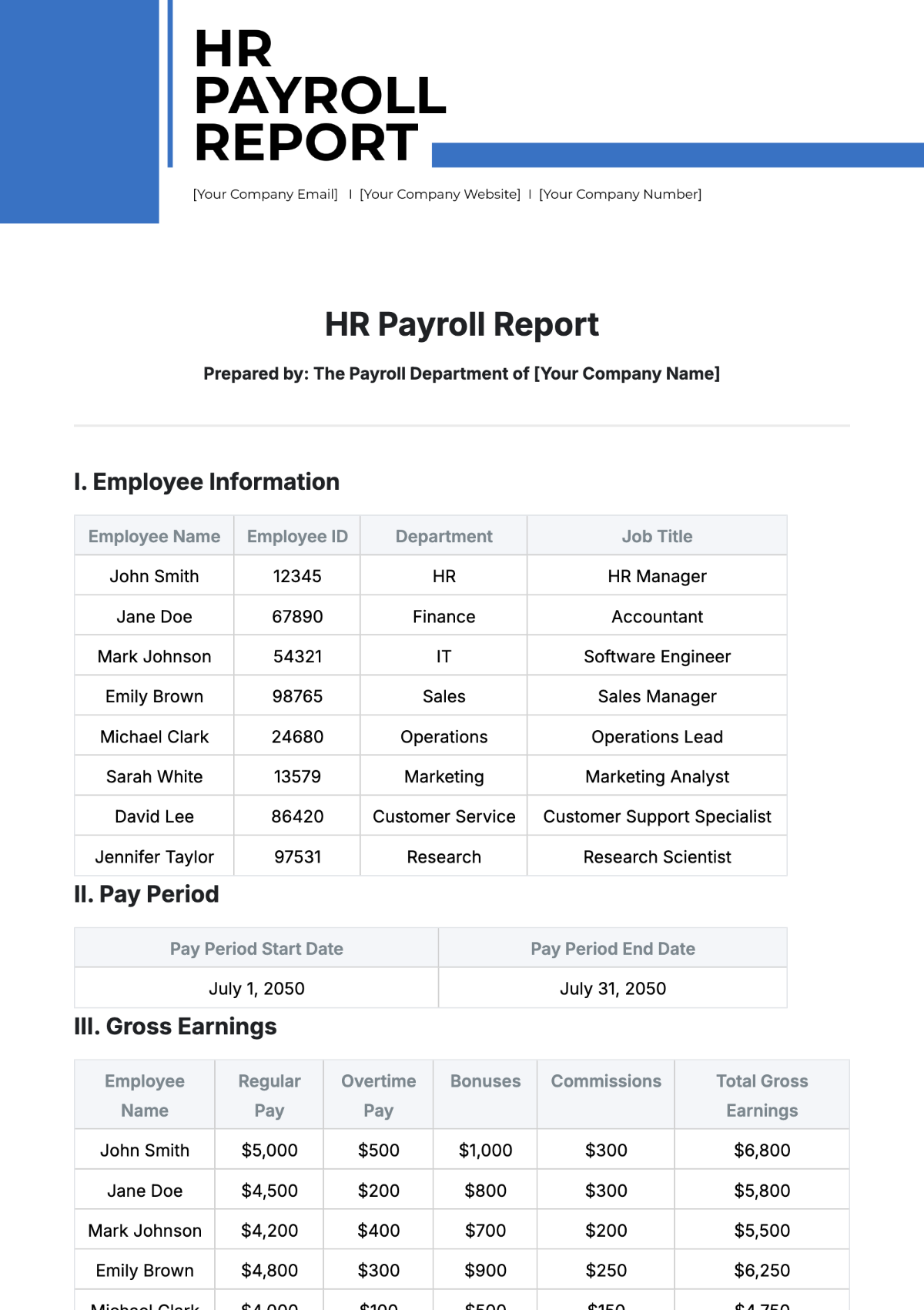

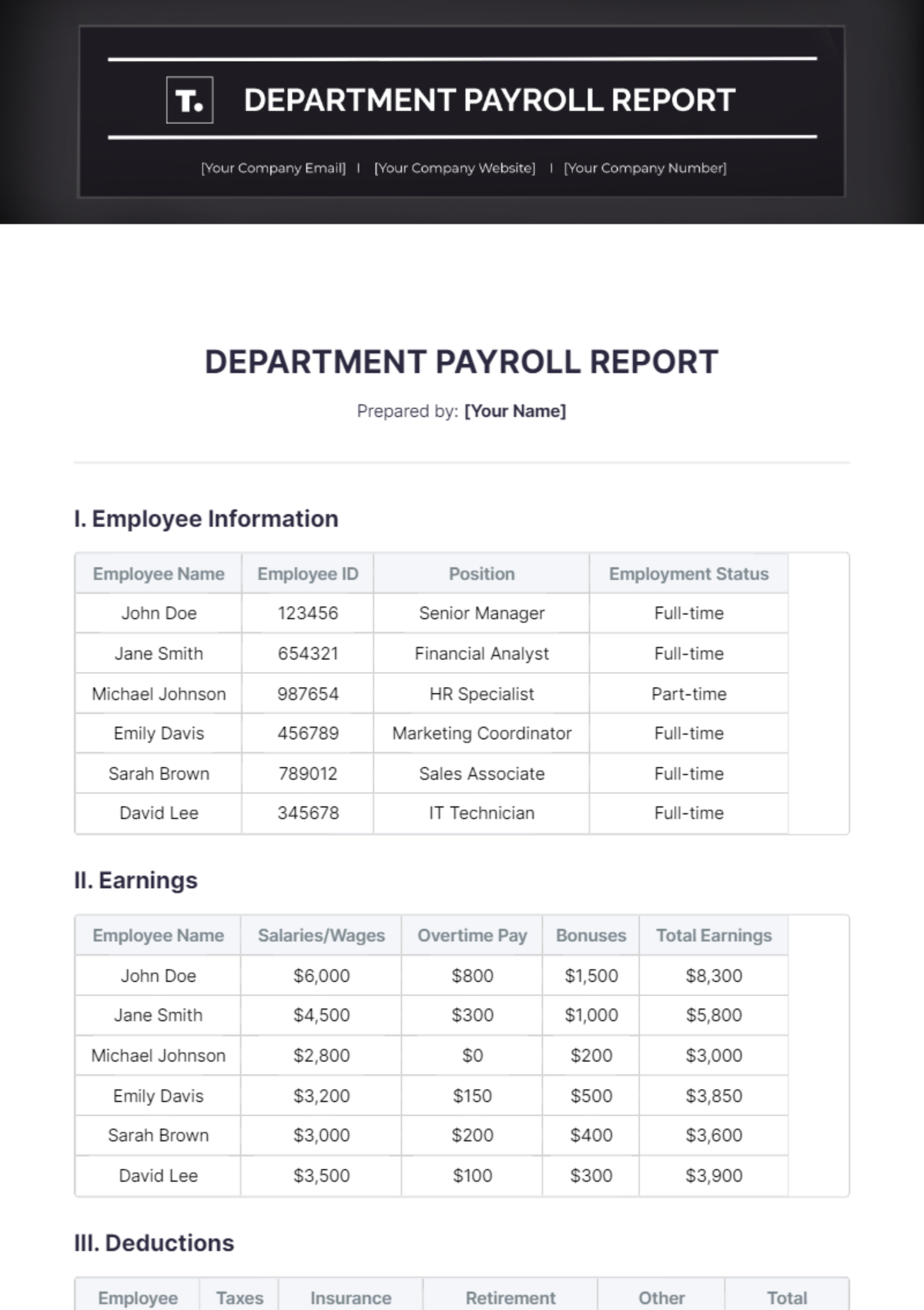

