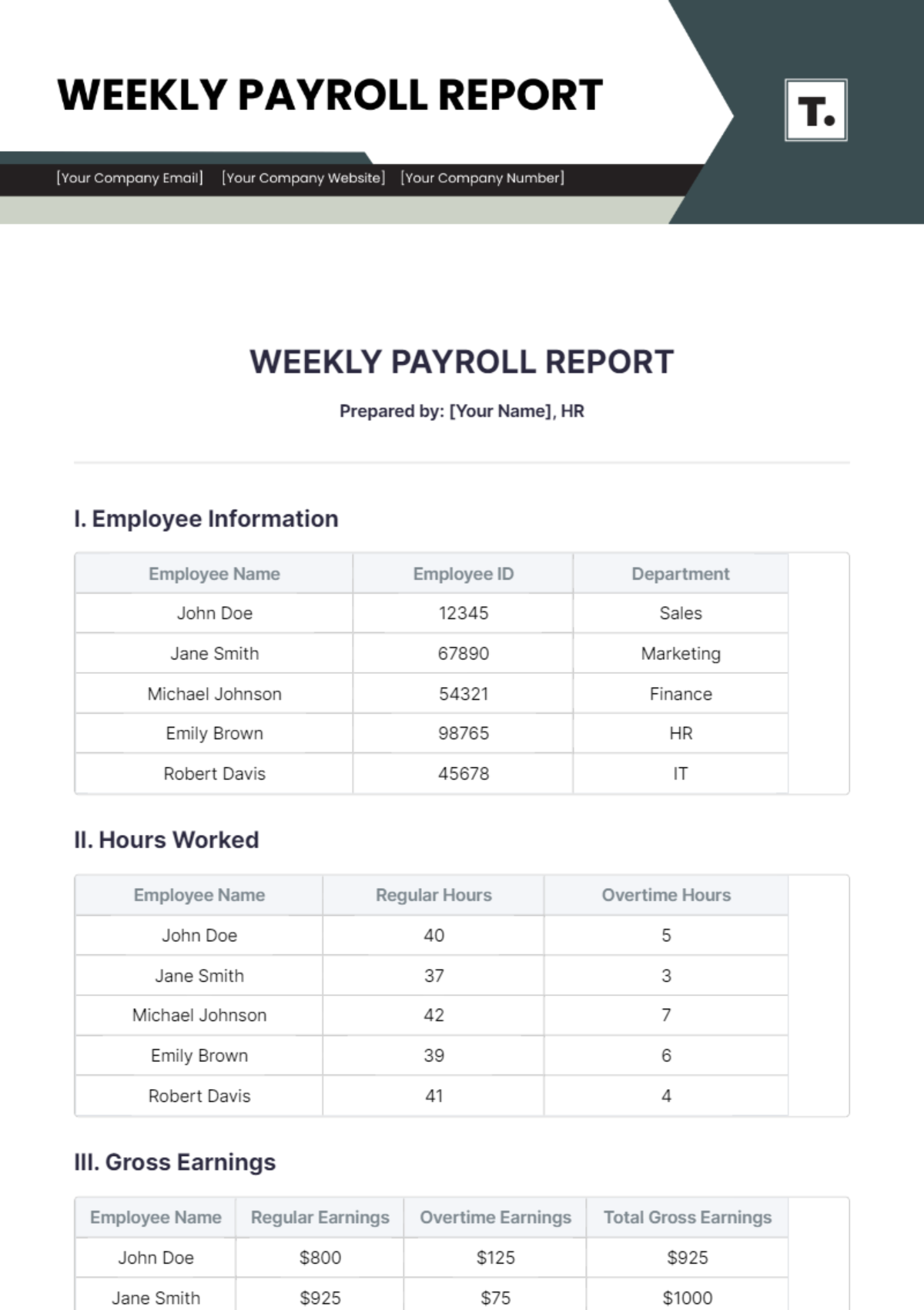

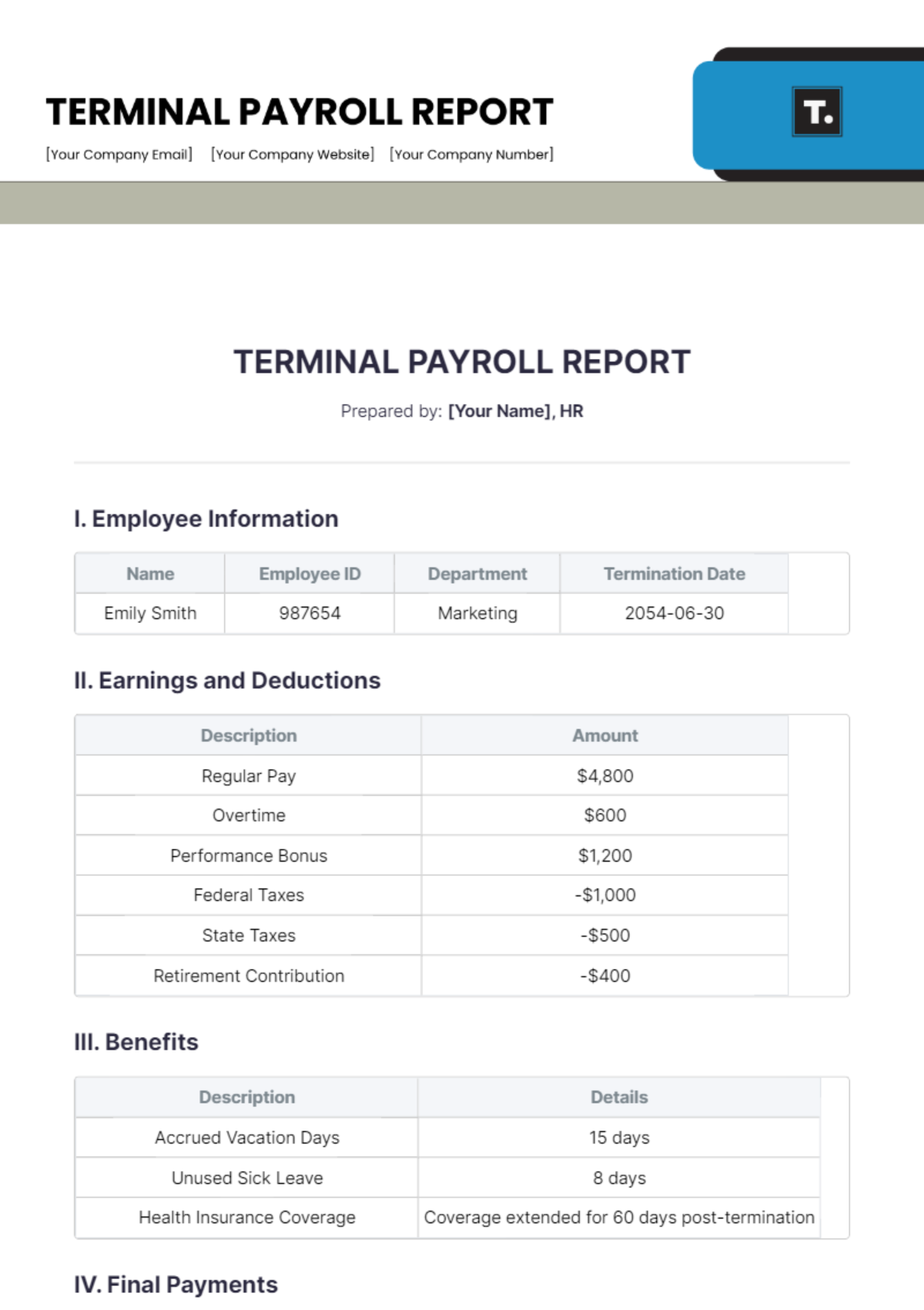

TERMINAL PAYROLL REPORT

Prepared by: [Your Name], HR

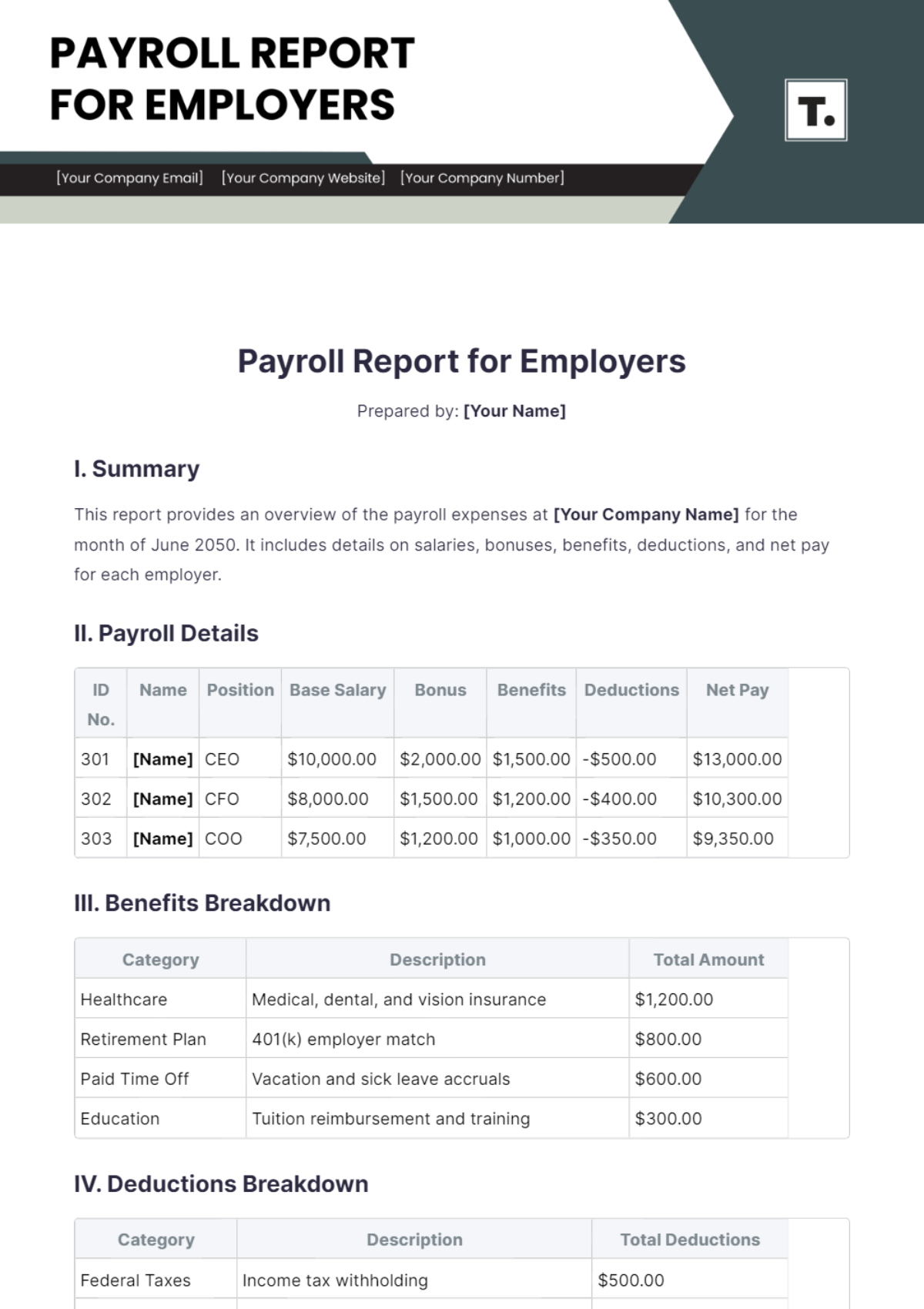

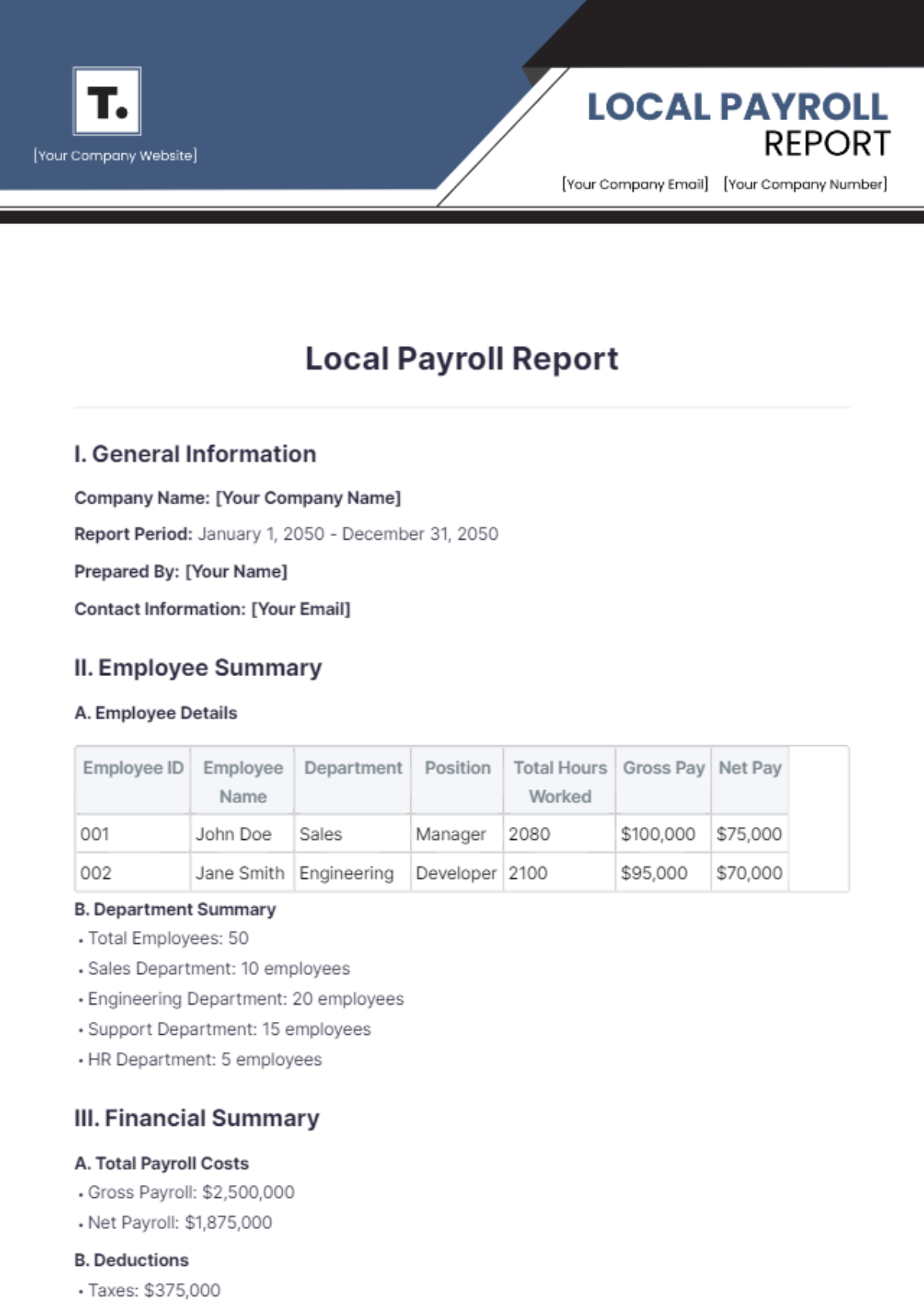

