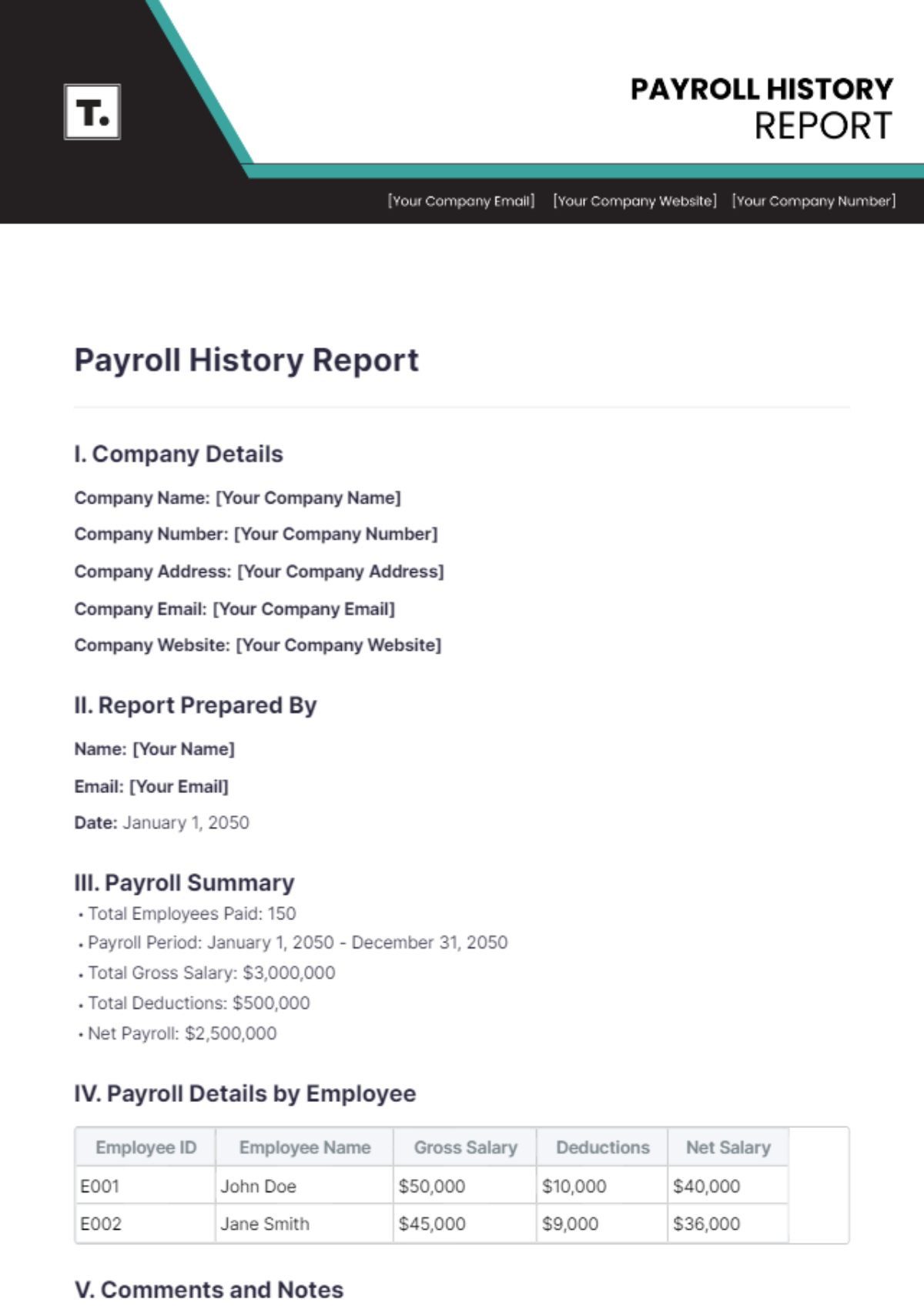

Payroll Register Report

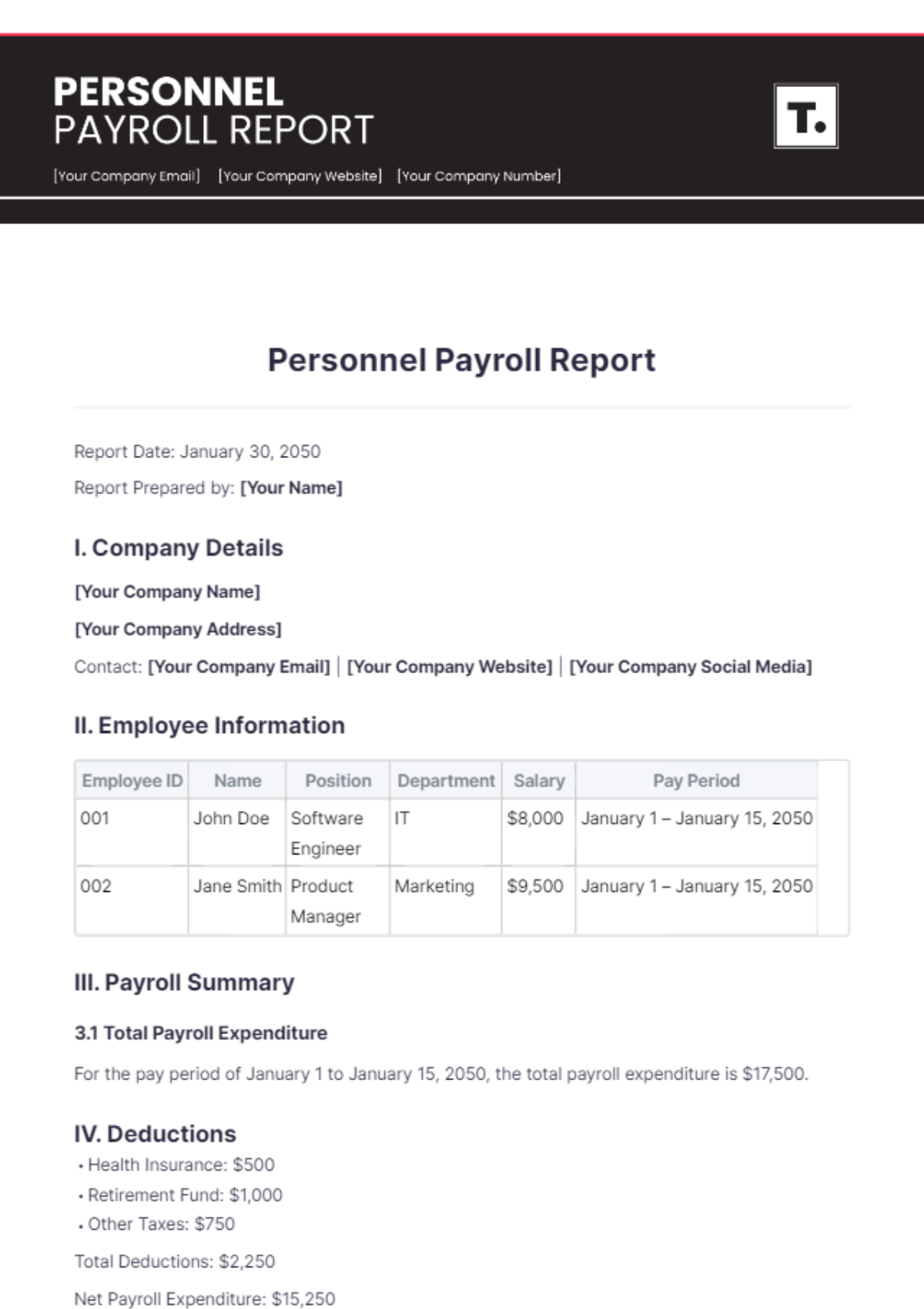

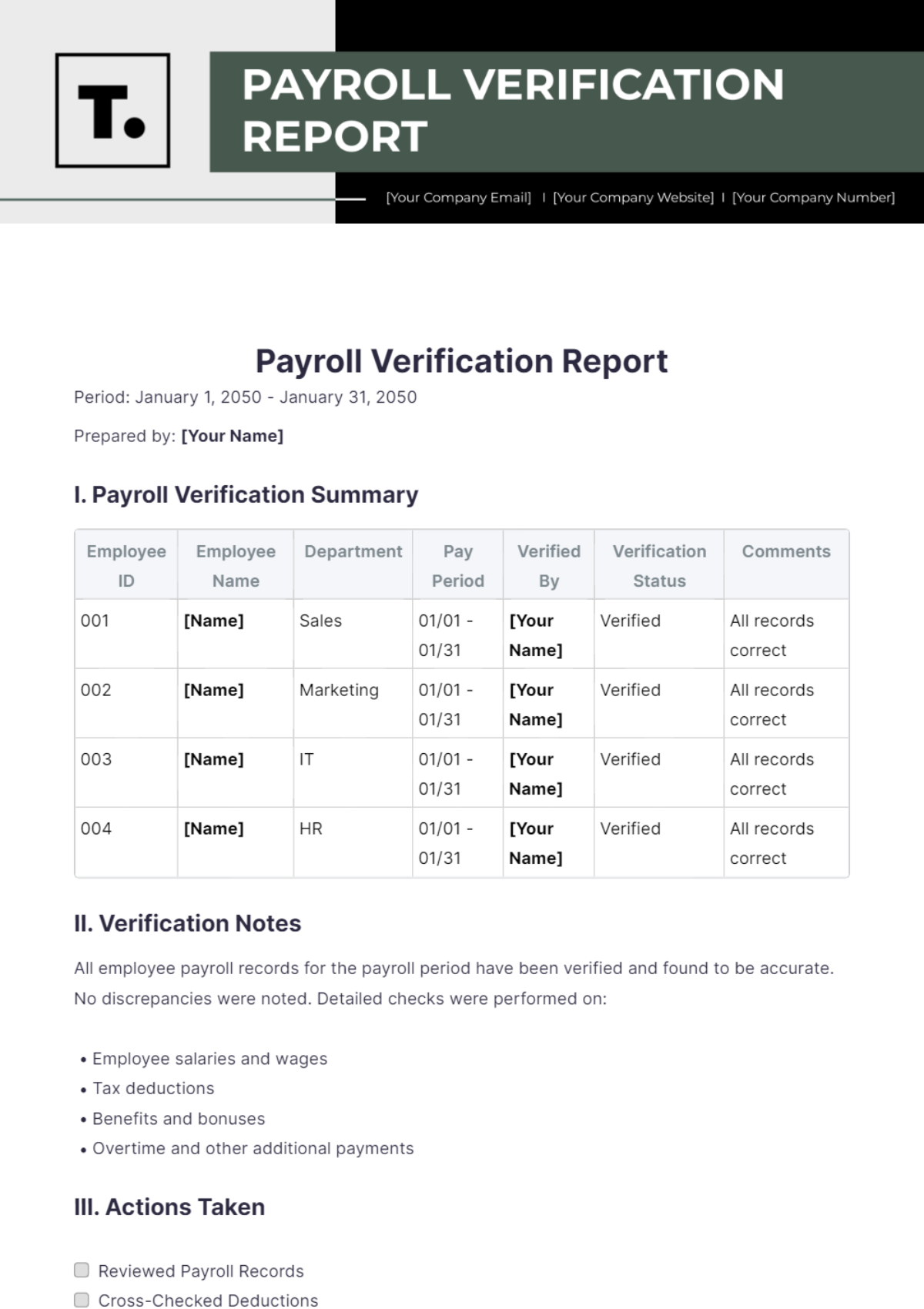

Prepared by: [Your Name]

Email: [Your Email]

Company: [Your Company Name]

Address: [Your Company Address]

