Architecture Sales Report

I. Executive Summary

In the fiscal year 2055, [Your Company Name] demonstrated robust growth in sales, driven by strategic market expansion and innovative architectural solutions. Total sales revenue increased by 18% compared to the previous year, reaching $45 million. This growth was fueled by a combination of new project acquisitions and enhanced service offerings that catered to a diverse client base, including residential, commercial, and public sectors.

Key performance indicators (KPIs) highlighted strong performance across all regions, with the North American market contributing 60% of total sales. Innovative design and sustainability were at the core of our projects, attracting high-profile clients and securing long-term contracts. The integration of cutting-edge technology in our design processes has also played a pivotal role in enhancing project delivery and client satisfaction.

Looking ahead, [Your Company Name] aims to sustain this growth trajectory by continuing to invest in research and development, expanding our market reach, and maintaining a client-centric approach. The outlook for 2056 is optimistic, with several high-value projects already in the pipeline and a committed team ready to tackle new challenges.

II. Introduction

A. Objectives

To provide a detailed analysis of sales performance for [Your Company Name] in the fiscal year 2055: This involves a comprehensive review of all sales activities, allowing for a better understanding of our strengths and areas needing improvement. By examining these details, we can fine-tune our strategies for even greater success in the coming years.

To identify key trends and factors contributing to sales growth: Recognizing what drives our sales allows us to leverage these factors more effectively. Understanding market demands and client preferences will help us stay ahead of the competition.

To offer insights for strategic planning and decision-making for future sales initiatives: These insights are crucial for formulating targeted sales strategies. They guide our investment decisions and help prioritize resources for maximum return.

To benchmark current performance against previous years and industry standards: This benchmarking provides context to our achievements. It helps us gauge our progress and set realistic, ambitious goals for future growth.

To highlight areas for improvement and potential opportunities for market expansion: Identifying these areas ensures we remain proactive. It allows us to address any weaknesses and capitalize on emerging opportunities promptly.

B. Scope

This report covers all sales activities from January 1, 2055, to December 31, 2055: The annual scope provides a comprehensive view of our performance over the year. It helps in understanding seasonal trends and their impact on sales.

It includes detailed sales data across various segments, including residential, commercial, and public projects: Segmenting the data allows for a nuanced analysis. It helps in identifying which areas are performing well and which need more attention.

The analysis extends to geographical performance, market trends, and client demographics: Geographical insights reveal regional strengths and weaknesses. Understanding client demographics helps tailor our services to meet specific needs.

Financial metrics such as revenue, profit margins, and sales growth rates are discussed: These metrics are vital for assessing our financial health. They provide a clear picture of profitability and overall business performance.

The report also examines the impact of technological advancements and sustainability practices on sales performance: Evaluating these impacts shows how innovation drives success. It highlights the importance of staying updated with industry advancements.

C. Importance

Understanding sales performance is crucial for aligning business strategies with market demands: Sales performance insights ensure that our strategies are effective and aligned with client needs. This alignment is key to maintaining market relevance and competitiveness.

The report provides insights that help in optimizing resource allocation and improving sales processes: With these insights, we can better allocate resources to high-impact areas. Optimizing our sales processes increases efficiency and drives better results.

It assists in identifying growth opportunities and potential risks in the market: Recognizing opportunities allows us to proactively expand our market presence. Identifying risks early helps mitigate their impact, ensuring stable growth.

The analysis aids in enhancing client relationships and service delivery: By understanding what clients value, we can enhance our service offerings. Strong client relationships are essential for repeat business and referrals.

It supports informed decision-making for future investments and strategic initiatives: Informed decisions lead to better outcomes. This report provides the data needed to make strategic investments that drive long-term success.