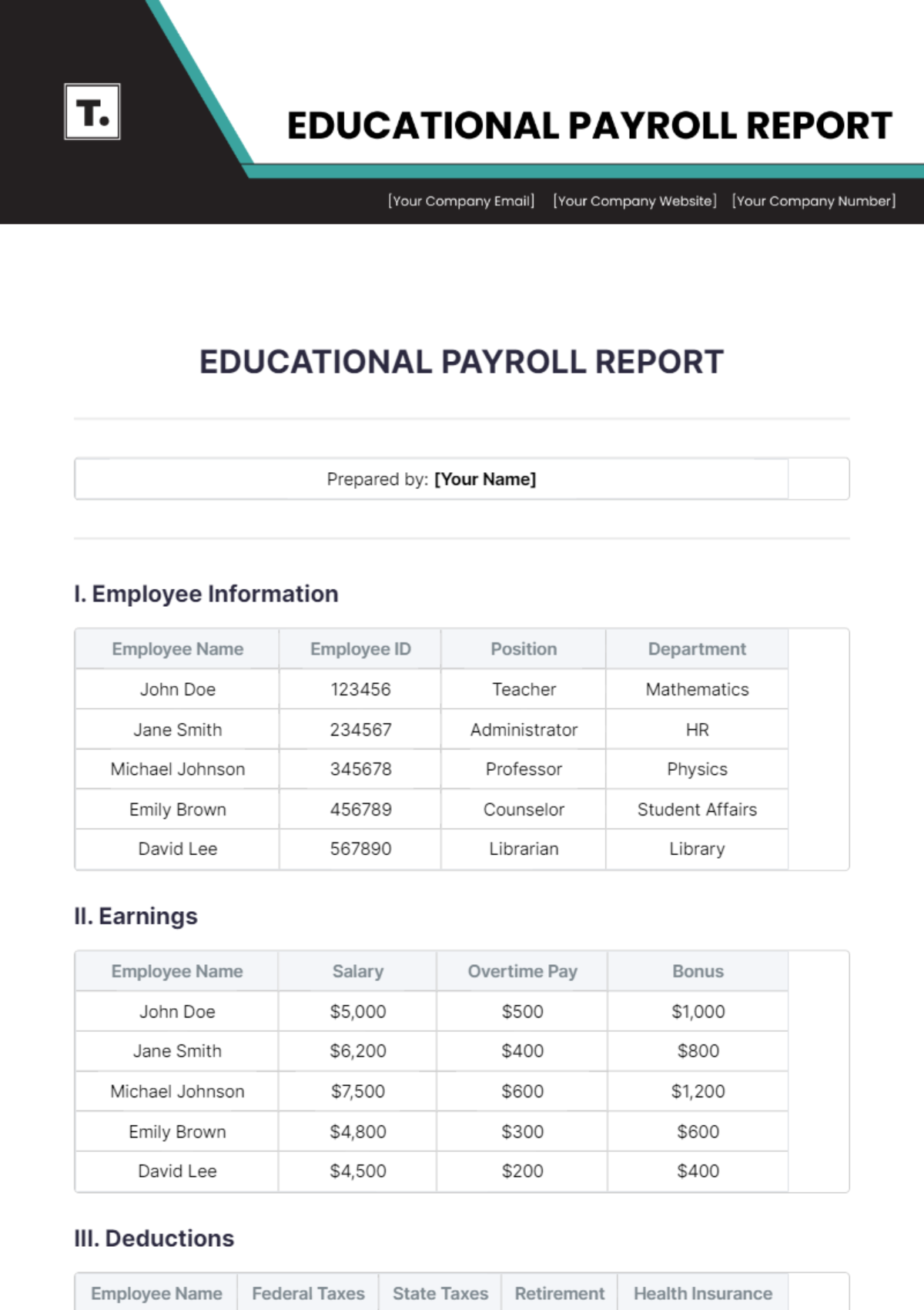

Employee Distribution

A breakdown of employees by department and their corresponding salaries is provided below.