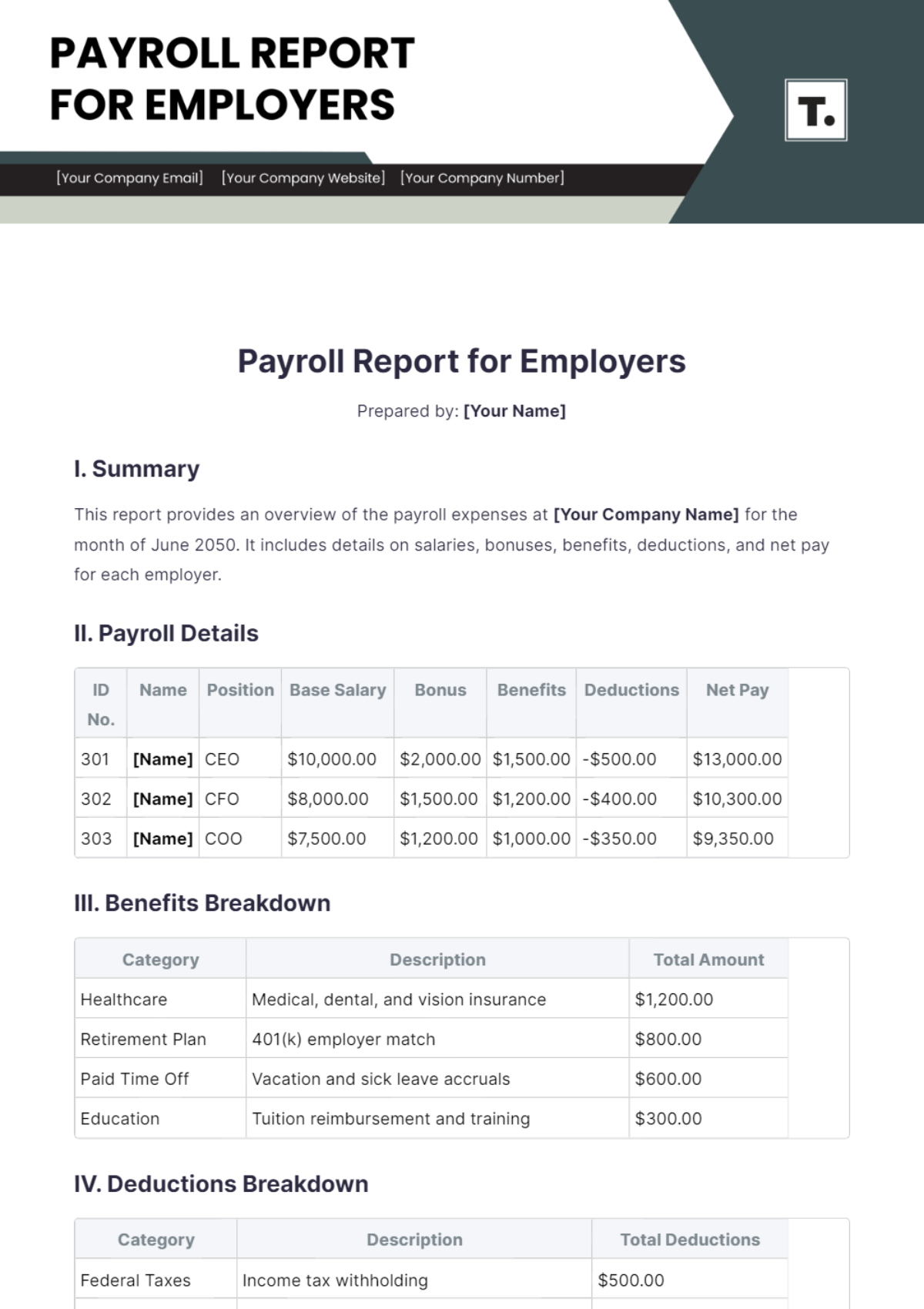

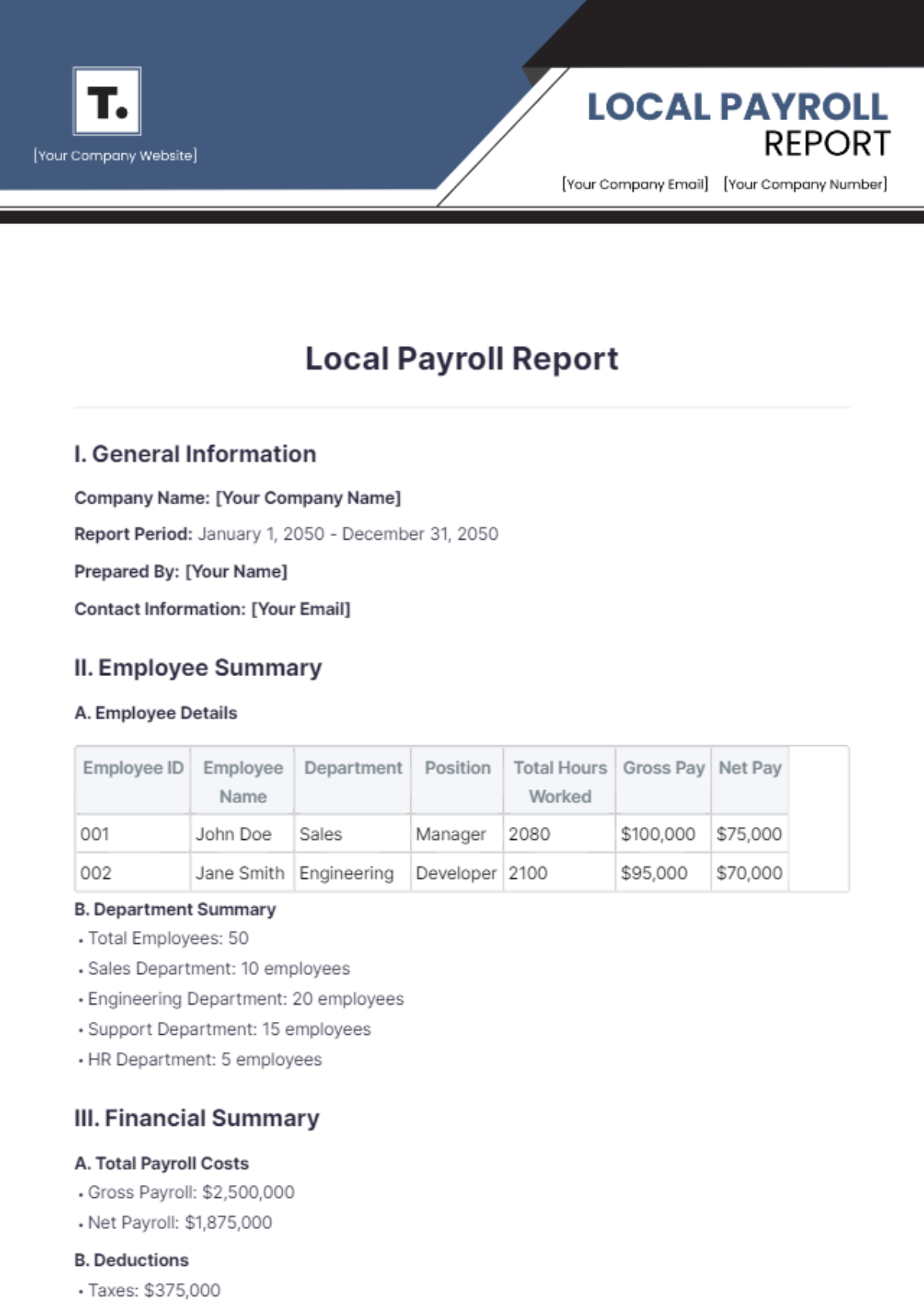

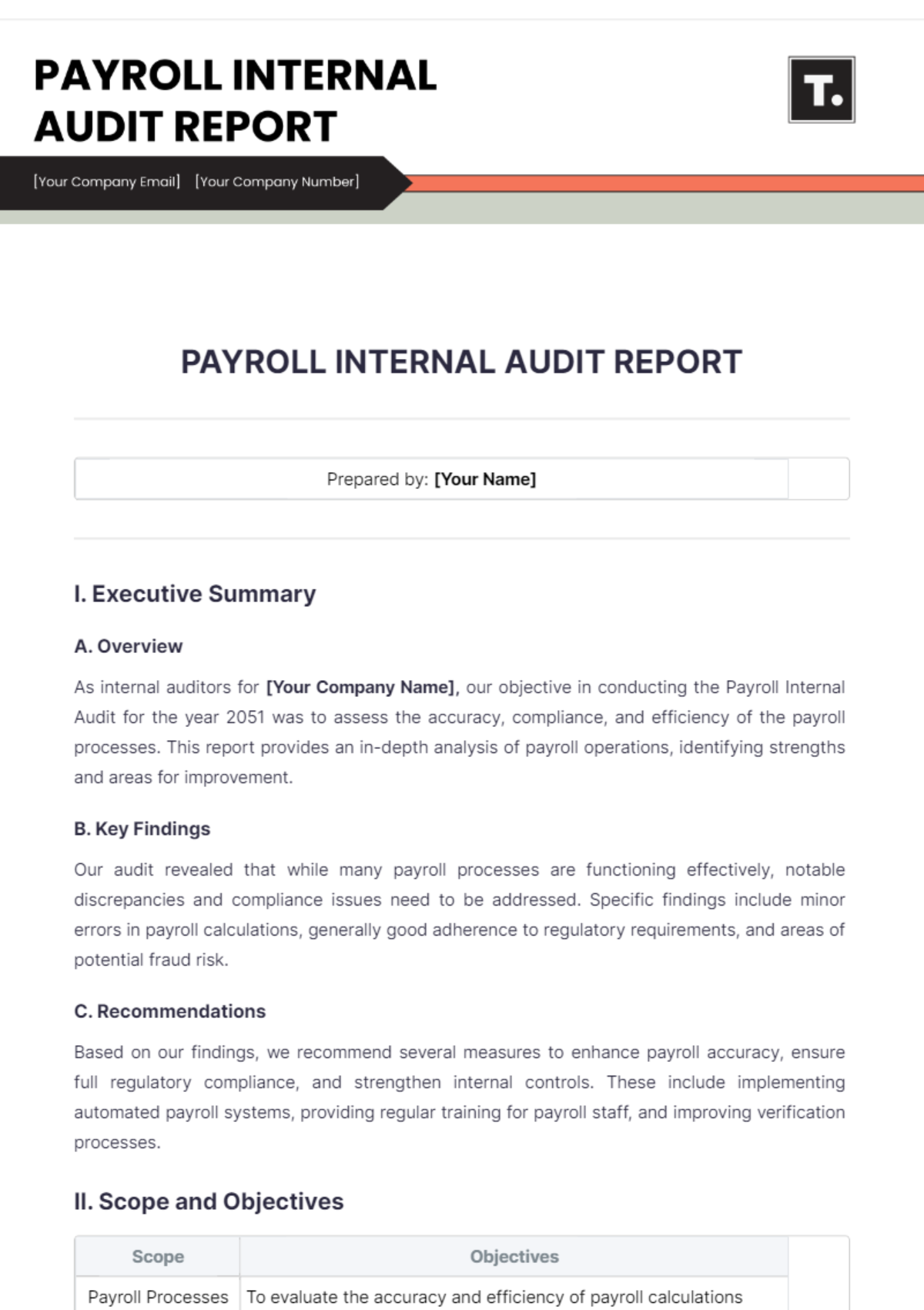

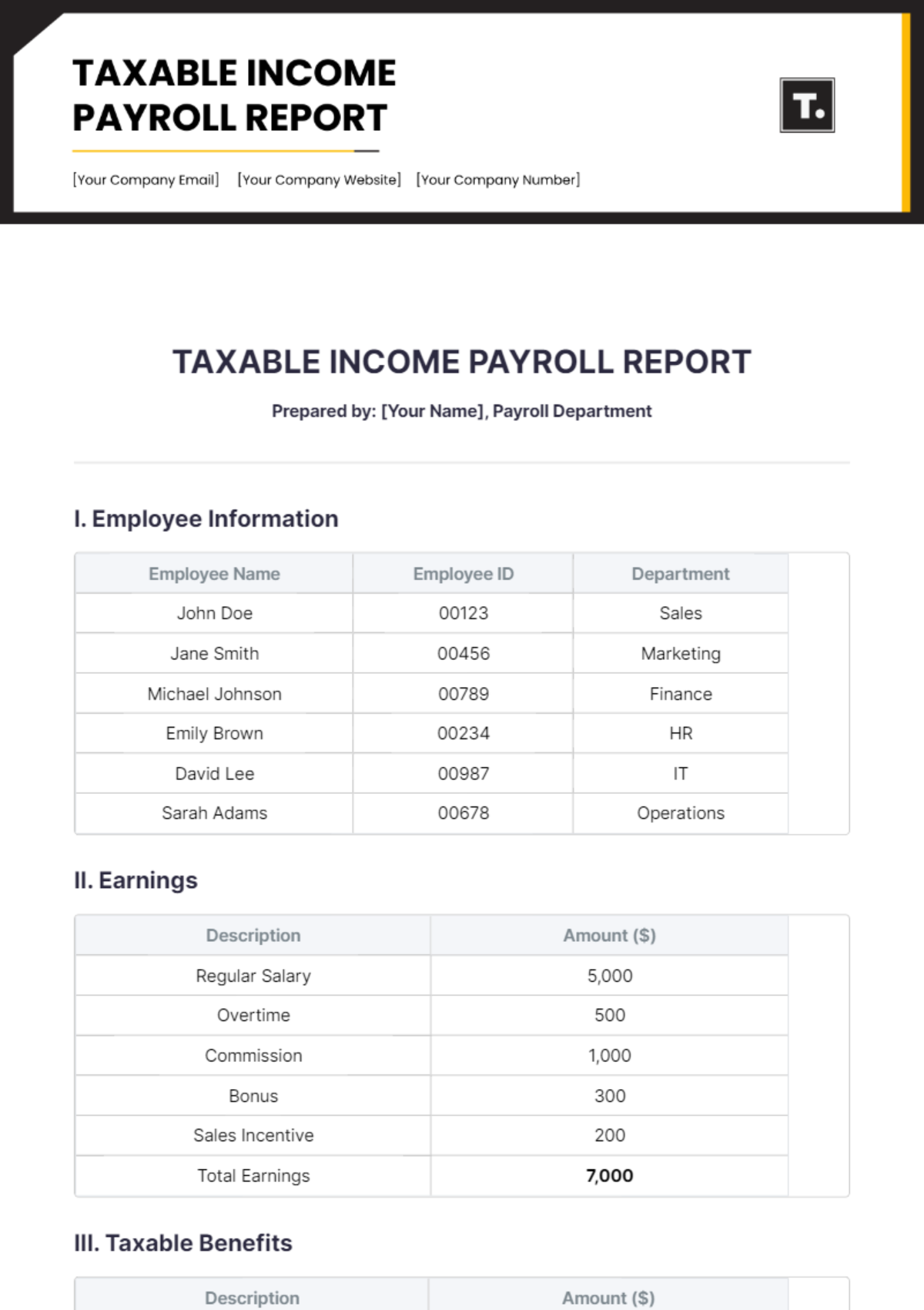

I. Report Summary

This Payroll Register Report provides a comprehensive overview of the payroll activities for the pay period ending on December 31, 2050.