III. Sales Performance Overview

A. Annual Sales Revenue

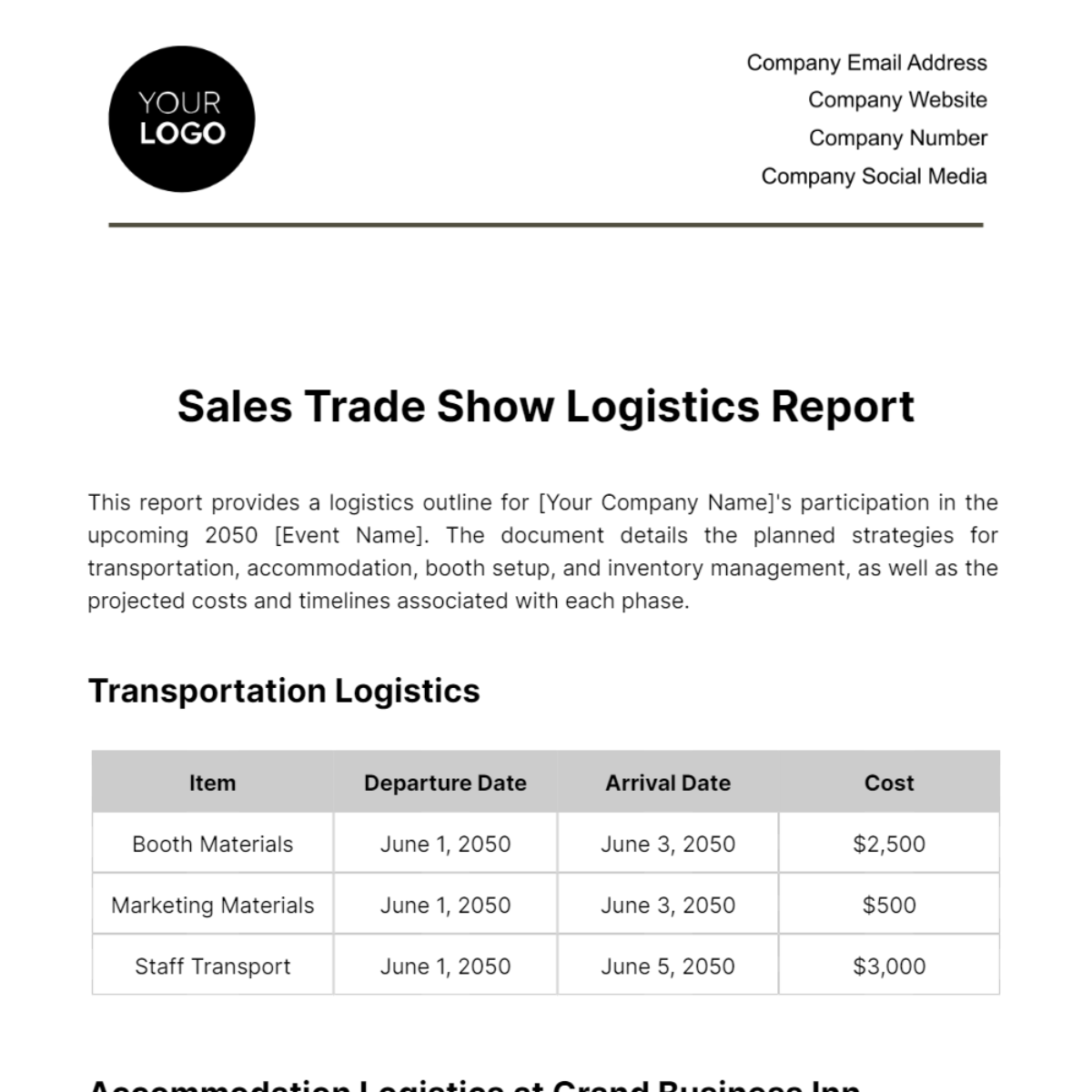

The following charts and table summarize the annual sales revenue for 2055:

January to June

July to December

Month | Sales Revenue |

|---|---|

January | $3,500,000 |

February | $3,200,000 |

March | $3,800,000 |

April | $3,900,000 |

May | $4,100,000 |

June | $4,300,000 |

July | $4,500,000 |

August | $3,900,000 |

September | $4,200,000 |

October | $4,400,000 |

November | $4,600,000 |

December | $4,600,000 |

The table above displays the monthly sales revenue for the year 2055. This data provides a clear picture of our financial performance throughout the year and helps identify trends and patterns.

January to March: Sales started strong in January with $3.5 million and saw a slight dip in February to $3.2 million. However, March rebounded with $3.8 million, reflecting the seasonal demand and successful project completions. The fluctuation in early months suggests that demand cycles and project timelines significantly impact revenue.

April to June: This period witnessed steady growth, peaking at $4.3 million in June. The increase can be attributed to the commencement of several large-scale commercial projects and favorable market conditions. The growth during these months indicates effective project management and execution strategies.

July to September: Despite a slight dip in August, sales remained robust, averaging around $4 million. The decline in August was due to project delays, which were subsequently recovered in September. This recovery demonstrates the company's ability to manage and mitigate delays effectively.

October to December: The last quarter saw a consistent increase in sales, culminating in $4.6 million in December. This was driven by the completion of high-value projects and an uptick in new contracts. The strong finish to the year showcases the company's capability to close significant deals and manage end-of-year project completions.