Department | Number of Employees | Total Salaries ($) |

|---|---|---|

Sales | 10 | 60,000 |

Marketing | 5 | 30,000 |

IT | 7 | 35,000 |

HR | 3 | 15,000 |

Total | 25 | 140,000 |

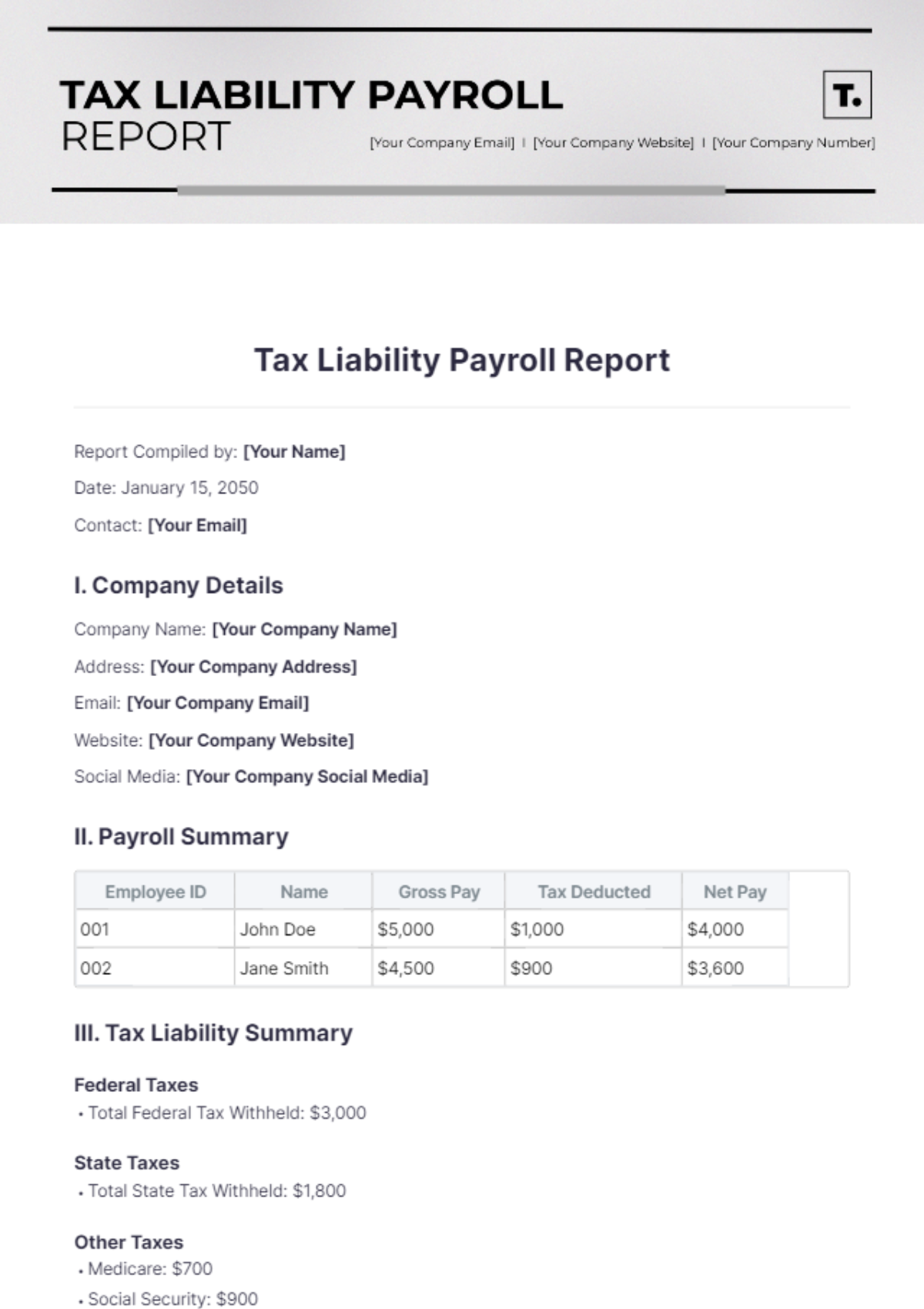

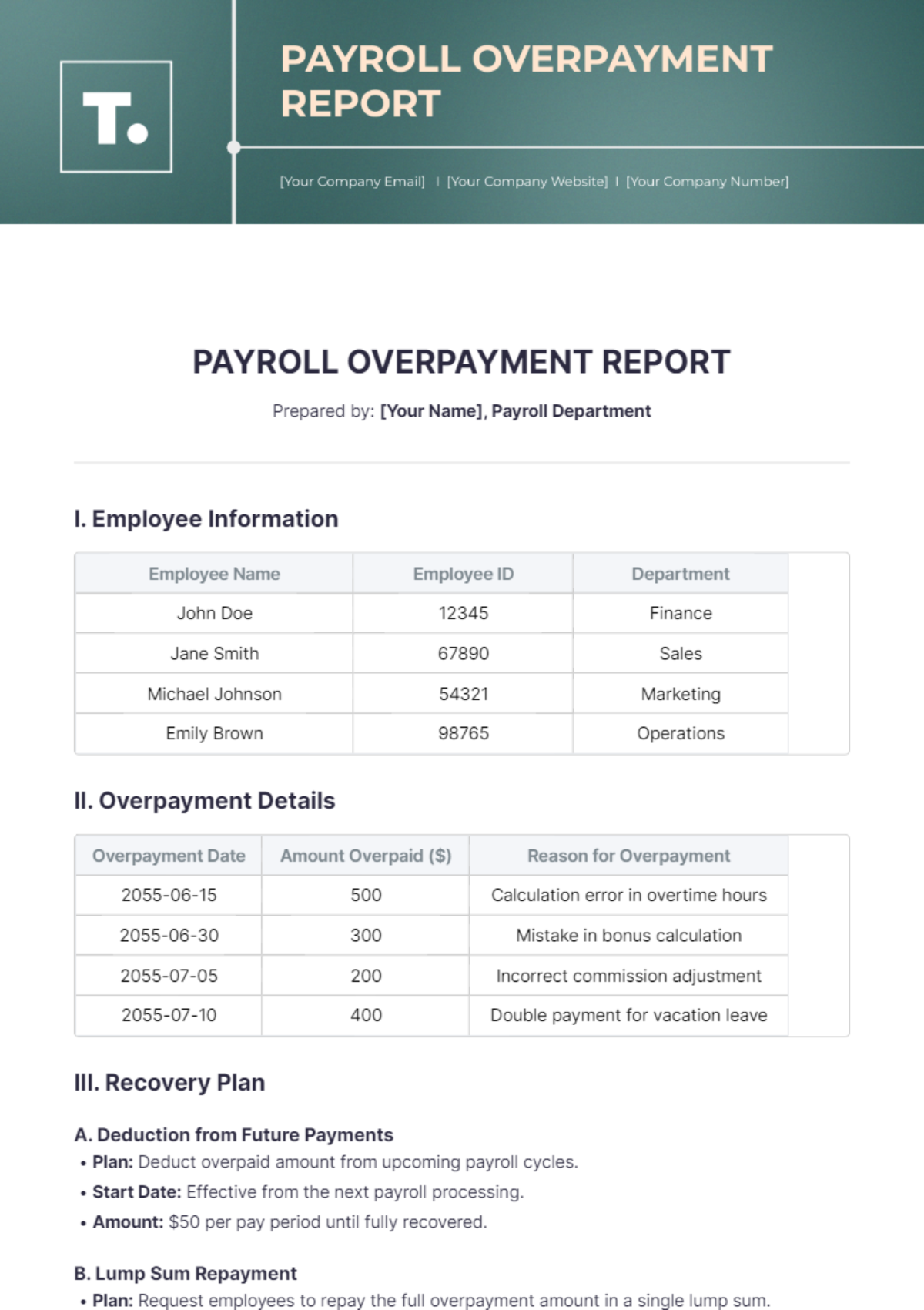

III. Deductions and Benefits

Employee Deductions

Employee deductions for October 2050 are detailed below:

Deduction Type | Amount ($) |

|---|---|

Federal Tax | 25,000 |

State Tax | 5,000 |

Health Insurance | 5,000 |

Retirement Savings | 5,000 |

Total Deductions | 40,000 |

Employee Benefits

Benefits offered to employees and their costs for October 2050 include:

Benefit Type | Cost ($) |

|---|---|

Health Insurance | 10,000 |

Retirement Plans | 8,000 |

Paid Time Off | 7,000 |

Total Benefits | 25,000 |

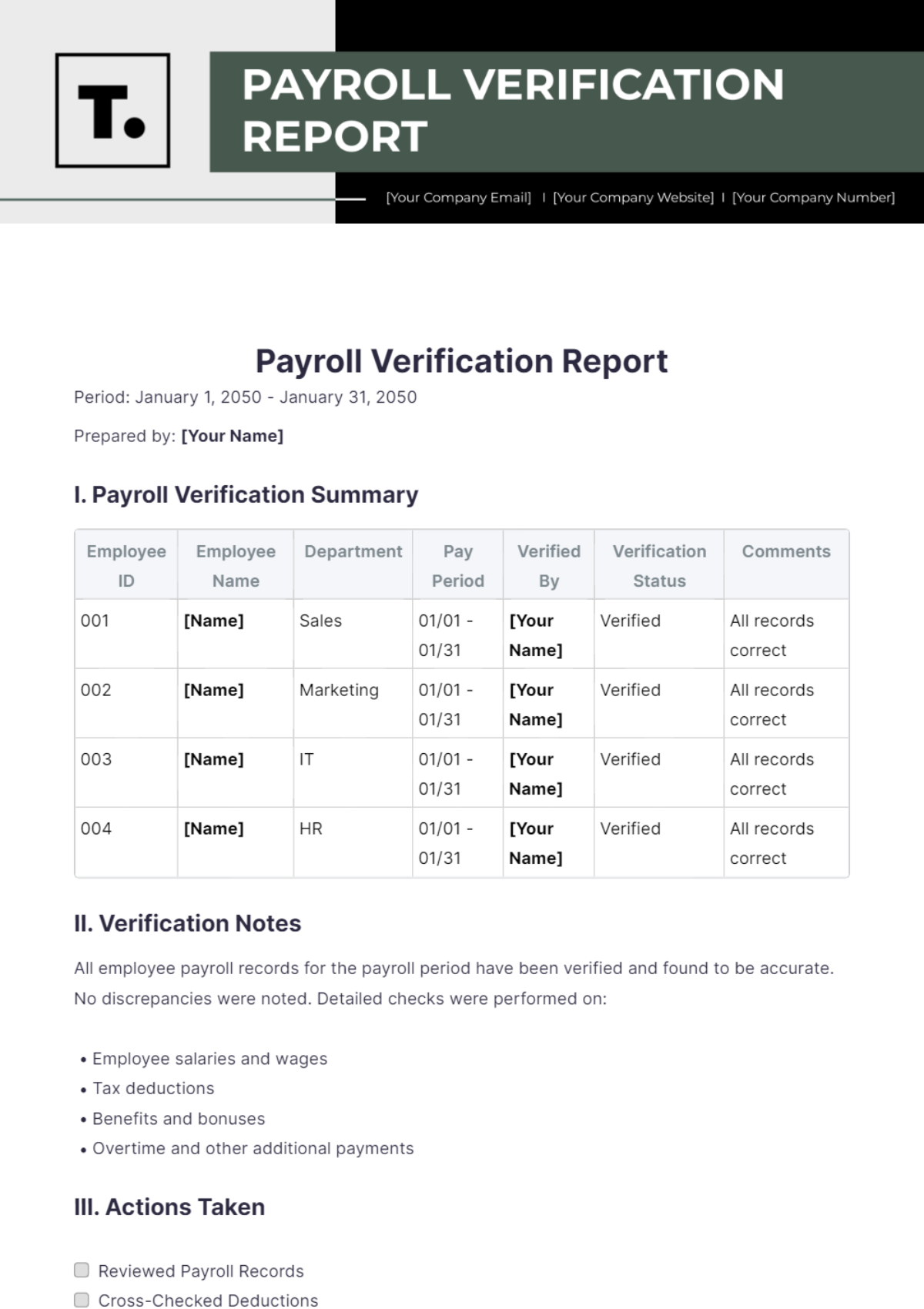