Total Employees Paid: 120

Total Gross Wages: $250,000

Total Deductions: $50,000

Net Payroll Amount: $200,000

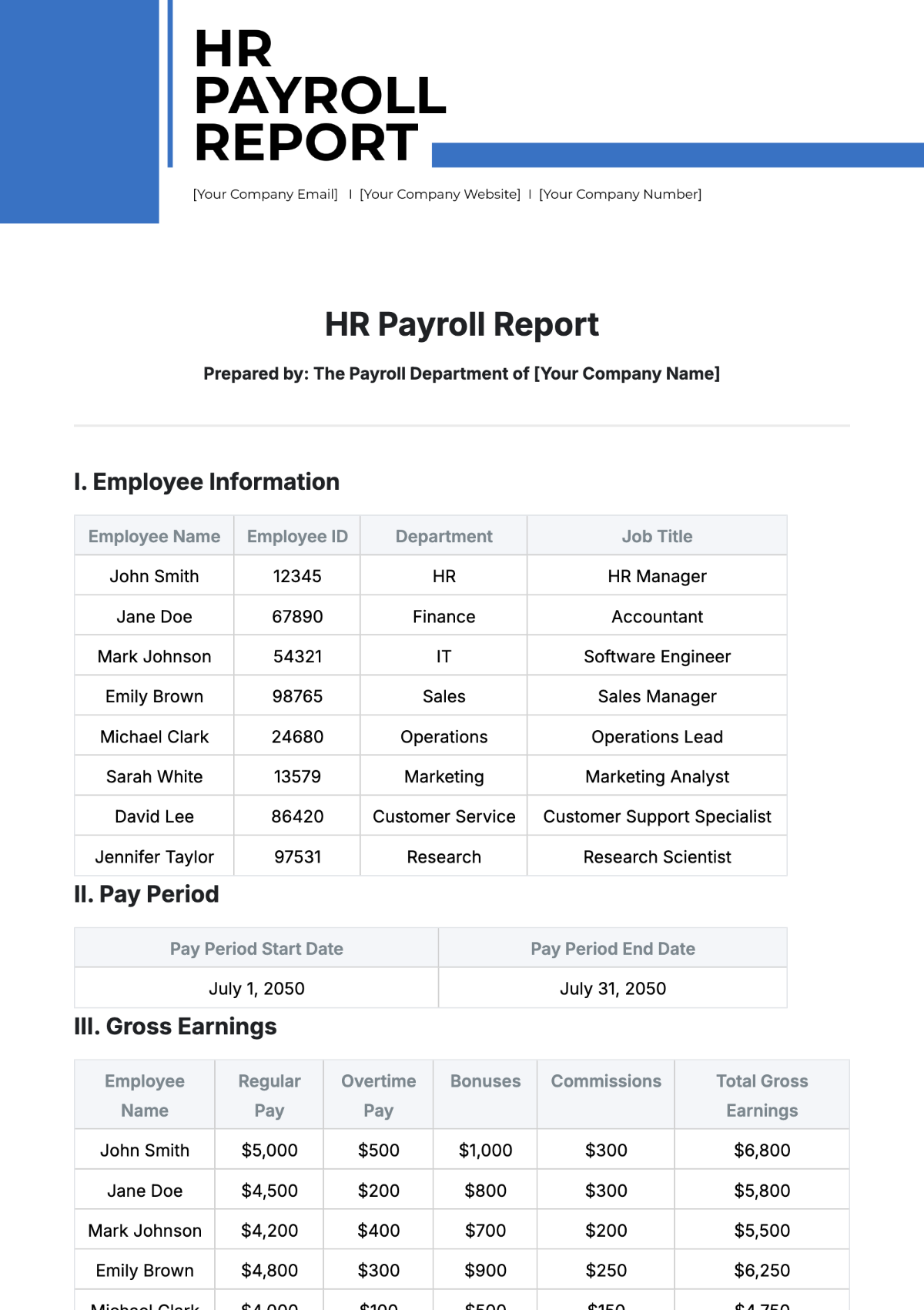

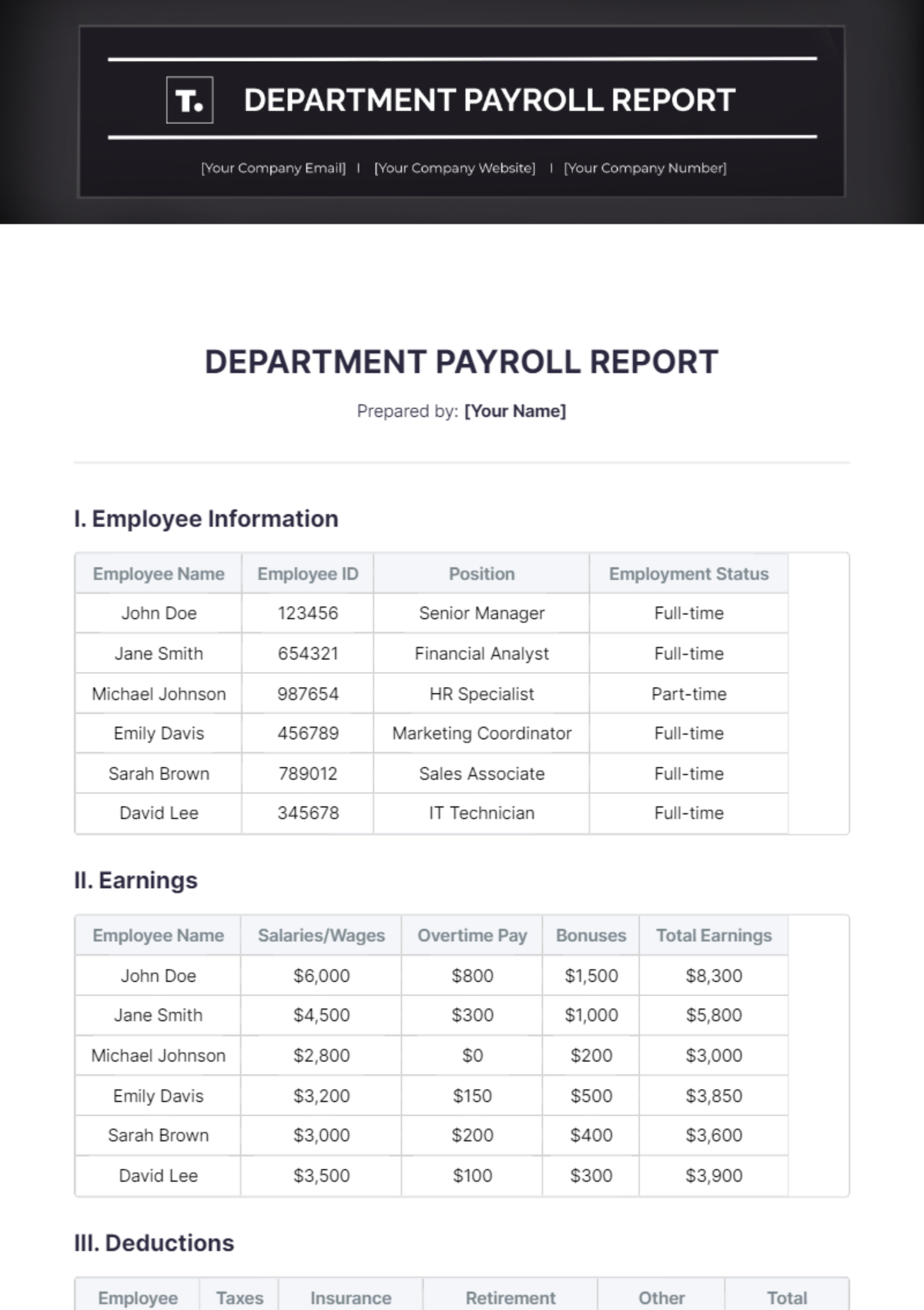

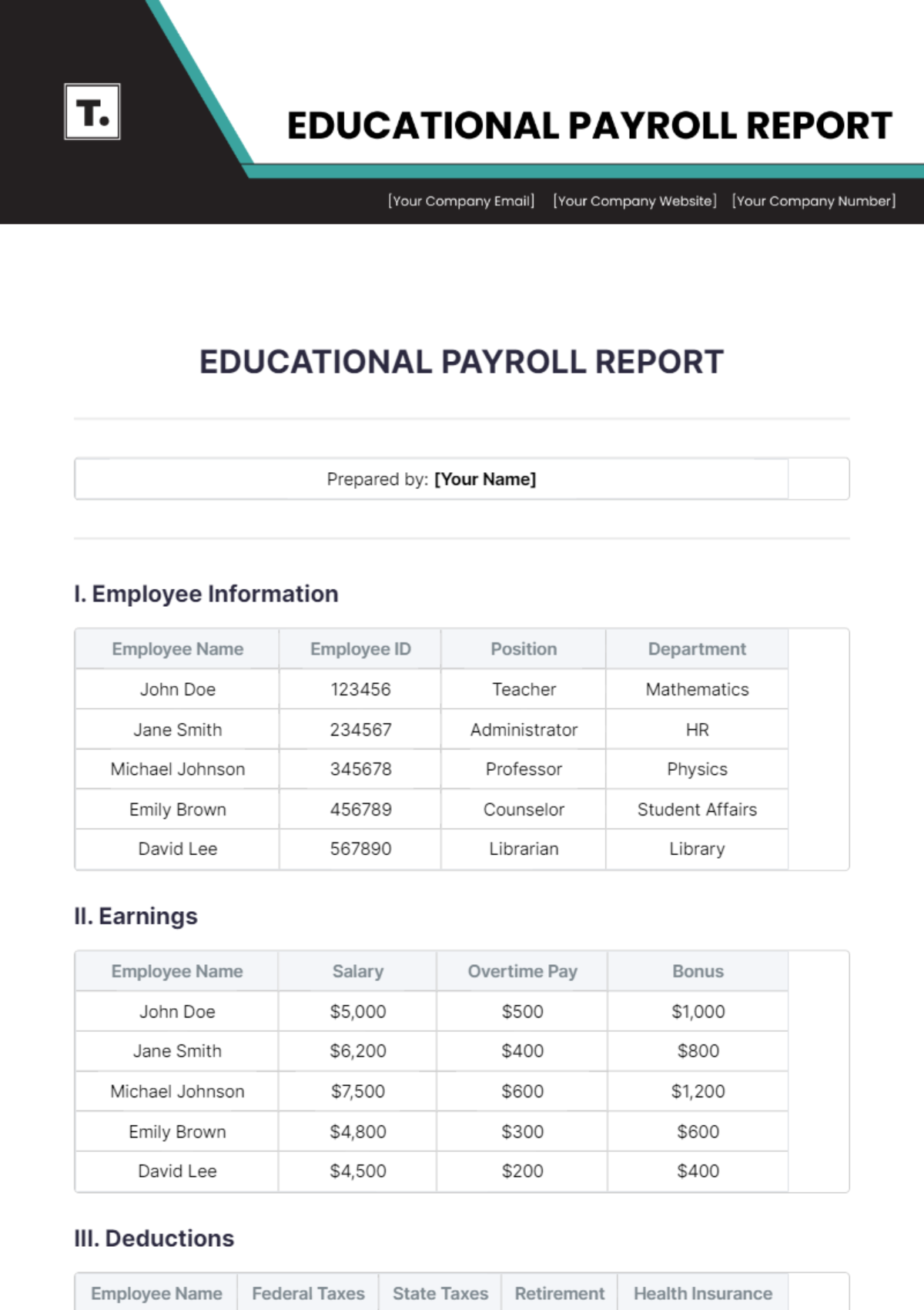

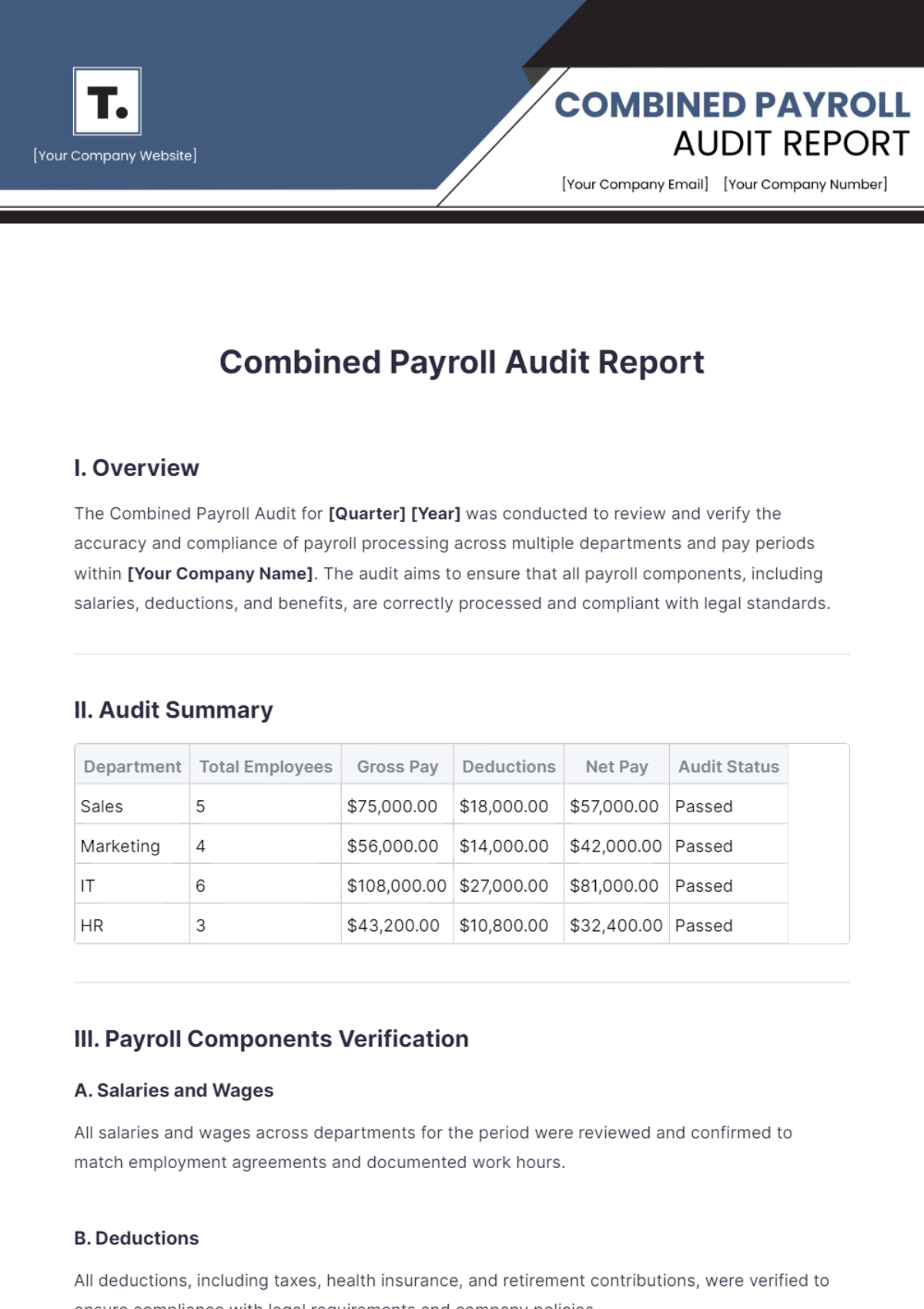

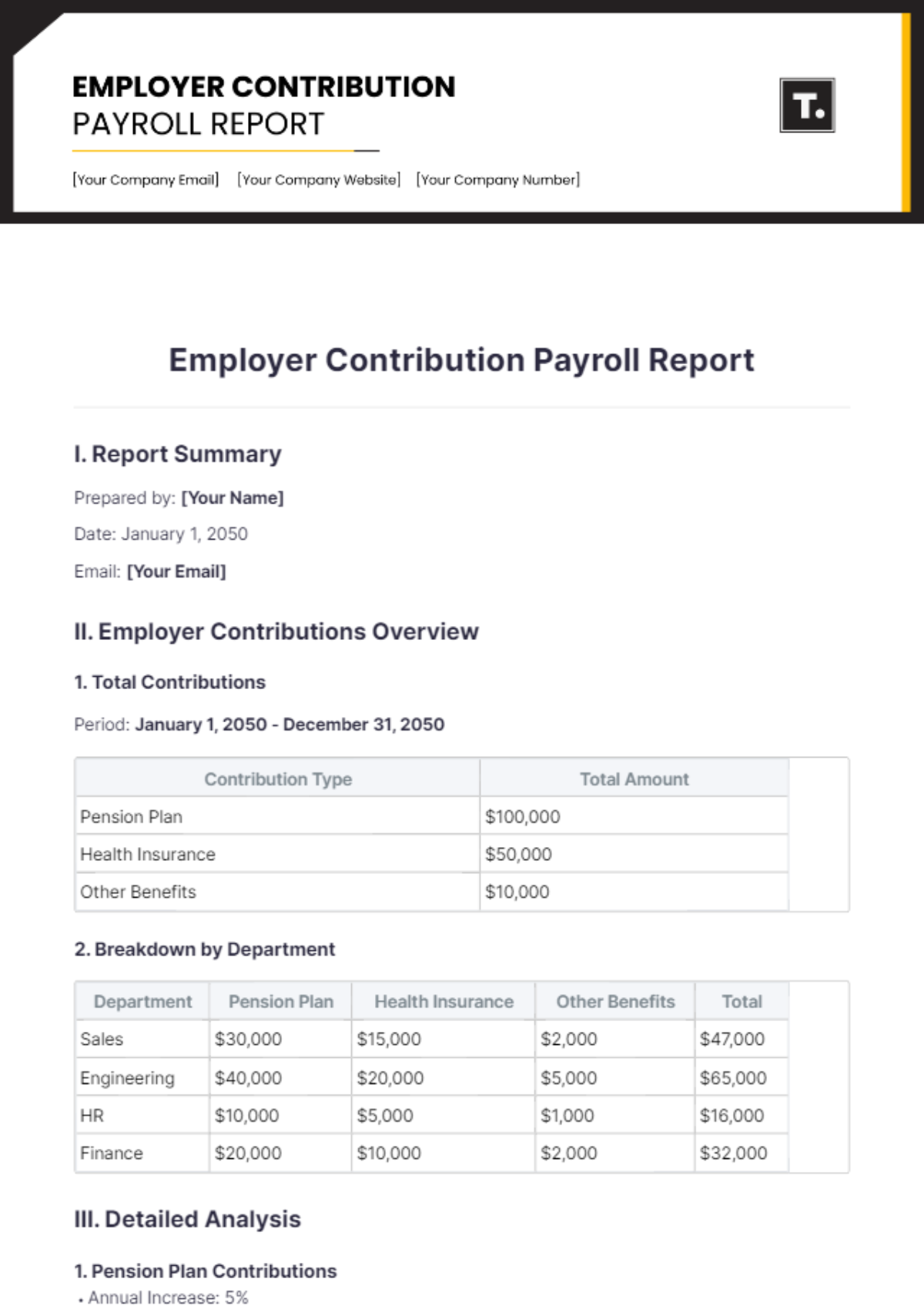

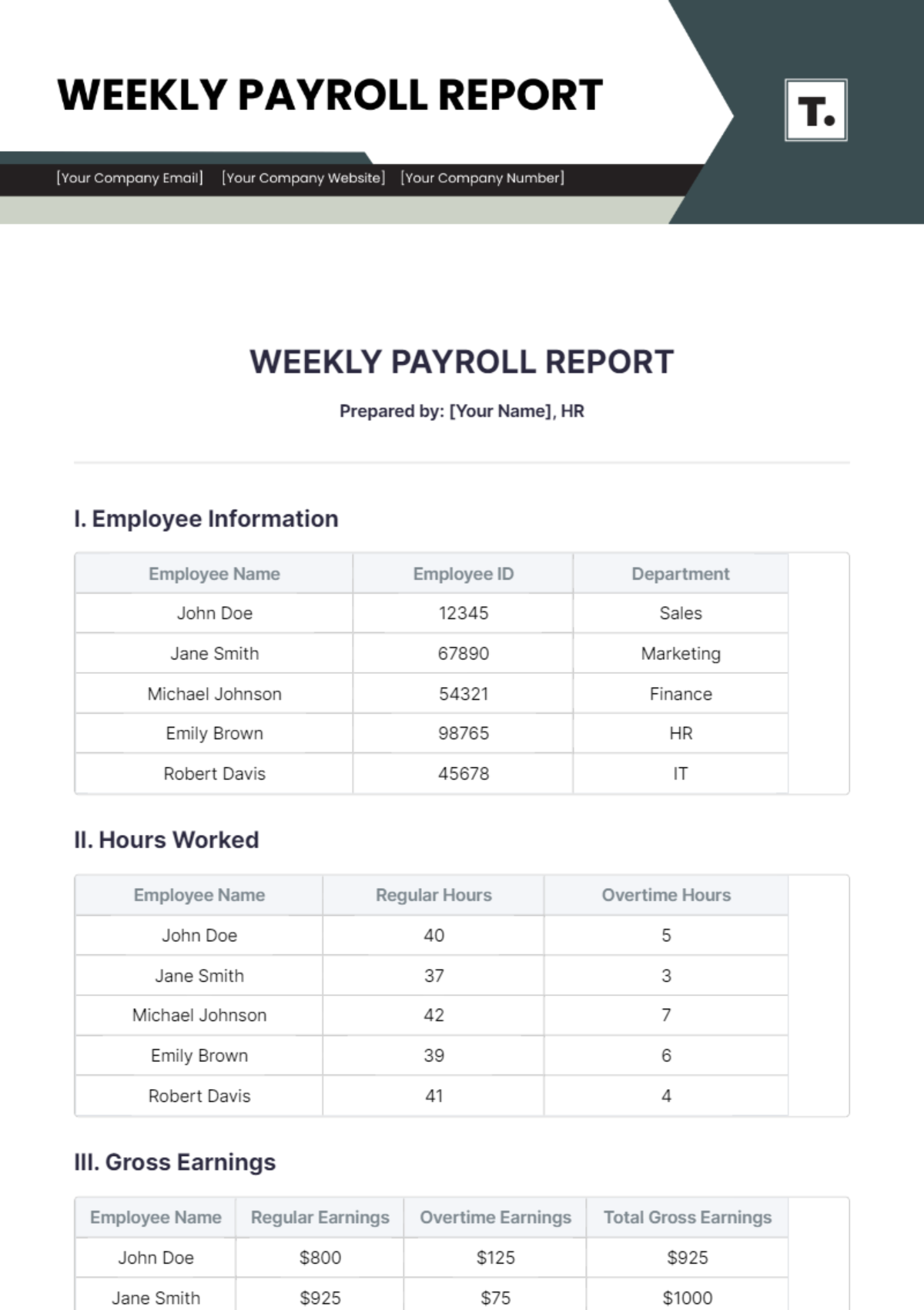

II. Payroll Details by Department

1. Finance Department

Employee ID Employee Name Gross Wages Deductions Net Pay F001 John Doe $5,000 $1,000 $4,000 F002 Jane Smith $4,800 $960 $3,840

2. Marketing Department

Employee ID Employee Name Gross Wages Deductions Net Pay M001 Tom Brown $6,000 undefined $5,300 M002 Sarah White $5,500 $1,100 $4,400