It is important to note that the overall increase in sales revenue reflects the company's strategic efforts in acquiring high-value projects and enhancing service offerings. The fluctuations observed during the year highlight the importance of managing project timelines and client demands effectively. Moreover, the consistent growth towards the year's end indicates a strong pipeline and efficient execution of projects, positioning [Your Company Name] well for future growth.

B. Regional Sales Distribution

The following table outlines the regional distribution of sales for 2055:

Region | Sales Revenue | Percentage of Total Sales |

|---|---|---|

North America | $27,000,000 | 60% |

Europe | $9,000,000 | 20% |

Asia | $6,300,000 | 14% |

Other Regions | $2,700,000 | 6% |

The table provides a breakdown of sales revenue by region for the year 2055. This distribution helps in understanding regional market performance and identifying areas for potential growth.

North America: Dominating with 60% of total sales, North America remains our strongest market. The region's growth is driven by robust demand for innovative residential and commercial designs. The strong performance in this region underscores the company's strategic focus on markets with high growth potential.

Europe: Contributing 20% of total sales, Europe showed steady performance. The market is characterized by high demand for sustainable and energy-efficient architectural solutions. This indicates a growing trend towards sustainability, which the company can further capitalize on by promoting eco-friendly designs.

Asia: With 14% of sales, Asia is an emerging market with significant growth potential. The increasing urbanization and infrastructure development are key drivers. Expanding in this region presents an opportunity to tap into rapidly growing urban areas and infrastructure projects.

Other Regions: While comprising a smaller portion of total sales, these regions present opportunities for future expansion, particularly in Latin America and the Middle East. Focusing on these areas can diversify the company's revenue streams and mitigate regional market risks.

The regional sales distribution highlights the importance of geographical diversification. By leveraging strengths in established markets like North America and Europe, while exploring growth opportunities in emerging markets like Asia and other regions, [Your Company Name] can achieve balanced and sustained growth. The focus on sustainability and innovative designs aligns well with global market trends, positioning the company to meet evolving client demands and regulatory requirements.

IV. Market Trends

A. Sustainability in Architecture

Green building practices have become a significant market driver, with clients increasingly prioritizing eco-friendly designs: This shift is fueled by growing environmental awareness and regulatory pressures. Companies that adopt green practices can differentiate themselves and attract environmentally conscious clients.

The integration of renewable energy solutions, such as solar panels and green roofs, is on the rise: These features not only reduce operational costs but also appeal to clients looking to minimize their carbon footprint. Incorporating renewable energy into designs adds value and enhances the marketability of projects.

Sustainable materials and construction methods are gaining traction, reducing environmental impact: Using materials with low environmental impact helps in meeting sustainability goals. Clients are increasingly looking for these options to align with their own sustainability initiatives.

Regulatory frameworks and incentives are supporting the adoption of sustainable practices: Governments and regulatory bodies are introducing policies and incentives to promote sustainable building practices. Staying compliant with these regulations can provide competitive advantages and open up new market opportunities.

Client awareness and demand for sustainability are expected to continue growing, influencing future project designs: As more clients become aware of the benefits of sustainable architecture, the demand for such designs will rise. Companies that can meet this demand will be well-positioned for future growth.

B. Technological Advancements

The adoption of Building Information Modeling (BIM) has streamlined design processes, improving accuracy and efficiency: BIM allows for better visualization, collaboration, and management of architectural projects. It enhances project delivery by reducing errors and improving coordination among stakeholders.

Virtual reality (VR) and augmented reality (AR) are enhancing client presentations and project visualization: These technologies provide immersive experiences, allowing clients to visualize and interact with designs before construction begins. This leads to better client engagement and informed decision-making.

3D printing technology is being utilized for creating detailed architectural models and prototypes: 3D printing enables the creation of precise and complex models quickly. It helps in demonstrating design concepts and making adjustments based on client feedback.

Smart building technologies are being integrated into designs, offering enhanced functionality and energy management: These technologies include automation systems for lighting, heating, and security. They provide added convenience and efficiency, making buildings more attractive to clients.

Advances in construction technology are reducing project timelines and costs, contributing to increased client satisfaction: Innovations in construction methods and materials are speeding up project completion and lowering costs. This leads to higher client satisfaction and repeat business.

V. Client Demographics

A. Residential Clients

Residential projects accounted for 40% of total sales, with a diverse client base ranging from individual homeowners to real estate developers: This sector shows strong demand for personalized and innovative home designs. The diversity in client base ensures a steady stream of projects across different price points.

The demand for custom home designs and renovations is high, driven by affluent clients seeking personalized solutions: High-net-worth individuals are willing to invest in unique and customized homes. Catering to this segment with bespoke designs can lead to lucrative projects.