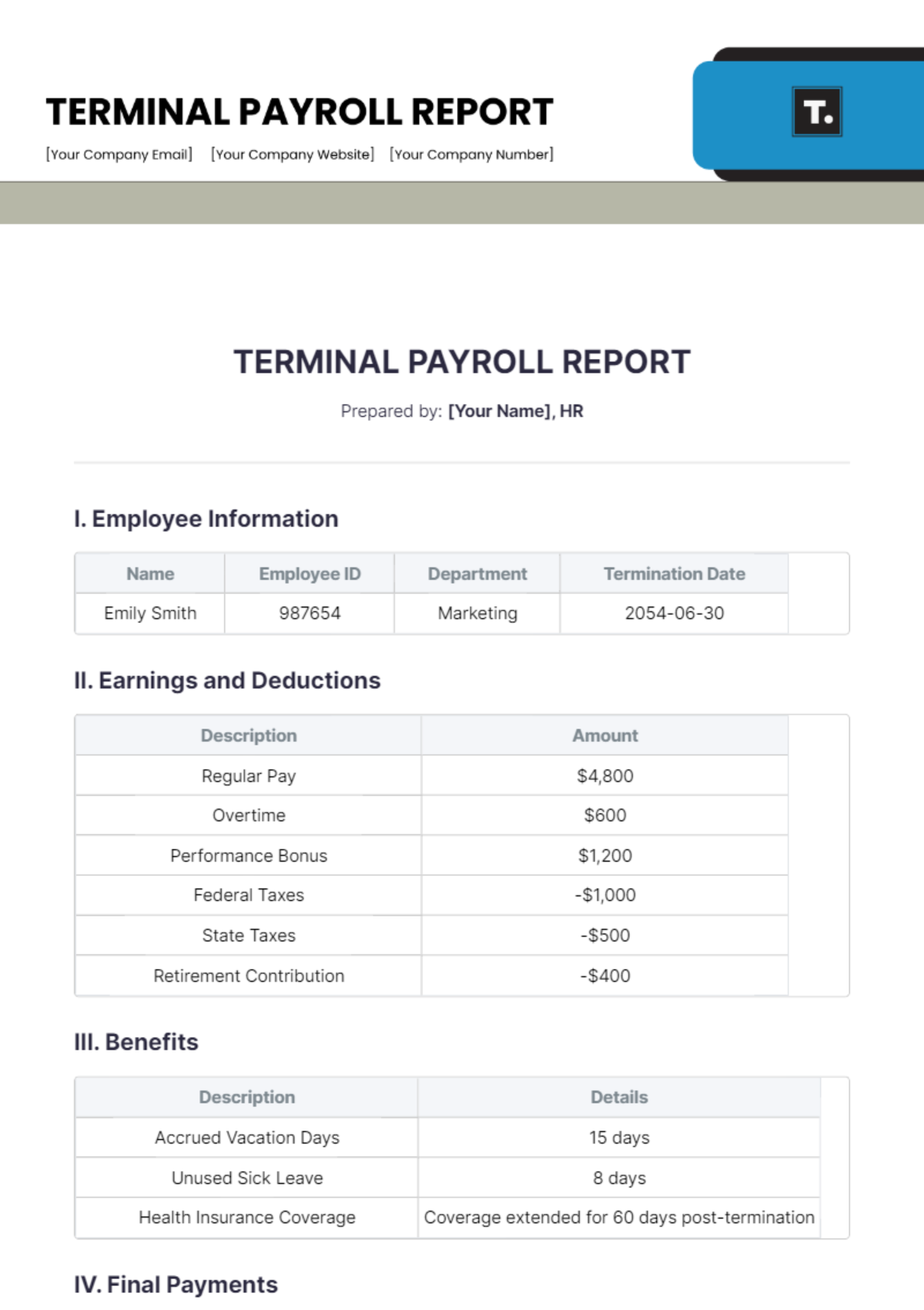

IV. Net Pay Calculation

The net pay calculation for employees for the month of October 2050 is summarized below:

Category | Amount ($) |

|---|---|

Gross Wages | 120,000 |

Total Deductions | 40,000 |

Net Pay | 80,000 |

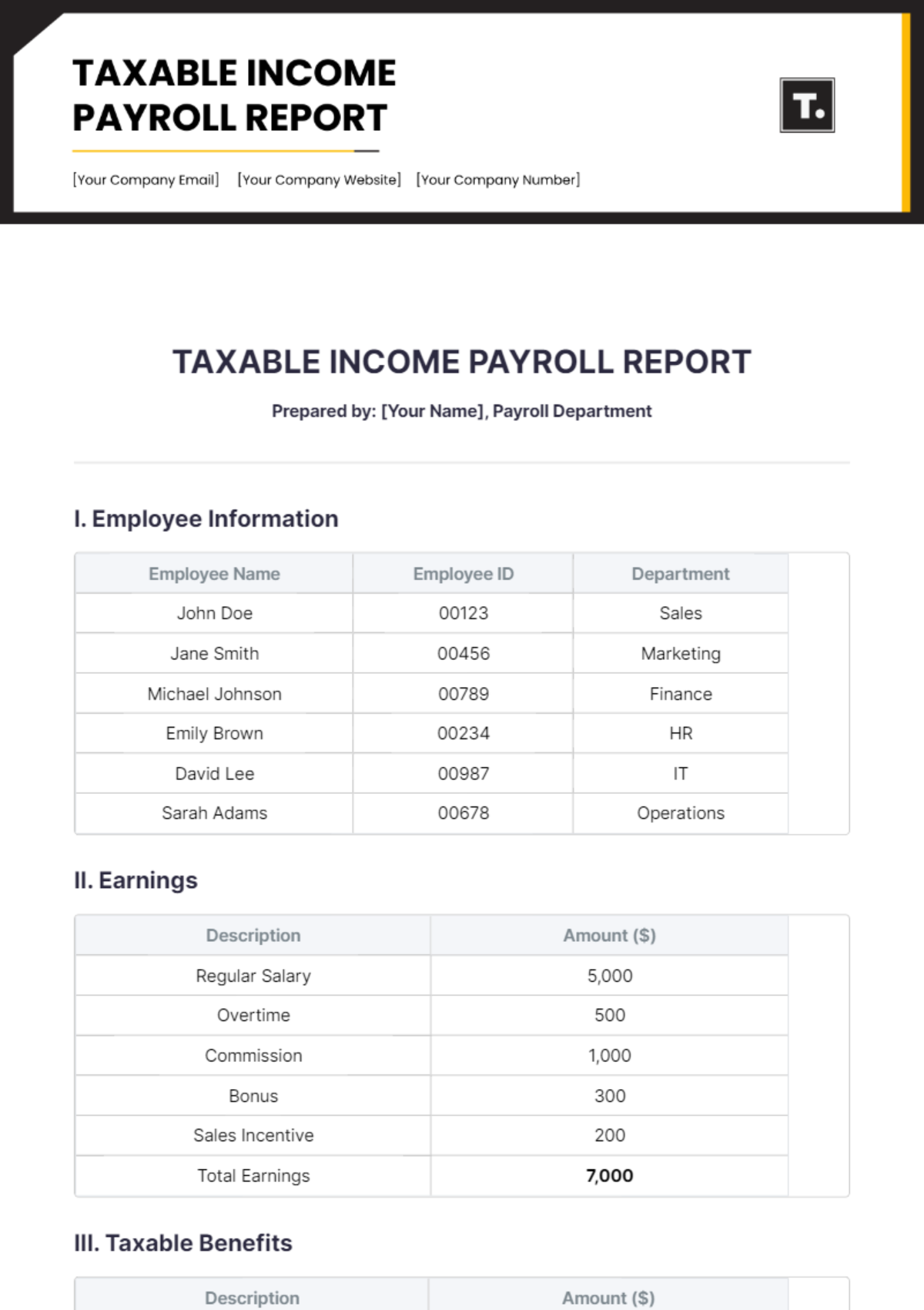

V. Conclusion

In conclusion, [Your Company Name] has successfully managed its payroll for the month of October 2050. The total payroll costs amounted to $145,000, with $80,000 distributed as net pay to employees after deductions. This report serves as a crucial tool for financial planning and ensures compliance with labor regulations.

For any inquiries regarding this report or payroll processes, please contact [Your Name] at [Your Email]. We encourage you to reach out for assistance or further clarification. For additional information about our company, you may also email [Your Company Email].

This Payroll Summary Report is designed to provide a comprehensive view of payroll operations and should be referenced for all payroll-related decisions moving forward.