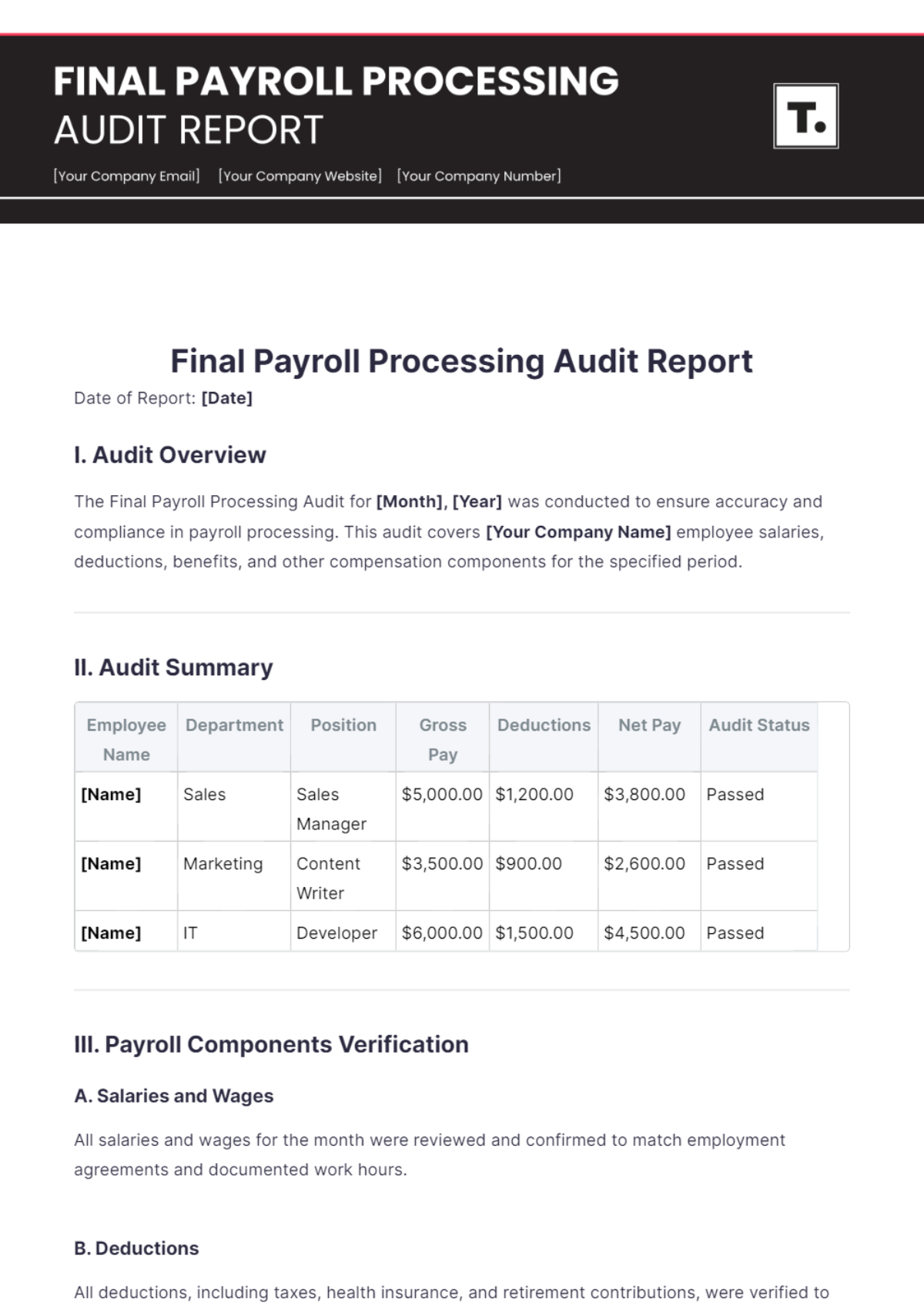

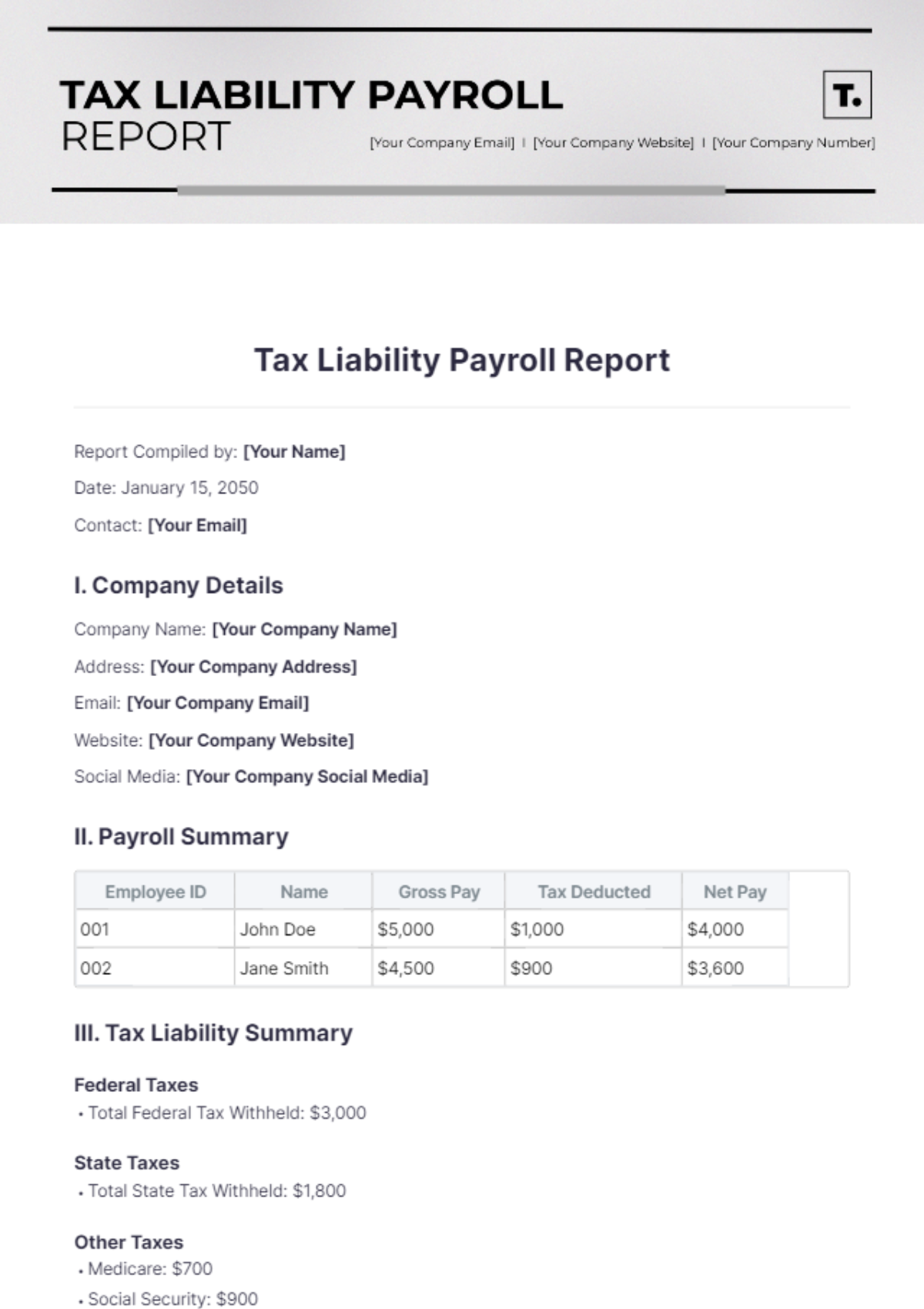

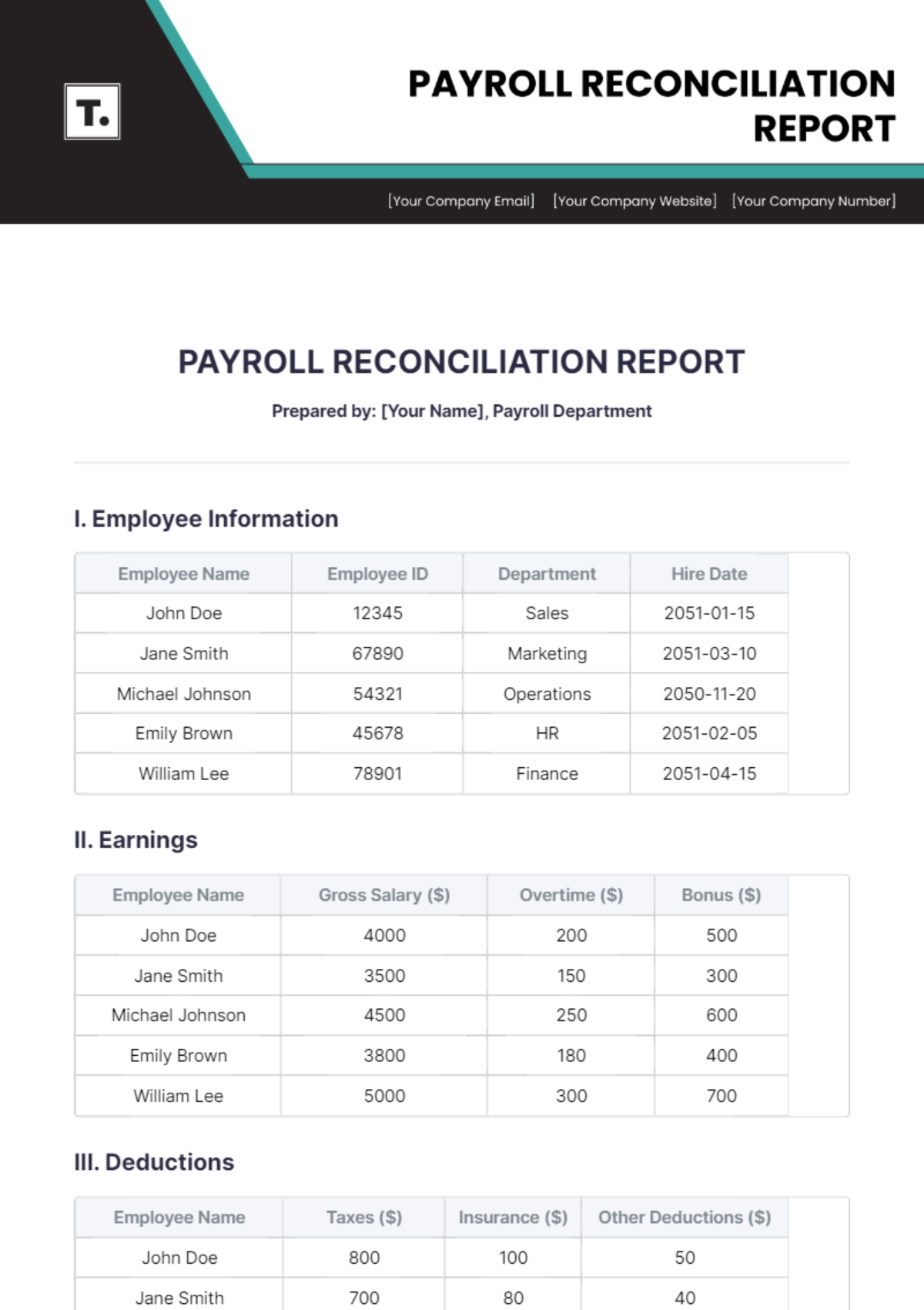

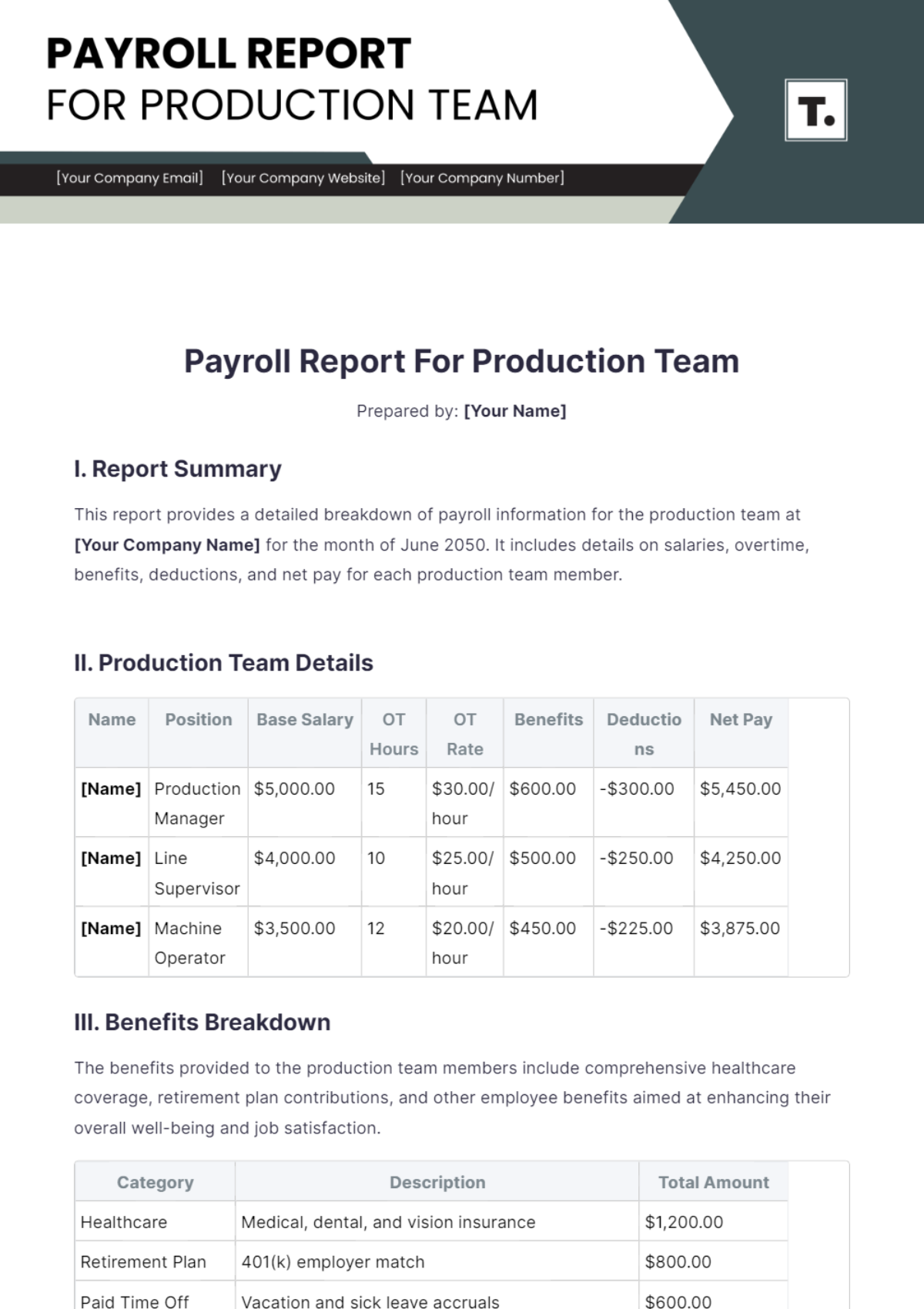

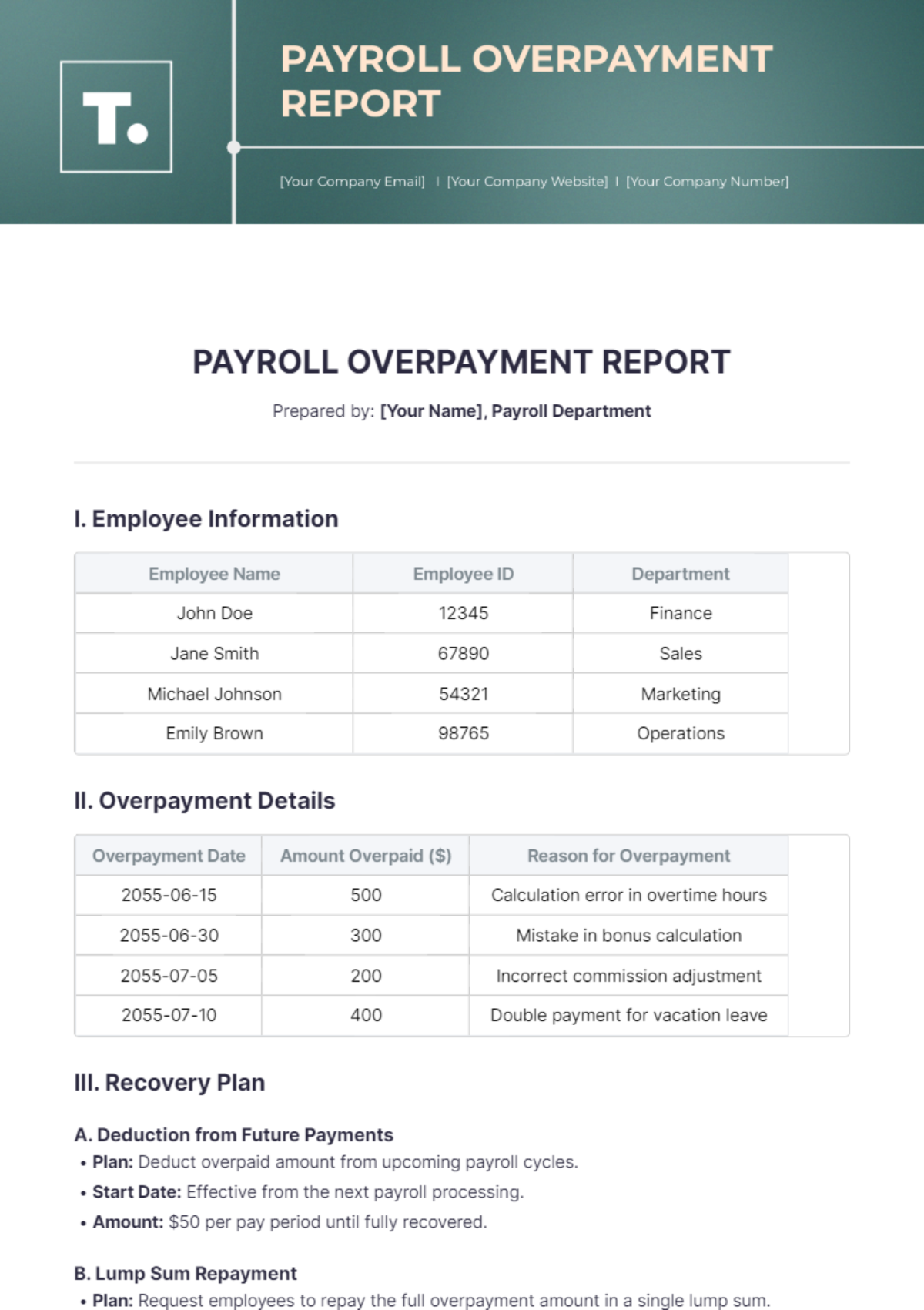