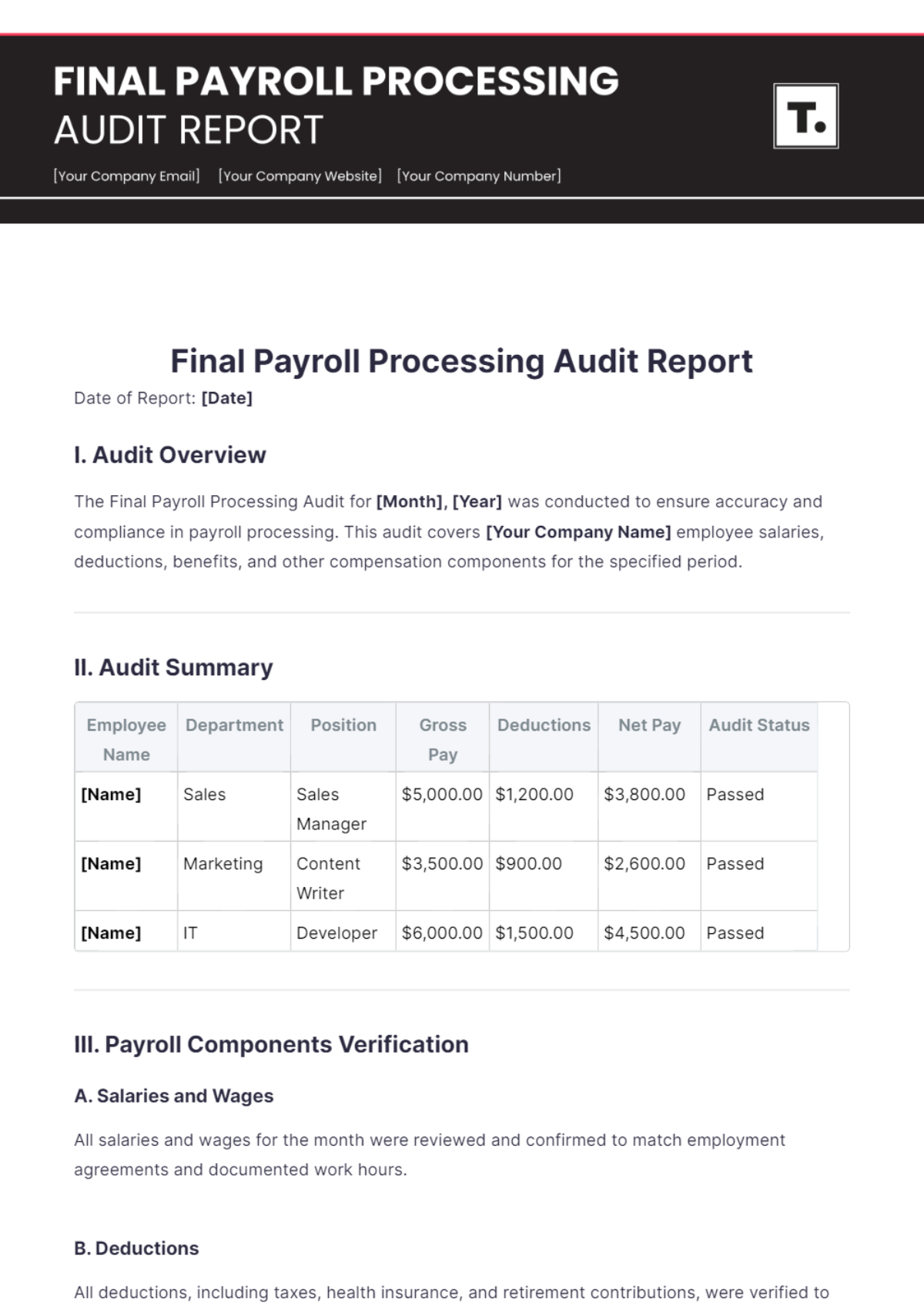

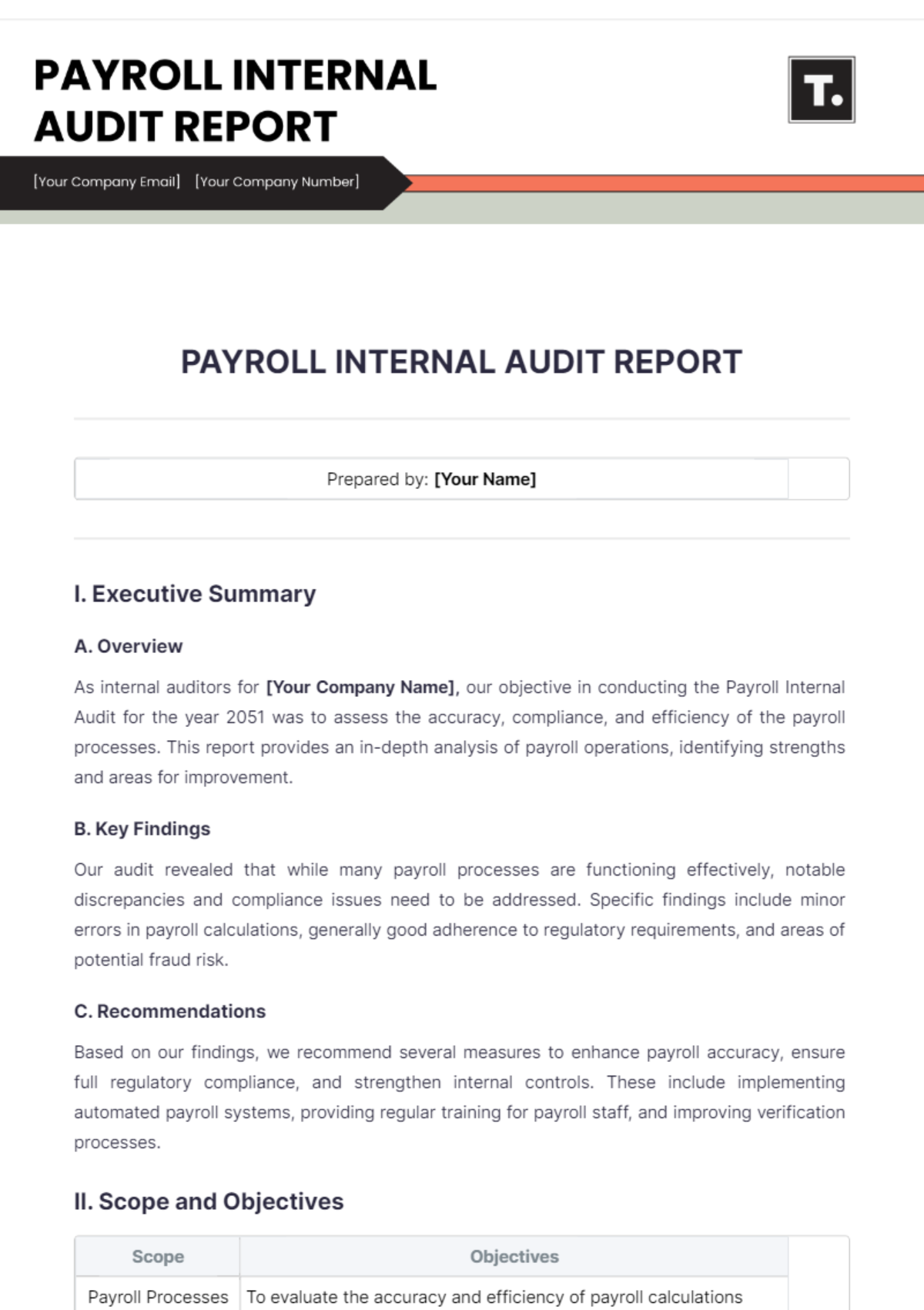

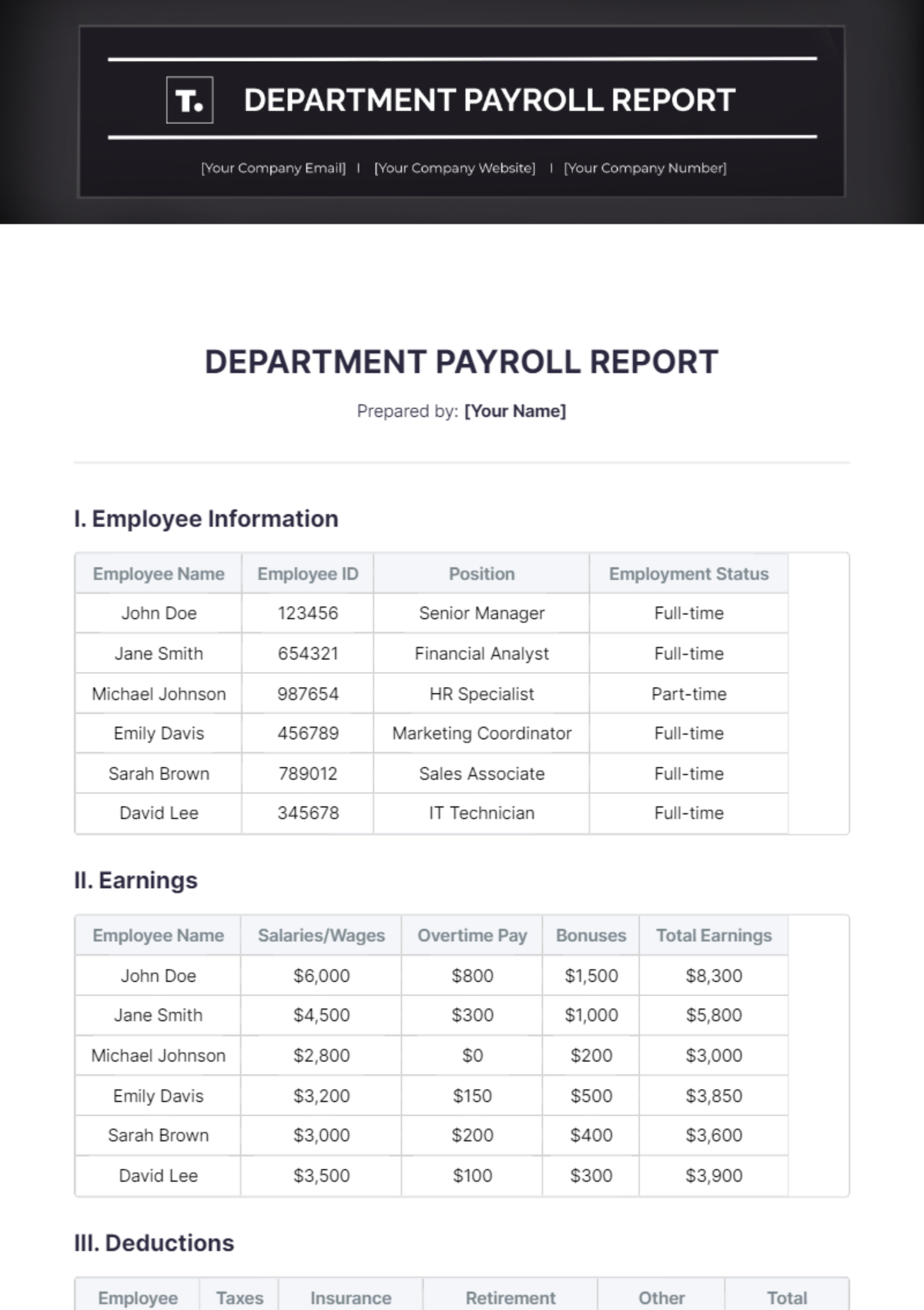

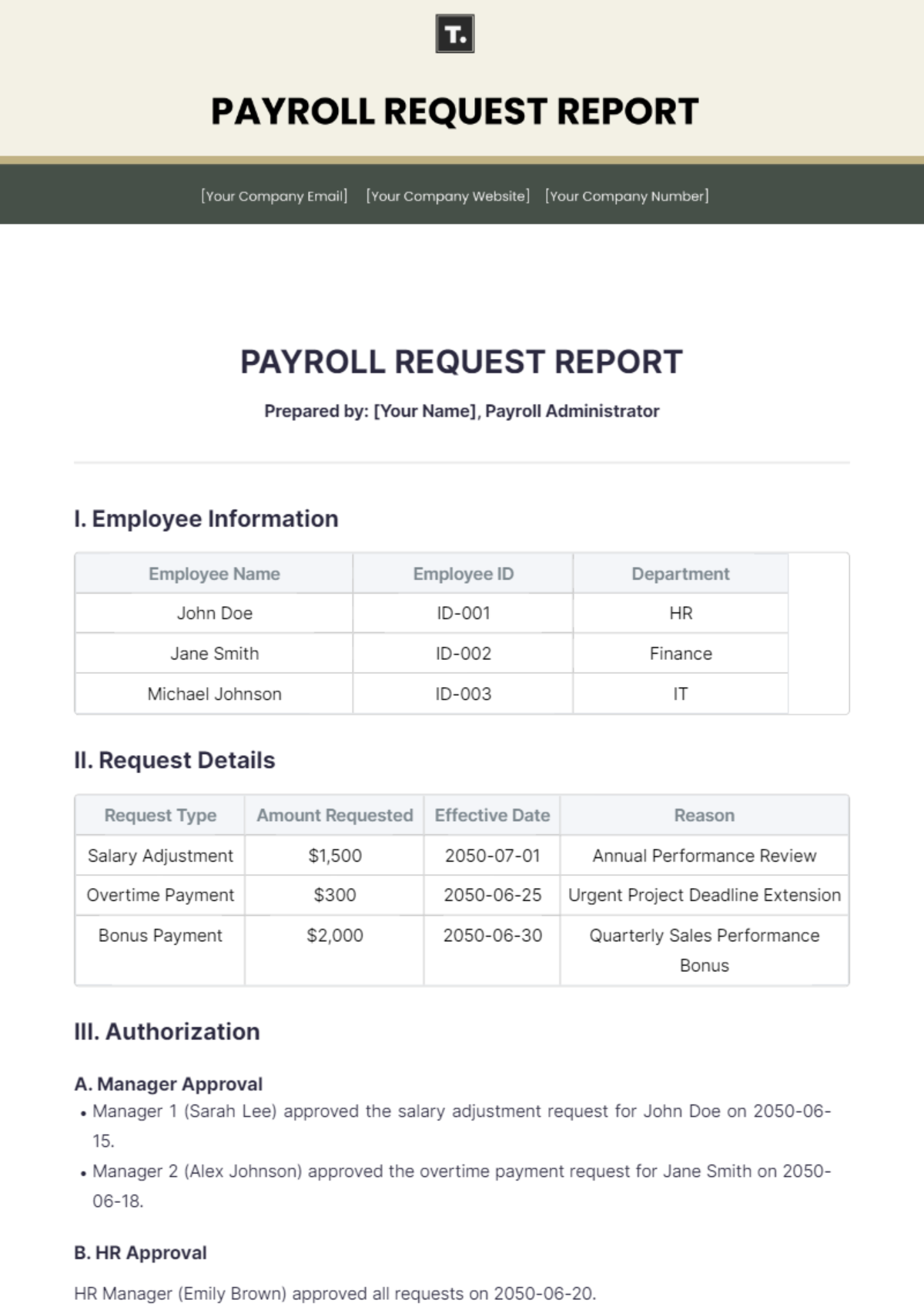

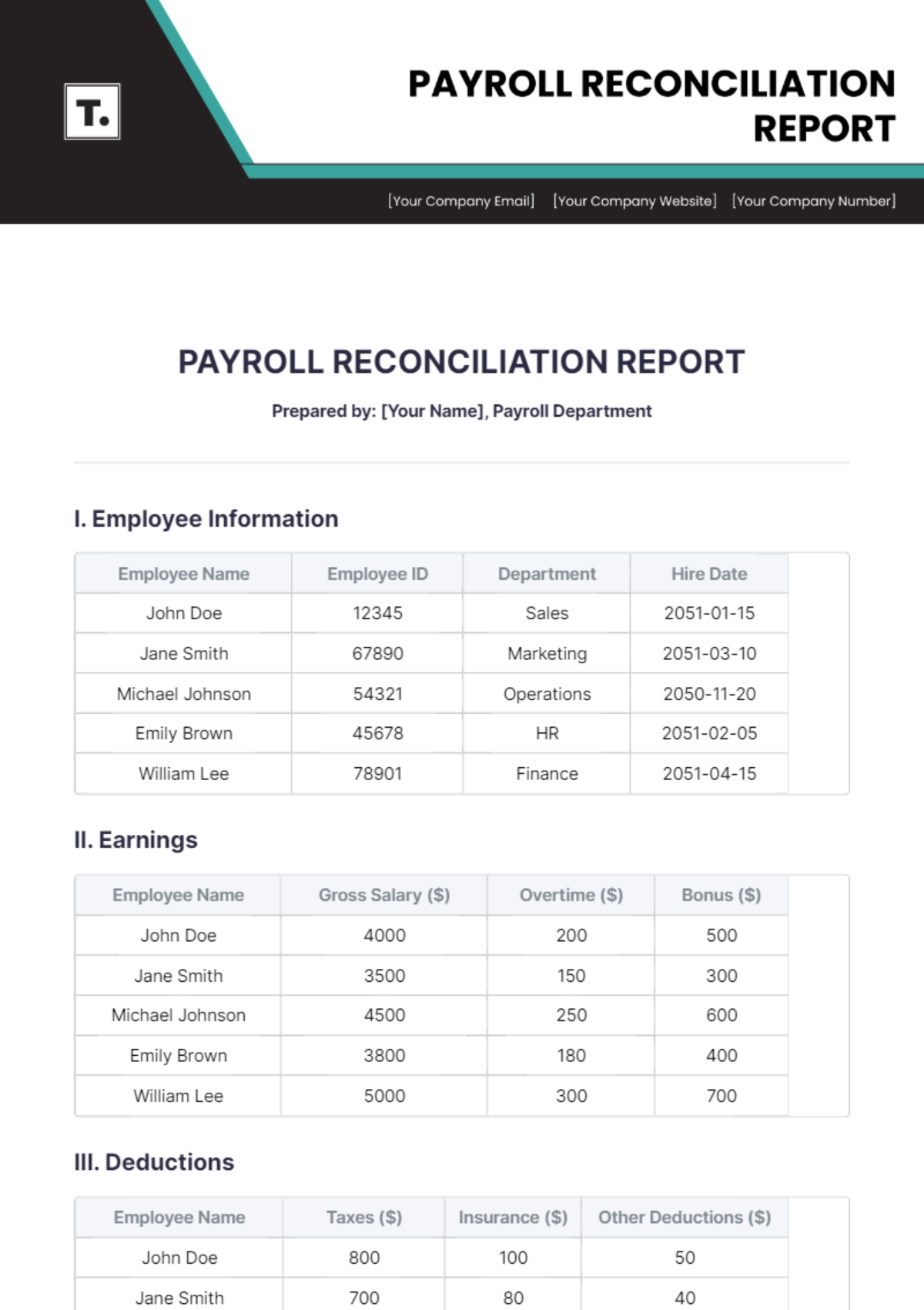

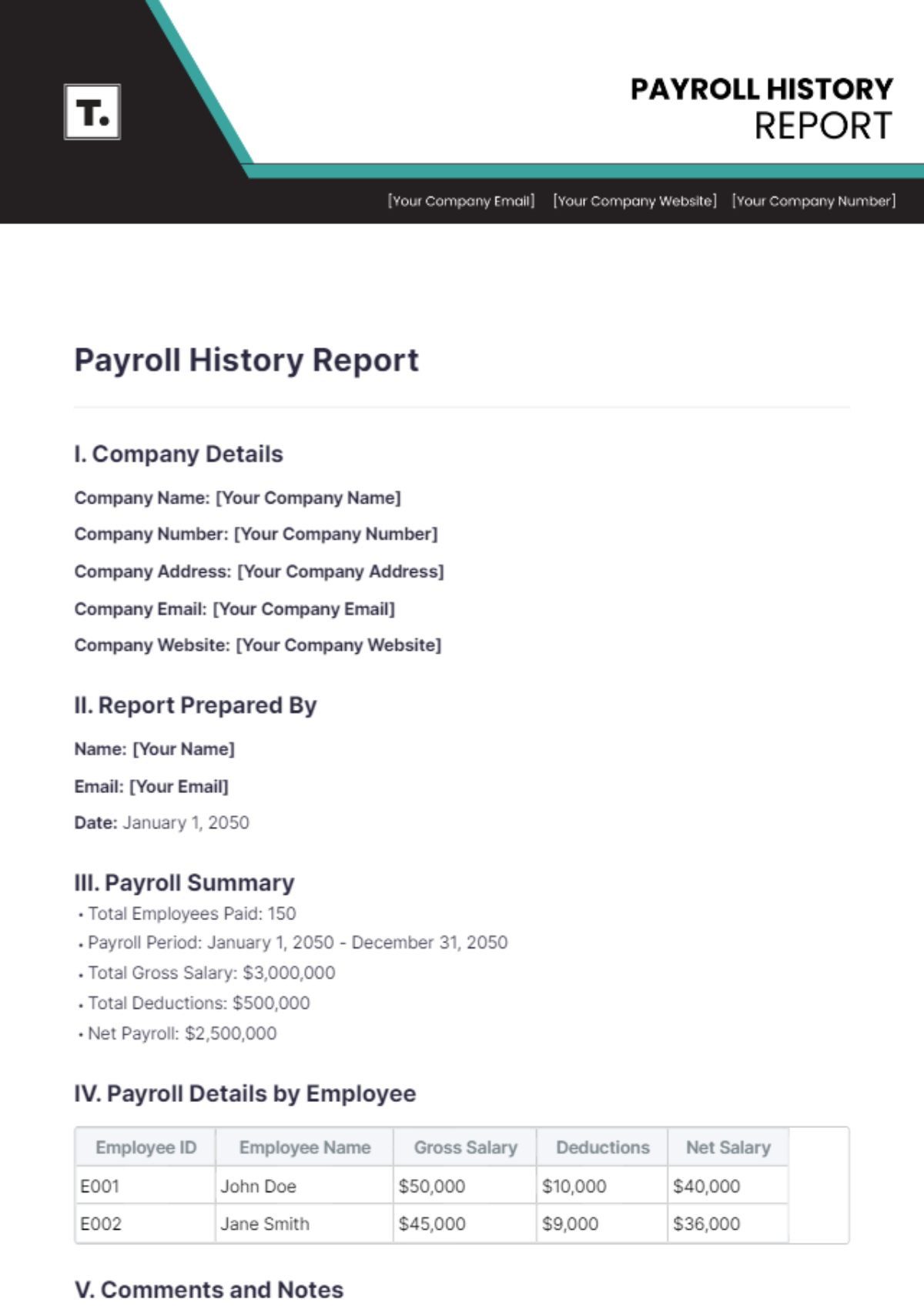