Urban areas show a higher concentration of residential clients, influenced by population growth and urbanization: The influx of people into cities is driving demand for residential developments. Focusing on urban areas can provide a steady flow of projects.

Suburban and rural areas are also seeing increased demand, particularly for sustainable and energy-efficient homes: Clients in these areas are looking for homes that are not only aesthetically pleasing but also environmentally friendly. Offering sustainable designs can capture this growing market.

Client preferences are shifting towards modern, minimalist designs with smart home features: There is a trend towards sleek, modern designs that incorporate smart technologies. Staying ahead of these trends can attract tech-savvy clients looking for the latest in home innovation.

B. Commercial Clients

Commercial projects contributed 35% to total sales, encompassing office buildings, retail spaces, and mixed-use developments: This sector is diverse, with a wide range of project types. Diversification within the commercial sector can mitigate risks and ensure steady revenue.

Corporate clients are seeking innovative and flexible office designs to accommodate changing work environments: The rise of remote and hybrid work models is driving demand for flexible office spaces. Designing adaptable work environments can attract corporate clients.

The retail sector is focusing on experiential designs that enhance customer engagement and brand identity: Retail clients are looking for designs that create memorable shopping experiences. Innovative retail spaces can drive foot traffic and sales, making them attractive to retailers.

Mixed-use developments are gaining popularity, integrating residential, commercial, and recreational spaces: These developments offer a blend of uses that cater to diverse needs. They are attractive to developers looking to maximize the utility and value of their projects.

Sustainable and energy-efficient designs are highly valued, aligning with corporate sustainability goals: Corporate clients are increasingly focused on sustainability. Offering green building solutions can align with their goals and attract environmentally conscious businesses.

VI. Project Portfolio

A. Notable Projects Completed

Greenwood Residences: A luxury residential complex featuring eco-friendly designs and smart home technologies. The project was completed on time and within budget, earning high client satisfaction. This project highlights [Your Company Name]'s ability to deliver high-end, sustainable residential solutions.

Metro Mall Expansion: An extensive renovation and expansion of a major shopping mall, incorporating modern architectural elements and sustainability features. This project significantly boosted our commercial portfolio. The successful completion of this project showcases our expertise in handling large-scale commercial developments.

Riverfront Office Park: A state-of-the-art office complex designed to promote a healthy and productive work environment. The project included green building certifications and advanced technological integrations. This project underlines our commitment to sustainable and innovative office designs.

Skyline Towers: A mixed-use development offering residential, commercial, and recreational spaces. The project emphasized urban living and community engagement, attracting high-profile tenants. This development exemplifies our ability to create vibrant, multi-use urban spaces.

SolarTech Headquarters: A corporate headquarters designed with cutting-edge solar energy solutions and sustainable materials. The project showcases our expertise in sustainable architecture. This project demonstrates how we can align with corporate sustainability goals through innovative design.

B. Ongoing Projects

Harborview Condominiums: A waterfront residential project expected to set new standards in luxury living. The project features innovative designs and premium amenities. This project promises to enhance our reputation in the high-end residential market.

Downtown Revitalization: A major urban redevelopment project aimed at transforming a historic downtown area into a vibrant mixed-use community. The project is in the initial phases, with significant client interest. This initiative reflects our ability to rejuvenate urban spaces and drive community engagement.

EcoPark Business Center: An upcoming commercial complex focusing on sustainability and smart technologies. The project is expected to attract leading businesses seeking green office spaces. This development highlights our commitment to providing innovative and sustainable commercial solutions.

Horizon Plaza: A multi-use complex integrating retail, residential, and entertainment spaces. The project is designed to enhance urban living experiences. This project underscores our capability to create integrated, dynamic urban environments.

TechHub Innovation Center: A technology park designed to support startups and tech companies. The project includes co-working spaces, labs, and collaborative areas. This initiative positions us as a leader in creating environments that foster innovation and growth.

VII. Conclusion

[Your Company Name]'s architecture sales report for 2055 highlights a year of significant achievements and robust growth. Our strategic focus on innovation, sustainability, and client satisfaction has driven impressive sales performance across all market segments. The insights from this report underscore the importance of continuous improvement and adaptation to market trends, ensuring our position as a leader in the architectural industry.

Looking forward, we are committed to building on this success by exploring new opportunities and leveraging our strengths. By maintaining a client-centric approach and investing in advanced technologies, we aim to sustain our growth trajectory and achieve even greater milestones in the coming years. The future looks promising, with a pipeline of high-value projects and a dedicated team ready to meet the challenges ahead.