III. Deductions Summary

Federal Tax: $20,000

State Tax: $10,000

Health Insurance: $5,000

Retirement Contributions: $7,000

Miscellaneous Deductions: $8,000

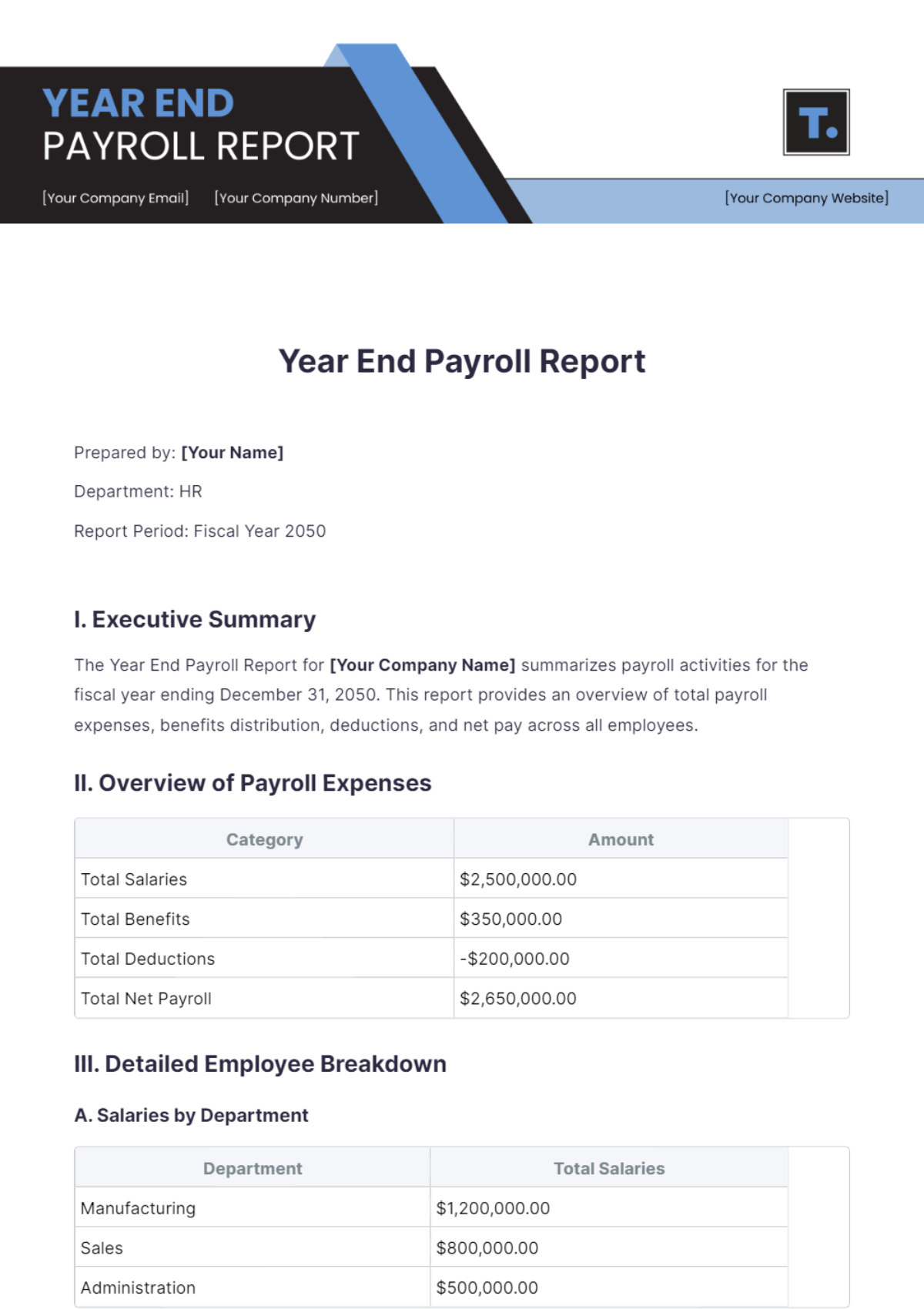