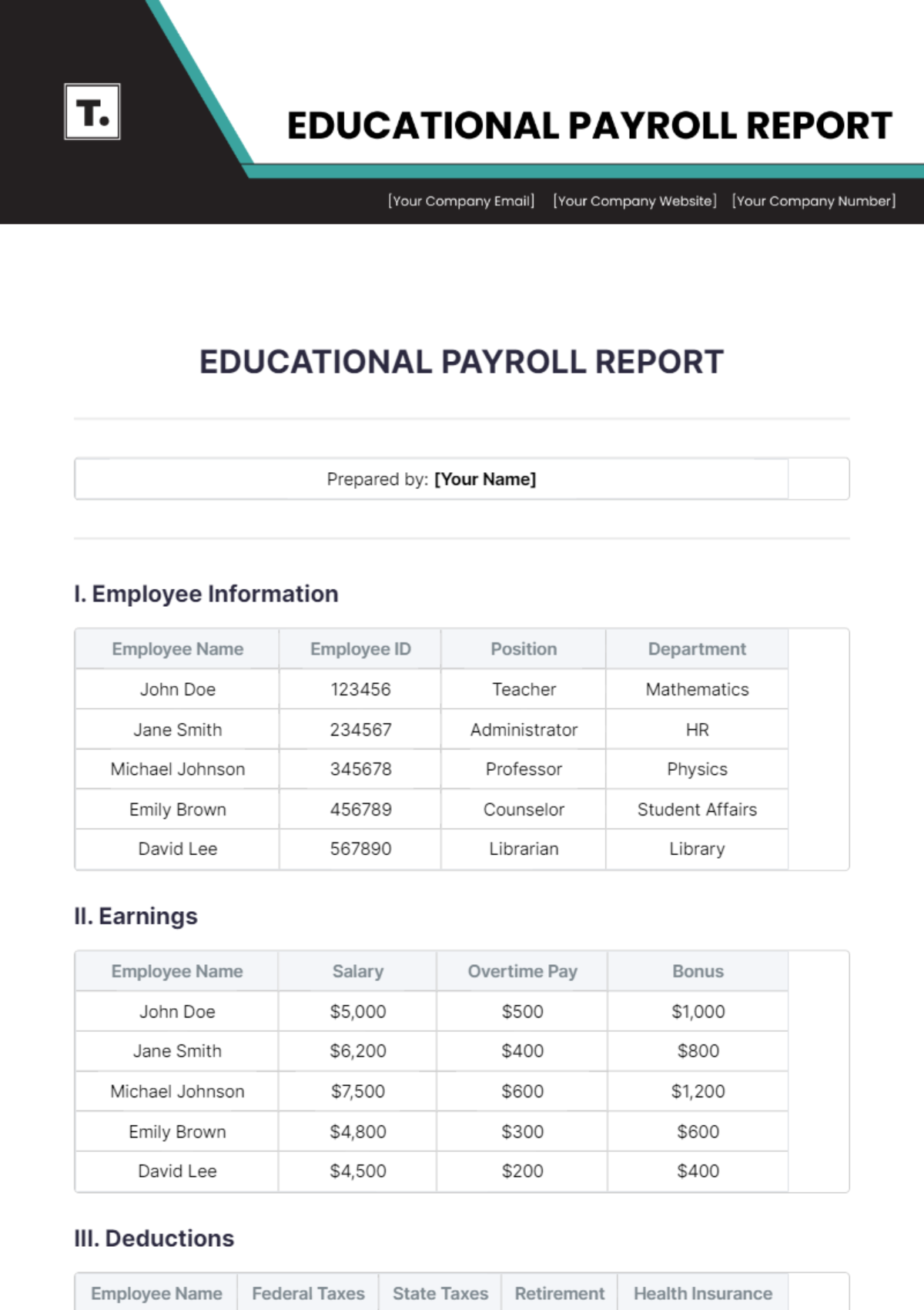

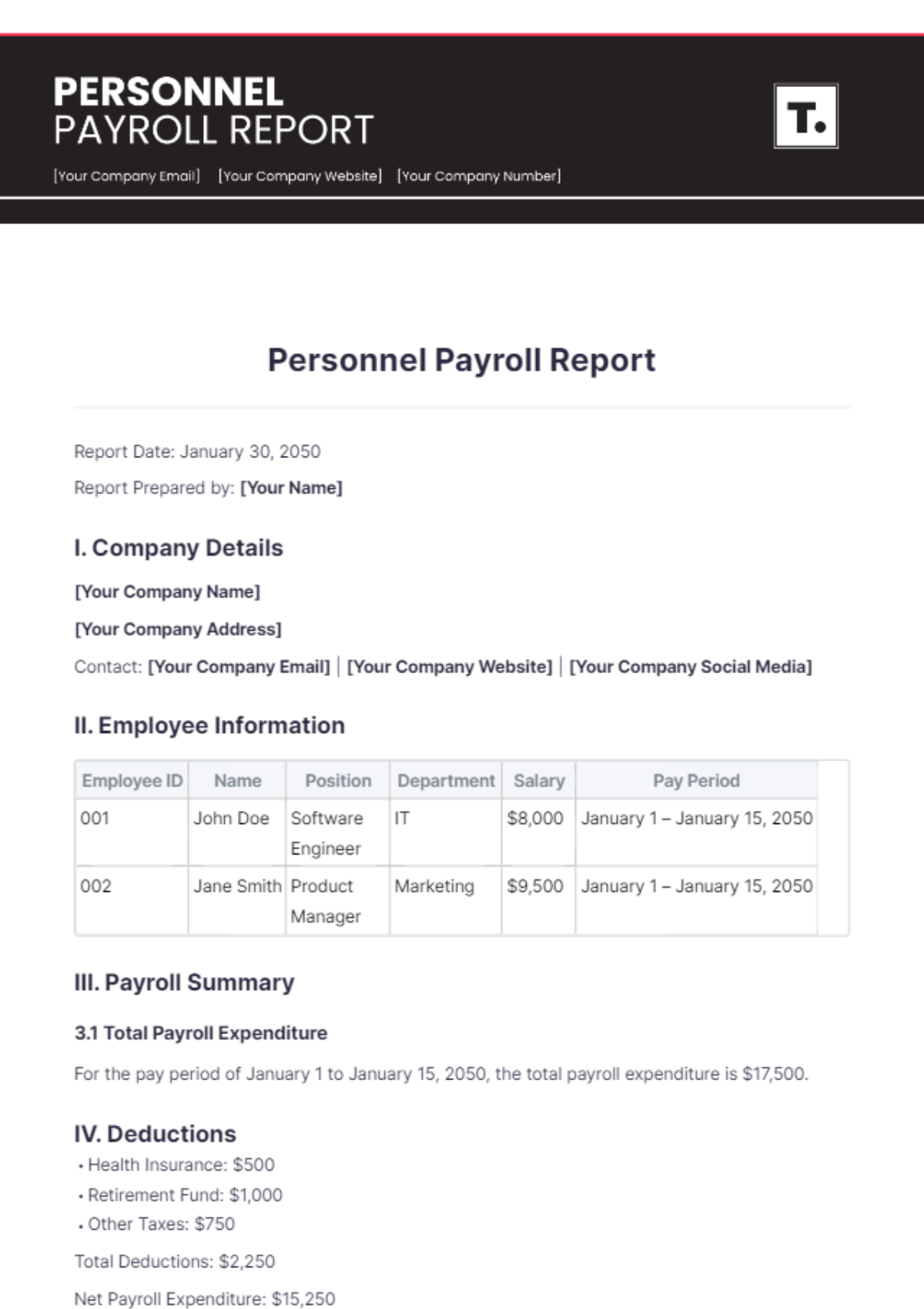

I. Employee Information

Name | Employee ID | Department | Termination Date |

|---|---|---|---|

Emily Smith | 987654 | Marketing | 2054-06-30 |

II. Earnings and Deductions

Description | Amount |

|---|---|

Regular Pay | $4,800 |

Overtime | $600 |

Performance Bonus | $1,200 |

Federal Taxes | -$1,000 |

State Taxes | -$500 |

Retirement Contribution | -$400 |

III. Benefits

Description | Details |

|---|---|

Accrued Vacation Days | 15 days |

Unused Sick Leave | 8 days |

Health Insurance Coverage | Coverage extended for 60 days post-termination |

IV. Final Payments

Description | Amount |

|---|---|

Total Earnings | $6,600 |

Total Deductions | -$1,900 |

Net Payment | $4,700 |

V. Legal Compliance

A. Employment Agreement

The final payment complies with the terms stipulated in Emily Smith's employment agreement, ensuring all obligations regarding final compensation are met according to company policy and employment laws.

B. Tax Compliance

All applicable federal and state taxes have been accurately deducted based on Emily Smith's final earnings, adhering to current tax regulations.

C. Benefits Continuation

Health insurance coverage has been extended for 60 days following Emily Smith's termination, providing her with continued access to healthcare benefits during the transition period.