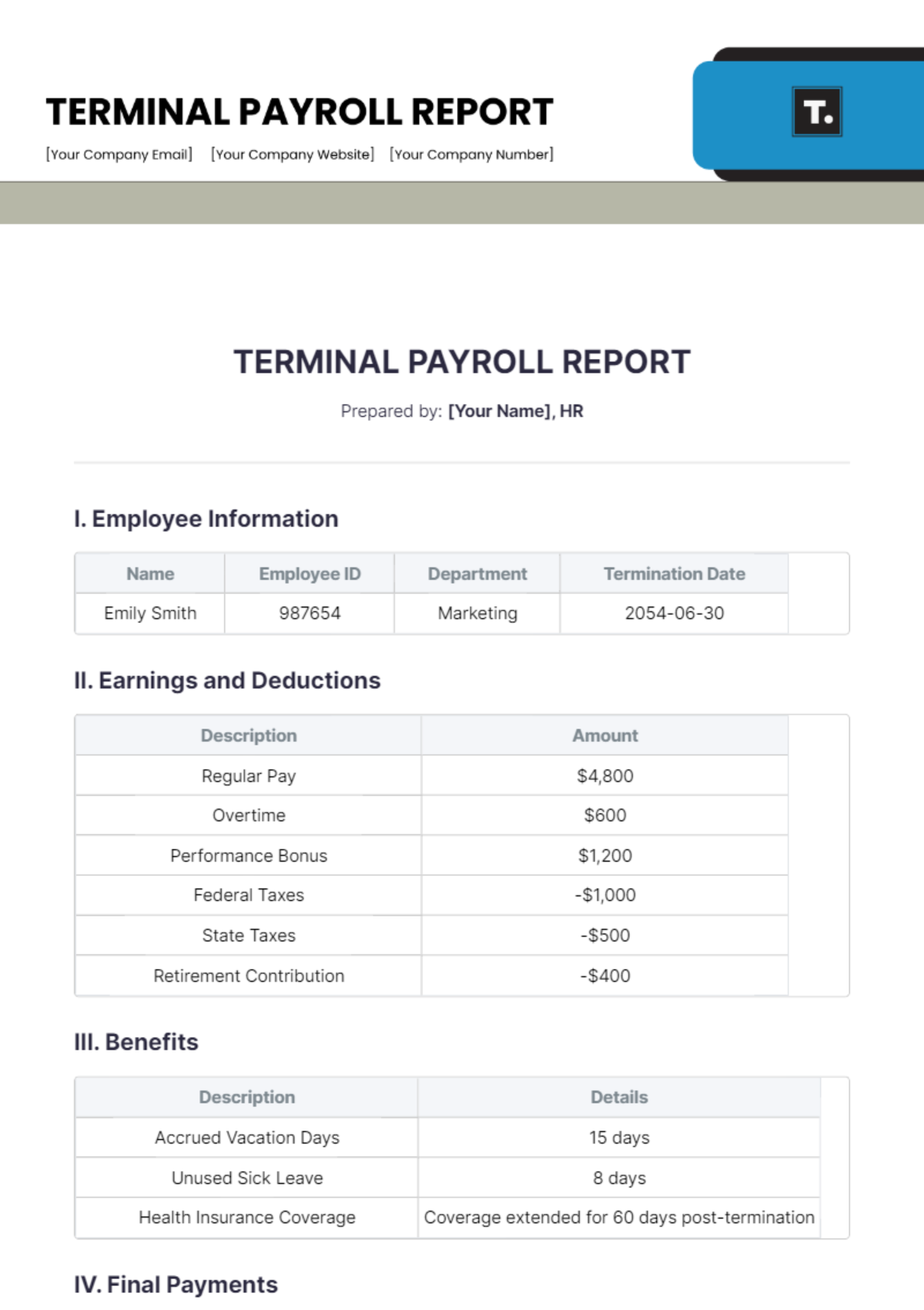

IV. Net Payroll Distribution

Department Net Payroll Amount Finance $50,000 Marketing undefined Operations $70,000 IT $60,000 HR $20,000